Pinned straw:

That was timely...

Here is the opposing argument from Morningstar!

Uncovering the hidden SaaS profits

How Investment Payback can help investors identify long-term winners.

Roy van Keulen

Here we discuss why software-as-a-service companies can be structurally underestimated by the market and how investors can use this market inefficiency to find opportunities. We believe narrow moat SiteMinder (ASX:SDR) provides such an opportunity, as it is trading well below our AUD 10 per share fair value estimate.

Other companies mentioned, all overvalued, are narrow-moat Xero (ASX:XRO), with a fair value estimate of AUD 90 per share, wide-moat Technology One (ASX:TNE), with a fair value estimate of AUD 17.75, narrow-moat Objective (ASX:OCL), with a fair value estimate of AUD 5.50, and narrow-moat Hansen (ASX:HSN), with a fair value estimate of AUD 4.

We observe that it is difficult to gauge the real profitability of SaaS companies using existing accounting standards. SaaS companies are required to expense most, or all of their customer acquisition costs upfront but can only recognize the returns from these investments over the lifetime of the customer, which is often measured in terms of years or even decades. Because of this mismatch between costs and revenues, as viewed through the matching principle, returns on invested capital are calculated incorrectly.

For early-stage, fast-growing SaaS companies, this results in ROICs being artificially depressed or even negative, even when these companies may be seeing high internal rates of return on their investments. This can easily deter many traditional investors, who might mischaracterize such companies as structurally unprofitable.

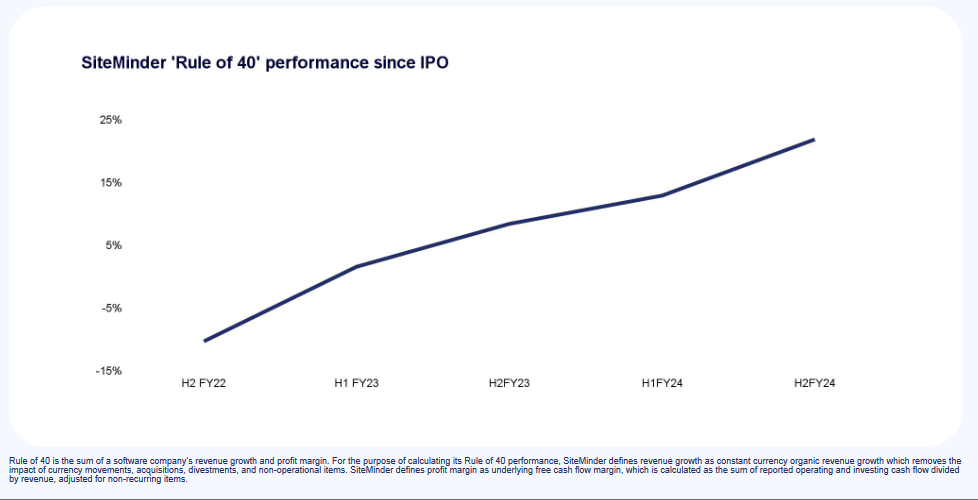

Modern investors have tried to address this issue using the Rule of 40, which adds up a company's profit margins (as measured by traditional accounting) and its annual revenue growth. We find this metric better incorporates the benefits from investments, compared with ROICs. However, we also find the metric still puts too much emphasis on current profits because it cannot account for investments that take longer than one year to generate returns.

Exhibit 1: Rule of 40 Scores show little consistency over time

Average Rule of 40 scores, fiscal 2020-24.

Uncovering the hidden SaaS profits

How Investment Payback can help investors identify long-term winners.

Roy van Keulen

Here we discuss why software-as-a-service companies can be structurally underestimated by the market and how investors can use this market inefficiency to find opportunities. We believe narrow moat SiteMinder (ASX:SDR) provides such an opportunity, as it is trading well below our AUD 10 per share fair value estimate.

Other companies mentioned, all overvalued, are narrow-moat Xero (ASX:XRO), with a fair value estimate of AUD 90 per share, wide-moat Technology One (ASX:TNE), with a fair value estimate of AUD 17.75, narrow-moat Objective (ASX:OCL), with a fair value estimate of AUD 5.50, and narrow-moat Hansen (ASX:HSN), with a fair value estimate of AUD 4.

We observe that it is difficult to gauge the real profitability of SaaS companies using existing accounting standards. SaaS companies are required to expense most, or all of their customer acquisition costs upfront but can only recognize the returns from these investments over the lifetime of the customer, which is often measured in terms of years or even decades. Because of this mismatch between costs and revenues, as viewed through the matching principle, returns on invested capital are calculated incorrectly.

For early-stage, fast-growing SaaS companies, this results in ROICs being artificially depressed or even negative, even when these companies may be seeing high internal rates of return on their investments. This can easily deter many traditional investors, who might mischaracterize such companies as structurally unprofitable.

Modern investors have tried to address this issue using the Rule of 40, which adds up a company's profit margins (as measured by traditional accounting) and its annual revenue growth. We find this metric better incorporates the benefits from investments, compared with ROICs. However, we also find the metric still puts too much emphasis on current profits because it cannot account for investments that take longer than one year to generate returns.

Exhibit 1: Rule of 40 Scores show little consistency over time

Average Rule of 40 scores, fiscal 2020-24.

Source: Company filings, Morningstar estimates. HSN, OCL, SDR, WTC fiscal years end June. XRO fiscal year ends March. TNE fiscal year ends September.

We therefore propose Investment Payback as an additional metric. This metric—which calculates how long it takes for investments in sales and marketing and research and development to be paid back—better ties growth back to a company's investments and allows investors to better assess a company's internal rates of return.

Exhibit 2: Investment Payback delivers more-consistent scores over time investment

Payback scores, fiscal 2020–24.

Source: Company filings, Morningstar estimates.