Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Discl: Held IRL 2.65% and in SM

Catching up on some EML announcements this week.

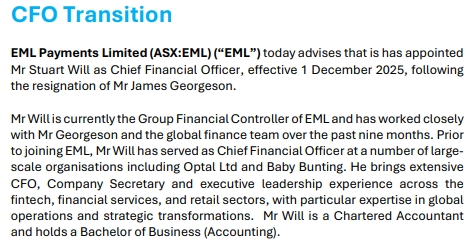

CFO TRANSITION

This CFO transition feels orderly.

James has had a 2.25 year stint at EML - think he was hired by Anthony as part of the Executive change. James’ Linked-In profile has him working at AMP for the past 22 years prior to joining EML, but each of his stint within AMP averages about 2-3 years, so this EML employment period fits that pattern

Stuart Will has been a EML contractor since Mar 2025 - given the ~6M gap, it does feel that this change was in the mix and the contracting stint was in preparation for James’ exit

Given that the EML legal/compliance troubles are mostly over, EML 2.0 Transformation is progressing nicely, in 1 or so years time there will be an increasing transition to BAU operationally, and the main driver behind the transformation is Anthony, I am not concerned with James leaving

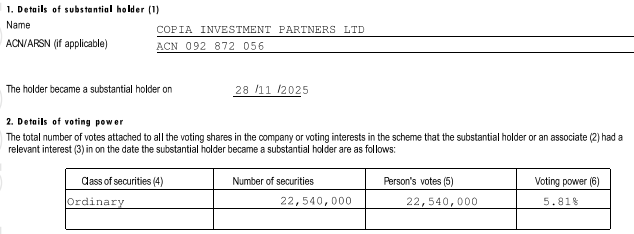

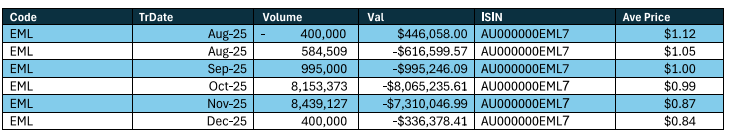

NEW FUNDIE: Copia Investment Partners Ltd

Always nice to see a new fundie show up on the register. Looks like they have been accumulating since the FY25 results, averaging down as the price drifted downwards.

Discl: Held IRL 2.90% and in SM

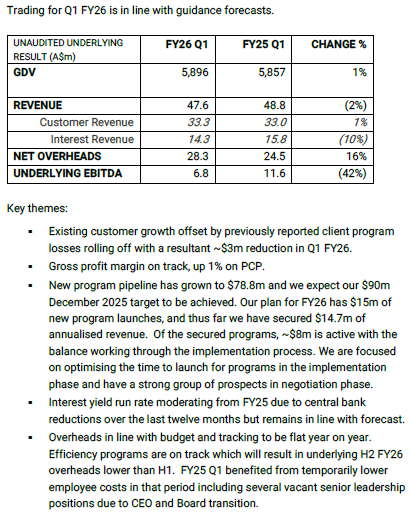

Quite a few interesting developments and data points in going through the EML FY25 AGM meeting notes and material.

Worth a read - Anythony Hynes is a complete cut-the-crap kind of guy and I appreciated the punchy updates to the updates he presented against the FY26 objectives on Page 3.

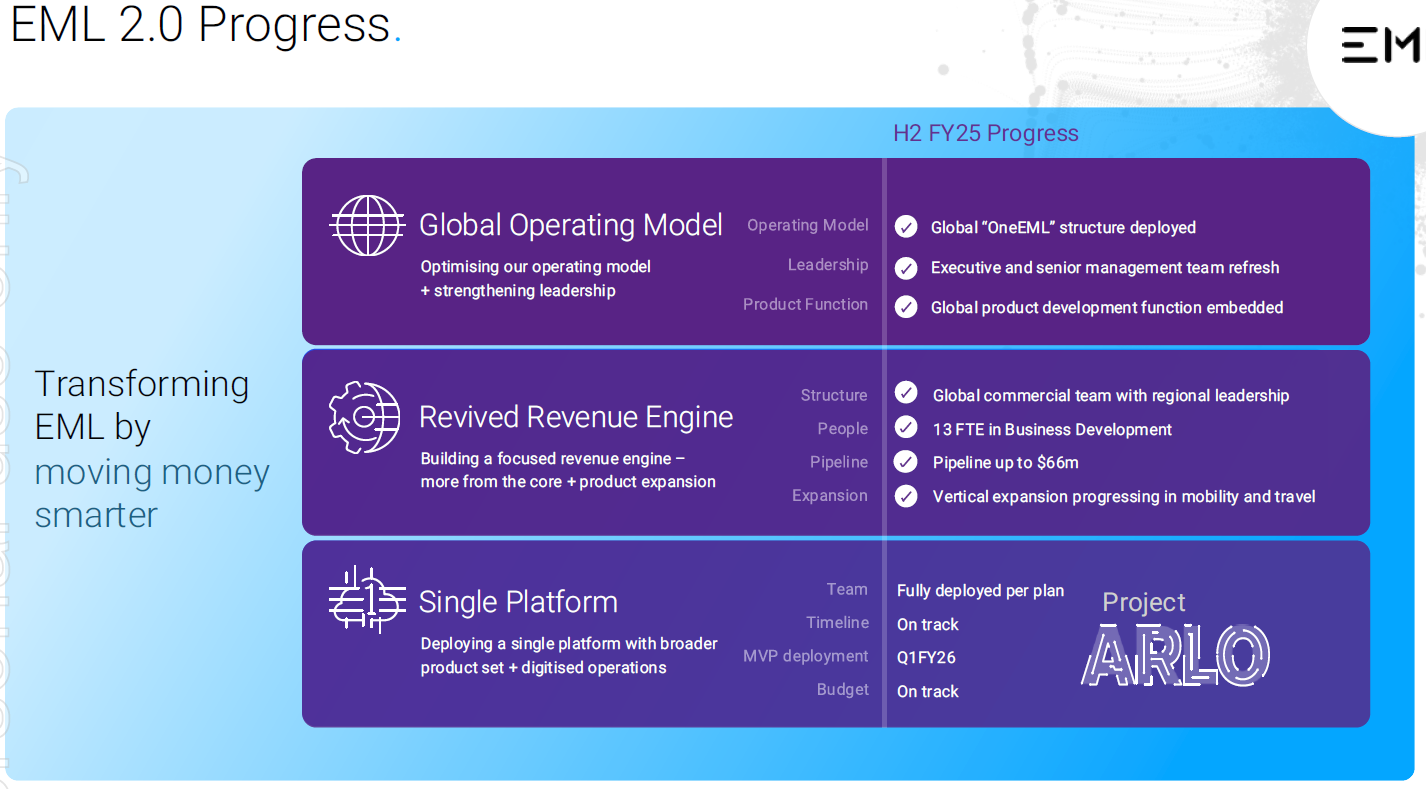

FY26 was always positioned as a huge year on internal transformation - the updates from a straight shooter like Anthony gives confidence that things are going to plan, particularly the critical Project Arlo which has been deployed into the UK

FY26 EBITDA guidance in the range of A$58-63m was reaffrmed and Q1 trading was in line with that

Given that EML is chewing gum while running, I see this as good news as EML is running both BAU and Transformation, at pace.

Given a lot of market commentary since the FY25 results, I do sense that the fundies who are still onboard have given EML time to get its house in order. Todays muted market reaction to the trading update, amidst a horrible week, augurs well on this front.

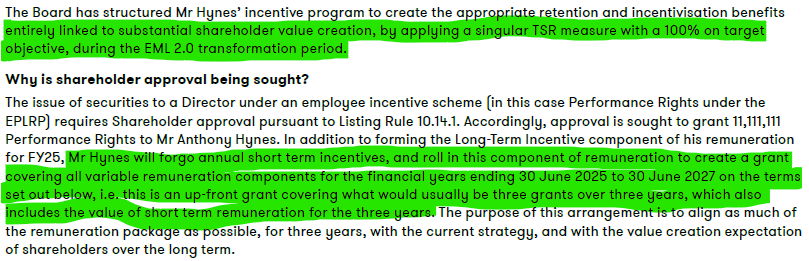

Anthony’s Long Term Incentive Plan Approved

The plan was approved with 86% For.

I am really good with this as (1) he is completely incentivised to ensure the success and sustainability of EML 2.0 (2) it is over 3 years, absolutely encouraging long-term thinking and the building of sustainable capability (3) he no longer has annual short term variable incentives, which further embeds the long term thinking

SUMMARY

From past Corporate Transformation experience, large scape corporate Transformations like EML 2.0 only succeed if you have Executive alignment and buy in on the Transformation and then the focus and energy of the Executive to drive the Transformation forward, aggressively. My read of this is that the EML Board and Anthony not only understand this, but have aligned the incentives and the organisation and have driven the organisation hard in the past year to get going.

The 3 year horizon is why he needs to get on with it, in terms of building and deploying the capabilities urgently, so that the rest of the organisation can then get onboard and use the new capabilities to move the business forward. From all indications, Anthony ain’t being polite about this nor is he fluffing around - that is very good news as a shareholder.

The downside and risk is that if Anthony goes, EML 2.0 will go with him. But with this LTIP and his own personal holdings of EML (he bought 0.24% in Oct 2024), this risk should be reasonably mitigated.

But this is a 2-3 year journey, and so, patience is absolutely needed. I am definitely sticking around to see what happens ...

@Bear77 , could I please get your expert input into the attached announcement and see if this is a legit stake increase?

I think it is given the relatively large transaction volumes that have gone through and I didn't think WAM allowed its holders to trade?

Discl: Held IRL and in SM, and staying In

SUMMARY

As the Earnings call was progressing, the following were the impressions that I wrote down and took away:

- Relentless and furious peddling with EML2.0 transformation occurring on multiple fronts - there is significant complexity to confront and fix everywhere management turns

- Management is continue to chew gum while it sprints - the analysts on the call appear to clearly get this focus on restructure

- Flat Customer Revenue has been offset by significant improvement in Interest/Treasury Income - FY25 EBITDA guidance was met

- Anthony Hynes summed it best at the end with a quote he says he uses with his wife: “I am a work-in-progress. Stick with me, the best will still be”

Having managed and been a part of many an organisation’s Transformation journey’s, I totally get the necessary pain that EML2.0 is bringing to the EML organisation, both in the actual work needed for the transformation AND in parallel, the need to still keep the business running and growing. EML 2.0 is a wholesale clean out and change - the people have been cleaned out, the systems and processes rebuilt, the culture changed. It is brutal.

I have very high confidence in EML2.0 as one key thing stands out - the very public and strong drive for that Transformation by the Exec Chairman himself, who, is also a major shareholder on his own coin. The language that he uses is the sort of brutality that any Transformation PMO wants by their side, and this is him being polite in public. That sort of ownership is pure manna from Transformation Heaven ...

And so, I will have a lot of toothpaste remaining to squeeze out of my EML toothpaste tube, to give management the next 1-2 years that it needs to fully transform and transition, before the growth trajectory of old takes off.

Chart Review

With the meh-like results, and despite the analysts sounding generally congratulatory in the call Q&A, I expected the price to be belted to the tune of maybe ~5%, given how unforgiving and short term the market is these days. So, was very surprised to see EML close unchanged, albeit with a long down wick in today’s candle. This provides an immediate data point, at least for now, that the market understands where EML is and where it is heading - that is hugely positive.

I do expect the price to drift sideways/downwards - I will be looking to top up if the price retraces to say, 80c-ish, to position further average down and position for 2HFY26, where the real action will begin.

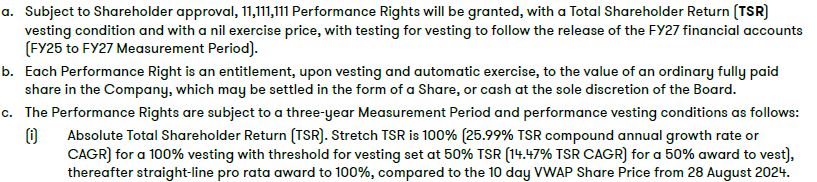

FINANCIAL PERFORMANCE

In absolute terms, the EML FY25 results were “Meh-to-OK-ish”. But in the context of massive organisation transformation, it was very pleasing.

- Revenue grew 9% YoY to $220.9m

- Underlying EBITDA was $58.6m, meeting guidance of $54-$60m towards the top, up 13% YoY

- Modest 3% growth in customer revenue

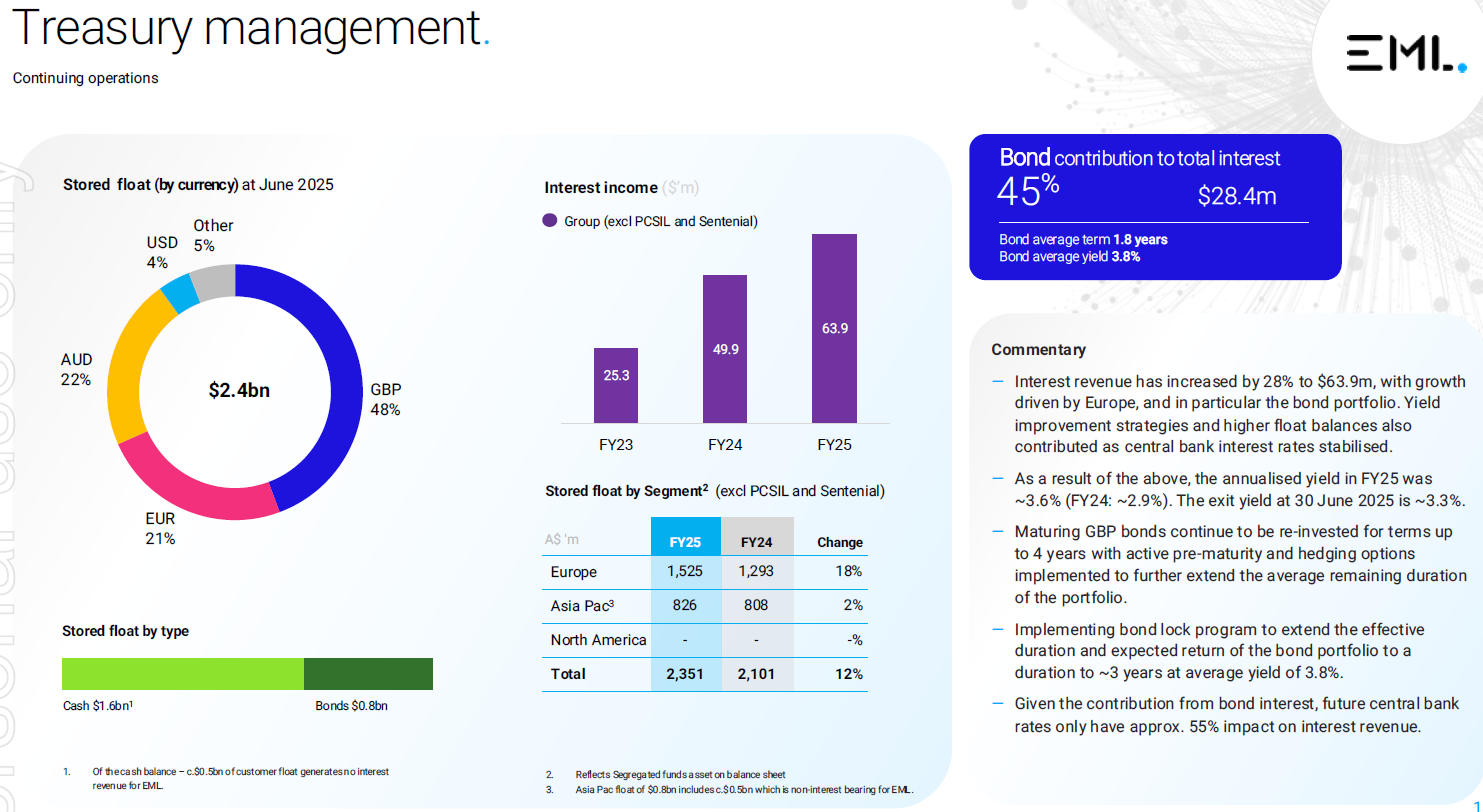

- Higher interest revenue, jumping 28% - driven by yield improvement strategies, higher central bank rates and higher float FY25 annualised yield was ~3.6% (FY24: ~2.9%), exit yield ~3.3% at FY25

- Partly offset by overhead cost increases - up 1% HoH, up 8% YoY

- Underlying Gross Margins were sustained at 75%, underlying EBITDA margin

- Statutory NPAT took a big hit from the ~$35m Shine Class Action settlement

- Cash increased $18.6m YoY , which resulted in cash of $59.3m. Up 46% YoY

- Cash conversion ratio of 72%, generating $16.7m net cash from operations, higher than normal

- Further $55m borrowing capacity

Other FY25 key achievements that provide evidence of a bit more than green shoots:

- 8 top 30 contracts were renewed, including 2 in the top 5

- 27 new clients secured

- Bond yields fixed on ~45% of the float for 3 years locked in at 3.8% - very positive given the lower trajectory of interest rates

- Class action settled - no more uncertainty about the size of the settlement of ~$35m

- Pipeline up to $66m vs target of $60m (from a start of zero pipeline in Dec 2024)

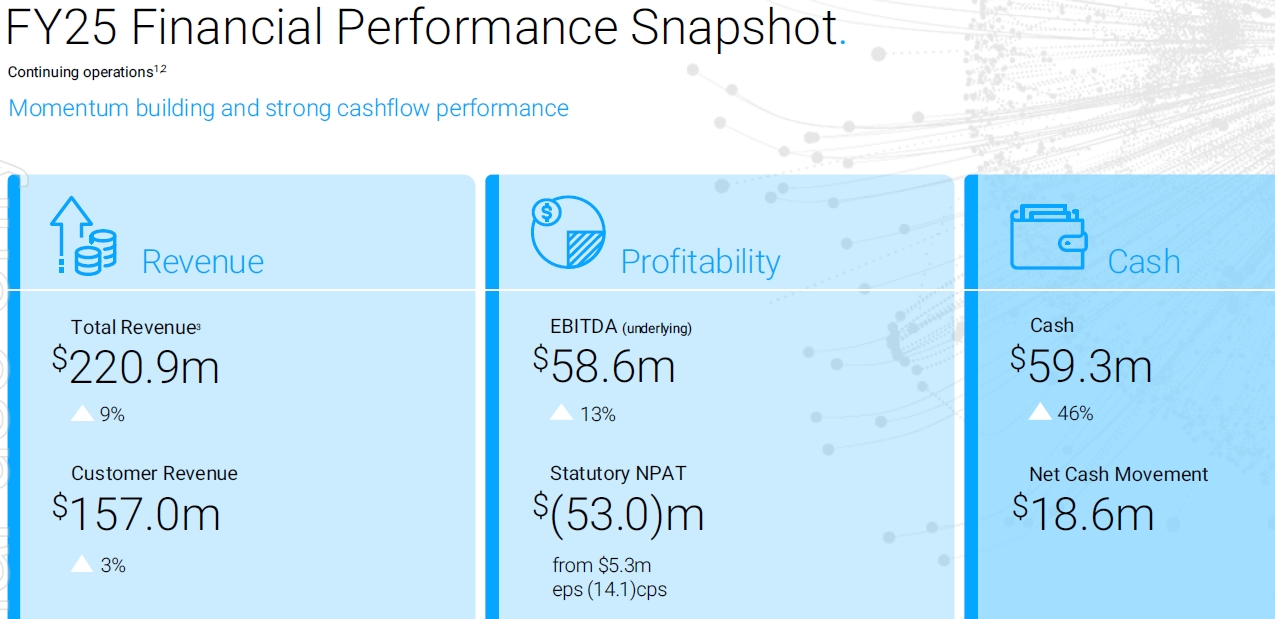

Geographic Segments

Treasury Management

Interest income has grown nicely in the last 3 years

Future central bank rates only have approximately 55% impact on interest revenue

EML 2.0 Update

Comments by Anthony around the Transformation Journey shows the breadth, depth and intensity of the Transformation

- “Wholesale refresh of People, Process, Technology and Culture” - “if you started before 2024, you must be no good”

- “Doing more with our Core” - focused effort, moving hard

- “No corner of our business is being untouched by EML 2.0”

- “Often we turn more rocks and fine more rocks - getting rid of rocks and deadwood”

- Key risk is the inability of the organisation to fully digest and absorb this change - it requires a high level of multi-tasking

- Project Arlo objective is to combine 3 platforms into 1 - once in a lifetime fix - On Track

- Key constraint is on the customer-end - how to lift and shift customers to the new platform around customer constraints

FY26 OUTLOOK

- FY26 is a “Bridge Year”

- Started the year with new signings, starting to see growth in revenue - key is to win and onboard quickly

- Expect cost base to be flat

- Target pipeline to $90m by end-Dec 2025

- Expect to go back to 10-12% Market Growth CAGR over a multi-year period through to 2028, starting with back-end of FY2026

- Unable to provide the are at which the pipeline will translate to revenue - pipeline was zero to start with and so, there is no data to support a conversion metric

- Will get a better sense of conversion dynamics by end CY2025 and will update in early CY2026

This caught my eye:

- The 3 WAM funds collectively appear to have increased their holdings of EML by 2.24% to go from 6.59% to 8.83% between 30 April and 20 June

- Look like each of the 3 funds were buying daily - Botanical Nominees being the smallest number, WAM Capital and WAM Microcap have significantly larger volumes

- Average cost would have been around ~$1.05 as the buying started around ~$0.96 through to the top of ~$1.17

- If this was indeed what happened (very cautious about getting over excited with these announcements), this is another sign of increasing market confidence in EML - can’t be bad for us retailers!

Similar to AIM, EML also announced a LTIP for it Exec Chairman, Anthony Hynes earlier this week.

Key difference to the AIM LTIP is that there are performance vesting conditions around Total Shareholder Return and Anthony needs to serve the full 3 year period.

Am pleased with this given the revolving door that the CEO/Chairman positions have been in recent years. This locks Anthony in for 3 years, making good his comment during the 1HFY25 results call that "I am not going anywhere". This is a decent window to get EML rocking and rolling again (and for me to get my money back!)

Discl: Held IRL and in SM

A deeper look into EML's 1HFY25 results.

Discl: Held IRL and in SM

SUMMARY

A really good result which the market seems to have appreciated. Very good to see the Exec Chair's big on-market purchase last week and today's QVG Capital stake increase immediately following the results. Hoping this is the start of the market taking more notice of EML2.0 ...

Comparisons are still messy with remnants of Sentenial's operations still requiring lots of adjustments etc, but expect all these to wash through in the next half.

The single phrase that for captures the mood of management and my view: “We are talking about growth and efficiency every day”.

I took away the following themes from the investor session and slide pack:

Positives

- EML is now Statutory NPAT profitable in 1HFY2025, with NPAT $9.5m, up from Net Loss of ($4.7m) in 1HFY2024

- Underlying EBITDA increased ~50% to $33.4m, YoY

- Cash position has improved materially, post Senteniel - moved from a net debt to net cash position, and reflects further stabilising of the business - debt of $38.5m repaid, overall cash increased $7.5m, $4.6m cash generated from operations

- Europe is driving earnings with 30+% revenue increase, following the lifting of UK growth limitations, Asia-Pac still contributing with 5% revenue increase

- Interest revenue up 49% to $32.8m, mostly from growth in Europe, annualised yield in 1H25 was ~3.7% (1H24: ~2.5%

- There appears to be laser focus on cost efficiencies - net overheads remained flat YoY, but managements wants the new technology platform to do more to improve efficiency and productivity

- Management ELT is more or less in place and stable

- Management appears to be relentlessly driving the EML2.0 culture change at pace, across the 4 pillars

- Financial performance on track to FY25 guidance ($54-60m EBITDA underlying) - run rate of 1HFY25 underlying EBITDA is slight ahead of guidance but 1H is seasonally stronger due to the holiday season

Needs More Work

- Asia Pac (flatish) and US (subdued), particularly, needs growth focus - Management understands this and are taking action as part of EML2.0

- Expecting interest yield to moderate further as interest rate cuts kick in and central banks plan further interest rates cuts, Float is largely in AUD and GBP where the rate outlook is more stable - size of UK bond investment, Europe segment is expected to temper the interest rate cuts

- Build out of Technology Platform - Project Arlo, kicked off and progressing well in early stages, expecting to see more momentum in the next 6-12M

EML 2.0, QUOTES FROM CALL

- "Largely emerged from the structural challenges of the last 3 years, turning the focus to industrialising the business and recapturing the growth mindset which has been missing for some time"

- "Global structure deployed - focused on removing organisational silo’s - the previous zero integration of regional businesses is coming to an end"

- “The velocity of decision-making and activity in this company has changed immeasurably over the past 60 days”

Pipeline is sitting at $45m, expecting to increase to $60m by EOFY 2025, then $90m by end CY2025

- Working on a 20% conversion rate

- Management emphasis and focus will be on new verticals and bringing new solutions to market in FY26 in existing markets/customers over new markets

- “Pipeline is not as full as we would like it to be, but it is not empty”

- “Free up best talent to focus on these new initiatives, something EML has not done in years”

Project to build single platform is in early stages - good momentum in this initial phase, expect to spend $3-4m on Project Arlo in 2HFY25, wanting technology to do more to reduce operating cost

On Anthony’s position as Exec Chair: “I am not going anywhere, mate. I am very energised about what we are doing and I look forward to doing some positive outcomes for everyone”

This was BEFORE Anthony made his monster on-market purchase - it does feel like he has doubled down on this comment, by putting real money on the table

FINANCIALS

Accounts have been restated for continuing operations only

Change in segment reporting from the previous product-centric view to the current region-based view to align to new org structure - sell all products in all markets

SEGMENT ANALYSIS

- Franked dividends are low on the priority list as the recovery is still in its early days

- No inorganic opportunities on the radar - focus is entirely on getting back to growth

Nice to see QVG Capital up its stake in EML by 1.63% to 7.32%. Looks like they have accumulating since Nov 2024 prior to the results through to 26 Feb 2025, the day of EML's results.

Discl: Held IRL and in SM

SUMMARY

- The story makes sense, is clear, coherent and consistent with earlier management communications - this continued clarity is usually a good sign of good things to come

- Strategy makes sound sense

- Goes back to basics, nothing grandiose, no large capex spend in the next 3-5 years that could result in any capital raising, no sign (as of now anyway) of potential M&A stupidity - never say never, but for now, I will take it

- Key ingredients are in place, scene is set, it is now all about execution

- Early signs that EML is moving at pace, and starting to yield positive results

Too early to be happy (will have a small glass to celebrate today's pop!), more relieved that we are now going back to BAU in a clear, decisive way. Come what may from hereon ...

Have already doubled down in recent months, so will not take further action for now and enjoy the ride for a change.

Discl: Held IRL and in SM

--------------------

Business Objective

Solving complex money flows living at the intersection of business, government and consumers...

Management 3-Year Objective

On a mission to power double-digit transaction revenue (excluding interest revenue) growth by FY27

Conditions to Grow are Optimal

An attractive and growing market - strong tailwinds from (1) Digital Payments continuing to replace cash & paper (2) explosion of Digital Wallets (3) Experience and efficiency battlegounds (4) complex use cases remain underserved eg. Employee benefits

EML is an end-to-end, embedded payments issuer operating in 3 of the world’s most highly valued payments markets - a good business to grow from, diversified revenue mix, have revenue levers across the entire value chain, have capabilities which “move many smarter”

Balance Sheet repaired, regulatory madness is gone, leadership has reset

How EML Will Win

Strategic Pillars to Deliver The Plan

Nothing grandiose, almost predictable, boring back-to-basics enablers, really.

Progress Thus Far

Modest Capex requirements - $43m in Cash Reserves at 30 June 24, generated $14m net cash from operations in FY24 - should be able to fund required capex comfortably.

Nice turnaround thesis confirmation trading update and pop today.

Will spend some time later this morning to do a more detailed review of the Strategy Update. In a superficial quick glance, it feels like:

- lots of nice slides explaining the world that EML operates in and the opportunity

- we have a great business, great assets and a nice clean base after cutting out the crap, from which to launch EML 2.0

- we are going to be very focused, disciplined to chase whats out there, with what we've got

The original EML strategy was not flawed, so going back to basics makes absolute sense. If only EML had stayed this exact course 3-4 years ago, instead of going down the path of stupidity that it did ....

Very happy with the turnaround progress thus far, particularly the re-focus back to EML's core business basics. Just now need to give management time to execute and embed.

Discl: Held IRL and in SM

Very nice to see that EML's new chair has put down $0.52m into EML, on market, at ~$0.595 in the last 2 days.

He now holds ~0.24% of EML, up from a now minute 50k share holding prior to these purchases.

Anthony replaced Luke Bertolli in Aug 2024 and appears to be well credentialed in the payments business.

This feels like a huge tick of confidence in EML from the new Chair when EML was dredging its 52 week lows these past few weeks.

Discl: Held IRL and in SM

@thunderhead , very fair comment around the impact of interest rates on EML's interest income. Intuitively, as interest rates fall, EML's interest income should fall, negatively impacting earnings and hence negatively impacting the share price. The fall in the price post the FY24 results bothered me somewhat as I was questioning whether I had doubled down on the wrong end of the rates cycle.

To work out the correlation, I plotted each RBA rate change since EML listed in ~2013 against EML's share price. The dots are placed on the approximate date where the rate changes occured (had no space to make the dots any larger!)

Red Dots = rate DECREASES, which should negatively impact EML earnings based on the reasoning above (hence Red)

Green Dots = rate INCREASES, which should positively impact EML earnings (hence Green)

Interesting Perspective

When Rates were DECREASING in the ~2013 to ~2020 period, EML's share price was generally trending UP - it went from a ~$0.20 stock in 2013 when the Cash Rate was 2.5%, to its peak of ~$5.68 in early 2020 when the cash rate was 0.75%.

2019 to 2020 was a disaster year when all the PCSIL dramas erupted, and the price crashed to $1.25 when the Cash Rate was 0.5% - clearly, EML-specific issues drove the share price then.

CY2020 to April 2021 saw the price spike from $1.25 to $5.89, its all-time high when the cash rate was still FALLING from 0.5% 0.1%.

CY2021 to mid-CY2022 was disaster period 2 post the Sentenial Acquisition and more PCSIL dramas and the price fell to $1.25 again. The Cash Rate INCREASED from 0.1% to 2.35% in that time. Since mid-CY2022, the cash rate increased to 4.35% while the share price fell to its all time low of ~$0.40 through to current day $0.665.

So, based on the history, the impact of Covid, the big dramas around PCSIL/Sentenial, it actually appears that the EML price has actually moved broadly in the opposite direction of changes in the cash rate. The EML price has made its best gains when the rates fell, Conversely, rate increases have done very little to the price.

This is terribly counter-intuitive, I have to say. But it lines up with EML managements comment in the results call that managing interest income is BAU really, regardless of where the cash rates are.

What Does This Mean

The perceived negativity of the imminent fall in the Cash Rates in CY2025 on EML's earnings is very much in play currently, I suspect.

But the facts around the historical EML share price does not quite support that negativity. The very bullish view would be that rate cuts actually seem to play in EML's favour. The mild bullish view would be that there is no tangible evidence that rate decreases have previously depressed EML share prices.

With this rates analysis out of the way, my view is that EML is in a very good place from a turnaround perspective. The bad stuff has been decisively cremated, new management with good industry credentials are in the driving seat, there is laser focus on EML 2.0 going back to its core businesses in terms of driving revenue growth and containing costs. Further progress will take time to wash through, given cost of living pressures and business cost pressures, and patience is absolutely needed.

I topped up in late Aug at 73c, and will top up again if the price dips below say 55c.

Discl: Held IRL and in SM

TLDR Summary

The FY24 results, in absolute terms, were good but not great. 2HFY24 was flattish. However, the results were impressive once I layered on the very eventful events throughout FY24 as EML focused on exiting the loss making businesses, decisively addressed regulatory issues and revamped management.

Turnaround thesis remains intact. Ingredients for a successful turnaround are in place and subject to more detail at the AGM, appears directionally correct. Will need patience as management refocuses and re-invigorates the core businesses, free of distractions.

Discl: Held IRL and in SM

FY2024 RESULTS SUMMARY (All Comparisons YoY unless otherwise indicated)

Context of Results

The FY2024 results are a good reminder that EML is very much a company still in turnaround mode. FY24 has been a year where EML has been actively working to spit out the bad gum that it has been chewing AND continuing to run and grow the core EML businesses.

The parts of the businesses that has dragged EML down are now decisively gone - PCSIL, and from yesterday, Sentenial. Much of FY2024 will have been to stabilise the rest of the business while these 2 parts were cauterised.

This was a good summary of EML’s FY24.

FY2024 Results, High-Level Summary

The Core business has still been growing, although not at the historical growth rates, reflecting management distraction at the exiting of the problematic businesses. The results were certainly not too shabby, given the turnaround context:

- Total Revenue up 18% to $217.3m, Gross Debit Value up 18% to $1.46b, but this was primarily driven by a sharp 97% increase in Interest Revenue to $49.8m, with Customer Revenue growing only 6% to $167.5m

- Interest Revenue reflects improved market rates and optimisation activities which have earned higher yields - need to understand management’s plan on how this will be sustained as the interest rate cycle shifts from rate hikes to rate cuts

- Treasury management optimisation actions have resulted in uplifting interest yield from 1.6% to 2.9%

- Underlying Gross Profit is up 19% to $166.1m, with Underlying Gross Profit sustained at ~76%

- Net Overheads are up 14%, but the historical period-by-period upward trajectory of costs in recent years have been stopped with costs in 2HFY24 falling 8% from 1HFY2024 - $5m of costs have been taken out from the 1HFY2024 cost base of $61.2m to $56.2m in 2HFY24 - management focus on cost optimisation is starting to show results. Cost take outs appear sustainable (30 roles exited, reduced ICT costs, improved debtor recoverabilities etc) - this sustainability will need to confirmed in 1HFY2025

- Underlying EBITDA including PCSIL was $57.1m - this was at the top end of market guidance of between $52m to $58m, excluding PCSIL, underlying EBITDA was $49.0m, a 19% increase

- Net Loss After Tax from continuing operations was ($9.6m), a 96% improvement.

- PCSIL loss as a discontinued operation was ($16.9m) from ($24.5m) YoY but showed what a huge drag it was on the group

Customer revenue breakdown:

- Gifts & Incentives - flat 3% increase - some challenges with turnover of several accounts, good $4.2m, 16% growth in Corporate Incentives, but offset by continued weakness in shopping mall revenue, down $2.3m, 5%

- General Purpose Reloadable - up 7% despite growth restrictions in place for the UK business through to April 2024, underlying gross profit margin up 3% to 73%

- Digital Payments - up 12%, driven largely from Sentenial, the size of this business will shrink with the discontinued Sentenial operations in FY2025

Balance Sheet

Underlying Operating Cash Flow was $22.0m.

Cash on hand was $43.1m, a reduction of $28.3m due to $40.8m of one-off outflows from (1) PCSIL cash usage including deconsolidation ($18.4m) (2) Net paydown of external liabilities reflecting Vendor loan note repayments and Sentenial earn out payment, net of debt drawdown ($14.4m) (3) Remediation and restructuring costs paid ($8.0m).

The net debt position is ($47.6m), but with the completion of the Sentenial sale announced on 3 Sep 2024, the net debt position will move to a net cash position of ~$5m, which significantly strengthens the balance sheet.

FY2025 Guidance

Underlying EBITDA guidance of $54m to $60m - growth of between 10% and 22% from the FY2024 Underlying EBITDA of $49m. Not too shabby at all

EML 2.0 - Building for Growth - this theme is repeated throughout the Annual Report

Extract from Chairman’s Report which best summarises the thinking and approach:

Where to From Here in FY2025

Onward and upward with EML 2.0, completely free of the baggage of PCSIL and Sentenial!

The TAM of the Prepaid market is huge and growing

And EML has a strong core, that has yet to be fully unleashed due to the severe distractions of PCSIL/Sentenial.

Key Areas to Look Out For in the EML AGM

- Refreshed Go-to-Market Strategy for EML 2.0

- Ambitions, Plans and Targets for growth - am expecting this to restore market excitement in what should have been EML’s growth trajectory had it not embarked on the slippery slope that was PCSIL/Sentenial.

- How the current good momentum in Interest Revenue will be sustained in a rate cut global interest rate environment

THESIS EVALUATION

Turnaround thesis is still intact.

Since the management refresh in FY2023, EML management has laid out a clear turnaround plan and thus far, have executed against the plan - exit of PCSIL, Sentenial, cost optimisation etc. During the investor call, the new CEO described EML as “Challenge, Determination and Achievement”, a good summary of the past year and what lays ahead

Management credibility is still intact

Sensing energy in the new CEO Ron Hynes - “move at pace”, “rebuild our sales capability” and “exploit EML’s right to win” were phrases used - these feel like the right sense of urgency and priorities. Seems to have the right background and experience to lead EML 2.0. Liking the language used in his CEO’s Report

- CEO’s 6m shares LTI requires a $1.50 share price hurdle and a strike price of $1 after 2 years - good skin in the game

- The FY24 AGM will be the next major data point

- This will be a 12-18M journey at least but am prepared to be very patient and allow management to do what needs to be done

Potential Thesis Breakers

Abrupt leadership/management change - this would be a huge red flag - it has been a period of good stability since Emma Chand exited, any change to this stability would be bad news

AGM is underwhelming in terms of EML2.0 growth ambitions

An acquisition, no matter how compelling, would be another big red flag, as I can’t see management being able to handle anything new for the next 12-18 months at least - suspect the risk of this occurring is low given that the recent “troubles” are still very fresh in the mind of management and the market

Underwhelming 1HFY25 results without logical rationale would also be a red flag as it would be a sign that EML 2.0 is not quite working or gaining traction or management has lost direction/focus/energy

Position Size

Comfortable with current portfolio position size of ~2.6%.

However, current levels are very attractive to top up as downside from here is likely to be limited and the price is at the 61.8% retracement level

Will seriously consider a top up if the price drifts close to 0.60, otherwise will use the AGM as the next key data point from which to reassess the portfolio allocation.

Another milestone in EML's ongoing turnaround with the completion of the Sentenial Sale announced today:

- Sale of the Sentenial business for an enterprise value of €32.75m (A$53.4m1) has completed

- Proceeds will be used to retire debt, strengthening EML’s balance sheet

- Balance sheet will transition from net debt of $48m to net cash $5m

- Liquidity to support growth materially improves following the sale of Sentenial and establishment of new debt facilities - debt limit facility will rise to $70m

- EML will benefit further from an earnout payment from GoCardless for an amount in connection with contracts signed by Sentenial between 1 February 2024 and 2 October 2024 based on the first year’s revenue derived from those contracts, multiplied by 4.1.

There was no downward adjustment to the sale price for key contract performance - this is icing on the cake.

In the midst of digesting the FY24 earnings reports. Thesis for EML turning around is very much intact as the company has executed against the turnaround plan, with Sentenial being the last piece of the bad stuff being conclusive sold, with a little bit of earnout upside potentially. Am prepared to be patient for this turnaround to play out ...

Company is now in a much healthier position from which to go onward and upward in their core business.

Discl: Held IRL and in SM

Appointment of Managing Director and Board Directors

- Credentials of both Ron and Anthony look good

- Retaining Kevin was flagged previously but he's earned the right to be retained with the good work he has done these past 12M

- Ron's Rem at AUD$0.8m base, with 6m shares as LTI, 2/3's vestable in 2 years assuming share price hits $1.50, with a strike price of $1, plus another $3m of service rights, vestable each year (1) looks reasonable (2) ensures good skin in the game and (3) provides an indication of where management thinks the price will be at in the short to medium term.

In the past 12-18M, Kevin has decisively cleared the stage of bad stuff. The stage is now set for Ron to perform. He sure sounds like he can put on a show. Let the real show now begin (albeit a few years later ....)!

Disl: Held IRL and in SM

This is another growth barrier lifted and EML marches towards its old operational self pre-PCSIL/Sentenial. Onward and upward, literally!

Following the close of trading on 23 April 2024 EML’s UK subsidiary Prepaid Financial Services Limited (“PFSL”) received correspondence from the Financial Conduct Authority (“FCA”) advising that following PFSL’s completion of regulatory remedial work it was satisfied that PFSL has appropriate structure and risk management controls in place and that the Voluntary Application for Imposition of Requirements (“VREQ”) preventing PFSL from entering into new customer contracts would no longer apply effective 23 April 2024.

With immediate effect, PFSL may now onboard new customers and the team look forward to once again being an active participant in the UK payments market leveraging PFSL’s end-to-end issuance, processing and program management capabilities and UK domiciled management and operations team

EML announces that it has entered into an agreement to settle all outstanding deferred acquisition payments (“Loan Notes”) from the acquisition of Prepaid Financial Services Group (“PFS Group”) in 2020 for £15.0m (A$28.8m)

- This represents a £7.9m (A$15.2m) or ~35% reduction to the total value of the Loan Note liability if paid at face value plus interest by the specified instalment dates

- All historical earnout arrangements are confirmed at zero

- This agreement represents the conclusion of all outstanding actual and potential liabilities for EML and its shareholders flowing from the 2020 PFS Group acquisition structure.

- Settlement of the Loan Notes concludes all outstanding matters between EML and the PFS vendors including but not limited to acquisition earnout arrangements for which nil will be paid

- The settlement amount will be paid by 31 July 2024 and funded from EML’s cash balance.

- Settlement of all outstanding actual or potential liabilities from EML’s PFS Group acquisition structure is another important milestone in the delivery of the EML Group’s strategic review. By reducing the Loan Note liability and negating all other potential liabilities arising from the PFS Group acquisition structure, inclusive of potential earnout disputes, EML will strengthen its balance sheet and further de-risk the business.

This feels like the final nails in the PFS Group coffin, thank goodness!

Another piece of positive news, amidst a series of positive developments in recent months, relating to both the winding up of PCSIL and the disposal of Sentenial.

I viewed the recent exit of the Alta Fox Director and the appointment of Kevin Murphy to the Board as also being another positive sign that the turnaround has reached a definitive milestone.

Topped up IRL today given the recent price pullback and on the back of this news.

Discl: Held IRL and in SM.

Finally had the chance to work through the EML 1HFY24 results after all the excitement with the Sentenial sale. I prefer HY-o-HY instead of PCP comparisons, so reworked some of the numbers to give me that view. It also helped that EML management is now focused on the Core business segments, so they have taken pains to focus on, and publish, H-o-H performance.

Summary of the key Group numbers, green shows growth, orange are flat to down

In summary, and the rationale for my top up of 0.25% IRL and in SM today:

- The underlying EML business in the last 18M has been growing nicely across the key metrics, stripping out the impacts of the PCSIL and Sentenial remediation costs and isolating post-disposal impacts. This is summarised in the table below - green is growing, orange is flat to backwards.

- Expecting EML to meet or exceed underlying EBITDA FY24 guidance - at the half year mark 53.3% of the mid point guidance has already been met.

- Continued strong interest income revenue - interest rates likely to remain higher for longer, which is a good tailwind for EML revenue

- Strong cash generation

- Upside from cost remediation efforts as costs remain high and management is very focused on this.

- Risks of another (stupid) acquisition will be remote for at least the next few years (we would hope).

- By getting rid of PCSIL and Sentenial, EML is essentially back to being the company it was prior to the acquisition - it was a much-loved growth company. As both acquisitions were entered into when the EML price was $3.75 (PCSIL, 31 Mar 20 announcement) and $3.89 (Sentenial, 30 Sep 21 completion) (1) the core business has still been growing, and (2) we have the tailwind of high interest rates, it would appear that a re-rating to perhaps ~$3.00 is not an unthinkable scenario now.

Risks

- Sentenial sale does not complete - low risk, it would seem

- Another stupid acquisition - low to none, for the next few years perhaps

- Further Board instability - low, given how the Board has stayed the course in the last year

- New CEO - always a risk (think Emma Chand), but EML is on a much clearer and firmer trajectory now for the Board to stuff up the appointment.

- Growth stalls due to macro factors - medium risk if Central Banks overreach and cause a major recession. an inherent risk.

At peak, my paper loss was close to 85%, and I was completely anchored to the loss. It took a lot of effort to un-anchor this negativity.

I now feel EML is back on the right path again and the growth ahead looks bright. My conviction for EML has now turned from negative to high, enough to top up 2x and bring my average cost down to a reasonable $2.31. Whether this was a right move will be revealed in the fullness of time!

Discl: Held IRL and in SM

1HFY24 Summary Slides

Further notes in digesting the Sentenial sale announcement:

- Non-Core to the Group’s operations as it is unprofitable (estimated ~A$2m EBITDA loss in FY24), does not have any material product overlap with other EML Group business lines, and is separable from the Group’s wider business

- Significant milestone to the delivery of the Group’s Strategic Review

- Sale price is subject to (1) customary completion adjustments for working capital and net debt (2) potential downward price adjustment, capped at EUR7.5m linked to ongoing key contract performance in the period up to completion of sale (3) earn out based on recurring revenue from new contracts signed by the Sentenial business from 1 Feb and 30 days after Completion.

- Completion is not subject to financing

- Expected to be completed within 3 to 6 months and is subject to approval from the French and UK financial regulators

@jimmybuffalino , @thunderhead , as a long-term shareholder, I share your sentiments with the overall Sentenial debacle. I had very low expectations of a meaningful sale price, as I was more looking forward to EML minus Sentenial, so am simply esctatic at the sale, whatever the price. It just releases EML from the ongoing burden that PCSIL and Sentenial have inflicted.

I topped up in late Jan when the PSCIL wind down was announced, looking to top up again today as the Sentenial sale was an earlier defined trigger point. Hoping that with both out of the way, EML can refocus and go back to becoming the growth company it was, hopefully that much wiser about making dumb-arsed acquisitions in the future!

Discl: Held IRL and in SM.

Finally got round to working through what to do with EML after the recent AGM and price crash. Went back to the FY22 Annual Report and laid out the key numbers from FY21-FY23 in a xls to make better sense of what has happened - I find summarising this 3+ year horizon into a format which I am comfortable with from the Annual Reports provides me with significantly better picture of the commentary rather than the usual YoY or PCP basis.

Disc: Held IRL 1.06% of Portfolio

SUMMARY

- Core businesses continue to grow Gross Debit Volume and Revenue, gross margins have mostly sustained around 65%

- Continues to benefit from high interest rates for EML’s substantial stored float - this benefit will continue for the next 12-18M as interest rates stay higher for longer

- Underlying Expenses, ex-Impairment, have step increased ~26%, a good portion of that is from the Sentiniel full year contribution, impacting Profitability - management has clearly recognised the need to reign this in - cost optimisation is one of its 4 key focus areas

- Cash Flow position has improved significantly - would have been cash flow positive if not for continued compliance remediation spend

- Trading Update for 4M ending October 2023 encouraging - expect to significantly improve FY23 EBITDA by 40-56%, cash flow positive, but will continue to burn~$20m for PCSIL remediation efforts

- Management changes, other than a final CEO, appear to be stabilising, strategy has been revised and is clear, transformation effort is underway

- PCSIL continues to require significant remediation effort focus and is clearly impacting further revenue growth in Europe - Kevin Murphy the Interim CEO seems to be the right person, team to resolve has been expanded, what we now need to see is positive traction via positive Central Bank of Ireland acknowledgement

Portfolio Action

- Current holdings of EML is 1.06% of the portfolio with the average cost of $2.991, down 71.59%

- Happy to continue holding this % allocation on the back of still-robust Core businesses and the eventual resolution of the CBI issues vs exiting with NRV of ~$11k

- Not prepared to add to the holdings at the moment, but will consider this if there is tangible progress on the CBI remediation, as evidenced by formal acceptance of that improvement and/or the progressive removal of growth restrictions

CONTEXT

- Previous long-term strategy was declared flawed by new management as it (1) focused on longer-term aspirations (2) did not account for today’s business challenges which required immediate and concentrated attention (3) did not offer a clear plan to solve these challenges

- More recent acquisitions have not yielded the desired results or given rise to identifiable synergies delivering real value (1) PFS Group operates in a highly technical and evolving regulatory environment in Europe (2) Sentenial Group, slower ramp on anticipated revenues and limited synergies for EML’s open banking business

- Good progress on focus to solve the biggest business challenges today - (1) Leadership & Talent retention (2) Remediation and Regulation (3) Escalating costs and loss-making businesses (4) constrained growth

THE GOOD

- Core business strong and growing, FY23 revenue and underlying EBITDA, outperforming guidance:

- Gifting and General Purpose Reloadable Cards - Australia and UK - strong and growing Gross Debit Volumes and Revenue

- Digital Payments, including problematic Sentenial acquisition - also growing GDV and Revenue

- Gross Margins sustained at ~65%

- Cash balance $71.4m, cash flow from Operations almost at breakeven ($2.6m) vs ($41.5m FY22)

- Interest investment return, a core part of EML’s revenue mix continues to improve - $33.1m in FY23 vs $5.0m in FY22 - will continue to benefit from the global higher-for-longer interest rates forecast

- YTD Oct 2023 results and trend positive (1) Underlying EBITDA up to A$12.5m vs A$3.3m in pcp (2) Revenue is up 39% at A$26.3m, 19% growth on pcp in recurring business revenue and strong contribution from higher interest revenue and yield improvements

- FY24 guidance

- Underlying EBITDA - range of $52-$58m, an increase of 40-56% on FY23 EBITDA of $37.1m

- Cash flow broadly neutral in FY24, including PCSIL’s cash burn of ~$20m. Excluding PCSIL, EML would be significantly cash flow positive in FY24

- New leadership team is settling down after resignation of previous CEO and focused on (1) executing the Transformation Strategy (2) addressing the compliance issues (3) running the core business

THE NOT GREAT

- Declining profitability of 28% YoY

- Overhead costs are 26% higher - at least 10% across each major expense item

- Lower establishment revenue impacted by macro considerations

- Growth restriction in PFS business in UK & Ireland offset by higher interest revenues across float holdings in Gift and GPR

- 2 very problematic acquisitions - PFS Card Services Ireland Ltd (PCSIL) and Sentenial - major regulatory compliance issues crimping operations, bleeding costs to comply and taking up a disproportionate amount of management attention - progress made but a lot of work left to do

- PCSIL cash burn in FY24 estimated to be ~$20m, elevated cash burn “likely to continue over the mid-term”

- Central Bank of Ireland not satisfied with PCSIL’s remediation plan and completion timetable

- Continued impairments of PCSIL and Sentenial businesses - $258.9m hit in FY23

PROGRESS ON OPERATIONAL PRIORITIES

- PFS business (UK and European GPR business) - made progress, now in embedding phase of remediation, added additional resources to uplift capability to resolve issues with the Central Bank of Ireland in the European business

- Cost Optimisation - simplified operating model, rationalisation of global roles to align to new strategy, identified FY24 cost savings initiatives from further simplification

- Growth in Core Business - committed investment to rebuild Sales, Marketing and Commercial teams

WHAT GOOD LOOKS LIKE

- Continued growth of core businesses while resolving compliance issues in parallel

- Completion of the execution of the Transformation Strategy

- Complete exit of PCSIL or resolve compliance issues - reduce cost burn

- Step drop in Operating Overheads as leaner organisation and cost optimisation kicks in - $10m identified thus far for FY24 execution - not big enough

- Sale of Sentenial - expressions of interest received, being reviewed but no sale forthcoming yet

- Cashflow and EBITDA positive

Just caught up with the AFR on EML.

Alta Fox is behind the moves "It fishes in small caps globally, moving quickly once buying in and often uses M&A to create value". Alta Fox’s entry price was in the 50-60¢ a share range and they first re-entered 168 days ago.

EML is clearly and openly being fattened for the eventual roast ...

Should have connected the dots earlier, duh! to self!

Today's announcement probably says 3 things for me:

- The CBOI issues require someone with seriously strong expertise to deal with (duh!) and Emma was more a grow sales vs fix-mess CEO. Kevin sounds like he has the right expertise and experience to focus on the CBOI mess. That he would take the job on would hopefully mean he CAN see a way out? POSITIVE

- The Board has formalised the dumping of the old strategy to now focus on operations to plug the big holes - again, duh! It means that the Board has fully internalised the fact that they were with the fairies and need to come back to reality - POSITIVE (as in better than doing nothing or staying the course with the old strategy)

- Formal notice that EML is up for sale, either in sum or in parts - not surprising given that the other parts of EML are still running well, but this will limit the ability for the share price to fully get out of this deep hole.

Discl: Holding IRL (very painfully).

Post a valuation or endorse another member's valuation.