Time to do a review of recent news for UBI. (held in SM and RL)

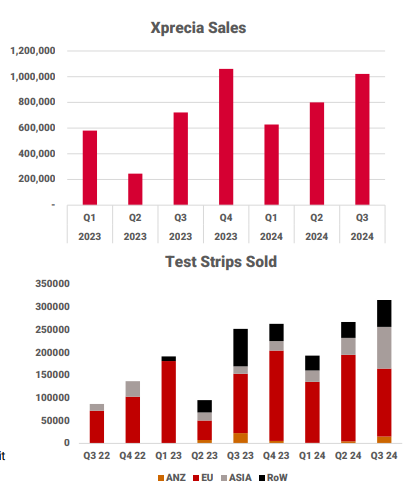

As previously forecast by the company 2 US distribution agreements have been signed for Xprecia Prime, Henry Schein and National Distribution & Contracting, Inc.

NDC is a healthcare supply chain solution, serving as one of the USA’s largest and most successful distributors of medical products representing over 1,900 distribution partners through the NDC network. The deal is for a two year non-exclusive term with automatic one year extensions unless terminated by either party.

Henry Schein will become a non-exclusive distributor for an initial term of 1 year, with annual extensions by agreement.

Mr John Sharman CEO of UBI said, “Henry Schein/NDC undertook a comprehensive product review before agreeing to partner Xprecia Prime. Henry Schein / NDC service thousands of coagulation clinics and hospitals throughout the USA which can now access Xprecia Prime through their network."

In addition, UBI has sold its first Xprecia Prime product to NDC as part of the deal.

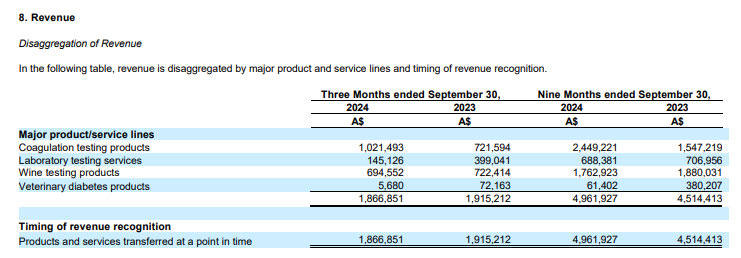

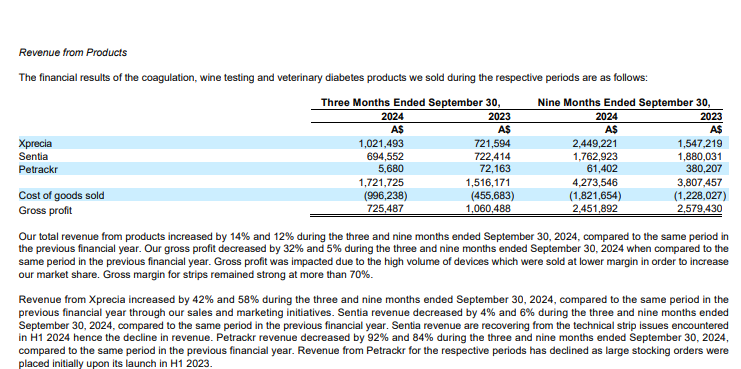

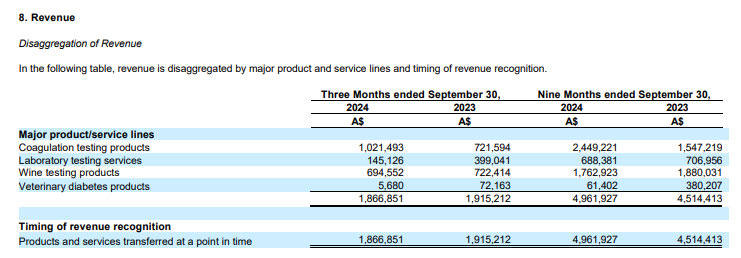

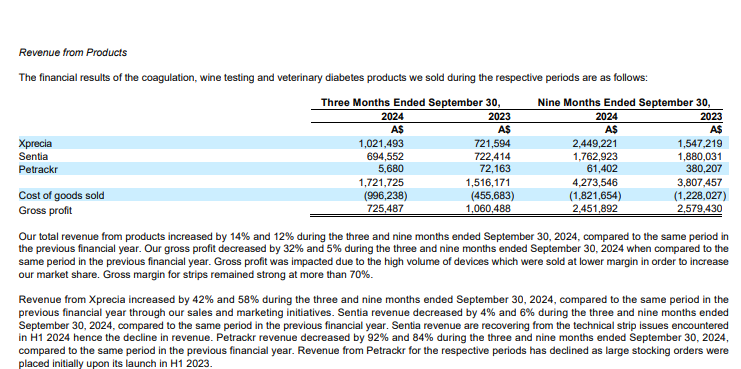

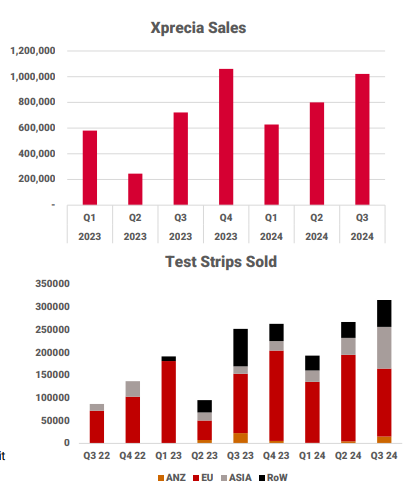

Xprecia is going to have to do the majority of the revenue increase if they are to get close to break even. 5000 analysers currently and 320K strips sold last quarter (at a gross margin of 70+%)

Also the 4C (Presentation)

Looking for things to recover in coming quarters after the free replacement of the faulty Sentia test strips and the sell down of the initial stocking inventory on Petrackr.

Margins have reduced due to selling the Xprecia and Sentia analysers at lower margin to gain market share.

It will be interesting to see if their e-commerce platform is effective.

"UBI has developed an e-commerce platform capable of transacting direct with consumers via / Amazon / Shopify / Chewy / Walmart / POS. This technology will be used to also support Sentia and Xprecia sales"

Key developments during Q3 2024 as reflected in the attached Appendix 4C were:

Cash outflows from operating activities decreased by 11% to $5.2 million from previous quarter as follows:

Research & development spend decreased by 65%

Product manufacturing and operating costs decreased by 34%

Administration and corporate costs decreased by 29%

Short-term borrowings to fund the Company’s insurance premium were fully repaid during the quarter