Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Discl: Held IRL 4.80% and in SM

Keeping a close watch on the SDR chart as the position allocation drifts below the ~6% allocation I would ideally like to be holding.

The 5.64 to 5.95 support zone has held up very nicely since late Nov 2025. This is a rather interesting technical zone as it is at the confluence of 3 "usually-strong" support factors:

- Medium-term support/resistance going back to March 2024 and prices bouncing up from this zone since late Nov 2025

- Rectracement from the previous uptrend move is around 50% on no adverse news - quite a bit of froth should have been taken out in the process

- The 200day Simple Moving Average is hovering around 5.63

With these 3 factors occurring at roughly the same level, the theory suggests that this may be a reasonable place to top up ...

If this area does not hold, then the next support looks to be ~5.45, from which the last gap up occured following the FY25 earnings announcement in late Aug 2025, failing which, 4.81 to 4.92.

Discl: Held IRL 5.10% and in SM

SDR is looking to have entered a nice top up zone for me:

- Approaching the 50% retracement level from the recent run up at ~5.69

- The 5.64 to 5.95 is a medium-term support/resistance area that goes back to March 2024

- The 200 SMA line is hovering around 5.46, providing the next downside support

- Thereafter 5.15 is the 61.8% retracement level

Discl: Held IRL 5.72% and in SM

Had a quick look at the SDR FY25 AGM material. It was a good opportunity to sit back and reflect on the journey thus far (super-pleased) and where this is all heading (north-ward bound!).

The one significantly misunderstood aspect of SDR is that it is NOT a channel distribution manager but a central revenue platform manager. Very pleased that during the FY25 results and the recent Investor Day, management has used more decisive and precise language to articulate this sharp pivot in positioning - this continued in the CEO address, highlighted below.

KEY THEMES FROM ADDRESSES

The SiteMinder team is delivering: “We are delivering for our investors, achieving a strong financial performance headlined by accelerating growth, improving unit economics, and critically, profitability, with both underlying EBITDA and free cash flow positive for the financial year”

On AI:

“We are not just participating in this shift; we are defining the future of our industry”

On FY25:

“It was a year defined not just by our strong financial achievements, but by the successful execution of our Smart Platform strategic plan”

“FY25 was a year where the travel industry faced volatile and challenging trading conditions buffeted by geopolitical conflicts and policy pivots. Against this backdrop, SiteMinder managed to deliver robust growth and momentum .... This acceleration is a powerful endorsement of the resilience of the business, our strategic product initiatives and the growing value hoteliers find in our platform”

“Our enhanced operating model provides the healthy, self-sustaining bedrock for our continued expansion, ensuring that our growth is fully funded by our own success”

On the Smart Platform:

“By successfully executing the Smart Platform strategy, SiteMinder is leading efforts to address critical challenges facing hoteliers, and redefining how the hotel industry manages revenue and guest acquisition

“We are moving beyond the role of a channel manager to become their central revenue platform - the unified interface where revenue decisions are made, executed, and automated.

On the opportunity ahead:

Our current annual recurring revenue unlocks approximately 0.3% of the $85b of gross booking value we facilitate. This is a very small fraction of the value we create for our hoteliers. However, when we estimate the potential value unlock at full product attach - meaning customers adopting the full suite of Smart Platform tools - that figure rises to over 1.5%. This is a significant revenue opportunity simply by deepening our relationship and value delivery to our current customers. This is an organic, high-margin, and a greater share of wallet from additional product adoption.

Outlook and Trading Update:

“ ... the positive momentum from the end of FY25 has continued, with ARR growth (on a constant currency and organic basis) tracking in like with the rate achieved in FY25 (27.2%) - reinforcing the stability and resilience of demand across our platform”

Only picked up 2 new slides, worth pointing out:

Good summary of the momentum in play across the SDR business

And the opportunity ahead - the Smart Platform rollout is really only just beginning.

Chart Review

The share price made another all-time high today, peaking at $7.96. While I think the market is taking notice and becoming increasingly bullish, the price does feel somewhat exhausted for now after the post FY25 results re-rating. I do not expect it to do too much other than bounce around at this levels and retrace a bit - not a bad thing to take some froth out of the price ahead of the 1HFY26 results.

Discl: Held IRL and in SM

Very pleased to see SDR make a new all-time-high price of $7.85 today, surpassing its previous all-time-high price of $7.77, which was achieved on the day it listed on 9 Nov 2021. It has never seen this level until today, 3 years 11 months-ish later.

The price did not have sufficient momentum to close above $7.77, settling at $7.72 instead.

It sure has been a bit of a journey ...

Since the FY25 results pop, the re-rating has been rather orderly and textbook-like. Probably due for a bit of consolidation and thus expect the price to move sideways a bit, quite possibly down to ~$6.60-ish, which would be very healthy for the price thereafter.

Business-wise, SDR is only at the start of the Smart Platform journey, so will be letting this run for quite some time ...

Discl: Held IRL and in SM

Had a good look at the SDR Investor Day Presentation from 23 Sept 2025. It really annoys the hell out of me that as a retail investor, I can’t seem to participate in any of these SDR sessions ...

It is a large pack of slides intended to give investors a deeper understanding of the Smart Platform capabilities, the problems they solve etc. Having had some previous Reservations and Hotel IT systems and operations background, these capabilities make a lot of sense and is very exciting to see.

SUMMARY

There are 6 key themes that emerge from this very software-functionality driven slide pack:

- There is a sharp pivot to positioning SiteMinder as a “Revenue Management Platform for Hotels” - this really makes sense to more sharply differentiate SDR’s capabilities and value add, and allow SDR to pull away from being categorised as a “hotel distribution system” - it should now be clearer that global distribution is only 1 of many SDR’s capabilities

- Introduction of the concept of a “Revenue Flight Deck” - an integrated experiencing unifying intelligence, revenue management and distribution

- Better clarity on the problems that each Smart Platform capability is intended to solve and the value this brings to hoteliers

- The huge volume of very hotel-related data that SDR has and continues to collect, the “SiteMinder iQ” Data Lake that stores and manages this data and how the data is then leveraged to improve internal operating efficiencies and the embedded in the SDR products to enable better dynamic predictive/forecasting capabilities for hoteliers.

- With the Smart Platform, SDR is adding transaction revenue at subscription-like margins.

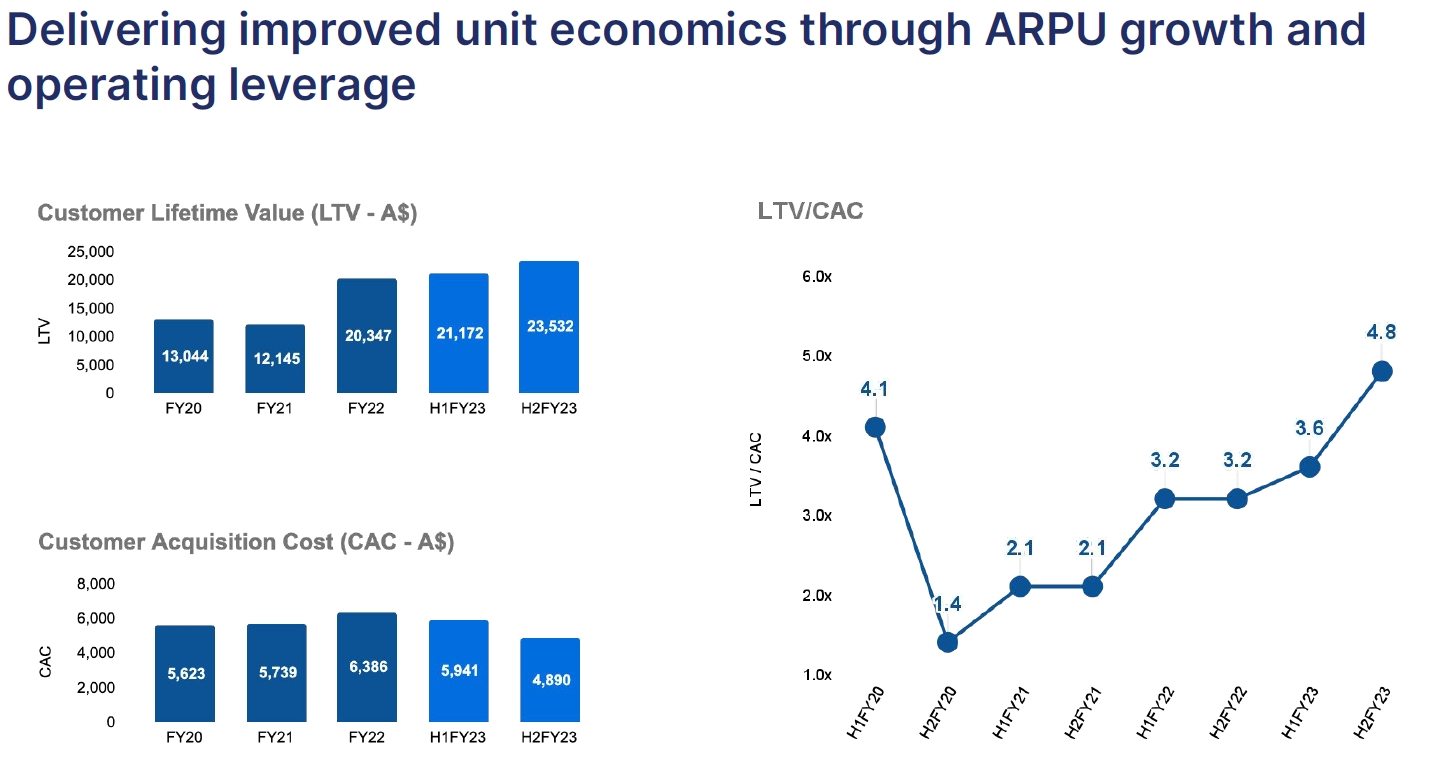

- Unit economics are getting stronger - Lifetime Value is rising, Cost of Acquiring Customers is falling as there is minimal incremental cost to upsell

MY TAKEAWAYS

The harder pivot towards Revenue Management is long overdue. To badge SDR as yet another global hotel distribution platform is to misunderstand SDR’s value add to the hotel industry across the continuum of hotel size

I get the very clear sense that SDR is now in scaling mode with very attractive economies of scale ripe to kick in given the already large base of customers, a significant portion, if not all, who can absolutely benefit from the Smart Platform capabilities

The real SDR journey is now truly beginning ...

SUMMARY OF SMART PLATFORM PRODUCTS

DATA AND AI

Nothing fancy with the SDR Data/AI strategy - it makes sense. SDR has significant data capability, which is is looking to directly monetise:

- $85b+ of Global Booking Value

- 130m+ reservations per annum

- 50k hotels in 150 countries

- 2 year forward rate plans, with full property booking insight

AI is then used on data accumulating in the Data SiteMinder iQ Data Lake to (1) drive efficiencies across operational functions (2) embedded in SDR’s products to drive additional customer value - both adding to the velocity of the flywheels of efficiency and value.

Next generation hotel clustering techniques - the practice of grouping properties most comparable to your own to shape commercial strategies

Leverage AI to deliver statistically rigorous forecasting tools for hoteliers - enable better demand forecasting

GO-TO-MARKET

This brings out the typical lifecycle of the customer, the scaling opportunity ahead with the Smart Platform products and the economies of scale benefits - there is a lot to like with this.

Discl: Held IRL and in SM

Bailador took some nice profit with the sale of ~3.46m SDR shares, ~25% of its holdings of SDR

Post the sale, BTI still holds 75% of its SDR holdings

Market seems to have absorbed the sale very nicely with the share price moving sideways and staying above both the 7.20 support line and the medium term uptrend line, despite the heavier-than-normal volumes - a really encouraging sign of continued price strength.

Nice to see a sharp, detailed, get-stuffed, response from SDR to the Speeding Ticket it received.

Since the re-rating, the price has consolidated in a nice textbook flag pattern, with the all time-high intersecting with the long term uptrend line at ~7.03 up ahead. Expecting the price to go sideways between ~6.40 to 7.03-ish for a while.

Discl: Held IRL and in SM

Discl: Held IRL and in SM

SDR Things To Focus On

Pre-reviewing the results, I listed these 6 questions to answer, followed by the answers:

- Is revenue growing - dollars, ARR, ARPU? Absolutely - a decent noticeable acceleration in 2HFY2025

- Are the Smart Platform products contributing to growth? Hell yeah .... ! Big Tick

- Was there progress on LTV/CAC? Yes, improvement of 0.8x to 6.2x, driven by rising Customer Lifetime Value (LTV) vs flat Customer Acquisition Cost (CAC)

- Was there progress on Rule of 40? Yes, 3.9% increase to 21.3%

- Was there progress in the path to profitability? Absolutely - 2 consecutive Half’s of Positive Underlying EBITDA, EBITDA 2H jumped HoH (1H: $207; 2H $6,704) resulting in SDR’s achieving the target of full year Underlying EBITDA positive in FY25 $7,052 - Big Tick

- Was there progress to positive FCF? Yes, Net Cash from Operations up sharply YoY from $14.4m to 23.6m, Cash Burn fell YoY from ($10.8m) to ($7.6m), cash balance $33.4m, need to peel FCF report more

TLDR SUMMARY

- Cracker of a result all round

- My 1H commentary was “Thesis is very much intact. 2HFY25 should be more interesting as rollout of the 3 Smart Products will be in full swing and the impact of accelerating revenue should be more pronounced.” - this has now played out very nicely

- Smart Platform products are now contributing to revenue and revenue acceleration from 2HFY25

- Strong continued momentum on all operating metrics - ARR, New Property Additions, No of Properties on the Platform, Transaction Product Uptake, ARPU

- Market concerns around slowing travel discretionary spend does not appear to have materialised - revenue growth was strong in all regions

- Translated into strong Revenue Growth across both Subscription and Transaction Revenue

- Margins have improved: Subscription 86.4% (FY24: 85.1%) and Transactions 33.7%, (FY24: 33.7%), Overall gross margin has fallen to 66.3% (FY24: 66.5%) as expected, due to the shifting revenue mix of 62% Subscription: 38% Transaction (FY24: 64%:36%) - very healthy

- Translated into a jump in EBITDA in 2H, and the first full year of Positive EBITDA and Underlying EBITDA

- And improved Free Cash Flow

Chart Review

Market has responded positively, but there is long-term resistance at ~7.03, which goes back to post IPO days of Dec 2021 as well as the long-term upward trend line, both converging at around the same levels, which has limited the pop.

Expecting the price to now bounce sideways around the ~6.40 to 6.50 levels, while the analysts re-crunch the numbers.

Action

None - already fully allocated

This is a long-term high-conviction hold as the thesis is only just starting to play out and need to give management time to build the growth momentum in the next 1-2 years.

--------------------------------------------

Attaching my detailed commentary for anyone interested in the detail:

Financial and Operating Metrics

- ARR has accelerated - sharp jump in 2H, ARR Growth Organic now 27.2% (1HFY25: 22%), driving Revenue Growth 19.2% (1HFY25: 17/2%)

- Significant jumps in Transaction Revenue ARR Growth and Transaction Revenue growth - SDR’s focus to monetise transactions flowing through the platform are now paying off

- Transaction ARR growth of 48.3% YoY Organic is running significantly ahead of revenue growth as the scaling of the Smart Platform initiatives kicked in towards the end of FY25

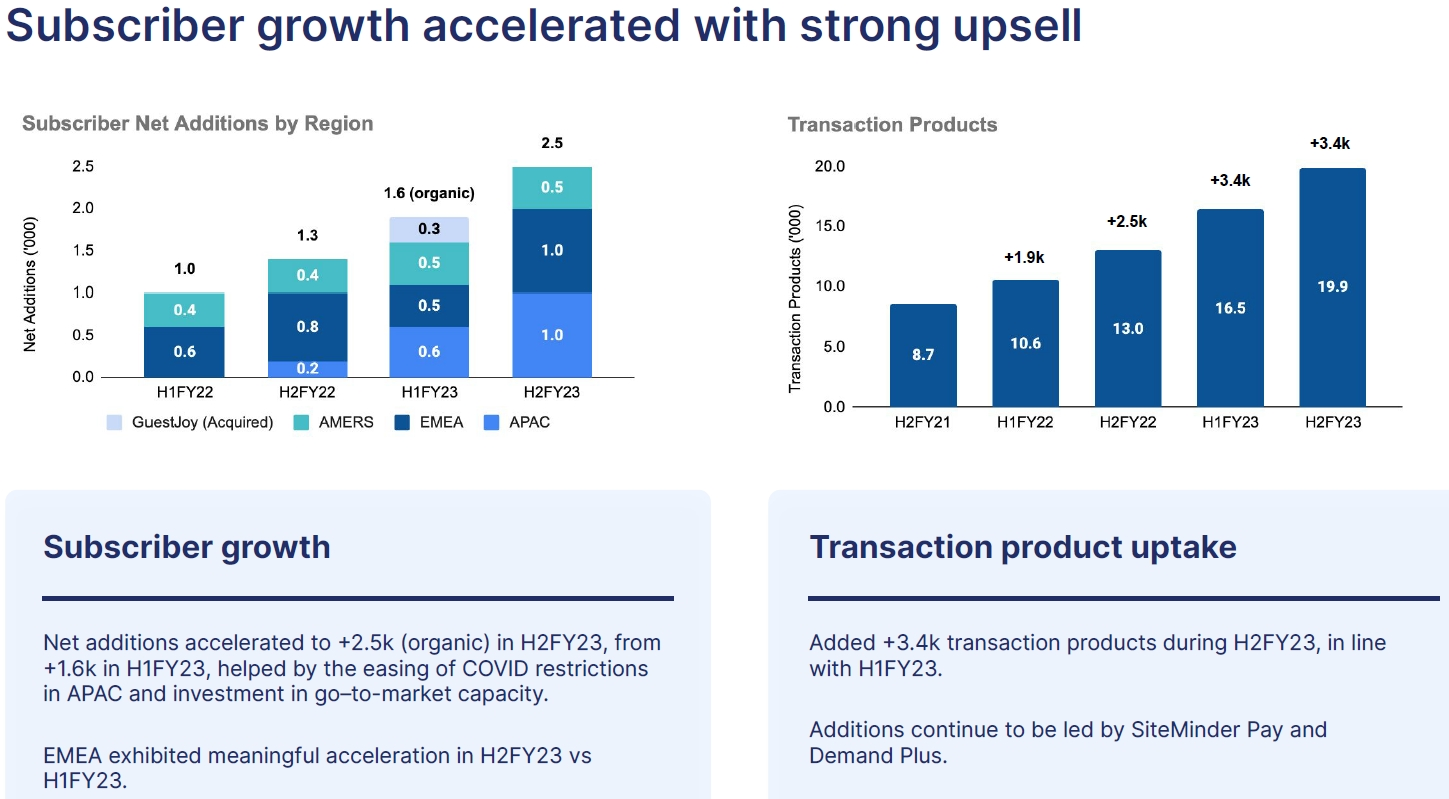

Strong continued momentum in (1) New Property Additions (2) No of Properties on the Platform and (3) Transaction Product Uptake

Continued focus on penetrating larger hotel properties - this was not SDR’s original customer base, but is now becoming significantly more important as SDR monetises Gross Booking Value on the platform.

Which drives continued ARPU increase momentum:

And translating into continued HoH Revenue and Annualised Recurring Revenue growth, respectively

Rate of revenue growth in 2HFY25 has noticeably increased - a 14.8% jump HoH vs fully year increase of 17.7%.

Revenue growth has driven profitability with 2 consecutive Half’s of Positive Underlying EBITDA, resulting in SDR’s achieving the target of full year Underlying EBITDA positive in FY25.

3.9% improvement in the Rule of 40

0.8x improvement in LTV/CAC, driven mostly by Customer Lifetime Value increases, with Customer Acquisition Costs remaining quite flat.

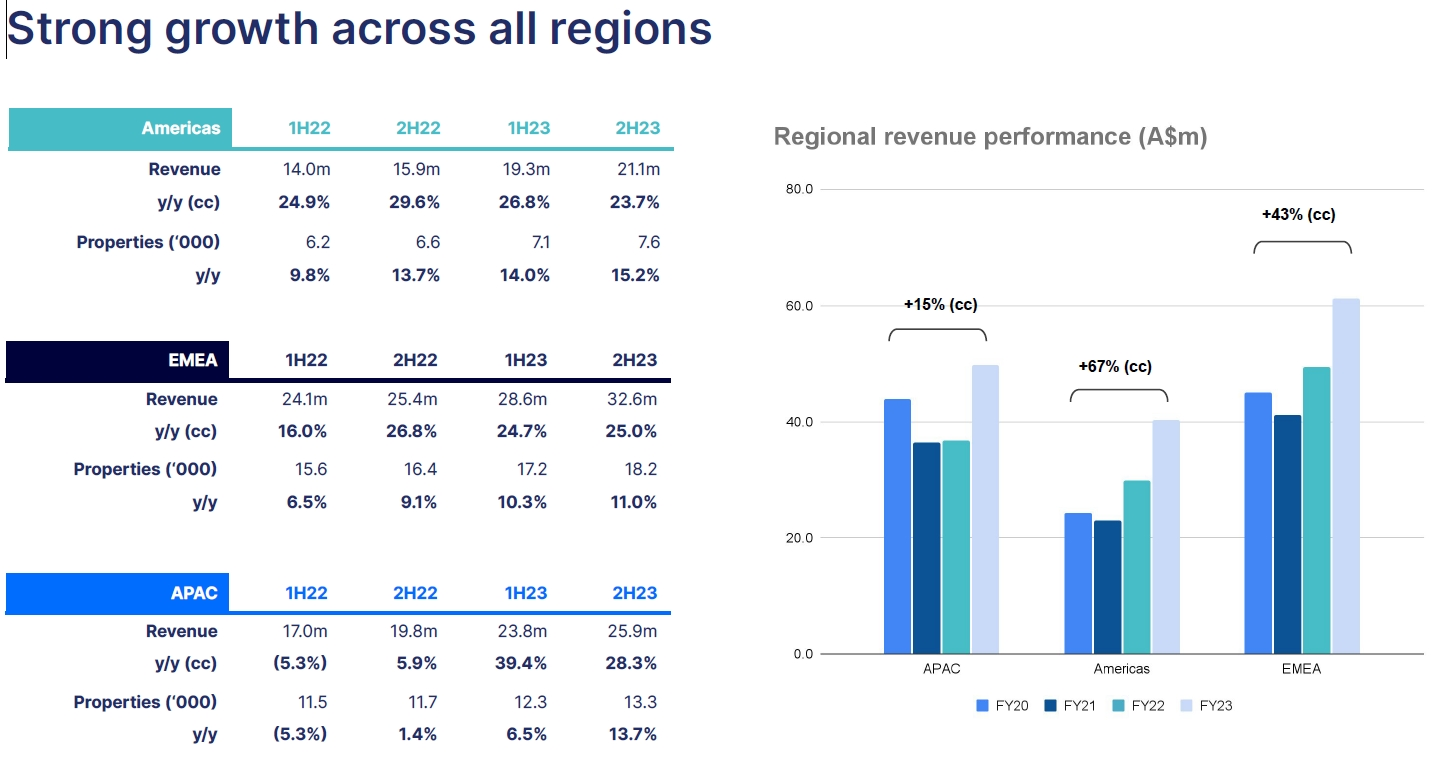

Regional Performance

Revenue growth was strong across all regions - debunking market concerns about slowdowns in travel-related spend, a discretionary expenditure, as cost of living pressures kicked in during FY25

- All regions grew in excess of 20% Organic in 2HFY25

- APAC and EMEA accelerated HoH reflecting resilient travel trends (perhaps the pivot away from the US as a travel destination) and contributions from the Smart Platform initiative

- America’s sustained HoH momentum - contributions from the Smart Platform initiatives offset the moderation in general travel conditions - the Trump effect?

This resilience augurs well for FY26 as the global interest rate cycle moves more firmly towards an easing bias in FY26.

Smart Platform

This is a really good slide which emphasises a point which I think the market still has not got clearly - SDR is not a global room distribution platform alone - it is much more than that.

SDR’s Smart Platform has deeply embedded capability in (1) Revenue Management - previously the domain of large hotels with dedicated headcount to directly manage revenue and (2) Guest Experience ON TOP OF (3) the more traditional “Guest Acquisition” capabilities - a very nice term for the Booking Engine, Global Distribution, Channels Plus capabilities

The monetisation engines would reside primarily in the Guest Acquisition and Guest Experience areas

Late FY24 into all of FY25 was about building out the Smart Platform capabilities and then deploying them to SDR’s customer base - evidence from 2HFY25 is that meaningful revenue is now coming through from these recently deployed capabilities - this was what the market needed to see to believe.

Cash Flow Position

Cash flow performance looks good at face value but need to peel this a bit more, especially the adjustments

- From the cash flow statement:

- Net Cash from Operating Activities was significantly up YoY - FY25 was $23.6m vs FY24 $14.4m

- Net Decrease in Cash fell to FY25 ($7.6m) from FY24 ($10.8m)

- Cash Balance is $33.4m, vs FY24 $40.2m

- No concerns on cash

OUTLOOK

More of the same FY25 in FY26

No change to the general medium-term 30% revenue growth target

Interesting, although I do not fully agree with the point around "room night demand heavily driving revenue". That "hotel room distribution" boxing of SDR's revenue is, in my view, an overly narrow one. The revenue base has platform subscription revenue, revenue management capabilities via the Smart Platform, payments-driven revenue etc.

Sentiment on SDR clearly has been hit by the caution around travel discretionary spend.

Very eager to see how SDR has gone this half amidst that caution, hopefully offset by the increasing impact of the Smart Platform products being rolled out and the ARR that that should drive.

Discl: Held IRL and in SM

The SDR price has recovered nicely and is now sitting above the long-term 200 SMA, clearing 3 resistance areas along the way ...

Given the sizeable lots, this looks like Australian Ethical Investment has upped its stake in SDR by 1.27% between 3 Apr and 6 May, to now hold 6.31%. Can’t hurt!

Discl: Held IRL and in SM

The following few SDR slides from the Macquarie Conference caught my eye:

Firstly, the Trading Update. Acceleration of the ARR sounds promising ..

This was a simple slide, but helps clarify where SDR plays between the Hotel and the Global Travel Distribution Channels

Lastly, 2 slides on its resillience. Presumably this is in response to market concerns that discretionary travel could be hit when the proverbial hits the fan once tariffs kick in, talk of recession etc.

One of my key thesis drivers when I first looked at SDR was that it more than survived Covid when the travel industry was as decimated as could be - my thinking than, and still remains, is that if it can survive Covid, it should be able to survive anything thereafter ...

The FY25 SDR results will be extremely interesting as it will reveal the traction from the rollout of Smart Platform products vs global concerns on recession, cutback of discretionary spend and how that impacts revenue and growth ...

Discl: Held IRL and in SM

Welcome to the SDR register, KKR .... a nice confidence booster which can't hurt.

Price has recovered nicely in line with the broader market. But will be interested to see how SDR travels through end-May/early June when tariff realities full bite and the Yanks reassess further discretionary spend like travel ...

Discl: Held IRL and in SM

Nice to see 2 Directors buying on-market into SDR's freefall. Looks like a staged action though - the volume is "coincidentally" around 10,000 shares. Probably small coin for them, but still 1 zero more than spare cash that I have. Definitely happier with them buying than selling!

From today's chart, looks like the selling has abated somewhat today, closing at $4.90, which was around where I thought it would find support. Whether it holds or not will be revealed in the next few days. But it is entering into my buy zone quite nicely now ...

Discl: Held IRL and in SM

Seems clear that BTI wanted to emphasise that this is just a small adjustment, but which takes their stake below the substantial shareholder threshold. I appreciated the Nothing-To-See-Here tone of the announcement ! The $20m value was somewhat surprising as it seemed rather small.

Discl: SDR Held IRL and in SM

-------------

Bailador has today announced it has completed a $20.0m cash realisation of a small portion of its investment in SiteMinder, while retaining 82% of its holding. The realisation was via a trade at an average price of $6.65 per share, 5.2% above Bailador’s previous carrying value of SiteMinder.

The valuation of this realisation represents an effective IRR of 37.9% and multiple of investment cost of 27.8x on Bailador’s investment in SiteMinder.

Following the realisation, Bailador will hold 4.9% of shares in SiteMinder, below the threshold for substantial holder declarations. As a result, on settlement of the transaction on 1 November 2024, Bailador will lodge a notice with the ASX ceasing to be a substantial holder of SiteMinder.

This realisation provides some rebalancing of Bailador’s investment portfolio, with SiteMinder remaining the largest holding by some margin. It represents a relatively modest realisation of Bailador’s SiteMinder investment, while providing cash availability for additional portfolio investments.

Summarised the CEO's Speech and Preso from this mornings FY2024 AGM as I digest and internalise the information. The more I read about the Smart Platform Strategy, the clearer it is becoming.

I highlighted in bold italics, insights that either I had not picked up before or further crystallises the strategy, all positive!

Discl: Held IRL and in SM

SUMMARY

No new news, but more clarity on the Smart Platform Strategy, the components, progress and revenue impact

No change in guidance for FY2025 but 1QFY2025 looks to be tracking nicely on both subscriber additions, transaction product adoption and Smart Platform development progress

SiteMinder also expects to be underlying EBITDA profitable and underlying free cash flow positive in FY25

SMART PLATFORM STRATEGY

The centrepiece of our plan to build on our strong momentum is the Smart Platform strategy. Announced last year, the strategy is about making the strengths of our platform work better together so we can help our hotelier customers and partners generate more revenue.

The three pillars of the Smart Platform strategy work together to deliver more revenues for hoteliers and our partners.

The key initiatives of the strategy are focused on answering three questions:

Q1. SiteMinder has a large and valuable repository of data unrivalled in size, depth and geographical coverage. How do we make this data accessible and useful to our hoteliers?

Q2. How do we translate that data into actionable recommendations across not just pricing but other commercial levers as well?

Q3. How do we help hoteliers execute those recommendations with minimal effort?

This is about creating a unified revenue management experience, something that doesn’t exist in the industry today but operators are crying out for.

SMART PLATFORM STRATEGY PROGRESS

The team has made great progress on delivering the Smart Platform strategy with all three pillars – Dynamic Revenue Plus, Channels Plus and the Smart Distribution Program – either in pilot or having commenced their launch.

Dynamic Revenue Plus

We were pleased to launch Dynamic Revenue Plus in Australia and New Zealand last month.

Dynamic Revenue Plus provides our hotelier customers with proprietary insights and execution tools to optimise key commercial decisions and drive more revenue. The launch has received very positive feedback from our hotelier customers and industry partners.

Dynamic Revenue Plus will level-up early next year with the integration of pricing recommendations from IDeaS ahead of its global launch in March 2025. IDeaS is the industry’s most trusted revenue management system, and we are pleased to have deepened our partnership with them.

This is very exciting but it is just the start of the journey for Dynamic Revenue Plus.

Advanced capabilities are under development that will combine the latest in artificial intelligence with SiteMinder’s deep and comprehensive data assets, to deliver even greater revenue gains for our hotelier customers. I look forward to sharing more details of these capabilities in due course.

Channels Plus

Second pillar of our Smart Platform strategy and is focused on making it easier than ever for our hotelier customers to distribute their inventory.

In less than five minutes, they can sell their inventory to 30 participating distribution partners. Achieving the same outcome without Channels Plus would take weeks, if not months, and is practically impossible for most hoteliers to sustain.

Today we have more than 1,000 hoteliers and 30 distribution partners signed up for Channels Plus.

We’ve received strong interest from our customers and have received strong support from some of the world’s leading booking platforms.

From January 2025, Channels Plus will be a default inclusion for all new customers on the SiteMinder platform.

Smart Distribution Program

The third pillar of our Smart Platform strategy is the Smart Distribution Program.

The Smart Distribution Program will drive unprecedented collaboration between our hotelier customers and distribution partners to deliver win-win-win outcomes through enhanced connectivity, optimised set-ups and technology investments. The program commenced during the September quarter just passed.

IMPACT ON REVENUE

For SiteMinder the Smart Platform strategy represents more than just incremental revenue.

The strategy transforms our revenue model from one that is just hotelier-oriented and largely based on fixed fees, into one that touches other parts of the travel ecosystem and is increasingly focused on activity based fees. This will allow us to better participate in the success of our hotelier customers and partners.

The three pillars will meaningfully contribute to revenue at different times over the next few years.

The Smart Distribution Program will come first, and its contributions will be compounded by Channels Plus and Dynamic Revenue Plus. Together they will help us achieve our guidance for 30% organic annual growth in the medium-term.

TRADING UPDATE

While we are doing a lot of work to position the company for the future, we have not lost sight of the now and present.

The company has continued to perform well in the first quarter of the 2025 financial year:

- Net property additions are tracking ahead of last year with continued focus on larger properties which present attractive long-term revenue opportunities for the company.

- The adoption of transaction products continues to grow across incoming and existing customers.

- On the Smart Platform, we are progressing as planned with the commencement of the Smart Distribution Program.

- Channels Plus is on track for its full commercial launch in January 2025

- Dnamic Revenue Plus is progressing through its staged launch program with positive early industry feedback.

Our guidance is unchanged. We continue to target organic revenue growth of 30% in the medium-term, aided by contributions from the Smart Platform.

SiteMinder also expects to be underlying EBITDA profitable and underlying free cash flow positive in FY25, and make continued progress on the Rule of 40

Pleasantly suprised to see todays little SDR pop. Technically, it looks like it broke out upwards quite decisively from a nice textbook horizontal flag consolidation in the past week. Theory has it that it "should continue" in the direction of the breakout.

~$7.03 looks like the next resistance zone, this being the 2nd highest peak on 30 Dec 2021 since SDR listed on 8 Nov 2021. This also coincidentally happens to be in the zone of the uptrend line resistance from the low of 28 Jun 23. Might thus be a a bit of a struggle to go past $7.00. Suspect it will bounce between ~$6.50 and ~$7.00 for a bit, which for the longer term, is a healthy thing to have happen.

Price is also not too far from SDR's all-time high was $7.77 on 9 Nov 2021, after which we will be in completely price uncharted waters ...

The next business update will be likely Jan 2025 when 1H results are announced as SDR no longer reports quarterly. Time will tell whether what is poured on this price fire from those results is kero or water!

Discl: Held IRL and in SM

SUMMARY

A very good all round operational result - very hard to find fault with it as the business appears to have fired on all CURRENT cylinders.

Smart Platform new capabilities are being progressively rolled out in 1HFY25 - sets the foundation for a good step up in revenue in 2HFY2025.

Focus is now increasing on larger hotel properties vs SDR’s earlier focus on small hotel properties - this opens up the TAM, is a good sign of growing product/platform confidence and will support future revenue momentum given the higher Gross Booking Value of larger hotels

Am very bullish as things are falling into place very nicely.

Thesis of SDR being the dominant platform in small and medium-sized hotels is very much intact and in play with the existing capabilities, and with the promise of more from the imminent Smart Platform capability rollout.

Market does not seem to have recognised this and prices have fallen to my top up zone of ~$4.90

Topped up today at $4.92 IRL and in SM, with dry powder kept on standby to further top up around $4.60, if prices fall to those levels.

Disc: Held IRL and in SM, High Conviction holding

Financials (all amounts and %’s are YoY comparisons)

Total revenue up 26.0% to $190.7m - while this is shy of SDR’s “medium term” goal of ~30% annual organic growth, it has grown at a fast clip and is before new Smart Platform capabilities are released.

- Subscription revenue up 18.8% to $122.4m, driven by a 13.8% increase in properties of 5,400 to 44,500 properties

- Transaction revenues up 41.2% to $68.3m, driven by strong Transaction Product Uptake which increased 41.2% to 26,300 products

- ARR is up 20.7% to $209.0m

- Revenue mix is shifting slowly in favour of Transaction Revenue, from 68% Subscription:32% Transaction to 64%:36%

- Revenue was earned more or less evenly across all 3 regions of APAC, EMEA, North America

Margins have been sustained:

- Reported margin - 66.7%

- Underlying subscription GM improved from 83.2% to 85.1%

- Underlying transaction GM moderated from 34.8% to 32.0% due to product mix, temporary expansion into new segments and acquisition channels - no concerns on this

Underlying EBITDA turned positive from FY23 ($21.9m) to FY24 $0.9m, importantly, this occurred in 2HFY24, reflecting the benefits of operating leverage and cost discipline

LTV/CAC continues to improve on a steep trajectory - 31.7% improvement from 4.1x to 5.4x

- Customer Lifetime Value improved 8.3% from $22,312 to to $24,130

- Customer Acquisition Cost (CAC) improved by 18.2% from $5,469 to $4,472

Rule of 40 performance improved 230%, from 5 to 17, reaching 21 in 2H

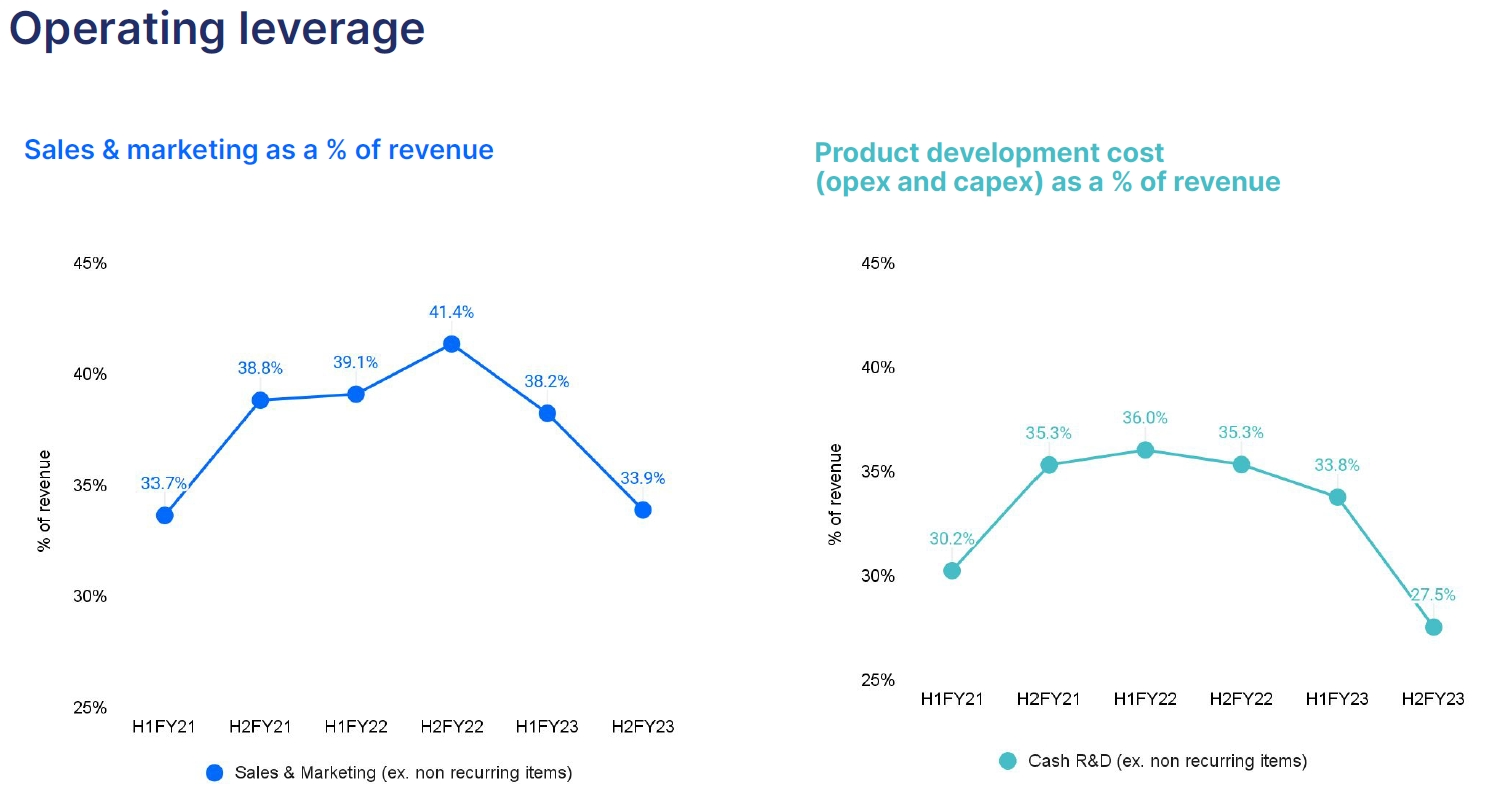

Operating leverage is kicking in as revenue increases - this is very evident in falling product Development Cost despite the intense focus on developing and deploying the new Smart Platform capabilities in the back half of FY2023.

Balance Sheet

Underlying FCF improved from ($34.0m to ($6.4m)

- FCF as a % of revenue improved from (22.5%) to (3.4%)

- FCF positive was achieved in 2HFY24, generating $2.3m or 2.4% of revenue

$72.3m in available funds, which includes $30.0m of undrawn debt facilities

3-Pillar Smart Platform Strategy

Clear evidence that the SDR platforms are being actively used

The industry is coming onboard, including the big Global Distributors

New capabilities appear on track for rollout in 1HFY25 - expect revenue to get a good leg up in 2HFY25 as a result

My notes on SDR's Appendix 4C and Trading Update today. I really like how things are panning out not only for FY24, but also what is ahead for FY25 ...

Disc: Held IRL and in SM

TAKEAWAYS

- Operating leverage and cost management is evident from the 4C, which should translate into improved EBITDA

- 2H Revenue of $99.0m, has increased $7.3m or ~8% from 1H revenue of $91.7m

- 2H Operational Costs of $86.6m has fallen $7.3m, ~7.7% from 1H costs of $93.9m

- Good solid growth across all metrics, but suspect it will fall short of 30% annual organic revenue growth in FY2024 - this 30% growth was positioned as a “medium-term” objective, so not achieving this in FY2024 should not be an issue so long as SDR demonstrates tangible YoY growth, which the 4C and Trading Update suggest, it has

- FY2024 into 1HFY2025 is the period where significant capability is being piloted, built/improved, ready for rollout throughout FY25 - Dynamic Revenue Plus, Channels Plus, Payment Solutions, Metasearch Manager, and the newly announced Smart Distribution Program - the rollout of these capabilities broadens SDR’s monetisation opportunities and hence, underpins the medium-term 30% organic growth target guidance

- The FY24 growth is thus all the more impressive as it does not include any revenue from any of these new capabilities

- Assuming the new capabilities are rolled out in FY25 as planned (and indications thus far that they are on track), FY25 revenue growth could be very interesting ...

Summary of the Updates on Key Metrics

SMART PLATFORM STRATEGY

Dynamic Revenue Plus

- Equips hoteliers with the ability to assess and react to changes in demand quickly and accurately - commenced pilot in Australia and NZ.

- Phased development is progressing as planned with the ANZ release on schedule for Q1FY25

- Entered into agreement with IDeaS to provide price recommendations for the product - 35-year track record in hospitality pricing, industry’s most trusted revenue management software - combines IDeaS pricing engine with SDR’s distribution execution capability and deep global and local intelligence to reset how hoteliers execute revenue management

Channels Plus

- Allows hoteliers to expand their distribution to multiple channels with ease and control

- General release remains on track for Q2FY25

- Pilot commenced in April, attracted interest from 25 distribution partners

Smart Distribution Program - Newly Announced

- 3rd pillar to accelerate and expand the revenue potential of SDR’s Smart Platform

- Designed to accelerate and expand the revenue potential of the Company’s Platform

- Secured support and commitment from key global distribution partners to jointly improve the distribution configurations of hoteliers through the Smart Platform to capitalise on significant opportunities to maximise revenue performance

TRANSACTION PRODUCT INITIATIVES

Payment Solution

- Extended into SIN and HKG, additional markets will go-live in FY25

- Work on introducing physical payment terminals, well progressed, pilot scheduled to commence in Q2FY25, followed by staged rollout from Q3FY25

Metaseach Manager

- SDR’s metasearch solution for the enterprise segment

- Entered pilot with strong interest from hotel groups looking to better manage their meta search campaigns

GUIDANCE

- Still targeting 30% organic annual revenue growth in the medium term, aided by contributions from the Smart Platform

- No change to financial guidance

- Underlying EBITDA profitable

- Underlying FCF positive for H2FY24

Good to know Aust Super is accumulating SDR, adding another 1%.

Following the post on SDR's 1HFY24 results earlier, here is the summary of the SDR 3QFY24 Appendix 4C. More of the same from 1HFY24 ...

Very excited with progress on the 2 new capabilities currently in pilot release ahead of 1QFY25 release as this will propel SDR's next phase of growth, in parallel to the ongoing growth in the current base products.

Discl: Held IRL and in SM

KEY POINTS FROM THE ANNOUNCEMENT

- Revenue increase driven by SDR’s metasearch offering, Demand Plus, driven by accelerated adoption and strong booking activity

- Net subscriber addition momentum continued from 1HFY24, focused on larger properties (vs the target market of small, independent hotels)

- Continued improvement in FCF - underlying FCF was ($0.2m), now only (0.4% of revenue) - accelerating throughout FY24 thus far - continuing benefits of sustained strong organic growth and operating leverage

- Liquidity remains strong at $72.2m

- No change to FY24 guidance - (1) organic revenue growth of 30% in medium term (2) underlying EBITDA profitable in 2HFY24 (3) underlying FCF positive in 2HFY2024.

- On track for mid-CY2024 release of 2 Smart Platform products

- Channels Plus:

- Signed up Trip.com Group to participate in the Channels Plus Program

- Channel Plus continues to gain traction - 14 distribution partners have signed up

- Channel Plus pilot commenced 29 April 2024, limited to 1,000 hotels, has drawn strong registered expression of interest from existing customers

- Dynamic Revenue Plus:

- Mobile App launched in March well received by users

Belatedly worked through SDR's 1HFY24 results and last week's 3QFY24 Appendix 4C after leaving it aside for about 6M.

The FY2024 slides is an easy read and tells the story very clearly SDR 1HFY24 Preso

Added notes taken during the 1HFY2024 call and a summary of the P&L and KPI's across the halfs, so that I can more clearly see the trend across half's rather than pcp.

SUMMARY

- This is a company that is firing on all cyclinders today, with new capabilities in pilot release now, which will drive the next wave of growth from FY2025

- Positive momentum and operational KPI’s all steadily trending in the right direction and improved on the pre-Covid 2019 trajectory - subscriber growth, across all regions

- Scale and leverage is clearly showing as revenue grows - unit economics continue to improve, LTV/CAC continues to grow, Sales and Product Development expense as a % of revenue continues to fall

- Underlying cash flow positive in 1HFY24 - on track to target of cashflow positive in 2HFY24

- Driving industry change via Smart Platform - the integration of Distribution, Intelligence and Revenue Optimisation, as the hotel industry is far behind airlines in yield management

- Smart Platform will provide the next step increase in SDR’s growth - good progress made in 1st 2 capabilities of Demand Plus and Channels Plus - due for release in 2HFY2024, will full impact to be felt in FY2025 - increases the moat

- Smart Platform will also see more transactional monetising opportunity for SDR by taking a clip of the gross booking value that goes through the SDR platform

- SDR is rapidly growing its base market with a huge TAM to go and in parallel, rapidly building new capabilities that will drive improvements in hotelier revenue via improvements in yield management

KEY POINTS FROM 1HFY24 INVESTOR CALL

- Comparison CY2023 against Pre-Covid CY2019 a better indication of performance as CY2022 was Covid-distorted - unable to sustain acceleration rates when compared to a distorted 2022, but underlying growth from CY2019 is ongoing

- APAC and Aust - higher growth pace, expect Asia to grow scale

- Subscription growth momentum - good pipeline and additions in 2M in CY2024, no slowdown

- Transactions held up better than most majors:

- GDS - big beneficiary of return of leisure travel post Covid

- Pay - on par with average growth rates

- Demand Plus - strong ability to drive activity and share of Gross Booking Value - strong in Jan/Feb

- LTV/CAC is 5.3x - higher than pre-Covid, LTV has expanded and CAC continues to moderate

- Channel Plus Partners - signed on Agoda and Hopper

- Agoda is either top 5th or 6th of global channels, strong in Asia and is very big

- Channels Plus takes away friction from inventory management

- Both sides have monetising opportunity - SDR, Hotels, Online Travel Agent

- SDR is one of the largest supplier of inventory to the majors

- Channels Plus creates new distribution channels, is not part of Demand Plus - complementary, not cannabilistic

- Channels Plus - hotel has 1 pipe which opens many distribution channels - removes inventory management friction

- Pilot in mid-CY24, impact will be seen in FY2025

- Revenue growth is driving leverage and scale

- Positive Underlying Cash Flow in Q1 and Q2

- Not looking at M&A

Discl: Held IRL and in SM

Went through the SDR Investor Day Presentation slide pack released yesterday 16 Oct 2023:

https://www.asx.com.au/markets/company/SDR

It was well worth spending the 25-30 mins working through the 78 slides to get a flavour of the 2 Smart Patform offerings targetted to be released in FY24 and the opportunity ahead to upsell within existing customers, over and above the signing up of new hotels.

Having had some past exposure to cruise ship revenue management and reservation systems, the offerings make complete sense to me. It solves some big problems, especially for smaller hotels that do not have extensive distribution and revenue management capabilities.

Very keen to see how the SDR customer base takes up these new offerings and the resultant financial impact in the coming Q's.

SUMMARY

- Strong uptake of SDR offerings across the 4 Global Hotel Industry segments

- Significant TAM remaining to chase

- Rolling out “Smart Platform” - sophisticated revenue management capability which converges distribution, intelligence and revenue optimisation to maximise hotel revenues

- 2 new offerings under Smart Platform:

- Dynamic Revenue Plus - real-time recommendation engine to help identify optimal commercial actions a hotelier can take in response to external events, intelligence etc. Address challenges in the lack of revenue management capability in small hotels

- 5 use cases showcased (slides 35-48)

- Channels Plus - capability to automatically connect distribution channels and hotel properties as they sign up to the program out of the box, eliminating today’s friction in many connections, agreements, connectivity configurations (slides 56-62)

- Commercial potential to deliver >10x ROI to hotels at 1% monetisation of FY23 GBV (Value of bookings processed by SDR)

- Previous guidance was reiterated - (1) target 30% organic revenue growth in the medium term (2) underlying EBITDA profitable and underlying free cash flow positive for H2FY24.

Discl: Held IRL and in SM.

SDR's FY23 results had no surprises as most of it was revealed during the earlier 4Q Appendix 4C Release. However, these charts in the pack stood out for me as it provided a bit more "colour" on the performance.

It was a strong result and it is executing/delivering on the trajectory Sankar said it would. Will be interesting to see how much this holds up in the next 2Q's as global economies decelerate further, eating into discretionary travel demand.

Discl: Held IRL and in SM.

- Growth was strong across all regions in terms of revenue and property additions

- Strong subscriber Net Additions, again across all regions, and strong uptake of transaction-based products

- LTV/CAC metric was missing in the 4C announcement - moved to 4.1x for FY23, but improved to 4.8x 2HFY23, HoH moves appear to be accelerating, as Sankar said it would

- LTV was up 9.7% to a record $23,212

- CAC improved 14% from $6,386 in FY22 to $5,469 in FY23, driven by operating leverage. CAC for H2FY23 was $4,890

- Both Sales & Marketing and Product Development cost as a % of revenue are trending down rather decisively

These are my notes from viewing the video on the Sankar Narayan chat from 3 June 2022, earlier this week. Nothing new for those who follow SDR but it was quite a revelation for me and I bought into SDR that same day. I have some prior (dated!) cruise ship hotel and reservation system experience, so the solution and the need it is trying to address makes sound sense. Very comfy with Sankar running the ship and his approach/thinking. He clearly has skin in the game, and showed during the chat that he is similarly hurting from the share price fall ... If it can get through Covid, it can get through anything really.

Discl: Hold SDR IRL and SM. Will be further topping up if it dips further towards $3 as this feels like a really good entry point for a well-run business with many ways to win.

OVERVIEW OF BUSINESS

- Founded in 2006, listed on the ASX in 2021

- World leading provider of a SAAS hotel commerce platform - focus is on independent, small and medium sized hotels, smaller hotel chains

- Market data confirms that SDR has the largest platform in the independent hotel space

ADDRESSABLE MARKET

- Globally, approximately 1m hotels:

- Excludes China

- Large hotel chains have about 50k properties (of this 1m hotels)

- Excludes vacation rentals etc - this is a huge adjacency

- Majority of the hotels are small, medium sized hotels - very distributed

- Very fragmented in technology adoption - an evolving space, a lot of non-automated/manual hotels

- Large hotel chains have enterprise systems and revenue management systems which smaller hotels do not have

- Online travel agents take between 15-30% of margin for each booking - SDR has the capability to power the hotel’s own website to allow direct bookings, avoiding online travel agents - this increases the ability of a small hotel to self-distribute

TECHNOLOGY OFFERING

- SDR’s solution spans the end-to-end of a hotel operation - from Distribution, Booking Operations, Business Management/Operations and Business & Revenue Optimisation

- Connects to the most (1) travel agents and (2) hotel Property Management Systems (PMS) in the world - largest ecosystem of its kind

- Platform runs in 8 languages

- SDR’s platform sits between the Hotel and the Booking Engines - it is the connectivity of the hotel room inventory to the world

GLOBAL DISTRIBUTION FOOTPRINT

- Global go-to-market capability

- Offices around the world, sales people in 20 countries

- Not focused on China - mostly to connect Chinese tourists to outbound travel agents outside of China

REVENUE BREAKDOWN

- 80% of revenue is from outside Australia

- Fixed subscription revenue for software - bundles, customers pick and choose modules that they need - growth is mostly ex-Australia

- With the launching of the 3rd generation of the platform, focus has been on generating transaction activity-based revenue eg. Payments, bookings etc via products that were launched and scaled in the past 3 years - this has allowed SDR to participate in the post-Covid rebound - this is the next growth driver to ride on the scale of the transactions that goes through the platform - pre-Covid, 100m reservations with a value of $40b, went through the platform.

MULTIPLE OPPORTUNITIES FOR GROWTH

- Lots of confidence for opportunities to achieve sustained long-term growth

- More fixed price software to sell with lots of hotels to sell to

- Global go-to-market footprint to enable the sales

- Multi-lingual software

- More transaction-based products to increase utilisation of the software

- Upsell to existing customers - currently 32% of customers have only 1 product, mostly from recent Covid-period, transaction-based products - huge opportunity to upsell

COMPETITIVE LANDSCAPE

- Market data suggests SDR is 3x the nearest competitor from a scale perspective, in the small & medium and independent space

- SDR has lots of critical mass in the local markets in which it operates in

- The global footprint and scale of the platform is key, but what is key is SDR has enough size to be “local” in each of its markets - you cannot do this if you are small. This “local” approach enables local advertising, language translations etc

- SDR has also fine-tuned and matured its remote support and management capability well before Covid struck

STRONG FOCUS ON COST OF ACQUIRING CUSTOMER

- Clear focus that SDR needs to grow in a profitable way

- Every customer add must create Lifetime Value greater than cost of acquisition

- LTV/CAC, the ratio between Lifetime Value (LTV) and CAC (Cost of Acquiring Customer), is the “single most important metric” to track unit economics - super important to ensure building a valuable business for the future

- Retention is captured in the LVT/CAC metric, as is margin and revenue

- Pre-Covid, LTV/CAC was ~4x - this went down during Covid. Coming out of Covid,LTV/CAC is now around 3x and is heading back towards 4x from the focus to upsell and upgrade existing customers

RESILIENCE OF BUSINESS & UNDERLYING ECONOMIC MODEL

- Very pleased with resilience of the business, especially during Covid where the entire travel industry globally declined 60-70% in activity - from a cash flow perspective, SDR rode through the period by moving away from “investment phase to drive business growth”, to focusing on keeping operations going. Strong gross margins enabled this to occur

- Sales & marketing costs were taken down during the Covid period - now getting staff back onboard to sustainable long-term growth path as revenue ramps up. Once the cost hump to onboard and settle in the new sales staff is crossed and they gain experience, expect to see operating leverage come into in FY23-FY25. Expect t cash outflow as a % of revenue to moderate

- This playbook is similar to that of other SAAS companies and is not unique to SDR

- On R&D spend and focus, many projects were delivered in the last 6M. These were the result of difficult choices made during the pandemic where the decision was made to focus on developing new products - this has set SDR up for the next 3-5 years. As a result, technical expenditure as a % of revenue should start moderating.

- SDR has a global development footprint comprising (1) the Core technology Centre in Sydney (2) Manila development centre, which was opened in the middle of Covid in Sep 2020 (3) new technology centre in Poland - this has provided the option to balance the development effort across the geographic locations

- SDR has been able to attract and retain staff as (1) the technology stack is cutting edge (2) good work culture and (3) ability to learn.

BAILADOR RELATIONSHIP

- Sankar has a very long relationship with Bailador - he was on the Board previously

- Considers them to be great partners, value adding without day-to-day intervention in the business, seeks advice on the broader technology world and markets

APPROACH TO GROWTH

- Not a fan of inorganic M&A of the software platform - technical integration is messy, inconsistent user experience, migration challenges etc - all of these distract from innovation on the core platform itself as the focus will end up being on migration

- M&A only really makes sense to add features to the core platform - these opportunities will be typically small in scale and size

- Sankar reinforced the point several times - SDR is an organic growth play.

- The TAM is there, the platform has scale and there is a strong global sales and marketing engine to support the growth

THOUGHTS ON MACRO ISSUES AND IMPACT ON SDR

- During Covid, SDR management modelled the Covid impact on travel very extensively, what-if scenario’s etc - things have played out as they thought it would

- The approach has not been to pick one macro theme and then bank the company against that macro theme but rather to focus on how the company will perform over different macros themes

- The Covid performance showed how resilient the business was/is

- Management has determined that the biggest impact on SDR is the re-opening of travel - this was a major structural change. This single event trumps all other macro factors, in terms of impacts to SDR. Based on this, SDR does not spend too much time worrying about the macro issues as these macros impacts are 2nd or 3rd order of priority impacts vs the single event of travel re-opening.

WHAT KEEPS SANKAR AWAKE AT NIGHT

- Navigating Covid was a major worry

- Given the resilience of SDR throughout Covid, feeling very positive now vs during the IPO - at IPO, projects still needed to be delivered/addressed

- The plan as to how the business should evolve is actually playing out, in some areas, better than expected eg. timing, customer feedback, performance etc - this has provided a lot of comfort

WHAT DOES THE MARKET MISUNDERSTAND OF SDR

- Sankar does not think that investors, large shareholders, backers have misunderstood SDR

- The focus of the market seems to be mostly on the platform, platform capability itself

- What is not as well appreciated perhaps (1) SDR’s go-to-market capability and (2) Global distribution footprint - the combination of these 2, together with the underlying scaled platform is what will power the growth of SDR in the coming years

INVESTMENT THESIS

- Multiple opportunities to grow in a clearly articulated target market with a huge TAM

- New suite of products are transaction-revenue based - introduction of these allows SDR to ride the up wave of travel re-opening

- Similar to WSP, hard work to scale the platform, develop new products (including transaction revenue-based products), expand development centre footprint and rebuilding of post Covid sales & marketing capability is either done or is well underway, ensuring that the company can focus on growth-related activities, reaping the benefits of operating leverage - it has reached or has just past the inflection point

- Covid performance has demonstrated the resilience of the business and the unit economics

- Strong experienced CEO - Sankar inspires confidence that he understands the business levers very well, has a clear plan to achieve growth, is executing against the plan and the plan is showing results

- 3 key moats - (1) scale and global breadth of the platform (2) the global go-to market capability (3) no clear competitor of similar scale and capability

- Share price has been battered - at very attractive entry level of $3-20-$3.30 vs 52 week highs of $5.25, with limited downside 52 week low of $2.68

- Low M&A risk as management has clearly positioned SDR to be an organic growth play - this clarity is reassuring

- Free cash flow positive target by Q4FY2024

- CEO and Management alignment and skin in the game - Sankar owns about 2.7% of SDR

KEY RISKS

- Cost of customer acquisition is key to watch - failure of LTV/CAC metric to hit 4x and beyond would be a cause for concern - good risk to take given current trajectory of the business - MEDIUM

- Watch cash burn metrics against revenue to ascertain extent operational leverage has kicked in - MEDIUM

- Cyber security issues - that would be very damaging - MEIDUM

- Achievement of free cash flow target, failing which a capital raise could be required - MEDIUM

- Disruptions to travel industry re-opening - LOW

Post a valuation or endorse another member's valuation.