Per Macquarie - this is in regards to the travel industry for CTD/FLT. Most of this seems positive read through in terms of conditions. Hopefully offsets weakness in the US from Trump.

Volumes better than feared. Since peak tariff uncertainty in Mar/Apr, the market has been concerned about overall volumes and activity in the US. US volumes appear to be holding up better than feared, with 2QCY24 TSA data down only -0.9% YoY. Subdued inbound leisure volumes will likely be a headwind, with inbound volumes from Canada/Mexico down 13%/7% in June. Across other regions volumes are solid, outside the timing of Easter shifting some travel to April.

• Airfare deflation still a headwind. Although the pace of airfare deflation has slowed, it remains a headwind and is likely most severe in the US (domestic fares down -3% in May). US airlines have been rationalising capacity to reflect the demand outlook. Combined with softer traffic, this has driven an increase in airfare deflation. In ANZ, we expect domestic airfares to grow at inflation and international to deflate mid-single digits. Continued international deflation is a drag on TMC's commissions and overrides, but appears to be stimulating volumes.

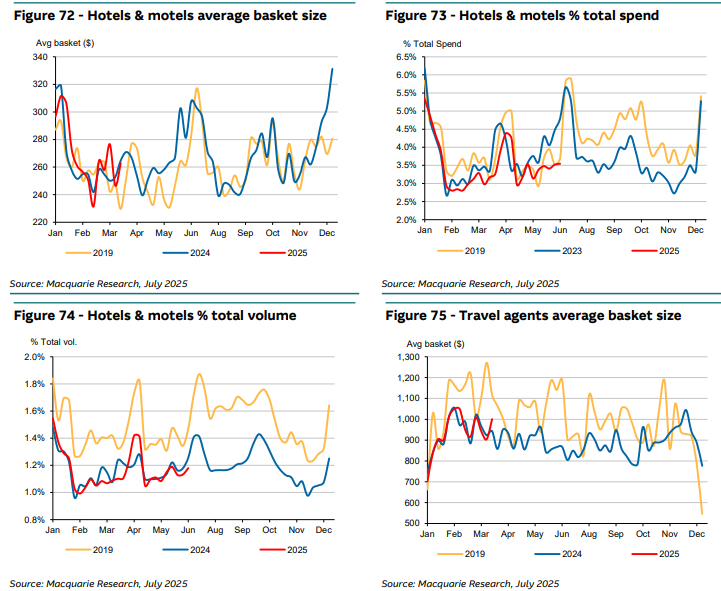

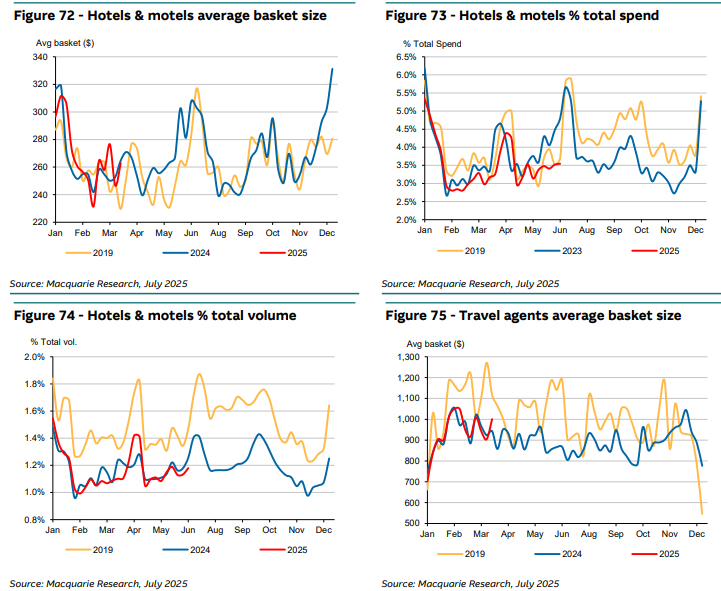

• Hotels and accomodation. Recent industry calls with European operators indicated industry conditions remain strong. Although conflict in the Middle East has caused some disruption, it appears to be isolated to specific countries, and concentrated around major news events.