Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Discl: Held IRL 4.80% and in SM

Keeping a close watch on the SDR chart as the position allocation drifts below the ~6% allocation I would ideally like to be holding.

The 5.64 to 5.95 support zone has held up very nicely since late Nov 2025. This is a rather interesting technical zone as it is at the confluence of 3 "usually-strong" support factors:

- Medium-term support/resistance going back to March 2024 and prices bouncing up from this zone since late Nov 2025

- Rectracement from the previous uptrend move is around 50% on no adverse news - quite a bit of froth should have been taken out in the process

- The 200day Simple Moving Average is hovering around 5.63

With these 3 factors occurring at roughly the same level, the theory suggests that this may be a reasonable place to top up ...

If this area does not hold, then the next support looks to be ~5.45, from which the last gap up occured following the FY25 earnings announcement in late Aug 2025, failing which, 4.81 to 4.92.

Assume three scenarios Bull, Base and Bear ranging from revenue growth 30% down to 10% for bear case for next 5 years. Net Margins in FY30 of 20% for bull and 5% for Bear case. Assigned PE ratio 45 for bull case in FY30 and Bear Case 25. Assumed Share Count grow at 2% per year to 296m shares. Discounted back to today and blend the 3 scenarios and get a Valuation of $7.89

25-Nov-2025

$8.10 ($4.50 - $12.00)

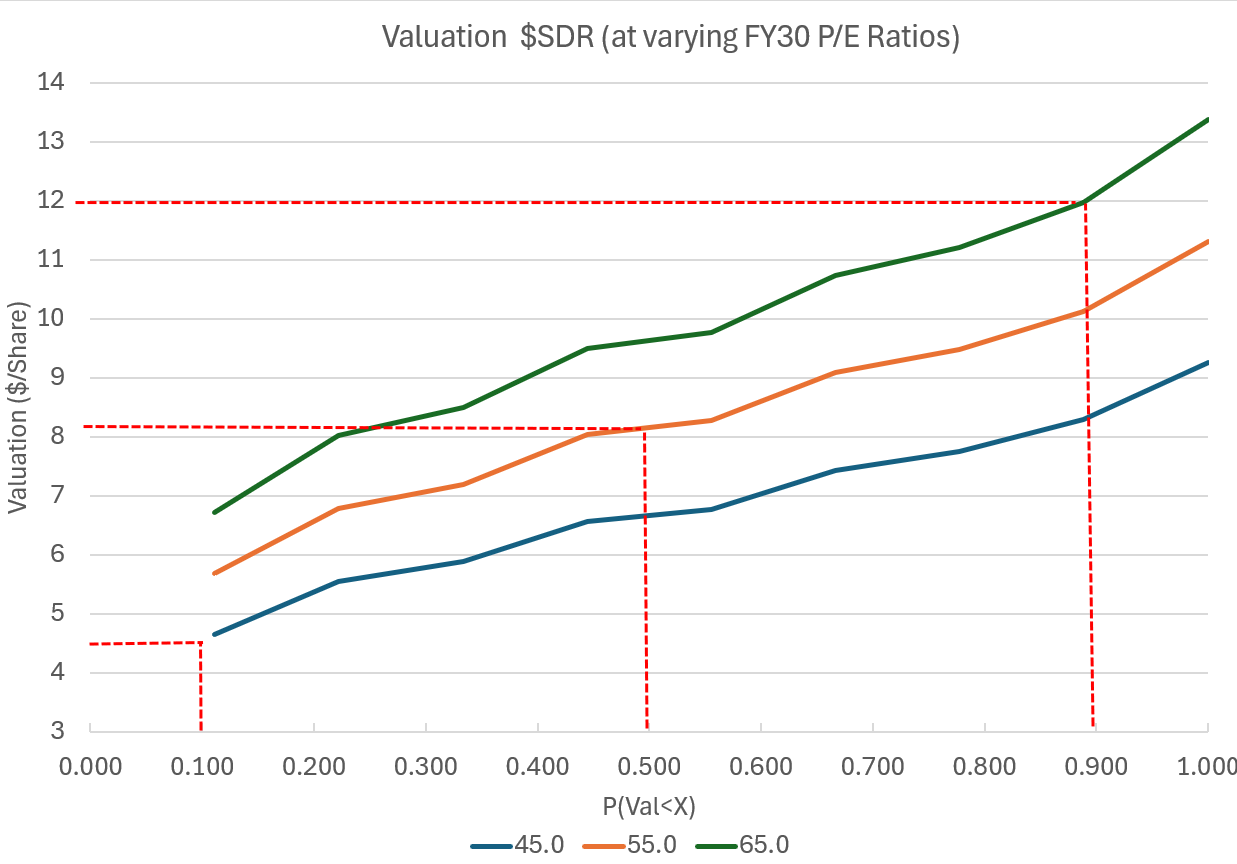

Method: scenarios to generate FY30 EPS, discounted back to start of FY26. Assumed P/E values of 45, 55, 65.

See today's Straw for details.

Earlier this week, I initiated a 6% position in RL in $SDR for $5.95 (funded by exiting my remaining holding in $RUL).

I originally took a smaller position (3%) in Feb this year; however, as is sometimes the case for me with "new holdings" as I got deeper into learning about it, the conviction I thought I had wobbled and when presented with a short-term profit of 30%+ and a need to allocate the funds elsewhere on the day of the FY25 results, I “bottled it” and exited. (This was not an intended short term trade, I simply doubted the basis on which I originally entered, and changed my mind!) However, I’ve used the time on the sidelines to reconsider the proposition and today I have a clearer view as to what I am doing!

For a more complete write-up of $SDR, particularly since the FY25 Results in August and the Investor Day in September, I refer to excellent straws by @jcmleng which includes helpful analysis. That work allows me to be more selective in my write-up here.

What is $SDR?

- An enterprise SaaS software business serving small/medium sized hotels and related accommodation (individual properties and small chains)

- Serves a truly global market, and is leader in its segment having already scaled to 50,100 customers in 150 countries for 250+million Room Nights annual. (This represents a global market share of only c. 5%.)

- While currently unprofitable, the business is at the inflection point and is expected to generate positive free cashflow in FY26.

- With 4 years of operations as a listed company, the operating economics including operating leverage are clear. (That said, a strong FY23 benefitted from the global re-opening of international tourism, so the results folllowing IPO must be understood in context,)

Leadership

- CEO Sankar Narayan joined in 2019 from $XRO.

- At $XRO he learned how to run an international SaaS company as CFO and Chief Operating Officer.

- I rate Sankar very highly.

Market

- Global, small and medium size properties, often independent operators, single properties or small chains.

- Most of its customer base are relatively immature in procuring software.

- Of those who have invested in systems, many have multiple, dated systems that lack integration (both within the property as well as externally to the increasingly-important online travel agents (OTAs)). These require manual interventions and support, and many properties are now looking to invest in next-generation products, including functionality which was hitherto only accessible by the larger chains.

- Quantifed, the global TAM is anywhere from 0.3% to 1.5% of the industry's Gross Booking Value of close to $1,000bn.

The Opportunity

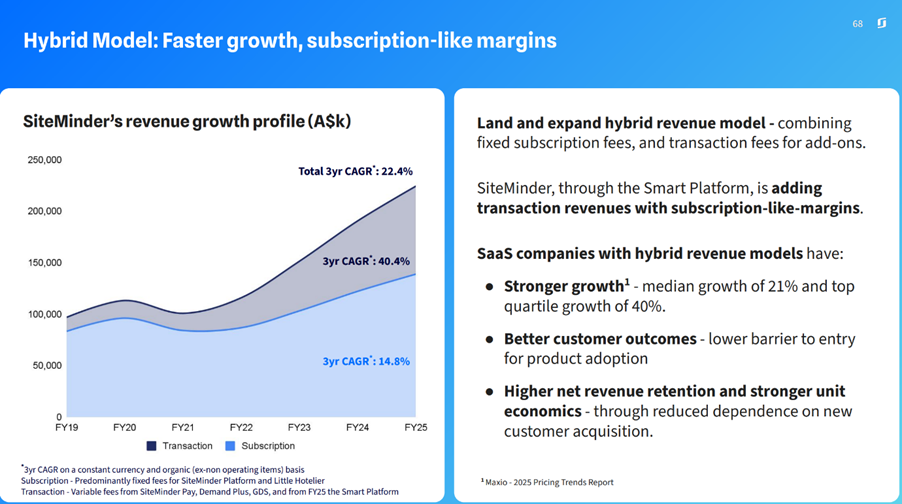

The key chart I am focused on is the following one from the recent Investor Day.

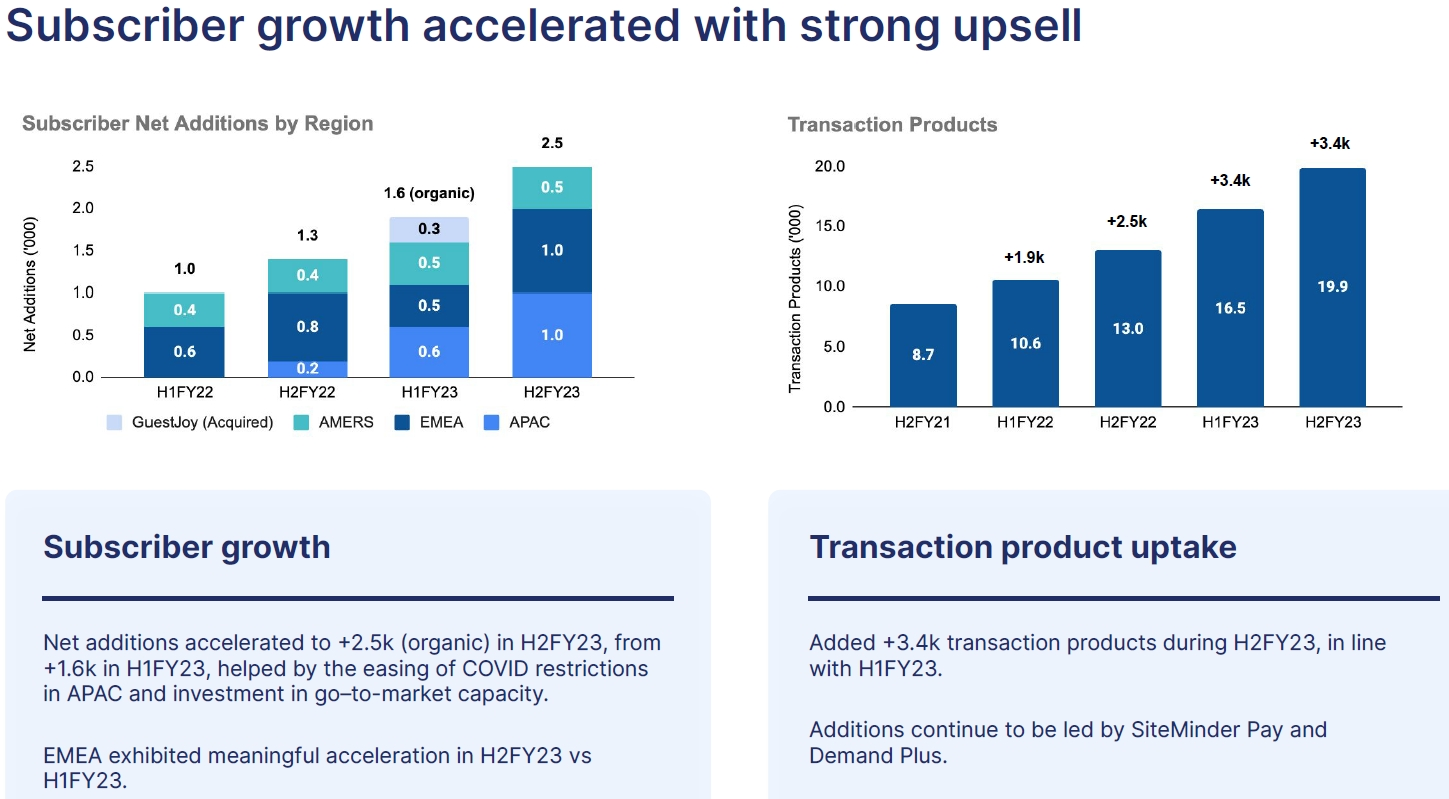

New customer acquisition has and continues to drive subscription revenue growth at low double-digit percentages annually.

More recently, the development and launch of a suite of “Smart Products” is adding volume-based transaction margins, where $SDR clips the ticket on specific, value-adding transactions for clients.

As @jcmleng highlighted following the recent AGM, this chart should be read together with this insight from Sankar's address at the AGM.

“We are moving beyond the role of a channel manager to become their central revenue platform - the unified interface where revenue decisions are made, executed, and automated."

Historically, most subscription revenue has been driven by Channel Manager, which connects a property's vacant room inventory to online travel agents (OTAs) that that act as channel partners. (Think Hotels.com). $SDR’s products are dynamically integrated, maintaining the inventory/availability live across multiple platforms. Without the use of a platform like $SDR (or the various other competitor offerings available) this has traditionally been a significant pain point for property managers.

Until recently, $SDR’s revenue has grown primarily as new properties subscribed to the product.

However, over the last 3-4 years, $SDR has been developing a suite of Smart Products, which include increased transaction revenues, where $SDR clips the ticket for activity in each of its Smart Distribution, Payments, Channel Optimisation, and Revenue Management modules.

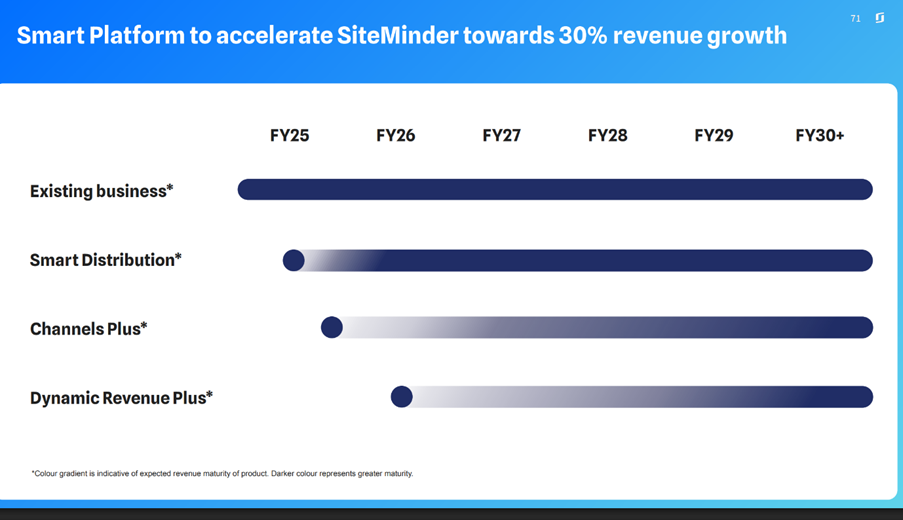

The "Smart Platform" was launced in earnest in FY25. The chart above shows how in the last few years, the transaction-driven component of revenue is growing more rapidly than the growing subscription base. And it is very important to recognise that it is still early days in rolling out the Smart Platform to customers, as the following chart indicates.

The FY25 result is only starting to show transaction revenue contributions from “Smart Distribution” and even less from “Channel Plus” (C+). In fact, at Investor Day, $SDR told us that 5,000+ properties have contracted C+, which is around 10% of existing customers. Reportedly, over 500 customers are signing up per month ( 1% or 12% annually).

Smart Channel management takes on more of the operational tasks of managing the relationship and room availability and promotion process with the OTAs. $SDR can do this more effectively and efficiently than a property manager, because the process is automated in the $SDR software. Instead of the flat subscription fee that hotels have historically paid for the standard Channel Manager integration into the OTAs , the Hotel only pays for the incremental value added by the OTA bookings in the Smart Platform, and in return, $SDR takes a transaction fee.

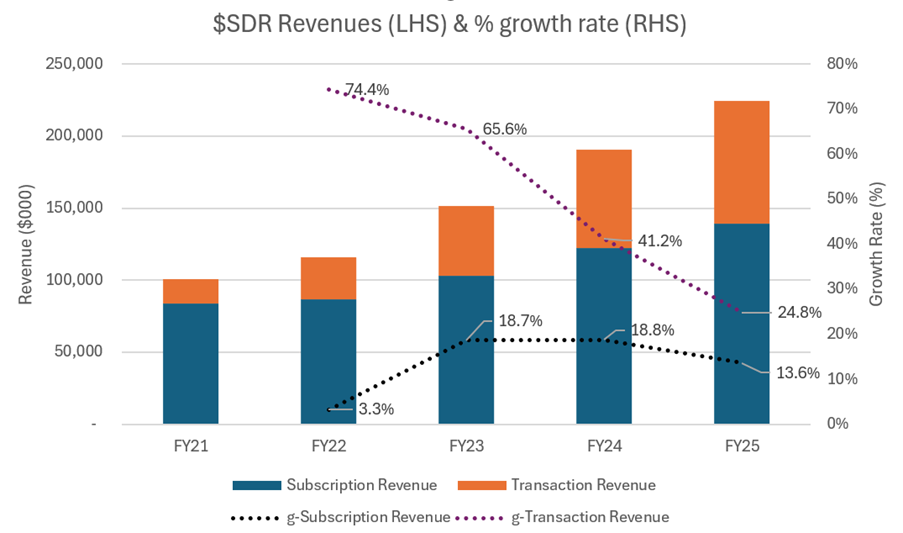

The roadmap chart above is important when we considered how both subscription and transaction revenues are evolving, shown in the following chart. This shows that transaction revenues are growing much faster than subscription revenues. However, the growth rates for both are clearly declining.

But taking together the Smart Platform roadmap chart and Sankar’s comment at the AGM, together with his oft-stated target that revenue growth will re-accelerate to 30% in the medium term, it is clear that $SDR are confident of the value the Smart Platform will capture.

In fact they’ve quantified this. They believe that based on the subscription platform and early transaction capabilities, $SDR currently captures 0.3% of its customers Gross Booking Value (GBV). For customers deploying the full Smart Platform suite, $SDR believe this can increase to 1.5% of GBV – a 5x revenue growth opportunity from within the existing customer base.

So, it is central to my thesis that in FY26, as we come to see a full year of C+ and Smart Distribution penetrating the existing $SDR customer base, that Transaction Revenue growth will accelerate.

But as Sankar said at the AGM, this is just the start. The real game changer is once Dynamic Revenue Plus (i.e., automated revenue management) kicks in, starting in FY26, and then building from FY27 onwards. Dynamic Revenue Management is something the large hotel chains have been doing for many years. However, it is a capability that small / medium-sized operations have yet to embrace ("80%" of hotels have not adopted a Revenue Management System as of early 2025).

As a global market leader of software for independent and small chain operators, $SDR is positioned to now capture this opportunity with the Dynamic Revenue Plus (DR+) offering, clipping the ticket along the way.

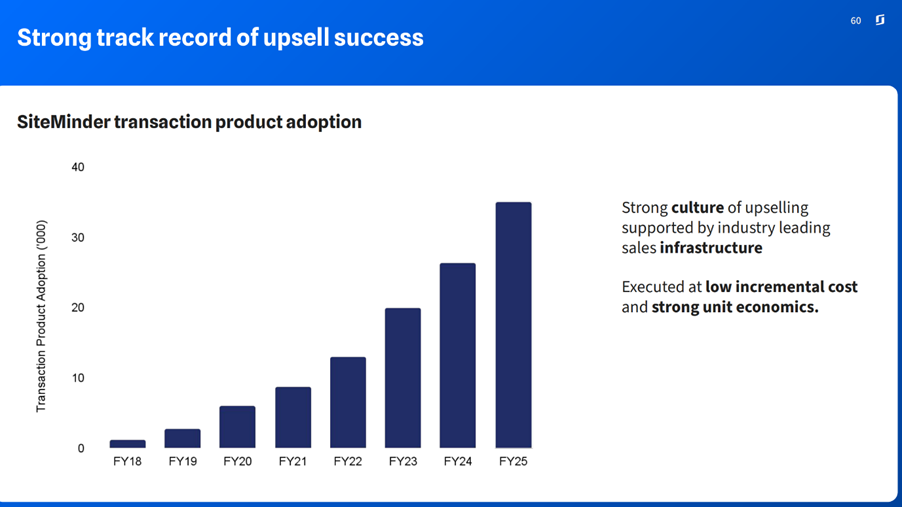

So, What’s the Track Record in Capture Transaction Revenue Opportunity?

This sounds great, But where’s the evidence $SDR can achieve this?

The chart below shows just how successful $SDR has been to date in selling its transaction revenue generating products. This growth is only now starting to include $SDR bringing "Channel Plus" and "Dynamic Revenue Plus" into the existing, growing customer base.

There’s a lot more detail about the rollout plans for the Smart Platform in the Investor Day pack, as well as why each module will deliver value to customers.

Before moving on to my valuation, I do believe that with the launch of Smart Platform in FY25 and the early adoption evidence, we will see an acceleration of transaction revenue in the years ahead.

However, from the analysis I have done, I am not convinced that $SDR will get back to overall 30% annual revenue growth. However, I do believe that $SDR will do significantly better than the market is currently giving credit for. Hence the investment opportunity today,

The valuation that follows provides a framework for me to track progress over the next year or two. I believe it shows that at $6.00, $SDR is a good buy.

Valuation

First, I am NOT going to assume that $SDR can achieve Sankar's 30% revenue growth vision. That would be an UPSIDE BULL CASE to what I am modelling.

The model projects EPS growth out to 2030 – the timeframe of the Smart Platform rollout.

I build the revenue model in two elements:

- Subscription Revenue: I assume scenarios of Subscription Revenue growing at 9%, 11% and 13% annually, delivering a constant Gross Margin that expands progressively from 86.0% in FY25 to 88,0% in FY30,

- Transaction Revenue: scenarios of 20%, 25% and 30% annual growth are assume, with a flat Gross Margin of 33%.

Taken together the combination of revenue scenarios delivered FY25 to FY30 Total Revenue CAGRs from 13.7% to 20.6% - still a far cry from Sankar’s aspirational 30%!

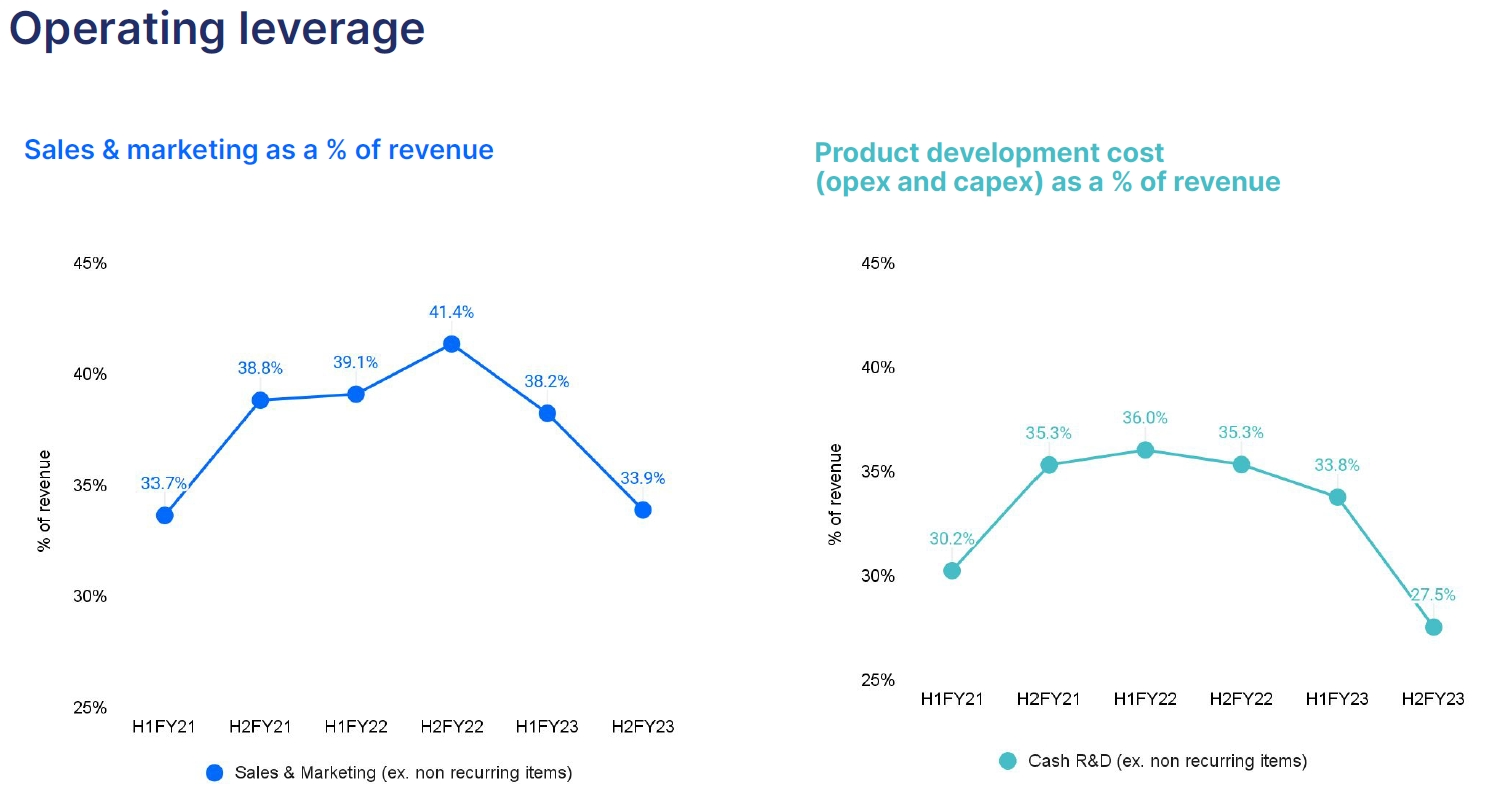

Annual Opex Growth (including D&A) vary across scenarios from a low of 6% up to 9% (underlying Opex growth was 0% in FY24 and 7% in FY25). I’ve matched the higher Opex Growth scenarios to higher revenue growth scenarios, assuming that these will related to more aggressive customer acquisition strategies and platform development investments. Overall, I think these are reasonably prudent scenarios, given the operating leverage presented in the FY25 results, showing a clear trend over that 5 years since FY21.

Finally, my model includes several constant parameters as follows:

- Finance Costs/Revenue = 0.5% (assumes $SDR maintains zero long term debt)

- Tax Rate = 30%

- Annual Growth in Share on Issue = 1.2%

- Discount Rate 10%.

FY30 EPS was calculated. Given that in FY30 the modelled EPS growth rate ranges from 60% - 67%, I’ve applied P/E ratios in FY30 of 45 (blue), 55 (orange) and 65 (green) – shown by each of the curves graph below.

The implied valuation at the start of FY26 is shown in the graph below.

From this, my estimated valuation is $8.10 ($4.50 - $12.00).

Given that $SDR is still unprofitable today, the uncertainty in the valuation is necessarily very wide indeed. However, I am comfortable that at an entry price of $5.95, the assumptions I have used generate a good asymmetry with even my uppermost scenarios being well short of the CEO’s revenue growth goals.

As ever, I’ll will reconsider the various assumptions in my model with each future report. However, on this basis, I was happy to buy $SDR on Monday of this week.

When I Would Sell

For my thesis to remain on track, I need to see:

- Continued new property additions, at minimum high single digit % growth annually (allowing for some pricing uplift).

- Transaction Revenue growth needs to re-accelerate. It certainly cannot continue to decline as we get further into the Smart Platform Roadmap execution.

- Cost control must be maintained - although there is some headroom for a more aggressive customer acquisition strategy.

- Low historical churn levels need to be maintained.

A significant deviation on any one of these metrics would require a fundamental revisiting of the thesis and could be a thesis-breaker.

I’d also like to see Sankar remain in post. However, with the strategy set and the product set built, this is a business that can now be executed by any competent operator, IMHO.

Disc: Held (RL 6%)

Discl: Held IRL 5.10% and in SM

SDR is looking to have entered a nice top up zone for me:

- Approaching the 50% retracement level from the recent run up at ~5.69

- The 5.64 to 5.95 is a medium-term support/resistance area that goes back to March 2024

- The 200 SMA line is hovering around 5.46, providing the next downside support

- Thereafter 5.15 is the 61.8% retracement level

Discl: Held IRL 5.72% and in SM

Had a quick look at the SDR FY25 AGM material. It was a good opportunity to sit back and reflect on the journey thus far (super-pleased) and where this is all heading (north-ward bound!).

The one significantly misunderstood aspect of SDR is that it is NOT a channel distribution manager but a central revenue platform manager. Very pleased that during the FY25 results and the recent Investor Day, management has used more decisive and precise language to articulate this sharp pivot in positioning - this continued in the CEO address, highlighted below.

KEY THEMES FROM ADDRESSES

The SiteMinder team is delivering: “We are delivering for our investors, achieving a strong financial performance headlined by accelerating growth, improving unit economics, and critically, profitability, with both underlying EBITDA and free cash flow positive for the financial year”

On AI:

“We are not just participating in this shift; we are defining the future of our industry”

On FY25:

“It was a year defined not just by our strong financial achievements, but by the successful execution of our Smart Platform strategic plan”

“FY25 was a year where the travel industry faced volatile and challenging trading conditions buffeted by geopolitical conflicts and policy pivots. Against this backdrop, SiteMinder managed to deliver robust growth and momentum .... This acceleration is a powerful endorsement of the resilience of the business, our strategic product initiatives and the growing value hoteliers find in our platform”

“Our enhanced operating model provides the healthy, self-sustaining bedrock for our continued expansion, ensuring that our growth is fully funded by our own success”

On the Smart Platform:

“By successfully executing the Smart Platform strategy, SiteMinder is leading efforts to address critical challenges facing hoteliers, and redefining how the hotel industry manages revenue and guest acquisition

“We are moving beyond the role of a channel manager to become their central revenue platform - the unified interface where revenue decisions are made, executed, and automated.

On the opportunity ahead:

Our current annual recurring revenue unlocks approximately 0.3% of the $85b of gross booking value we facilitate. This is a very small fraction of the value we create for our hoteliers. However, when we estimate the potential value unlock at full product attach - meaning customers adopting the full suite of Smart Platform tools - that figure rises to over 1.5%. This is a significant revenue opportunity simply by deepening our relationship and value delivery to our current customers. This is an organic, high-margin, and a greater share of wallet from additional product adoption.

Outlook and Trading Update:

“ ... the positive momentum from the end of FY25 has continued, with ARR growth (on a constant currency and organic basis) tracking in like with the rate achieved in FY25 (27.2%) - reinforcing the stability and resilience of demand across our platform”

Only picked up 2 new slides, worth pointing out:

Good summary of the momentum in play across the SDR business

And the opportunity ahead - the Smart Platform rollout is really only just beginning.

Chart Review

The share price made another all-time high today, peaking at $7.96. While I think the market is taking notice and becoming increasingly bullish, the price does feel somewhat exhausted for now after the post FY25 results re-rating. I do not expect it to do too much other than bounce around at this levels and retrace a bit - not a bad thing to take some froth out of the price ahead of the 1HFY26 results.

Discl: Held IRL and in SM

Very pleased to see SDR make a new all-time-high price of $7.85 today, surpassing its previous all-time-high price of $7.77, which was achieved on the day it listed on 9 Nov 2021. It has never seen this level until today, 3 years 11 months-ish later.

The price did not have sufficient momentum to close above $7.77, settling at $7.72 instead.

It sure has been a bit of a journey ...

Since the FY25 results pop, the re-rating has been rather orderly and textbook-like. Probably due for a bit of consolidation and thus expect the price to move sideways a bit, quite possibly down to ~$6.60-ish, which would be very healthy for the price thereafter.

Business-wise, SDR is only at the start of the Smart Platform journey, so will be letting this run for quite some time ...

Discl: Held IRL and in SM

Had a good look at the SDR Investor Day Presentation from 23 Sept 2025. It really annoys the hell out of me that as a retail investor, I can’t seem to participate in any of these SDR sessions ...

It is a large pack of slides intended to give investors a deeper understanding of the Smart Platform capabilities, the problems they solve etc. Having had some previous Reservations and Hotel IT systems and operations background, these capabilities make a lot of sense and is very exciting to see.

SUMMARY

There are 6 key themes that emerge from this very software-functionality driven slide pack:

- There is a sharp pivot to positioning SiteMinder as a “Revenue Management Platform for Hotels” - this really makes sense to more sharply differentiate SDR’s capabilities and value add, and allow SDR to pull away from being categorised as a “hotel distribution system” - it should now be clearer that global distribution is only 1 of many SDR’s capabilities

- Introduction of the concept of a “Revenue Flight Deck” - an integrated experiencing unifying intelligence, revenue management and distribution

- Better clarity on the problems that each Smart Platform capability is intended to solve and the value this brings to hoteliers

- The huge volume of very hotel-related data that SDR has and continues to collect, the “SiteMinder iQ” Data Lake that stores and manages this data and how the data is then leveraged to improve internal operating efficiencies and the embedded in the SDR products to enable better dynamic predictive/forecasting capabilities for hoteliers.

- With the Smart Platform, SDR is adding transaction revenue at subscription-like margins.

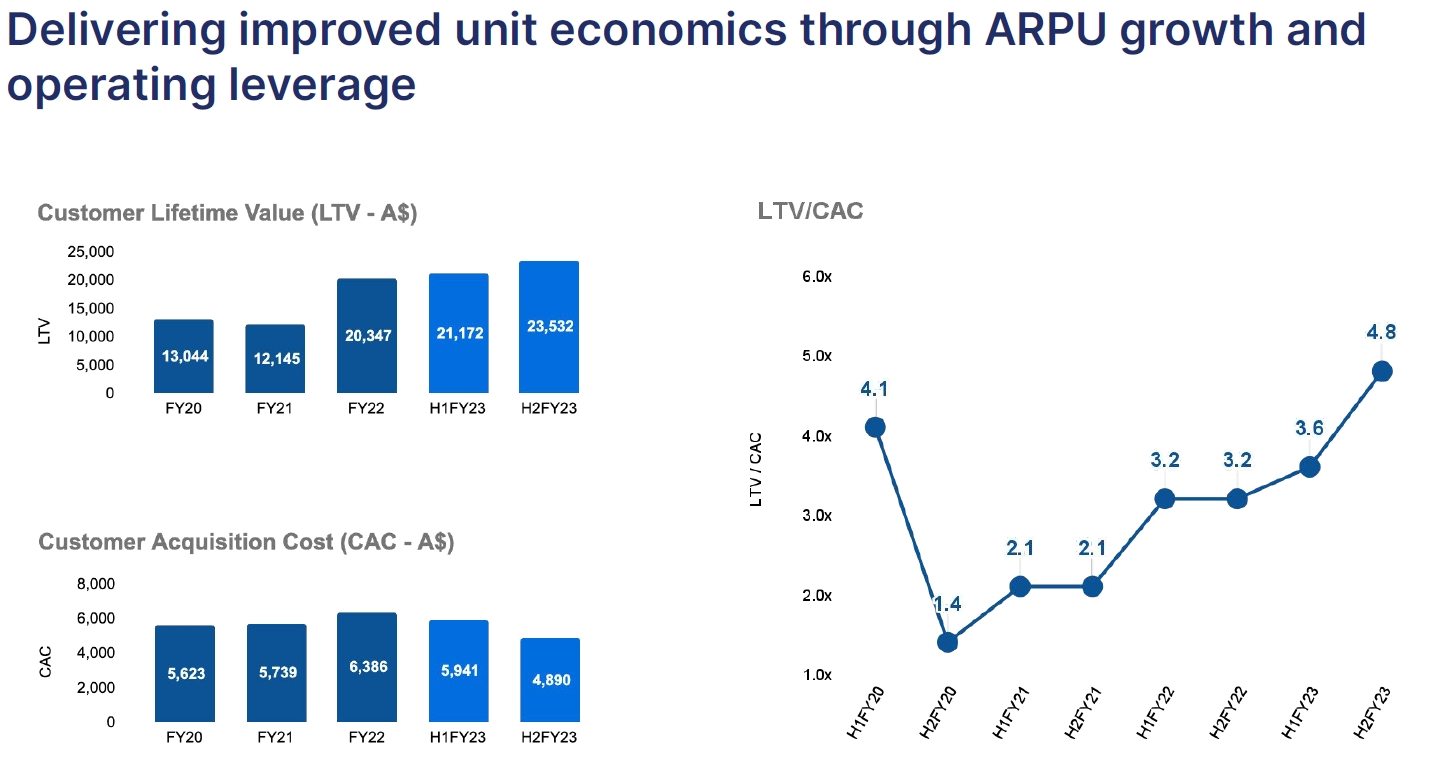

- Unit economics are getting stronger - Lifetime Value is rising, Cost of Acquiring Customers is falling as there is minimal incremental cost to upsell

MY TAKEAWAYS

The harder pivot towards Revenue Management is long overdue. To badge SDR as yet another global hotel distribution platform is to misunderstand SDR’s value add to the hotel industry across the continuum of hotel size

I get the very clear sense that SDR is now in scaling mode with very attractive economies of scale ripe to kick in given the already large base of customers, a significant portion, if not all, who can absolutely benefit from the Smart Platform capabilities

The real SDR journey is now truly beginning ...

SUMMARY OF SMART PLATFORM PRODUCTS

DATA AND AI

Nothing fancy with the SDR Data/AI strategy - it makes sense. SDR has significant data capability, which is is looking to directly monetise:

- $85b+ of Global Booking Value

- 130m+ reservations per annum

- 50k hotels in 150 countries

- 2 year forward rate plans, with full property booking insight

AI is then used on data accumulating in the Data SiteMinder iQ Data Lake to (1) drive efficiencies across operational functions (2) embedded in SDR’s products to drive additional customer value - both adding to the velocity of the flywheels of efficiency and value.

Next generation hotel clustering techniques - the practice of grouping properties most comparable to your own to shape commercial strategies

Leverage AI to deliver statistically rigorous forecasting tools for hoteliers - enable better demand forecasting

GO-TO-MARKET

This brings out the typical lifecycle of the customer, the scaling opportunity ahead with the Smart Platform products and the economies of scale benefits - there is a lot to like with this.

Discl: Held IRL and in SM

Bailador took some nice profit with the sale of ~3.46m SDR shares, ~25% of its holdings of SDR

Post the sale, BTI still holds 75% of its SDR holdings

Market seems to have absorbed the sale very nicely with the share price moving sideways and staying above both the 7.20 support line and the medium term uptrend line, despite the heavier-than-normal volumes - a really encouraging sign of continued price strength.

Nice to see a sharp, detailed, get-stuffed, response from SDR to the Speeding Ticket it received.

Since the re-rating, the price has consolidated in a nice textbook flag pattern, with the all time-high intersecting with the long term uptrend line at ~7.03 up ahead. Expecting the price to go sideways between ~6.40 to 7.03-ish for a while.

Discl: Held IRL and in SM

Discl: Held IRL and in SM

SDR Things To Focus On

Pre-reviewing the results, I listed these 6 questions to answer, followed by the answers:

- Is revenue growing - dollars, ARR, ARPU? Absolutely - a decent noticeable acceleration in 2HFY2025

- Are the Smart Platform products contributing to growth? Hell yeah .... ! Big Tick

- Was there progress on LTV/CAC? Yes, improvement of 0.8x to 6.2x, driven by rising Customer Lifetime Value (LTV) vs flat Customer Acquisition Cost (CAC)

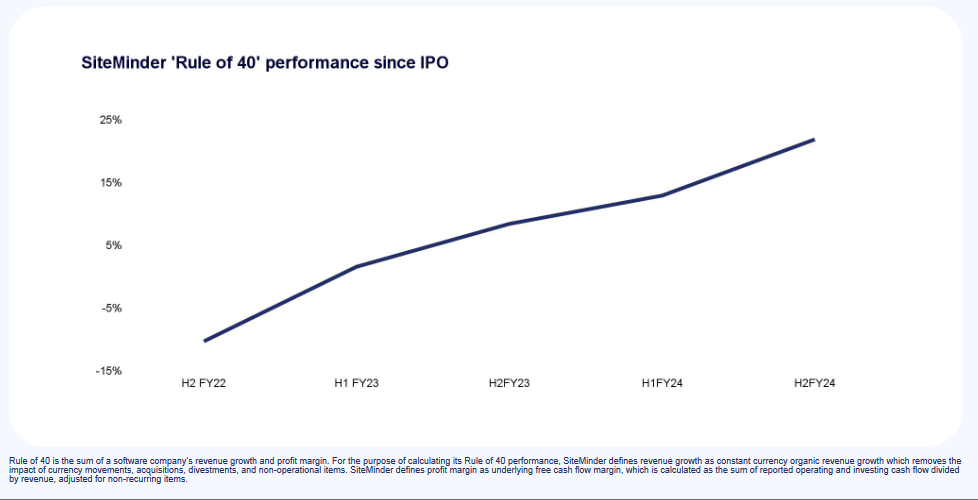

- Was there progress on Rule of 40? Yes, 3.9% increase to 21.3%

- Was there progress in the path to profitability? Absolutely - 2 consecutive Half’s of Positive Underlying EBITDA, EBITDA 2H jumped HoH (1H: $207; 2H $6,704) resulting in SDR’s achieving the target of full year Underlying EBITDA positive in FY25 $7,052 - Big Tick

- Was there progress to positive FCF? Yes, Net Cash from Operations up sharply YoY from $14.4m to 23.6m, Cash Burn fell YoY from ($10.8m) to ($7.6m), cash balance $33.4m, need to peel FCF report more

TLDR SUMMARY

- Cracker of a result all round

- My 1H commentary was “Thesis is very much intact. 2HFY25 should be more interesting as rollout of the 3 Smart Products will be in full swing and the impact of accelerating revenue should be more pronounced.” - this has now played out very nicely

- Smart Platform products are now contributing to revenue and revenue acceleration from 2HFY25

- Strong continued momentum on all operating metrics - ARR, New Property Additions, No of Properties on the Platform, Transaction Product Uptake, ARPU

- Market concerns around slowing travel discretionary spend does not appear to have materialised - revenue growth was strong in all regions

- Translated into strong Revenue Growth across both Subscription and Transaction Revenue

- Margins have improved: Subscription 86.4% (FY24: 85.1%) and Transactions 33.7%, (FY24: 33.7%), Overall gross margin has fallen to 66.3% (FY24: 66.5%) as expected, due to the shifting revenue mix of 62% Subscription: 38% Transaction (FY24: 64%:36%) - very healthy

- Translated into a jump in EBITDA in 2H, and the first full year of Positive EBITDA and Underlying EBITDA

- And improved Free Cash Flow

Chart Review

Market has responded positively, but there is long-term resistance at ~7.03, which goes back to post IPO days of Dec 2021 as well as the long-term upward trend line, both converging at around the same levels, which has limited the pop.

Expecting the price to now bounce sideways around the ~6.40 to 6.50 levels, while the analysts re-crunch the numbers.

Action

None - already fully allocated

This is a long-term high-conviction hold as the thesis is only just starting to play out and need to give management time to build the growth momentum in the next 1-2 years.

--------------------------------------------

Attaching my detailed commentary for anyone interested in the detail:

Financial and Operating Metrics

- ARR has accelerated - sharp jump in 2H, ARR Growth Organic now 27.2% (1HFY25: 22%), driving Revenue Growth 19.2% (1HFY25: 17/2%)

- Significant jumps in Transaction Revenue ARR Growth and Transaction Revenue growth - SDR’s focus to monetise transactions flowing through the platform are now paying off

- Transaction ARR growth of 48.3% YoY Organic is running significantly ahead of revenue growth as the scaling of the Smart Platform initiatives kicked in towards the end of FY25

Strong continued momentum in (1) New Property Additions (2) No of Properties on the Platform and (3) Transaction Product Uptake

Continued focus on penetrating larger hotel properties - this was not SDR’s original customer base, but is now becoming significantly more important as SDR monetises Gross Booking Value on the platform.

Which drives continued ARPU increase momentum:

And translating into continued HoH Revenue and Annualised Recurring Revenue growth, respectively

Rate of revenue growth in 2HFY25 has noticeably increased - a 14.8% jump HoH vs fully year increase of 17.7%.

Revenue growth has driven profitability with 2 consecutive Half’s of Positive Underlying EBITDA, resulting in SDR’s achieving the target of full year Underlying EBITDA positive in FY25.

3.9% improvement in the Rule of 40

0.8x improvement in LTV/CAC, driven mostly by Customer Lifetime Value increases, with Customer Acquisition Costs remaining quite flat.

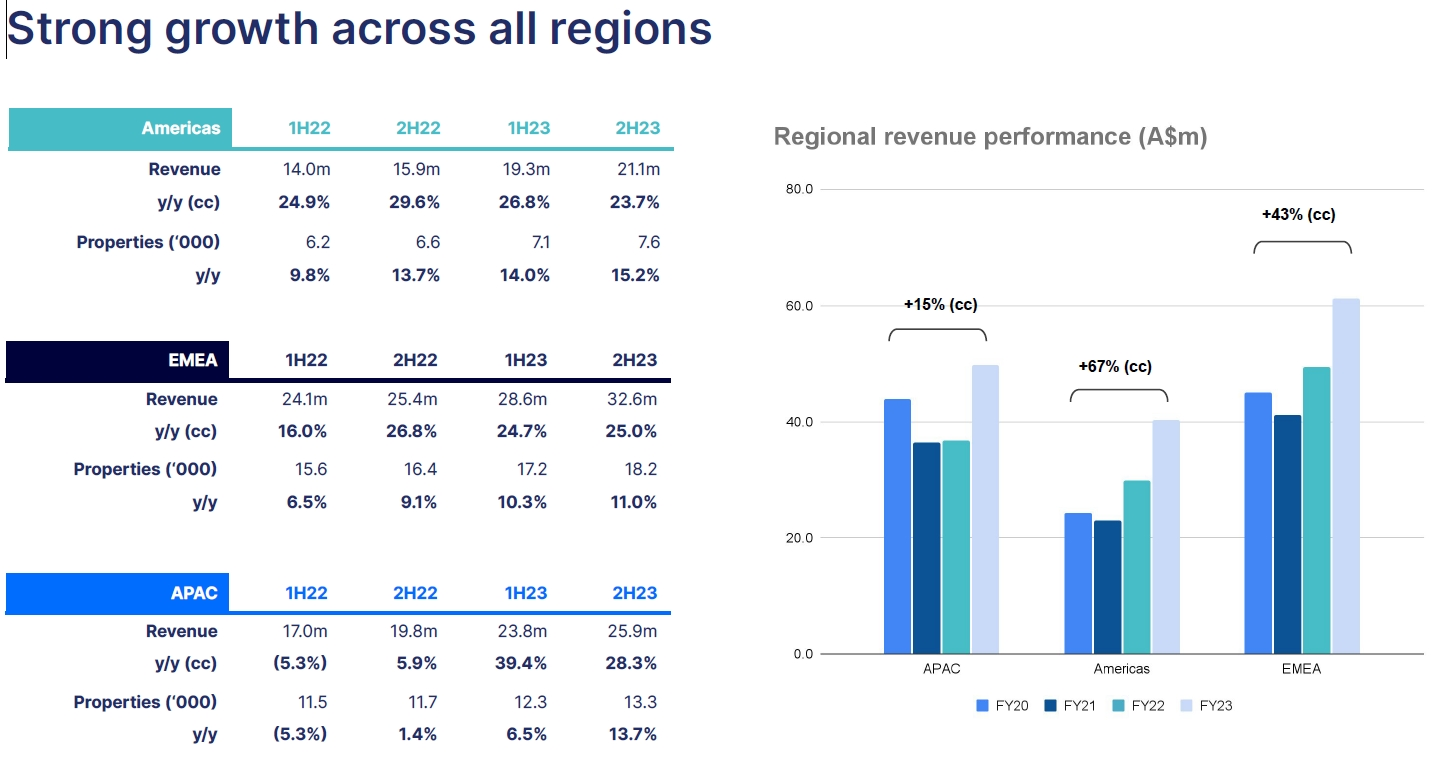

Regional Performance

Revenue growth was strong across all regions - debunking market concerns about slowdowns in travel-related spend, a discretionary expenditure, as cost of living pressures kicked in during FY25

- All regions grew in excess of 20% Organic in 2HFY25

- APAC and EMEA accelerated HoH reflecting resilient travel trends (perhaps the pivot away from the US as a travel destination) and contributions from the Smart Platform initiative

- America’s sustained HoH momentum - contributions from the Smart Platform initiatives offset the moderation in general travel conditions - the Trump effect?

This resilience augurs well for FY26 as the global interest rate cycle moves more firmly towards an easing bias in FY26.

Smart Platform

This is a really good slide which emphasises a point which I think the market still has not got clearly - SDR is not a global room distribution platform alone - it is much more than that.

SDR’s Smart Platform has deeply embedded capability in (1) Revenue Management - previously the domain of large hotels with dedicated headcount to directly manage revenue and (2) Guest Experience ON TOP OF (3) the more traditional “Guest Acquisition” capabilities - a very nice term for the Booking Engine, Global Distribution, Channels Plus capabilities

The monetisation engines would reside primarily in the Guest Acquisition and Guest Experience areas

Late FY24 into all of FY25 was about building out the Smart Platform capabilities and then deploying them to SDR’s customer base - evidence from 2HFY25 is that meaningful revenue is now coming through from these recently deployed capabilities - this was what the market needed to see to believe.

Cash Flow Position

Cash flow performance looks good at face value but need to peel this a bit more, especially the adjustments

- From the cash flow statement:

- Net Cash from Operating Activities was significantly up YoY - FY25 was $23.6m vs FY24 $14.4m

- Net Decrease in Cash fell to FY25 ($7.6m) from FY24 ($10.8m)

- Cash Balance is $33.4m, vs FY24 $40.2m

- No concerns on cash

OUTLOOK

More of the same FY25 in FY26

No change to the general medium-term 30% revenue growth target

Just doing what they said they would.....

I like the dislocation in ARR vs Revenue, 2026 could be break out...

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02984182-2A1616627&v=4a466cc3f899e00730cfbfcd5ab8940c41f474b6

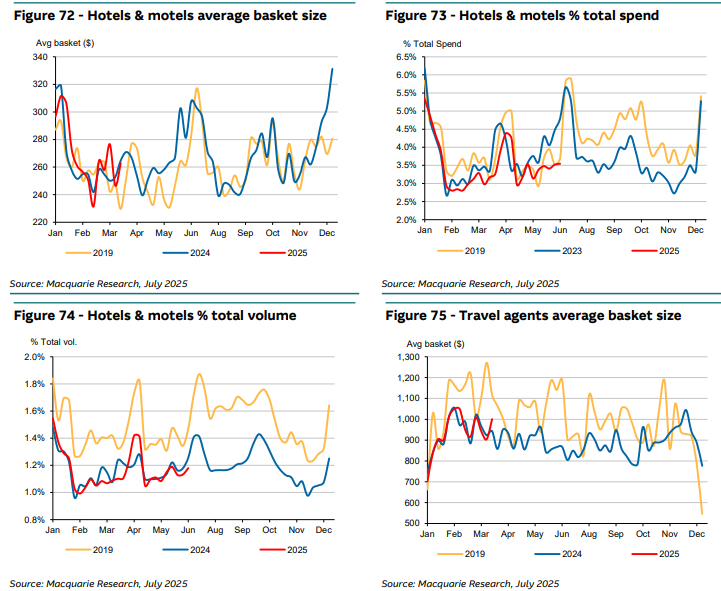

Interesting, although I do not fully agree with the point around "room night demand heavily driving revenue". That "hotel room distribution" boxing of SDR's revenue is, in my view, an overly narrow one. The revenue base has platform subscription revenue, revenue management capabilities via the Smart Platform, payments-driven revenue etc.

Sentiment on SDR clearly has been hit by the caution around travel discretionary spend.

Very eager to see how SDR has gone this half amidst that caution, hopefully offset by the increasing impact of the Smart Platform products being rolled out and the ARR that that should drive.

Discl: Held IRL and in SM

The SDR price has recovered nicely and is now sitting above the long-term 200 SMA, clearing 3 resistance areas along the way ...

Per Macquarie - this is in regards to the travel industry for CTD/FLT. Most of this seems positive read through in terms of conditions. Hopefully offsets weakness in the US from Trump.

Volumes better than feared. Since peak tariff uncertainty in Mar/Apr, the market has been concerned about overall volumes and activity in the US. US volumes appear to be holding up better than feared, with 2QCY24 TSA data down only -0.9% YoY. Subdued inbound leisure volumes will likely be a headwind, with inbound volumes from Canada/Mexico down 13%/7% in June. Across other regions volumes are solid, outside the timing of Easter shifting some travel to April.

• Airfare deflation still a headwind. Although the pace of airfare deflation has slowed, it remains a headwind and is likely most severe in the US (domestic fares down -3% in May). US airlines have been rationalising capacity to reflect the demand outlook. Combined with softer traffic, this has driven an increase in airfare deflation. In ANZ, we expect domestic airfares to grow at inflation and international to deflate mid-single digits. Continued international deflation is a drag on TMC's commissions and overrides, but appears to be stimulating volumes.

• Hotels and accomodation. Recent industry calls with European operators indicated industry conditions remain strong. Although conflict in the Middle East has caused some disruption, it appears to be isolated to specific countries, and concentrated around major news events.

Wanted to revisit SiteMinder and do a deep dive into what it's all about - here's what I came up with.

What’s SiteMinder All About?

SiteMinder is a cloud software company that helps hotels get booked online. Think of it as the “invisible middleman” that connects a hotel’s room availability to all the big booking sites - Booking.com, Expedia, Agoda, etc. It also helps hotels build their own websites, accept direct bookings, optimise pricing, and now even manage payments.

They’ve got ~44,500 hotel customers globally and power around 125 million bookings a year - about $80 billion worth of hotel revenue.

How They Make Money

Mainly through two revenue streams:

- Subscriptions: Monthly/annual fees for their core tools (channel manager, booking engine, etc.)

- Transactions: Fees from booking volume, payment processing, and extras like price optimisation tools.

In FY24:

- Revenue: $190.7m (+26% YoY)

- ARR (recurring revenue): $209m

- EBITDA: +$0.9m (first time in the green)

- Gross margin: 66.7% overall (85% on subscriptions)

- Cash burn: Down to –$6.4m for FY24, positive cash flow in H2 (huge turnaround)

Their unit economics are great: LTV/CAC is 5.4× and churn is super low (~1% monthly).

What’s the Big Opportunity?

SiteMinder is going after millions of small-to-midsize hotels still running clunky old systems. The travel tech space is hot, and they’re evolving fast - launching things like:

- Channels Plus: Advanced OTA integration (including new giants like Meituan in China)

- Dynamic Revenue Plus: AI-backed pricing tools for hotels

- Payments and metasearch upgrades: More “sticky” services to boost hotel revenue

They’re moving beyond a simple tool into an all-in-one “revenue platform” for accommodation providers. Think Xero, but for hotels.

Pros

- Big market & first-mover scale - global customer base, millions of bookings a year

- Recurring revenue engine - sticky SaaS with high-margin subscriptions

- Improving financials - nearly breakeven on EBITDA and free cash flow

- Strong retention & ARPU growth - customers spend more over time

- Global diversification - growing across APAC, EMEA, and Americas

Cons

- Still unprofitable on net income - FY24 loss was ~$25m

- Travel sector sensitivity - downturns hit bookings & transaction revenue

- Valuation is high - trading at ~7–8× revenue, so expectations are baked in

- Competitive space - others like Cloudbeds, OTAs themselves, or PMS vendors could fight for share

Final Take

SiteMinder’s looking like a well-run SaaS business on the verge of real scale. It’s got that “Xero-in-2012” feel - smart product, global footprint, and strong growth with improving margins. If they keep executing, grow those higher-margin upsells, and stay cashflow positive, there’s long-term upside.

Not a bargain-bin stock, but one with a solid strategy and a moat that’s quietly deepening.

Given the sizeable lots, this looks like Australian Ethical Investment has upped its stake in SDR by 1.27% between 3 Apr and 6 May, to now hold 6.31%. Can’t hurt!

Discl: Held IRL and in SM

The following few SDR slides from the Macquarie Conference caught my eye:

Firstly, the Trading Update. Acceleration of the ARR sounds promising ..

This was a simple slide, but helps clarify where SDR plays between the Hotel and the Global Travel Distribution Channels

Lastly, 2 slides on its resillience. Presumably this is in response to market concerns that discretionary travel could be hit when the proverbial hits the fan once tariffs kick in, talk of recession etc.

One of my key thesis drivers when I first looked at SDR was that it more than survived Covid when the travel industry was as decimated as could be - my thinking than, and still remains, is that if it can survive Covid, it should be able to survive anything thereafter ...

The FY25 SDR results will be extremely interesting as it will reveal the traction from the rollout of Smart Platform products vs global concerns on recession, cutback of discretionary spend and how that impacts revenue and growth ...

Discl: Held IRL and in SM

Welcome to the SDR register, KKR .... a nice confidence booster which can't hurt.

Price has recovered nicely in line with the broader market. But will be interested to see how SDR travels through end-May/early June when tariff realities full bite and the Yanks reassess further discretionary spend like travel ...

Discl: Held IRL and in SM

Nice to see 2 Directors buying on-market into SDR's freefall. Looks like a staged action though - the volume is "coincidentally" around 10,000 shares. Probably small coin for them, but still 1 zero more than spare cash that I have. Definitely happier with them buying than selling!

From today's chart, looks like the selling has abated somewhat today, closing at $4.90, which was around where I thought it would find support. Whether it holds or not will be revealed in the next few days. But it is entering into my buy zone quite nicely now ...

Discl: Held IRL and in SM

SiteMinder's results seemed pretty good to me.

Revenue up 17.2% and ARR growing 22.0%, but the market reaction suggests expectations may have been higher? This pace of growth is well below their medium-term target of 30% organic annual revenue growth.

Also, while they're making strong progress with their "Smart Platform" strategy, short-term incentives have weighed on subscription revenue growth (up just 11.8%). It's really just a marketing expense, and hopefully justified given the high customer retention and stickiness of the product.

There is also the fact that prior to today shares were trading at 8.3x ARR -- which aint cheap by any traditional standard, and assumes strong and lasting growth. So they really needed to knock it out of the park with these results to justify a further expansion of sales multiples.

Another assessment from Morningstar, with a bit more detail into their assumptions of SaaS metrics.

Stock Pitch: SiteMinder

An underestimated future category leader.

Roy van Keulen

Market struggles to see a clear path to profitability

The company’s lack of profitability as a listed company, despite an unusually supportive backdrop in recent years, is weighing on the shares.

Our Take

SiteMinder (ASX:SDR) is coming off a heavy investment cycle and has launched more substantively new products than any other company within our Australian technology coverage. The products are unique in the market, and we expect them to be highly appealing as they allow hotels to attract significant incremental demand, with limited incremental expense or effort. We believe these products will differentiate the company’s offering and allow it to pull away from competitors. We think this is likely to result in strong secular growth that will outweigh any cyclical softness in travel spending.

We see a clear path to profitability

- SiteMinder has invested to develop several new products: Channels Plus for demand aggregation, Dynamic Revenue Plus for pricing optimization, and Smart Distribution for inventory management.

- These products are unique in the market, driving differentiation and growth. Current R&D spending therefore doesn’t reflect baseline spending as it is not needed to stay up to date with competitors. Although we expect ongoing investment in absolute terms, we expect it to moderate as a share of revenue.

- We see SiteMinder’s new products as highly appealing to customers as they unlock incremental demand at little incremental expense or effort. They do this by putting the hotel inventory in front of more eyeballs, allowing them to access a larger pool of demand. These products should provide a new growth engine once launched in fiscal 2025.

- We expect SiteMinder’s new, unique products will improve conversion of prospects and deliver higher average revenue per user, or ARPU, thereby lowering customer acquisition costs, or CAC, per customer and increasing value per customer.

- We expect the new products to drive more business for hotels, which improves hotel unit economics and lowers business failure rates, thereby increasing the lifetime of these higher-value customers.

MARKET CONCERNS

Falling travel demand would reaccelerate losses and cash burn

A normalization of travel spending, or a travel recession, directly flows through to lower revenue. This is as transaction revenue primarily consists of payments revenue, which is a fixed percentage of booking value flowing through the platform.

Falling travel demand will also lead to higher business failure rates, and therefore churn, among SiteMinder’s small- and medium-size hotelier customers. This is a headwind for subscription revenue.

INVESTMENT THESIS

SiteMinder is a SaaS company, not a consumer cyclical company …

We think margins will be much more resilient than the market gives this company credit for. Operating deleverage from a potential downturn in travel demand is less severe than the company’s 70/30 revenue mix would suggest or example, if transactions were to decline by 10% with a 10% decline in travel demand, such as in a severe recession, this would only result in a 2% decline in gross profit for the group. This excludes any impact on subscription revenue, which we expect to be more stable.

Research and development spending is currently elevated

SiteMinder has launched significant new, unique products

- Channels Plus: Allows hotels to connect to dozens of second-tier online travel agencies, or OTAs, with a single connection. This unlocks significant new demand for hotels with minimal incremental cost or effort on the part of the hotel.

- Dynamic Revenue Plus: Allows hotels to automatically adjust room rates to optimize for conversion and yield, which boosts profitability.

- Smart Distribution: Allows first-tier OTAs to add more, and higher quality, inventory to their platforms.

- All three products are unique in the market and benefit from SiteMinder’s unique assets, such as its relations with OTAs, its large customer base, and its proprietary data assets.

SiteMinder is out-innovating other channel managers by a factor of 5

- SiteMinder is the only Tier 1 channel manager in the world, with around twice as many customers and twice as much revenue as Tier 2 channel managers, its closest competitors.

- SiteMinder’s scale allows it to fractionalize costs over a larger customer base, especially fixed costs for integrations with OTAs and existing products. We expect SiteMinder has at least 5 times the resources available for product innovation. Given the industry is early in its digitization journey, we expect high returns on these investments. We see scope for many more processes to be digitized and automated, like OTA marketing campaign management or loyalty programs.

R&D investment has produced compelling new products …

- Hotels operate in a competitive industry with low barriers to entry, resulting in low margins and high business failure rates. This means SiteMinder, and competitors, constantly need to replenish their customer base. It also means hotels should be highly receptive to solutions that help improve their odds of survival, such as SiteMinder’s new products.

- Connecting to OTAs is costly, resulting in hotels typically only connecting to a handful of OTAs.Channels Plus allows hotels to access around 15% of incremental gross booking value, or GBV, with minimal effort. This will mostly fall through to hotel profits given the high fixed costs within hotel businesses. For new SiteMinder customers, Channels Plus is enabled automatically, which should help adoption for SiteMinder and hotels.

- Using SiteMinder’s proprietary data assets, we expect Dynamic Revenue Plus will eventually enable hotels to improve the yield on their rooms by around 15%. This additional revenue is highly profitable for the hotels, given their high fixed costs, and represents a valuable revenue stream for SiteMinder to monetize.

Exhibit 1: New products will drive secular growth …

Sources: Company filings, Morningstar Equity Research. Data as of Nov. 30, 2024.

… Leading to secular growth and improving sales and marketing efficiency

- We expect SiteMinder’s new products to drive immediate benefits from higher conversion thus lowering customer acquisition costs, or CAC.

- In the medium term, as a larger share of SiteMinder’s customers start using the new products, we expect higher ARPU. We also expect lower customer churn due to decreased business failure rates because the products make hotels more profitable. Both help significantly lift lifetime customer value, or LTV.

- Lower CAC, higher value per customer, and longer average customer lifetimes are likely to make SiteMinder’s sales and marketing efficiency world-leading relative to peers. As a corollary, it means sales and marketing as a share of revenue can come down significantly.

Exhibit 2: … And boost sales and marketing efficiency

Sources: Company filings, Morningstar Equity Research. Data as of Nov. 30, 2024.

New products to drive growth and a clear path to profitability

As SiteMinder comes off its heavy research and development investment cycle, we expect the company to start generating strong returns from its investments into new products. We expect this to result in strong and efficient revenue growth, as new products improve conversion and retention, allowing for sales and marketing to come down as a share of revenue. We expect R&D investment to remain relatively fixed. We expect any cyclical downturn to have only a limited impact, given the long secular growth trajectory.

Intelligent investor weighs on SDR bear case

Research Wrap

Little Aussie Tech stocks are having a moment. SiteMinder, an unprofitable business that helps hotels navigate the complex world of online travel agents, has a higher price-to-sales ratio than Booking.com, Expedia and Airbnb, all of which are profitable.

Even worse, the company is—perfectly legally—minimising its losses by taking some of its payroll off the income statement, which in the trade is called ‘capitalising R&D’. Strange but true: accounting standards mean companies now get to decide whether developer salaries in a software business are a cost or an asset ($).

Other than the growth, where is the Rule of 40 in this chart?

This is more expensive than, dare I say, Gentrack? I remember screening this before and the Price to sales of SDR is "through the roof"

I’m on the sidelines now after a decent run.

Balidor then Leslie Szekeley sales, and more recently Paul Wilson as well. Too much movement for me to be comfortable.

Seems clear that BTI wanted to emphasise that this is just a small adjustment, but which takes their stake below the substantial shareholder threshold. I appreciated the Nothing-To-See-Here tone of the announcement ! The $20m value was somewhat surprising as it seemed rather small.

Discl: SDR Held IRL and in SM

-------------

Bailador has today announced it has completed a $20.0m cash realisation of a small portion of its investment in SiteMinder, while retaining 82% of its holding. The realisation was via a trade at an average price of $6.65 per share, 5.2% above Bailador’s previous carrying value of SiteMinder.

The valuation of this realisation represents an effective IRR of 37.9% and multiple of investment cost of 27.8x on Bailador’s investment in SiteMinder.

Following the realisation, Bailador will hold 4.9% of shares in SiteMinder, below the threshold for substantial holder declarations. As a result, on settlement of the transaction on 1 November 2024, Bailador will lodge a notice with the ASX ceasing to be a substantial holder of SiteMinder.

This realisation provides some rebalancing of Bailador’s investment portfolio, with SiteMinder remaining the largest holding by some margin. It represents a relatively modest realisation of Bailador’s SiteMinder investment, while providing cash availability for additional portfolio investments.

Summarised the CEO's Speech and Preso from this mornings FY2024 AGM as I digest and internalise the information. The more I read about the Smart Platform Strategy, the clearer it is becoming.

I highlighted in bold italics, insights that either I had not picked up before or further crystallises the strategy, all positive!

Discl: Held IRL and in SM

SUMMARY

No new news, but more clarity on the Smart Platform Strategy, the components, progress and revenue impact

No change in guidance for FY2025 but 1QFY2025 looks to be tracking nicely on both subscriber additions, transaction product adoption and Smart Platform development progress

SiteMinder also expects to be underlying EBITDA profitable and underlying free cash flow positive in FY25

SMART PLATFORM STRATEGY

The centrepiece of our plan to build on our strong momentum is the Smart Platform strategy. Announced last year, the strategy is about making the strengths of our platform work better together so we can help our hotelier customers and partners generate more revenue.

The three pillars of the Smart Platform strategy work together to deliver more revenues for hoteliers and our partners.

The key initiatives of the strategy are focused on answering three questions:

Q1. SiteMinder has a large and valuable repository of data unrivalled in size, depth and geographical coverage. How do we make this data accessible and useful to our hoteliers?

Q2. How do we translate that data into actionable recommendations across not just pricing but other commercial levers as well?

Q3. How do we help hoteliers execute those recommendations with minimal effort?

This is about creating a unified revenue management experience, something that doesn’t exist in the industry today but operators are crying out for.

SMART PLATFORM STRATEGY PROGRESS

The team has made great progress on delivering the Smart Platform strategy with all three pillars – Dynamic Revenue Plus, Channels Plus and the Smart Distribution Program – either in pilot or having commenced their launch.

Dynamic Revenue Plus

We were pleased to launch Dynamic Revenue Plus in Australia and New Zealand last month.

Dynamic Revenue Plus provides our hotelier customers with proprietary insights and execution tools to optimise key commercial decisions and drive more revenue. The launch has received very positive feedback from our hotelier customers and industry partners.

Dynamic Revenue Plus will level-up early next year with the integration of pricing recommendations from IDeaS ahead of its global launch in March 2025. IDeaS is the industry’s most trusted revenue management system, and we are pleased to have deepened our partnership with them.

This is very exciting but it is just the start of the journey for Dynamic Revenue Plus.

Advanced capabilities are under development that will combine the latest in artificial intelligence with SiteMinder’s deep and comprehensive data assets, to deliver even greater revenue gains for our hotelier customers. I look forward to sharing more details of these capabilities in due course.

Channels Plus

Second pillar of our Smart Platform strategy and is focused on making it easier than ever for our hotelier customers to distribute their inventory.

In less than five minutes, they can sell their inventory to 30 participating distribution partners. Achieving the same outcome without Channels Plus would take weeks, if not months, and is practically impossible for most hoteliers to sustain.

Today we have more than 1,000 hoteliers and 30 distribution partners signed up for Channels Plus.

We’ve received strong interest from our customers and have received strong support from some of the world’s leading booking platforms.

From January 2025, Channels Plus will be a default inclusion for all new customers on the SiteMinder platform.

Smart Distribution Program

The third pillar of our Smart Platform strategy is the Smart Distribution Program.

The Smart Distribution Program will drive unprecedented collaboration between our hotelier customers and distribution partners to deliver win-win-win outcomes through enhanced connectivity, optimised set-ups and technology investments. The program commenced during the September quarter just passed.

IMPACT ON REVENUE

For SiteMinder the Smart Platform strategy represents more than just incremental revenue.

The strategy transforms our revenue model from one that is just hotelier-oriented and largely based on fixed fees, into one that touches other parts of the travel ecosystem and is increasingly focused on activity based fees. This will allow us to better participate in the success of our hotelier customers and partners.

The three pillars will meaningfully contribute to revenue at different times over the next few years.

The Smart Distribution Program will come first, and its contributions will be compounded by Channels Plus and Dynamic Revenue Plus. Together they will help us achieve our guidance for 30% organic annual growth in the medium-term.

TRADING UPDATE

While we are doing a lot of work to position the company for the future, we have not lost sight of the now and present.

The company has continued to perform well in the first quarter of the 2025 financial year:

- Net property additions are tracking ahead of last year with continued focus on larger properties which present attractive long-term revenue opportunities for the company.

- The adoption of transaction products continues to grow across incoming and existing customers.

- On the Smart Platform, we are progressing as planned with the commencement of the Smart Distribution Program.

- Channels Plus is on track for its full commercial launch in January 2025

- Dnamic Revenue Plus is progressing through its staged launch program with positive early industry feedback.

Our guidance is unchanged. We continue to target organic revenue growth of 30% in the medium-term, aided by contributions from the Smart Platform.

SiteMinder also expects to be underlying EBITDA profitable and underlying free cash flow positive in FY25, and make continued progress on the Rule of 40

With Dynamic Revenue Plus one of Siteminders three pillars of future growth, a lot is riding on the success of this new product line which was launched in Aus in September. As a shareholder I think it’s great, as a consumer, not so much.

It appears the Labor government has a similar opinion with Dynamic pricing models coming into their cross hairs for cost of living relief measures.

Australia is only a small portion of Siteminders overall market, however it does highlight susceptibility of the current strategy to government regulation.

I know people are keen on SITEMINDER but with every hot tip share spike there are shorters around the corner. Short interest spiked with recent price increase.

Its rare to see Morningstar get so bullish in a SaaS valuation:

Updated Aug 27, 2024

We maintain our AUD 10 per share fair value estimate for narrow-moat SiteMinder. The company released fourth-quarter results last month, so the full-year result included limited new information. The shares screen as materially undervalued. The market does not seem to fully appreciate how the company’s scale-based advantages translate into the high winnability of a large market opportunity.

SiteMinder showed operating leverage as the business scales and broadens its product offering. For the past two years, the company increased the number of subscribed properties—which is the closest reported metric to customer count—by around 25%, which helped boost subscription gross margins by around 4 points. Given that SiteMinder works with around twice as many hotels as its closest competitors, we expect its superior scale to allow it to more efficiently translate revenue into gross profit, which the company can then reinvest into the business to make further gains relative to competitors.

SiteMinder is also demonstrating increased leverage from these investments. Despite increasing average subscription revenue per user by 14% over the past two years—which, all else equal, should lower conversion—customer conversion efficiency is improving, as measured by customer acquisition costs per customer decreasing 30% over the last two years. The company cites the use of artificial intelligence across operations, product, and engineering as contributing to the improvement.

Business Strategy and Outlook | by Roy Van Keulen Updated Aug 27, 2024

We expect SiteMinder’s strategy to be wide-ranging, including a focus on attracting new customers, increasing penetration of its current product suite, and developing and launching new products. We view SiteMinder’s strategy as appropriate, despite its wide-ranging nature, as all three focus areas provide large and highly winnable opportunities.

We expect SiteMinder to take significant market share within the hotels industry. SiteMinder’s market share among hotels currently sits in the midsingle digits, yet SiteMinder is the leader in its space, and has twice the market share of its closest competitor. We expect scale-based cost advantages to drive consolidation in the channel manager industry, as subscale players are pushed out of the market and scaled providers, like SiteMinder, take share. Specifically, we expect SiteMinder to take dominant market share in larger single-location hotels, and in hotel chains outside of the largest chains.

We also expect SiteMinder to increase its take rate through increased penetration of its existing product suite, especially through adoption of its transaction-based products. We estimate transaction-based revenue currently makes up around 10 basis points of the gross booking value, or GBV, of SiteMinder’s customers. For comparison, SiteMinder Pay has a take rate of around 2%-3% of payments that are processed through a hotel’s website or, from fiscal 2025, also on payments processed at a hotel’s premises. Similarly, SiteMinder Demand Plus has a take rate of 15% on incremental demand generated through search engine optimization.

Finally, we expect SiteMinder’s new products to be significant growth drivers, especially Channels Plus. We expect Channels Plus, which aggregates several smaller channels into a single channel, will see rapid adoption among SiteMinder’s existing customers, and help attract new customers. Although the take rate of this product is like that of payments, we expect its uptake to be much higher, due to its more differentiated nature, as well as the clear value it provides.

Economic Moat | by Roy Van Keulen Updated Aug 27, 2024

We assign SiteMinder a narrow economic moat based on switching costs, cost advantages, and nascent network effects.

Over 40,000 small and midsize accommodation businesses use SiteMinder’s e-commerce software to increase their room utilization, rates, and profitability, which is around twice as many accommodation businesses as use the products of its closest competitors. SiteMinder is principally a channel manager, meaning it provides the infrastructure for hotels to connect to travel channels—such as Booking.com and Expedia.com. Secondary tools include software for direct bookings, search engine optimization, corporate travel channel management, payments, and analytics.

We consider SiteMinder’s economic moat to be widest in its channel manager product. Like with other software-as-a-service, or SaaS, companies, SiteMinder’s products benefit from switching costs. These switching costs principally arise from the mission-critical nature of the products and the risks related to switching vendors—companies switching vendors risks core channels of customer demand temporarily not working or not working as well as they had previously. Additionally, there is direct time and expense involved with setting up channel managers. As customers adopt more products from SiteMinder’s suite, these switching costs increase commensurately.

SiteMinder’s customer retention metrics reflect its switching cost-based economic moat. Monthly revenue churn—which the company defines as the value of monthly recurring revenue attributed to subscribers who terminate their contract in a specific month—is about 1%, which implies about 12% churn on an annual basis. We consider this to be in line with other moated SaaS companies that have customers of comparably low quality and therefore also have a relatively high base churn rate due to the higher business failure risk inherent in their respective industries. We estimate business failure in the hotel industry, when adjusted for the size and maturity of SiteMinder’s customers, is around 9%. We believe business failure rates for SiteMinder customers are around 7%-8%, meaning its customers slightly outperform the industry average, which hints at utility-based switching costs. Of the remaining customers, the largest share switch because they have outgrown SiteMinder’s product geared toward very small hotels, Little Hotelier, not because they switch to a competing vendor.

We believe SiteMinder’s economic moat goes beyond switching costs. We see cost advantages from the company’s scale relative to competitors. Channel managers build the infrastructure to connect demand channels to property management systems. Given that the property management system market is highly fragmented and hotels typically only use one property management system, channel managers that integrate with a larger number of property management systems can tap into a larger base of prospective customers. Demand channels, on the other hand, are far less fragmented, with narrow-moat Booking and narrow-moat Expedia commanding the vast majority of market share. Nearly all hotels use these channels. Additional channels typically focus on niche demand, such as certain geographies, types of buyers (bulk buyer tour operators), price points (budget versus luxury) or specific use cases (last-minute and mystery bookings.) Although these channels are smaller, each incremental demand channel can help drive commensurate incremental demand and is therefore crucial to top-line and especially bottom-line performance for hotels. In addition to breadth of integrations, we believe customers also value the depth or quality of integrations, such as the number of data fields connected, and the reliability and security of connections.

Building the infrastructure to connect demand channels and property management systems is largely a fixed cost, consisting of technical costs from mapping data fields between systems, and incorporating regulatory logic. These costs are ongoing as technical specifications and regulations will constantly change. However, like with other infrastructure, costs are largely disconnected from usage. Given that we don’t believe different channel manager providers can build this infrastructure with a higher level of efficiency than peers, we believe SiteMinder’s superior scale provides it with a cost advantage, as it can spread out the costs over a customer base that is at least twice the size of its closest competitors.

We view SiteMinder’s scale-based economic moat as strong and don’t believe competitors have attractive options to escape their lack of scale. Competitors can try to offer similar coverage as SiteMinder, in terms of the breadth and depth of integrations, but this would reduce financial resources available for sales and marketing, or product innovation. Given high industry churn, this would see them quickly losing market share, as churned customers are not replenished at an appropriate rate. Alternatively, competitors can try to push harder on sales and marketing, while letting the product fall in quality and hoping for the market to be inefficient. However, we believe that having fewer demand channels would lead to higher business failure rates among their customer bases, thereby dampening market share gains. Focusing on product innovation also seems an unlikely solution, as SiteMinder can likely copy any innovations before they start to affect market share and do so at superior scale. Essentially, we believe that due to the cross-border nature of travel, the small and midsize segment of the hotel industry will consolidate globally toward the largest company with the broadest and deepest set of integrations.

We see SiteMinder’s superior scale evolving into network effects. Although channel managers provide access to hundreds of demand channels, most hotels only use around half a dozen channels due to the required costs to set up each channel, both from a technical and a commercial perspective. SiteMinder, using its superior scale, is standardizing various second-tier channels—such as Trip.com, Agoda.com, and Hopper.com—so that they can be accessed as a single, first-tier channel. Although this Channels Plus product is nascent, we believe it is a natural evolution of SiteMinder’s leading market position and will prove to be a highly attractive channel for hotels due to higher leverage on setup costs. In turn, we expect more second- and third-tier demand channels to join SiteMinder’s standard to connect to a large and growing pool of hotel inventory.

Fair Value and Profit Drivers | by Roy Van Keulen Updated Aug 27, 2024

Our fair value estimate for SiteMinder is AUD 10 per share, implying an enterprise value/sales multiple of 12 on our fiscal 2025 estimates. We use a weighted average cost of capital, or WACC, of 9%, reflecting high revenue cyclicality, medium operating leverage, and low credit risk.

We assume revenue to grow at an organic compound annual growth rate of 22% over the next decade, driven primarily by transaction-based products, including Channels Plus. We expect EBIT margins to expand to 18% by fiscal 2034, compared with negative 13% in 2024. We expect SiteMinder’s operating expenses to decline as a share of revenue over time, as it evolves from a middleware software company to a platform company. We expect this to result in lower customer acquisition costs, and integration costs with the platform increasingly being born by network participants, such as online travel agencies and hotels, rather than by SiteMinder itself.

Risk and Uncertainty | by Roy Van Keulen Updated Aug 27, 2024

We assign SiteMinder a Morningstar Uncertainty Rating of High.

We see high risk from economic cyclicality. Although most of the company’s revenue and gross profit comes from subscriptions, an increasingly large share of the company’s business will be coming from transaction-based products, which follow the highly cyclical travel industry.

We see medium risk from competition. SiteMinder is the largest provider in an industry where scale matters. SiteMinder can charge lower prices than competitors due to its ability to fractionalize fixed technological and regulatory costs over a customer base twice the size of its closest competitor. However, SiteMinder’s scale advantage is not insurmountable and we believe the market for channel manager software is not especially efficient. We expect SiteMinder’s competitive position to improve over time as its new Channels Plus product starts creating a network effect between hotels and online travel agencies.

Finally, we see medium risk from execution. We expect SiteMinder’s Channels Plus product will be a significant driver of revenue growth, margin expansion, and help widen its economic moat. But the product is still in its early stages and adoption of the solution could miss expectations.

Capital Allocation | by Roy Van Keulen Updated Aug 27, 2024

SiteMinder has an Exemplary Morningstar Capital Allocation rating, reflecting our assessment of a sound balance sheet, exceptional investment efficacy, and appropriate shareholder distributions.

SiteMinder’s balance sheet is sound. As of the end of June 2024, it held significant cash with no debt.

We rate investment efficacy as exceptional. The primary contributor to our rating is SiteMinder’s investment in new, market-leading products, such as Channels Plus. We view these as contributing significantly to SiteMinder’s economic moat through the establishment of network effects.

SiteMinder does not currently return capital to shareholders, which we view as appropriate, given that the company is currently not profitable

Anyone aware of who bought so aggressively?

Bear - 20% Revenue growth slowing to 15%

Base - 25% Revenue growth slowing to 20%

Bull - 30% Revenue growth slowing to 20%

Discount rate lowered to 12.5% since operating cashflow positive milestone met.

SUMMARY

A very good all round operational result - very hard to find fault with it as the business appears to have fired on all CURRENT cylinders.

Smart Platform new capabilities are being progressively rolled out in 1HFY25 - sets the foundation for a good step up in revenue in 2HFY2025.

Focus is now increasing on larger hotel properties vs SDR’s earlier focus on small hotel properties - this opens up the TAM, is a good sign of growing product/platform confidence and will support future revenue momentum given the higher Gross Booking Value of larger hotels

Am very bullish as things are falling into place very nicely.

Thesis of SDR being the dominant platform in small and medium-sized hotels is very much intact and in play with the existing capabilities, and with the promise of more from the imminent Smart Platform capability rollout.

Market does not seem to have recognised this and prices have fallen to my top up zone of ~$4.90

Topped up today at $4.92 IRL and in SM, with dry powder kept on standby to further top up around $4.60, if prices fall to those levels.

Disc: Held IRL and in SM, High Conviction holding

Financials (all amounts and %’s are YoY comparisons)

Total revenue up 26.0% to $190.7m - while this is shy of SDR’s “medium term” goal of ~30% annual organic growth, it has grown at a fast clip and is before new Smart Platform capabilities are released.

- Subscription revenue up 18.8% to $122.4m, driven by a 13.8% increase in properties of 5,400 to 44,500 properties

- Transaction revenues up 41.2% to $68.3m, driven by strong Transaction Product Uptake which increased 41.2% to 26,300 products

- ARR is up 20.7% to $209.0m

- Revenue mix is shifting slowly in favour of Transaction Revenue, from 68% Subscription:32% Transaction to 64%:36%

- Revenue was earned more or less evenly across all 3 regions of APAC, EMEA, North America

Margins have been sustained:

- Reported margin - 66.7%

- Underlying subscription GM improved from 83.2% to 85.1%

- Underlying transaction GM moderated from 34.8% to 32.0% due to product mix, temporary expansion into new segments and acquisition channels - no concerns on this

Underlying EBITDA turned positive from FY23 ($21.9m) to FY24 $0.9m, importantly, this occurred in 2HFY24, reflecting the benefits of operating leverage and cost discipline

LTV/CAC continues to improve on a steep trajectory - 31.7% improvement from 4.1x to 5.4x

- Customer Lifetime Value improved 8.3% from $22,312 to to $24,130

- Customer Acquisition Cost (CAC) improved by 18.2% from $5,469 to $4,472

Rule of 40 performance improved 230%, from 5 to 17, reaching 21 in 2H

Operating leverage is kicking in as revenue increases - this is very evident in falling product Development Cost despite the intense focus on developing and deploying the new Smart Platform capabilities in the back half of FY2023.

Balance Sheet

Underlying FCF improved from ($34.0m to ($6.4m)

- FCF as a % of revenue improved from (22.5%) to (3.4%)

- FCF positive was achieved in 2HFY24, generating $2.3m or 2.4% of revenue

$72.3m in available funds, which includes $30.0m of undrawn debt facilities

3-Pillar Smart Platform Strategy

Clear evidence that the SDR platforms are being actively used

The industry is coming onboard, including the big Global Distributors

New capabilities appear on track for rollout in 1HFY25 - expect revenue to get a good leg up in 2HFY25 as a result

My notes on SDR's Appendix 4C and Trading Update today. I really like how things are panning out not only for FY24, but also what is ahead for FY25 ...

Disc: Held IRL and in SM

TAKEAWAYS

- Operating leverage and cost management is evident from the 4C, which should translate into improved EBITDA

- 2H Revenue of $99.0m, has increased $7.3m or ~8% from 1H revenue of $91.7m

- 2H Operational Costs of $86.6m has fallen $7.3m, ~7.7% from 1H costs of $93.9m

- Good solid growth across all metrics, but suspect it will fall short of 30% annual organic revenue growth in FY2024 - this 30% growth was positioned as a “medium-term” objective, so not achieving this in FY2024 should not be an issue so long as SDR demonstrates tangible YoY growth, which the 4C and Trading Update suggest, it has

- FY2024 into 1HFY2025 is the period where significant capability is being piloted, built/improved, ready for rollout throughout FY25 - Dynamic Revenue Plus, Channels Plus, Payment Solutions, Metasearch Manager, and the newly announced Smart Distribution Program - the rollout of these capabilities broadens SDR’s monetisation opportunities and hence, underpins the medium-term 30% organic growth target guidance

- The FY24 growth is thus all the more impressive as it does not include any revenue from any of these new capabilities

- Assuming the new capabilities are rolled out in FY25 as planned (and indications thus far that they are on track), FY25 revenue growth could be very interesting ...

Summary of the Updates on Key Metrics

SMART PLATFORM STRATEGY

Dynamic Revenue Plus

- Equips hoteliers with the ability to assess and react to changes in demand quickly and accurately - commenced pilot in Australia and NZ.

- Phased development is progressing as planned with the ANZ release on schedule for Q1FY25

- Entered into agreement with IDeaS to provide price recommendations for the product - 35-year track record in hospitality pricing, industry’s most trusted revenue management software - combines IDeaS pricing engine with SDR’s distribution execution capability and deep global and local intelligence to reset how hoteliers execute revenue management

Channels Plus

- Allows hoteliers to expand their distribution to multiple channels with ease and control

- General release remains on track for Q2FY25

- Pilot commenced in April, attracted interest from 25 distribution partners

Smart Distribution Program - Newly Announced

- 3rd pillar to accelerate and expand the revenue potential of SDR’s Smart Platform

- Designed to accelerate and expand the revenue potential of the Company’s Platform

- Secured support and commitment from key global distribution partners to jointly improve the distribution configurations of hoteliers through the Smart Platform to capitalise on significant opportunities to maximise revenue performance

TRANSACTION PRODUCT INITIATIVES

Payment Solution

- Extended into SIN and HKG, additional markets will go-live in FY25

- Work on introducing physical payment terminals, well progressed, pilot scheduled to commence in Q2FY25, followed by staged rollout from Q3FY25

Metaseach Manager

- SDR’s metasearch solution for the enterprise segment

- Entered pilot with strong interest from hotel groups looking to better manage their meta search campaigns

GUIDANCE

- Still targeting 30% organic annual revenue growth in the medium term, aided by contributions from the Smart Platform

- No change to financial guidance

- Underlying EBITDA profitable

- Underlying FCF positive for H2FY24

Morningstar imitating with a $10 price target.

Same points made:

- $40M of cash and move to CF positive in FY25.

- Expect metrics to adopt that of a platform as the channel manager industry consolidates - SDR being the leader at double other market shares at 5% - natural winner (some risk this does not happen). SDR then becomes natural choice lowering customer acquisition costs.

- Attraction to hotels to use SDR due to operating leverage from incremental guests despite dominance of Booking.com and Expedia.

Good to know Aust Super is accumulating SDR, adding another 1%.

The Good

- Increase in positive operating cash flow to $4.9m for the quarter. FCF is still not quite positive due to investing cash outflows of $5.3m. Siteminder is trending well to meet their FCF target by the end of FY24.

- Operating expenses remain flat, so going forward, most of the top line growth should be going to the bottom line.

- $39.5m in cash available as the business reaches FCF positive. Cash balance should improve going forward offering a solid operational buffer for future R&D spend.

- 14 agreements signed on for Channel Plus which indicates there is a demand for the new product. Currently this is running in pilot for Q4FY24 so unlikely there will be any significant contribution from Channels Plus until H2FY25.

The Not So Good

- ARR is up YoY and the previous quarter but still down on Q1. It’s a similar story with quarterly revenue, which has been largely flat for FY24 and still down on Q1. For the company to be close to the targeted growth rate of 30% much of this will need to come over the next 2 quarters.

What To Watch

- Channel Plus and Dynamic Revenue Plus release as per target in Q1FY25

- Siteminder Pay Terminals rollout in H1FY23

- Updates on Little Hotelier Autopay and contributions to increase in transaction revenue.

Watch Status

- Unchanged. Slower growth QoQ but business developing opportunities for FY25 and beyond.

Valuation Status

- No Change

Board

Inside Ownership Ordinary Shares %SDR Issued Net Value at $5.40

Pat O’Sullivan 65,976 0.02% $356K

Sankar Narayan 7,147,691 2.58% $38.598m

Jenny Macdonald 54,525 0.02% $294K

Paul Wilson 16,760,807 6.05% $90.508m

Les Szekely 15,549,072 5.61% $83.965m