Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Discl: Held IRL 2.66% and in SM

Good to see Copia Investment Partners increase their holdings of EML by 1.04% to take their holdings to 7.88%.

Discl: Held IRL 2.65% and in SM

Catching up on some EML announcements this week.

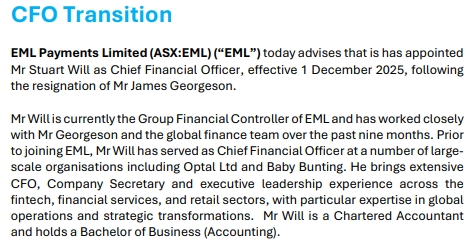

CFO TRANSITION

This CFO transition feels orderly.

James has had a 2.25 year stint at EML - think he was hired by Anthony as part of the Executive change. James’ Linked-In profile has him working at AMP for the past 22 years prior to joining EML, but each of his stint within AMP averages about 2-3 years, so this EML employment period fits that pattern

Stuart Will has been a EML contractor since Mar 2025 - given the ~6M gap, it does feel that this change was in the mix and the contracting stint was in preparation for James’ exit

Given that the EML legal/compliance troubles are mostly over, EML 2.0 Transformation is progressing nicely, in 1 or so years time there will be an increasing transition to BAU operationally, and the main driver behind the transformation is Anthony, I am not concerned with James leaving

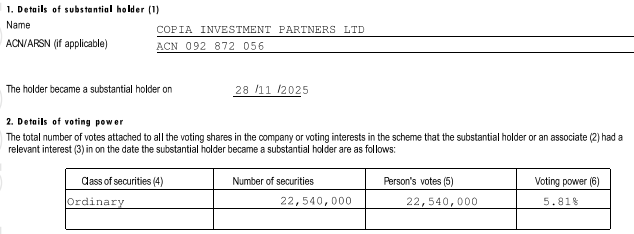

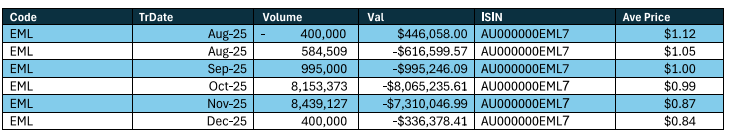

NEW FUNDIE: Copia Investment Partners Ltd

Always nice to see a new fundie show up on the register. Looks like they have been accumulating since the FY25 results, averaging down as the price drifted downwards.

Discl: Held IRL 2.90% and in SM

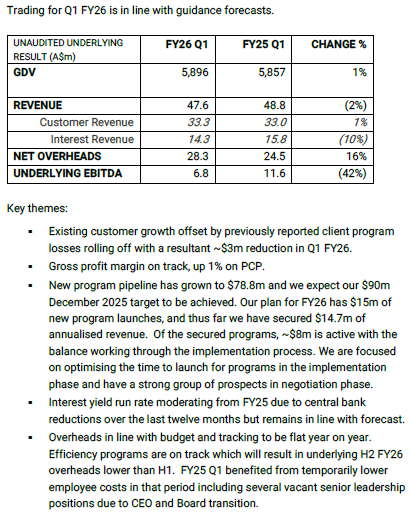

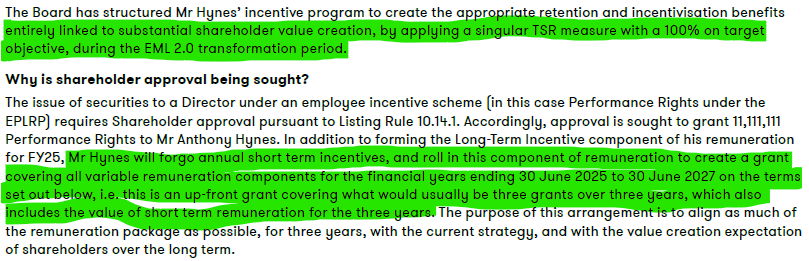

Quite a few interesting developments and data points in going through the EML FY25 AGM meeting notes and material.

Worth a read - Anythony Hynes is a complete cut-the-crap kind of guy and I appreciated the punchy updates to the updates he presented against the FY26 objectives on Page 3.

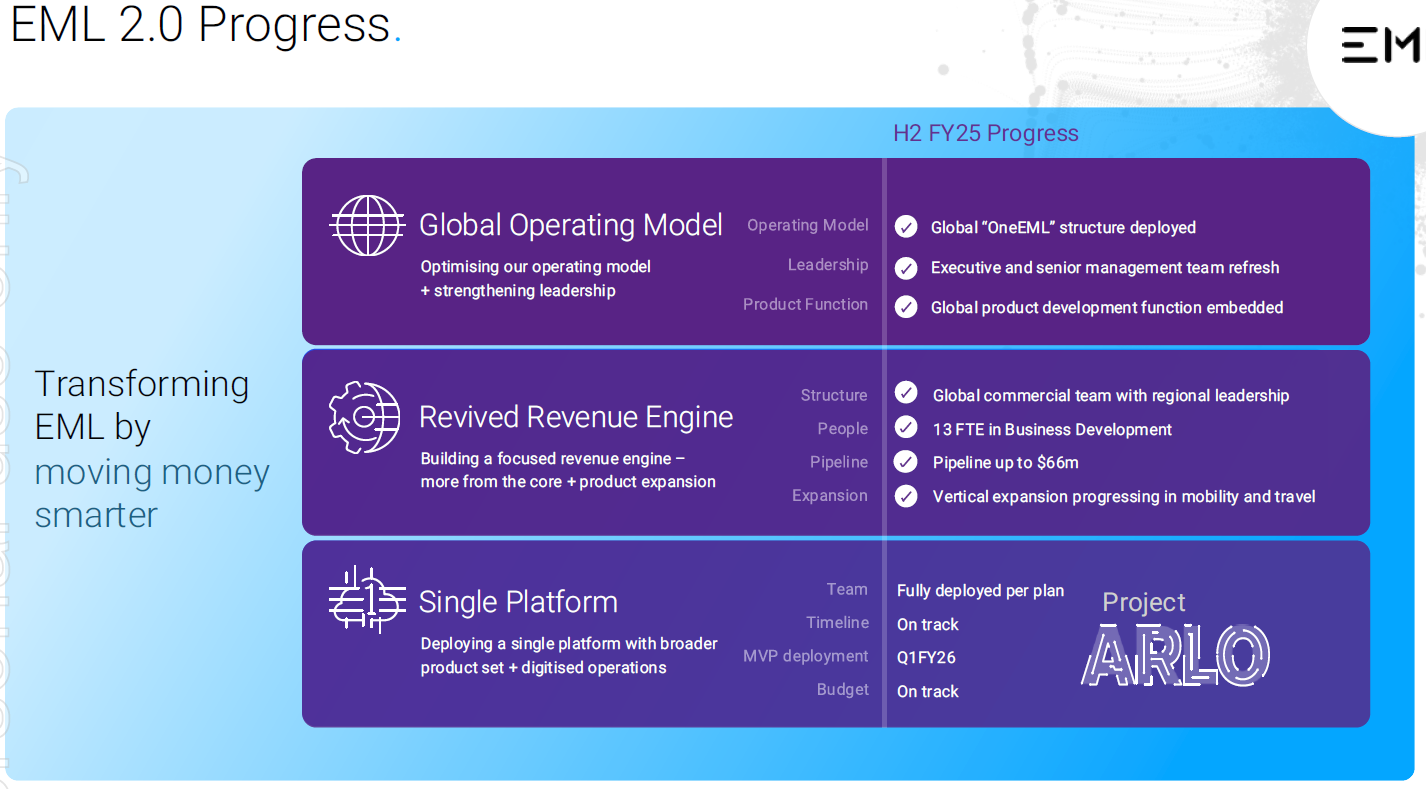

FY26 was always positioned as a huge year on internal transformation - the updates from a straight shooter like Anthony gives confidence that things are going to plan, particularly the critical Project Arlo which has been deployed into the UK

FY26 EBITDA guidance in the range of A$58-63m was reaffrmed and Q1 trading was in line with that

Given that EML is chewing gum while running, I see this as good news as EML is running both BAU and Transformation, at pace.

Given a lot of market commentary since the FY25 results, I do sense that the fundies who are still onboard have given EML time to get its house in order. Todays muted market reaction to the trading update, amidst a horrible week, augurs well on this front.

Anthony’s Long Term Incentive Plan Approved

The plan was approved with 86% For.

I am really good with this as (1) he is completely incentivised to ensure the success and sustainability of EML 2.0 (2) it is over 3 years, absolutely encouraging long-term thinking and the building of sustainable capability (3) he no longer has annual short term variable incentives, which further embeds the long term thinking

SUMMARY

From past Corporate Transformation experience, large scape corporate Transformations like EML 2.0 only succeed if you have Executive alignment and buy in on the Transformation and then the focus and energy of the Executive to drive the Transformation forward, aggressively. My read of this is that the EML Board and Anthony not only understand this, but have aligned the incentives and the organisation and have driven the organisation hard in the past year to get going.

The 3 year horizon is why he needs to get on with it, in terms of building and deploying the capabilities urgently, so that the rest of the organisation can then get onboard and use the new capabilities to move the business forward. From all indications, Anthony ain’t being polite about this nor is he fluffing around - that is very good news as a shareholder.

The downside and risk is that if Anthony goes, EML 2.0 will go with him. But with this LTIP and his own personal holdings of EML (he bought 0.24% in Oct 2024), this risk should be reasonably mitigated.

But this is a 2-3 year journey, and so, patience is absolutely needed. I am definitely sticking around to see what happens ...

@Bear77 , could I please get your expert input into the attached announcement and see if this is a legit stake increase?

I think it is given the relatively large transaction volumes that have gone through and I didn't think WAM allowed its holders to trade?

Discl: Held IRL and in SM, and staying In

SUMMARY

As the Earnings call was progressing, the following were the impressions that I wrote down and took away:

- Relentless and furious peddling with EML2.0 transformation occurring on multiple fronts - there is significant complexity to confront and fix everywhere management turns

- Management is continue to chew gum while it sprints - the analysts on the call appear to clearly get this focus on restructure

- Flat Customer Revenue has been offset by significant improvement in Interest/Treasury Income - FY25 EBITDA guidance was met

- Anthony Hynes summed it best at the end with a quote he says he uses with his wife: “I am a work-in-progress. Stick with me, the best will still be”

Having managed and been a part of many an organisation’s Transformation journey’s, I totally get the necessary pain that EML2.0 is bringing to the EML organisation, both in the actual work needed for the transformation AND in parallel, the need to still keep the business running and growing. EML 2.0 is a wholesale clean out and change - the people have been cleaned out, the systems and processes rebuilt, the culture changed. It is brutal.

I have very high confidence in EML2.0 as one key thing stands out - the very public and strong drive for that Transformation by the Exec Chairman himself, who, is also a major shareholder on his own coin. The language that he uses is the sort of brutality that any Transformation PMO wants by their side, and this is him being polite in public. That sort of ownership is pure manna from Transformation Heaven ...

And so, I will have a lot of toothpaste remaining to squeeze out of my EML toothpaste tube, to give management the next 1-2 years that it needs to fully transform and transition, before the growth trajectory of old takes off.

Chart Review

With the meh-like results, and despite the analysts sounding generally congratulatory in the call Q&A, I expected the price to be belted to the tune of maybe ~5%, given how unforgiving and short term the market is these days. So, was very surprised to see EML close unchanged, albeit with a long down wick in today’s candle. This provides an immediate data point, at least for now, that the market understands where EML is and where it is heading - that is hugely positive.

I do expect the price to drift sideways/downwards - I will be looking to top up if the price retraces to say, 80c-ish, to position further average down and position for 2HFY26, where the real action will begin.

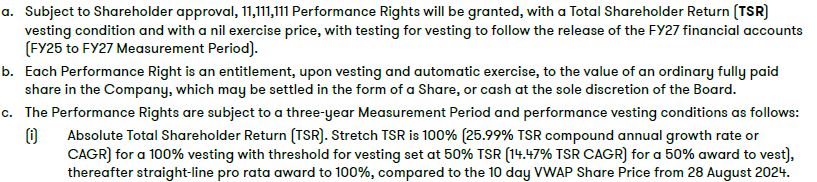

FINANCIAL PERFORMANCE

In absolute terms, the EML FY25 results were “Meh-to-OK-ish”. But in the context of massive organisation transformation, it was very pleasing.

- Revenue grew 9% YoY to $220.9m

- Underlying EBITDA was $58.6m, meeting guidance of $54-$60m towards the top, up 13% YoY

- Modest 3% growth in customer revenue

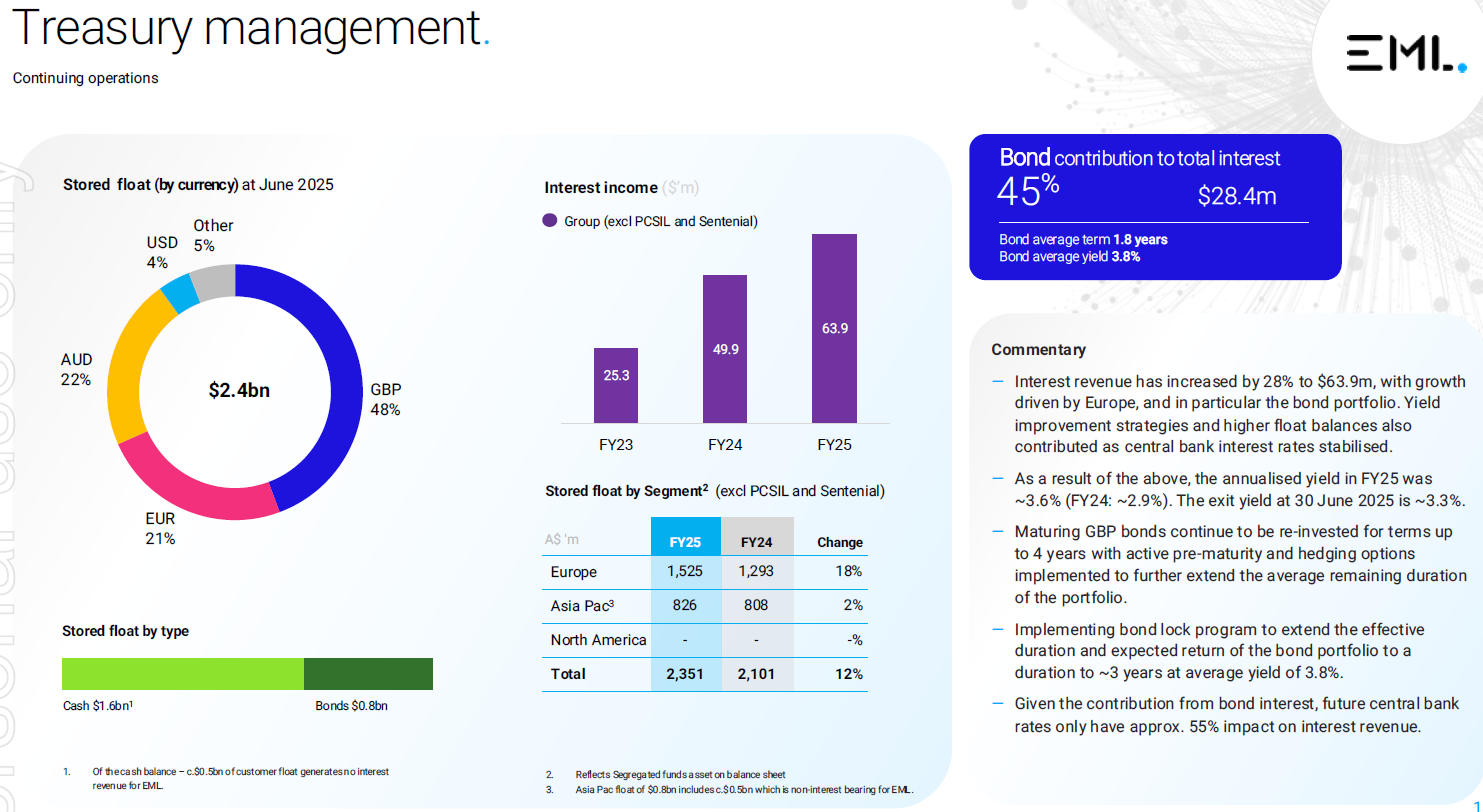

- Higher interest revenue, jumping 28% - driven by yield improvement strategies, higher central bank rates and higher float FY25 annualised yield was ~3.6% (FY24: ~2.9%), exit yield ~3.3% at FY25

- Partly offset by overhead cost increases - up 1% HoH, up 8% YoY

- Underlying Gross Margins were sustained at 75%, underlying EBITDA margin

- Statutory NPAT took a big hit from the ~$35m Shine Class Action settlement

- Cash increased $18.6m YoY , which resulted in cash of $59.3m. Up 46% YoY

- Cash conversion ratio of 72%, generating $16.7m net cash from operations, higher than normal

- Further $55m borrowing capacity

Other FY25 key achievements that provide evidence of a bit more than green shoots:

- 8 top 30 contracts were renewed, including 2 in the top 5

- 27 new clients secured

- Bond yields fixed on ~45% of the float for 3 years locked in at 3.8% - very positive given the lower trajectory of interest rates

- Class action settled - no more uncertainty about the size of the settlement of ~$35m

- Pipeline up to $66m vs target of $60m (from a start of zero pipeline in Dec 2024)

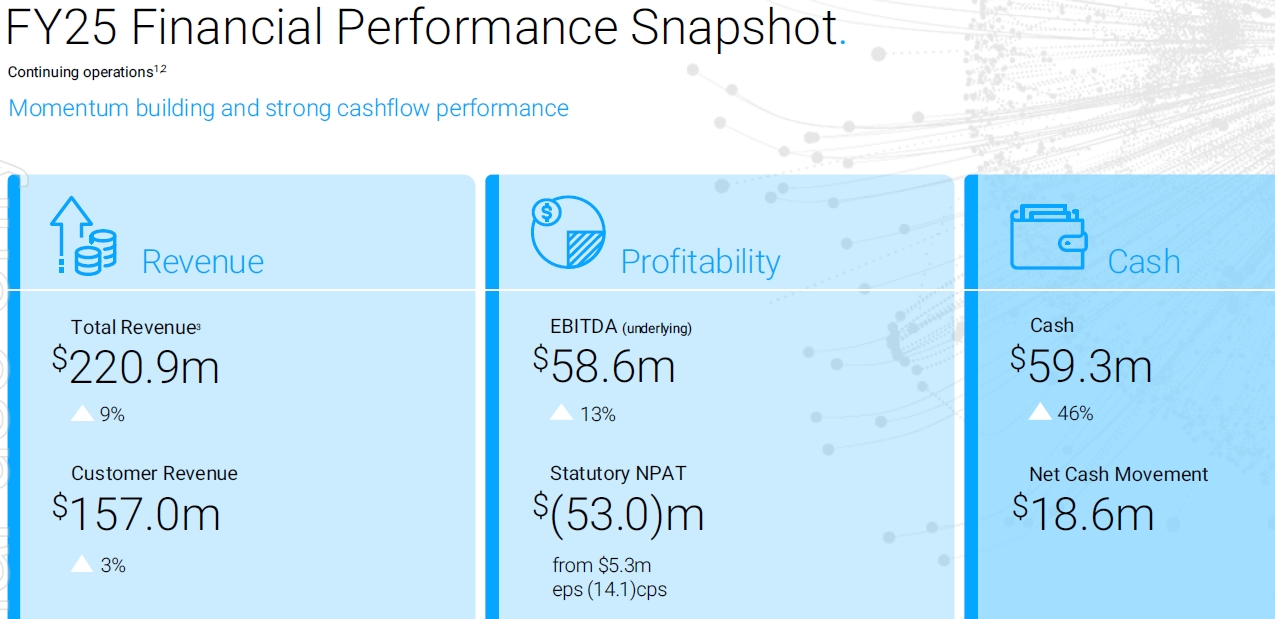

Geographic Segments

Treasury Management

Interest income has grown nicely in the last 3 years

Future central bank rates only have approximately 55% impact on interest revenue

EML 2.0 Update

Comments by Anthony around the Transformation Journey shows the breadth, depth and intensity of the Transformation

- “Wholesale refresh of People, Process, Technology and Culture” - “if you started before 2024, you must be no good”

- “Doing more with our Core” - focused effort, moving hard

- “No corner of our business is being untouched by EML 2.0”

- “Often we turn more rocks and fine more rocks - getting rid of rocks and deadwood”

- Key risk is the inability of the organisation to fully digest and absorb this change - it requires a high level of multi-tasking

- Project Arlo objective is to combine 3 platforms into 1 - once in a lifetime fix - On Track

- Key constraint is on the customer-end - how to lift and shift customers to the new platform around customer constraints

FY26 OUTLOOK

- FY26 is a “Bridge Year”

- Started the year with new signings, starting to see growth in revenue - key is to win and onboard quickly

- Expect cost base to be flat

- Target pipeline to $90m by end-Dec 2025

- Expect to go back to 10-12% Market Growth CAGR over a multi-year period through to 2028, starting with back-end of FY2026

- Unable to provide the are at which the pipeline will translate to revenue - pipeline was zero to start with and so, there is no data to support a conversion metric

- Will get a better sense of conversion dynamics by end CY2025 and will update in early CY2026

This caught my eye:

- The 3 WAM funds collectively appear to have increased their holdings of EML by 2.24% to go from 6.59% to 8.83% between 30 April and 20 June

- Look like each of the 3 funds were buying daily - Botanical Nominees being the smallest number, WAM Capital and WAM Microcap have significantly larger volumes

- Average cost would have been around ~$1.05 as the buying started around ~$0.96 through to the top of ~$1.17

- If this was indeed what happened (very cautious about getting over excited with these announcements), this is another sign of increasing market confidence in EML - can’t be bad for us retailers!

Similar to AIM, EML also announced a LTIP for it Exec Chairman, Anthony Hynes earlier this week.

Key difference to the AIM LTIP is that there are performance vesting conditions around Total Shareholder Return and Anthony needs to serve the full 3 year period.

Am pleased with this given the revolving door that the CEO/Chairman positions have been in recent years. This locks Anthony in for 3 years, making good his comment during the 1HFY25 results call that "I am not going anywhere". This is a decent window to get EML rocking and rolling again (and for me to get my money back!)

Discl: Held IRL and in SM

A deeper look into EML's 1HFY25 results.

Discl: Held IRL and in SM

SUMMARY

A really good result which the market seems to have appreciated. Very good to see the Exec Chair's big on-market purchase last week and today's QVG Capital stake increase immediately following the results. Hoping this is the start of the market taking more notice of EML2.0 ...

Comparisons are still messy with remnants of Sentenial's operations still requiring lots of adjustments etc, but expect all these to wash through in the next half.

The single phrase that for captures the mood of management and my view: “We are talking about growth and efficiency every day”.

I took away the following themes from the investor session and slide pack:

Positives

- EML is now Statutory NPAT profitable in 1HFY2025, with NPAT $9.5m, up from Net Loss of ($4.7m) in 1HFY2024

- Underlying EBITDA increased ~50% to $33.4m, YoY

- Cash position has improved materially, post Senteniel - moved from a net debt to net cash position, and reflects further stabilising of the business - debt of $38.5m repaid, overall cash increased $7.5m, $4.6m cash generated from operations

- Europe is driving earnings with 30+% revenue increase, following the lifting of UK growth limitations, Asia-Pac still contributing with 5% revenue increase

- Interest revenue up 49% to $32.8m, mostly from growth in Europe, annualised yield in 1H25 was ~3.7% (1H24: ~2.5%

- There appears to be laser focus on cost efficiencies - net overheads remained flat YoY, but managements wants the new technology platform to do more to improve efficiency and productivity

- Management ELT is more or less in place and stable

- Management appears to be relentlessly driving the EML2.0 culture change at pace, across the 4 pillars

- Financial performance on track to FY25 guidance ($54-60m EBITDA underlying) - run rate of 1HFY25 underlying EBITDA is slight ahead of guidance but 1H is seasonally stronger due to the holiday season

Needs More Work

- Asia Pac (flatish) and US (subdued), particularly, needs growth focus - Management understands this and are taking action as part of EML2.0

- Expecting interest yield to moderate further as interest rate cuts kick in and central banks plan further interest rates cuts, Float is largely in AUD and GBP where the rate outlook is more stable - size of UK bond investment, Europe segment is expected to temper the interest rate cuts

- Build out of Technology Platform - Project Arlo, kicked off and progressing well in early stages, expecting to see more momentum in the next 6-12M

EML 2.0, QUOTES FROM CALL

- "Largely emerged from the structural challenges of the last 3 years, turning the focus to industrialising the business and recapturing the growth mindset which has been missing for some time"

- "Global structure deployed - focused on removing organisational silo’s - the previous zero integration of regional businesses is coming to an end"

- “The velocity of decision-making and activity in this company has changed immeasurably over the past 60 days”

Pipeline is sitting at $45m, expecting to increase to $60m by EOFY 2025, then $90m by end CY2025

- Working on a 20% conversion rate

- Management emphasis and focus will be on new verticals and bringing new solutions to market in FY26 in existing markets/customers over new markets

- “Pipeline is not as full as we would like it to be, but it is not empty”

- “Free up best talent to focus on these new initiatives, something EML has not done in years”

Project to build single platform is in early stages - good momentum in this initial phase, expect to spend $3-4m on Project Arlo in 2HFY25, wanting technology to do more to reduce operating cost

On Anthony’s position as Exec Chair: “I am not going anywhere, mate. I am very energised about what we are doing and I look forward to doing some positive outcomes for everyone”

This was BEFORE Anthony made his monster on-market purchase - it does feel like he has doubled down on this comment, by putting real money on the table

FINANCIALS

Accounts have been restated for continuing operations only

Change in segment reporting from the previous product-centric view to the current region-based view to align to new org structure - sell all products in all markets

SEGMENT ANALYSIS

- Franked dividends are low on the priority list as the recovery is still in its early days

- No inorganic opportunities on the radar - focus is entirely on getting back to growth

Nice to see QVG Capital up its stake in EML by 1.63% to 7.32%. Looks like they have accumulating since Nov 2024 prior to the results through to 26 Feb 2025, the day of EML's results.

Discl: Held IRL and in SM

NED Anthony Hines, who has a good background in the FinTech space, bought $2.93m worth at an average price of 97.6c.

Good sign.

Quite the early Christmas turd for shareholders. Abrupt announcement with not a lot of clarity or context.

Leadership Changes

The Board of EML Payments Limited (EML:ASX) (“EML”) today announces that it has

elected to discontinue Mr Ron Hynes’s employment agreement as Managing Director

and Chief Executive Officer from 21 December 2024 having resolved that alternate

leadership is required to execute the Company’s strategy, EML 2.0. Ron will receive

six months’ notice but will not receive any equity grants given he will not be in

employment on the relevant vesting dates.

The Board and leadership team are wholeheartedly committed to our medium-term

strategy EML 2.0 which was communicated to shareholders and the investment

community at the Company’s 2024 Annual General Meeting on 26 November 2024.

Guidance for FY25 underlying EBITDA in the range of A$54-60m is affirmed.

Executive Chair

Current Independent Non-Executive Chair, Mr. Anthony Hynes will assume the role of

Executive Chair effective 23 December 2024. Anthony brings a wealth of experience

in the operation of successful global payments businesses and has developed a

deep understanding of the EML business over the past six months since his

appointment to the Board on 30 June 2024. Anthony’s remuneration during the

period of his Executive Chair appointment will be A$67,000 per month, inclusive of

his current Chair fee, being the equivalent of the former CEO’s Total Fixed

Remuneration.

Anthony said “Our energised, passionate and broadened leadership team is building

momentum and I’m excited to lend them my further support as we work hard to build

a high-performance culture and make 2025 a formative year for EML. I love the

payments industry having dedicated a significant part of my professional life to it

and the upside for EML following the successful execution of our strategy is

significant.”

Deputy Chair

The Board has appointed Independent Non-Executive Director and Chair of the Audit

and Risk Committee, Mr. Ken Poutakidis as Deputy Chair effective 23 December

2024. Ken is an experienced ASX Director with deep understanding in equity capital

markets and financial services. Ken’s remuneration as Deputy Chair will increase to

$175k per annum in line with EML’s Non-executive Director fee structure as

published in the Company’s 2024 Remuneration Report.

Anthony, together with the leadership team, look forward to sharing progress on EML

2.0 and the FY25 H1 financial results with shareholders at the FY25 Interim results

presentation scheduled for 26 February 2025.

SUMMARY

- The story makes sense, is clear, coherent and consistent with earlier management communications - this continued clarity is usually a good sign of good things to come

- Strategy makes sound sense

- Goes back to basics, nothing grandiose, no large capex spend in the next 3-5 years that could result in any capital raising, no sign (as of now anyway) of potential M&A stupidity - never say never, but for now, I will take it

- Key ingredients are in place, scene is set, it is now all about execution

- Early signs that EML is moving at pace, and starting to yield positive results

Too early to be happy (will have a small glass to celebrate today's pop!), more relieved that we are now going back to BAU in a clear, decisive way. Come what may from hereon ...

Have already doubled down in recent months, so will not take further action for now and enjoy the ride for a change.

Discl: Held IRL and in SM

--------------------

Business Objective

Solving complex money flows living at the intersection of business, government and consumers...

Management 3-Year Objective

On a mission to power double-digit transaction revenue (excluding interest revenue) growth by FY27

Conditions to Grow are Optimal

An attractive and growing market - strong tailwinds from (1) Digital Payments continuing to replace cash & paper (2) explosion of Digital Wallets (3) Experience and efficiency battlegounds (4) complex use cases remain underserved eg. Employee benefits

EML is an end-to-end, embedded payments issuer operating in 3 of the world’s most highly valued payments markets - a good business to grow from, diversified revenue mix, have revenue levers across the entire value chain, have capabilities which “move many smarter”

Balance Sheet repaired, regulatory madness is gone, leadership has reset

How EML Will Win

Strategic Pillars to Deliver The Plan

Nothing grandiose, almost predictable, boring back-to-basics enablers, really.

Progress Thus Far

Modest Capex requirements - $43m in Cash Reserves at 30 June 24, generated $14m net cash from operations in FY24 - should be able to fund required capex comfortably.

Nice turnaround thesis confirmation trading update and pop today.

Will spend some time later this morning to do a more detailed review of the Strategy Update. In a superficial quick glance, it feels like:

- lots of nice slides explaining the world that EML operates in and the opportunity

- we have a great business, great assets and a nice clean base after cutting out the crap, from which to launch EML 2.0

- we are going to be very focused, disciplined to chase whats out there, with what we've got

The original EML strategy was not flawed, so going back to basics makes absolute sense. If only EML had stayed this exact course 3-4 years ago, instead of going down the path of stupidity that it did ....

Very happy with the turnaround progress thus far, particularly the re-focus back to EML's core business basics. Just now need to give management time to execute and embed.

Discl: Held IRL and in SM

Very nice to see that EML's new chair has put down $0.52m into EML, on market, at ~$0.595 in the last 2 days.

He now holds ~0.24% of EML, up from a now minute 50k share holding prior to these purchases.

Anthony replaced Luke Bertolli in Aug 2024 and appears to be well credentialed in the payments business.

This feels like a huge tick of confidence in EML from the new Chair when EML was dredging its 52 week lows these past few weeks.

Discl: Held IRL and in SM

@thunderhead , very fair comment around the impact of interest rates on EML's interest income. Intuitively, as interest rates fall, EML's interest income should fall, negatively impacting earnings and hence negatively impacting the share price. The fall in the price post the FY24 results bothered me somewhat as I was questioning whether I had doubled down on the wrong end of the rates cycle.

To work out the correlation, I plotted each RBA rate change since EML listed in ~2013 against EML's share price. The dots are placed on the approximate date where the rate changes occured (had no space to make the dots any larger!)

Red Dots = rate DECREASES, which should negatively impact EML earnings based on the reasoning above (hence Red)

Green Dots = rate INCREASES, which should positively impact EML earnings (hence Green)

Interesting Perspective

When Rates were DECREASING in the ~2013 to ~2020 period, EML's share price was generally trending UP - it went from a ~$0.20 stock in 2013 when the Cash Rate was 2.5%, to its peak of ~$5.68 in early 2020 when the cash rate was 0.75%.

2019 to 2020 was a disaster year when all the PCSIL dramas erupted, and the price crashed to $1.25 when the Cash Rate was 0.5% - clearly, EML-specific issues drove the share price then.

CY2020 to April 2021 saw the price spike from $1.25 to $5.89, its all-time high when the cash rate was still FALLING from 0.5% 0.1%.

CY2021 to mid-CY2022 was disaster period 2 post the Sentenial Acquisition and more PCSIL dramas and the price fell to $1.25 again. The Cash Rate INCREASED from 0.1% to 2.35% in that time. Since mid-CY2022, the cash rate increased to 4.35% while the share price fell to its all time low of ~$0.40 through to current day $0.665.

So, based on the history, the impact of Covid, the big dramas around PCSIL/Sentenial, it actually appears that the EML price has actually moved broadly in the opposite direction of changes in the cash rate. The EML price has made its best gains when the rates fell, Conversely, rate increases have done very little to the price.

This is terribly counter-intuitive, I have to say. But it lines up with EML managements comment in the results call that managing interest income is BAU really, regardless of where the cash rates are.

What Does This Mean

The perceived negativity of the imminent fall in the Cash Rates in CY2025 on EML's earnings is very much in play currently, I suspect.

But the facts around the historical EML share price does not quite support that negativity. The very bullish view would be that rate cuts actually seem to play in EML's favour. The mild bullish view would be that there is no tangible evidence that rate decreases have previously depressed EML share prices.

With this rates analysis out of the way, my view is that EML is in a very good place from a turnaround perspective. The bad stuff has been decisively cremated, new management with good industry credentials are in the driving seat, there is laser focus on EML 2.0 going back to its core businesses in terms of driving revenue growth and containing costs. Further progress will take time to wash through, given cost of living pressures and business cost pressures, and patience is absolutely needed.

I topped up in late Aug at 73c, and will top up again if the price dips below say 55c.

Discl: Held IRL and in SM

With the sugar hit from high interest rates set to weigh heavily on interest income, it seems the market is taking a dim view of the quality of EML's earnings now, and into the foreseeable future. The share price has copped it quite severely since hitting its highs from earlier in the year.

Is the market missing the forest for the trees in this turnaround story?

TLDR Summary

The FY24 results, in absolute terms, were good but not great. 2HFY24 was flattish. However, the results were impressive once I layered on the very eventful events throughout FY24 as EML focused on exiting the loss making businesses, decisively addressed regulatory issues and revamped management.

Turnaround thesis remains intact. Ingredients for a successful turnaround are in place and subject to more detail at the AGM, appears directionally correct. Will need patience as management refocuses and re-invigorates the core businesses, free of distractions.

Discl: Held IRL and in SM

FY2024 RESULTS SUMMARY (All Comparisons YoY unless otherwise indicated)

Context of Results

The FY2024 results are a good reminder that EML is very much a company still in turnaround mode. FY24 has been a year where EML has been actively working to spit out the bad gum that it has been chewing AND continuing to run and grow the core EML businesses.

The parts of the businesses that has dragged EML down are now decisively gone - PCSIL, and from yesterday, Sentenial. Much of FY2024 will have been to stabilise the rest of the business while these 2 parts were cauterised.

This was a good summary of EML’s FY24.

FY2024 Results, High-Level Summary

The Core business has still been growing, although not at the historical growth rates, reflecting management distraction at the exiting of the problematic businesses. The results were certainly not too shabby, given the turnaround context:

- Total Revenue up 18% to $217.3m, Gross Debit Value up 18% to $1.46b, but this was primarily driven by a sharp 97% increase in Interest Revenue to $49.8m, with Customer Revenue growing only 6% to $167.5m

- Interest Revenue reflects improved market rates and optimisation activities which have earned higher yields - need to understand management’s plan on how this will be sustained as the interest rate cycle shifts from rate hikes to rate cuts

- Treasury management optimisation actions have resulted in uplifting interest yield from 1.6% to 2.9%

- Underlying Gross Profit is up 19% to $166.1m, with Underlying Gross Profit sustained at ~76%

- Net Overheads are up 14%, but the historical period-by-period upward trajectory of costs in recent years have been stopped with costs in 2HFY24 falling 8% from 1HFY2024 - $5m of costs have been taken out from the 1HFY2024 cost base of $61.2m to $56.2m in 2HFY24 - management focus on cost optimisation is starting to show results. Cost take outs appear sustainable (30 roles exited, reduced ICT costs, improved debtor recoverabilities etc) - this sustainability will need to confirmed in 1HFY2025

- Underlying EBITDA including PCSIL was $57.1m - this was at the top end of market guidance of between $52m to $58m, excluding PCSIL, underlying EBITDA was $49.0m, a 19% increase

- Net Loss After Tax from continuing operations was ($9.6m), a 96% improvement.

- PCSIL loss as a discontinued operation was ($16.9m) from ($24.5m) YoY but showed what a huge drag it was on the group

Customer revenue breakdown:

- Gifts & Incentives - flat 3% increase - some challenges with turnover of several accounts, good $4.2m, 16% growth in Corporate Incentives, but offset by continued weakness in shopping mall revenue, down $2.3m, 5%

- General Purpose Reloadable - up 7% despite growth restrictions in place for the UK business through to April 2024, underlying gross profit margin up 3% to 73%

- Digital Payments - up 12%, driven largely from Sentenial, the size of this business will shrink with the discontinued Sentenial operations in FY2025

Balance Sheet

Underlying Operating Cash Flow was $22.0m.

Cash on hand was $43.1m, a reduction of $28.3m due to $40.8m of one-off outflows from (1) PCSIL cash usage including deconsolidation ($18.4m) (2) Net paydown of external liabilities reflecting Vendor loan note repayments and Sentenial earn out payment, net of debt drawdown ($14.4m) (3) Remediation and restructuring costs paid ($8.0m).

The net debt position is ($47.6m), but with the completion of the Sentenial sale announced on 3 Sep 2024, the net debt position will move to a net cash position of ~$5m, which significantly strengthens the balance sheet.

FY2025 Guidance

Underlying EBITDA guidance of $54m to $60m - growth of between 10% and 22% from the FY2024 Underlying EBITDA of $49m. Not too shabby at all

EML 2.0 - Building for Growth - this theme is repeated throughout the Annual Report

Extract from Chairman’s Report which best summarises the thinking and approach:

Where to From Here in FY2025

Onward and upward with EML 2.0, completely free of the baggage of PCSIL and Sentenial!

The TAM of the Prepaid market is huge and growing

And EML has a strong core, that has yet to be fully unleashed due to the severe distractions of PCSIL/Sentenial.

Key Areas to Look Out For in the EML AGM

- Refreshed Go-to-Market Strategy for EML 2.0

- Ambitions, Plans and Targets for growth - am expecting this to restore market excitement in what should have been EML’s growth trajectory had it not embarked on the slippery slope that was PCSIL/Sentenial.

- How the current good momentum in Interest Revenue will be sustained in a rate cut global interest rate environment

THESIS EVALUATION

Turnaround thesis is still intact.

Since the management refresh in FY2023, EML management has laid out a clear turnaround plan and thus far, have executed against the plan - exit of PCSIL, Sentenial, cost optimisation etc. During the investor call, the new CEO described EML as “Challenge, Determination and Achievement”, a good summary of the past year and what lays ahead

Management credibility is still intact

Sensing energy in the new CEO Ron Hynes - “move at pace”, “rebuild our sales capability” and “exploit EML’s right to win” were phrases used - these feel like the right sense of urgency and priorities. Seems to have the right background and experience to lead EML 2.0. Liking the language used in his CEO’s Report

- CEO’s 6m shares LTI requires a $1.50 share price hurdle and a strike price of $1 after 2 years - good skin in the game

- The FY24 AGM will be the next major data point

- This will be a 12-18M journey at least but am prepared to be very patient and allow management to do what needs to be done

Potential Thesis Breakers

Abrupt leadership/management change - this would be a huge red flag - it has been a period of good stability since Emma Chand exited, any change to this stability would be bad news

AGM is underwhelming in terms of EML2.0 growth ambitions

An acquisition, no matter how compelling, would be another big red flag, as I can’t see management being able to handle anything new for the next 12-18 months at least - suspect the risk of this occurring is low given that the recent “troubles” are still very fresh in the mind of management and the market

Underwhelming 1HFY25 results without logical rationale would also be a red flag as it would be a sign that EML 2.0 is not quite working or gaining traction or management has lost direction/focus/energy

Position Size

Comfortable with current portfolio position size of ~2.6%.

However, current levels are very attractive to top up as downside from here is likely to be limited and the price is at the 61.8% retracement level

Will seriously consider a top up if the price drifts close to 0.60, otherwise will use the AGM as the next key data point from which to reassess the portfolio allocation.

Another milestone in EML's ongoing turnaround with the completion of the Sentenial Sale announced today:

- Sale of the Sentenial business for an enterprise value of €32.75m (A$53.4m1) has completed

- Proceeds will be used to retire debt, strengthening EML’s balance sheet

- Balance sheet will transition from net debt of $48m to net cash $5m

- Liquidity to support growth materially improves following the sale of Sentenial and establishment of new debt facilities - debt limit facility will rise to $70m

- EML will benefit further from an earnout payment from GoCardless for an amount in connection with contracts signed by Sentenial between 1 February 2024 and 2 October 2024 based on the first year’s revenue derived from those contracts, multiplied by 4.1.

There was no downward adjustment to the sale price for key contract performance - this is icing on the cake.

In the midst of digesting the FY24 earnings reports. Thesis for EML turning around is very much intact as the company has executed against the turnaround plan, with Sentenial being the last piece of the bad stuff being conclusive sold, with a little bit of earnout upside potentially. Am prepared to be patient for this turnaround to play out ...

Company is now in a much healthier position from which to go onward and upward in their core business.

Discl: Held IRL and in SM

Upto 8.62%

Appointment of Managing Director and Board Directors

- Credentials of both Ron and Anthony look good

- Retaining Kevin was flagged previously but he's earned the right to be retained with the good work he has done these past 12M

- Ron's Rem at AUD$0.8m base, with 6m shares as LTI, 2/3's vestable in 2 years assuming share price hits $1.50, with a strike price of $1, plus another $3m of service rights, vestable each year (1) looks reasonable (2) ensures good skin in the game and (3) provides an indication of where management thinks the price will be at in the short to medium term.

In the past 12-18M, Kevin has decisively cleared the stage of bad stuff. The stage is now set for Ron to perform. He sure sounds like he can put on a show. Let the real show now begin (albeit a few years later ....)!

Disl: Held IRL and in SM

This is another growth barrier lifted and EML marches towards its old operational self pre-PCSIL/Sentenial. Onward and upward, literally!

Following the close of trading on 23 April 2024 EML’s UK subsidiary Prepaid Financial Services Limited (“PFSL”) received correspondence from the Financial Conduct Authority (“FCA”) advising that following PFSL’s completion of regulatory remedial work it was satisfied that PFSL has appropriate structure and risk management controls in place and that the Voluntary Application for Imposition of Requirements (“VREQ”) preventing PFSL from entering into new customer contracts would no longer apply effective 23 April 2024.

With immediate effect, PFSL may now onboard new customers and the team look forward to once again being an active participant in the UK payments market leveraging PFSL’s end-to-end issuance, processing and program management capabilities and UK domiciled management and operations team

The 'Wilson Stable' have accumulated EML -

The total number of votes attached to all the voting shares in the company or voting interests 6.11%

The investment Case for EML Feb 2024:

tamim_australia_all_cap_february_2024.pdf

EML Payments (ASX: EML) continued to progress with its simplification strategy and delivered a strong result benefitting from rising interest rates. Now that management has put the Irish subsidiary into liquidation, more granularity was provided to the remaining core business. Management guided to improving Ebitda margins towards 30% by FY26 through further cost cutting and new business growth. In addition the removal of the growth cap from the UK PFS subsidiary is imminent, and so is the sale of Sentenial being pursued. A new CEO will be appointed shortly and more likely will be Australian based.

We estimate the core biz will deliver $50M of Ebitda next year with strong cashflows and growing to $60M in FY26 with $30M of free cashflows.

We value the stock around $1.50 with a high likelihood of a takeover once the above catalysts are finalised. We believe a takeover of EML in time, will be closer to $2.00

EML announces that it has entered into an agreement to settle all outstanding deferred acquisition payments (“Loan Notes”) from the acquisition of Prepaid Financial Services Group (“PFS Group”) in 2020 for £15.0m (A$28.8m)

- This represents a £7.9m (A$15.2m) or ~35% reduction to the total value of the Loan Note liability if paid at face value plus interest by the specified instalment dates

- All historical earnout arrangements are confirmed at zero

- This agreement represents the conclusion of all outstanding actual and potential liabilities for EML and its shareholders flowing from the 2020 PFS Group acquisition structure.

- Settlement of the Loan Notes concludes all outstanding matters between EML and the PFS vendors including but not limited to acquisition earnout arrangements for which nil will be paid

- The settlement amount will be paid by 31 July 2024 and funded from EML’s cash balance.

- Settlement of all outstanding actual or potential liabilities from EML’s PFS Group acquisition structure is another important milestone in the delivery of the EML Group’s strategic review. By reducing the Loan Note liability and negating all other potential liabilities arising from the PFS Group acquisition structure, inclusive of potential earnout disputes, EML will strengthen its balance sheet and further de-risk the business.

This feels like the final nails in the PFS Group coffin, thank goodness!

Another piece of positive news, amidst a series of positive developments in recent months, relating to both the winding up of PCSIL and the disposal of Sentenial.

I viewed the recent exit of the Alta Fox Director and the appointment of Kevin Murphy to the Board as also being another positive sign that the turnaround has reached a definitive milestone.

Topped up IRL today given the recent price pullback and on the back of this news.

Discl: Held IRL and in SM.

Finally had the chance to work through the EML 1HFY24 results after all the excitement with the Sentenial sale. I prefer HY-o-HY instead of PCP comparisons, so reworked some of the numbers to give me that view. It also helped that EML management is now focused on the Core business segments, so they have taken pains to focus on, and publish, H-o-H performance.

Summary of the key Group numbers, green shows growth, orange are flat to down

In summary, and the rationale for my top up of 0.25% IRL and in SM today:

- The underlying EML business in the last 18M has been growing nicely across the key metrics, stripping out the impacts of the PCSIL and Sentenial remediation costs and isolating post-disposal impacts. This is summarised in the table below - green is growing, orange is flat to backwards.

- Expecting EML to meet or exceed underlying EBITDA FY24 guidance - at the half year mark 53.3% of the mid point guidance has already been met.

- Continued strong interest income revenue - interest rates likely to remain higher for longer, which is a good tailwind for EML revenue

- Strong cash generation

- Upside from cost remediation efforts as costs remain high and management is very focused on this.

- Risks of another (stupid) acquisition will be remote for at least the next few years (we would hope).

- By getting rid of PCSIL and Sentenial, EML is essentially back to being the company it was prior to the acquisition - it was a much-loved growth company. As both acquisitions were entered into when the EML price was $3.75 (PCSIL, 31 Mar 20 announcement) and $3.89 (Sentenial, 30 Sep 21 completion) (1) the core business has still been growing, and (2) we have the tailwind of high interest rates, it would appear that a re-rating to perhaps ~$3.00 is not an unthinkable scenario now.

Risks

- Sentenial sale does not complete - low risk, it would seem

- Another stupid acquisition - low to none, for the next few years perhaps

- Further Board instability - low, given how the Board has stayed the course in the last year

- New CEO - always a risk (think Emma Chand), but EML is on a much clearer and firmer trajectory now for the Board to stuff up the appointment.

- Growth stalls due to macro factors - medium risk if Central Banks overreach and cause a major recession. an inherent risk.

At peak, my paper loss was close to 85%, and I was completely anchored to the loss. It took a lot of effort to un-anchor this negativity.

I now feel EML is back on the right path again and the growth ahead looks bright. My conviction for EML has now turned from negative to high, enough to top up 2x and bring my average cost down to a reasonable $2.31. Whether this was a right move will be revealed in the fullness of time!

Discl: Held IRL and in SM

1HFY24 Summary Slides

EML bought a Lemon - Sentenial..The fatal - on 7 April 2021. {(A$112.7 million1 ) plus an earn-out component of up to €40 million (A$64.4 million1 ). }

EML: Share price up ~ 9% this arvo

EML PAYMENTS LIMITED EML(ASX) - ASX Share Price & News | HotCopper Forum

History Below:

Microsoft Word - 011021 ASX - Completion of Sentenial v3 (Clean) (afr.com)

EML is acquiring Sentenial, including their open banking product suite, Nuapay, for an upfront enterprise value of €70 million (A$112.7 million1 ) plus an earn-out component of up to €40 million (A$64.4 million1 ). A summary of the transaction is outlined below, please also refer to our ASX announcement and presentation released on 7 April 2021.

Further notes in digesting the Sentenial sale announcement:

- Non-Core to the Group’s operations as it is unprofitable (estimated ~A$2m EBITDA loss in FY24), does not have any material product overlap with other EML Group business lines, and is separable from the Group’s wider business

- Significant milestone to the delivery of the Group’s Strategic Review

- Sale price is subject to (1) customary completion adjustments for working capital and net debt (2) potential downward price adjustment, capped at EUR7.5m linked to ongoing key contract performance in the period up to completion of sale (3) earn out based on recurring revenue from new contracts signed by the Sentenial business from 1 Feb and 30 days after Completion.

- Completion is not subject to financing

- Expected to be completed within 3 to 6 months and is subject to approval from the French and UK financial regulators

@jimmybuffalino , @thunderhead , as a long-term shareholder, I share your sentiments with the overall Sentenial debacle. I had very low expectations of a meaningful sale price, as I was more looking forward to EML minus Sentenial, so am simply esctatic at the sale, whatever the price. It just releases EML from the ongoing burden that PCSIL and Sentenial have inflicted.

I topped up in late Jan when the PSCIL wind down was announced, looking to top up again today as the Sentenial sale was an earlier defined trigger point. Hoping that with both out of the way, EML can refocus and go back to becoming the growth company it was, hopefully that much wiser about making dumb-arsed acquisitions in the future!

Discl: Held IRL and in SM.

I received an email from Qantas Money yesterday;

We are writing to advise you of upcoming changes to Qantas Travel Money. The below changes are effective from 27 February 2024 and are summarised as follows:

- the Issuer will be changing from Heritage and People's Choice Limited trading as Heritage Bank (ABN 11 087 651 125, AFSL 244310) (HPC) to EML Payment Solutions Limited (ABN 30 131 436 532, AFSL 404131) (EML);

- the Terms and Conditions for your Card will be moved to EML (called a novation). This means that your contract with HPC will end and be replaced with a contract between you and EML (New Terms and Conditions); and ... blah blah blah etc.

An additional one customer is nothing big - even though QFF as linked through Qantas Money is one of the largest rewards programs in the whole country - and it got me thinking. So I googled EML's ABN. Fascinating to see it pop up in a long list of different company websites because the ABN is listed in their T&C aka the fine print. Note to self, an interesting way of gathering data.

Finally got round to working through what to do with EML after the recent AGM and price crash. Went back to the FY22 Annual Report and laid out the key numbers from FY21-FY23 in a xls to make better sense of what has happened - I find summarising this 3+ year horizon into a format which I am comfortable with from the Annual Reports provides me with significantly better picture of the commentary rather than the usual YoY or PCP basis.

Disc: Held IRL 1.06% of Portfolio

SUMMARY

- Core businesses continue to grow Gross Debit Volume and Revenue, gross margins have mostly sustained around 65%

- Continues to benefit from high interest rates for EML’s substantial stored float - this benefit will continue for the next 12-18M as interest rates stay higher for longer

- Underlying Expenses, ex-Impairment, have step increased ~26%, a good portion of that is from the Sentiniel full year contribution, impacting Profitability - management has clearly recognised the need to reign this in - cost optimisation is one of its 4 key focus areas

- Cash Flow position has improved significantly - would have been cash flow positive if not for continued compliance remediation spend

- Trading Update for 4M ending October 2023 encouraging - expect to significantly improve FY23 EBITDA by 40-56%, cash flow positive, but will continue to burn~$20m for PCSIL remediation efforts

- Management changes, other than a final CEO, appear to be stabilising, strategy has been revised and is clear, transformation effort is underway

- PCSIL continues to require significant remediation effort focus and is clearly impacting further revenue growth in Europe - Kevin Murphy the Interim CEO seems to be the right person, team to resolve has been expanded, what we now need to see is positive traction via positive Central Bank of Ireland acknowledgement

Portfolio Action

- Current holdings of EML is 1.06% of the portfolio with the average cost of $2.991, down 71.59%

- Happy to continue holding this % allocation on the back of still-robust Core businesses and the eventual resolution of the CBI issues vs exiting with NRV of ~$11k

- Not prepared to add to the holdings at the moment, but will consider this if there is tangible progress on the CBI remediation, as evidenced by formal acceptance of that improvement and/or the progressive removal of growth restrictions

CONTEXT

- Previous long-term strategy was declared flawed by new management as it (1) focused on longer-term aspirations (2) did not account for today’s business challenges which required immediate and concentrated attention (3) did not offer a clear plan to solve these challenges

- More recent acquisitions have not yielded the desired results or given rise to identifiable synergies delivering real value (1) PFS Group operates in a highly technical and evolving regulatory environment in Europe (2) Sentenial Group, slower ramp on anticipated revenues and limited synergies for EML’s open banking business

- Good progress on focus to solve the biggest business challenges today - (1) Leadership & Talent retention (2) Remediation and Regulation (3) Escalating costs and loss-making businesses (4) constrained growth

THE GOOD

- Core business strong and growing, FY23 revenue and underlying EBITDA, outperforming guidance:

- Gifting and General Purpose Reloadable Cards - Australia and UK - strong and growing Gross Debit Volumes and Revenue

- Digital Payments, including problematic Sentenial acquisition - also growing GDV and Revenue

- Gross Margins sustained at ~65%

- Cash balance $71.4m, cash flow from Operations almost at breakeven ($2.6m) vs ($41.5m FY22)

- Interest investment return, a core part of EML’s revenue mix continues to improve - $33.1m in FY23 vs $5.0m in FY22 - will continue to benefit from the global higher-for-longer interest rates forecast

- YTD Oct 2023 results and trend positive (1) Underlying EBITDA up to A$12.5m vs A$3.3m in pcp (2) Revenue is up 39% at A$26.3m, 19% growth on pcp in recurring business revenue and strong contribution from higher interest revenue and yield improvements

- FY24 guidance

- Underlying EBITDA - range of $52-$58m, an increase of 40-56% on FY23 EBITDA of $37.1m

- Cash flow broadly neutral in FY24, including PCSIL’s cash burn of ~$20m. Excluding PCSIL, EML would be significantly cash flow positive in FY24

- New leadership team is settling down after resignation of previous CEO and focused on (1) executing the Transformation Strategy (2) addressing the compliance issues (3) running the core business

THE NOT GREAT

- Declining profitability of 28% YoY

- Overhead costs are 26% higher - at least 10% across each major expense item

- Lower establishment revenue impacted by macro considerations

- Growth restriction in PFS business in UK & Ireland offset by higher interest revenues across float holdings in Gift and GPR

- 2 very problematic acquisitions - PFS Card Services Ireland Ltd (PCSIL) and Sentenial - major regulatory compliance issues crimping operations, bleeding costs to comply and taking up a disproportionate amount of management attention - progress made but a lot of work left to do

- PCSIL cash burn in FY24 estimated to be ~$20m, elevated cash burn “likely to continue over the mid-term”

- Central Bank of Ireland not satisfied with PCSIL’s remediation plan and completion timetable

- Continued impairments of PCSIL and Sentenial businesses - $258.9m hit in FY23

PROGRESS ON OPERATIONAL PRIORITIES

- PFS business (UK and European GPR business) - made progress, now in embedding phase of remediation, added additional resources to uplift capability to resolve issues with the Central Bank of Ireland in the European business

- Cost Optimisation - simplified operating model, rationalisation of global roles to align to new strategy, identified FY24 cost savings initiatives from further simplification

- Growth in Core Business - committed investment to rebuild Sales, Marketing and Commercial teams

WHAT GOOD LOOKS LIKE

- Continued growth of core businesses while resolving compliance issues in parallel

- Completion of the execution of the Transformation Strategy

- Complete exit of PCSIL or resolve compliance issues - reduce cost burn

- Step drop in Operating Overheads as leaner organisation and cost optimisation kicks in - $10m identified thus far for FY24 execution - not big enough

- Sale of Sentenial - expressions of interest received, being reviewed but no sale forthcoming yet

- Cashflow and EBITDA positive

Noted Now Present Voting power: 12.15%

Just catching up on coverage of the news flow for EML and saw there were at least three articles in todays AFR on this including:

EML ousts CEO, appoints Barrenjoey to sell ‘all or part’ of business

Activist turns EML on its head in just five months

The Chook's article probably summarises it best ...

It’s astonishing how quickly an activist investor with barely a 10 per cent stake can turn a company’s strategy, board and management team on its head.

This time last year it was Mike Cannon-Brookes’ Grok taking on AGL Energy, in a stoush that ended with a cancelled demerger, new board, new chairman and new CEO.

Grok did it with an 11.28 per cent stake, initially held in shares and derivatives.

Now it’s Texas-based Alta Fox Capital, another newcomer to the Australian activist scene, that has gone after prepaid cards business EML Payments.

Alta Fox started buying shares on November 1 last year, and built an 8.14 per cent stake across the Australian summer.

Only 168 days since that first trade, EML Payments’ board has ripped up the company’s strategy, replaced the CEO and called in the bankers to consider selling the business and/or its parts as announced on Monday morning.

The announcement was signed off by a new board put together only two months ago and including Alta Fox founder Connor Haley, an American, and former UBS banker and Afterpay CFO Luke Bortoli who is now EML Payments chairman.

The new crew also includes investment bank Barrenjoey, tasked with the strategic review.

Alta Fox track record

It’s about as wholesale as changes at a company can get, and largely sparked by Alta Fox, a small investment manager that targets underperforming companies, management teams and boards.

The situation shows it doesn’t take much to get an activist campaign going. The activists are good at picking targets, and sometimes even an 8 per cent stake is more than is needed. Once a campaign gains traction, it’s hard to stop.

Alta Fox has made a business of it. The firm has gone after US-listed toys and games maker Hasbro and digital billboards group Daktronics in the past 12 months with mixed success, and now ASX-listed EML Payments.

It fishes in small caps globally, moving quickly once buying in and often uses M&A to create value. It claims to have made about 30 per cent a year (net of fees) since inception five years ago, with its biggest winners including Swedish group Enlabs and US small-cap Collectors Universe. Both Enlabs and Collectors Universe were sold.

While it’s one thing to turn up and demand changes, it’s another to make money for shareholders. EML Payments has performed terribly for investors, with its shares down 77.8 per cent in the past year and nearly 50 per cent in the past five years.

Task No. 1 for EML’s new interim CEO Kevin Murphy, a former Bank of Ireland cards business executive, is getting on top of regulatory issues that have dogged the company for the past two years. It has underlying anti-money laundering/KYC issues, and the Central Bank of Ireland on its back.

The new board, together since February, has come in with a three-point plan for EML: strategy, leadership and focus on remediation (specifically talks with the regulator in Ireland).

The strategy has shifted to short-term in nature – resetting to focus on today’s issues, not aspirations for the long term – and should be pretty simple; offload or shutdown the trouble PFS business (the one with the regulatory issues), if possible, and allow EML and its shareholders to focus on the group’s three strong business units. The leadership change has happened.

While Murphy deals with the regulator, Barrenjoey’s bankers will try to drum up interest in the company and/or its assets. EML Payments has attracted serious interest from the likes of Bain Capital and Canada’s Nuvei Corp in the past year or two, but couldn’t agree on terms, often pushing suitors for unrealistic prices.

M&A’s expected to feature heavily in Alta Fox’s playbook at EML which for now at least seems to be in sync with chairman Bortoli and the wider board. Alta Fox sees EML as a conglomerate of payments businesses, the crown jewel of which is the gift and incentive business that’s big in Australia and offshore.

Management change

Ironically, it was M&A that turned Alta Fox off the ASX-listed payments company when it first invested a few years. Alta Fox had a small position in 2019, but sold out after EML bought Europe-based Prepaid Financial Services (Ireland) Ltd for more than $400 million.

EML popped back up on Alta Fox’s radar mid last year, when it became apparent multiple suitors were sniffing around the business. At the same time most listed fund managers had given up on the story, unable or unwilling to deal with EML’s regulatory problems.

Having started buying shares last November, Alta Fox used its still small stake to vote against resolutions at the payments’ company’s AGM on November 25. Chairman Peter Martin was not re-elected, while there was a 29 per cent vote against the remuneration report.

Alta Fox disclosed a substantial stake three days later.

EML Payments’ board has turned over since, with three new directors joining two incumbents. The next task was the company’s strategy and management, with Alta Fox concerned by the way the former board had appointed CEO Emma Shand last year, and the company’s strategy.

In the new board’s eyes, EML needed a “wartime CEO” – someone to get in the weeds, make tough decisions and deal with its regulatory issues.

It is understood EML tried to hire Murphy a few years ago – and the new brigade is confident he shouldn’t take too long to get his head around the business.

Murphy, appointed on an interim basis, was said to have “a deep understanding of the global payments industry”, “significant regulatory experience (including with the Central Bank of Ireland)” and “been involved in several successful business turnaround scenarios for private equity funds” in the board’s statement to shareholders. He’s a bit of an unknown quantity for local investors.

EML’s former long-time CEO Tom Cregan remains a significant shareholder, but is on the sidelines. He’s not connected to Alta Fox or the company’s new board.

There’re plenty of moving parts, and much talk of widespread change that could take months to play out.

Still, investors liked what they saw on Monday, pushing EML Payments shares up 13.9 per cent to 66¢. It will be a long way back to $5 plus, where the stock traded only two years ago, while it is worth remembering that activist Alta Fox’s entry price is in the 50-60¢ a share range.

DISC: (now) microscopic position held in RL and SM

I think it's worth reflecting on what the Board said of the now departing CEO when they appointed her in July last year.

Part of my readings of this was that she was expected to far better suited than the outgoing CEO Tom Cregan to deal with the Irish regulatory debacle. Now the deck chairs are being moved again. The board is responsible for overseeing risk, which the Bank of Ireland and the Sentenial Fraud stuff suggests they've failed at. The board is responsible for appointing the CEO, which they've self-evidently failed at. The board is responsible for strategy. If you look at what they were spruiking at the 2022 AGM to what they announced today I think the kindest thing you could say about their management of strategy was they were late to adapt...and that would be real kind.

I've been critical of this Board before and that remains the case. Their new operational priority includes cost optimisation. To that end I wouldn't bother putting the new CEO's name on the door as I'm not sure he's going to be there that long.

[Not held]

Price pop on a very short announcement that the Central Bank of Ireland directed that a nil% growth cap would apply to EML’s Irish subsidiary and EML confirms no change to FY23 guidance.

Full Announcement:

EML Payments Limited (ASX:EML) (“EML”), refers to its ASX announcement on 24 February 2023 and confirms that after close of trading on Thursday, 30 March 2023, the Central Bank of Ireland directed that a nil% growth cap will apply to EML’s Irish subsidiary, PFS Card Services Ireland Limited (‘PCSIL’), for the 12 months ending 31 March 2024.

EML confirms there is no change to its guidance for FY23, being Revenue of A$235m – A$245m, and underlying EBITDA of A$26m -- $34m as disclosed to the market on 22 February 2023.

EML and PCSIL remain focused on engaging constructively with the Central Bank of Ireland, working to complete the remediation program and ensuring all of the regulator’s concerns are addressed.

I am calling it quits on EML, my thesis on this stock was a simple one. A rising interest rate environemnt would give them the extra cashflow and room needed to get the regulators back onside and enable EML to become an integrated financial services company rather than a series of bolted on acquisitions. I thought Emma Shand (new CEO) and the board renewal process was key to this transistion. Emma had been in the job just under 6 months, and the board renewal had only just been completed so I was willing to give her and the board some time to turn it around. The commentary at the half was that it is a slow expensive process but is moving in the right direction @mikebrisy gives a good rundown on how the costs on professional services balloned.

Despite this, the first major cracks in my thesis started the next day after the letter from the Central Bank of Ireland was released which said they were not on track and that their remediation efforts to date were unsatisfactory. In my thesis I had expected the full change in leadership to be the first step in appeasing the Bank but this clearly is not happening. Not only were they unhappy they were also going to further restrict growth until the remediation effort was completed to their satisfaction. I did have a bit of thesis creep here and toyed with the possiblity that they would spinoff the problem acquisitions or shutdown of this part of the buisness could result in a smaller but still profitable Gift card buisness in North America, but in hindsight this was more wishful thinking than a good bet.

The 2nd and final strike for me is yesterdays sell down by Alta Fox, who only recently bought a 10% stake in the company and got a seat on the board as@Magneto and @ArrowTrades explained. For them to have aggressively bought on market, got on the board and had a good look inside the company to now want to offload their stake really can only communicate that this company is on the way out, or at best it is not going to be making them a decent return anytime soon.

So for me I am selling my EML shares, I only had a small position in RL as it was always a high risk play. The lesson I am taking from this is stay away from any comany that has major regulation issues as they suck up a lot of time and money to fix. Also dont get sucked into a company that you watched but didn't buy years ago on the implicit assumption that history would repeat. So I have sold on market this morning.

EML has today announced Connor Haley (nominated Director) fund Alta Fox Capital has sold down there position in EML.

Selling total of 7,919,513 shares at average price $0.44 ($3,484,724). Huge big red flag considering they only built a position very recently. Refer previous Straws.

Alta Fox still owns 30,434,127 shares at todays close of $0.44, its worth approx $13.4m or 8.14% shares on issue.

Start off with what we know are biggest Problems/negatives – Acquisitions been nightmare with both PFS and Sentenial both had regulatory issues. There’s been no or little effort in the remediation process with the Central Bank of Ireland. https://www.asx.com.au/asxpdf/20230224/pdf/45lzt24m6gc7l5.pdf Regulatory issues likely to impact the amount EML can grow and its compliance cost for the foreseeable future.

Positives – What needs to happen make EML investable again!!!

First steps been taken we have a new CEO and new board. Alta Fox has recently brought in a major stake in the business and looks to have at least one seat on the board. Connor has stated publicly he’s been actively been looking for overlooked stocks that will benefit from interest rates increasing. Not sure if that’s only reason EML has appealed to Alta Fox. EML should benefit as interest rates rise due to the float it carries. Below summary of the new director’s background and current holdings.

Current Directors

Dr Luke Bortoli (Chairman) Effective 22/02/2023 was CFO of global payments platform, Afterpay. He was with the company from 2018 to 2021 during which time the company scaled from a small-cap start-up to a globally recognised market leader. Prior to Afterpay, Dr Bortoli held various senior executive roles at Aristocrat (2015 – 2018). Effective 22/02/2023.

Peter Lang (Non-Executive Director) Effective 22/02/2023. - is a veteran payments expert, previously Group Executive at ASX-listed McMillan Shakespeare Ltd (MMS). Mr Lang was part of the management buyout team who went on to IPO MMS and deliver 30%+ CAGR during his 14-year tenure leading to the Company's admittance into the ASX200. Mr Lang’s provision of advisory services to EML in 2017 was instrumental in EML’s capture of 90%+ of the Australian salary packaging payment card market which represents a significant earnings vertical for EML today. Announced 24 Feb 23 Peter Lang will be in charge of the sub committee to oversee remediation program with CBI.

Brent Cubis (Non-Executive Director) Appointed 06/02/23 is currently the Non-Executive Director and Audit and Risk Committee Chair for A2B Australia Limited (ASX: A2B), Silverchain Group, Carbon Cybernetics, and leading youth cancer charity, Canteen Australia. His previous roles have included CFO of Cochlear Limited, CFO of Nine Network Australia and Non-Executive Director and Chair of the Audit and Risk Committee of Prime Media Group Limited.

Manoj Kheerbat (Non-Executive Director) Appointed 05/12/22 - he brings to EML, deep insights from 20+ years’ experience working in UK and European payments ecosystems. Mr Kheerbat is European based, which reflects EML’s significant presence in Europe and the UK. He has a wealth of experience managing regulatory relationships, risk and compliance frameworks, and building structured, robust and scalable operational infrastructure to support growth.

Emma Shand CEO effective 11/07/2022 - is a seasoned executive and multi- disciplinary leader having worked at the intersection of technology, financial services and capital markets for 25 years across Asia Pacific, the US and EMEA. She has deep experience of different operating and technology environments and diverse cultural settings in a career which includes over 16 years with US based market leader Nasdaq.

Connor Haley (Nominee Non-Executive Director) - is the Managing Partner of Alta Fox Capital Management, the second largest shareholder of EML. Advise Nomination 22/02/23. Haley founded Alta Fox in 2018 after working at Scopia Capital Management, a New York-based alternative asset management firm.

No longer on Board David Liddy, Melanie Wilson, Tony Adcock

Current Market Cap $179.5m

Inside Ownership Ordinary Shares % EML Issued Net Value at $0.48

Luke Bortoli 0 0 0

Peter Lang 861,427 0.23% 413K

Brent Cubis 0 0 0

Manoj Kheerbat 0 0 0

Emma Shand 0 0 0

Connor Haley (Alta Fox) 38,353,640 10.25% $18.4m

I use to hold EML shares and I have been intrigued by Alta Fox’s quick entry into EML. Currently have no plans to buy shares and I happy to watch from the sidelines for now but if we were to see the regulatory issues finally resolved and the new board buying shares on the market, I could see room for EML in my portfolio as a turnaround special situation stock. As you can see from table above the new board holds very little or no stock at all currently. For now, it’s a watch and wait, maybe it be a takeover target, it current stock price in my opinion is very under demanding or maybe continue to disappoint!!

Oh well, wishful thinking on my part. The Halt is due to a letter received by PFS from Central BoI. Good news or Bad, let's see.

If its bad news, it will not be a good reflection on the management and Board changes or the early days of the new strategy.

But, I am getting ahead of the facts.

Disc. Held.

$EML, which delivered its results yesterday, has paused trading pending an announcement.

Are we about to see it be taken out?

Disc: Held

· April 2021 Sentenial Limited A$108.6m - Sentenial is a leading European Open Banking and Account-to- Account (“A2A”) payments provider, utilizing a cloud-native, API-first, full stack enterprise grade payment platform. Combining the EML & Nuapay platforms and capabilities is an opportunity to deepen customer relationships, enter new industry verticals and diversify our revenue streams. https://www.asx.com.au/asxpdf/20210407/pdf/44vb12zj1db0lv.pdf

· March 2020 Renegotiated Terms Prepaid Financial Services Upfront A$252.3m https://www.asx.com.au/asxpdf/20200331/pdf/44gk8l3wj9lys8.pdf

· November 2019 Prepaid Financial Services A$423 plus earn-out component of up to A$103m. PFS was founded in 2008 primarily as a reseller of pre-paid cards and has since evolved into a leading provider of white label payments and banking-as-a-service technology with a pan-European footprint. PFS provides payments and digital banking capabilities, e-wallets and payout / distribution programs, regulatory Electronic Money Institution status and flexible software to enable financial institutions and non-financial institutions alike to deliver feature-rich transactional banking and other payment services to their end-user base without becoming a regulated entity. PFS operates in 24 countries and supports over 26 currencies. https://www.asx.com.au/asxpdf/20191111/pdf/44bfybyr6bs3tz.pdf

· May 2019 Flex-E-Card Approx. A$40.5 - is a FinTech company providing gift card solutions to the shopping mall sector, with 226 shopping centres under contract in Europe (principally the United Kingdom, Ireland, Poland, Italy, and Finland), and the United Arab Emirates. https://www.asx.com.au/asxpdf/20190520/pdf/4456ltjts3dfc3.pdf

· July 2018 Perfect card DAC €6.0m - Ireland’s first authorised eMoney institution and a FinTech company providing incentive and corporate expense solutions. As Perfectcard is regulated by the Central Bank of Ireland, the regulator needs to approve EML as majority shareholder and we expect that approval to be forthcoming in the following months. https://www.asx.com.au/asxpdf/20180705/pdf/43w9mhn4jl6nxw.pdf

· February 2018 Presend Prepaid Solutions (Presend Nordic AB) - SEK 10m (A$1.6m) and a two-year earn out capped at SEK 60m (A$9.5m), 100% of which is payable in shares. A leading provider of Non-Reloadable solutions for shopping malls and city/town programs in Europe, principally in the Nordic and Baltic regions. https://www.asx.com.au/asxpdf/20180207/pdf/43rdlzfkn807xj.pdf

· May 2016 Store Financial Services, LLC US$35m - a leading provider of prepaid stored value programs in the United States of America and Canada. https://www.asx.com.au/asxpdf/20160502/pdf/436yfvm5gk3rlw.pdf

· September 2014 Store Financial United Kingdom A$24.9 - leading provider of prepaid stored value programs in 9 European countries, including the UK. Ex Ceo Tom Cregan, was a 25% shareholder of SFUK and excluded himself from all negotiations. https://www.asx.com.au/asxpdf/20140926/pdf/42sglsymytgwyg.pdf

$EML reported their 1H FY23 Results this morning.

Their Highlights:

• Group Gross Debit Volume of $49.4 billion, up 55% on PCP, reflecting the benefits gained from the Sentenial acquisition

• Group Revenue of $116.6 million, up 2% on PCP, largely due to a significant increase in interest income of $7.1 million

• Underlying Gross Profit3 up 5% on PCP, driven by increased high margin revenues from Sentenial and interest

• Group Underlying EBITDA4 of $13.4 million, a decrease of 50% on PCP, largely reflecting increased underlying overheads as we continue to invest in EML’s European businesses

• Group Underlying NPATA of $0.7 million, down 95% on PCP, reflecting the same factors which reduced EBITDA

• One-off, non-cash impairments of $121.3 million against the PFS Group and the Sentenial Group

• Group net loss of ($129.9 million) largely reflecting the non-cash impairments

• Continued strength of Balance Sheet and Cash position, with cash balance up 7% to $79.2m on PCP and underlying operating cashflow conversion of 102%

• Underlying EBITDA guidance reaffirmed

• Execution of the Company’s transformation strategy, including progress with remediation activities in the UK and Ireland, streamlining the organisation and launching a new campaign in Human Capital Management

My Takeaways

First, I acknowledge that I should have put this one down a long time ago, and it is quite close to the bottom of my conviction list. (And it is much more fun writing up results from $WTC.) All that said, these results present some evidence of stabilisation.

The impairment was inevitable, given everything that has happened over the last 2 years. Reversing that non-cash item out, statutory NPAT loss actually narrowed over the PCP.

Revenue growth was achieved thanks to higher interest rates generating interest income.

We are now seeing the full effects of the extra costs of overhead, representing all the resources that have been added to improve governance and regulatory compliance - employee expense up to $40m from $30m. Plus they are burning a steady $15m, ($30m/yr!) on professional fees, of which I assume a lot is lawyers. There is also a large bucket of $15m other expenses, which includes a variety of elements including risk and compliance. So the costs of risk and compliance appear to be spread over a number of categories and are representing a very material sum.

After everything, cash increased, thanks to the offloading of some financial assets.

These are just a few quick reflections. I'll be recording the call at 10am AEDT, as I'll be watching the Richard White concert live. I am very interested to hear what Emma Shand has to say, particularly in the Q&A. She has been on board long enough to have her arms fully around this. Whether I stay or finally go will rest on this, I expect.

Disc: Held IRL (0.75%) SM (2.9%)

Good to see that the board renewal process at EML has started - David Liddy, Melanie Wilson and Tony Adcock will resign by the next AGM. The CFO has also recently resigned. The old long serving chair got voted out at the last agm, so it will now be a completely new board and hopefully much better governance than the previous team. I wonder if the Alta fox fund is helping to get these changes through.

I am watching EML as I think the new(ish) CEO Emma Shand will do a good job of turning it around and getting the compliance problems sorted and a solid board behind her could make all the difference to the future of this company.

Update on Alta Fox position 16 Dec 22

Alta Fox have once again increased there holding in EML payments to 9.14% of shares on issue and now hold 34,177,580 shares (~$20.6 million worth stock at Fridays closing price $0.605). Increase of 3,854,311 Shares since last disclosure on 2 December 2022.

EML AGM Recording is up on their IR webiste if anyone feels like a good laugh / cry

The Chair (who was voted out at that meeting) said "A recording of the AGM will be available on our website as soon as possible after the meeting." and sure enough, after I chased it, up it went. Only took a week and a bit. Hopefully because they are all hands to the pump trying to empty their bilge faster than it keeps filling up...

Direct link is here - https://www.youtube.com/watch?v=ESmZk0vw0pk

Update on Alta Fox position

Alta Fox have increased there holding in EML payments to 8.11% of shares on issue and now hold 30,323,269 shares. Increase of 6,872,258 shares at average cost of $0.64 ($4,419.118.47).

This was also reported in an article in todays AFR:

US activist Alta Fox in EML’s henhouse, gunslinger in tow

For those without access behind the paywall...

Bombed-out EML Payments has caught the attention of a US activist investor, who’s announced its arrival with Melbourne law firm Arnold Bloch Leibler in tow

Alta Fox Capital Management, known for a crusade against Monopoly owner Hasbro in the US, only began buying EML shares on November 1 and hit 6.27 per cent on Friday, according to its initial substantial shareholding notice filed on Monday afternoon

It is understood the filing was sent to the company and the ASX by Arnold Bloch Leibler’s renowned gunslinger Jeremy Leibler, who’s never scared of a corporate stoush and has claimed more than a few scalps

While the substantial shareholder noticed only dropped on Monday, sources said Alta Fox had already been influential at EML. Its vote helped block former chairman Peter Martin’s re-election to the board on Friday. [50.49 per cent of votes cast were against his re-election]