Pinned straw:

Yeah, I've been lazy on these types of stocks. WES, TLS, BHP, and CBA have all done well for me, but they are part of a dividend portfolio that is past its use-by date--now these are mainly stub holdings. The major focus for me is quality growth stories, given the time I now have to analyse and invest in them. It's hard to see any of the above generating eye-catching returns over the next 10 years. I'll use the next result season to reallocate and take the tax hit. so be it.

It's a bit of a shame that what was once one of the world's best engineering companies has to hire a bunch of management consultants to roll out what will probably not amount to more than a new chat bot for customer service. But if you take a look at the board you can see that Telstra is no longer powered for engineering, it's just a directionless infrastructure business with a poor retail experience tacked on.

@Strawman perhaps this might be the one thing that turns the business around. It would certainly be the exception after more than a decade of declining performance! ;)

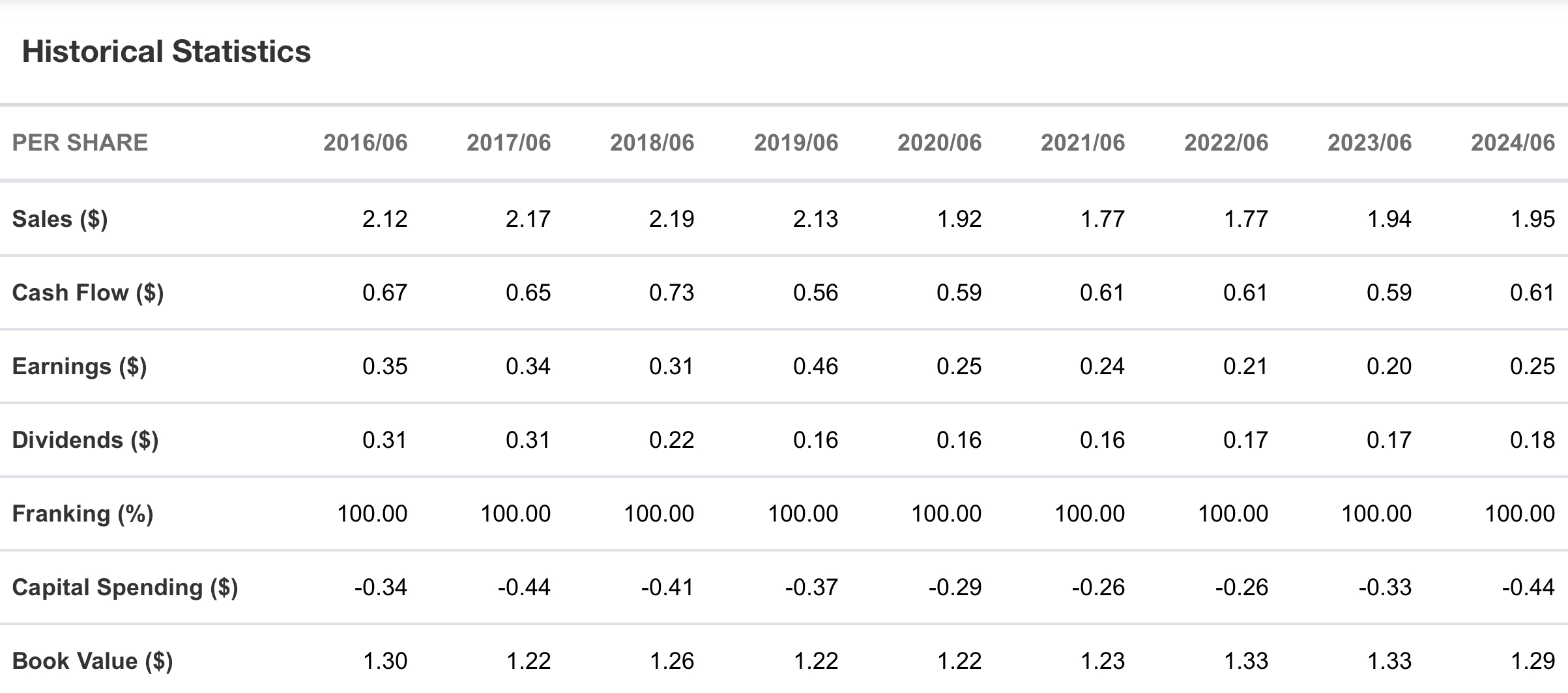

The metrics speak for themselves. Over 10 years all these metrics have declined:

- Revenue

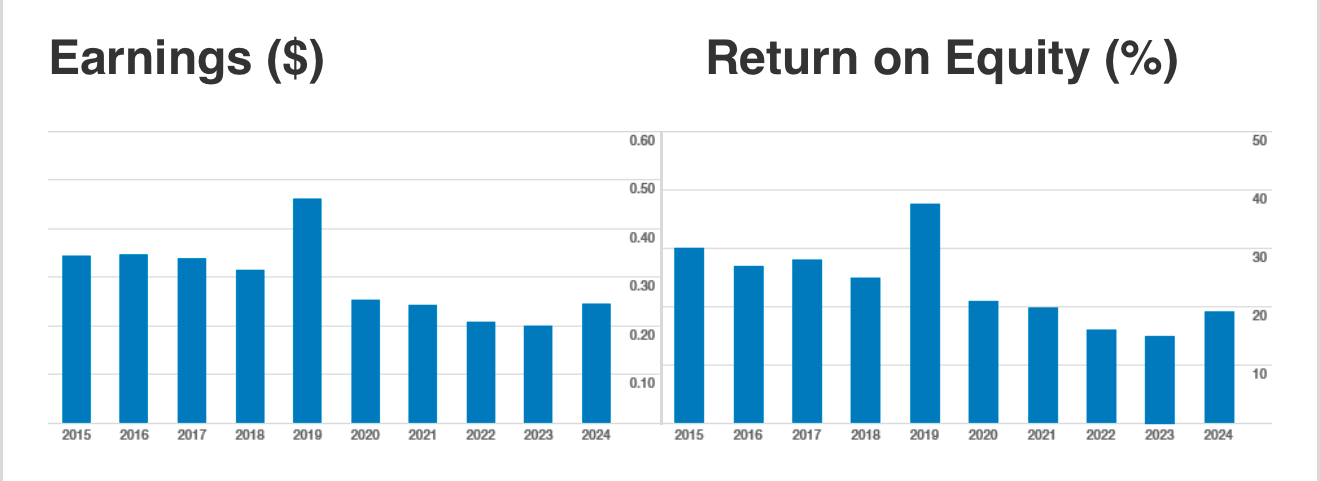

- Earnings

- Cashflow

- Dividends

- Book value

- ROE

- ROC

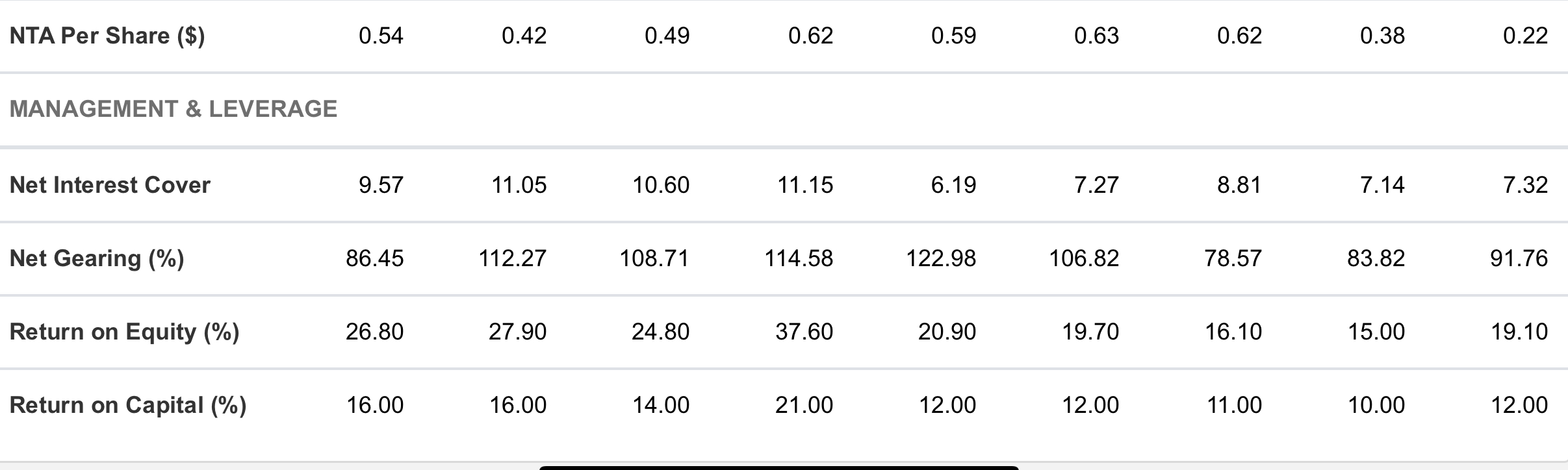

There is one metric that has increased from 10 years ago,

- Net gearing! :D