Earlier this week, I initiated a 6% position in RL in $SDR for $5.95 (funded by exiting my remaining holding in $RUL).

I originally took a smaller position (3%) in Feb this year; however, as is sometimes the case for me with "new holdings" as I got deeper into learning about it, the conviction I thought I had wobbled and when presented with a short-term profit of 30%+ and a need to allocate the funds elsewhere on the day of the FY25 results, I “bottled it” and exited. (This was not an intended short term trade, I simply doubted the basis on which I originally entered, and changed my mind!) However, I’ve used the time on the sidelines to reconsider the proposition and today I have a clearer view as to what I am doing!

For a more complete write-up of $SDR, particularly since the FY25 Results in August and the Investor Day in September, I refer to excellent straws by @jcmleng which includes helpful analysis. That work allows me to be more selective in my write-up here.

What is $SDR?

- An enterprise SaaS software business serving small/medium sized hotels and related accommodation (individual properties and small chains)

- Serves a truly global market, and is leader in its segment having already scaled to 50,100 customers in 150 countries for 250+million Room Nights annual. (This represents a global market share of only c. 5%.)

- While currently unprofitable, the business is at the inflection point and is expected to generate positive free cashflow in FY26.

- With 4 years of operations as a listed company, the operating economics including operating leverage are clear. (That said, a strong FY23 benefitted from the global re-opening of international tourism, so the results folllowing IPO must be understood in context,)

Leadership

- CEO Sankar Narayan joined in 2019 from $XRO.

- At $XRO he learned how to run an international SaaS company as CFO and Chief Operating Officer.

- I rate Sankar very highly.

Market

- Global, small and medium size properties, often independent operators, single properties or small chains.

- Most of its customer base are relatively immature in procuring software.

- Of those who have invested in systems, many have multiple, dated systems that lack integration (both within the property as well as externally to the increasingly-important online travel agents (OTAs)). These require manual interventions and support, and many properties are now looking to invest in next-generation products, including functionality which was hitherto only accessible by the larger chains.

- Quantifed, the global TAM is anywhere from 0.3% to 1.5% of the industry's Gross Booking Value of close to $1,000bn.

The Opportunity

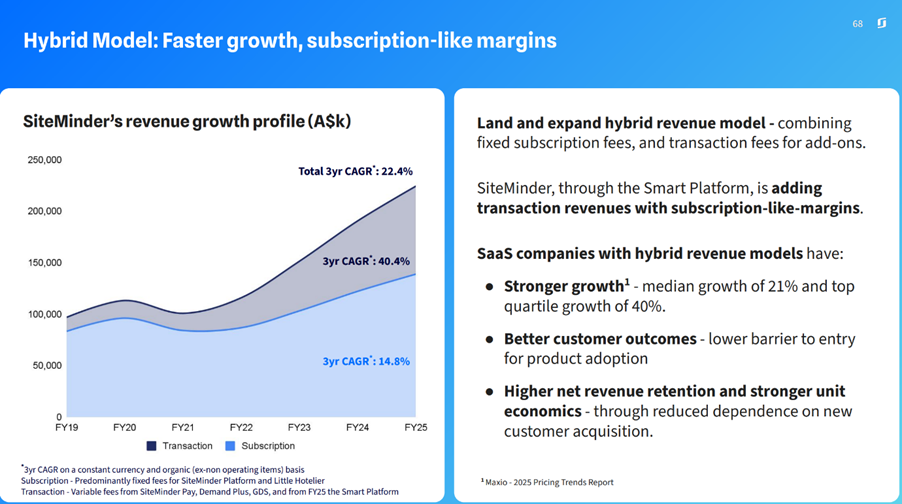

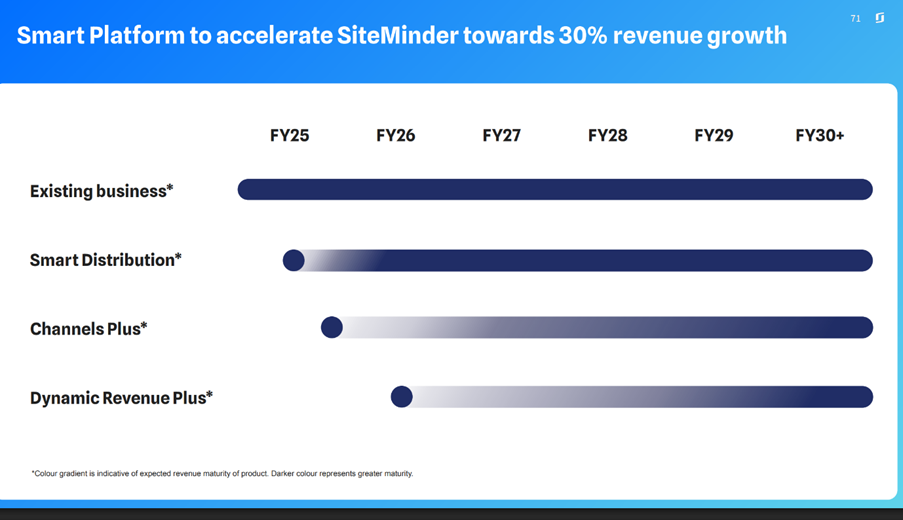

The key chart I am focused on is the following one from the recent Investor Day.

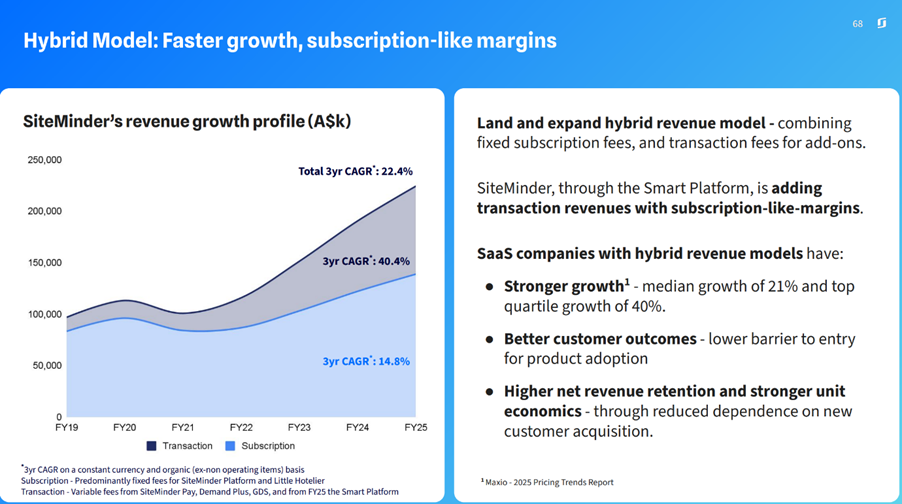

New customer acquisition has and continues to drive subscription revenue growth at low double-digit percentages annually.

More recently, the development and launch of a suite of “Smart Products” is adding volume-based transaction margins, where $SDR clips the ticket on specific, value-adding transactions for clients.

As @jcmleng highlighted following the recent AGM, this chart should be read together with this insight from Sankar's address at the AGM.

“We are moving beyond the role of a channel manager to become their central revenue platform - the unified interface where revenue decisions are made, executed, and automated."

Historically, most subscription revenue has been driven by Channel Manager, which connects a property's vacant room inventory to online travel agents (OTAs) that that act as channel partners. (Think Hotels.com). $SDR’s products are dynamically integrated, maintaining the inventory/availability live across multiple platforms. Without the use of a platform like $SDR (or the various other competitor offerings available) this has traditionally been a significant pain point for property managers.

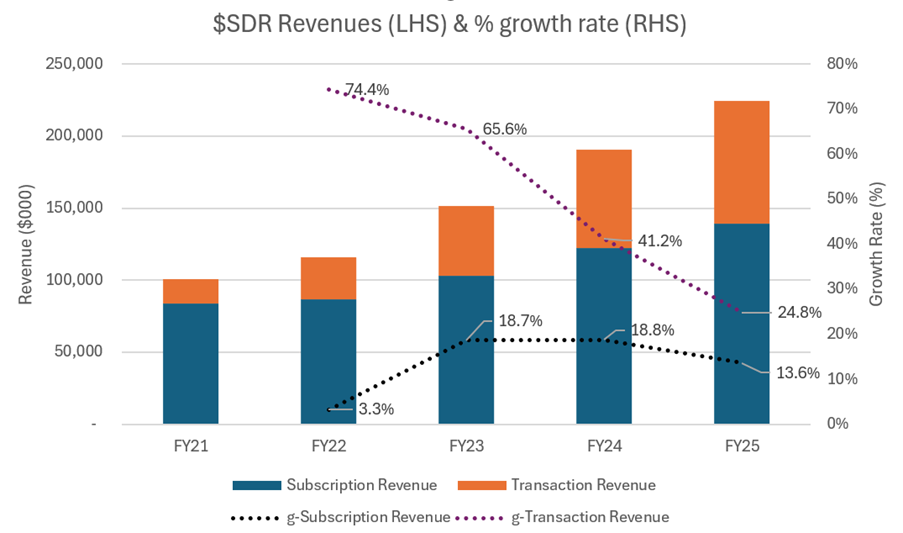

Until recently, $SDR’s revenue has grown primarily as new properties subscribed to the product.

However, over the last 3-4 years, $SDR has been developing a suite of Smart Products, which include increased transaction revenues, where $SDR clips the ticket for activity in each of its Smart Distribution, Payments, Channel Optimisation, and Revenue Management modules.

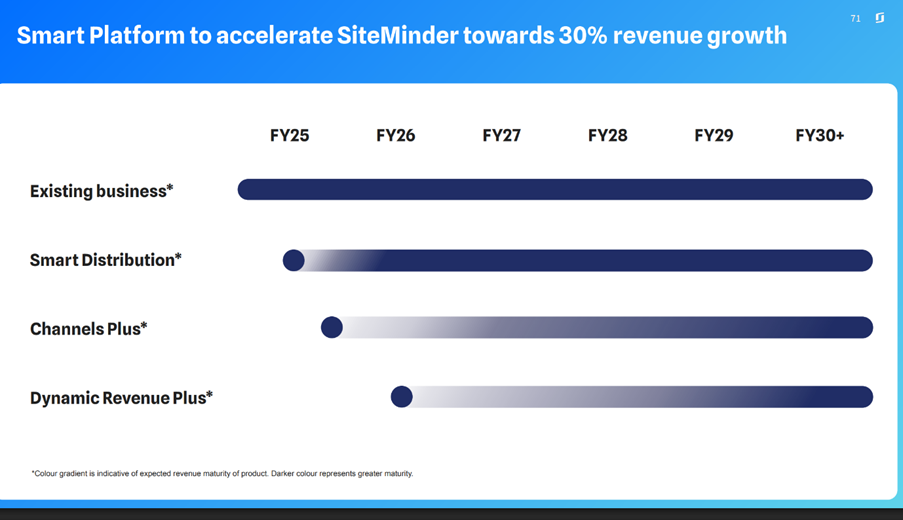

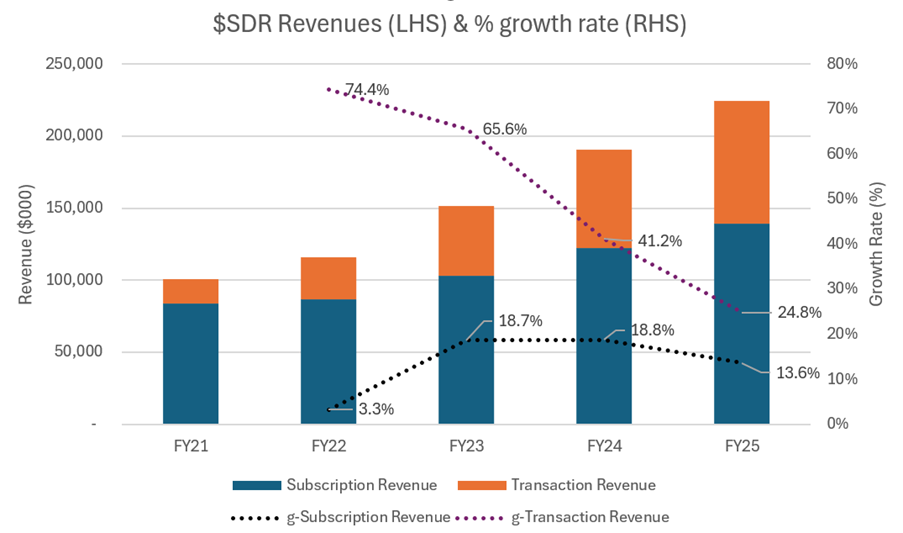

The "Smart Platform" was launced in earnest in FY25. The chart above shows how in the last few years, the transaction-driven component of revenue is growing more rapidly than the growing subscription base. And it is very important to recognise that it is still early days in rolling out the Smart Platform to customers, as the following chart indicates.

The FY25 result is only starting to show transaction revenue contributions from “Smart Distribution” and even less from “Channel Plus” (C+). In fact, at Investor Day, $SDR told us that 5,000+ properties have contracted C+, which is around 10% of existing customers. Reportedly, over 500 customers are signing up per month ( 1% or 12% annually).

Smart Channel management takes on more of the operational tasks of managing the relationship and room availability and promotion process with the OTAs. $SDR can do this more effectively and efficiently than a property manager, because the process is automated in the $SDR software. Instead of the flat subscription fee that hotels have historically paid for the standard Channel Manager integration into the OTAs , the Hotel only pays for the incremental value added by the OTA bookings in the Smart Platform, and in return, $SDR takes a transaction fee.

The roadmap chart above is important when we considered how both subscription and transaction revenues are evolving, shown in the following chart. This shows that transaction revenues are growing much faster than subscription revenues. However, the growth rates for both are clearly declining.

But taking together the Smart Platform roadmap chart and Sankar’s comment at the AGM, together with his oft-stated target that revenue growth will re-accelerate to 30% in the medium term, it is clear that $SDR are confident of the value the Smart Platform will capture.

In fact they’ve quantified this. They believe that based on the subscription platform and early transaction capabilities, $SDR currently captures 0.3% of its customers Gross Booking Value (GBV). For customers deploying the full Smart Platform suite, $SDR believe this can increase to 1.5% of GBV – a 5x revenue growth opportunity from within the existing customer base.

So, it is central to my thesis that in FY26, as we come to see a full year of C+ and Smart Distribution penetrating the existing $SDR customer base, that Transaction Revenue growth will accelerate.

But as Sankar said at the AGM, this is just the start. The real game changer is once Dynamic Revenue Plus (i.e., automated revenue management) kicks in, starting in FY26, and then building from FY27 onwards. Dynamic Revenue Management is something the large hotel chains have been doing for many years. However, it is a capability that small / medium-sized operations have yet to embrace ("80%" of hotels have not adopted a Revenue Management System as of early 2025).

As a global market leader of software for independent and small chain operators, $SDR is positioned to now capture this opportunity with the Dynamic Revenue Plus (DR+) offering, clipping the ticket along the way.

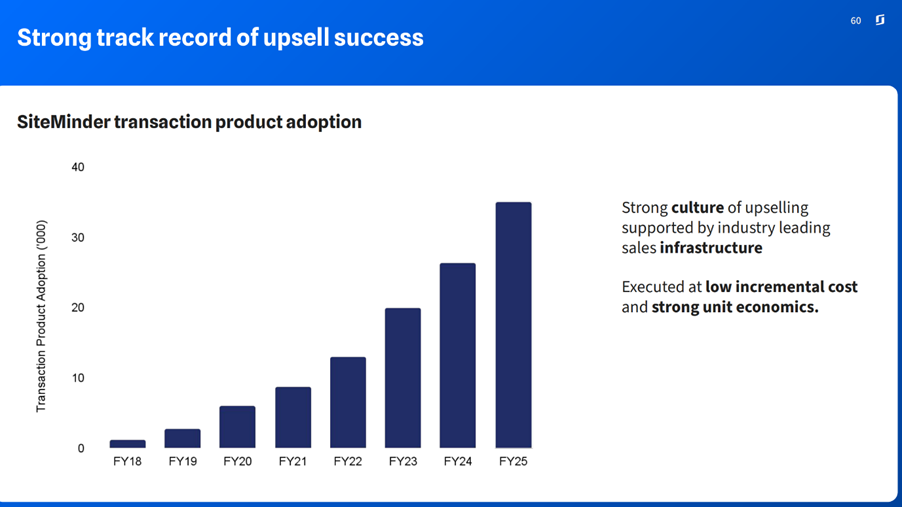

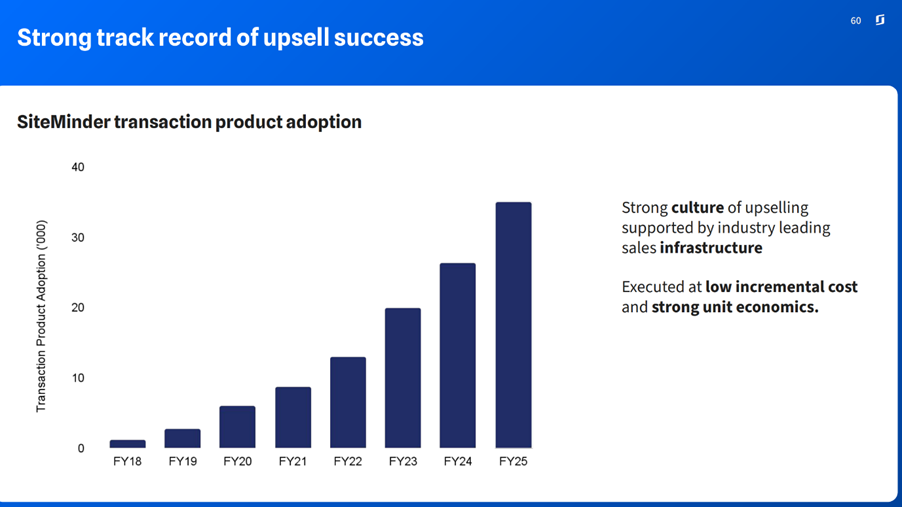

So, What’s the Track Record in Capture Transaction Revenue Opportunity?

This sounds great, But where’s the evidence $SDR can achieve this?

The chart below shows just how successful $SDR has been to date in selling its transaction revenue generating products. This growth is only now starting to include $SDR bringing "Channel Plus" and "Dynamic Revenue Plus" into the existing, growing customer base.

There’s a lot more detail about the rollout plans for the Smart Platform in the Investor Day pack, as well as why each module will deliver value to customers.

Before moving on to my valuation, I do believe that with the launch of Smart Platform in FY25 and the early adoption evidence, we will see an acceleration of transaction revenue in the years ahead.

However, from the analysis I have done, I am not convinced that $SDR will get back to overall 30% annual revenue growth. However, I do believe that $SDR will do significantly better than the market is currently giving credit for. Hence the investment opportunity today,

The valuation that follows provides a framework for me to track progress over the next year or two. I believe it shows that at $6.00, $SDR is a good buy.

Valuation

First, I am NOT going to assume that $SDR can achieve Sankar's 30% revenue growth vision. That would be an UPSIDE BULL CASE to what I am modelling.

The model projects EPS growth out to 2030 – the timeframe of the Smart Platform rollout.

I build the revenue model in two elements:

- Subscription Revenue: I assume scenarios of Subscription Revenue growing at 9%, 11% and 13% annually, delivering a constant Gross Margin that expands progressively from 86.0% in FY25 to 88,0% in FY30,

- Transaction Revenue: scenarios of 20%, 25% and 30% annual growth are assume, with a flat Gross Margin of 33%.

Taken together the combination of revenue scenarios delivered FY25 to FY30 Total Revenue CAGRs from 13.7% to 20.6% - still a far cry from Sankar’s aspirational 30%!

Annual Opex Growth (including D&A) vary across scenarios from a low of 6% up to 9% (underlying Opex growth was 0% in FY24 and 7% in FY25). I’ve matched the higher Opex Growth scenarios to higher revenue growth scenarios, assuming that these will related to more aggressive customer acquisition strategies and platform development investments. Overall, I think these are reasonably prudent scenarios, given the operating leverage presented in the FY25 results, showing a clear trend over that 5 years since FY21.

Finally, my model includes several constant parameters as follows:

- Finance Costs/Revenue = 0.5% (assumes $SDR maintains zero long term debt)

- Tax Rate = 30%

- Annual Growth in Share on Issue = 1.2%

- Discount Rate 10%.

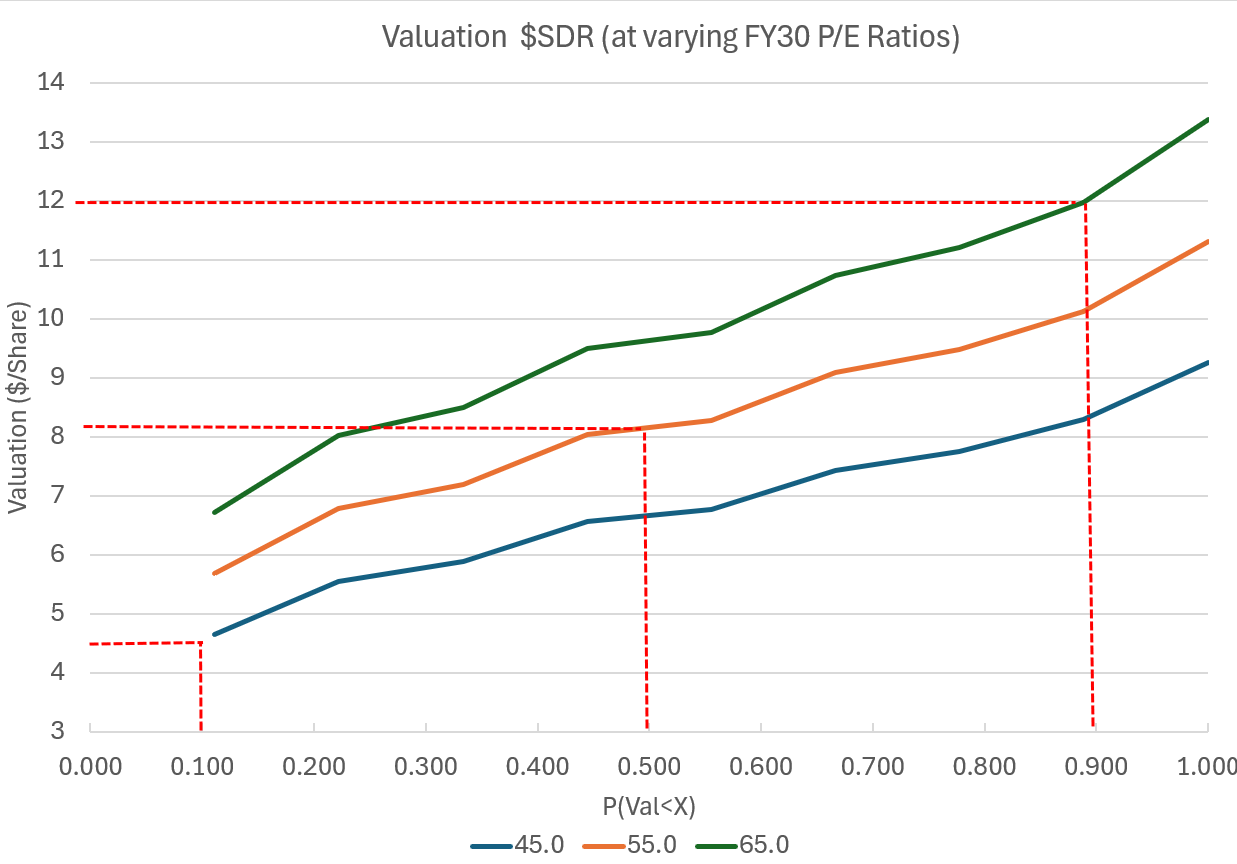

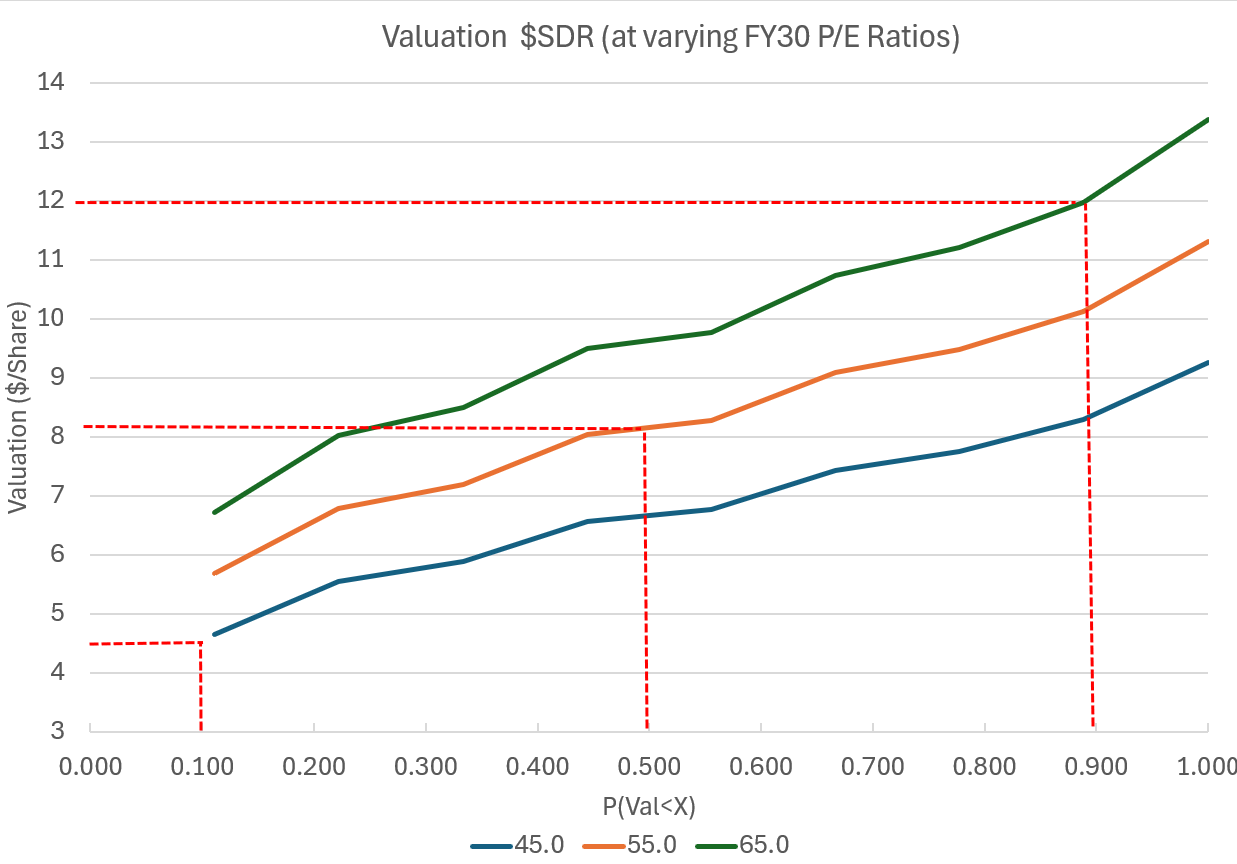

FY30 EPS was calculated. Given that in FY30 the modelled EPS growth rate ranges from 60% - 67%, I’ve applied P/E ratios in FY30 of 45 (blue), 55 (orange) and 65 (green) – shown by each of the curves graph below.

The implied valuation at the start of FY26 is shown in the graph below.

From this, my estimated valuation is $8.10 ($4.50 - $12.00).

Given that $SDR is still unprofitable today, the uncertainty in the valuation is necessarily very wide indeed. However, I am comfortable that at an entry price of $5.95, the assumptions I have used generate a good asymmetry with even my uppermost scenarios being well short of the CEO’s revenue growth goals.

As ever, I’ll will reconsider the various assumptions in my model with each future report. However, on this basis, I was happy to buy $SDR on Monday of this week.

When I Would Sell

For my thesis to remain on track, I need to see:

- Continued new property additions, at minimum high single digit % growth annually (allowing for some pricing uplift).

- Transaction Revenue growth needs to re-accelerate. It certainly cannot continue to decline as we get further into the Smart Platform Roadmap execution.

- Cost control must be maintained - although there is some headroom for a more aggressive customer acquisition strategy.

- Low historical churn levels need to be maintained.

A significant deviation on any one of these metrics would require a fundamental revisiting of the thesis and could be a thesis-breaker.

I’d also like to see Sankar remain in post. However, with the strategy set and the product set built, this is a business that can now be executed by any competent operator, IMHO.

Disc: Held (RL 6%)