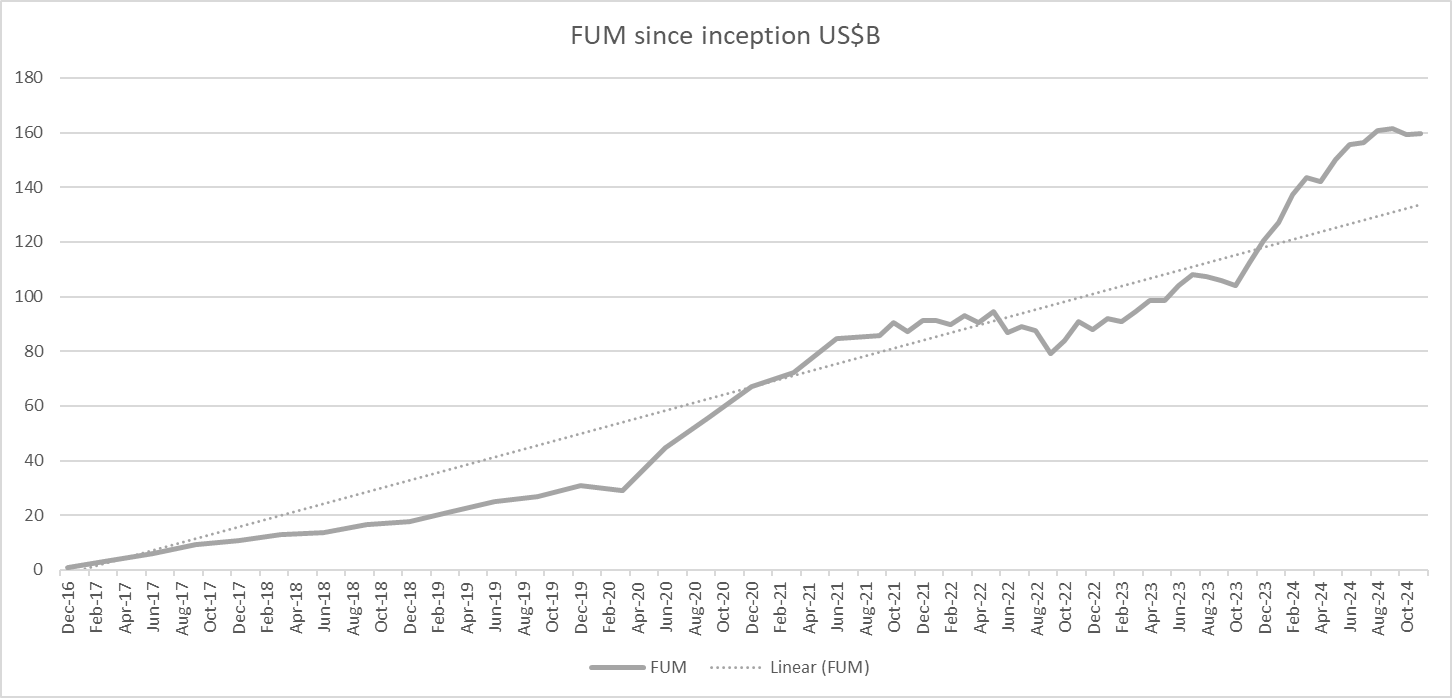

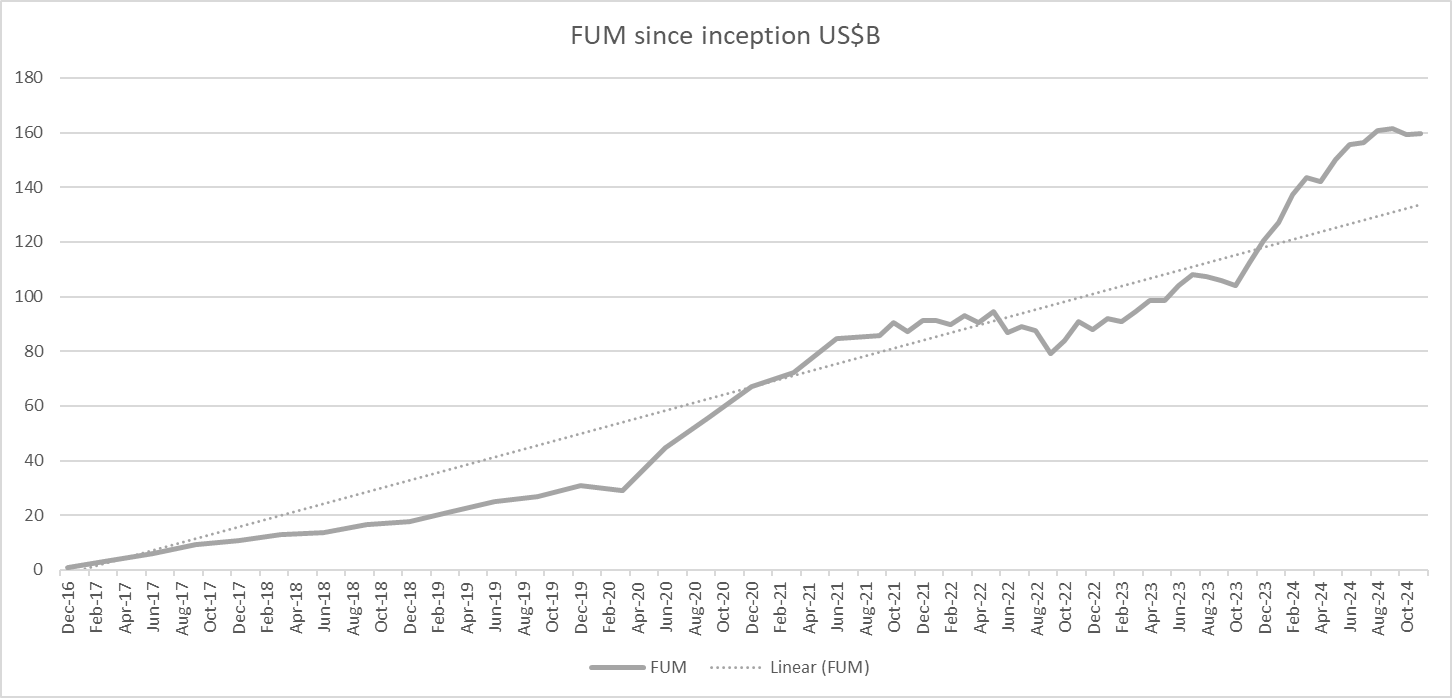

It was a hotly anticipated FUM update this month, by me anyway, given how hard I've gone at this one. With this morning's release of flat FUM both from flows and performance you might be wondering what the fuss was about - and you'd be right!! But that ignores the kafuffle in recent weeks caused by Adani-related allegations of management impropriety. Those allegations led to major falls in Adani-owned companies share prices, and given Adani is one of - if not THE - largest GQG holding, it also led to an immediate major fall in GQG's CDI price.

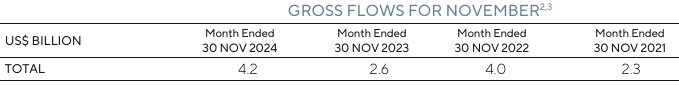

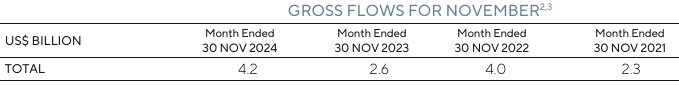

The GQG fall seemed exaggerated given Adani represented less than 10% of their FUM, but unlike the Adani companies the GQG share price didn't bounce back. The discrepancy could really only be attributed to an expectation that there would be a rush to the exits and institutions would take their GQG business elsewhere. That may still happen but thus far any impact from Adani appears to be minor, with net flows in November actually slightly positive. The inclusion of a table showing gross inflows over the past four Novembers would appear to be a poke in the eye to those who were expecting Armageddon.

Even the short term effect of Adani's performance impact on FUM was able to be offset by positive contributors from other parts of the portfolio, with overall portfolio performance flat in the month. Management also noted both flows and performance have been strong in the first week of December, with total FUM at a near record of US$161.5 billion.

The only slight negative was the announcement that their CDI buyback would be cancelled given concerns about the tax treatment in the US. Mixed feelings. On the one hand if they're going to buy them back, this is the time to do it. On the other, the effect of that would be to reduce the free float, and to some extent it's the lack of free float that is causing such volitivity in their price. Founder Rajiv Jain has indicated he will be personally buying on market instead.

At the current price they're 10x consensus EBIT. I accept "cheap" is a nebulous concept when it comes to valuation but compare them to companies growing at a similar rate, or its peers, or almost any other valuation metric you want to pick and it's hard to come up with any other conclusion than it looks cheap.