Total Shares = ~375m

Share Price = ~$3 /Share

Market Cap = $1125m

Cash at hand = $140m

Enterprise Value = $985m

FY21 Revenue = $192.2m ( 60% revenue from Europe, 20% from North America and remaining 20% from Australia)

( 85% of revenues are recurring)

In FY21, EML generated $48m Cash from Operating activity, based on the guidance for FY22 It will generate $53m Cash from Operating activity)

Valuation:

at $3 = EV/EBITDA ratio is ~15

In other words, If you buy EML with an Enterprise Value of $985m ( i.e $3 a Share), it generates 5.3% yield in cash in FY22 ( i.e it generate 53m of cash). EML is growing rapidly so this (in mind) is very attractive.

Is Inflation good for EML?

- EML doesn't rely on debt, it has sufficient cash

- It earns more interest on money if interest rates go up

- because of inflation, GDV should increase at a higher rate and Hence EML's revenue

Two near term issues

- Central Bank of Ireland regulation issue ( its been mainly sorted but not 100%)

- Shine Lawyers Class Action ( EML denies any liability and defending the proceedings - will wait for the outcome)

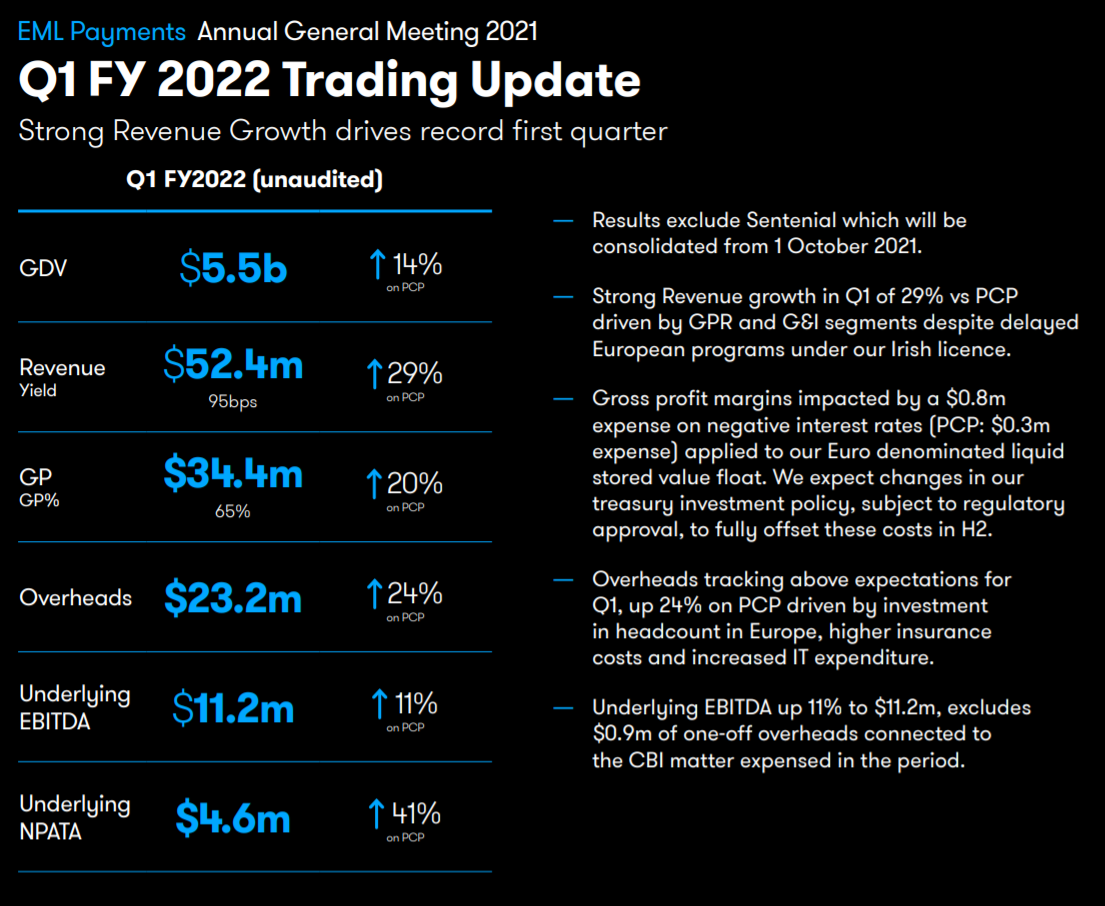

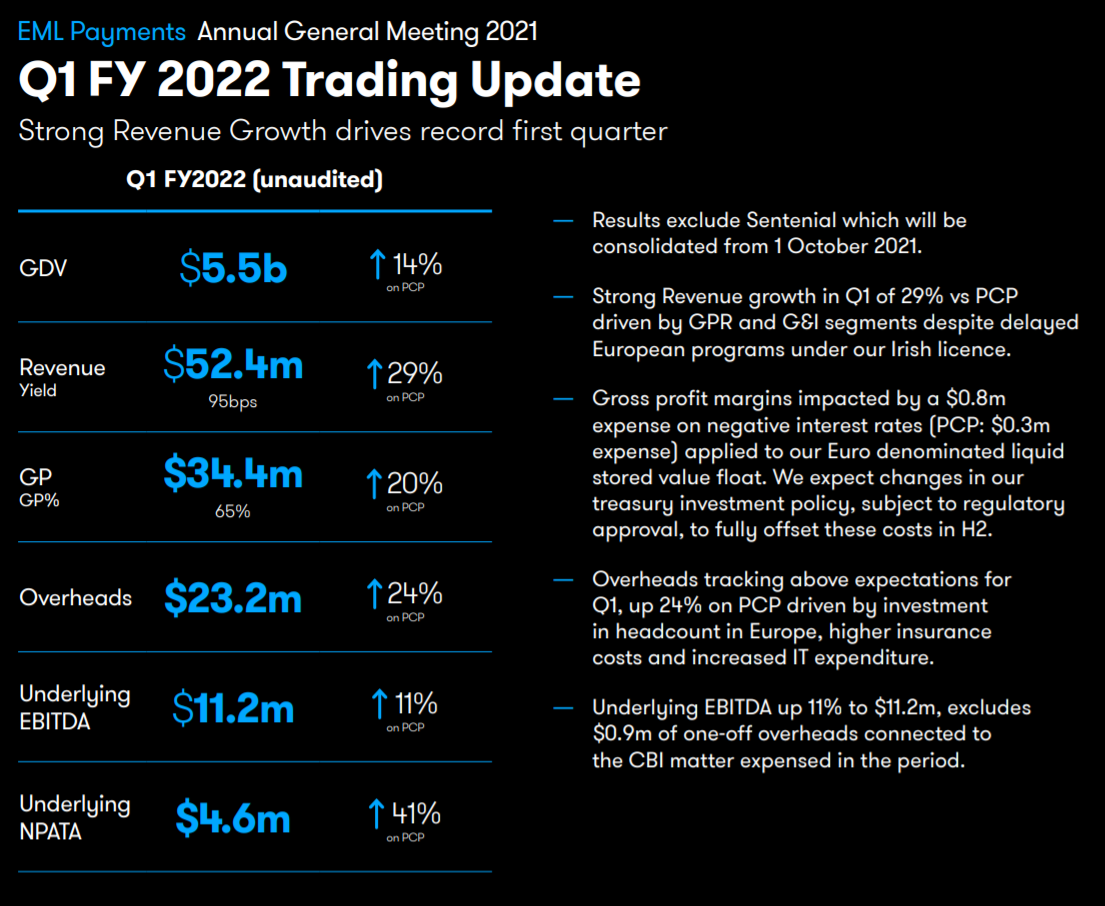

Following is Q1 FY22 Trading update

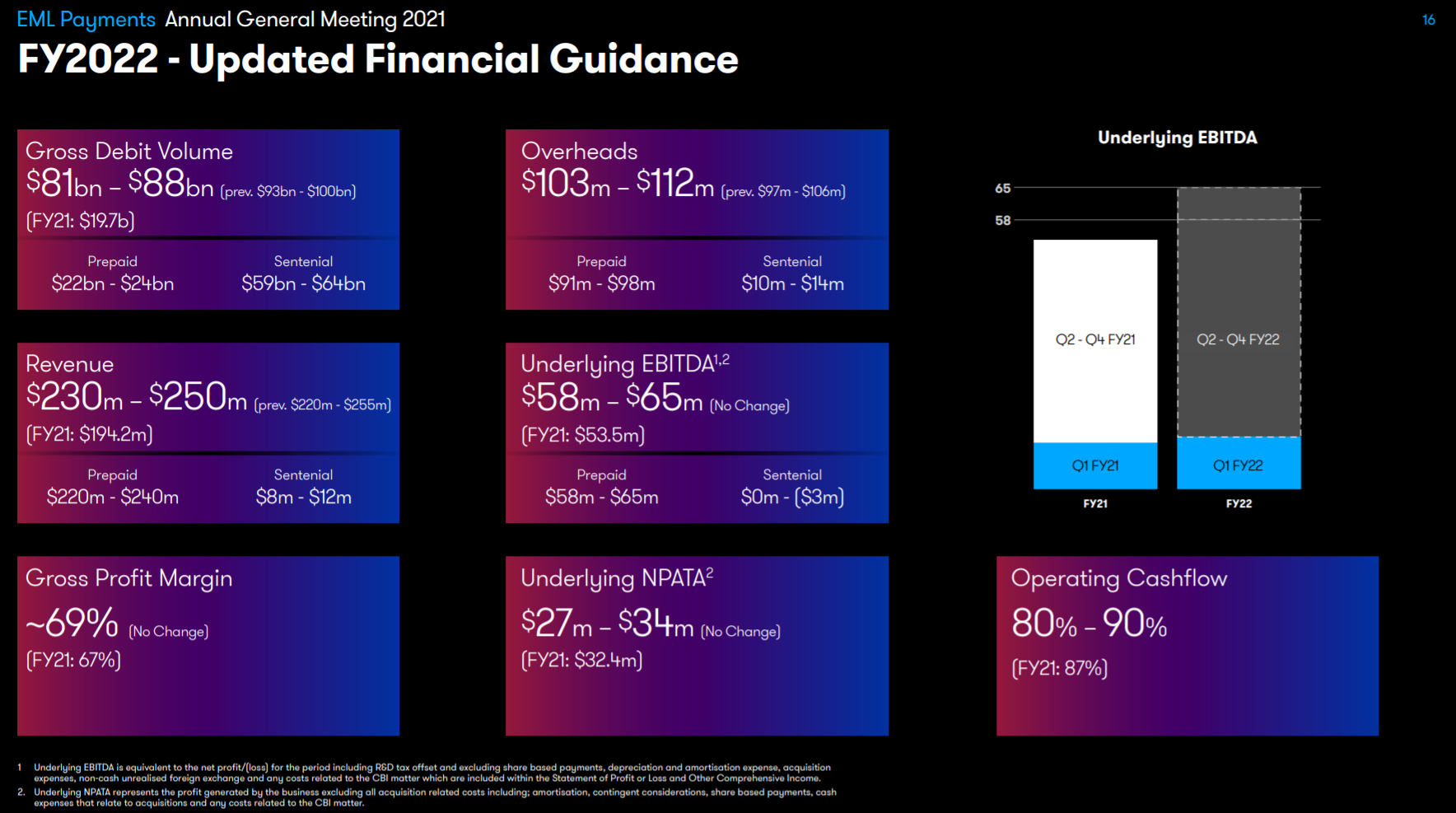

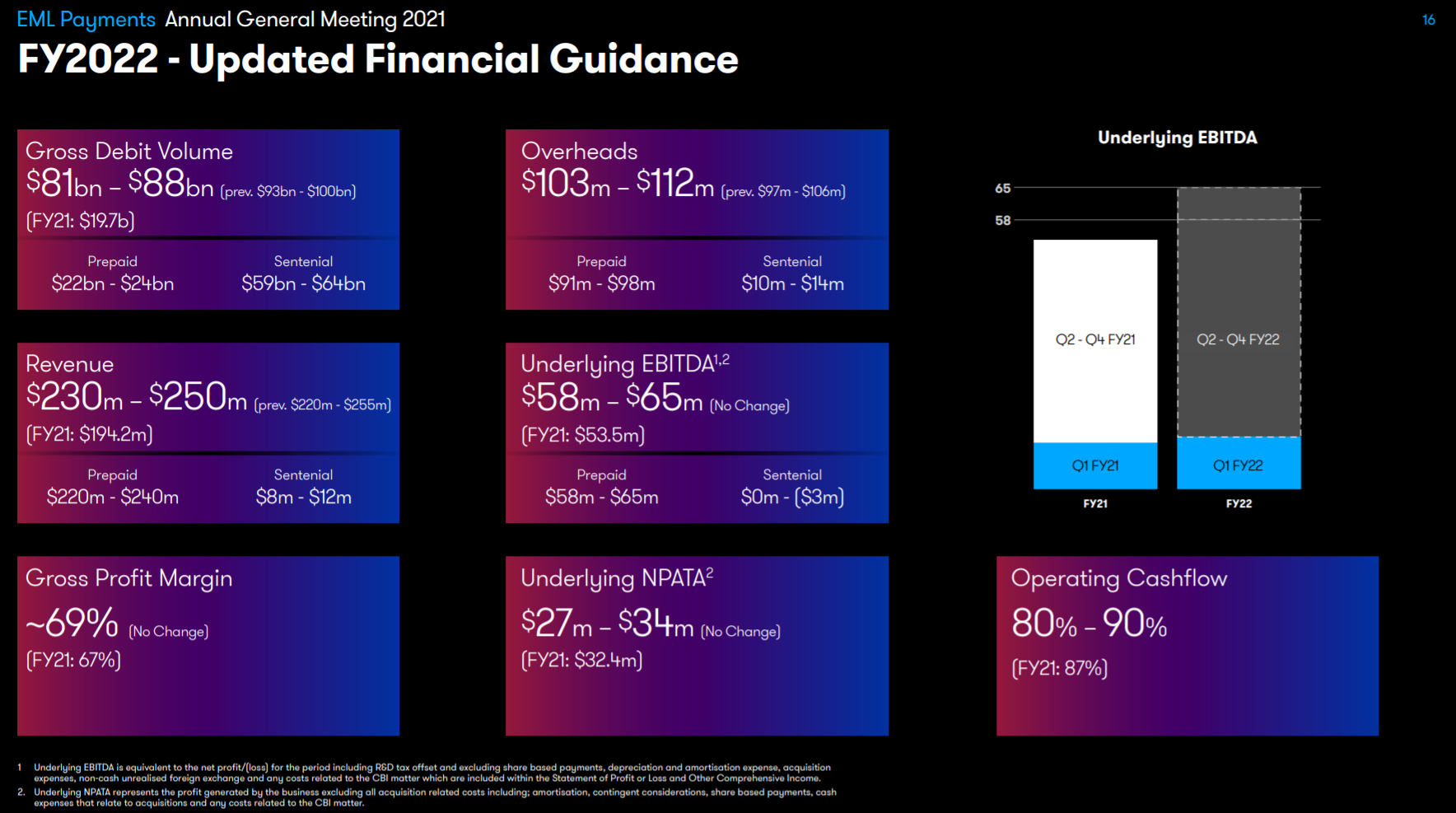

Following FY2022 Guidance

So far evidence suggests that it is growing its market share.