What happens to a growth company with a high PE when it announces it won't be growing the coming 12 month period, then subsequently announce to market that it's revenue will reverse?

Well the share price will fall, substantially. We are down ~23% at time of writing, and down close to 50% in the space of about 3 months. Why?

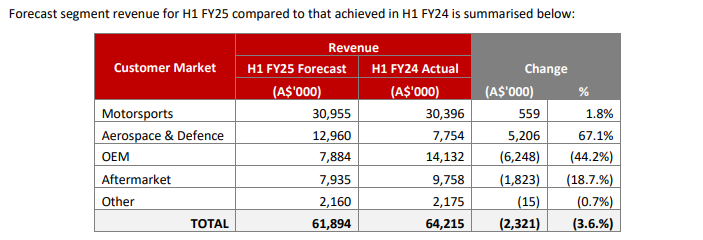

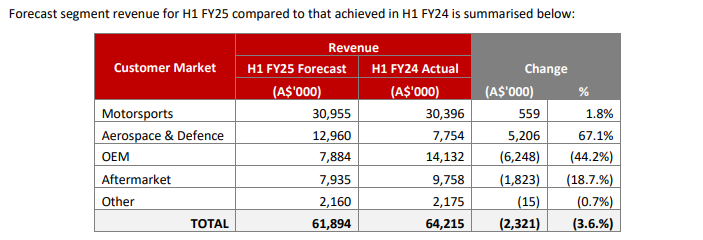

Well, PWR Holdings (PWH), has provided this update to the market this morning.

Key points to the above table are as follows:

- Lower revenue in two markets:

- OEM – three niche OEM EV programs are not proceeding in FY25 despite PWR receiving purchase orders in FY24 for the FY25 work program. Whilst several new programs are in various stages of discussion, the volatility of the EV market is creating unpredictability; and

- Aftermarket – revenue globally has been impacted by broader economic pressures.

- Semi-Fixed Production Costs – production costs are higher than pcp as they cannot be immediately reduced to match lower than expected volumes and, accordingly, are expected to disproportionately impact forecast earnings for H1 FY25.

This has come as a bit of a sucker punch after their full year release back on the 15th of August that FY25 will be a "transitional year" for them as they look to position themselves for "future growth" which will impact margins. What the market didn't expect is that revenue will go backwards, so this is a bit of a surprise and hence likely to take some time to digest.

I'm still mulling this one over, as PWH is a long term compounder for me, however this will cause for some reflection. Concerned about management not guiding for this a couple of months ago, and also the added pressure this will place on management which, if they depart or lighten holdings may be a deal/thesis breaker for me.

At this stage I am keen to see how this transitional year progresses but FY26 will definitely want to see them shift back to some growth and see some runs put on the board after the "transition" settles. Always risky to take a bet on how long this takes.

HELD here and IRL.