30-Jan-2024: One of my largest real life positions - my second largest across my largest two real money portfolios, Genesis Minerals (GMD) - which is held in both of them - made another 12-month (52 Week) high (share price) today. It could be considered an all-time high also, as while the share price chart does show a spike up above these levels briefly back in 2011 and again even further back in 2008, they were a very different company back then with different management and those spikes were immediately followed by drops to below $1/share in both 2008 and 2011. Now, with Raleigh Finlayson running the company, we don't see that sort of volatility in the share price, just a nice uptrend:

And what an uptrend it's been. I trimmed another 2,000 GMD shares this morning from my largest portfolio - to free up another $6 K - but still hold 10,000 GMD in that one and another 20,000 GMD in my super (SMSF) which is limited to ASX300 companies and is currently heavily skewed to Aussie gold producers.

Here's a snapshot of the shares portion of my SMSF portfolio as of last night:

My ex-300 companies plus more GMD and RMS and AEL are held within my other larger portfolio outside of super.

The market certainly views Genesis (GMD) as a growth company now - here is their latest quarterly report:

16/01/2025 8:17 am AEDT : Quarterly Activities Report - December 2024

Some highlights:

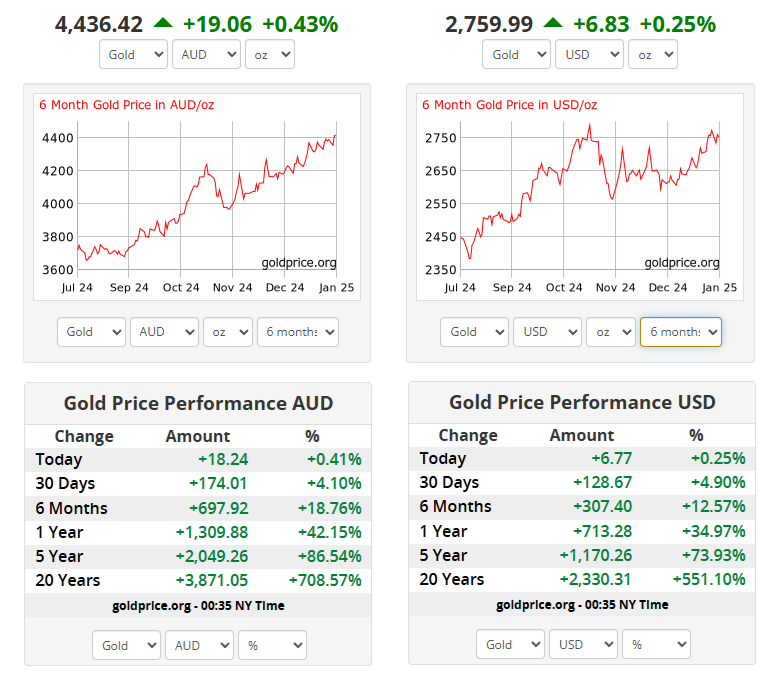

- December quarter production of 57,055oz at an all-in sustaining cost (AISC) of A$2,202/oz. With costs reducing over the next 4 years to closer to A$1,600/oz. The A$ gold price is now over $4,400/oz (see chart below).

- Cash generation was robust. Gold sales of 49,643oz underpinned revenues of A$200.9 million, allowing Genesis to grow its cash and equivalents to A$237.5 million at quarter-end. This was up $59.9 million from last quarter (A$177.6 million).

- During the quarter, Genesis brought forward the re-start of the Laverton mill to October 2024, six months earlier than flagged in the March 2024 Five-year Plan. This resulted in an increase in the FY25 production outlook to 190 - 210,000oz (from 162 - 188,000oz) at an AISC of A$2,200 - 2,400/oz (from A$2,250 - 2,450/oz).

- With the Laverton mill already running at 3.0Mtpa nameplate, Genesis has 4.4Mtpa processing capacity from two mills at the one production centre. With record December half production of 93,075oz at an AISC of A$2,383/oz Genesis is on track to meet upgraded guidance.

- As planned, Gwalia stoping progresses through a selective, lower grade portion of the mine schedule in the current March quarter, before the next lower cost bulk stope comes online in the June quarter. So we can expect grades to drop in the current quarter after rising in the December quarter, but Gwalia will return to higher gold grades in the June quarter this year. Gold mined at Gwalia underground for the December quarter was 35.3koz at 6.0g/t vs. the September quarter which produced 29.9koz at 5.0g/t. Remember that Gwalia underground is now 2km deep (vertical depth), so one of the deepest producing gold mines in the world, and by far the deepest in Australia, so it takes some time to get that ore to surface for milling, however Gwalia underground is not where Genesis' main growth is going to come from.

- At Ulysses underground, stoping successfully commenced late in the December quarter following the completion of escapeway installations, ahead of schedule. Ore production totalled 3.5koz mined at 3.4g/t (September quarter 2.7koz at 3.2g/t). Ulysses is ramping up, and will be significant for them in the future.

- The Leonora mill processed 349kt at 4.1g/t (September quarter 345kt at 3.5g/t) with a metallurgical recovery of 93.8% (September quarter 93.1%). Building on the processing rates accomplished in August and September 2024, the Leonora mill achieved a full half year of delivery at nameplate capacity of 1.4Mtpa being the first time since 2015 that the mill has been fully utilised. Importantly, grades increased and recoveries did also (vs the previous quarter).

I won't go on - it's all in their quarterly report. Point is, Raleigh is delivering on his promises, as he did with Saracen previously.

And they have a nice tailwind with the Aussie gold price STILL being on a tear:

Aussie gold prices on the left, US$ gold prices on the right.

Source: https://goldprice.org/

Yep, investment thesis is still on track.

Disc: Holding.

Further Info: Excerpts from quarterly report:

Ulysses Underground:

Leonora Mill (formerly known as the Gwalia Mill when it was owned by St Barbara - SBM):

The following is just one example of future growth with Genesis:

And their current Hedging situation:

Plenty of flexibility through the use of collars and put options, with minimal forward sales of just 13,500 ounces of gold in total.

Lots to like about GMD!