Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

This funding deal looks bad to me. 15% interest plus a perpetual 10% royalty increasing to 15% and a 5% arrangement fee.

senior secured loan facility of up to A$8.5 million with substantial securityholder, Viburnum Funds Pty Ltd

The Company intends to undertake an equity raising to provide existing securityholders with an opportunity to participate in the Company's potential growth.

Given his association with Viburnum, Non-Executive Director, Mr. Craig Coleman, has resigned from the Board of the Company to avoid any potential conflicts of interests as the transaction progresses.

First Draw: A$3.5 million available upon securityholder approval of the Proposed Transaction being obtained (see below); and

Second Draw: Up to A$5 million available in the period of 60 days to 120 days after the First Draw, subject to the approval of Viburnum.

Interest Rate: 15% per annum, capitalised and payable in two instalments at 12 months and 18 months from the First Draw.

Royalty: A perpetual royalty of 10% on gross revenue from the Company's water and wine testing strips, with the royalty increasing to 15% where the Second Draw is utilised by the Company.

Arrangement Fee: 5% of the Facility Limit, payable in options over UBI ordinary securities issued to Viburnum, with an exercise price of A$0.05 and a three-year term. The number of options will be calculated by reference to a customary option value calculation and will be issued as soon as practicable following securityholder approval.

Condition on second draw:

the Company using its best endeavours to launch an ordinary equity offer under a Security Purchase Plan prior to any request by the Company under the Second Draw;

I guess they didn't have any other options. Seems to cede control of the company to Viburnum.

I don't see this turning around from here and have to accept a significant loss in SM and smaller loss in RL.

Time to do a review of recent news for UBI. (held in SM and RL)

As previously forecast by the company 2 US distribution agreements have been signed for Xprecia Prime, Henry Schein and National Distribution & Contracting, Inc.

NDC is a healthcare supply chain solution, serving as one of the USA’s largest and most successful distributors of medical products representing over 1,900 distribution partners through the NDC network. The deal is for a two year non-exclusive term with automatic one year extensions unless terminated by either party.

Henry Schein will become a non-exclusive distributor for an initial term of 1 year, with annual extensions by agreement.

Mr John Sharman CEO of UBI said, “Henry Schein/NDC undertook a comprehensive product review before agreeing to partner Xprecia Prime. Henry Schein / NDC service thousands of coagulation clinics and hospitals throughout the USA which can now access Xprecia Prime through their network."

In addition, UBI has sold its first Xprecia Prime product to NDC as part of the deal.

Xprecia is going to have to do the majority of the revenue increase if they are to get close to break even. 5000 analysers currently and 320K strips sold last quarter (at a gross margin of 70+%)

Also the 4C (Presentation)

Looking for things to recover in coming quarters after the free replacement of the faulty Sentia test strips and the sell down of the initial stocking inventory on Petrackr.

Margins have reduced due to selling the Xprecia and Sentia analysers at lower margin to gain market share.

It will be interesting to see if their e-commerce platform is effective.

"UBI has developed an e-commerce platform capable of transacting direct with consumers via / Amazon / Shopify / Chewy / Walmart / POS. This technology will be used to also support Sentia and Xprecia sales"

Key developments during Q3 2024 as reflected in the attached Appendix 4C were:

Cash outflows from operating activities decreased by 11% to $5.2 million from previous quarter as follows:

Research & development spend decreased by 65%

Product manufacturing and operating costs decreased by 34%

Administration and corporate costs decreased by 29%

Short-term borrowings to fund the Company’s insurance premium were fully repaid during the quarter

Investor presentation which gives a mixed outlook. Recent quarter was disappointing on some fronts and encouraging on others. Clarification as to why HRL subsidiary is retained. New water testing product (Cu/Pb). $3.1M in sales 1H24 for a loss of $8M @ 33% margin so still a very long way to go for a +ve cash flow.

The good

Sales up 19% Gross Margin up 21% Expenses down 4% Xprecia Sales up 73% HRL Revenue up 76%

Xprecia sales appear to be going well $1.4M 1H24

Sales up 73% (off a fairly low base) Devices in market up 24% Strips sales up 63%.

Recent Tenders won in Italy & Chile. Approval in Thailand and first order imminent

UBI’s strategy is to partner the commercialisation of Xprecia either globally or regionally. Negotiations and due diligence is underway with multiple parties. UBI is targeting to complete a transaction(s) during H2 2024.

New product

Aqua Sense is being developed to analyze impurities in water using UBI’s handheld platform technology.

Initially Aqua Sense will test for Copper and Lead and will:

Deliver laboratory comparable results within a few minutes

Deliver the analytical result at the location of the sample

Manage and transfer the data wirelessly

Run tests without any sample preparation or additional chemicals

Allow unskilled operators to run tests

Deliver test results with a much lower carbon footprint

Deliver test results for a fraction of the price of laboratory methods

The addressable market for laboratory-based testing of Lead and Copper in water is estimated at more than $1.5 billion. The total addressable market for heavy metal analysis including Lead, Copper, Arsenic, Cadmium, and others is estimated at $4b+

UBI expect Aqua Sense to launch in H1 2025 Other heavy metals sensors are being assessed for proof of concept.

UBI’s oncology detection technology has improved (increased limits of detection) to the extent that UBI is now looking at existing oncology biomarkers as potential products.

A leading American University approached UBI to develop a blood fructose biosensor. There is no commercially available blood fructose sensor for biomedical applications.

Initial testing at UBI has proven that’s its existing fructose biosensor performs well in whole blood and delivers the required performance across the entire measuring range of fructose in blood. UBI has supplied fructose strips and devices, and work continues at the University.

Importantly UBI’s infrastructure is already in place to facilitate both Aptamer and NAFLD work. As such, UBI is not investing large amounts of cash and work continues in the background.

The not so good

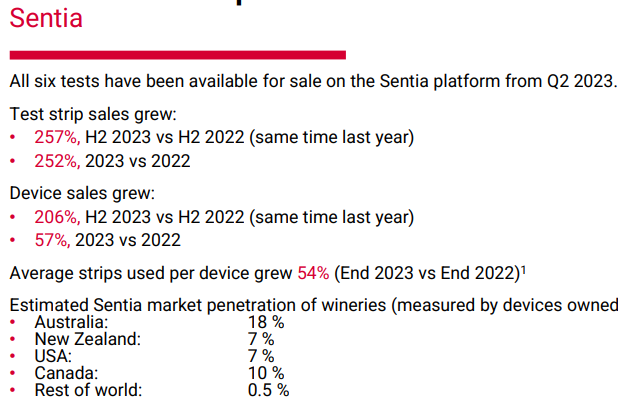

Sentia sales down 8%( $1.07M 1H24) Number of wineries using Sentia up 44% Strips sales up 26%

Sales were negatively impacted in H1 by a reporting anomaly associated with a very low / very high Sulphur samples (mostly associated with new harvest fruit). The impact was mainly in North America. UBI replaced FSO2 strips free of charge to customers who were affected. This negatively impacted sales momentum for H1 UBI believes there are no ongoing issues and customers’ sentiment is not impacted The issue has been resolved and sales in June were recovering

UBI strategic targets: • 1,750 – 2,000 devices 2024 • 2,500 – 3,000 devices 2025 • Over time 10,000 devices, generating 1,000 strips per device and over $50m of revenue

I asked about Sentia use during a recent visit to a McLaren Vale winery here in SA and they were not using it. The feedback was that they are using the existing (expensive) equipment that they have. I think adoption may well be slow as it will be when equipment needs replacing that the Sentia platform is considered to have an advantage.

HRL is not cash flow positive but is considered a significant strategic asset given its unique service offering in terms of the need for calibrating Xprecia Prime / Stride strip lots in accordance with FDA and global regulatory guidelines

Our Petrackr business is performing below expectations. $56K 1H24

Contributing factors include:

The amount of stock pet owners and vets have of their current product, which delays the purchase decision for Petrackr

The continued global dumping of “discontinued” product of a major competitor into the market, which is delaying the purchase decision of pet owners

Both of these factors have impacted UBI’s sales in the short term

UBI has closed a number of distribution deals in recent months, and we now have 13 distributors selling product in 8 countries. UBI is negotiating a further 9 deals globally In the longer run

Petrackr offers pet owners a superior product to the others in the market and we remain confident it will be a valuable business for UBI

Importantly, whilst the Petrackr business is not contributing positive cash flow to UBI in the short term, it is not burning material amounts of cash

This video on Sentia wine testing came up on HC and in summary is a test between the standard enzymatic analysis and Sentia for malic acid.

Pros

Big time saver, doesn't need a high skill level, consistent results.

Cons

$2 USD per test more expensive, one of the three testers got significantly different results, $2500 investment in Sentia unit when the winery may already have a $3500 spectrophotometer for the enzymatic test. Result below external laboratory gold standard.

The advice from 2 of 3 testers was use Sentia despite the cost and has the benefit of other tests particular SO2 and acetic acid. The third felt that if you did not have the spectrophotometer then Sentia was the way to go but cost for her small winery was important and so was unconvinced.

Test for nitrogen was mentioned as something needed.

Shows that although the product clearly has advantages there may be a time delay before adoption in smaller wineries that already have a capital investment in laboratory equipment.

There is a balance to be found by UBI between margin and adoption of the system.

Xprecia Prime receives FDA approval. SP up +60% at peak. Now to see how they can convert this to revenue.

UBI CEO John Sharman said, “Approval to sell Xprecia Prime in the USA is a historic moment for UBI. It represents more than 10 years of research & development work and many millions of dollars of investment.”

Mr Sharman said, “This is the first time the FDA have granted a CLIA Waiver by Application to any coagulation device, and it is testament to the performance of Xprecia Prime. The number of PT/INR tests performed in clinics is the largest part of the USA market so to have won unrestricted access to all clinics and hospitals across the USA is a major achievement.”

Mr Sharman said, “There are more than 6 million patients who take warfarin (coumadin) in the USA and more than 140 million PT/INR test strips are sold each year.

This FDA approval represents the first opportunity in UBI’s history to access the lucrative (and fully reimbursed) USA market. Our expectation is Xprecia Prime will qualify under the existing reimbursement codes used by Medicare, Medicaid and USA Health insurers. UBI has a pipeline of sales and distribution contracts already in negotiation and now that we have FDA approval we expect to conclude some, if not all of these contracts, win market share and generate substantial revenue for the company.

Held in RL and SM

Results Investor presentation and a CR announced. Good news is the increase in Sentia sales and the reduction in expenses and therefore losses. Not so good news is a 40% dilution, $12.5M Cap raise at a historically cheap price of 15c when they have $10M in the bank. Suggests that they are not expecting a profit in the next 18+ months? Viburnum possibly increases its 26% stake by underwriting the raise and receives a 5% fee in options or 6% in cash.

Language has changed for Xprecia Prime FDA "Current US FDA 510k submission under review with feedback expected Q1 2024." in the annual report "assuming there are no further queries, an FDA decision is expected during Q1 2024;" are they being conservative is a further delay expected? One of the uses for CR is stated as "Ongoing costs associated with the approval of Xprecia Prime in the USA" positive that "Large European and USA deals in negotiation." Xprecia Prime still has to be the biggest potential for increasing revenue significantly in the short term but dependent on FDA approval.

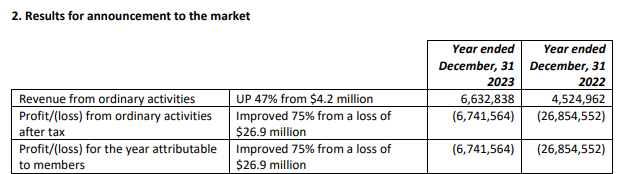

Highlights Year-on-year (2023 v 2022)

Key developments during 2023 include:

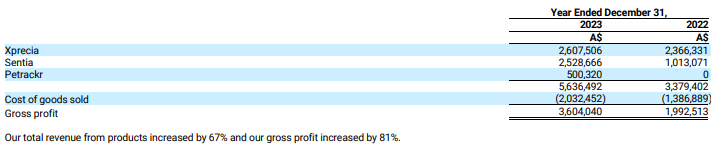

Revenue from the sale of products increased 67% to $5.64m

Total revenue increased 47% to A$6.63 million

Gross profit increased 100% to A$4.28 million

Operating costs decreased as follows:

R&D expenses declined by 60% to A$4.97 million

Total operating expenses declined by 43% to A$20.97 million

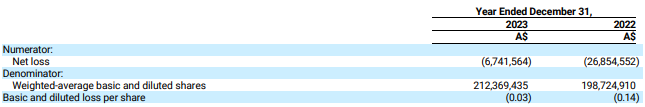

Net loss after tax and impairment of intangible assets improved by A$20.11 million

Revenue from coagulation testing products grew 10% but was negatively impacted by the “aggressive selling of stock” by Siemens as a result of its rights to sell Xprecia products ending formally on March 31, 2023.

Revenue from wine testing products increased by 150%. During 2022, our revenues from wine testing products were primarily from the sale of Sentia analyzers, Free SO2 and Malic Acid test strips. During 2023, we began generating revenues from the sale of the following additional test products – Fructose, Glucose, Acetic Acid and Titratable Acidity.

Petrackr, launched in May 2023, generated revenue of A$500,320.

Universal Biosensors, Inc (ASX: UBI) ("UBI") advises that it intends to raise approximately $12.5m of capital.

The capital will be used to support UBI’s: • working capital requirement (to support the expected inventory build and growth in sales); • ongoing product development; • operating losses in the shorter term; and • Ongoing costs associated with the approval of Xprecia Prime in the USA

An underwritten pro rata non-renounceable entitlement offer of new CHESS Depository Interests over fully paid shares of common stock of UBI to raise approximately A$10 million at a proposed ratio of 1 New CDI for every 2.55 existing CDIs held and a non-underwritten placement of New CDIs to institutional and sophisticated investors to raise up to A$2.5 million

New CDIs will be issued at a price of A$0.15 per New CDI participants in the Placement and Entitlement Offer shall receive one attaching Option for every New CDI issued, at an exercise price of A$0.20. The Options will vest upon issue, expire 3 years from the date of issue, be exercisable in multiple tranches and each entitle the option holder to 1 CDI upon exercise

UBI has received a binding commitment from existing shareholder Viburnum Funds (Viburnum Funds holds a beneficial interest and voting power over approximately 26% of our shares.)to fully underwrite the Entitlement Offer. Viburnum is an associate of Mr. Craig Coleman (the Non-Executive Director of UBI who is also the Executive Chairman of Viburnum and a substantial shareholder in Viburnum). Viburnum shall have the right to require the Entitlement Offer to be repriced in the event that the trading price of UBI CDI's falls below A$0.10 per existing CDI for any three consecutive days prior to the securityholder meeting (see below). In the event the parties are unable to agree the repriced amount, Viburnum shall be entitled to terminate the underwriting agreement. Viburnum will receive 13,849,567 options, as its underwriting fee , equal in value to 5.0% of the underwritten amount of A$10 million. The Underwriter Options will be issued on the same terms as the Options issued to investors under the Entitlement Offer. If the Underwriter Options are not issued, including where securityholder approval is not obtained for the issue of Underwriter Options, UBI shall pay Viburnum an underwriting fee equal to 6% of the underwritten amount in cash, at the time of issue of CDIs under the Entitlement Offer.

Technology update

Lead & Heavy Metals detection UBI’s has identified a significant market opportunity in detecting heavy metals and other impurities in water. The opportunity uses UBI’s existing infrastructure and technology and is low cost. UBI is completing proof of concept for Lead and Copper sensors

Admittedly these financials are a lag to the last announcement of the first $1M month but at $1.6M total for the quarter and a burn of $5.15M albeit including $1.8M non recurring and $1.2M on inventory the revenue was below expectation and the SP took a hit down around 20%. No detail on progress of various products.

The Company spent $1.8m during the period on non-recurring capital items and product development, including costs relating to the FDA application for Xprecia Prime. The Company also spent $1.2m on inventory relating to new products launched in markets around the world.

Sales for H2 2023 were up 55% on H1 2023

Repost from a forum response to@PinchOfSalt with his comments at the end.

UBI has quite a lot of detailed analyst coverage which all got the share price wrong but gives a good overview of the company. Bell Potter the latest with a valuation of $0.38 Hold in January 23 down from $0.60 Buy

SP has been hammered on the back of delayed FDA approval of Xprecia Prime and slow uptake of the Sentia platform globally compared to AU. Roughly 5% ROW compared to 17%AU.

Margins for the the main platforms are Sentia 71% on TAM of $900M, Xprecia 66% on TAM of $1Bn, Petrackr 49% on TAM of $260M.

R&d spend had been big at appx 16% of revenue in 22, 8% in 23 and 6+% for 24. The unanswered question is whether they will pursue cash flow or continue to chase further development of the cancer, fertility, heavy metals testing which could take a lot of funds.

The big opportunity appears to be the US market for Xprecia Prime as there was a big hangover in sales of the old system as the deal with Siemens came to an end in 23.

Some interesting thoughts on HC on Prime revenue in India

"Just for reference the retail list price for a Xprecia Prime handset in India is Rupees 65,000 (A$ 1,150) and a Pack of 100 Strips is Rupees 22,500 (A$ 4 per strip). If we use the order earlier this year in Italy as a usage benchmark that was for 100 units and 130,000 strips over 24 months (65,000 per year). At a similar usage rate the India sales from this order would result in 330,000 strip sales per year. That is a retail value of A$ 1,320,000 in strip sales from this order alone"

Another post looking at cashflow.

"In regards the reference to $1.4m of sales a month for breakeven, I can't get the maths on that to work. I think the breakeven sales figure is much higher at $2.7m per month.

Showing my working in case anyone can spot an error.

From the six months to June 2023 report

- Annualised operating expenses of $21.4m (10.7 x 2)

- Gross margins of 65%

- Thus sales required to breakeven on opex = $32.9m (21.4 / 0.65)

- Monthly sales for breakeven $2.7m (32.9 / 12)

The December sales result was good but I still expect around $3m of cash burn in the December quarter."

Sentia widely regarded as market leading in ease of use and now with a suite of available tests should gain traction.

Petrackr has better accuracy and lower cost than most competitors.

Xprecia has about 2000 devices in market. Not sure how many they can deliver per year. Siemens had 5000+ installed on old platform.

Capacity to manufacture 70M tests per year.

So in conclusion answering questions arising from the latest update.

1. Cash flow positive? Probably not yet but with US Xprecia approval in 24 should be coming as long as r&d spend is kept tight.

2. Is the $1M repeatable? Yes but likely to be lumpy at this early stage with stocking orders for devices and strips before recurring strip revenue becomes steady.

3. Earlier broker reports had revenue forecasts for 24 @ ~$40M but Bell Potter Jan 23. @$16M at a current MC of $47M you would have to think there is danger of a take over before the good times appear. Top 20 holders own 64%

From @PinchOfSalt

"I don't think TAM means much but your other points are good. High margin, growing sales, decreasing R&D.

But they need to more than double revenue to $2.7M p/m to break-even.

With cash and cash equivalents at $16.6M in the last 4C (Sept '23) they've got till the end of 24 at current cash burn rates ($3M / qtr) before needing a CR. If they can continue to increase revenue during '24 then they've got longer. Seems to be a path to profitability (or at least break even) if they can open up some new markets."

Hope this helps and feel free to comment Strawpeople.

Disc: 8% holding in SM down 17% and a small holding in RL.

Things turning the corner for UBI? Xprecia Prime sales starting to build and FDA decision in Q1. Update lacking in detail and is this just a lumps sales month or a trend?

Sales orders in December are forecast to exceed $1,000,000 (unaudited estimate).

• UBI has received its largest order for Xprecia Prime devices from India. The order is for 520 devices, which are to be delivered in December.

• UBI submitted its full response to the FDA’s “Request for Additional Information” on 23 November. Assuming there are no further queries, an FDA decision re the approval of Xprecia Prime for sale in the USA is expected during Q1 2024.“

December is forecast to be UBI’s biggest revenue month ever and is the first time we expect to record $1,000,000 from selling our products directly to customers (excluding Siemens). Six of UBI’s new products have been in the market for approximately 6 months and sales growth during H2 2023 has been strong (compared with H1 2023). We now have 11 revenue generating products in market and we are starting to build sales momentum.”

Expanding Xprecia Prime sales into India has not helped the SP which is back down to near June lows.

Universal Biosensors, Inc. (ASX: UBI) is pleased to announce it has received approval from the Indian Central Drugs Standard Control Organisation (CDSCO) for the sale of Xprecia Prime, with the first order received from UBI’s distributor for the region.

This first order is in the process of being delivered and will see first sales into the market in Q3 CY23.

Mr John Sharman, CEO of UBI said; “We have been working on the approval of Xprecia Prime in India for more than 12 months, and we are delighted with this significant step forward. Whilst this first order is not material in value (under $100,000), India is a powerful and emerging market, and we are excited for the opportunities Xprecia Prime represents to disrupt this market.”

Petrackr gaining traction with 5 more distributors signed up and an improved revenue forecast.

Universal Biosensors signs five more Petrackr distribution deals

We now have 8 distribution deals in total and received purchase orders of $480,000 in the first two months since launch. First year sales value from these 8 deals is expected to exceed $4 million with sales growth expected in the following years.

Mr John Sharman, CEO of UBI said; “We are confident that “Petrackr” provides customers with a better alternative in terms of price, accuracy, latest technology, user mobile application and overall performance compared to the current products available in the market.”

UBI CEO's address making some bold statements at the AGM. Let's see them follow through.

"UBI believes that it can achieve operating cash break even on a monthly basis towards the end of calendar 2023 and then ongoing throughout 2024."

Petrackr

Global launch May 2023. Superior features and performance compared to market leader.

4 distribution agreements have been signed. • First orders expected to be $0.33m. • First full years sales expected to be $2.25m.

Another 10 transactions are being negotiated • First orders are expected to be $1m. • First full year sales expected to be $4m

Next gen manufacturing line will accelerate the development of UBI’s new technology platform. Validation to be completed in June 23 Project is $0.70m below budget.

Specifically it will allow UBI to design and manufacture: • 2 and 3 electrode strips in unique configurations.

• 3 electrode strips using aptamer based technology to detect and measure a range of targets previously not achievable with the legacy technology.

• 3 electrode Lubricin based strips to detect and measure a range of targets previously not achievable with the legacy technology.

As @PinchOfSalt pointed out UBI is spending big with little revenue but the pet diabetes test starts to move things in the right direction. First year sales in the US alone predicted to be $2M. Europe/Asia distribution to come. It will be interesting to see the next couple of quarters as revenue from Xprecia Prime, Petrackr and Sentia comes in to get a better picture of whether the company can start to make money.

UBI launches PETRACKR® Diabetes product for dogs and cats.

UBI signs multiple distribution deals and makes “first sales” in USA and Canada.

Universal Biosensors, Inc. (ASX: UBI) is delighted to announce it has today launched its PETRACKR blood glucose monitoring product for dogs and cats with diabetes globally.

To coincide with the launch, UBI announces it has signed three distribution partnerships in the United States of America and Canada and received initial purchase orders of circa $280,000. First year sales value from these three deals is expected to exceed $2 million with sales growth expected in the following years.

10,000 PETRACKR analysers and 375,000 diabetes test strips have been delivered or are in transit to UBI warehouses in the USA and Europe. Stock to fill “first orders” for the newly acquired UBI customers in the United States of America and Canada will be delivered during May.

UBI expect to announce first sales to additional distribution partners over the coming 6-8 weeks with multiple deals in the USA, Europe and Asia Pacific in the final stages of negotiation and documentation.

Held in SM and RL

Sentia wine testing new test Titratable Acidity. US growing well but Europe seems less positive. Maybe more reluctant to change from standard practice? Positive statement about financial opportunity. Increased uptake should lead to a steady revenue stream from the consumable strips. If they can do the same thing with the animal diabetes product should start to see good revenue flows in coming quarters.

Mr John Sharman, CEO of UBI said; “The launch of our Titratable Acidity test means we now have the six most important tests undertaken by winemakers available on the Sentia platform. Current testing for Titratable Acidity relies on traditional enzymatic tests using expensive machinery and time consuming processes or simple “colour changes” on enzymatic paper strips. Sentia represents a compelling alternative for winemakers to buy when compared with this and other more expensive, time-consuming and often less accurate laboratory equipment and chemistries currently in use.”

Mr Sharman said; “ In-market sales for Q123 v Q122 grew at 188% with 165 devices sold into wineries and over 65,000 strips sold. In Australia we estimate 16% of the market is using Sentia and our business in the USA is growing strongly. We estimate we have 5% of the USA winemaking market using Sentia and our ambition is to have 8-10% of that market by the end of this year. Sales in Europe are growing from a small base.”

Mr Sharman said; “The feedback we have received about the market opportunity for Sentia has been strong and we believe Sentia represents a significant financial opportunity for the company.”

Next Sentia wine test with 2 more coming in next 2 months. First batch of previous fructose sensors sold out quickly.

Universal Biosensors has launched its Acetic Acid biosensor test, the 5th test now available on the Sentia wine testing platform.

Acetic acid is tested continuously throughout the year and is of particular importance for red wine ageing in barrels. The timing of the launch is ideal for the upcoming fermentation and maturation period for wineries in the northern hemisphere. High levels of Acetic acid in wine are considered a highly undesirable fault and therefore monitoring is extremely important.

We have two more Sentia products in development being a Titratable Acidity test and our next generation Free SO2 test, which will be a significant enhancement for the very good Free SO2 product already in market. Both products are scheduled for launch within the next two months.”

Mr Sharman said; “Sentia now has 5 tests on the platform which makes it a more compelling alternative

It should also provide momentum in terms of device sales during 2023. We hope that Acetic Acid will be as well received as our Fructose biosensor, where the first batch of sensors sold out within a few weeks.”

Look forward to seeing the next set of results and the revenue from Xprecia Prime. UBI makes first sales of next generation Xprecia Prime in Europe

Mr John Sharman, CEO of UBI said; “This is a significant achievement for UBI and something we have been anticipating for many months. It represents the beginning of our new coagulation business based around our next generation Xprecia Prime platform.”

Mr Sharman said; “Looking forward, the Siemens relationship ends in March, our own distribution network is growing and our new Xprecia Prime device looks very promising in terms of sales. The supply chain issues appear behind us, our USA based clinical trial is complete and we are well positioned to submit our 510K application to have Xprecia Prime approved for sale in the USA. We are looking forward to a much better sales performance from our coagulation business during 2023.”

Maybe this announcement of Fructose test release provides some explanation as to the revenue drop. "the measurement of Glucose without Fructose is not meaningful for winemakers and Sentia sales were negatively impacted by the delay of Fructose. Now that we have both Glucose & Fructose available for sale, we are confident the Sentia wine testing platform can deliver strong sales growth during 2023.”

"We estimate the market for Total Sugars to be more than $160m pa." Need to see that happening this quarter or Sentia does not seem to be fulfilling its promise.

Big drop in revenue from $1.4M to $590K with no explanation! In reality $4.5M cash burn not counting the $3.9M rebate. Nothing new in the quarterly. Some activity expected in 1H 23.

• The finalization of the development and preparations for the launch of our blood glucose monitoring product

for dogs and cats with diabetes. Petrackr product is expected to be launched in Q1 2023.

• Ongoing development of the Sentia wine testing products which includes Fructose, Total Acid and Titratable

Acidity. We expect all these products to be launched during H1 2023.

• UBI’s 510K submission to the FDA, which is expected to be lodged during Q1 2023.

FINANCIAL UPDATE

Net cash (cash and cash equivalents less short and long-term debt) as at 31 December 2022 was $26.8 million.

Highlights are as follows:

• Receipt of R&D Tax Incentive for 2021 of $3.9 million

• Increase in receipts for the year by $51k. Not sure why this is a highlight and no explanation of where it comes from.

UBI completes Xprecia Prime clinical trial in USA (should lead to revenue in H2) nice to see +ve SP movement.

The study is designed to provide clinical evidence as to the performance and safety of Xprecia Prime and will be used in UBI’s 510K submission to the FDA, which is expected to be lodged during Q1 2023.

Mr John Sharman, CEO of UBI said; “The completion of the clinical study in the USA is a key milestone for the future of UBI’s coagulation business. UBI has spent more than 10 years developing its Point of Care coagulation platform and the data generated by the clinical study is strong.” Mr Sharman said; “UBI’s existing coagulation product (Xprecia Stride) has insignificant sales in the USA which represents about 50% of the estimated global US$1 billon PT/INR market. We expect an approval to sell Xprecia Prime in the USA will add significant value to our coagulation business into the future.”

A good update today with some more details following the results presentation. @Chagsy points still hold on cash burn but some targets to see whether UBI can meet in Sentia and animal testing. Update on cancer testing and Covid / fertility testing. Plenty of news to come in H2 22 and H1 23

For the 9 months ending 30 September 2022, “In Market” Device sales are estimated to grow at an average of 24% per quarter. For the 9 months ending 30 September 2022, “In Market” Strip sales are estimated to grow at an average of 41% per quarter. Average Selling Price per strip has increased 21% between H1 2021 and H1 2022.

Three more products are expected to be released over the coming months (Q4 2022 / Q1 2023) • Fructose – our reworked chemistry is working well, and the strip is now in stability trials. • Titratable Acidity – the chemistry is working well, and the strip is now in stability trials. • Acetic Acid - the chemistry is working well, and the strip is now in stability trials. We now have 20 distribution agreements in place covering 25 countries.

Xprecia Prime USA clinical studies progressing well with 308 patients of the FDA’s required 360 enrolled. UBI now have 27 distribution agreements in place covering 19 countries. Sales in 2023 are expected to benefit from the finalization of the Siemens hand over and the launch of Xpreica Prime.

Animal Blood Glucose Biosensor Update 60 prototype devices are to be delivered to UBI in October. Contact has been made with 45+ potential distributors globally. 10 companies in advanced discussions (ie. NDA, Term Sheet) covering: • United States (4x) including one global player, • United Kingdom (2x), • Europe, • Australia, • China, • Finland. Sales expected to commence H1 2023.

It’s estimated 1.25m animals have diabetes globally of which: • 552,000 animals are in the US: 300,000 dogs (1 in 300 have diabetes). 252,000 cats (1 in 230 have diabetes). Estimated global market size $239m in 2022. Market is growing at a CAGR of 11.35% and projected to be $414m in 2027. 138 million test strips estimated in 2022 (62 million in the US). Projected number of test strips per animal with diabetes is 112 p.a.

Supply chain issues delayed the delivery of a key raw material (Lubricin) by several months which in turn delayed our second development trial using Victorian Cancer Biobank blood samples. New Lubricin arrived at UBI during the last week of August. UBI’s second development trial, (Victorian Cancer Biobank trial), is expected to report results before the end of 2022.

Work on our aptamer based COVID-19 biosensor platform is progressing. Our first pilot clinical study, testing live COVID-19 virus, will begin during Q4 2022. The work performed on the aptamer based COVID-19 biosensor platform is all transferrable to our fertility hormone monitoring tests and will fast track this development (on the same platform). The three aptamers for estradiol, progesterone and luteinizing hormone have been developed and are at the UBI facility. Initial testing has been performed and the results look promising. Full proof of concept work will begin in Q4 2022.

Disc: hold in SM and RL

1/2 Yr result presentation probably won't be taken well by market as big R&D cash burn and increased staffing costs. However the platform has a diverse market in health, veterinary, wine. Good to see a timeline for cash break even in 2023 although this is not allowing for further product development. New wine tests and vet blood glucose test launching in 2023. Supply chain disruptions to revenue from Xprecia Prime. I am still seeing this as a long term hold and looking to top up as funds allow in SM and RL

Pros

Sentia wine testing progressing, 21% direct sales growth quarter on quarter (Q1 2022 : Q2 2022). 21% increase in Average Selling Price per strip between H1 2021 and H1 2022

Well-funded and has $33.4m cash ($8M / Yr burn rate +$5M R&D) stating fully funded

UBI expect 350 Xprecia Prime devices will be delivered during Q3 2022. Sales will commence and growth is expected during 2023. Importantly UBI recorded 93% sales growth of sales directly to non-Siemens distributors. UBI has successfully transitioned 50% of the legacy Siemens distribution network which are now buying directly from UBI (another 15% are still in negotiation). The result of the changing sales mix is a 13% increase in Average Selling Price per strip.

Cons

Xprecia sales growth not expected until next generation Xprecia Prime device is in the market. Global supply chain issues have delayed the delivery of Xprecia Prime devices to date.

Product release

Work continues on the stability of our Sentia Fructose biosensor. The performance of the sensor is excellent and multiple runs are now down for stability. We remain on track for launch Q4 2022 / Q1 2023 (subject to stability). Work continues on the Sentia Titratable Acidity and Acetic Acid biosensors. Both products are on track for launch Q4 2022 / Q1 2023 (subject to stability). Supply chain issues has meant one of the raw materials for our Tn Antigen cancer biosensor has been delayed by several weeks which has pushed our target reporting deadlines out. We still expect to be reporting the next results from our development clinical trials on Q3 2022. The development of our blood glucose biosensor for cats and dogs is on track and due for completion towards the end of Q4 2022 with launch expected shortly after.

Financials

For the year ending 31 December 2022 UBI will spend $17m in cash:

• $8m spend on day-to-day operating expenses; and

• $9m investment in Development Assets.

Moving forward UBI can control the spend on Development Assets:

• UBI is forecasting to have a closing cash balance of $25m as at 31 December 2022.

• UBI is forecasting for sales to reach a monthly level that it will achieve cash break-even during 2023 (on a monthly basis excluding investment in Development Assets – refer slide 15)

• UBI expect cash spend on Development Assets for FY23 to be materially lower ($5m +/-) than FY22. • UBI expect to have enough cash to fund all Development Asset investments and day-to-day operations.

Good to see an update on further Sentia distribution agreements, release of new Glucose test and increasing revenues although R&D and staff costs increased 75% YOY. Cash burn of $4.4M vs $1.4M of revenue shows the need for Xprecia Prime revenue (US trial 78% recruited)

Receipts from customers during the three months ended 30 June 2022 increased by 39% to $1.4 million compared to the previous corresponding period • Receipts from customers during the six months ended 30 June 2022 increased by 80% to $2.4 million compared to the previous corresponding period

Sentia quarter on quarter direct sales increased 21% between Q2 2022 and Q1 2022; • Overall sales of Sentia for H1 2022 were in line with H1 2021;

Sentia Update UBI signs 2 new distribution deals in Europe, first sales in the UK and launches Glucose Test Universal The launch of Sentia into the Italian, Austrian and eastern European markets is a significant step in the commercialisation of Sentia globally. There are tens of thousands of wineries in Italy; they are the biggest wine-producing country worldwide. In addition to Austria, Biomedica gives us access to Poland, Czech Republic, Hungary, Croatia and eight other countries. Wineries in these markets have limited access to lab testing.

” Petra Wiedemann, Managing Director at Biomedica Medizinprodukte GmbH commented: “We are delighted to be partnering with Universal Biosensors to build Sentia in Austria and eastern Europe. We conducted due diligence for over 12 months and are confident that Sentia is a unique and attractive proposition for large and small winemakers.”

Both deals include an initial commitment to purchase volumes for Sentia devices and strips which will be delivered over the course of August.

Additionally, UBI announces: it has recently made its first sales of Sentia product into the United Kingdom to Berlin Packaging; it has launched its Glucose test which will allow winemakers to monitor glucose levels during primary fermentation. This will be complemented by a fructose test later in 2022 / Q1 2023, which will then provide a ‘total’ sugars profile to identify when fermentation is complete;

310 devices (estimated. 3.1% of the USA market) have been sold into the USA (distributors and direct to wineries). We estimate approximately 30% of stock sold remains in the hands of USA distributors.

Xprecia Prime received regulatory approval to sell in 32 countries in Europe; 281 patients have been enrolled in the Xprecia Prime clinical trial in the USA (360 patients required in total);

CEO's address to shareholders. Nothing new but some positive statements including targets for Sentia market penetration and clear timeline for Xprecia Prime to market in early 2023 and no need for additional raises. Market cap now only 2x cash held.

The last 8 weeks have been brutal on global stock markets, but UBI’s business has never been in better shape. UBI is investing more than $9m into new technologies and another $3m on new manufacturing equipment. The investment should deliver new biosensor products in Coagulation, Vet, Wine, Oncology, Fertility and Infectious Disease. The investment into our new manufacturing equipment will add circa 35m test strip capacity for new products.

UBI is now fully funded with no foreseeable need for additional cash

UBI has a number of interested global companies in discussion for our technology. • We are confident Sentia will be a global success. • We are confident Xpreica Prime will be a global success. • We are confident our Vet blood glucose product will be a global success. • We are confident our oncology product will be a global success. • We are confident our fertility products will be a global success. • We are confident other products we develop can deliver global leadership in each of their markets. • Our technology platform allows for additional biomarkers made by third parties, such as in oncology, cardiology or the environment ….., to be integrated into our test strips to create more global biosensor products.

Sales for Sentia for H122 are expected to be up 5% - 10% compared to H121. Importantly the mix of sales has moved away from large stocking orders (to distributors) towards more direct sales to wineries and repeat orders for the consumable test strips. Whilst sales have grown, the delay in the launch of our Total Sugar Test (Glucose + Fructose) has deferred up to $2.2m of revenue which was forecast for FY22. We are confident we are on track to deliver the Total Sugar test and have more than 10 formulations down on stability. The Total Sugar Test should be ready for sale by the end of 2022. Our Total Acid and Acetic Acid tests are progressing well and should be available for sale late Q4 2022 / early 2023. We have improved the original versions of the Free Sulphur and Malic Acid tests as part of our continual improvement process and these are performing very well.

Australia –11.3% of the estimated 1,800 production wineries have already purchased Sentia and are buying our Free Sulphur and Malic Acid strips. Our ambition is to achieve 15%-20% market penetration by the end 2022. New Zealand –4.4% of the estimated 500 production wineries have already purchased Sentia and are buying our Free Sulphur and Malic Acid strips. Our ambition is to achieve 10% market penetration by the end 2022. USA –3.1% of an estimated 10,000 production wineries have already purchased Sentia and are buying our Free Sulphur and Malic Acid strips. Our ambition is to achieve 6%-10% market penetration by the end 2022. Canada –5.1% of an estimated 700 wineries production wineries have already purchased Sentia and are buying our Free Sulphur and Malic Acid strips. Our ambition is to achieve 10% market penetration by the end 2022. Europe <1%. Because of COVID and travel restrictions we have not effectively launched in Europe. However, We have appointed an experienced manger to begin selling Sentia direct in Europe who joins us in July 2022.

Negotiating distribution contracts in Italy, Austria, Germany, Hungary, Serbia, Poland, Bulgaria, Romania England, Argentina, Chile, Turkey, USA.

We do expect to see strong sales growth during H2 2022 for our Xprecia products.

The Clinical trial required for FDA approval commenced and first patient was enrolled late 2021. We are well on the way to fulfilling the FDA requirements and submitting for approval • 264 of 360 patients recruited. • Clinical trial expected to be completed Q3 2022. Regulatory submission (USA H2 2022) then approval expected in 2022 or Q1 2023. Direct sales staff have been employed in Europe to facilitate growth. Distribution center and European subsidiary established. UBI expect to increase its market share of the global PT/INR coagulation market with the launch of Xprecia Prime.

Since the announcement of the CR for retail the SP has fallen (68c at time of writing) so would seem unlikely that many will apply for shares at 77c let alone extras. So looks like Viburnum will pick up a big increase in its shareholding.

Universal Biosensors, Inc. (ASX: UBI) (Company) advises that, in respect of its capital raising announced on Wednesday, 20 April 2022, the fully underwritten 1 for 6.85 non-renounceable entitlement offer of CHESS depositary interests over fully paid ordinary shares in the Company (Entitlement Offer) opens today.

The Entitlement Offer is fully underwritten by Viburnum Funds Pty Ltd, an entity associated with UBI Chairman, Craig Coleman (Viburnum).

Viburnum, as an investment manager for its associated funds, currently holds a beneficial interest and voting power in approximately 16% of UBI’s CDIs. In the event all the New CDIs are taken up by Viburnum under the Entitlement Offer, its voting power in UBI would increase to approximately 26.77%.

Viburnum will receive 3,840,000 unlisted options, in two tranches, as its underwriting fee (Underwriter Options), equal in value to 3.4% of the underwritten amount of A$20 million. The Underwriter Options will vest upon issue, and have an expiry date of 3 years from their date of issue. The exercise price in respect of half (1,920,000 options) of the Underwriter Options shall be an amount equal to the Offer Price plus 20%, with the remaining Underwriter Options (1,920,000 options) being exercisable for an exercise price of the Offer Price plus 30%. In the event that shareholder approval for the issue of the Underwriter Options is not obtained by 30 June 2022, or where UBI does not issue the Underwriter Options within 1 month of receipt of shareholder approval, UBI shall pay Viburnum a cash underwriting fee of 4.5% of the underwritten amount of A$20 million (being $900,000).

If certain events occur, some of which are beyond the Company's control, Viburnum may terminate the Underwriting Agreement. The events which may allow termination of the Underwriting Agreement include the following: • the S&P ASX 200 Index is 10% or more below its level as at the close of business on the business day prior to the date of the Underwriting Agreement, at close of trading for more than 3 consecutive business days;

UBI intends to apply the net proceeds to support new product development, provide working capital to support growth and invest in the Company’s manufacturing and R&D capability. In particular, working capital will be applied to support in-market sales growth of existing products, new manufacturing equipment and marketing and business development.

CR details. Good that it is only a small discount and involves shareholders

New manufacturing and R&D equipment is required to deliver these opportunities as the existing manufacturing equipment (which supports our existing range of products) cannot adequately support the new biosensors in development.

UBI will undertake a fully underwritten non-renounceable entitlement offer to Eligible Securityholders to raise A$20m (“EntitlementOffer”). 1new UBICDI for every 6.85 existing CDIs held as at 7:00pm on Tuesday, 26 April 2022

• Eligible Securityholders who take up their full entitlement may subscribe for an additional New CDIs in excess of their entitlement under the Top-Up Facility, up to a maximum of 100% of their entitlement (“Top-Up Facility”)

• UBI is also undertaking a non-underwritten institutional placement of new CDIs to raise a minimum of A$5m (“Placement”) under UBI's existing placement capacity (the Placement together with the Entitlement Offer, the “Offer”)., with the ability to accept oversubscriptions. The results of the Placement are expected to be released on Thursday, 21 April 2022

Offer Price of A$0.77 per New CDI payable for all CDIs issued under the Offer representing a:

• 2% discount to the last close price on 14 April 2022 of A$0.79; and

• 5% discount to 5-day VWAP of A$0.81

UBI in a trading halt for a CR followed by an announcement about interim results of antigen testing trials.

Positive results from 3 electrode test strips which will require a $2M investment in manufacturing upgrade (9-12 months) but large addressable market for cancer monitoring blood test. ($17B claimed)

“The results suggest that the Tn Antigen handheld biosensor is potentially more sensitive and more specific than the existing FDA approved Carcinoembryonic Antigen “CEA” biomarker used for monitoring colorectal cancer (sensitivity 55.2% and specificity 83.6%)[5]. Sales of the CEA biomarker are estimated in excess of $3 billion pa. UBI sensitivity 100% and specificity 90%

Although the sample sizes are not statistically significant and patient samples are from pre-screened cohorts, these development clinical results give UBI confidence in the Tn Antigen product and that there is significant improvements to be achieved through continued development of the chemistry and 3 electrode strip.

UBI expects results from the Victorian Cancer Biobank sponsored study (n=130) on the three-electrode test strip design made on one of the R&D manufacturing lines to be available during H1 2022. UBI will also be retesting clinical samples from the CIC bioGUNE study on the three-electrode test strip design and expects results to be available during H1 2022.”

I really like the potential of this company due to their leading technology and the wide range of applications with significant revenue streams.

Disc held in rl

Regulatory Approval to sell Xprecia Prime in 32 countries in Europe. The annual market for PT/INR testing in Europe is estimated as $370m p.a. Analyser, strips, control.

This will be a major proving period for UBI. Can they convert existing Xprecia users to the new Prime units and will the distribution network acquired from Siemens give the desired market penetration?

“Because of the superior performance of Xprecia Prime, UBI expect to increase the installed base of Xprecia Analyzers in Europe and increase the number of test strips sold annually.

In addition, as part of UBI’s global growth strategy we have commenced Xprecia Prime clinical trials in the USA that are designed to achieve FDA approval (and support ongoing approvals around the world). 53 patients have already been enrolled in a 360-patient trial which is expected to complete during H2 2022.

UBI expect Xprecia Prime to win significant market share over time since its performance is equal to or better than anything else on the market and will be offered at a very competitive price point.”

Annual report to SEC is very detailed. Include detailed revue of risks and acknowledges the hurdles to profitability in competition with big companies in the medical space.

s a

s a

Timeline for Sentia "Total sugars" test launches Q1 22, Acetic and Total acids Q2

Overview of finances. R&D expenditure ($9.2M) behind increased losses. $3.9m R&D tax incentive credit

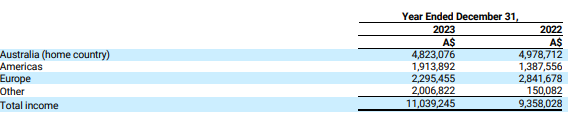

Aus income down but Americas and Europe up move away from Siemens in coagulation income.

This could have impacts

Sentia over 1/4 of product revenue and increased margin, testing services growing.

Increase in inventory

Gender diversity ok overall but not much in senior management.

Animal diabetes license from lifescan has timeline and revenue clauses (LifeScan is a leader in blood glucose monitoring products with 2017 net revenue of approximately $1.5 billion. Bought by Johnson &Johnson in 2018)

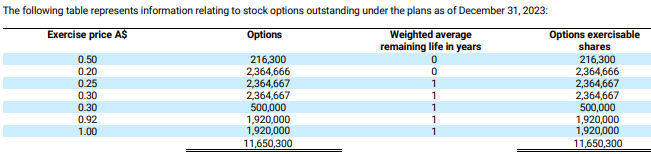

Viburnum Funds PTY Ltd 16% ownership. 178M shares on issue, 2500 holders, 8.8M options at a weighted ave of $29c,

Cash outflow of 483K after receipt of $2.8 million under the R&D Tax Incentive rebate. Large spend on R&D ongoing hopefully leading to major revenue increases in the next 5yrs but positive increases in revenue. Sentia revenues should continue to grow with new tests.

Net cash (cash and cash equivalents less short and long-term debt) as at 31 December 2021 was $18.1 million.

Highlights are as follows:

• Receipts from customers during the three months ended 31 December 2021 increased by 255% to $1.3 million

compared to the previous corresponding period

• Receipts from customers during the twelve months ended 31 December 2021 increased by 412% to $4.0 million

compared to the previous corresponding period

• Total revenue for the twelve months ended 31 December 2021 increased by 80% to $5.8 million compared to

the previous corresponding period

• UBI invested $9.3 million in research and development activities in 2021 ($5.0 million in 2020)

The primary reasons for the increase in receipts from customers included:

• the Company benefited from a new revenue stream in 2021 following the successful global launch of our Sentia

Free Sulphur Dioxide wine testing product;

• the contract liability (deferred revenue) relating to the Company’s obligation to transfer Xprecia Stride strips

to Siemens which was received in 2019 was fully utilised in Q2 of 2021; and

• our revenue from coagulation testing increased by 245% year on year due to our subsidiary, Hemostasis

Reference Laboratory Inc. entering into a number of new contracts, including a contract with Bayer Inc.

Development expenditure increased during the year ended 31 December 2021 because the Company invested in multiple development projects (detailed above). In October 2021, the Company received $2.8 million under the R&D Tax Incentive rebate.

UBI expanding the Sentia handheld wine testing platform adding to revenue. Glucose /Fructose tests coming soon.

UBI launch Sentia Malic Acid Test. First delivery and sales of the Sentia Malic Acid Test is scheduled for late January 2022

into USA, Australia and New Zealand markets.

Malic Acid is one of the most important, time consuming and difficult tests performed by winemakers and typically takes winemakers 30 minutes but can take up to several hours to complete. The Sentia Malic Acid Test will provide wine makers with accurate and timely measurement of the Malic Acid in their wine within 60 seconds of sample application and at a low cost by using the Sentia portable, handheld device.

Typically, a winemaker will track and test the levels of Malic Acid in each variety of wine many times during the secondary fermentation process. The number of Malic Acid tests performed globally is estimated at 15 million.

John Sharman, CEO of UBI said; “The launch of Sentia’s Malic Acid Test globally is an important achievement for our Sentia product. We have now the two most important tests used in winemaking being Free Sulphur and Malic Acid available on our platform. UBI estimate the combined market for both these tests is approximately $270 million pa. Given the time saving, cost saving and accuracy of our Sentia device, we hope to win a significant market share.”

Mr Sharman added, “UBI is ready to launch its Sentia Glucose Test and is finalising the Sentia Fructose Test. We expect to launch Sentia “Total Sugar’s” Test into the global wine market in the coming weeks.”

UBI signs new technology licensing deal to commercialise SARS-CoV-2 N-Protein test.

With the current difficulty in getting a PCR test here in SA and the rapid antigen tests also having supply issues another test should be good but will it still be relevant in a year’s time? How much will it cost to develop? Expands the test platform into advanced aptamer testing not just COVID.

”Based on what we know is available in the world today, a COVID-19 Test offering an accurate result within 30 seconds of the patient sample will be the first of its kind globally.”

The COVID-19 Test will use UBI’s proprietary electrochemical strip and device technology designed to provide a positive or negative result as to a patient’s viral status within 30 seconds (based on internal validation work performed to date) from a small saliva sample.UBI’s electrochemical test method also has the potential to measure the relative viral load associated with a patient’s infection status.

UBI has been working with Dr Shalen Kumar of IQ Science for 6 months performing due diligence on the aptamer technology and the performance quality of IQ Science products:

• The License is global, exclusive, and perpetual.

• Payment of Commercialisation Fees is triggered on the earlier of receiving a regulatory approval for the COVID-19 Test or generating $1 million of sales from the sale of the COVID-19 Test

• Where Commercialisation Fees are not yet payable, a Pre-Commercialisation Fee of $50,000 per year will be paid for a maximum of three years.

• Where Commercialisation Fees become payable, either:

• a minimum payment of $50,000 in the first year which increases by $100,000 each year up to a maximum of $450,000 in the fifth year

• UBI will be responsible for funding and obtaining all regulatory approvals and all commercialisation activities.

Company quotes

“the UBI platform is expected to be the first of its kind to offer advanced aptamer-sensing in a handheld portable device. In addition, it is possible the UBI platform will be able to quantify the amount of the virus in the sample which will lead to incredibly valuable data being generated for patients, physicians and governments around the world.”

“Recent events, including the response to Omicron, suggest that the demand for COVID-19 testing will remain significant at least for the next 5 years. Subject to further internal and clinical testing, our initial estimate is that we should have a product ready for market in the next 9-18 months.”

DISC: own in RL

Further support to UBI’s cancer biomarker test development

UBI signed a Master Collaboration Agreement with The Mayo Clinic to test and validate our Tn cancer biomarker and then investigate the utility of The Mayo Clinic’s “research biomarkers” on UBI’s platform.

UBI’s ambition is to:

• Develop a finger prick blood test which can be used at home or at the physician’s clinic.

• The Tn cancer biomarker test will initially be used to monitor the status and progression of a cancer patients' tumors whilst in remission.

• Ultimately the Tn cancer biomarker test may be used for cancer screening and staging.

Sequoia updates its detailed report on UBI. Revises 2yr forecast down to $1.57 on increased R&D and costs and emphasises a 2yr horizon for FCF. Also a significant acknowledgement of the Sentia wine testing device. Sentia received an Australian “2021 Good Design Award” in the Product Design category in recognition for outstanding design and innovation.

https://www2.asx.com.au/content/dam/asx/broker-reports/2021/ubi-update-sequoia-291021.pdf

Forecasts & Recommendation

We revise our revenue forecasts by -20%, 0% and +7% for CY21, CY22 and CY23 mainly for more conservative forecast sales of Xprecia (blood coagulation strips) transitioning from Siemens. We slightly upgrade our Sentia forecasts given increased confidence.

Costs: We now factor in a temporary increase in R&D for CY21 and CY22, and higher SG&A costs.

CY21 Net loss forecast -$8.8m (was -$6.4m); CY22 - $7.3m (was -$3.7m); CY23 +$3.0m (was +$4.0m).

Our revised valuation range is $1.44 to $1.70 (previously $1.42 to $1.69). We set our 24-month price target at $1.57 (was $1.69) being the mid-point. With a strong R&D and new product release schedule, numerous catalysts and 115% share price upside potential, we maintain our Buy (High Risk) recommendation.

As UBI is in the early stages of launching its new Sentia Wine Analyser product, and also in the early stages of expanding the distribution base for the Xprecia Stride coagulation product, and other new biosensor products under development and yet to launch, we think investors need to allow at least 2 years for UBI to achieve its growth.

Sentia wins Australian Design Award (13/10/21) –Good Design Awards Jury commented: “A simple to use, a fast, sleek, precision analyser that will change the sulphur dioxide testing process for winemakers. Less time in the lab and results in less than a minute increases efficiencies and reduces costs for winemakers. It’s a clever solution to a usually messy and time-consuming process. The form and user interface are intuitive and it is easy to see how this device will have a big impact in the lives of winemakers.” Source: www.mysentia.com/news/sentia-has-received-an-australian- good-design-award/ .

Start of the next growth phase for UBI with sales expected of the new market leading coagulation device to existing clients after the 6 month trial.

UBI launches USA based Regulatory Clinical Trial for Xprecia Prime

“We expect when Xprecia Prime is approved for sale in the USA and Europe, it will lead to a significant growth in sales of our coagulation monitoring platform.”

Data generated from the Clinical Study will be used to support an application for Xprecia Prime to be approved for sale in the USA (by the FDA) and by regulators in Europe and around the world.

Xprecia Prime is UBI’s next generation coagulation product and will ultimately replace Xprecia Stride which is already approved for sale in 67 countries throughout the world.

The trial will take six months to recruit and will include more than 200 patients across multiple sites.

John Sharman, CEO of UBI said; “UBI has invested millions of dollars developing this next generation product for coagulation and it is exciting to see the project entering the final stage. We expect the clinical trials will take six months to complete and for our submission to the FDA (510K) and other European regulatory bodies to be lodged during H1 2022”.

Our new Xprecia Prime device is a significant improvement from Xprecia Stride and we expect it to deliver market leading performance. We are excited for our new technology to come to market. We expect when Xprecia Prime is approved for sale in the USA and Europe, it will lead to a significant growth in sales of our coagulation monitoring platform.”

USA distribution sets up for further growth as other wine tests are released in the near future.

UBI signs another distribution deal in the USA.

Sentia achieves $1 million of sales.

UBI released its quarterly results and the headlines were:

Receipts for the quarter increased by 698% to $1.4 million

Receipts during the nine months increased by 547%to $2.7 million

Total revenue for the three months ended 30 September 2021 increased by 181% to $1.2 million compared to the previous corresponding period

Early stages but good to see some revenue.

Meet the CEO of UBI from August

Good overview of where the company is going.

https://reachmarkets.com.au/webcast/the-insider-meet-the-ceos-18-august/

This deal would seem to be a big step in expanding the market for Sentia by having the backing of a significant European distributor.

UBI signs major French distribution deal for Sentia

non- exclusive Distribution Agreement with Vivelys SAS (France) which is part of the Oeneo Group of companies, for the distribution of its wine testing platform device, Sentia.

The Distribution Agreement is for a three-year term

. Vivelys is part of the Oeneo Group which has more than 10,000 customers worldwide and has a reputation for developing and selling high end products. Vivelys completed several months of diligence on Sentia before committing to this deal. Importantly this partnership extends beyond the simple distribution of Sentia as Vivelys has expressed a strong desire to participate in the development of other wine testing capabilities to be used on UBI’s Sentia platform.”

Laurent Fargeton, Director of Development for Vivelys commented: “Vivelys is a leader in the wine industry in France and more broadly around the world. We are pleased to partner with Universal Biosensors to offer Sentia to French wine companies. We were seduced by Universal Biosensors' expertise and the practicality of their measurement solution, and so we felt it was logical to sign a partnership agreement. With its ability to measure free SO2 simply and immediately, and soon sugars and malic acid, Sentia strengthens Vivelys' solutions, enabling winemakers to make the right decisions at the right time.”

“As a frontrunner in precision oenology, Vivelys strives to optimise the winemaking process by mastering the key parameters at each stage.”

Although there are many companies chasing the cancer test market (eg recent press about the UK Galleri multi cancer test trial) the interesting point of difference with UBI is to develop a point of care test (like Diabetes test). Also they have other products so this is not the only pipeline.

An easier and cheaper test allowing monitoring of treatment progress. If all goes well product release forecast 2024.

From today’s release:

Tn Antigen cancer biosensor trial agreement with the Peter MacCallum Cancer Centre to supply cancer patient samples which will be used to develop and validate the performance of UBI’s handheld point-of-care cancer biosensor for Tn Antigen (Tn).

This agreement provides UBI with access to plasma samples collected from patients with colorectal, breast and prostate cancer.

Trial results will be used to confirm the presence of Tn in multiple cancer types and determine the clinically relevant range of Tn concentrations.

The trial is scheduled to commence during October and results should be available during Q1 2022.

UBI’s objective is for the handheld Tn biosensor to accurately measure a patient’s cancer status (monitoring of remission and reoccurrence) in easier, cheaper and more frequent tests.

John Sharman, CEO of UBI said, “The blood testing market for cancer remission patients globally is AUD $17 billion per annum. Potentially the Tn biosensor may be used for early cancer diagnosis, disease staging and monitoring of treatment effectiveness.”

Interesting highlights from the sequoia report.

Moving in to the wine industry where the test for malic acid will be a gamechanger for many wineries that currently have to test externally at higher cost and time delay.

Developing a world first point of care cancer sensor aiming to be on market in 5 years. Owns the IP to the antigen behind the test. Expected cost 10M

2nd gen blood coagulation device due in 3Q22 with an expected uptake by existing users. Strong bounce back revenue from existing device after COVID drop.

Animal blood glucose test due 1H22

20M net cash

Buy recommendation from Sequoia as part of the asx weekly broker reports with a valuation of 1.69 as their 12 month target. Worth a read.

Post a valuation or endorse another member's valuation.