This is clearly a risky investment given the distinct lack of profitability. Despite that, I have a small holding, the thesis primarily based on the Human and animal testing sticking to its knitting, but a huge uptake from the wine segment "Sentia". It seems to solve a significant problem, or pain point, for wine producers and as such I am disappointed to see barely any traction in sales.

From the announcement:

Sales increased marginally over the period but:

21% direct sales growth quarter on quarter (Q1 2022 : Q2 2022).

21% increase in Average Selling Price per strip between H1 2021 and H1 2022.

So the eye is naturally drawn to those red increases, but the important bit is the "sales increased marginally" ie no evidence of traction. This may be because of a lumpy order book....but I was hoping for more. Yes, they will generate higher margins through their direct sales channel, but it may be more important to just ramp up sales through distributors and achieve FCF+ve.

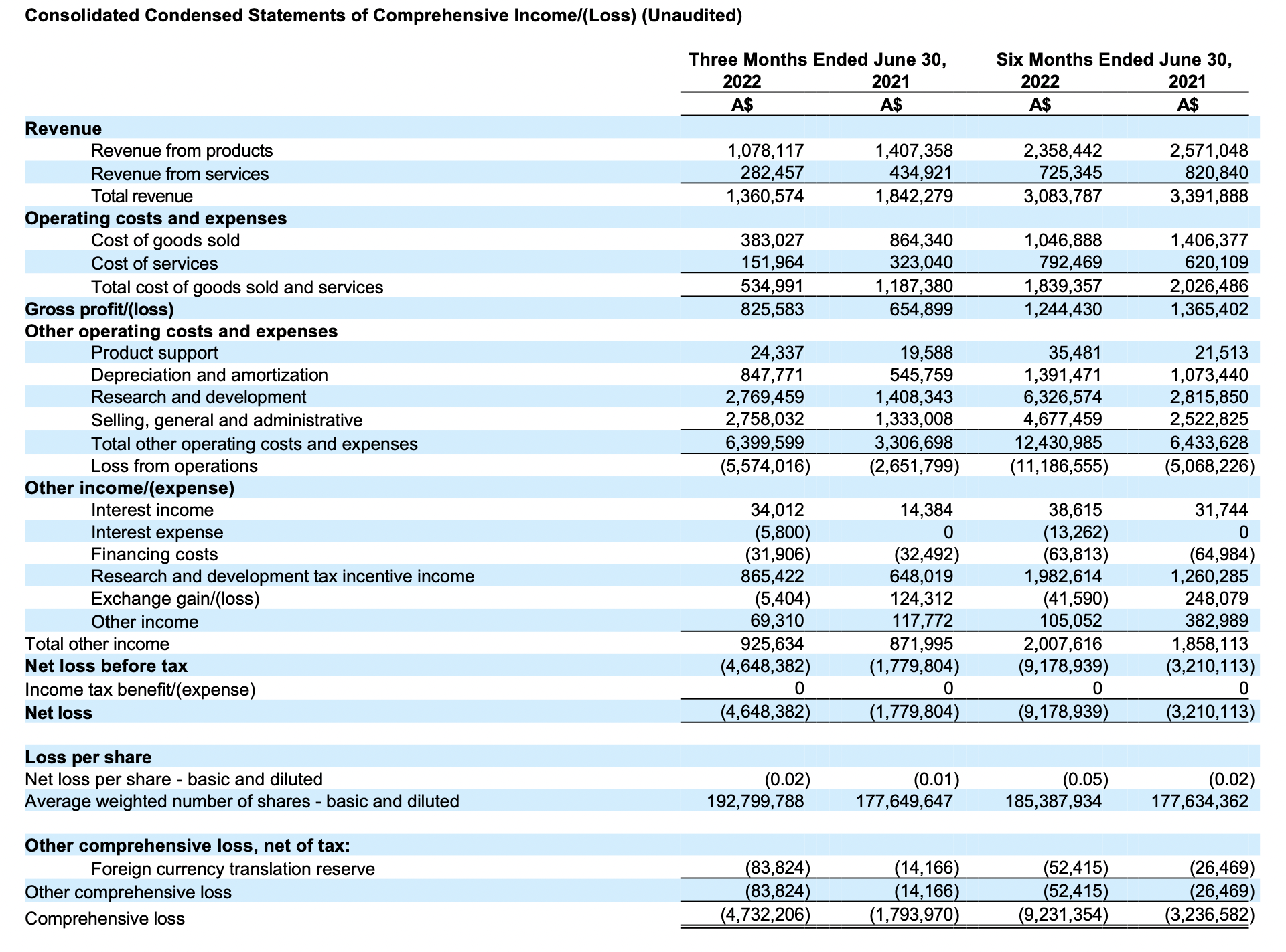

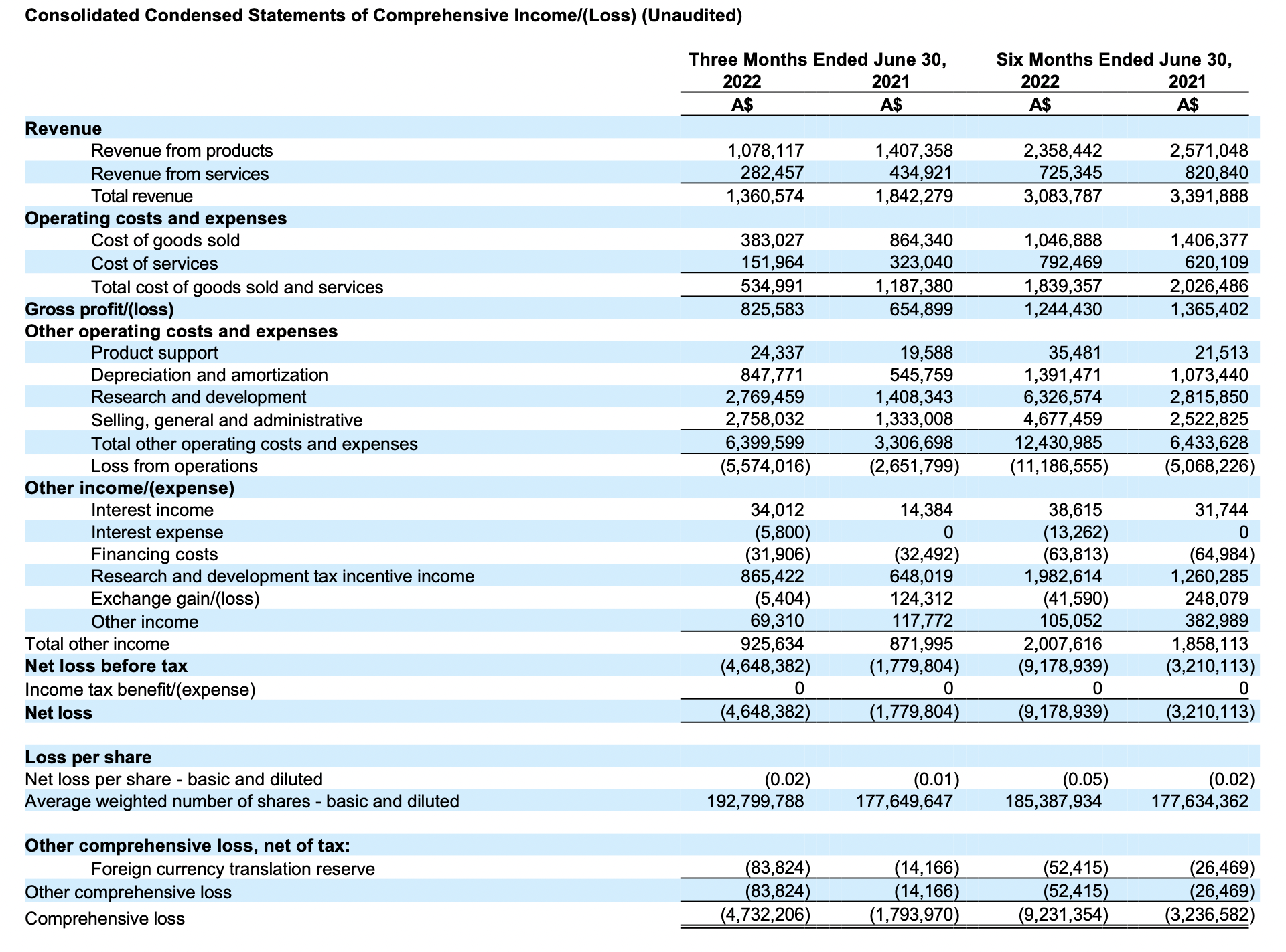

Looking at the PnL:

revenue was down 10%

losses up 186% at 9 million.

The 6/12 comprehensive loss tripled vs same period last year:

It's not clear to me how much of this is non-recurring. Presumable some of the $6mill research is one off, but not all of it. That still leaves a shade under $5mill in general and administrative.

So, they really are going to have to turn this around pretty fast if they are not going to come back to institutions/shareholders for some more funds. They sound confident, but if there is no evidence of traction in next quarterly I'll be cutting my losses.

Held IRL