Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

The AGM on Friday gave us a peek beneath the sheets on 1HFY26 and it summarizes as follows:

Expect revenue to be up slightly (they used the word 'positive' against comps)

Margins, however, are under the pump, + they have to put additional $$$ into upskilling and systems in preparation for renewed activity in key areas once the Federal Government budget is established in December.

The current cash balance is a good indicator of their profitability for the half. It's now at $10m, so up some $300k from FY25 + they have paid out some $2.1m in dividends - so expect 1HFY26 NPAT at around $2.5m

A tad disappointing, but still a good grossed-up dividend flow.

Hitech (ASX:HIT) is a small, tightly held, illiquid personnel resources company that punches way above its weight—and has done so for over a decade, even in the very fluky macro conditions for this industry over the last two years. With a ROCE of 75% in FY25, it donkey-licks industry heavyweights SEEK (SEK) with 4% and Mader (MAD) at a more respectable 33%. Forget the rest, they literally caved in with the legislative changes affecting casual employees.

Of course, FY25 was also an election year, so the brakes on staff employment were ‘hard on’ for most of 2HFY25 (particularly in the IT area of the Public Service, where HIT dominates). And whether you like him or not, the ‘Albo-tross’ got up and yippee, it was giddy spending time again, despite what Grim Jim might say publicly. And the spending party is continuing!

The easiest way to assess HIT’s performance is to count the number of job vacancies on its website each month, and they are revealing.

Immediately after the elections in May 2025, the jobs advertised went ballistic – great for the profitability in June and even better for the FY26 year, where the company will not only collect about $3m+ in excess cash which had accumulated in debtors at FY25, but for the 4 months of this year, the job vacancies are better than comps.

To this simple man, this screams more 1HFY26 revenue, profits, and cash!

Bingo! The Holy Trinity. Yet the market suggests there are problems as it drifts lower for this debt-free, pile-of-cash company that pays brilliant, fully franked dividends. Plus, the macro market for IT staff in the Public Service, given requirements for AI and emerging specialty interests in defense, etc., suggests strong tailwinds.

It’s a pretty good addition to one’s SMSF – particularly in pension mode – a grossed-up dividend nearing 9%!

A pretty good result in a very lacklustre year because of the uncertainty over contract income in the light of the government 'union inspired' changes.

A drawback was the lack of cash caused by a build up in receivables of some $4m.- just hope this wasn't 'invoice writing' in order to boost FY25 revenue, if it is, lets hope it is just various govt departments spending their budgets.

On the positive side it means there has to be some $4m in liquidity occurring sometime in FY26.

Easily the best of the people placement companies and their ROE is excellent, though dropping on previous years,

Good ff divs. I think an IV of around $2.35 is justified on FY26 projected eps of 16c

18/07/2025

Current share price, $1.60. My valuation, $2.00.

The HiTech Group has consistently grown earnings over 10 years, and H1 2025 was no exception. NPAT was up 29% on pcp to $3.44 million, or 8 cps. A fully franked 5 cps dividend was paid on 20 March, a payout ratio of 62%.

HiTech finished H1 2025 holding $9.7 million in cash and has no debt. There’s enough cash in reserve to pay over 2 years of dividends at the current 10 cps per year, a gross yield of 9% (including franking credits).

Assuming HiTech’s earnings can be sustained in the second half, FY2025 earnings could be approx. $6.8 million, or 16 cps, up 14% on FY2024. At the current share price of $1.60, that’s a very undemanding 10 times PE. I think that’s cheap for a business that has demonstrated double digit earnings growth for a decade, 10% net profit margins, and over 60% ROE currently.

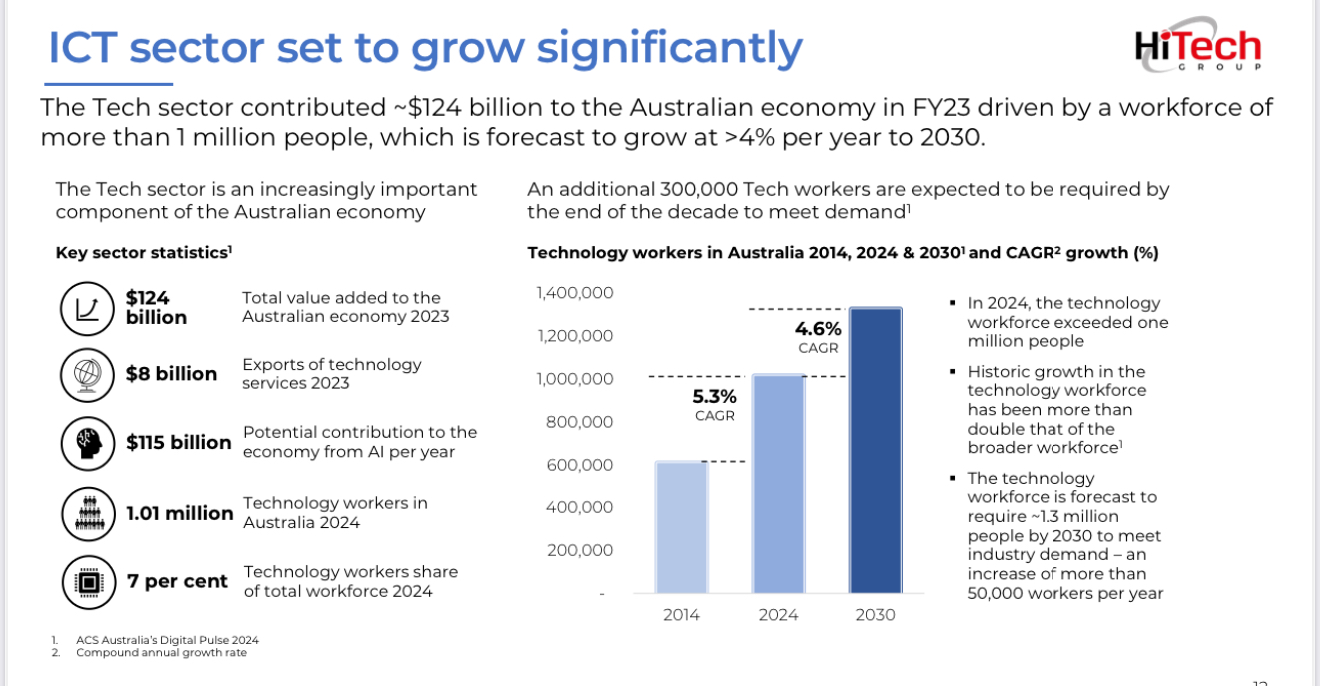

The future for the company is underpinned by a growing ICT industry. According to ChatGPT the future outlook for ICT in Australia is robust, but could be challenged by the demand for skilled ICT workers:

- Australia’s ICT industry is on a robust growth trajectory, with annual growth expected between 7–13%, depending on segment focus and forecast period.

- IT services and enterprise-level ICT spending are the standout growth drivers, fueled by government-led digital transformation, AI expansion, cloud adoption, and cybersecurity pressures.

- Despite strong demand, challenges remain—particularly ensuring a skilled workforce to fill projected ICT roles (~1.2 million by 2030).

Using McNiven’s valuation formula assuming 60% ROE, current shareholder equity value of 25 cps, a fully franked 6.3% dividend (9% including franking credits), 25% of earnings reinvested, and requiring an annual return of 15%, I came up with a valuation of $2.11. At the current share price you could expect an 18% annual return.

If the share price returned to $2.00 (where it was in March 2025) within the next 14 months, and in this time you received three fully franked dividend payments of 5 cps (9% yield), it might be feasible to achieve a 40% return on shares acquired at the current share price. That looks like a reasonably good risk/return proposition to me.

HiTech has a market cap of only $68 million, and is very illiquid. Due to this, it is likely HiTech will trade on a lower PE than it deserves for some time to come. However, does this really matter if the business continues to perform as it has over the past decade, and you are happy to hold for a very long time?

Held IRL (1%), accumulating under $1.60

Source: Commsec

Stable company and if I think who will win the election does there will be more government spending, not less. Looks like job advertisements on their website have been higher not lower despite expected lower spend due to the election.

I wish they'd do a buyback with the cash and not acquire anything. Dividend is sustainable at $0.10 per share ff.

At $1.60, yielding 8.9% (grossed up) - over 10% if you adjust for cash.

Not going to shoot the lights out but decent for income.

Not sure how sold it down on some pretty lazy selling.

Coffee Microcap with HIT presenting

Date & Time

Dec 5, 2024 09:00 in Canberra, Melbourne, Sydney

Description

Coffee Microcaps Presents;

Danny Maher, CEO & MD of Firstwave Cloud Technology Ltd (ASX: FCT) 9.00-9.30

Elias Hazouri, CEO & Executive Director of Hitech Group Australia Ltd (ASX: HIT) 9.30-10.00

Mark Harrison, CFO of Alfabs Australia Ltd (ASX: AAL) 10.00-10.30

Past Performance

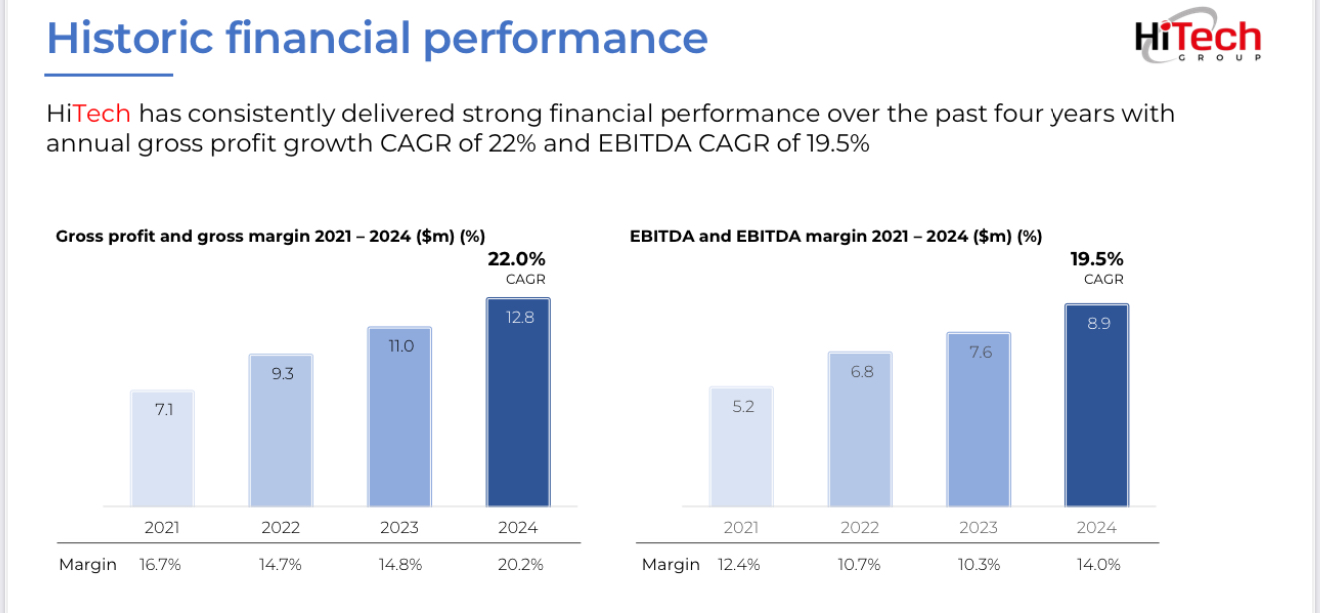

Here is a business that has consistently delivered strong financial performance over the past four years:

- annual gross profit growth CAGR of 22%

- EBITDA CAGR of 19.5%,

- increased shareholder equity by 57% (14cps to 22cps)

- increased cash reserves by 140% (from $5 million to $12 million)

- remains debt free (has been for 9 years)

- has averaged over 60% ROE

- Has paid out 5% fully franked dividends (7% gross yield)

In fact it has 10 years of consistent growth and improving quality (ROE). Free cash flows have followed NPAT reasonably well.

In FY204, HiTech delivered a record year with Gross Margin growth of 16.5% and EBITDA growth of 16.6%, capitalising on the growing demand for ICT professionals to drive digital transformation. However, revenue did fall:

- Operating Revenue of $63.6m - down 14.5%

- Gross Profit of $12.8m, 20% GP margin – an increase of 16.5% year on year

- EBITDA of $8.9m, 14% EBITDA margin – an increase of 16.6% year on year

- NPAT of $6.03m - an increase of 10.9% year on year

- EPS of $0.14 – an increase of 10.6% year on year

- Strong balance sheet with $12.1m in cash reserves

- Full year fully franked dividend of 10 cents per share

Go Figure!

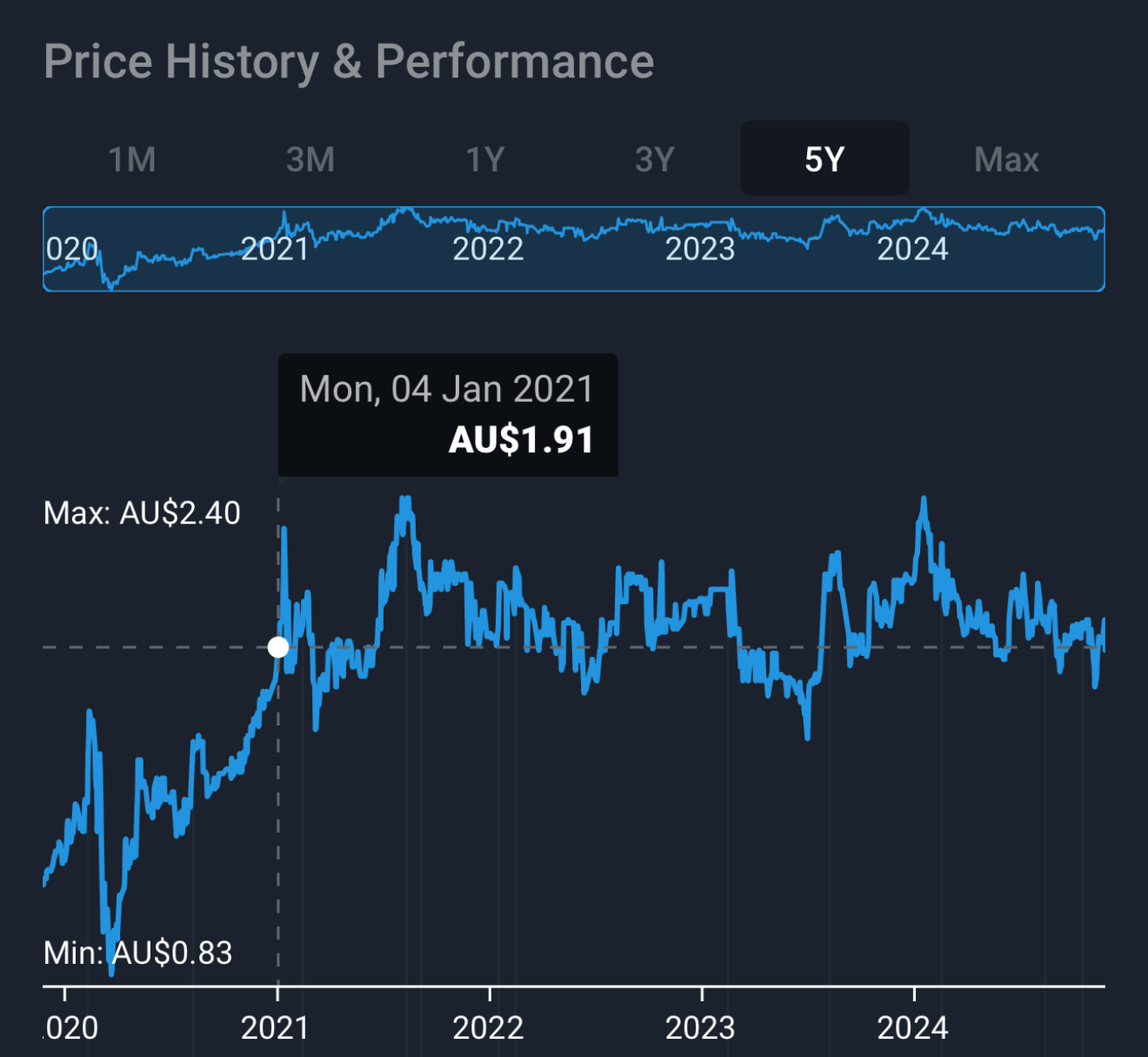

Theres no doubt this business has performed very well, yet here I am scratching my head and wondering why it trades on a PE multiple of 13.6 x FY2024 earnings per share (14 cps) and the share price hasn’t moved in four years!

Valuation

Maybe the share price hasn’t moved because it was overpriced 4 years ago and the performance is just catching up with the share price? I think that’s party true.

If I use McNiven’s Formula to value the business assuming future ROE of 60%, shareholder equity of 22 cps, 30% of earnings reinvested, 70% of earnings paid out as 5% fully franked dividends (7% gross yield), and requiring a 12% return I get a valuation of $2.00. Assuming 11% annual return the valuation increases to $2.20. Hitech has a market cap of only $84.6 million. If this were a larger, better known business I doubt you could buy it for a PE multiple of 13.6.

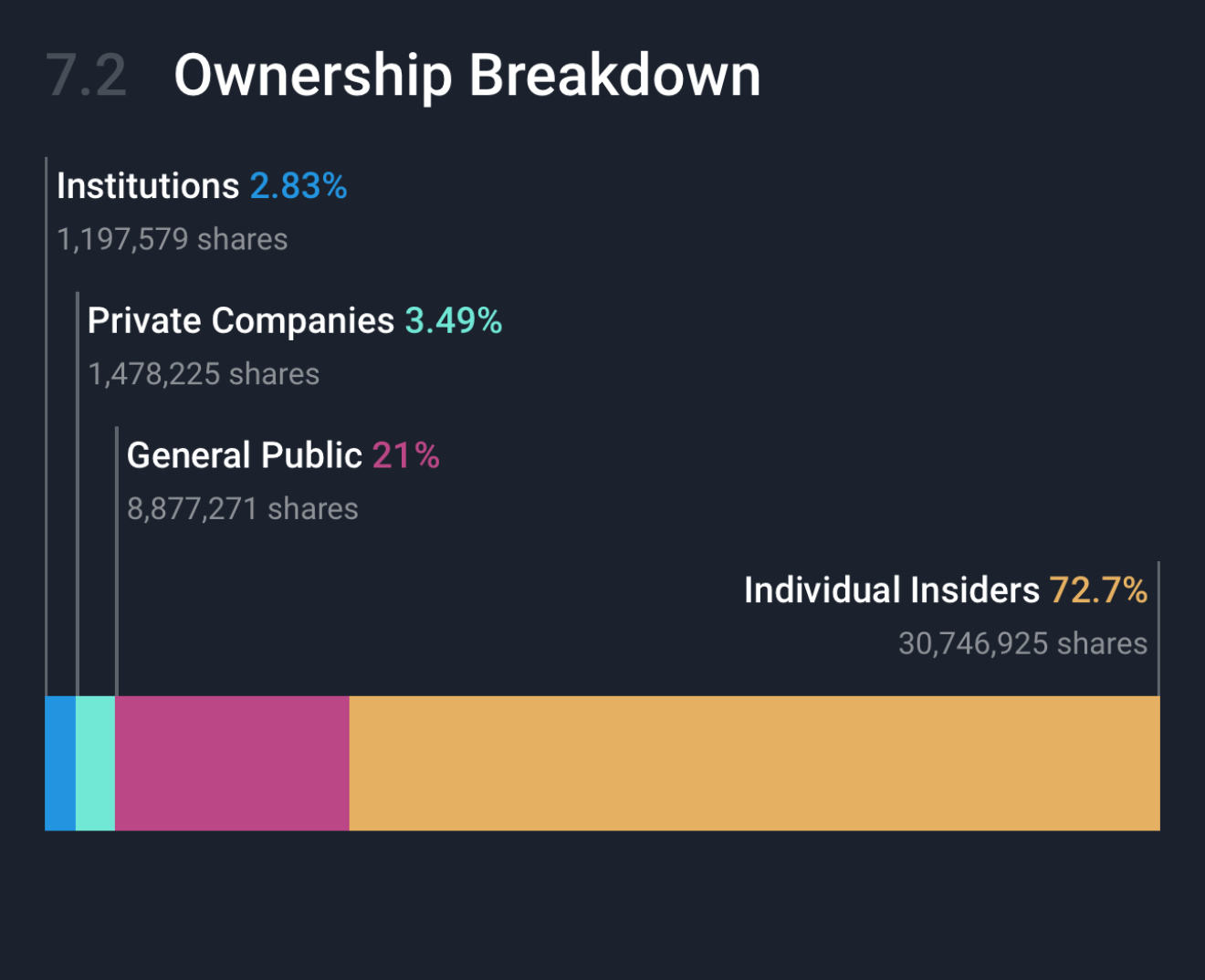

Liquidity

I think the other problem Hitech has is low liquidity. Over 72% of the shares are owned by insiders. The Hazouri brothers own 67% of the business between them. Only 21% of the business (value $17.7 million) are in the hands of the general public. Today only 21,593 shares were traded and the share price was down 5% ($1.90). Over the last month shares have traded between $1.78 and $2.00. I think you could do OK picking up shares on the days when there are no buyers.

The Future

Hitech doesn’t provide guidance and there is no analyst coverage. I think it should perform well into the future with the demand for ICT growing steadily.

Will shareholders ever see share price appreciation? I’m starting to wonder? I’m going to hang on to the small holding we have as it pays a good dividend while I wait and see. There’s no debt and there’s $12 million cash on the balance sheet ready for an acquisition that will further add to EPS growth. However it might be hard to find an another business with ROE to match Hitech’s 60%. Maybe the board should just had over a bit more cash in dividends. There’s plenty there to give back to shareholders!

Held IRL (0.5%)

About HiTech Group

The HiTech Group is Australia’s leading specialised ICT contracting, consulting and recruitment organisation. Our personnel division provides staffing solution in the areas of ICT, Finance, Admin & HR, Sales and Marketing. HiTech provides services to Australian and international organisations and has more than 27 years experience in the industry (founded in 1997). Our clients include Federal & State Government departments (https://hitechaust.com/about)

Record 1H24 Results

On the 19th February HiTech Group announced a record half year result (see 1HFY24 Results Announcement below). Here’s the highlights:

➢ Gross profit $6.08m up 37% on pcp

➢ EBITDA of $4.14m up 27% on pcp

➢ Net profit before tax $4.15m up 30% on pcp

➢ Net profit after tax $2.66m up 18% on pcp

➢ Interim dividend of 5.0 cents per share

This is quite an achievement when you consider that other labour hire/contractor type businesses, (eg. PeopleIn - PPE), have reported labour hire and consulting services revenue in the lucrative (high margin) Information, Communication and Tech (ICT) sector falling significantly in the first half of FY24. HiTech appears to have a more resilient business model than its peers operating in this sector. The business might have some similarities to the consulting component of Technology One or Data#3.

HiTech management have noted that “Despite facing challenges in the first half of FY24, we confronted them with renewed focus and determination. Demand for top-tier ICT talent and services in the Government sector persists, despite recent changes in government.”

Optimistic Outlook for FY2024

Despite a challenging 1H24, Management seemed to be optimistic about the full year, saying:

“HiTech is well positioned to capture market demand for ICT talent and services with a strong balance sheet and long-term supplier agreements in place.

The Australian Government has targeted a reduction in ICT contracting in some agencies. We have seen a reduction in contracting agreements leading into the end of the calendar year, however, there are several Government agencies still looking to bolster their talent pool, especially in the cyber security and digital infrastructure space which should counter the other agencies’ reduction.

Early signs of continued demand in the federal government sector for specialist IT talent are encouraging. HiTech remains fully prepared to take advantage of the demand for skilled IT talent as and when the opportunities present themselves.

HiTech has several active client mandates for our services and continues to see various tender pipelines for new business in both the federal and state government sectors where some ICT programs of work remain vital.”

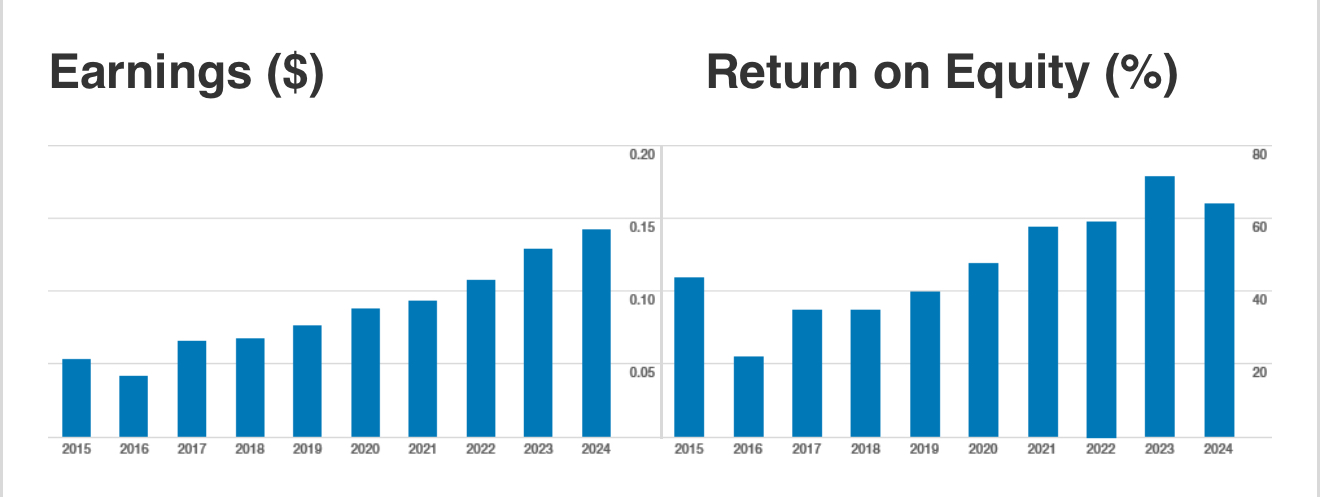

High Return on Equity

HiTech Group has a very high ROE (71.5% for FY23) and it has been consistently improving every year for eight years now. Management did not provide guidance, however were optimistic about 2H24. If we assume NPAT will be similar in the second half, we might expect full year earnings for FY24 to be approx $5.3 million ($5.86 million for FY23). With shareholder equity of $8.16 million that would put FY24 ROE at 65%.

Good Margins

Gross Margin 19%, Net Profit Margin 8.65% (1H24).

Double Digit Earnings and Dividend Growth

Earnings have grown at over 10% per year for 8 years while it has paid out 70% of its earnings as fully franked dividends. The current yield is 4.8% fully franked (6.9% including franking credits). With continued strong earnings and a very strong balance sheet the dividends look sustainable into the future.

Excellent Balance Sheet

HiTech has been debt free for over 10 years and it currently holds over $10 million in cash. That means it’s holding 11.5% of its market cap of $87 million in cash, and more than its total shareholder equity of $8.2 million. That’s an incredibly solid balance sheet. It sounds a bit too lazy actually, and I wonder what plans management have for this much cash. Perhaps they are waiting for an acquisition opportunity?

Management

(Source, Simply Wall Street)

The CEO, Mr. Elias Hazouri, B.Sc., MBA (55 yrs) has been the Chief Executive Officer of HiTech Group Australia Ltd. since August 2016. Mr. Hazouri serves as the Chief Information Officer and General Manager of HiTech Group Australia Ltd. and has been its Company Secretary since February 13, 2015. Elias Hazlouri owns 20.9% of the business.

Mr. Hazouri has many years’ experience in IT and banking. His knowledge of HiTech's business is extensive. Throughout his career, he has been integral to the development of many IT systems and IT support departments.

He has held roles ranging from programmer to technology support head. He is a key resource and knowledge base to HiTech account managers and is jointly responsible for generating new business by way of tender. He has advised on business strategy, both from a financial and operational perspective, since the inception of HiTech in 1993. He has been Director of HiTech Group Australia Limited Since July 19, 2013.

He served as Director of HiTech from 1993 to March 2000. Mr. Hazouri holds B Sc, MBA.

Ownership and Liquidity

HiTech shares are tightly held and relatively illiquid (a true lobster pot). It’s taken me a while to accumulate just a small holding IRL. You could get seriously burnt if you needed to get out in a hurry.

The Hazouri family owns nearly 68% of the business and the top 21 shareholders hold nearly 81% of the shares in the businesses. That might explain things. On some trading days there are no shares changing hands at all. Actually, with such concentrated ownership you’d have to wonder why they bothered listing in the first place?

Things I don’t like

I think HiTech could do a better job of its capital management. The share count has increased from 31 million (2015) to 42.2 million (2023) over 9 years. As a result the book value hasn’t changed in 8 years (19 cps).

Perhaps management should be using some of their spare cash to buy back shares. With such a high ROE (+70%) and with shares trading at a reasonable price, I think shareholders would benefit from a lower share count, increased book value, and less lazy cash sitting on the balance sheet.

Valuation

HiTech trades on a PE multiple of 16 times FY23 earnings of 13cps. I expect FY24 earnings to be flat to slightly lower given some slowing in the economy (approx 12.6cps). That would put HiTech on a forward PE of 16.4 x estimated FY24 earnings. This seems reasonable for a business investing c. 20% of their earnings back into growth at +60% return on equity.

Using McNiven’s Formula and assuming future ROE of 65%, Equity of $0.19 per share, 20% of earnings reinvested, fully franked dividends (4.8% or 6.8% gross), and requiring an annual return of 11%, I get a valuation of $2.14 per share. It’s currently trading @ $2.06 per share, not a huge discount, but it looks like a quality business.

Disc: Very small holding IRL at this stage (0.4%)

Share price flat for 3 years. PE multiple of 15x

➢ Gross profit $6.08m up 37% on pcp

➢ EBITDA of $4.14m up 27% on pcp

➢ Net profit before tax $4.15m up 30% on pcp

➢ Net profit after tax $2.66m up 18% on pcp

➢ Interim dividend of 5.0 cents per share

INTERIM DIVIDEND

We are pleased to declare an interim fully franked dividend of 5 cents per share.

“The performance of the HiTech Group is exceptionally satisfying. Our first-half FY24 results set a new record, underscoring the relevance and effectiveness of our service and value creation model. Achieving record profits involved prompt measures to reduce operational costs in areas with unattractive margins. We are now strongly positioned to enhance shareholder returns and fortify our cash reserves.

Our unwavering determination to achieve record growth in operating profits, positions us well to continue to supply a critical and essential service to the Australian community.

Despite facing challenges in the first half of FY24, we confronted them with renewed focus and determination. Demand for top-tier ICT talent and services in the Government sector persists, despite recent changes in government.

I extend my gratitude to our valued clients, candidates, contractors, and our highly dedicated and skilled staff for contributing to another successful half-year record.” CEO, Elias Hazouri said.

Outlook for FY2024

HiTech is well positioned to capture market demand for ICT talent and services with a strong balance sheet and long-term supplier agreements in place. The Australian Government has targeted a reduction in ICT contracting in some agencies. We have seen a reduction in contracting agreements leading into the end of the calendar year, however, there are several Government agencies still looking to bolster their talent pool, especially in the cyber security and digital infrastructure space which should counter the other agencies’ reduction.

Early signs of continued demand in the federal government sector for specialist IT talent are encouraging. HiTech remains fully prepared to take advantage of the demand for skilled IT talent as and when the opportunities present themselves.

HiTech has several active client mandates for our services and continues to see various tender pipelines for new business in both the federal and state government sectors where some ICT programs of work remain vital.

With more than 55 years combined expertise in the ICT Talent and Services market, there is no more experienced and financially secure Australian organisation in our sector or board suitably positioned to maximise shareholder return and navigate economic headwinds as they are encountered.

-ENDS-

Might be why they did so well last few years if true - Coalition government spent $20.8b on ‘shadow’ public service (afr.com) wonder if it'll continue.

"The former Coalition government spent close to $21 billion on external labour hires in the public service, an audit has shown.

The Australian Public Service Audit of Employment found the service was 37 per cent larger than originally thought, with an additional 53,900 full-time equivalent workers employed.

Those workers were external labour hires, mostly in the form of contractors and consultants.

The audit showed that workforce cost the government $20.8 billion, with about 43 per cent of total spending on external labour relating to ICT (Information and communication technologies) and digital solutions."

HY Summary details are below

Revenue of $40.71m up 37% on 1HFY22 ($29.82m)

Gross profit $4.94m up 21% on pcp

EBITDA of $3.23m up 10% on pcp

Net profit before tax $3.17m up 10% on pcp

Net profit after tax $2.25m up 14% on pcp Interim dividend of 5.0 cents per share

As noted, it is the 8th consecutive period of increase in revenue, EBITDA and profit.

But I have sold today, happy to make next to no capital gain but between 5-8% dividend yield over a number of years.

They have flagged:

"The Australian Government has targeted a reduction in ICT contracting in some agencies. We have seen a reduction in contracting agreements leading into the end of the calendar year, however, there are several Government agencies still looking to bolster their talent pool, especially in the cyber security and digital infrastructure space which should counter the other agencies’ reduction."

I have decided to sit on the sidelines and see if this is true.

The SP rarely varies much and could probably re-enter at much the same price as I sold out today, should in six months I prove to have been chicken-little.

Year in year out been a great business - nice yield and reasonably priced, bullet proof balance sheet. Powered thru CoVID. Watch out for how much profit goes to managment/dilution but it’s the price you pay sometimes for a good business.

See previous valuation for reference

given a subdued market I have applied a PE of 20 and assumed 20% increase in EPS.

To repeat, it is illiquid and prone to significant swings in price. With patience a good entry point is point.

Held IRL

HIT reported yet another record result - their 8th consecutive year of double digit growth.

Headline figures are:

- Operating revenue is $63,096,126, an increase of 49.7% over the previous corresponding period (pcp) (FY21: $42,168,504).

- Gross Profit is $9,304,117, an increase of 31.8% over pcp (FY21: $7,059,491).

- NPAT is $4,403,625, an increase of 21.1% over pcp (FY21: $3,636,602).

- EBITDA is $6,757,822, an increase of 29.6% over pcp (FY21: $5,214,886).

- The directors have declared a fully franked dividend of 6 cents per share to be paid on 16 September 2022 to shareholders registered on close of business on 2 September 2022.

As per my previous straws, one of my concerns was the liberal use of options to the Hazouri brothers who are founders and controlling shareholders with 65% of the registry.

Pleasingly EPS also tracked up from 9.32 to 10.73

The share price is up ~8% at 2.12 which equates to a FF yield of 5.2%

They have not provided guidance but sounded optimistic about the coming FY.

HiTech Group Australia Limited ASX:HIT

- Founded in 1993, listed on the ASX in 2000 at $0.70

- MC $83m

- What they do: Supplies permanent/contract staff from their pool of specialised ICT/finance/office support professionals. Majority of their revenue in FY21 was from contracts with the Federal Government (93% of revenue), with the remaining coming from State Government and private sector contracts.

- HiBase (their database) contains 380,000 candidates if a client needs a job to be filled (contract/project basis or permanent). They help clients find the right talent for highly specialised jobs - eg cybersecurity, cloud computing etc. HiBase

What I like:

- Proven execution strategy in winning contracts with blue chip clients like the Fed and state governments. I believe all of their growth has been organic. The thing with supplying talent for government agencies is that it takes time to form this trust, and I believe this has helped the company win contracts so far.

- They are operating in a niche space, and the ongoing digital migration is a massive tailwind for them. More budget for their clients = more spend with HIT. I also suspect management has not taken any risk in expanding into collateral spaces for the sake of it, they have stuck to what they know they do best. Also the Great Resignation / shortage of IT talent may also a tailwind for HIT.

- Still founder led - The Hazouri brothers own a combined ~65% of the outstanding shares. Ray Hazouri is the Chairman, and Elias Haziouri is the CEO.

- Steady rising revenue in last 5 years, ample cash reserves + no LT debt, consistent share count.

- Dividends growing last 5 years. Decent fully franked 5% yield based on today's price ($2.13)

What I am keeping my eye on:

- Illiquid register

- Board is controlled by the Hazouri brothers - buying into this company also means putting full faith in the management//founders to deliver shareholder returns

- This is a mature company, there is no real advantage in scaling (operating costs rising steadily with growing revenue).

Its a family firm, with the 2 0f the 3 Hazouri brothers running the business as Executive Chairman and Executive director. The third brother Sam is on the board. There is high inside ownership: fully 70% of the company is owned by these three.

While this aligns interests with shareholders, I wonder whether this introduces risks of nefarious activities that a wider spread of executives might prevent.

An example of this might be issuing options, or paying themselves too handsomely:

And indeed nearly a million options were exercised at a price of 0.58c by one director and there are another 3million outstanding with an exercise price of 0.75. This (combined) represents 10% of the float. The annual report states: "Options issued to directors are approved by shareholders at annual general meetings." Clearly, with the Hazouris owning 70% of shares, they can approve whatever they want.

This concern is partly allayed by the fact there has been a consistent increase in EPS and no further granting of options for the last 3 years or so. But when those 3 million options land, EPS will no doubt take a hit.

Secondly they do pay themsleves well: $576k and $275k.

The combination of these two findings has been a red flag too big for me to ignore. I owned back at ~85c a share when it yielded 10%, but sold due to these concerns.

Since then, I have watched the dividends slowly increase and the SP more than double with record result after record result. So, whilst these fundamental issues have not resolved, the rewards to shareholders have not been impacted over the last 4 years that i have been watching.

HiTech delivers Record Results:

Improves revenue by 19% and NPAT by 17%

Fully franked 4 cents per share dividend plus Fully franked Special dividend of 1.5 cents per share

For the first half financial year ending 31 December 2020, the consolidated entity’s results are:

~ Revenue of $18.84m up 19% of 1HFY20 ($15.79m) ? Gross profit $3.26m up 11% on pcp

~ EBITDA of $2.15m up 9% on pcp

~ Net profit before tax $2.11m up 8% on pcp ? Net profit after tax $1.65m up 17% on pcp

Disc: I have held in the past, shame I didn't keep some