Pinned straw:

Yeah @pubenvelope I did comment on that earlier here (https://strawman.com/forums/topic/10402#post-31726) this afternoon, posting that just as the market closed I think it was. It's under "CYL instead of "GNG" because I had commented on GNG rising up to $2.92 this arvo in my post about CYL (Catalyst Metals) rising on drilling results and continuing drilling newsflow to come, so I thought I'd tack on the extra post about the ASX's Query Letter there as well.

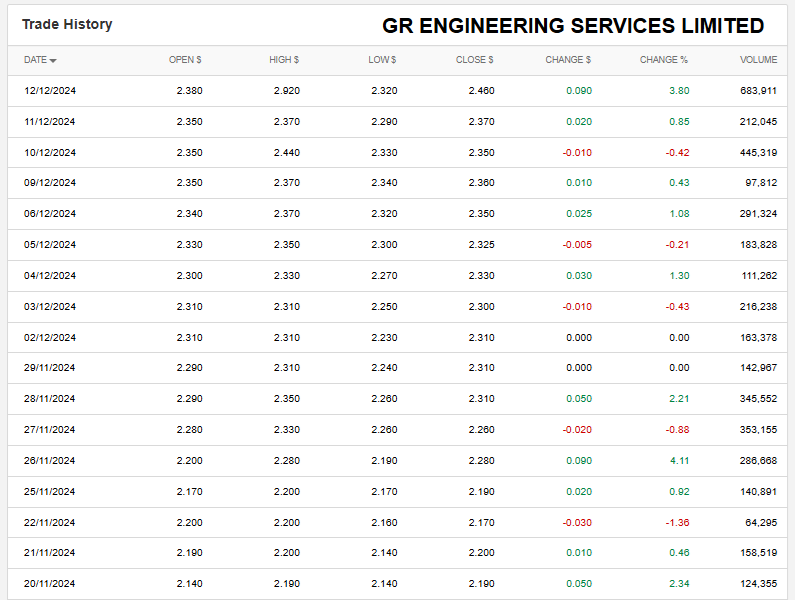

Something to keep in mind, as I mentioned there, is the low liquidity, so while volume was up, it wasn't crazy-high, like they traded 684,000 shares today for a total traded dollar value of $1.7 million, and that is 3 times what they traded yesterday, about 35% up on Tuesday's volume, and so on. It wasn't shooting the lights out high.

Daily traded volume is in the far right column, dates are in the left side column.

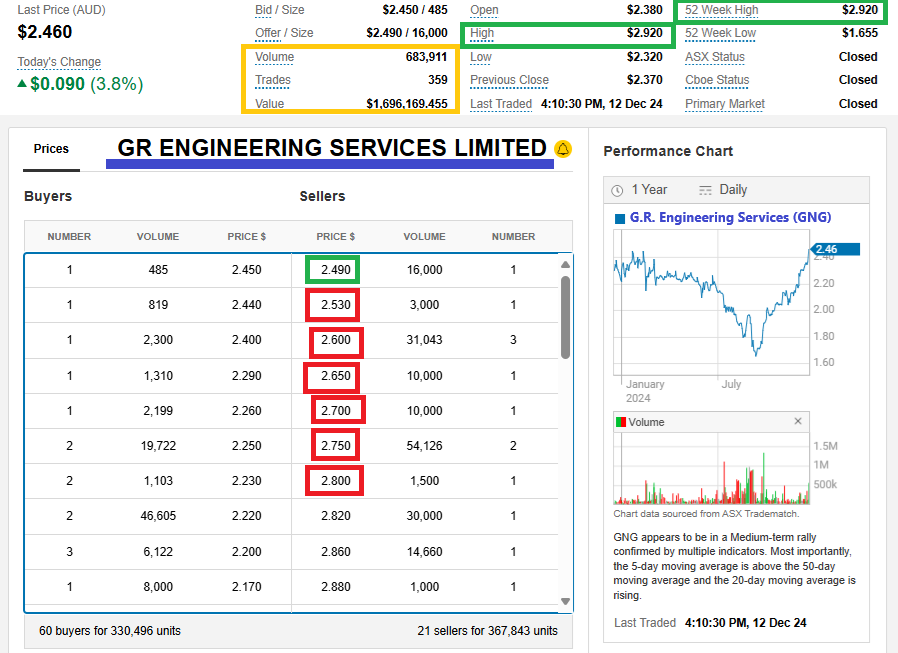

Here's how GNG ended today after the CSPA at 4:10pm:

[Note their intraday high of $2.92 became their new 52 week high as highlighted by the green boxes, below right]

If that was the spread during the trading day (instead of after the close) and somebody placed one buy trade "At Market" (meaning without a limit price) for 71,000 shares (worth around $188 K), that would take the price up to $2.75. If the buy was instead for 127,000 shares (not 71,000), the new last traded price would be $2.82.

Even buying just 19,001 shares would take the price from $2.46 (last traded price) up to $2.60.

And an "At Market" sell for just 7,200 shares would take the share price down to $2.25 based on that spread.

I can't know for sure, but I'd bet that's what happened; somebody placed an "at market" buy order without checking the buy/sell spread, specifically the offer price points and volume (the Sellers, how much they were selling, and what they wanted to sell for). That explains why it spiked up suddenly taking out a bunch of sellers at different price points, and then came back down almost as quickly. It certainly generated some FOMO interest, but as the sellers stepped up to take advantage of a share price above $2.50 the trading slowed down considerably and they closed up +3.8% instead of +23.2% which is what they would have been up if they had held on to that intraday high of $2.92. Which was never going to happen of course.

You have to set limit prices with these low liquidity companies!

There are two other possibilities of course. One is that somebody is trying to accumulate a decent stake, but the volume traded and the fact that the share price came back down so fast suggests this was a mistake not an intentional strategy. The other possibility is that somebody is trying to generate interest in the company and suggest that it's either in play or is in demand, but if that's the plan, it's fairly clumsy and not too convincing, so I think the most likely cause was an order placed "At Market" instead of "At Limit".

Below the one year GNG share price line graph above, on the right, you can view the daily volume bar graph of GNG shares traded over the last year (the red and green vertical bars), and you can see they've traded over a million shares on two days, been up to a million on another two, and have traded over 500,000 (half a million) shares on more than 20 days over the past 12 months, so today's volume of 683,911 shares isn't out of the ordinary for GNG; it's a solid day; it's more than what they usually trade, sure, but they've traded greater volume on more than a dozen other days in the past year.

Anyway, it had me interested, as I do hold GNG shares, and I like the company a lot.