Intelligent investor weighs on SDR bear case

Research Wrap

Little Aussie Tech stocks are having a moment. SiteMinder, an unprofitable business that helps hotels navigate the complex world of online travel agents, has a higher price-to-sales ratio than Booking.com, Expedia and Airbnb, all of which are profitable.

Even worse, the company is—perfectly legally—minimising its losses by taking some of its payroll off the income statement, which in the trade is called ‘capitalising R&D’. Strange but true: accounting standards mean companies now get to decide whether developer salaries in a software business are a cost or an asset ($).

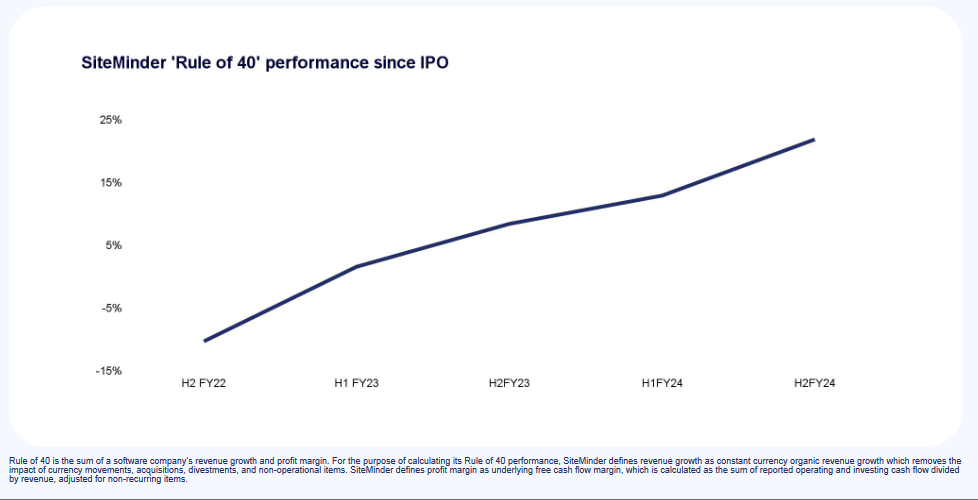

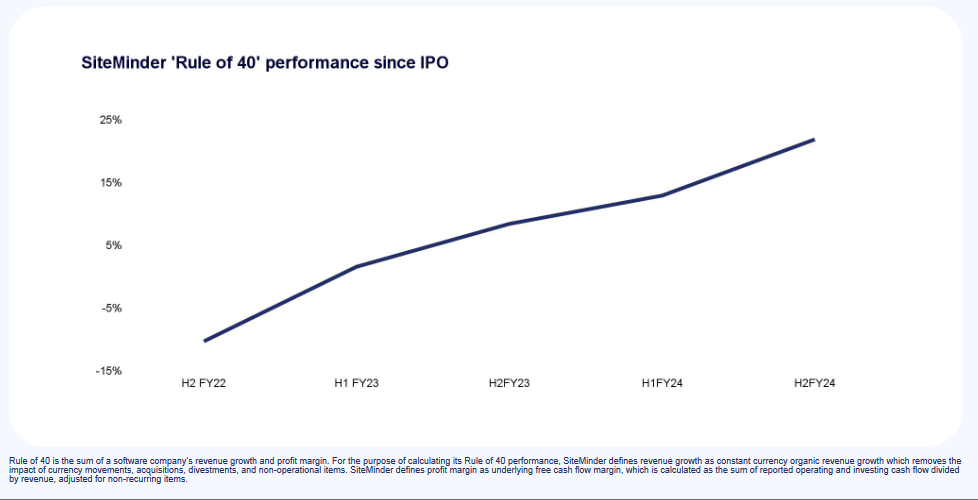

Other than the growth, where is the Rule of 40 in this chart?

This is more expensive than, dare I say, Gentrack? I remember screening this before and the Price to sales of SDR is "through the roof"