Past Performance

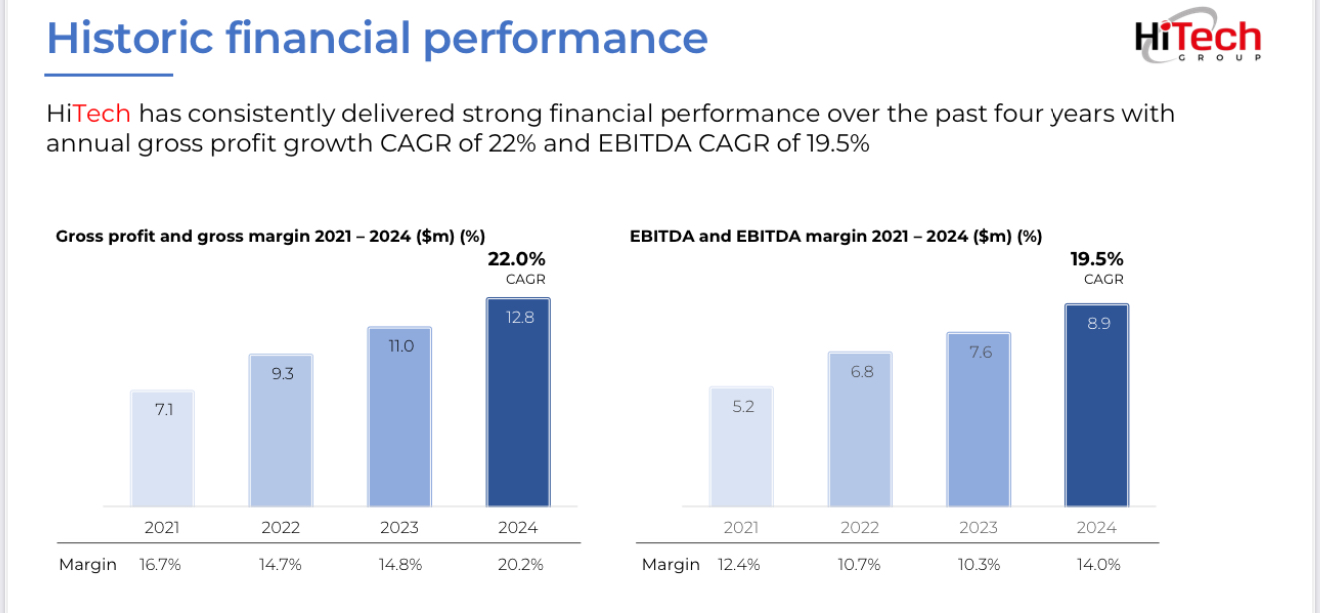

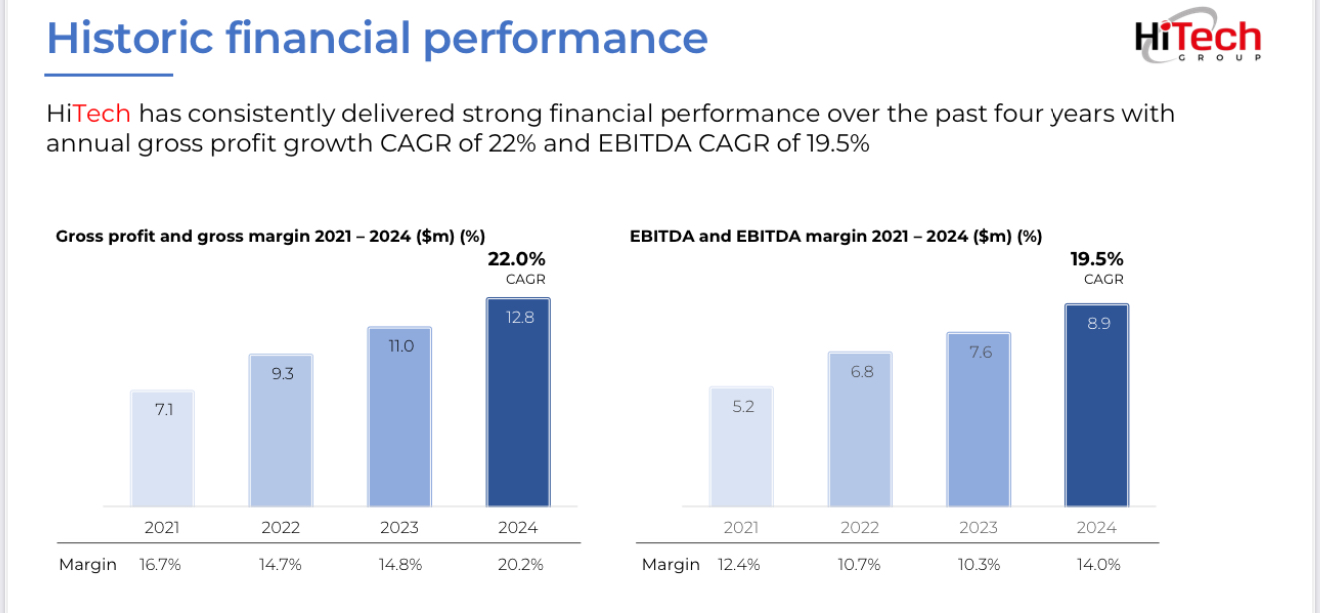

Here is a business that has consistently delivered strong financial performance over the past four years:

- annual gross profit growth CAGR of 22%

- EBITDA CAGR of 19.5%,

- increased shareholder equity by 57% (14cps to 22cps)

- increased cash reserves by 140% (from $5 million to $12 million)

- remains debt free (has been for 9 years)

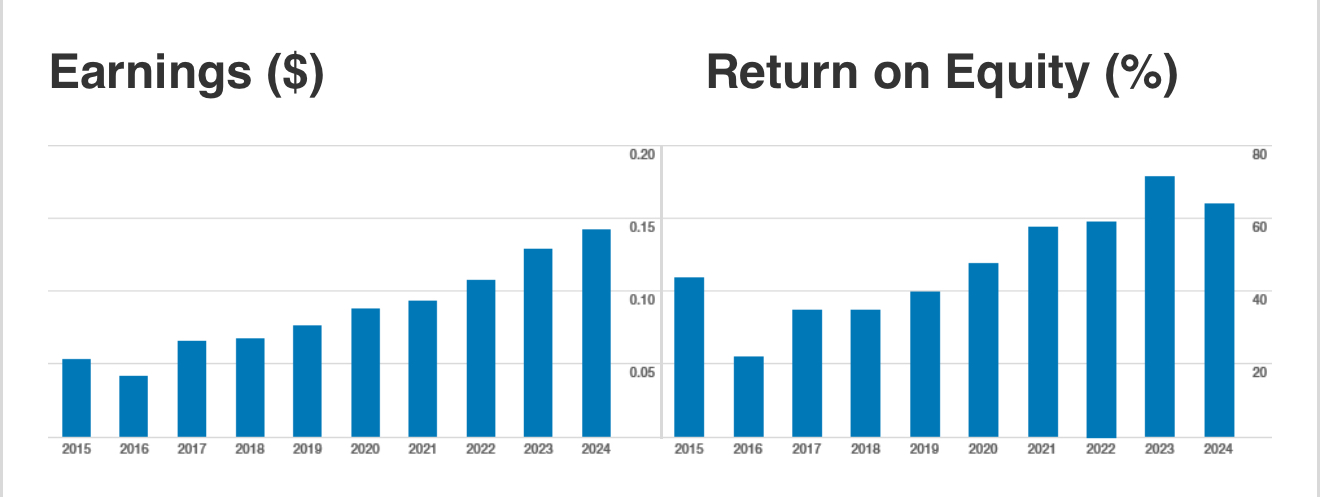

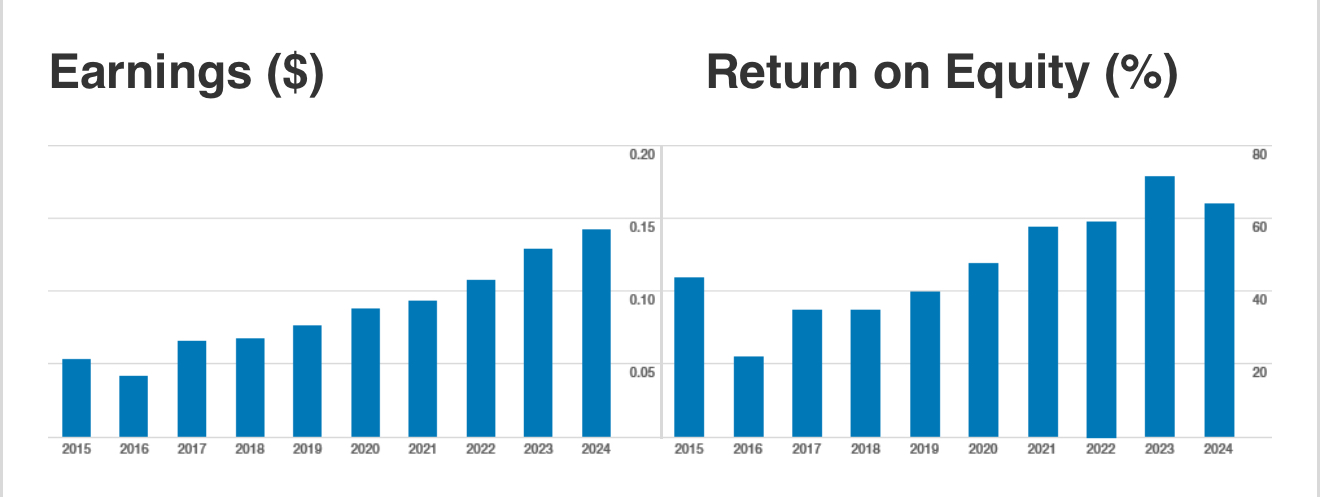

- has averaged over 60% ROE

- Has paid out 5% fully franked dividends (7% gross yield)

In fact it has 10 years of consistent growth and improving quality (ROE). Free cash flows have followed NPAT reasonably well.

In FY204, HiTech delivered a record year with Gross Margin growth of 16.5% and EBITDA growth of 16.6%, capitalising on the growing demand for ICT professionals to drive digital transformation. However, revenue did fall:

- Operating Revenue of $63.6m - down 14.5%

- Gross Profit of $12.8m, 20% GP margin – an increase of 16.5% year on year

- EBITDA of $8.9m, 14% EBITDA margin – an increase of 16.6% year on year

- NPAT of $6.03m - an increase of 10.9% year on year

- EPS of $0.14 – an increase of 10.6% year on year

- Strong balance sheet with $12.1m in cash reserves

- Full year fully franked dividend of 10 cents per share

Go Figure!

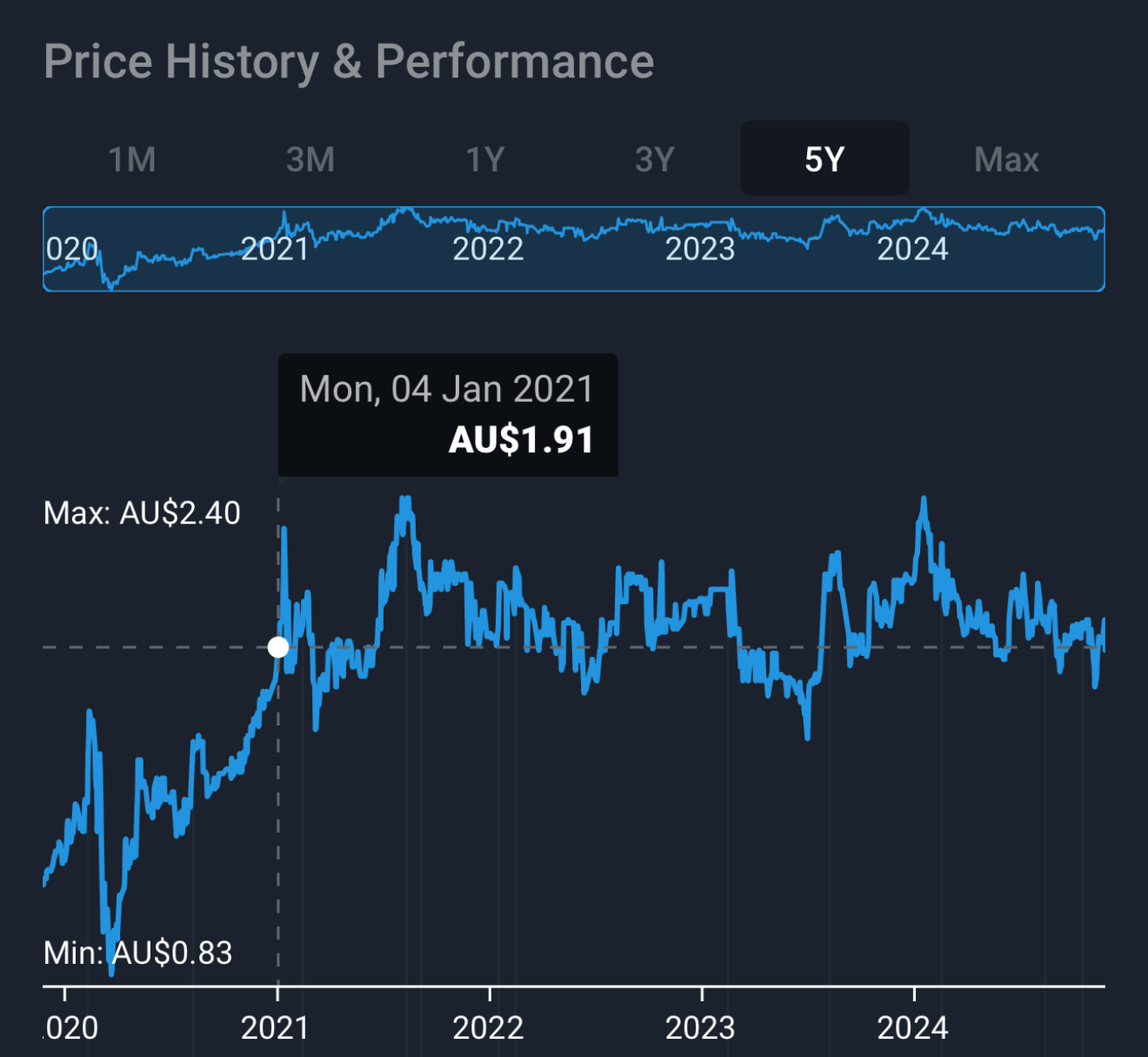

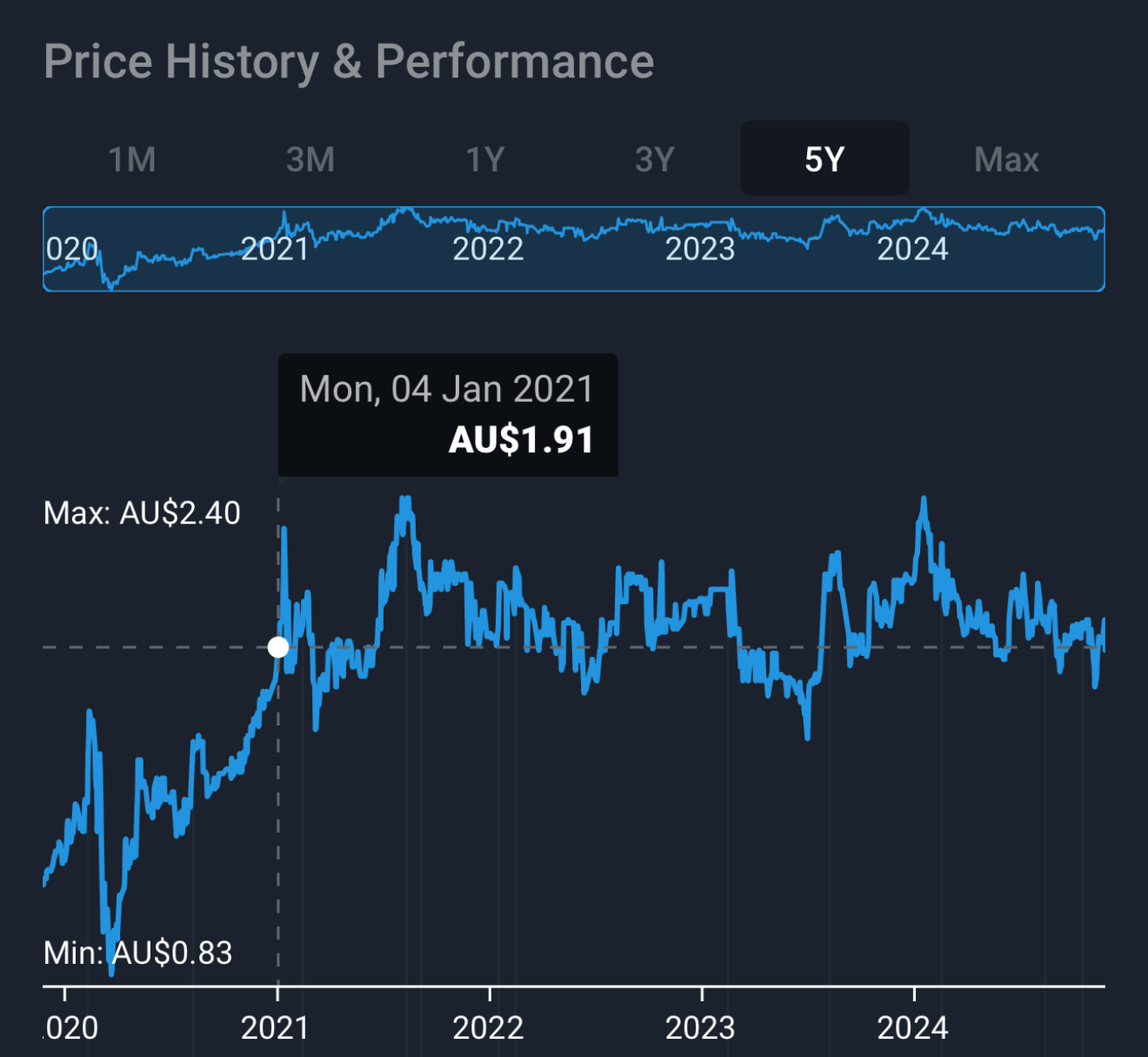

Theres no doubt this business has performed very well, yet here I am scratching my head and wondering why it trades on a PE multiple of 13.6 x FY2024 earnings per share (14 cps) and the share price hasn’t moved in four years!

Valuation

Maybe the share price hasn’t moved because it was overpriced 4 years ago and the performance is just catching up with the share price? I think that’s party true.

If I use McNiven’s Formula to value the business assuming future ROE of 60%, shareholder equity of 22 cps, 30% of earnings reinvested, 70% of earnings paid out as 5% fully franked dividends (7% gross yield), and requiring a 12% return I get a valuation of $2.00. Assuming 11% annual return the valuation increases to $2.20. Hitech has a market cap of only $84.6 million. If this were a larger, better known business I doubt you could buy it for a PE multiple of 13.6.

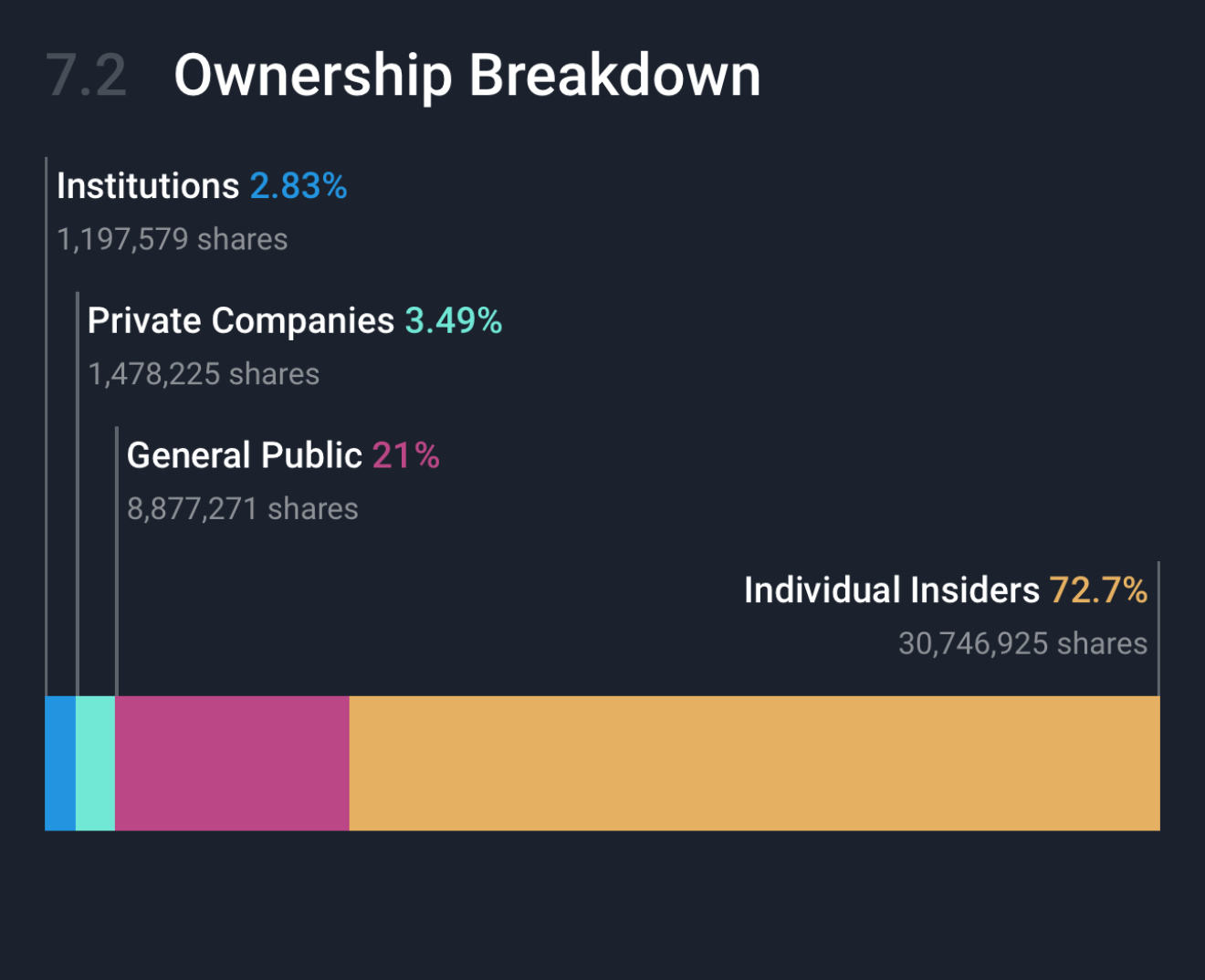

Liquidity

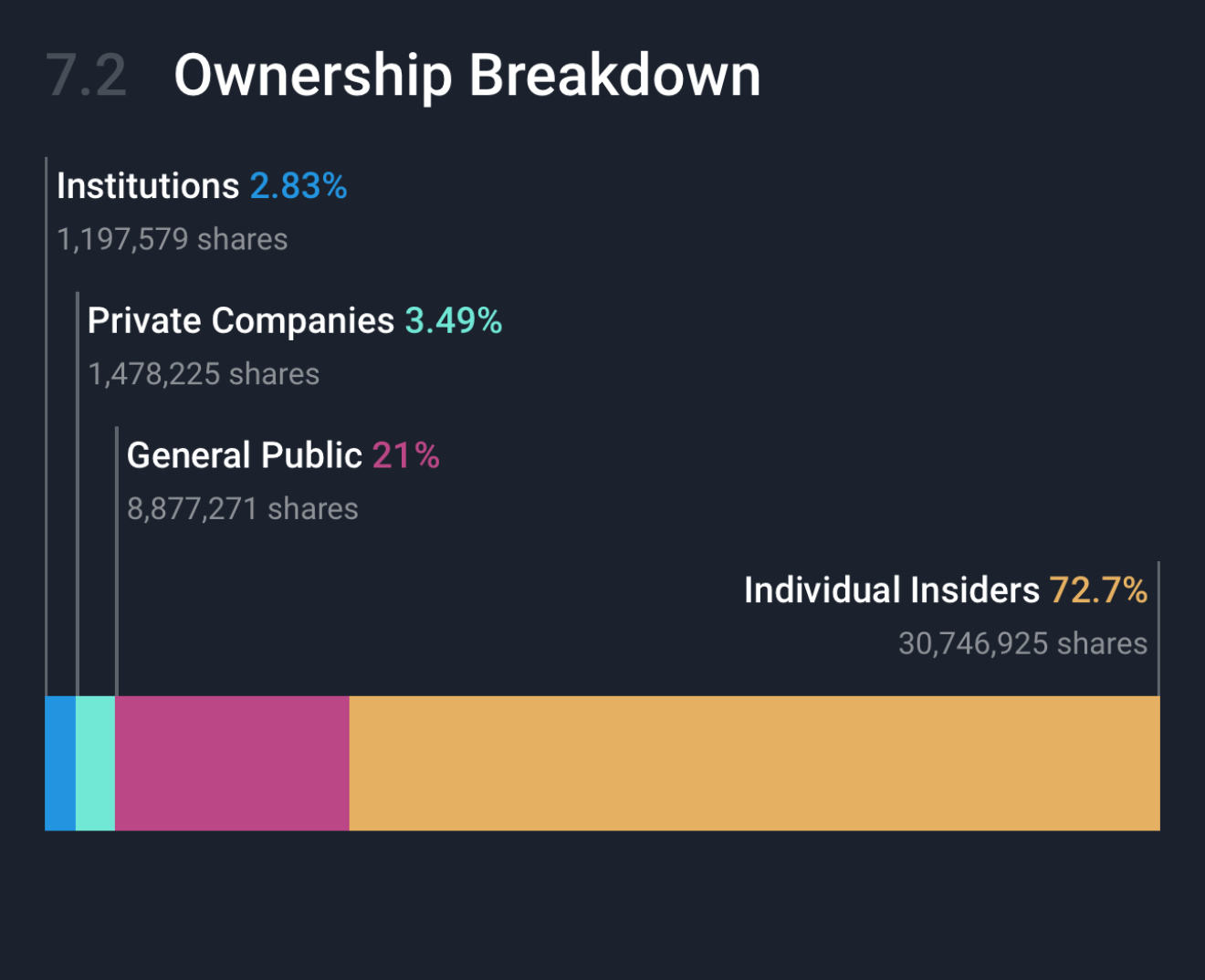

I think the other problem Hitech has is low liquidity. Over 72% of the shares are owned by insiders. The Hazouri brothers own 67% of the business between them. Only 21% of the business (value $17.7 million) are in the hands of the general public. Today only 21,593 shares were traded and the share price was down 5% ($1.90). Over the last month shares have traded between $1.78 and $2.00. I think you could do OK picking up shares on the days when there are no buyers.

The Future

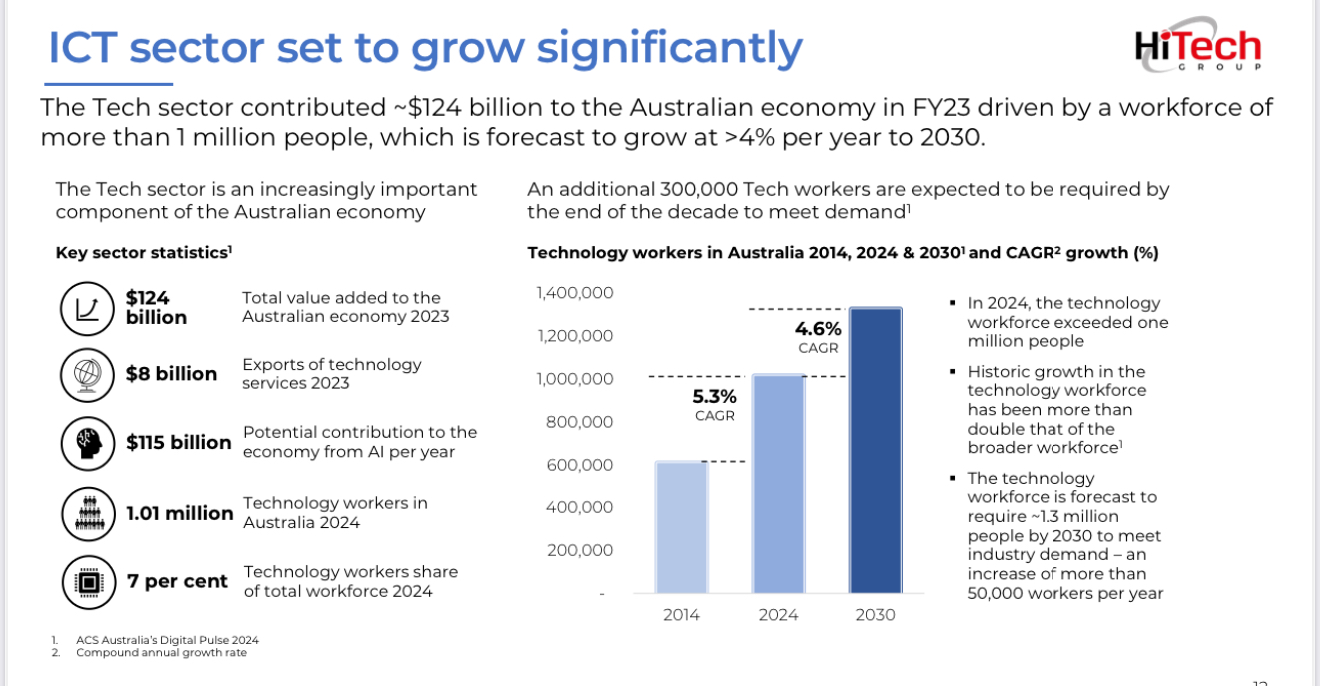

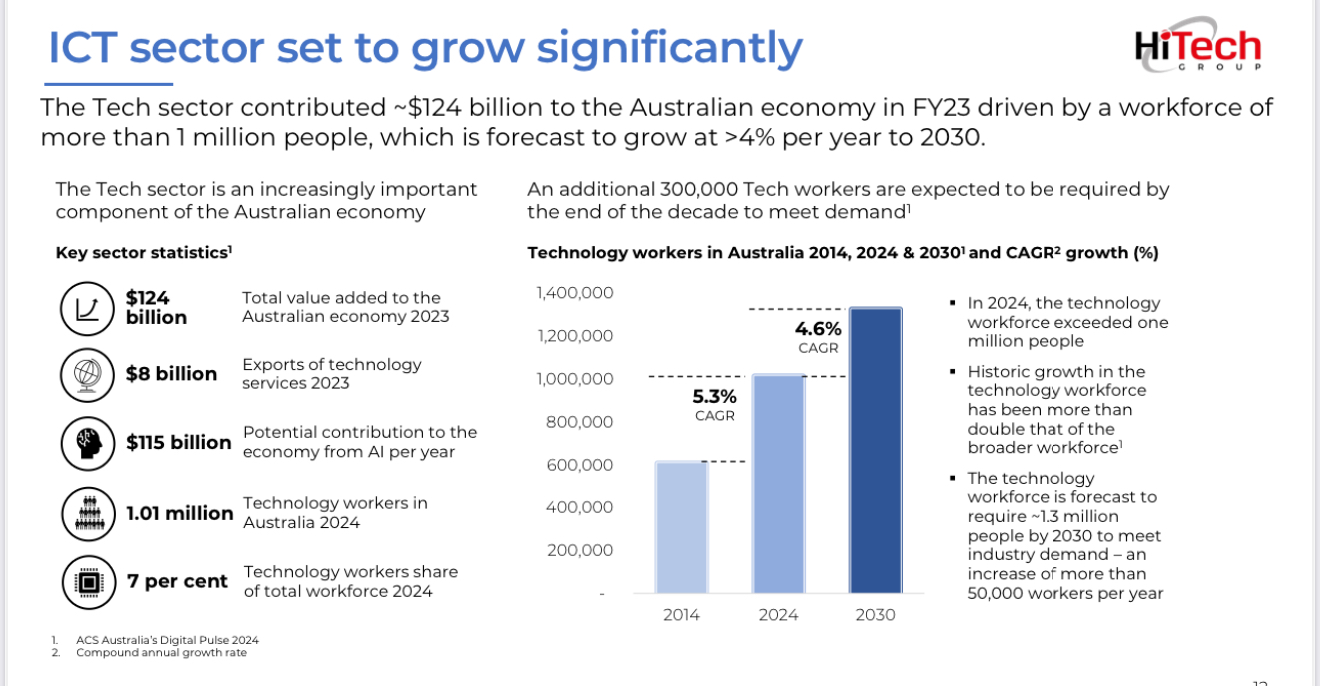

Hitech doesn’t provide guidance and there is no analyst coverage. I think it should perform well into the future with the demand for ICT growing steadily.

Will shareholders ever see share price appreciation? I’m starting to wonder? I’m going to hang on to the small holding we have as it pays a good dividend while I wait and see. There’s no debt and there’s $12 million cash on the balance sheet ready for an acquisition that will further add to EPS growth. However it might be hard to find an another business with ROE to match Hitech’s 60%. Maybe the board should just had over a bit more cash in dividends. There’s plenty there to give back to shareholders!

Held IRL (0.5%)