Discl: Held IRL

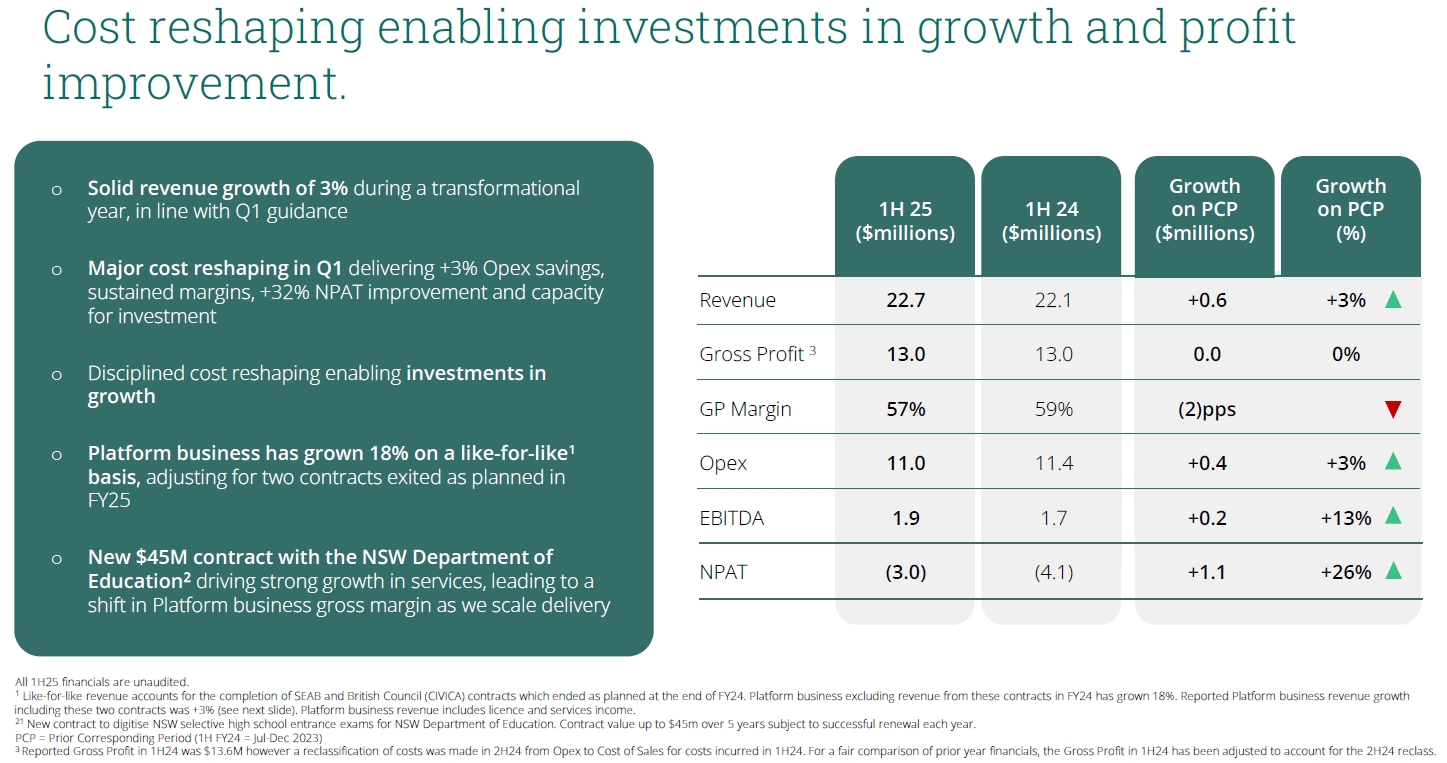

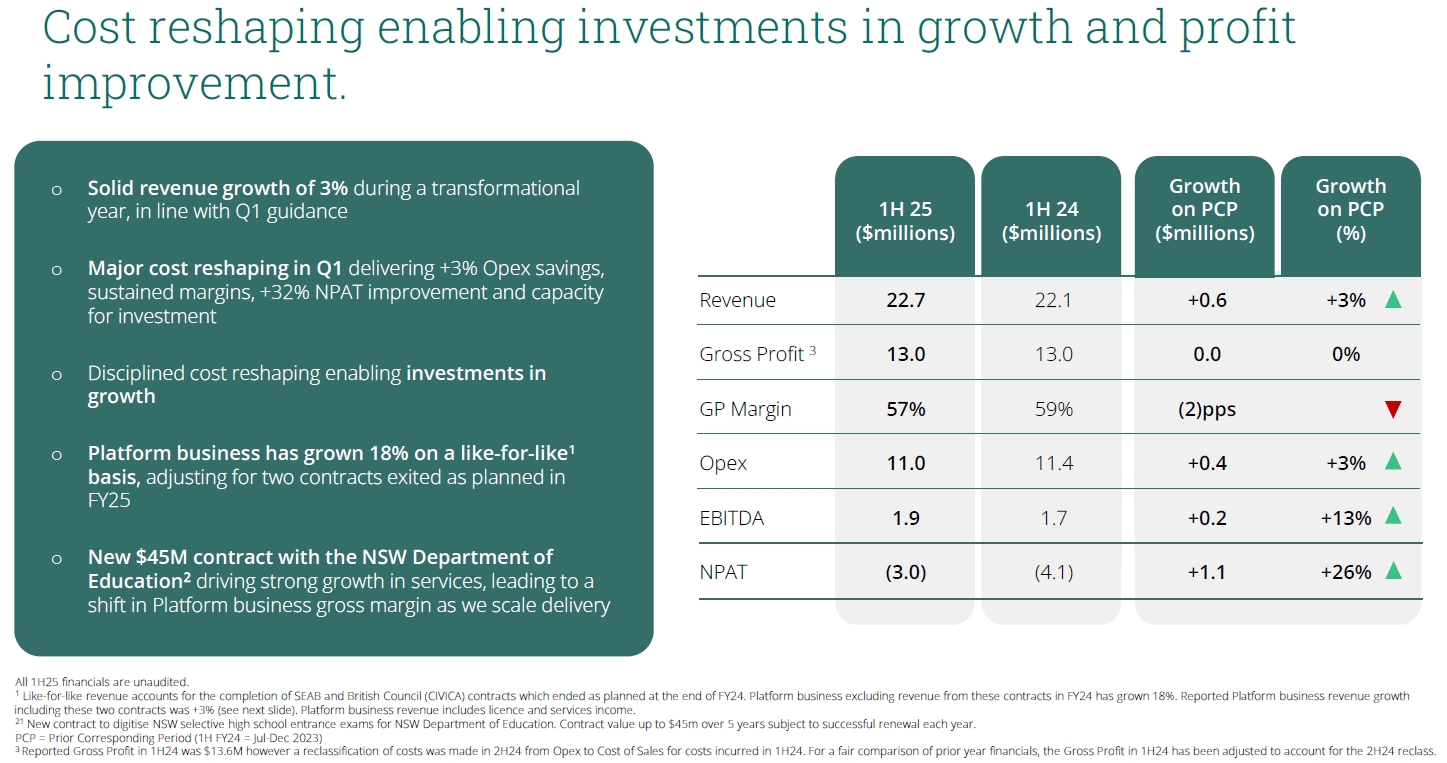

In Year 1 of its “Transformational”, go-back-to-basics year, JAN's 1HFY25 financial results were decent against this context - sustained revenue, GP, EBITDA and better NPAT - running while chewing gum, essentially.

Need to work through the Appendix 4D to work through how cost “reshaping” has changed the cost base - quite hard to see from these high-level numbers.

1 new contract - Australian Christian College, unlikely to be material in value - but its a start.

Management is doing what it said it would, under-the-hood, to get back to the basics in JAN’s core competence of the Assessments Platform:

- Reshape the cost base

- Build AI capabilities - operating, now in trial mode with customers

- Improve business operating processes to improve operating efficiency

- Restructure the organisation and bring in the key Executives - CTO, Chief Growth Office and new Board Member have come onboard very recently/about to come onboard

- Refocus and rebuild sales pipeline

- Continue to deliver against existing contracts including the new NSW DoE contract

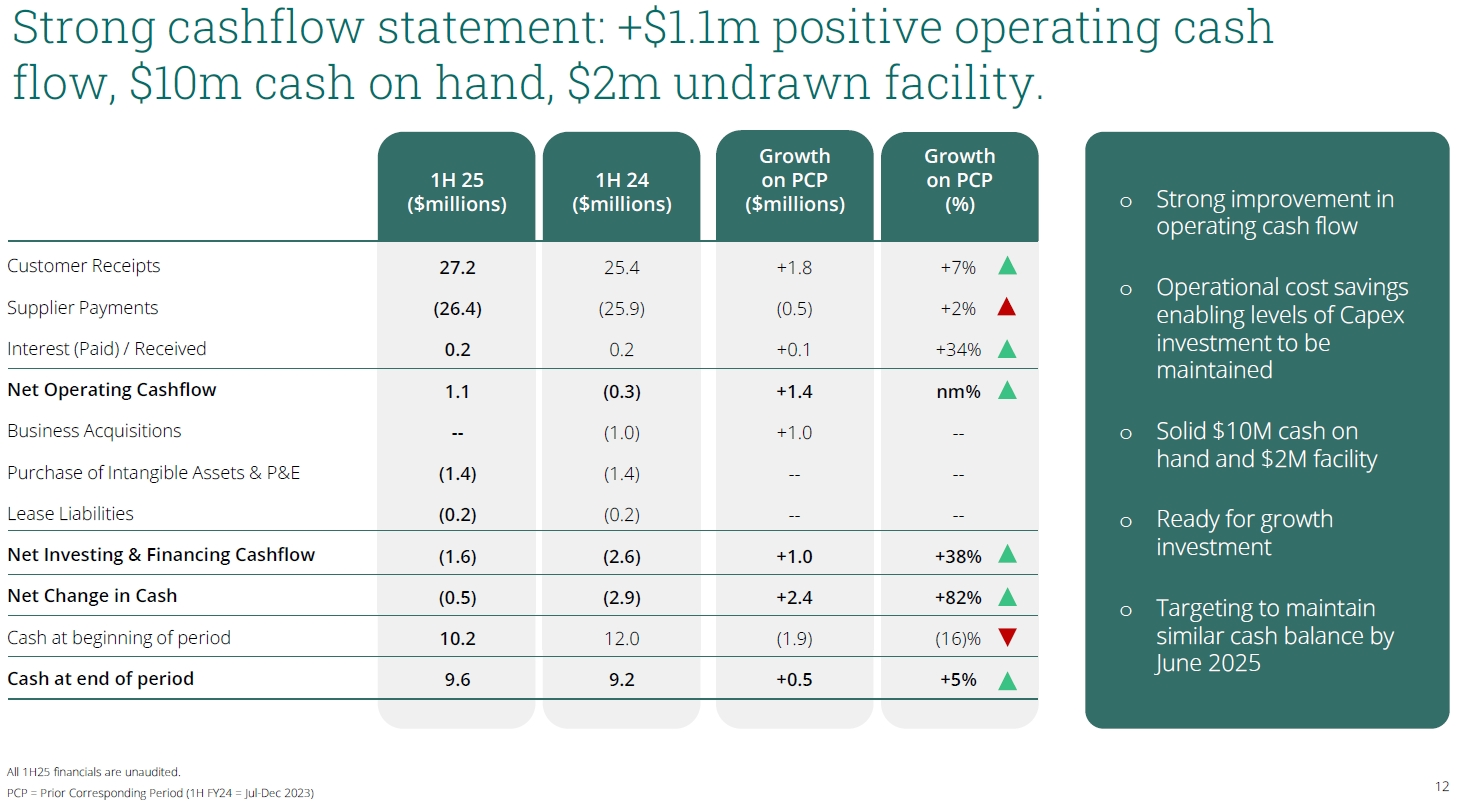

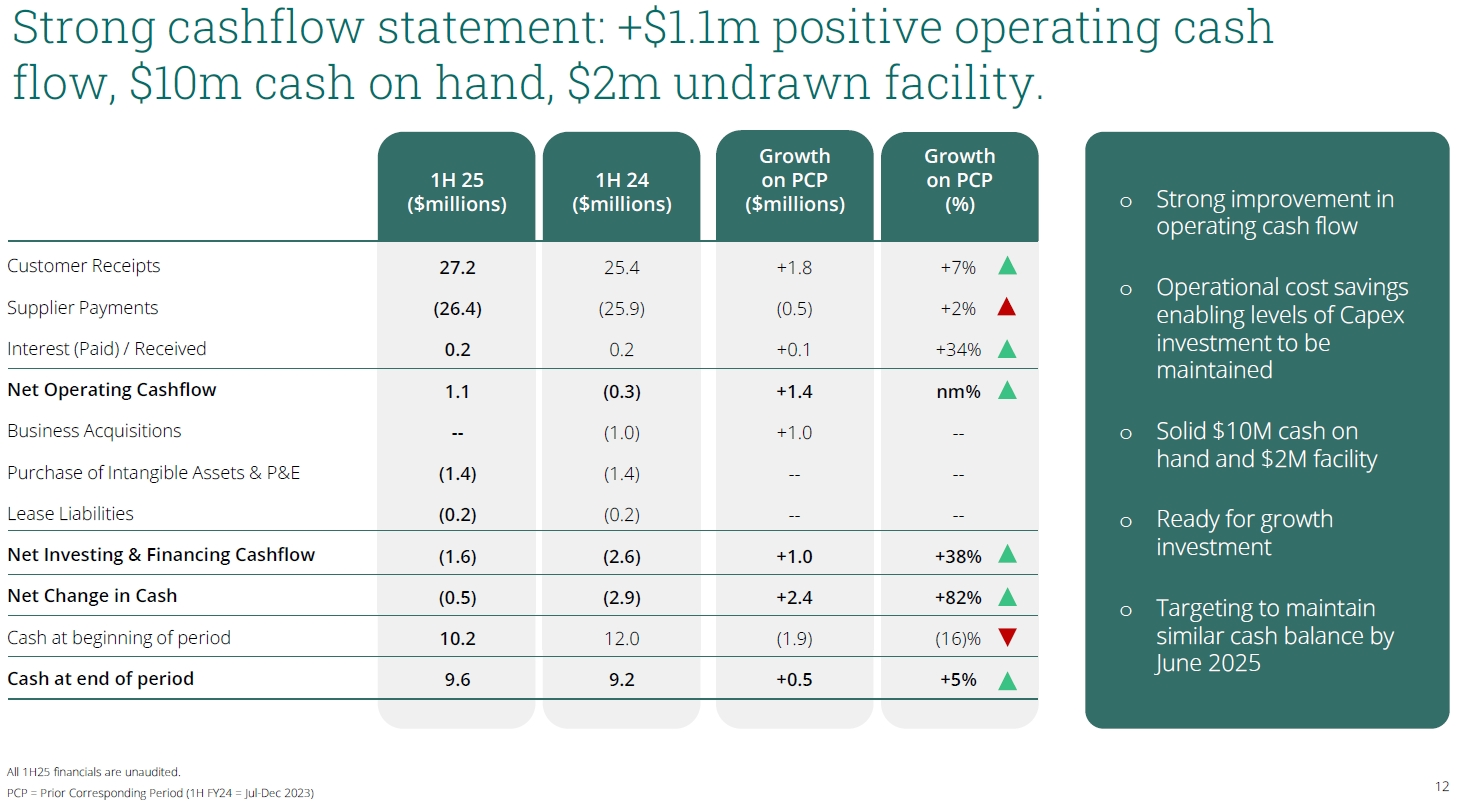

These actions, together with +$1.1m positive operating cashflow, $10m cash on hand and $2m undrawn facility, sets JAN up nicely for growth investment vs the market opportunity assessment digitisation

Ingredients for the next phase of growth are almost fully in place, the actual cooking is happening, but there is no food on the table just yet.

Need to give management time and have a lot of patience for these efforts to transform into revenue growth - market reaction yesterday (up ~8%) and recent increase in funds shareholding (see earlier post) suggests that JAN has shareholder support and appetite for this. But like everyone else, really need to see this growth ambition translated to real financial growth.

No burning reason to exit now as JAN is well into the turnaround, but I also have no immediate full-on strong conviction to top up now either as my portfolio allocation for JAN feels about right.

Hold and reassess in the next 6M