Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

I don't see how outflows don't accelerate from here with weak performance across all strategies. The arguments are all logical and he will probably be proven right in time but 'too early is the same as being wrong. They really need a large sell off and be able to stay flat. I don't think he has garnered the investor base that will persevere.

GQG Global Equity Fund

Emerging Markets Fund

GQG, it’s time we part,

A word that rhymes is fart.

It’s not me, my dear – it’s you,

The spark is gone, the thrill is through.

You wooed me with fat, sweet yield,

Golden crops in a dividend field.

For many years you won the benchmark race,

But lately you’ve been ambling in last place.

Now flows are heading out the door,

And Magellan whispered, “There is no floor”

In this bull market I’ve come to hate,

Defensive positioning does not rate.

So goodbye, GQG, we’re done, we’re through,

I’m out the door before it all turns to poo.

But don’t change the locks or call blocker install,

For if conditions change, I might be back for a booty call

Nova Nordisk is their largest holding in the global equity fund - and sold off a lot over December. Not related to Adani but bad timing with those looking for strong performance short term to substantiate holding the fund.

It was a hotly anticipated FUM update this month, by me anyway, given how hard I've gone at this one. With this morning's release of flat FUM both from flows and performance you might be wondering what the fuss was about - and you'd be right!! But that ignores the kafuffle in recent weeks caused by Adani-related allegations of management impropriety. Those allegations led to major falls in Adani-owned companies share prices, and given Adani is one of - if not THE - largest GQG holding, it also led to an immediate major fall in GQG's CDI price.

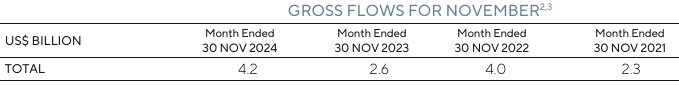

The GQG fall seemed exaggerated given Adani represented less than 10% of their FUM, but unlike the Adani companies the GQG share price didn't bounce back. The discrepancy could really only be attributed to an expectation that there would be a rush to the exits and institutions would take their GQG business elsewhere. That may still happen but thus far any impact from Adani appears to be minor, with net flows in November actually slightly positive. The inclusion of a table showing gross inflows over the past four Novembers would appear to be a poke in the eye to those who were expecting Armageddon.

Even the short term effect of Adani's performance impact on FUM was able to be offset by positive contributors from other parts of the portfolio, with overall portfolio performance flat in the month. Management also noted both flows and performance have been strong in the first week of December, with total FUM at a near record of US$161.5 billion.

The only slight negative was the announcement that their CDI buyback would be cancelled given concerns about the tax treatment in the US. Mixed feelings. On the one hand if they're going to buy them back, this is the time to do it. On the other, the effect of that would be to reduce the free float, and to some extent it's the lack of free float that is causing such volitivity in their price. Founder Rajiv Jain has indicated he will be personally buying on market instead.

At the current price they're 10x consensus EBIT. I accept "cheap" is a nebulous concept when it comes to valuation but compare them to companies growing at a similar rate, or its peers, or almost any other valuation metric you want to pick and it's hard to come up with any other conclusion than it looks cheap.

Fascinating price action today, with the fund manager being down almost 26% at one point. Why? It follows the revelation that Gautam Adani and fellow execs has been indicted in the US on bribery and fraud charges. Almost 10% of GQG's FUM is made up of Adani companies. Hence the GQG hit.

But that means more than 90% of the FUM isn't related to Adani. Plus, Adani shares are only down around 20%. The only way you can make the GQG price action make any sense is if you assume the Adani link will result in outflows - a lot of outflows. I don't see it. Even if they were to liquidate the position and take a 2-4% FUM performance hit as a one-off, not great but in the washup just one of many bad guys being offset by good guys (one of the latter being the contribution from the Adani investment up until this point).

I think it's an opportunity and topped up at $2.05 IRL this afternoon. With a little more patience I could even have gotten a better price than that.

GQG breaches SEC whistleblower protection laws | Financial Standard

GQG Partners was hit with a US$500,000 fine by the US Securities and Exchange Commission (SEC) for violating whistleblower protection laws via the use of non-disclosure agreements (NDAs).

"Specifically, the settlement agreement said that it permitted reporting possible securities law violations to government agencies, including the Commission; however, it also required the former employee to affirm that he or she had not done so; was not aware of facts that would support an investigation; and would withdraw any statements already made that might support an investigation," the SEC said

Aug-24 update

Overall a good half year update, with a few things to be considered.

- Revenue higher than I expected, mainly because of performance fees. Their model is heavily biased towards management fees but some Australian clients (in particular), like them incentivized with a performance fee.

- Costs up more than you'd ideally want to see. It does track that the performance they've delivered will come with some fat bonuses though. Add to that the opening of new offices and acquisition of a private equity arm - altogether they've got some excuses for not seeing as much operating leverage as might be hoped.

- Acquisition of Private Capital Solutions business - I wouldn't have a Scooby Doo if this is a good idea or not. I would say that over US$70 million (debt funded) sounds like a decent wedge for a business that's not expected to materially add to earnings for 3-5 years. But what do I know?

- Re-reading the transcript I thought it was interesting that they have actively resigned commissions where clients have demands not aligned with their own. I think they'd be referring to ESG and other requirements that might result in lower alpha. Right at the end of the Q&A Rajiv said "Even now we have discussion with a few clients where we've offered to resign. And you will see that impact, by the way, in some of these future months of a little lumpiness because of that." He probably could have left that nugget unsaid.

- I now think it's trading much closer to fair value. It's a Hold for me at these levels. Analyst expectations for the full year have come up much closer to where I'm modelling them so I'm not expecting we'll see a repeat of the last 12 months, with the SP up over 100%.

Mar-24 update

After doing not much for some time (despite ever-increasing FUM), the share price has been on a bit of a tear of late. I still don't think it's expensive. On a trailing EPS basis it's around 15x, but FUM is more than 50% higher than the same point last year. On my figures, forward EPS is only 10x earnings. (Plus, using EPS is a conservative measure for GQG. The amortisation of a tax asset generated on listing means cash earnings are more closely aligned to EBITDA, and on that basis they're less than 8x my forward EBITDA).

There's a few things keeping it tamed. Until relatively recently the proposed merger with PAC was making some nervous and interventions by activist shareholder River Capital eventually scuppered the deal.

More recently PAC has just sold its remaining shareholding in GQG (circa 4%) at a discount to the current share price. But most importantly I just think the analysts are wrong. Given GQG's primarily management fee business model, once you know the FUM, you can guestimate revenue with a fair degree of certainty. Based on 9 estimates, analysts have forecast revenue of US$661m. I think FUM would have to hold where it is now to for revenue to be that low.

There's really only two drivers of FUM - flows and performance. Since inception in 2016 GQG has reported a month of negative flows just once, in April 2022. I don't see that changing dramatically in the near future. So that means you would have to assume performance will be negative. Their past performance speaks for itself (compared to benchmarks), but they won't be immune if there's a correction or market downturn. Is that what analysts are assuming? I can't think of another explanation.

One thing is for sure, the longer we go without a correction the more certain GQG's FY24 result becomes. I estimate revenue in the first two months of this year as US$108 million already.

Aug-23 update

A reasonably solid half year report - if largely expected given monthly FUM updates - from GQG.

The market didn't love it but you tell from the analysts questions why that would be the case, with questions centred around expected performance fee growth and shift in product mix to higher margin areas. These types of questions don't just miss the point but run counter to one of the key attributes of this fund manager - that being that they actively seek to get the overwhelming majority of their earnings from management fees and this fee should be set at a level that it can compete with passive strategies. The benefit of the above as an investor is that if you know what the blended management fee is (about 0.5%) you can use the monthly FUM updates to get what proves to be a very reliable predictor of revenue in any given period.

I also like the transparency of their disclosures, the fact they very openly called out two of the strategies underperforming in the past 6 months but still kept all the same disclosures/graphs etc. which clearly highlight this. All strategies have still significantly outperformed benchmarks over longer time periods.

Most of all I like the fact they're getting inflows - an average $1B a month in the first half - and combined with performance growth the FUM keeps growing. Inflows are key to this type of business. Despite this their multiple is close to an industry low. Based on some fairly conservative assumptions (FUM growing from $108B in Jul-23 to $112B in Dec-23) I think they're on a forward PE of about 11x.

The recent move to announce they would be putting in a bid for PAC was in some ways surprising and I wouldn't be devastated if it fell through, but given the first-hand knowledge Rajiv Jain and Tim Carver have of PAC, you'd have to give them the benefit of the doubt they could unlock some value. Since they made the announcement last month they're yet to put an offer on the table.

Alot of people don't like fund manager investments and that's fair enough as they're the very definition of a cyclical business, but with added leverage because when the market drops not only does FUM drop from rerating but the decline gets juiced down by outflows. For now though they're delivering and paying 90% of earnings as dividends while you wait for a rerate.

****

There's been lots of talk of whether Magellan's recent issues and share price sell off have been overdone and represent an opportunity. But how about a company in the same sector, is on a similar multiple but is growing much faster (any growth would tick that box) and is just printing cash and returning 90% of it back to shareholders.

In this excellent blog Martin Tran lays out the case for investing in GQG Partners. You might remember GQG listed last year, which crystalised a gain for Pacific Current Group (PAC) who partially own GQG and was the catalyst for a rerating of PAC. After listing at $2, GQG got caught up the broader market selloff and probably a bit of Magellan blowback and got as low as $1.12. It's currently trading around $1.40.

Without regurgitating the work Martin did in the blog below are some key points.

Good:

- relatively simple business to get your head around.

- very low capital/expense requirements, which means majority of growth flows straight to bottom line

- vast majority of revenue (97%+) is from management fees, which means that unlike some of its peers it's not a famine vs feast dynamic waiting for the company to hit high watermark benchmarks to generate performance fees.

- has a relatively low management fee (average 49bips) versus peers. This plays out as it being far more able to maintain margin and defend against the headwind of the increasingly popularity of passive investing options. It's also possible that this will be some (probably limited) protection against a period of underperformance.

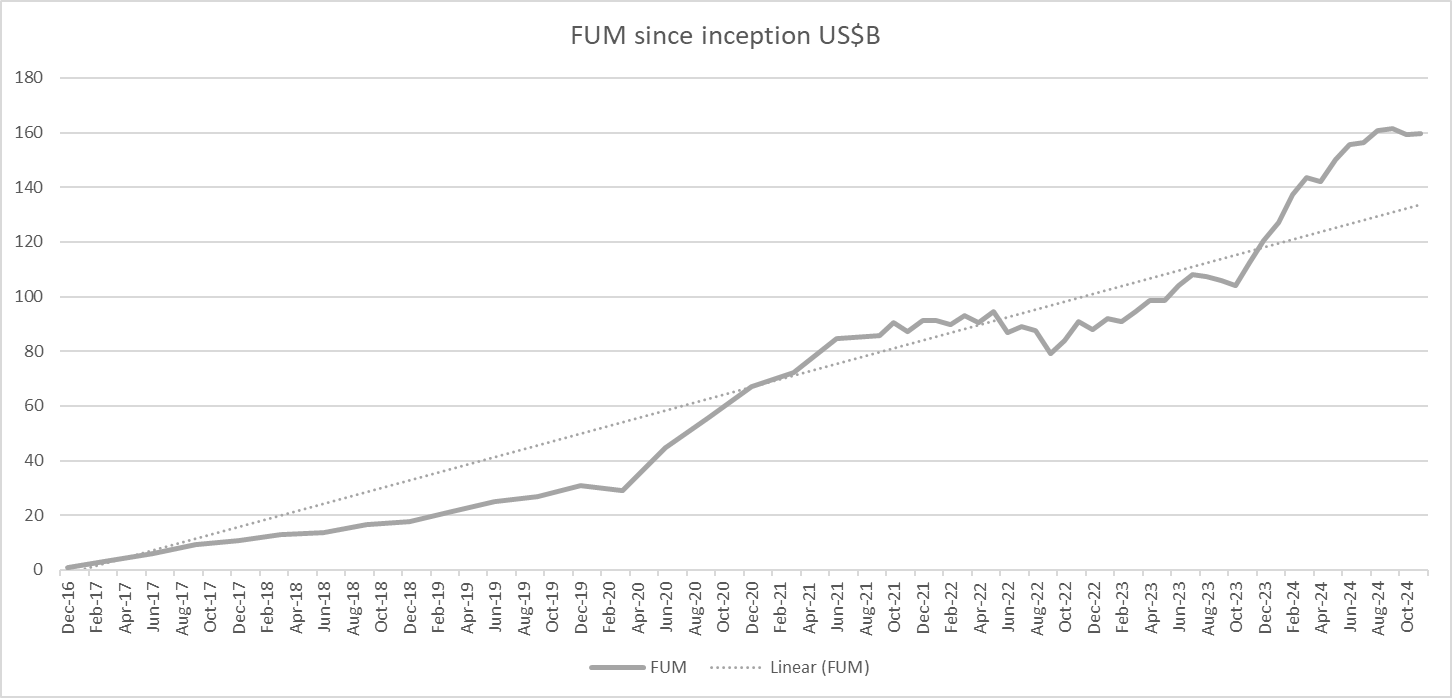

- despite the above two points historical performance v benchmarks are very strong. Of it's four main products all have beaten benchmarks over 3 and 5 year timeframes and all but one have beaten benchmarks over a 1 year timeframe. This is reflected in inflows with FUM having grown from nil at inception in Jun 2016 to US$89.8 billion at 28 Feb 2022.

- 85-95% payout ratio paid quarterly with default of 90%

Less good:

- limited free float of around 20% of CDIs, with founders, PAC and employees making up the majority of the registry. Escrow for majority of these ends 30 Jun 22.

- key person risk, in particular CIO Rajiv Jain. Some of GQG's customers hold options to exit if Rajiv splits.

- highly exposed to currency movements, particularly USD.

- as we've seen with Magellan this is a highly competitive industry and if performance suffers it doesn't take long for this to be reflected in outflows.

- Not a risk as such but worth noting that prior to listing, as a partnership GQG wasn't subject to US Federal company tax but since listing it has started having to pay tax. This is likely to result in lower earnings in FY22 despite top line growth. It will also be subject to the amortisation of a deferred tax asset generated in the listing (US$16m p.a. for 15 years), although this is non-cash.

- vast majority of divis will be unfranked.

- you're buying CDIs and not ordinary shares, which for one thing means you don't get to vote at company meetings (if you value that).

It's difficult to predict growth rates as the biggest variable (market performance) is beyond GQG's control but I've used the same 15% p.a. as Martin and come up with a valuation of $1.77. That's far lower than their historical growth rate and could well be very conservative but better that than the alternative.

[Held IRL only, will need to sell some of my shitco microcaps to get them into Strawman]

Poor bastard...he has to sell $88 million worth of shares (to fellow founder Rajiv Jain) to settle a divorce agreement and, on the same day it gets announced, he watches the share price surge as much as 12%. It eased as the day went on to "only" be up 7%, but still...insult to injury. I guess some days you just can't get rid of a bomb!

[Held]

11-Mar-2024: All eyes on GQG co-founder Rajiv Jain; $300 million block tipped (afr.com)

AFR Street Talk article, by Sarah Thompson, Kanika Sood and Emma Rapaport, Mar 11, 2024 – 12.25pm.

This is an interesting AFR "Street Talk" article in that it is painting the GQG co-founder and CIO Rajiv Jain, who’s sitting on 68.8 per cent – or $4.5 billion worth – of the fund manager, as being willing to sell down to give them a shot at the ASX200 Index. He would potentially sell up to 5% of his position and if GQG is subsequently included in the S&P/ASX200, that would potentially "open the floodgates for passive funds which have a mandate to track the index."

Rajiv Jain, CIO of GQG. Arsineh Houspian

Excerpt:

It appears Pacific Current Group’s $257 million block trade in GQG Partners on Thursday was the tip of the iceberg.

Street Talk can reveal investment banks are elbows-out ahead of a potential selldown from GQG co-founder and CIO Rajiv Jain, who’s sitting on 68.8 per cent – or $4.5 billion worth – of the fund manager.

Sources reckon Jain would look to sell about 5 per cent of his stake to give GQG a shot at being included in the ASX 200. In turn, that would open the floodgates for passive funds which have a mandate to track the index.

Macquarie Capital’s desk, in particular, was sniffing out interest among fund managers on Friday. UBS and Goldman Sachs, which helped float the company in late 2021, are also expected to pitch for the lucrative trade.

Jain co-founded GQG in 2016, after 21-years at Vontobel Asset Management. Funds under management stood at $US137.5 billion ($207.6 billion) as of February 29, while GQG stock has risen 50 per cent over the past 12-months.

The firm’s $5.91 billion float meant Jain’s stake dropped from 86 per cent to 68.8 per cent. As is customary, his shareholding was escrowed until after GQG’s half-year results to June 2022 were published. That was 18-months ago, but he’s yet to sell a single share.

GQG sold shares at $2 apiece in its IPO bookbuild and the stock has only just returned to similar levels this year, after trading as low as $1.24 a share. Pacific Current’s selldown, on Thursday, was done via UBS at $2.16 a share or a 3.6 per cent discount to the last close.

--- ends ---

The rationale is that Index inclusion is based on the market cap, but "free float adjusted" so shares held by founders and other insiders as well as long-term "Subs" are not included for the purposes of index inclusion criteria - the largest shareholder selling down in this way (as described above) has the potential of increasing the free float and giving them a better chance of index inclusion.

Disc: I do not hold PAC or GQG shares.

So this is less about GQG's latest FUM update than it is about a single line buried in the commentary. In it they note positions in their portfolios are significantly different now compared to three months ago, in particular two of their portfolios "are now overweight in the information technology sector".

A bit of background here. GQG is a genuinely active fund manager - as opposed to pseudo one that charges active fees while hugging the index. They were lauded for nailing the timing of transitioning from IT to energy in late 2021/early 2022. Fortuitous? Brilliant? Somewhere in between? I dunno, but I do know that a lot has gone right for them having grown FUM from nil in 2016 to approaching US$100B today. They are going to have caught some breaks along the way, but can I put all of that or even most of that down to luck, especially at a time that most of their competitors are going in the other direction? Nup - they're doing something right.

So does April mark the month we're now fully risk off and off to the races? It'd be nice but probably not. Still, it's some affirmation the worst may be behind us and prospects for growth companies may be on the improve.

A summary of GQG's FUM history is shown below. Prior to listing the breakdown between net flows and performance were erratic and sometimes absent. Since listing they've updated FUM monthly and given the breakdown at least quarterly and sometimes more regularly.

[Held]

@Noddy74 i think that hits the nail on the head there, also assisted by the implosion of the others especially Magellan. Not sure they will repeat the increase in FUM given so many in the space now - they were helped by advisers given you can access the fund through as many avenues as magellan - active etf and on every investment platform.

Having reviewed the GQG fund i think it’s an all star fund manager and that i can only imagine it will be a time when Rajiv does get it wrong and faces some heat. Pivoting 35% of the fund into gas/oil/coal within a month for what was meant to be a ‘quality GARP’ fund was masterful at the start of 2022 - something many of the competitors with that style would never do - also make you wonder about what the strategy actually is too.

The increased FUM though now should see that nice operating leverage. Wonder how Pinnacle i’ll go now that hyperion (was the bull of FUM) is also struggling.

Interesting article in the AFR (behind paywall) on 2022: The year funds management ate itself. I've put this straw in the GQG stable but it lists any number of other funds management companies (Magellan, Perpetual, Pendal etc.).

I thought this was a really interesting graphic:

A few observations:

- Magellan and GQG aside, active fund managers have been experiencing structural net outflows since about 2017.

- It really brings home just how quickly the tide turned for Magellan. Print this graph in mid-2021 and Magellan would be be an absolute star. In 18 months they have gone from hero to zero.

- It brings home how exceptional GQG's performance has been. It is the only one to consistently have net inflows, and it has done so at different points in the cyclical cycle.

I suspect GQG's ability to record inflows comes down to two things:

- Performance under Rajiv Jain has grown FUM organically

- The lowest management fees of any of its competitors (sub-0.5%) has kept passive strategies at bay.

[Holding GQG]

GQG announced half year numbers today for the first time since listing. Given it reports FUM monthly and generates almost all revenue from a very stable management fee, the top line growth of around 21% YoY was well telegraphed. NPAT was down 14% but that too was expected given it didn't previously pay tax in the US and now must do so as a result of a change in it's status following listing.

Inflows were above prospectus forecasts, which helped offset the performance miss due to general market conditions. Although GQG weren't immune to the downturn they were early to pivot to energy, consumer non-discretionary, materials and health.

This has led to some impressive outperformance versus benchmarks. The graphs below show all four strategies have outperformed their benchmarks versus 1, 3 and 5 year timeframes.

Institutional inflows were not particularly strong so that's a watch to see if that's just the current trading environment or something more structural. Other than that they're just getting on with it and paying out 90% of profits as dividends (unfranked).

I hold IRL only.