SUMMARY

- The story makes sense, is clear, coherent and consistent with earlier management communications - this continued clarity is usually a good sign of good things to come

- Strategy makes sound sense

- Goes back to basics, nothing grandiose, no large capex spend in the next 3-5 years that could result in any capital raising, no sign (as of now anyway) of potential M&A stupidity - never say never, but for now, I will take it

- Key ingredients are in place, scene is set, it is now all about execution

- Early signs that EML is moving at pace, and starting to yield positive results

Too early to be happy (will have a small glass to celebrate today's pop!), more relieved that we are now going back to BAU in a clear, decisive way. Come what may from hereon ...

Have already doubled down in recent months, so will not take further action for now and enjoy the ride for a change.

Discl: Held IRL and in SM

--------------------

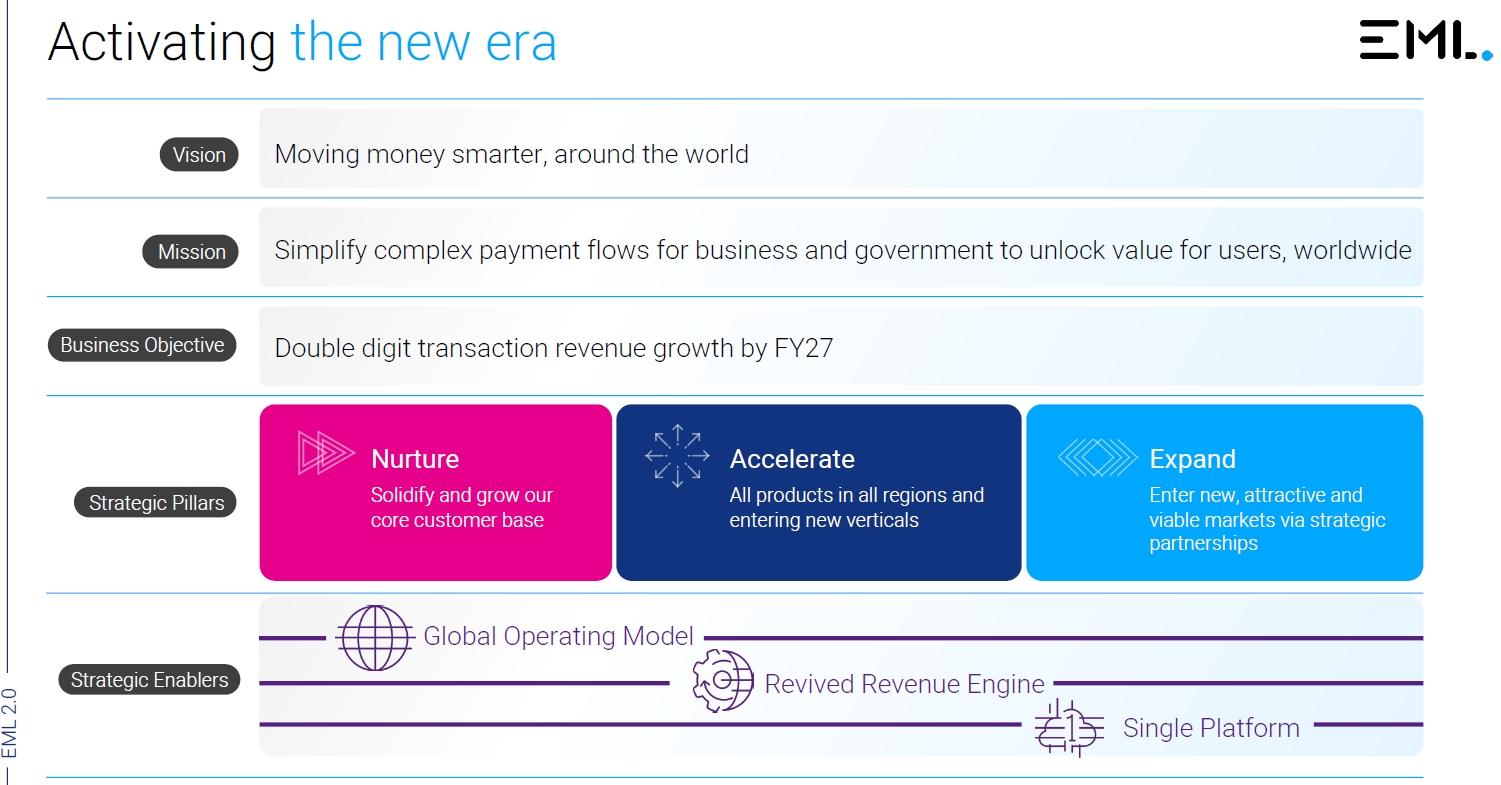

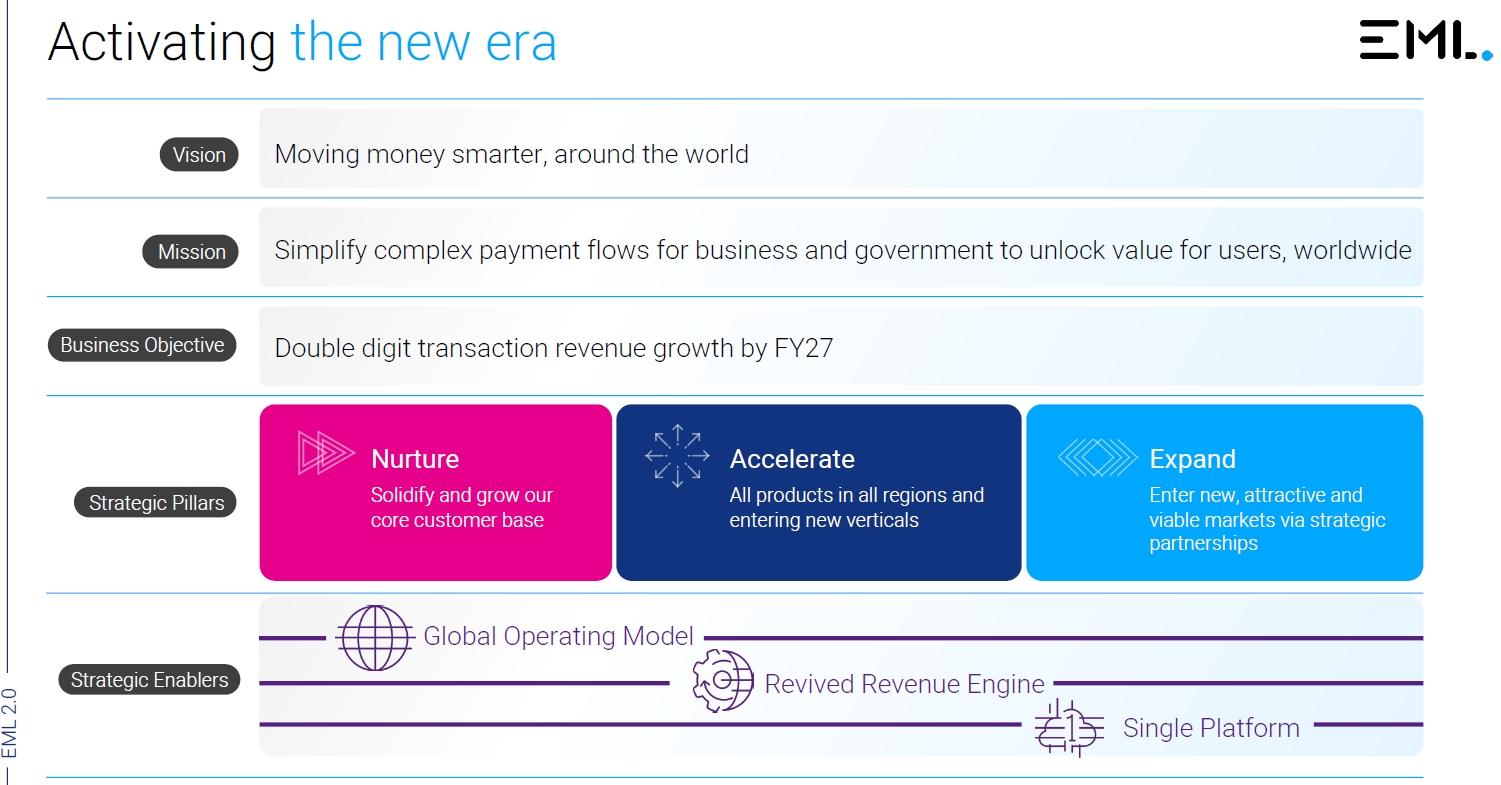

Business Objective

Solving complex money flows living at the intersection of business, government and consumers...

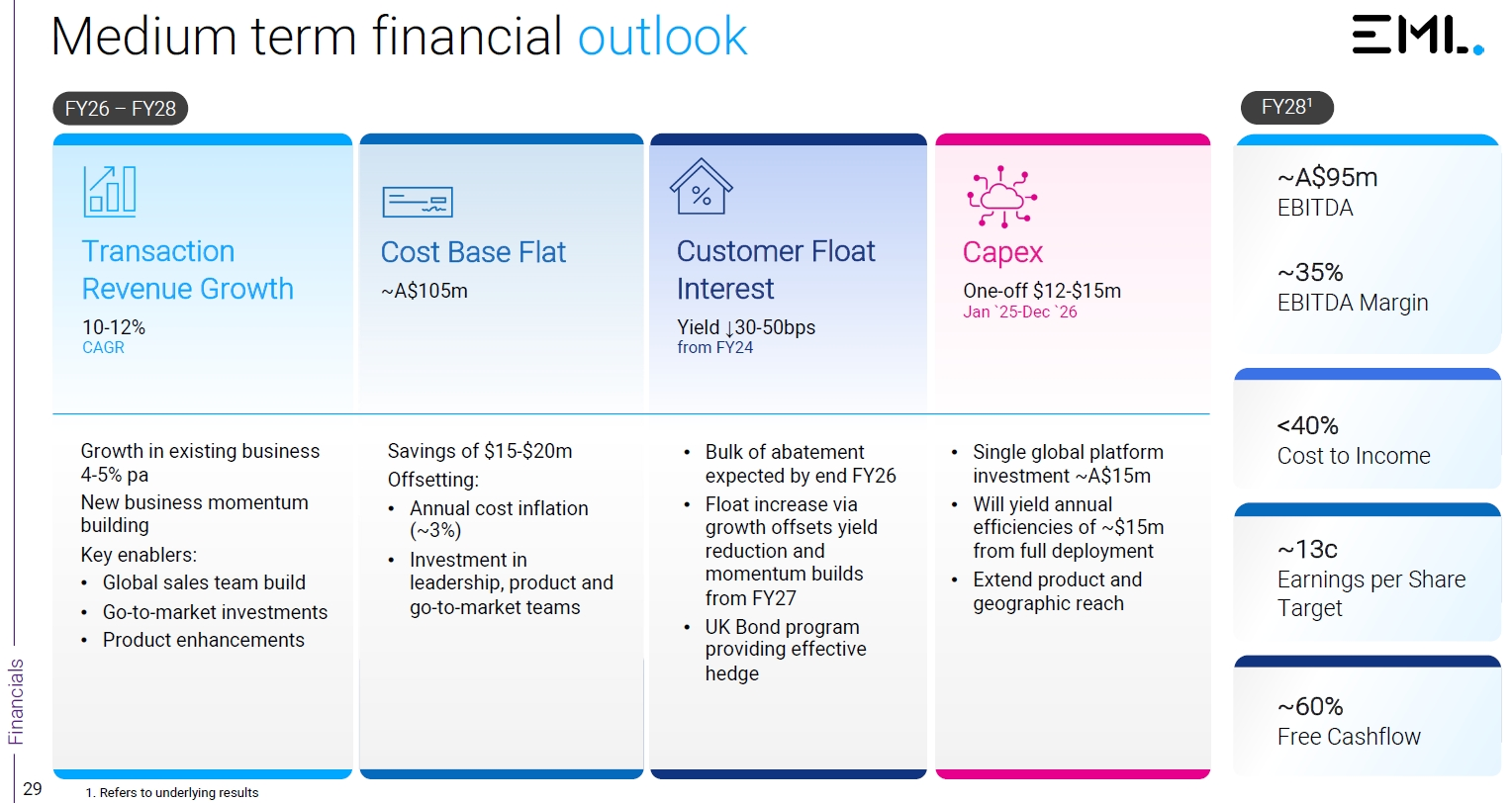

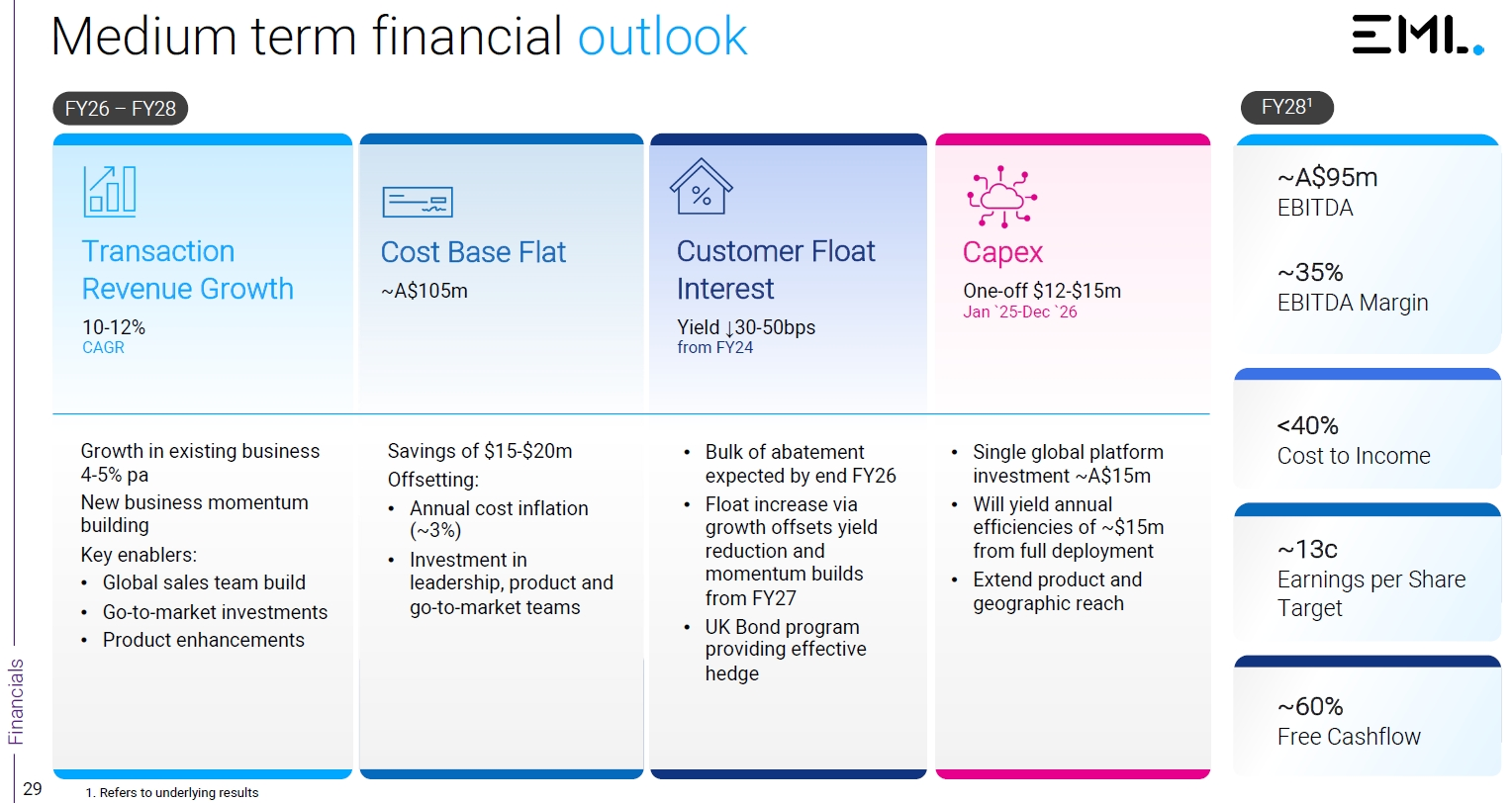

Management 3-Year Objective

On a mission to power double-digit transaction revenue (excluding interest revenue) growth by FY27

Conditions to Grow are Optimal

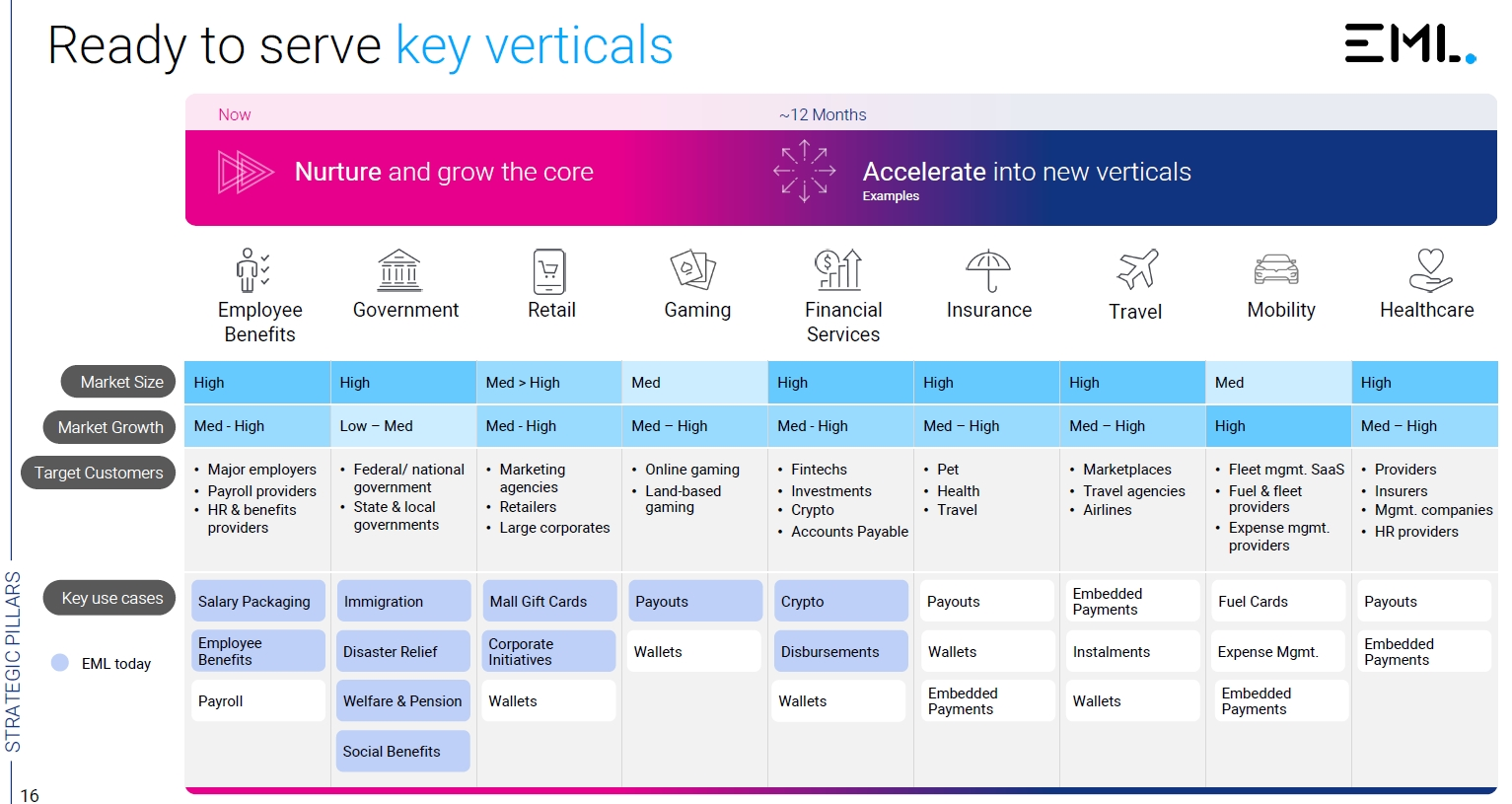

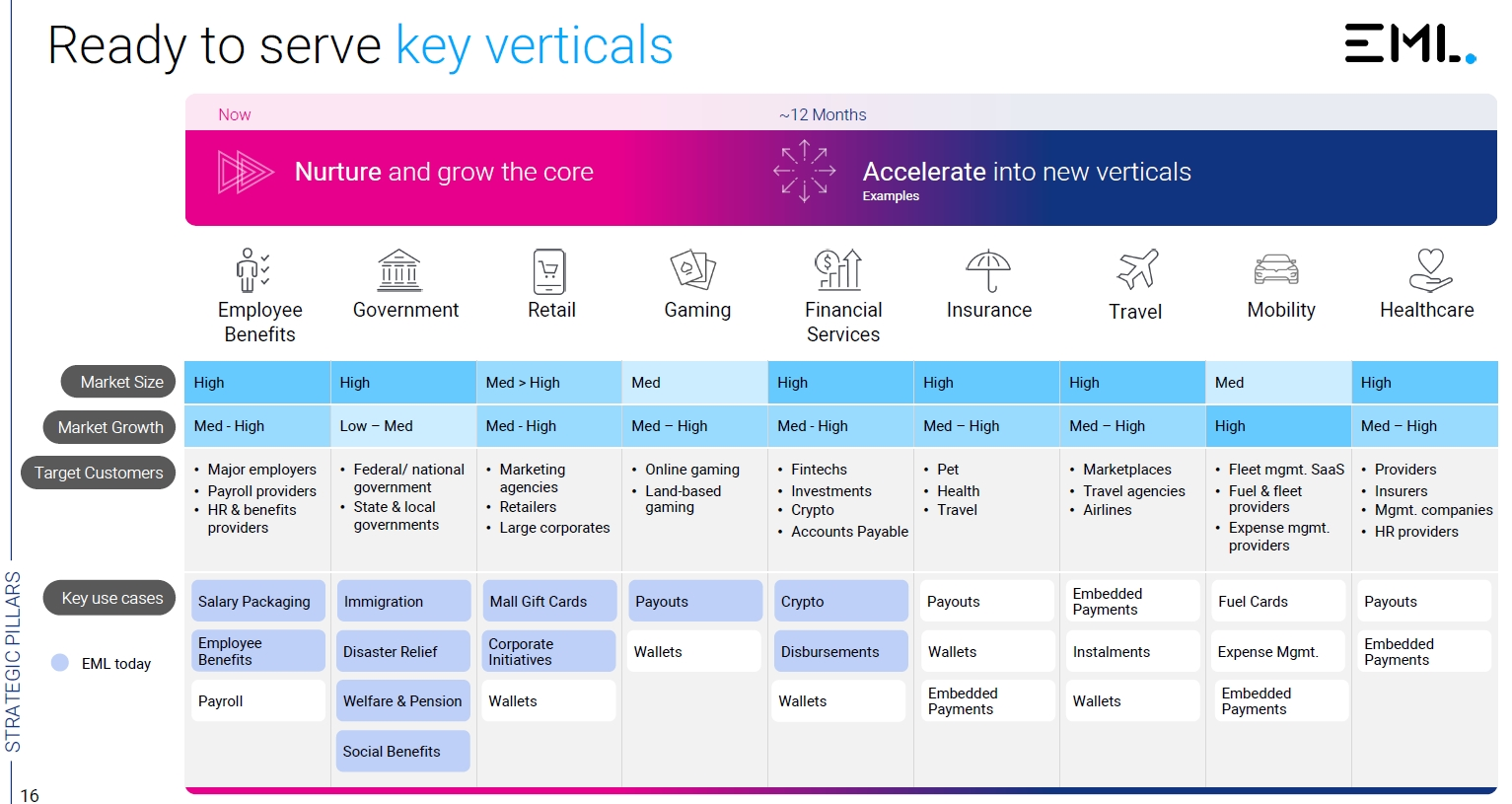

An attractive and growing market - strong tailwinds from (1) Digital Payments continuing to replace cash & paper (2) explosion of Digital Wallets (3) Experience and efficiency battlegounds (4) complex use cases remain underserved eg. Employee benefits

EML is an end-to-end, embedded payments issuer operating in 3 of the world’s most highly valued payments markets - a good business to grow from, diversified revenue mix, have revenue levers across the entire value chain, have capabilities which “move many smarter”

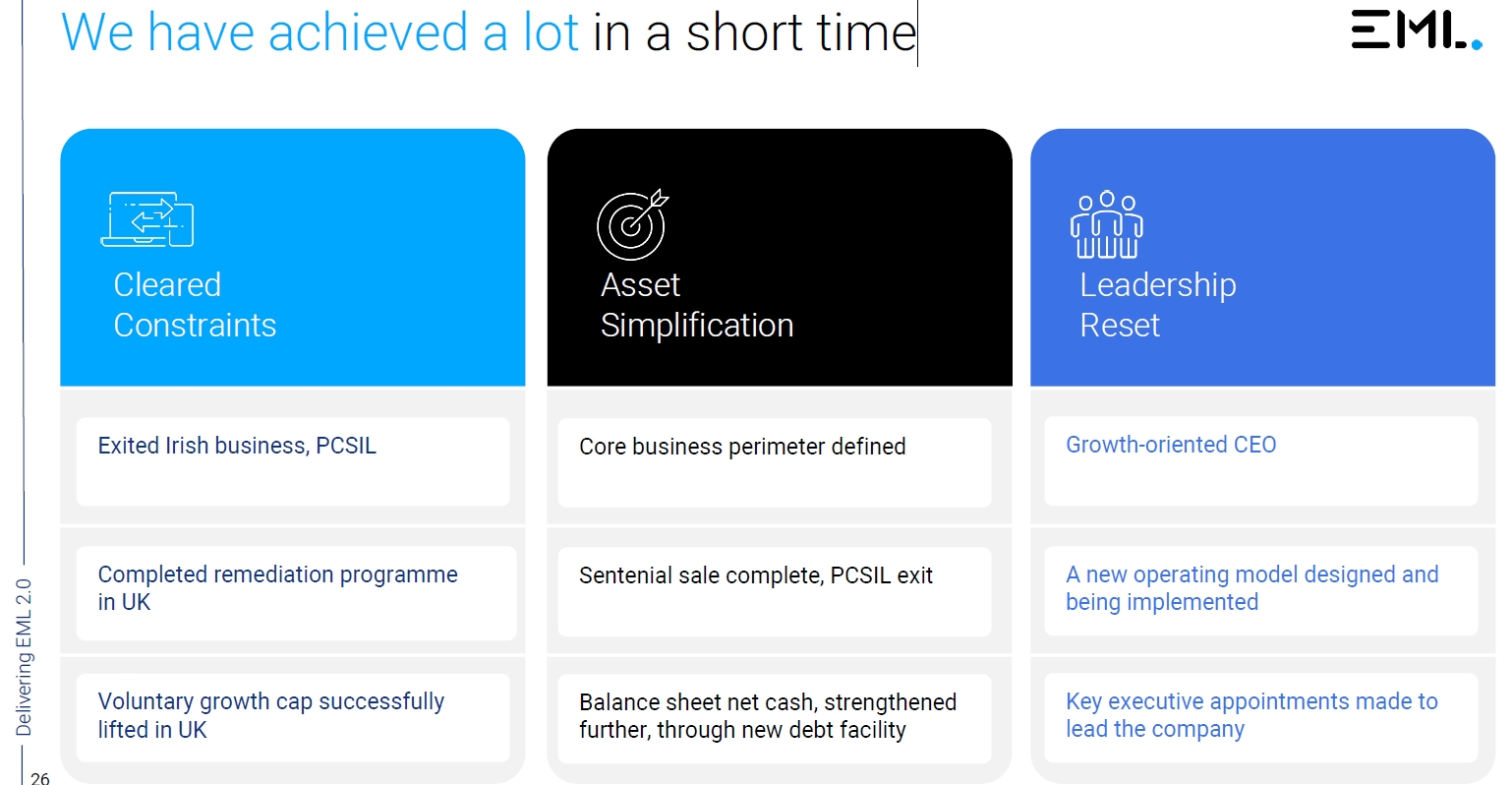

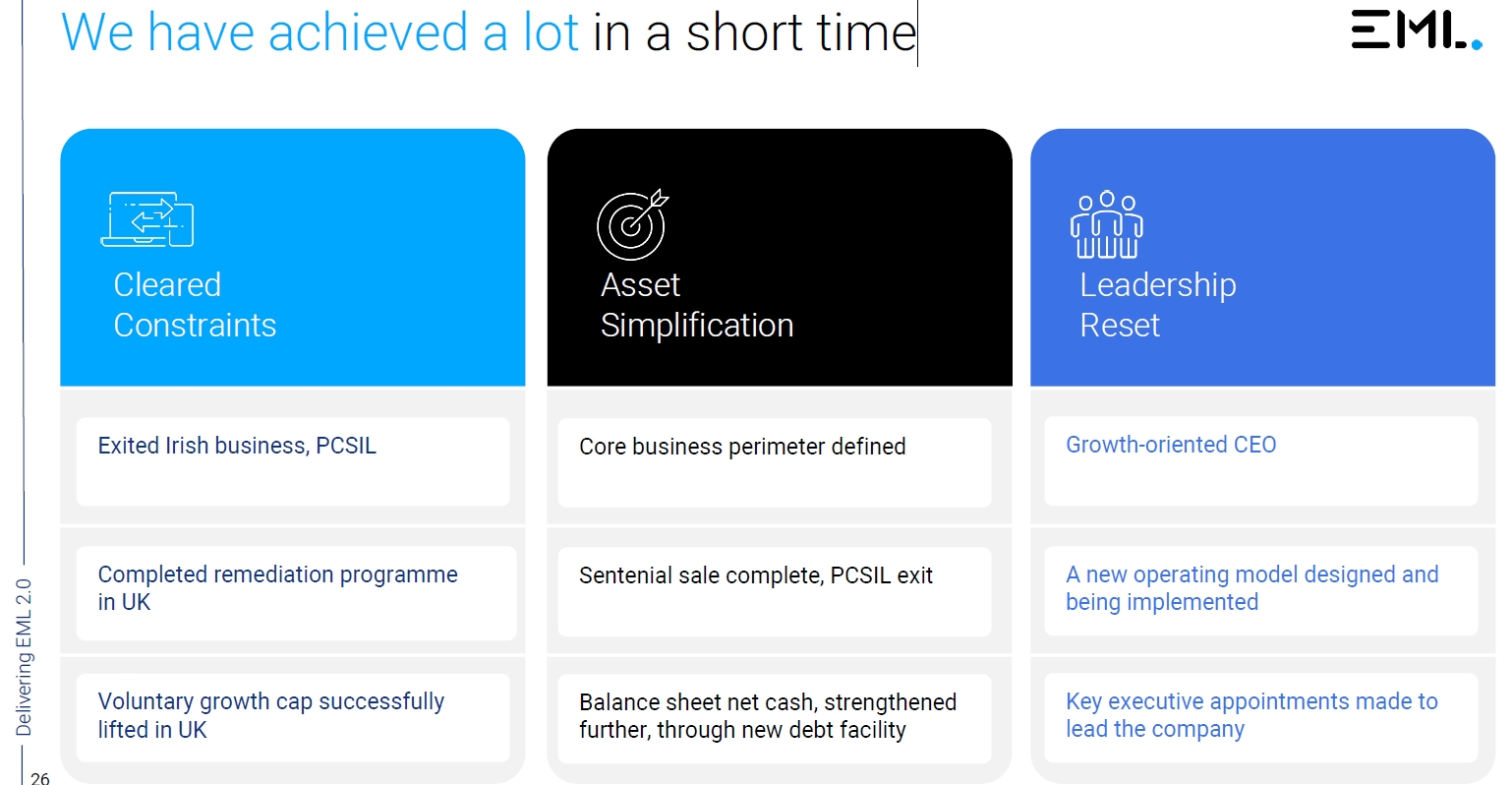

Balance Sheet repaired, regulatory madness is gone, leadership has reset

How EML Will Win

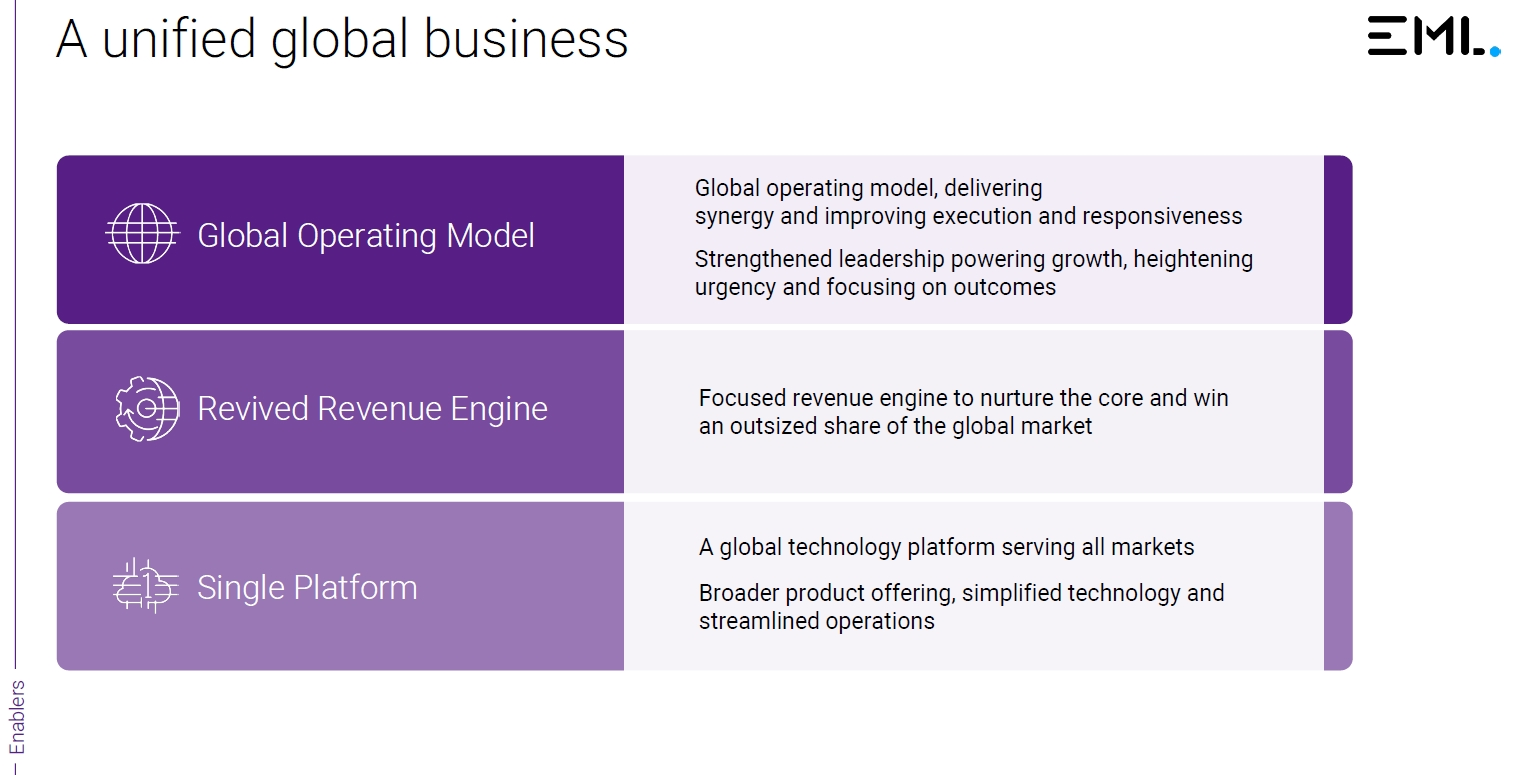

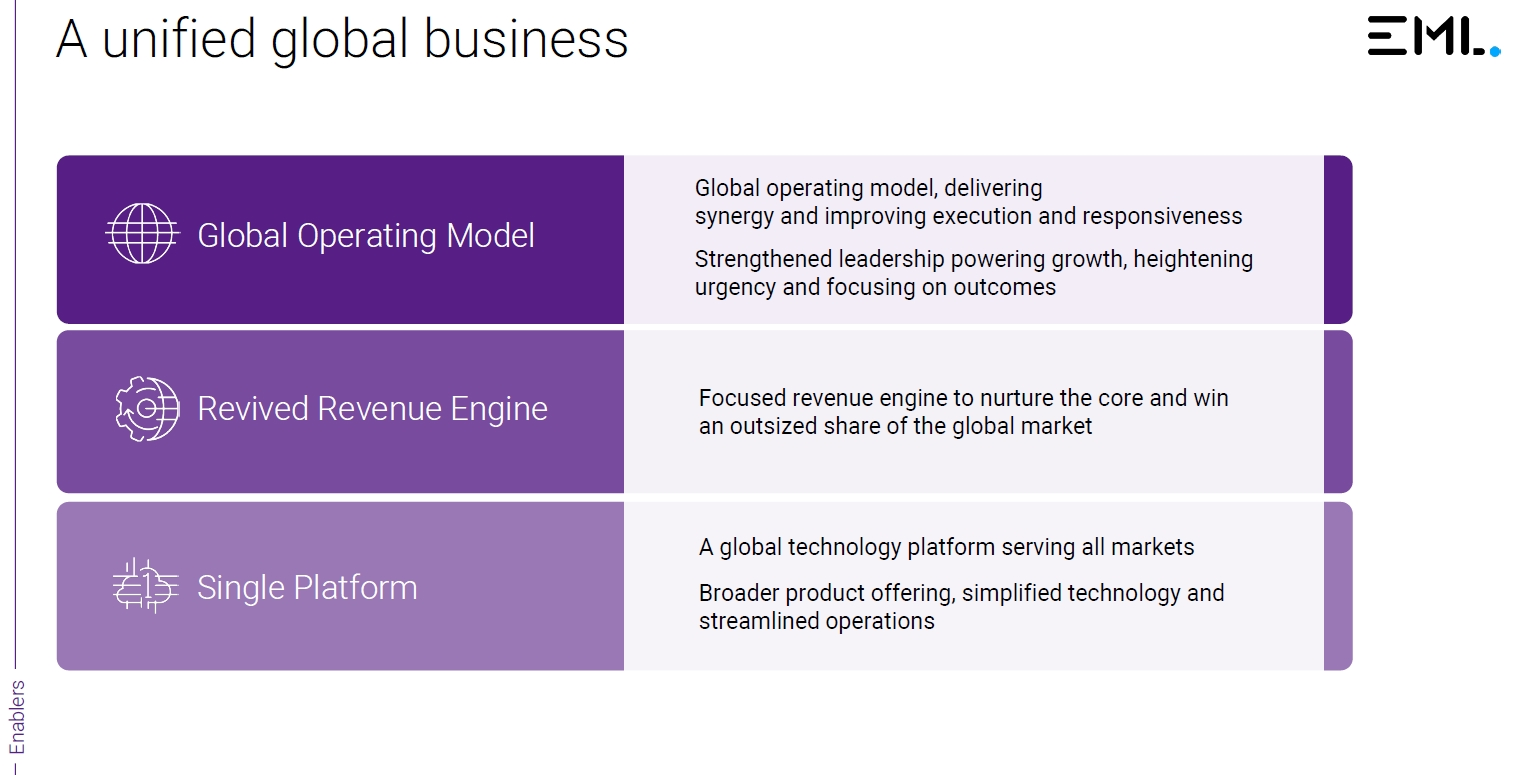

Strategic Pillars to Deliver The Plan

Nothing grandiose, almost predictable, boring back-to-basics enablers, really.

Progress Thus Far

Modest Capex requirements - $43m in Cash Reserves at 30 June 24, generated $14m net cash from operations in FY24 - should be able to fund required capex comfortably.