Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Market Cap $72.77m at $0.28 per share

Board Bio's

Kathleen Bailey-Lord - Chair

Kathleen is an experienced independent company director and business advisor. She is passionate about the opportunities for business and society to “build back better”. She believes that together, people and technology can make the world a better place – with conscious decision-making and effective governance.

As a senior executive Kathleen has enjoyed a career at the forefront of transformational change within a wide range of industries across Australasia and Asia. This includes leading businesses in technology (IBM), professional services (Law and Accounting) and Financial Services (ANZ Bank, Fordham Group). Blending strategy and pragmatism, Kathleen is known for her curiosity, optimism and eye to the future. Kathleen enjoys nudging enterprises forward to embrace the opportunities of today to build value for all stakeholders.

Kathleen is a Fellow of the Australian Institute of Company Directors (AICD), as well as a member of the AICD Victorian Council and the AICD Governance of Innovation and Technology Panel. She is an active member of Chief Executive Women and currently serves on the boards of Alinta Energy, QBE Insurance (Auspac), Melbourne Water Corporation and Monash College. Her past boards include Bank of Queensland (BOQ), Trinity College at the University of Melbourne and Australian Government Solicitor (AGS).

Wayne Houlden - Director of AI Research & Vice Chair

Wayne Houlden founded Janison Education Group Ltd in 1998 and is regarded as a market shaper and thought leader internationally in education technology. Since the earliest days of the World Wide Web, he created solutions that continue to transform how education is delivered in Australia and beyond.

His award-winning national education portals, learning management systems and digital assessment platforms are now used in more than 100 countries and have been repeatedly recognised by tech giants including Google and Microsoft.

Wayne was instrumental in winning and delivering world-first national schools assessment projects in Australia, national exams for the Singapore Examinations Assessment Board (SEAB) and, more recently, partnership with the OECD to deliver its PISA-Based Test for Schools internationally.

Wayne has a global vision for Janison and has strong relationships in the education technology industry and edtech investment community around the world. His focus is now on developing Janison’s AI capabilities, as well as building our brand’s strategic partnerships, and mentoring and supporting the Janison executive team.

He is also a fund advisor for Europe’s leading edtech investment group, Emerge Education.

Allison Doorbar - Non-Executive Director

Allison is Managing Partner at EduWorld, a company that provides market research and strategic consulting services to the education sector. She has spent most of her career working with education providers globally helping them to develop and implement their marketing strategies. This includes working with many of the World’s leading universities, major global providers as well as many government departments and agencies.

Jodie Baker - Non-Executive Director

Jodie is a Non-Executive Director with 30+ years’ experience banking, funds management and stockbroking. She is currently on the board of Beyond Bank, where she chairs the Risk Committee and CareFlight, where she chairs the Audit and Risk Committee. She was formerly on the boards of Export Finance Australia, Percussion Australia, and Disability Sports Australia where she chaired the Audit and Risk Committees, as well as Spaceship Superannuation and Financial Executives Institute.

During her executive career, Jodie’s roles included Managing Partner of Blackhall & Pearl, a board, risk, and governance advisory firm; CEO and Managing Director of a fintech business Morgij Analytics; and senior executive credit and risk roles at ANZ, Société Générale and BT Financial Group. Earlier in her career, Jodie worked in front line and credit roles at Westpac, Macquarie Bank and Bankers Trust Australia.

She holds a Bachelor of Commerce from University of Western Australia and is Trustee Fellow of the Association of Superannuation Funds Australia and a Graduate of the Australian Institute of Company Directors.

Stephe Wilks - Non-Executive Director

Stephe Wilks is a lawyer, technologist, and an experienced company director with a long record of leading successful global technology companies in high growth and disruptive industries. He has guided several Australian and international telecommunications and technology companies, including as Regional Director (Asia and Japan) Regulatory Affairs for BT Asia Pacific, Managing Director of XYZed Pty Ltd (an Optus company where Stephe developed and managed Australia’s first competitive broadband wholesaler), Chief Operating Officer of both Nextgen Networks and Personal Broadband Australia, and as Consulting Director of NM Rothschild and Sons. He has held numerous non-executive director and non-executive chair roles in both ASX Listed and private companies.

The recording for today's chat is now on the meetings page and you can view the transcript here: JAN Transcript.pdf

My initial thoughts: this is a business which has doubled revenues in the past 5 years.. but much of that has been diluted through many capital raises, and for which they have never managed a sustainable profit. Sujata is clearly tasked with turning this around, and seems to be making some early progress, but the operating margins are still razor thin, there's at least another year's worth of investment needed.

I think it's important to understand that this is really a services business more than a technology business. The sales cycles are long, and a lot of customisation is required for each client.

I'm sounding negative, but there is clearly a big opportunity and it's entirely possible a leaner more focused business can emerge and deliver sustainable and strong profit growth. I'd just want to see a bit more evidence of traction and improving financials before I was more interested.

Here's the I summary of the meeting:

Janison Education Group (ASX: JAN) — CEO Interview Summary

1. Company Overview

- Business Model: Janison builds and operates digital assessment platforms used by schools, governments, and corporates worldwide.

- Core Products & Services:

- Platform — end-to-end assessment delivery (authoring, rendering, marking, results, analytics).

- Products — proprietary assessments like ICAS (school competitions) and AAS (scholarship & placement tests).

- Scale:

- Runs NAPLAN online for 1.3M Australian students across 10,000 schools.

- Presence in 117 countries with ~7M assessments delivered in the past year.

- Average platform client generates >$1M annual revenue.

2. Market Opportunity

- Global TAM: Estimated US$27B digital assessment market by 2032, growing 10–12% CAGR.

- Strategic Focus:

- Maintain leadership in Australia & NZ.

- Expand globally, particularly APAC, UK, and adjacent regions.

- Leverage partnerships to enter new geographies without overextending resources.

3. Competitive Advantages

- Robust Technology:

- Scalable infrastructure proven under heavy loads (e.g., NAPLAN’s 500k concurrent users).

- High security, accessibility, and offline capabilities.

- Partnership Model:

- Unlike pure SaaS providers, Janison co-designs solutions with clients, especially government departments.

- Extremely high retention — virtually no customer churn.

- Agility:

- Smaller, more responsive than large competitors.

- Domain Expertise:

- Deep understanding of assessment standards, security, and reliability.

- Founder Wayne Holden now leads AI research, blending tech with assessment expertise.

4. AI Strategy — “JA” Platform

- Launched FY25 in 10 months — a key growth initiative.

- Functionality: Generates high-quality assessment items using proprietary datasets trained on decades of ICAS material.

- Benefits Delivered:

- 50% reduction in item development costs.

- 5× productivity gain in question creation.

- 5% improvement in margins for ICAS and similar products.

- Customer case study: 70% reduction in assessment creation time, 90% acceptance of AI-generated items.

- Differentiation:

- AI-powered but domain-specific and tool-agnostic.

- Designed as an “AI team member”, not a black-box tool.

5. Revenue Model & Growth Dynamics

- Platform Revenue:

- Predominantly B2G contracts — large, competitive tenders (e.g., NZ Ministry of Education).

- Contracts average 3–5 years with scope for upsell (e.g., new assessments, services).

- Products Revenue:

- ICAS and AAS delivered directly to schools and increasingly direct-to-parent (B2C shift).

- Sales Cycles:

- Enterprise contracts have 12–18 month cycles.

- Growth tends to be lumpy, stepwise, not linear, but sticky once secured.

- Pipeline Strength:

- FY25 pipeline grew 80% YoY.

- ~$25M–$30M active opportunities, ~30%+ conversion probability.

6. Transformation Under New Leadership

- Sujata Stead (CEO since ~2024):

- 20+ years in international education & assessment.

- Previously grew Cambridge Boxhill’s OET product to global market leadership.

- Strategic Priorities (FY25–26):

- Sharpen Focus — prioritising the platform and two core products.

- Build Capability — refreshed executive team from companies like SiteMinder, Pearson, and 3P Learning.

- Invest in Innovation — heavy AI investment while remaining self-funded.

- Drive Operational Excellence — standardisation, efficiency, and scalability.

7. Culture & Execution Strength

- Collaborative Culture: Described as “hungry, humble, and smart”.

- Resilience in Action:

- Example: After crowd management issues led to cancellations at three large Sydney exam venues, Janison reorganised 20,000 tests in just two weeks — a task that normally takes months.

- Customer-Centricity:

- High-touch partnerships underpin retention and long-term growth.

8. Medium-Term Vision (to 2029)

- Financial Goals:

- Accelerate revenue growth while expanding EBITDA margins.

- Market Position:

- Become synonymous with digital assessment delivery in Australia, NZ, APAC, and UK.

- Diversify customer base and revenue streams globally.

- Brand Aspiration:

- Recognised as a market leader in digital assessment technology, combining tech excellence + domain expertise + customer partnership.

9. Key Investor Takeaways

- Sticky, High-Value Contracts: Long-term B2G deals averaging >$1M ARR per client.

- Global Expansion Potential: Large TAM with early international wins (e.g., NZ Ministry).

- AI as a Differentiator: Proprietary datasets + domain expertise = defensible edge.

- Transformation in Progress: New leadership, tighter focus, stronger execution.

- Short-Term Lumpy, Long-Term Attractive: Expect stepwise growth, but high retention and significant operating leverage over time.

I fully exited my JAN position today which was a 0.57% holding in my portfolio. Rationale:

- I think it was @Bear77 who said in a post maybe a year or so ago, that has stuck in my head, that you should not hang on to a position, however small the $ value of the position is, if there was a better opportunity available

- I do think that the JAN turnaround is in play and that good things should eventually come out of it but vis-a-vis AIM's prospects, my capital is better allocated to AIM

- I hence topped up AIM today @0.75, but only got 25% of what I was after, will get the rest tomorow to fully invest the JAN proceeds

It is a simple capital allocation rule, but one that is not as simple to execute against, particularly as I was resisting the crystallising of the paper loss on JAN.

So, while this will have been a no-brainer decision to many, am happy that I finally took the step to act ... it is another positive step in my investing journey.

Discl: Held IRL

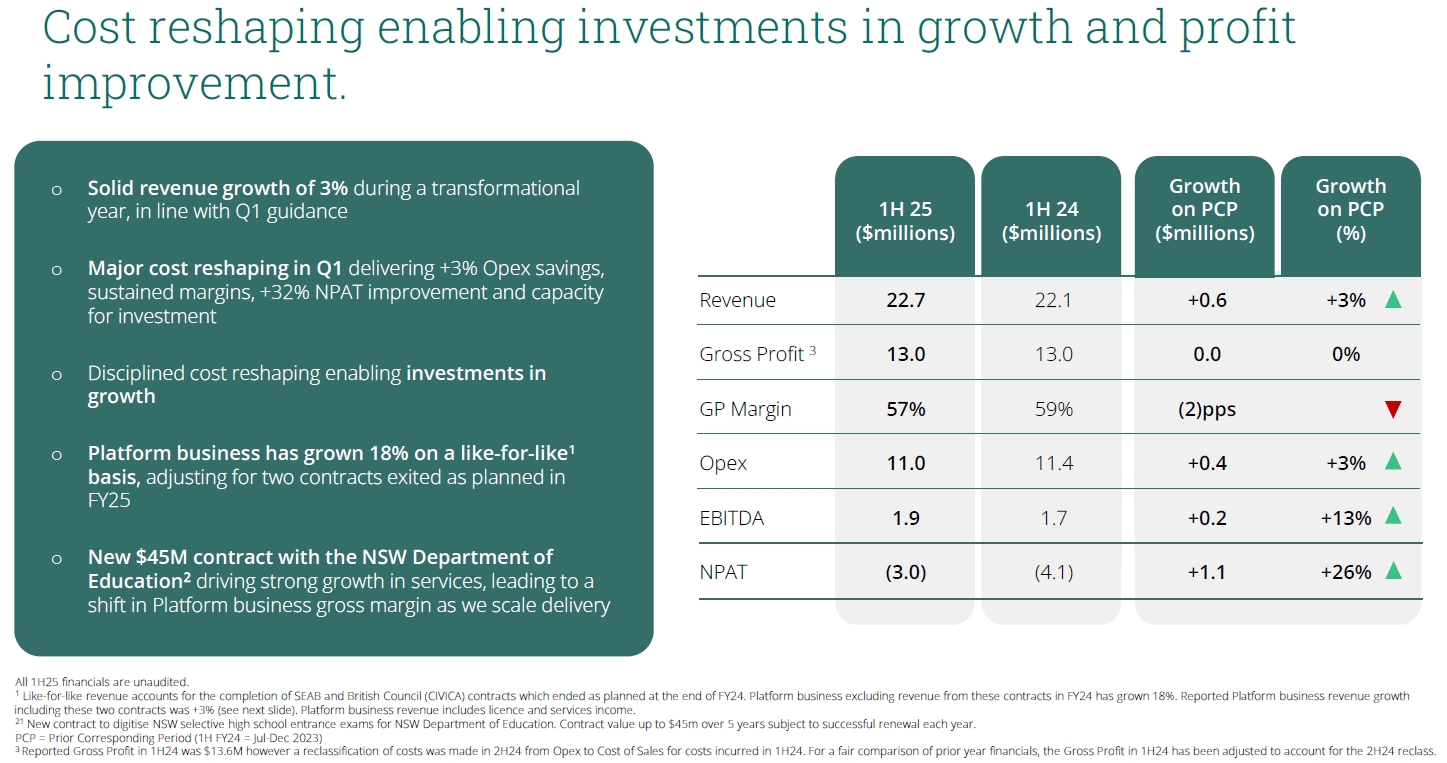

In Year 1 of its “Transformational”, go-back-to-basics year, JAN's 1HFY25 financial results were decent against this context - sustained revenue, GP, EBITDA and better NPAT - running while chewing gum, essentially.

Need to work through the Appendix 4D to work through how cost “reshaping” has changed the cost base - quite hard to see from these high-level numbers.

1 new contract - Australian Christian College, unlikely to be material in value - but its a start.

Management is doing what it said it would, under-the-hood, to get back to the basics in JAN’s core competence of the Assessments Platform:

- Reshape the cost base

- Build AI capabilities - operating, now in trial mode with customers

- Improve business operating processes to improve operating efficiency

- Restructure the organisation and bring in the key Executives - CTO, Chief Growth Office and new Board Member have come onboard very recently/about to come onboard

- Refocus and rebuild sales pipeline

- Continue to deliver against existing contracts including the new NSW DoE contract

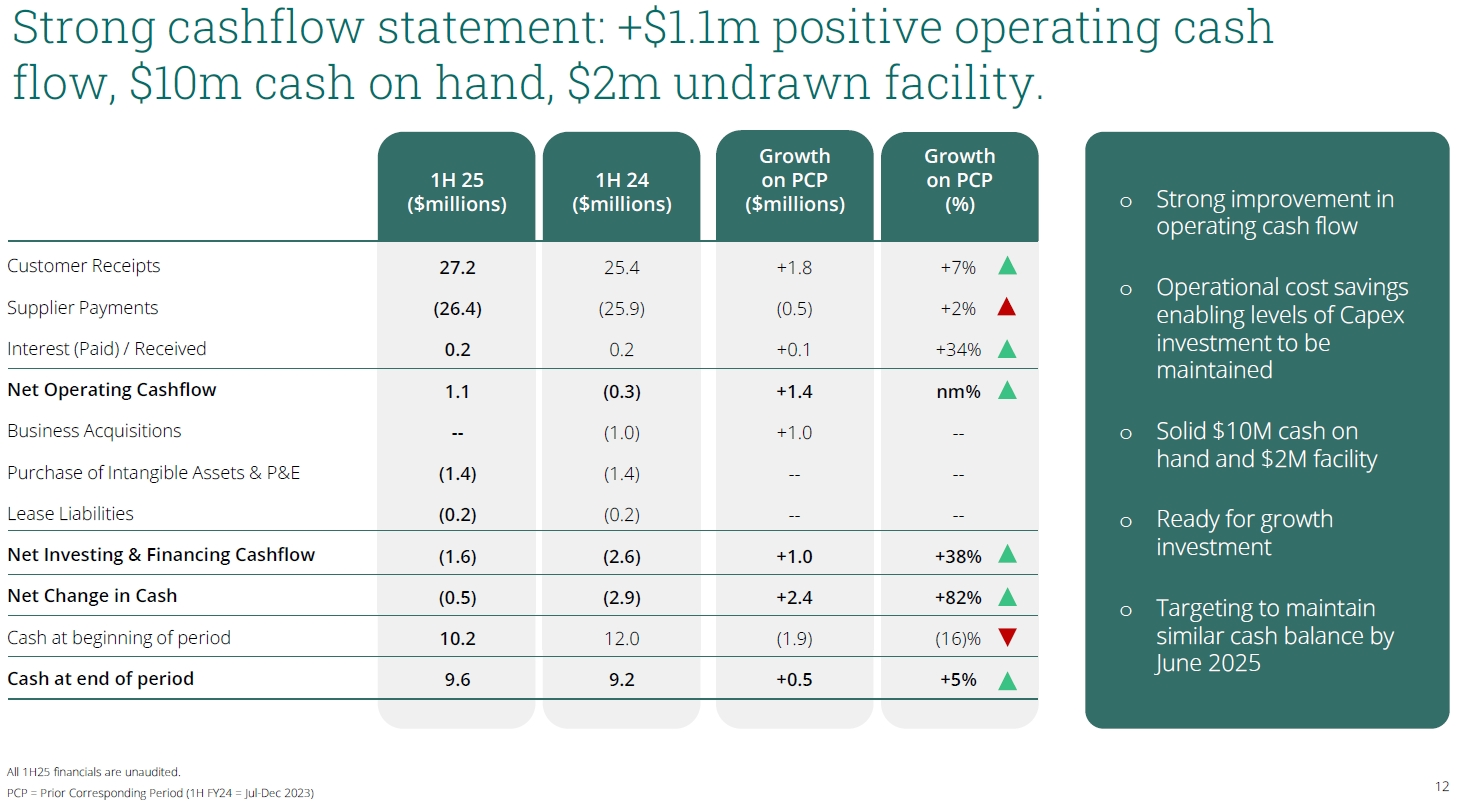

These actions, together with +$1.1m positive operating cashflow, $10m cash on hand and $2m undrawn facility, sets JAN up nicely for growth investment vs the market opportunity assessment digitisation

Ingredients for the next phase of growth are almost fully in place, the actual cooking is happening, but there is no food on the table just yet.

Need to give management time and have a lot of patience for these efforts to transform into revenue growth - market reaction yesterday (up ~8%) and recent increase in funds shareholding (see earlier post) suggests that JAN has shareholder support and appetite for this. But like everyone else, really need to see this growth ambition translated to real financial growth.

No burning reason to exit now as JAN is well into the turnaround, but I also have no immediate full-on strong conviction to top up now either as my portfolio allocation for JAN feels about right.

Hold and reassess in the next 6M

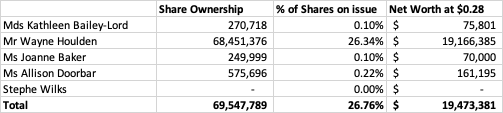

Interesting and pleasing fundie moves in the past week, ahead of the 1HFY2025 results announcements today.

- Ryder Capital increased its stake by 1.17% from 9.76%

- Australian Ethical Investment increased its stake by 3.04% from 8.34%

Attended this morning's call and am working through the results now - the phrase running through my head to sum up the earnings is "running while chewing gum".

It was a decent, solid result in the context of a lot of "going-back-to-basics-under-the-hood" progress. Reminiscent of EML 12-18M ago, EOS 12-18M ago and CAT 3+ years ago ...

From today's price action and these fundie moves, the market seems keen to give Sujata the time and lattitude she needs to work things through - promising from my perspective.

Will posts thoughts later today ...

Discl: Held IRL

Small 0.2%, $31k increase in stake @$0.2207 from W Houlden the founder.

Spare change for him and likely to be a planned signal to the market. But clearly better that he be buying than selling, thats for sure.

Following Aust Ethical adding 1.8% to its stake earlier this week, these are good and welcomed data points on the confidence in the trajectory of the JAN turnaround.

Discl: Held IRL

Have just reviewed the JAN FY2024 AGM slides and my action plan yesterday. Was not planning to post my thoughts as there is probably no interest in JAN, but seems like I may not be the only one planning on giving JAN more runway with this accouncement this morning:

My thoughts from yesterday:

KEY TAKEAWAYS

FY24 was clearly a “holding pattern” year while waiting for Sujata to come onboard.

Pre-FY24, JAN was all over the show, getting into areas outside of its core Janison Assessment Platform and losing focus.

FY25 Strategy has been reviewed and refreshed, org structure changes have mostly been made - at the core of it is the Janison Insights Assessment Platform, which is a world-leading platform in a big ~$21bn growing market for the digital transformation of global education.

Strategy is reinforcing the Assessments Platform as the asset and everything is built around maximising/leveraging that asset - consolidating current capabilities and going back to basics.

POSITIVES

Positive but tentative start to 1QFY25.

The turnaround is under way - what Sujata said she would do has been done and delivered - good start to earning credibility.

The Strategy refresh is underwhelming on the one hand, but the question then is, “what else could be expected” - the main asset is still the Assessment Platform, so going back and making that as the centre of JAN’s universe does make good business sense, even though it comes across as underwhelming.

The NSW DoE contract is a good opportunity to cement the strategy and further enhance the reputation of JAN’s Assessment Platform.

Sujata is under water with her stake at $0.25, so she is absolutely incentivised to grow the business.

Exiting now does not give the strategy and re-focus back to the basics, a chance to work .

The turnaround now has, in place:

- Leadership

- Ownership by Sujata and the Board

- A refreshed strategy with clear goals, aspirations and timelines

- New org structure with renewed sales focus

- Re-focus on the core product, a world class digital assessments platform

- The DoE contract which buys management some time to get new contracts

- Renewed focus on innovation and the adding of new capabilities into the platform - whether it is “AI” or not is really not that important so long as the new capabilities enhance the value of the platform for customers

- EBITDA positive

- Cash on hand

- Increasing push in education to digitise - TAM is still there

Can’t think of any turnaround ingredient that is NOT in place - what is needed is some contract wins to confirm that the refreshed strategy is working.

ACTION

Stay invested for another 6M and see if the revised strategy gains traction as all the ingredients for a successful turnaround appear to be in place. It just needs time now.

Discl: Held IRL

Feeling underwhelmed by the JAN Strategy update.

SUMMARY OF THOUGHTS

On the one hand, it was probably not realistic to expect too much - the platform is world class, but JAN seems to have been sitting on its reputation and current cohort of customers, has been all over the show, lost focus etc.

So, the New CEO is going back to basics, leveraging on the core strength, and actually SELLING JAN to the broader market. Not sure there is anything wrong with this approach - not sure what else she could do really.

There was a lot of use of big buzz phrases, particularly "AI", but there were no specifics as to what this actually meant from a new capability, area to focus efforts on, cost estimates etc.

What was needed, and was conspicuously missing, were clear measurable numbers/targets as to what good looks. That is troubling. I get that Sujata is 4M in the role, but she would have known that shareholders would be clamouring for something tangible to re-focus their investments on. While she has lived and breathed Assessments in her career, I am concerned that this was in a private company setting (OET is what her Linked-In profile says, 11 years+, decent length).

That she did not pro-actively address shareholder anxieties with more specifics could be telling of her lack of experience in a public company environment and the additional expectations management requirements that go with it.

BUT

The platform is still world class, is robust and there are some big contracts already in play and coming into play - there is a decent base to work from.

The actions, while lacking specifics, all make sense - going back to basics, repositioning the company, selling the company and its capabilities etc. All are needed, regardless of who ran JAN and what other things it does/does not do.

WHAT TO DO

Unlike my other turnaround holdings (EML, EOS, CAT etc), other than the CEO coming onboard, I can't quite see all the ingredients to make JAN successful being in place today.

But to be fair to JAN, I ignored those turnaround holdings while the new CEO got its ducks in a row and only revisited after they were in place for some time. So perhaps I should give Sujata the time to really get going rather than exit now - it could well be too early.

JAN is only 0.6% of my portfolio and I have too much cash as it is today, so crystallising the loss to raise more cash, does not help things.

The JAN price is already rock bottom - the only way from here is up really. But it will be an uncertain 12M or so until Suhata puts out clearer markers AND show tangible progress that we can see in the financials.

Going to sit on this for a few days before working out what to do.

Discl: Held IRL

STRATEGY SUMMARY

We've got a great assessments technology platform, not many know what we do, we have undersold ourselves - we need to double down on our core strength, let the market know who we are, what value we can deliver

We want to "AI" the platform - lots of "AI" thrown around, no specifics in terms of scope, timing, cost

Market is growing to USD21b by 2030, 10-12% CAGR projected, AI is driving assessment innovation/disrupting the assessment industry, the competitive landscape is evolving

Blueprint for Growth, the 3 Horizons

YEAR 1 FY2025, PRIORITIES AND OUTLOOK

I have been very patient with Janison, a serial underperformer in my RL portfolio. My reasons for liking the company are well summarised in @jcmleng 's previous post.

However after reading through the FY24 annual report documents and presentations there are numerous disclosures that I find unsettling:

- Despite ostensibly having a seasoned and well experienced board of directors, despite the business founder still being on the board, and despite the recruitment of a new CEO with "20 years spent in global education and assessment", the company has retained the Nous Group to advise on a new strategy. "In July 2024 a significant reshaping of the business was implemented to create capacity to invest in capability to drive long-term growth." Create a capacity to invest in capability??? This sounds like bullsh*t - I hoped for better communication from the new CEO.

- There is a bit more detail in the full annual report: "More specifically, we have created two new senior enterprise sales positions and engaged external professionals to assist in building the foundation for growing our pipeline of deals and establishing the processes and support necessary for the best chance of success in winning new business." So they don't know how to sell the value proposition of their assessment platform despite having been trying to do so since inception, and need some more expensive consultants to tell them how to do it. It sounds like Janison lacks the skills internally to grow the business. If nothing else, I expect operating costs to swell in FY25 due to this dependency on external consultants. Let's hope that revenue grows to compensate.

- The company has ceased working with Singapore Exam Board, allegedly this is an intentional choice because it required a lot of bespoke work, but this marks the end of a long term relationship and one that helped shape the current Insights platform. This is perhaps not a material loss - worth maybe $0.5 million in revenue pa.

- Alarmingly, the much vaunted 5-year contract with the OECD to be the platform for delivering the PISA for Schools program has not been extended. Instead for FY25 onwards "ETS has been selected as the international digital delivery platform provider for the OECD’s PISA-based Test for Schools (PBTS) digital assessment through 2029 pending final signature. In this role, ETS will design, develop, and maintain an international digital delivery platform for the PBTS." (https://www.theewf.org/news/2024/ets-expands-its-longstanding-work-with-oecd-becoming-the-international-digital-delivery-platform-provider-for-pisa-based-test-for-schools-pbts-digital-assessment-through-2029). It sounds like ETS don't even have a delivery platform the PISA test, so Janison must have done something seriously wrong to lose the OECD contract to them. This represents a loss of at least $2.5m pa.

- "In August 2024 a company-wide restructure was completed resulting in the loss of approximately 40 roles and an annualised savings of approximately $4 million – to be realised across Opex, Capex and Cost of Sales." Since they had 190 full time staff at the end of FY24, this means that 21% of the employees have been sacked.

- "Acquisitions in the Assessments business over the past 3 years have proved challenging and not performed as initially expected."

Against the backdrop of a 5 year $45m contract win with the NSW Dept of Education, none of the above may be material from a financial perspective, but at the end of the day a business is a collection of people and I'm afraid these people no longer convince me that they deserve my support. So I'm out.

Had a closer look at my JAN position these past few days.

Discl: Held IRL

SUMMARY

- Thesis appears intact but short-term headwinds to growth aspirations have appeared and are still being battled

- New CEO Sujata Stead is well regarded in the Assessments world, likely to be the catalyst to restart the growth engine - much will depend on how she views the business and her strategy going forward

- The Janison Insights platform is still a formidable moat and allows JAN to rapidly scale new contracts, but contracts need to be won

ACTION PLAN

- Stay invested as a turnaround from a decent base of average growth appears on the cards

- Opportunistically top up position from current 0.90% to max 1.25% if price falls below $0.25, ahead of results, on the expectation that 2HFY24 meets expectations and slightly improves on 1HFY24 and pcp, indicating that gains thus far in terms of platform enhancements, customer stickiness, cost containment can be sustained

- This sets up the platform for the new CEO to present the new strategy for the business

- Takes advantage of current prices at historical lows to average down cost

- This approach may well be too early to take, particularly as the new strategy is unknown - this is the risk, but the reward is higher upside for a thesis that appears very much intact, subject to understanding the new strategy.

- Risk mitigation is that the price is at all-time low levels, so downside and losses is expected to be limited from here

- Progressively top up to 2.0% max if the new strategy makes sense

- Review position after the FY24 results are announced and again when the new strategy is announced

EXIT PLAN

- The new CEO’s strategy does not make sense and/or lacks ambition or aggression to return JAN to a growth profile

- Loss or non-renewal of big contracts

ORIGINAL THESIS IN MID-2022

JAN’s Moat

- Janison Insights is JAN’s Digital Online Assessment platform - proven ability to deliver online assessments globally, at scale, (eg. National NAPLAN assessments)

- End-to-End capability in design, implementation and delivery of assessments for school-based clients

Competitors

Digital Assessment Platforms:

- Inspera Assessment

- Local Government- City of Lund, EICOM Institute, Norwegian Directorate for Education & Training, AQA Global Assessment Services

- Higher Education - Oxford University, UNSW, University of London, University of Cambridge, University of Queensland among others

- No national government clients highlighted

- JAN delivered 5x more assessments, 33m, this is significantly bigger delivery scale

- Caveon Scorpion - mostly corporate clients

- Rest appear to be much smaller assessments software

Others - much smaller competitors competing against individual product offerings

Review of Thesis

WHAT HAS HAPPENED SINCE

- Price fell to all-time low since listing of $0.24, still languishing ~$0.275

- Evolving into (1) an end-to-end Assessments provider with Assessment-related services to Janison Insights Assessment Platform and (2) a stronger JAN-parent relationship in its direct assessment product offerings - International Competitions and Assessment for Schools (ICAS), Academic Assessment Services (AAS), RISE+ etc

- CEO change - Sujata Stead replaced David Caspari in May 2024

- Revenue is a mixture of organic and acquisition-driven growth, margins around 63%

Negatives

- Still growing but growth slower than projected - growth aspirations/aggression seems to have eased off, could be one of the reasons for David Caspari’s departure

- Headwinds from (1) ICAS revenue flatlined in 1HFY24 (2) OECD/Pisa Based Test for Schools did not quite take off

- Acquisitions have made sense, but have mostly been smallish and lack the step-change ambition required to resume growth trajectory

- Going forward strategy is in limbo until Sujata develops the new strategy, expected in 1QFY25

Positives

- Reached cash flow positive goal in FY23, sustained into 1HFY24 - cash on hand $9m, no debt, significant improvement in free cash flow vs 1HFY24 Capex coming under $1.5m

- No immediate concern of capital raising, particularly as share price is not raising-conducive - no capital raising since Jul 2021, which raised $3m @ $0.82

- Further extension of NAPLAN contract to 2030, $24m across 6 year contract

- Big $45m over 5-Year win with NSW Dept of Education for 5 Year Selective Education Placement assessments, on track to a May 2025 startup

- Cost cuts have occurred in FY23/FY24 - $2m annualised cost taken out

- The products that JAN has acquired and launched have made sense and been well integrated - ICAS, AAS, QAT, RISE+ - product offerings appear clearer

Financials

My digesting of the clarification announcement from JAN this morning.

The biggest takeaways for me was (1) the change in the role of JAN in DOE services - from implied "sub-contractor", to prime contractor (2) the significantly expanded scope of services (3) the implementation of the JAN digital assessments platform and hopefully start of longer-term "sticky revenue" (4) 3x expansion of FY23 DOE revenue, once fully operational.

Agree with @lankypom on the JAN issues. There is a Trading Update this Mon 12 Feb, which will provide the next data point. And then there is the new CEO Sujita to lock forward to.

- Deal appoints JAN as the Lead Contractor to deliver the state’s selective education placement tests as computer-based tests via JAN’s digital assessment platform - prior to award, JAN delivered some DOE services (1) towards the paper delivery of the NSW Selective High School and Opportunity Class Placement Tests, but not as prime contractor (2) ran the physical services component only ($3.2m revenue in FY23) - deal is thus a big change in scope and role

- 5-year deal + option to extend for a further 5 years - hoping the implementation of the platform will make it a thy-kingdom-come customer ...

- Revenue profile:

- Year 1 - Transition, Implementation & Pilot commencing 2HFY24, $5m revenue across CY2024, will begin recording a portion of the total contract value as new platform license income from 2HFY25 onwards

- Year 2 - Initial Placement Test cycle on the JAN Digital Platform, May 2025 delivery, $10m revenue

- Years 3-5 - Subsequent Placement Test cycles for May 2026, 2027, 2028 , $10m revenue in each of the FY’s

- Revenue includes (1) services to develop, deliver and manage the tests and (2) digital technology platform to run online digital tests on JAN’s examination platform

- No material conditions precedent to proceed, termination clauses are standard

Looking back, I bought into both JAN and CET at the same time with similar portfolio allocations. Decided that JAN had a better chance of growing from the PISA deal and stayed with it, but it fell flat. Thought CET would struggle given economic headwinds impacting customer spend and sold out at ~$0.80 but CET took off instead. Can't win them all, but the sharp contrasts of fortunes is still painful each time CET spikes up, like it just did!

Perhaps this DOE deal is the boost of energy that JAN has long needed to move forward decisively.

Disc; Held IRL

JAN signed an agreement with the NSW Department of Education (the department) and Cambridge University Press & Assessment (Cambridge) to deliver the state’s selective education placement tests as computer-based test via Janison’s digital assessment platform

- Won via competitive tender

- Largest contract signed in JAN’s history

- Estimated 30,000 students take the test each year

- Scope includes delivery of: (1) Placement Tests (2) Computer-based test platform (3) Managing Test Centres including invigilation

- Extends 20+ years relationship with the NSW Dept of Education and bolsters JAN’s relationship with Cambridge

- Up to A$45m over the initial 5 year term, with option to extend a further 5 years

- Work to commence on new platform and services in early 2024, pilots to be concluded in 2024, full rollout of the digital assessment platform for the department will be completed in 2025

Very nice win and good to have some good news. Market popped 50% today!

Discl: Held IRL

I've always been disappointed on how this company communicates. A lot numbers engineering (swapping around divisions, dividing things into core and non-core, etc, etc) and opaqueness.

This is a new low. Slipped it into a non-price sensitive AGM chairman's address

The company released unaudited financial highlights today, in advance of the end of year results due to be published on 21st August.

It looks like they were keen to get the good news out:

FY23 Financial Highlights

- The company achieved record group revenue of $41 million, an increase of +13% compared to FY22.

- This growth was driven by a 21% increase in Janison Assessments and a 17% increase in Janison Solutions core growth (9% Solutions combined growth including Learning and PBTS IPP).

- Gross profit margins remained strong due to improved pricing, scale benefits, and efficiency, reaching 63%, a 28-percentage point increase since FY19.

- Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBITDA) grew by +111% to $4 million compared to last year, driven by improved operational leverage and strong gross margins.

- The company generated a positive operating cashflow of $5 million showing a combination of disciplined cost management of operational expenses and solid revenue growth.

- Net cashflow was positive for the year and improved by $11.5 million compared to the prior year, to finish the year with a cash balance of $12 million as of 30 June 2023.

Janison is the most speculative holding in my RL portfolio. I had kept it to a small position size due to its lack of profitability, but I really like the business model and the company is clearly gaining traction with a small but prestigious client list.

After the announcement I threw caution to the winds and doubled down on my holding. What could possibly go wrong?

https://announcements.asx.com.au/asxpdf/20230614/pdf/05qmd0kdb350kx.pdf

The NAPLAN extension is nice and underpins a portion of the revenues for the next several years. Supposedly this is the largest contract that Janison has signed in its history. I believe it's larger than the previous contract that was first initiated in 2016, but not by a large amount in per annum terms.

What's potentially just as, if not more, exciting was the unrelated final paragraph of the announcement

"The Cambridge agreement was signed with a minimum contract value of ~$1m in revenue over three years but has to date added $2.5m in the last nine months in FY23 and is expected to grow significantly in FY24 and beyond. The Oxford agreement has commenced with a range of tests worth approximately ~$1m in TCV but, similar to the Cambridge agreement, test volumes are likely to be higher than minimum contract amounts, and further opportunities exist to deliver additional OUP tests on the Janison assessment platform."

Janison signed a 3-year $1m minimum umbrella contract with Cambridge Assessments at the end of Q1 FY23. And in the first 9 months, has already booked $2.5m and will look to grow this significantly. Also hinted that the Oxford deal might head down a similar path.

I feel like this is the first time they've under-promised and over-delivered. Normally management have front run operational performance with flashy forecasts that they've never come close to hitting - ICAS, PISA for schools, etc.

Janison calling for break even over the 2023 financial year and announcing new projects with Oxford University Press… bullish

ASX Announcement 28 April 2023

Janison awarded global agreement with Oxford University Press, and reaffirms FY’23 guidance

Janison Education Group Limited (ASX:JAN) (“Janison” or the “Company”) is pleased to announce it will provide its digital assessment technology and event support services to enable Oxford University Press (“OUP”) to develop and deliver a range of new and existing assessment products globally.

This represents another exciting advancement in Janison’s international expansion plans that follows the recent announcement of Janison’s new global partnership with Cambridge University Press & Assessment and cements Janison’s place as a strategic partner in two of the three largest higher education institutions globally (World University Rankings – Times Higher Education).

OUP is the education publishing arm of Oxford University, one of the largest and most prestigious providers of learning and assessment content today. This strategic partnership between Janison and OUP will accelerate the implementation of OUP’s digital strategy, and supports their objective to maximise the opportunities for students and teachers to access OUP content.

Signed by OUP’s global headquarters in the UK, the three-year umbrella agreement worth approximately AUD$1m TCV based on minimum assessment volumes will see Janison and OUP add further digital assessments over the next few years. The first new products are expected to be launched in the UK and Europe in 2H FY24. In addition to these, the partnership will see additional new products developed across OUP’s primary, secondary and international education markets, with the potential to position OUP as one of Janison’s largest enterprise customers globally.

Janison will assist OUP with a number of new digital products across a range of tests and markets, initially focusing on:

- Phase 1 - for Years 6 and 9 – 10,000 tests p.a. from 2024 with growth to 50,000 by 2027

- Phase 2 – roll-out from 2025 with estimate of 100,000 tests p.a. by 2028

- Phase 3 - for years 5-8 in India and Pakistan – roll out from 2025 with estimate of 500,000 tests p.a. by 2028.

Janison will implement its standardised digital assessment platform, Janison Insights, and leverage its Microsoft Azure UK cloud deployment to support this new growth phase and enable OUP to take its assessment products to market, quickly and easily in a secure and reliable manner.

Janison is pleased to have achieved this milestone in its strategy to partner with large global enterprise, government and education institutions globally. Janison’s UK-based Chief Operating Officer, Derek Welsh, will lead the expansion of Janison’s UK-based teams to support this growth. These teams will support our existing UK and European partnerships, such as the OECD, Cambridge University Press & Assessment and now Oxford University Press.

About Oxford University Press (OUP)

Oxford University Press is the world’s largest university press with offices in 50 countries. It publishes print and digital texts in more than 40 languages.

OUP’s mission is to further Oxford University's objectives of excellence in research, scholarship, and education by publishing worldwide. OUP creates and distributes learning and assessment products to over 180 countries spanning across primary, secondary, higher education and English language sectors which are multidisciplinary in nature.

OUP has over 7,500 employees globally. OUP’s learning and assessment IP contains more than 32,000 educational titles published across digital and print medium. OUP’s digital platform ‘Oxford Owl’ attracts over 2 million users per month to access personalised learning and assessment journeys. In English Language Testing, the Oxford Placement Test attracts over 600,000 users p.a. across 94 countries.

FY23 Outlook

With a quarter of FY23 to go, Janison reiterates previous guidance of revenue ($41-43m) and EBITDA ($4-5m) with ongoing disciplined cost control. Larger cash receipts in 2H23 from ICAS in Q4 are expected to see the business finish break-even for total cashflow on a full year basis – a significant improvement over FY22.

*** End ***

This release has been approved by the board. For further enquiries, please contact Stuart Halls

at: [email protected] Visit janison.com

2

The AGM today was curiously muted, hardly any questions were asked, it's almost as if nobody cares. Some highlights:

- Q1 revenue of $12.1m was up 95% on pcp

- (By comparison FY22 revenue for the year was $36m)

- Revenues are growing faster than expenses, despite investment of sales staff in UK and USA

- Q1 was EBITDA positive (for the first time ever, I think) at $2.1m, and company is guiding to positive free cash flow for the year

- The post-COVID world is one which favours JAN, as governments increase their investments in education to make up for the learning loss of the past few years

- "Management has confidence in achieving +20% CAGR in revenue for the next 3-5 years with gross profit margins of 70%-75%".

Clearly it is still early days. I am very optimistic for the future based on the customer wins over the past year, particularly with Cambridge University Press, which validate JAN's market leadership in high volume, high stakes online assessment. I almost wish that management would be less cautious in their growth strategy, and invest more in sales and marketing.

I hold a small parcel in my rl portfolio. My conviction level is high, but given JAN is not yet profitable I am still holding back from a full position size.

The good:

- Revenue up 20% to 36m, all segments of the business reported growth

- New product Rise+ launched as a direct-to-consumer offering for practice tests, allegedly has a TAM of $200m. This is evidence of Janisson starting to monetize the IP of its huge bank of questions.

- Gross margin has expanded 9% to 64%

- Delivered NAPLAN testing to 1.2m students, a 48% increase. The Insights platform supported 0.5 million concurrent users during this test, which was conducted 100% online for the first time. This is very impressive.

- "Management have confidence in surpassing analyst consensus and achieving +20% CAGR in revenue for the next 3-5 years with gross profit margins of 70-75%"

The not so good:

- $4.1m of revenue came from the acquisition of Academic Assessment Services in November 2021 (upfront cash payment of $6m.) $0.7m came from the acquisition of QATs in October 2021 (upfront cash payment of $1.25m). If you take the acquired $4.8m out of the total revenue of $36.3, then the organic revenue growth on FY21 is only 4%, or $1.3m

- A paltry $0.9m of revenue came from new or expanded customers using the Insights platform. According to the investor presentation "New client acquisition (Chartered Accountants ANZ) and expansion of existing assessment platform clients in FY22 added $1.6m of revenue", yet platform revenue only increased $0.9m for the year so most probably the missing $0.7m will be recognised in future years.

- Still not profitable, but expects to be 'operating cash flow' or 'net cash flow' positive in FY23 after a significant rationalisation and cost take out process in FY22.

- PISA has only grown from 15 to 17 countries in the past year, out of the TAM of 90+ countries. In the prior year it added 8 countries, and reported that ARR was $2.6m, which no longer seems to be accurate. The segment of PISA where Janisson is the National Service Provider increased revenue 69% from $0.8m to $1.3m, thanks mostly to becoming the NSP in the UK, as well as more take up of the test in the US. Being charitable, I have to assume that Covid is responsible for the lacklustre performance of this business unit.

- Cash reduced by $11.3m to a balance of $11.7m. There could be another capital raising on the cards.

The ugly:

- EBITDA declined 38% to negative $1.9m, and net loss increased a whopping 181% to $9.1m.

- The company highlights that it's cost of sales has declined slightly (3%), contributing to 9% improvement in gross margin, without mentioning that operating expenses have increased by 56%. This is explained as a 'necessary step change in the operating structure of the business to satisfy the growth in revenue' A step change of $7.7m in opex to support a $6.1m increase in revenue either means the company is very positive about its future growth opportunities, or is lacking in budget discipline.

- Personnel costs increased 100% ( but headcount only increased 34%) and share based payments increased 300%.

- 'Non operating expenses' (restructuring, acquisition costs and share-based payments) have increased by 145%.

- Janisson stil seems to be struggling with how they classify the different segments of their business. 6 months ago the business units were grouped into two buckets 'Educational Assessments' and 'Assessment Platform'. Now we still have 'Educational Assessments', which basically seems to mean the administration of tests where Janisson owns the IP for the tests themselves, as in the case of ICAS and PISA. 'Assessment Platform' has become 'Janisson Solutions', and seems to refer to the use of the Janisson platform for executing large scale testing, where Janisson does not own the IP for the tests, e.g. NAPLAN. To make matters more confusing, revenue from PISA tests in countries where Janisson is the National Service Provider is classed under 'Assessments', whilst revenue from other countries is classed under 'Solutions'. The business unit structure still seems like a work in progress to me.

Takeaways

- The upside still beats the downside with many revenue drivers

- The scalability of the Insights platform and the depth of test bank IP gives Janison a healthy moat

- I'm happy to keep holding my very small rl allocation to Janisson, but see no reason to increase my holding whilst profitability still seems to be a few years (and CRs) away

Following trading update today - 7/7/2022.

Revenue growth for FY2022 coming in at 20%, well below what I previously expected.

It appears PISA for Schools may not be the growth engine previously expected. I am struggling to get a handle on this, so am taking a more conservative peak revenue growth rate of 30% pa for Janison.

Assuming 2030 Revenue of $110 M, at a profit margin of around 10%, I come up with EPS of 4.4 cents. On a PE of 25, I get a share price of $1.09 in 2030. Using a discount of 15%, and a 20% margin of safety, I come up with a valuation of 33 cents per share.

But it is in the "too hard" basket for me. As I don't have the confidence in revenue stickiness.

Fully online delivery of NAPLAN across multiple subjects. SUCCESSFUL, COMPLETED. 45% increase online students from last year. Contract in place until 2024.

So should we be expecting some more interest in Janison? Archer Materials? Cogstate?

JAN survived MF's previous recco on April 1 (up about 50% since), proving they're more than just April Fools :)

Janison is stock of the week in this Motley Fool podcast.

I hope that's not the kiss of death.

Held in SM and RL.

National Catholic Education Commission (NCEC) and Janison have entered a partnership in relation to PISA for Schools.

News release: https://www.ncec.catholic.edu.au/news-events/media-releases/582-catholic-education-to-enhance-student-learning-through-pisa-for-schools-partnership/file

In NCEC's 2020 annual report, it states they represent ~500 secondary schools in Australia. So there's a potential of $3.5m in ARR here (500 x $7000/school).

This is where Janison can get some quick runs with PISA for Schools penetration - through partnerships with private and government bodies. NSW Department of Education, who they have a very strong relationship with, would be firmly in their sights.

We own. Rocket emoji.

I have been on the hunt for a new investment candidate for my IRL portfolio since ditching APX a few weeks ago. I took a good look at ReadyTech, but somehow just couldn’t get too excited about it. It is now in my Strawman portfolio but I don’t have sufficient conviction to invest real money in the company.

A few weeks ago I stumbled across Janison, and naturally the first place to start my research was Strawman. I must thank @elapso96 for the many insightful straws. The more I read both here and in company reports, the more surprised I am that Janison hasn’t come to my attention before, since it is exactly the kind of business I like:

- Primarily a SaaS business, with high recurring revenue

- A recognised market leader in a growing market, with a global customer base

- Very sticky customers

- A no-nonsense management team who tell it like it is

- Providing a valuable service to society

Where Does The Revenue Come From?

Learning

At first I thought Janison was all about providing a portal for organisations to manage their internal staff training needs. Customers can curate their own custom learning materials on the Academy platform, and can also access off-the-shelf content provided in partnership with the likes of Deloitte, McKinsey and LinkedIn as well as content developed in house. I’m not sure how self-service the content creation is on this platform, it sounds like customers typically buy consulting from Janison as well as the Academy platform, to help them implement their own learning management system.

If you Google ‘Janison Portal’, a host of organisations that use this platform are revealed, including The Australian Sports Commission, the Commonwealth Government, Corrective Services NSW, David Jones, Netball Australia, NSW Ambulance, NSW Dept of Education, Royal Life Saving Society, Sailing Australia, Ryman Healthcare. A pretty impressive collection, I thought, with a strong focus on state (mostly NSW) and federal government organisations, and large enterprises. In 2019 for example Janison renewed a 3-year contract with Westpac worth $4.2m for “an integrated enterprise learning solution.”

This segment of the business is however static or even in decline, with revenue going from $5.7m to $7.3m to $6.1m in the past 3 years. Yet net client retention is 109%. There are 52 customers (47 in pcp). There is virtually no mention of this segment in the CEO or Chairmans’s narrative for the growth drivers of the business - it appears that it is going to be left to wither on the vine.

Assessment

The segment of the business that is getting all the attention is Assessments. The Janison Insights digital assessment platform allows education organisations to create the assessment, and deliver it in a locked-down, controlled environment, as well as closely manage the marking process. It also offers an analytics tool that, once results are in, can help staff identify how to improve student performance through reviewing the data. This segment has seen accelerated growth as the world has had to transition to online assessments and away from the classroom in the past year - a trend which Janisson reckons is a long term structural shift rather than a short term Covid sugar rush.

The beauty of the Assessments business is that it has multiple growth opportunities, using the Insights platform as the foundation. Janisson can sell SaaS subscriptions to organisations that want to conduct online assessments using their own test materials, a recent sale to the CFAA being a case in point. The CFAA deal is worth $5m over 5 years.

More excitingly though, Janisson can acquire the IP for widely used educational tests then charge a fee for administering those tests via the Insights platform. In 2019 Janisson won a tender from the OECD to administer the Programme for International Student Assessment (PISA) test to member countries. This test is used by schools to benchmark their performance against other institutions. So far Janisson has agreements in place with 9 countries. In Australia and the USA Janison is the service provider, meaning they enroll schools and manage the test cycle, for which they collect $7000 per school. At least 200 schools in Australia signed up this year. There are 2,700 schools that serve secondary students across Australia, meaning a total addressable market of $19 million, just for this one test in one country. In the other 7 countries Janison provides the Insights platform and the test materials, but other organisations administer the test. According to OECD materials the base cost for a country to participate in PISA is 205 000 euro spread over 4 years. Assuming (arbitrarily) 60% of this cost flows through to Janison as revenue, that equates to $50,000 per country per year. The target market for PISA testing is 90+ countries.

The second assessment that is really building a reputation for Janison is NAPLAN. In May 2021, 800,000 school students completed their NAPLAN tests online. Janison’s digital assessment platform had over 3 million tests completed in a two-week period, and at the peak, more than 195,000 students were being tested concurrently., with more than 32,000 transactions a second.

The NAPLAN test typifies the high-stakes, high-volume testing in which Janison is carving out a niche. In 2021 NAPLAN Online became the largest online schools assessment ever run world-wide, breaking all records, and considered by all parties to be an amazing success. 70% of students sat NAPLAN online in 2021 and the plan is to move to 100% in 2022. Janison’s customer here is Education Services Australia (ESA), i.e. the federal government. Janison was paid $367,000 for the development of Naplan Online in FY20. Presumably there is an ongoing revenue stream for making enhancements to the test, as well as for delivering it to schools.

The third assessment that Janison can now deliver on the Insights platform is the ICAS competition. In a very astute move Janison bought the rights to the ICAS test from a division of UNSW called Educational Assessments (EA) this year (for less than $1m!) so all revenue from running this test each year will flow to Janison. The target is to charge $15 per test, with 1 million tests pa, but Janison acknowledges it will take 'a few years' to get to $15m pa. EA had an annual recurring revenue of $10m in 2019. As well as the ICAS test itself Janison acquired EA’s item bank of 20,000 test questions, developed by academics over the past two decades, plus the skillset of EA’s team of psychometricians, statisticians, and exam authoring and reporting experts. This gives Janison the raw material to develop further test products for delivery on the Insights platform.

A final major (?) growth opportunity is the recent (March 2020) partnership with D2L (Desire to Learn), developers of the Brightspace learning management system, which is a cloud-based software suite used by schools, institutes of higher education, and businesses for online and blended classroom learning. D2L has 1,000 customers in 40 countries. The idea behind this partnership is that D2L provides online learning and Janison provides online examinations to measure the results of this learning. However, after a hunt around the D2L website I couldn’t find any reference to Janisson, so I suspect that it is going to be up to Janisson to knock on the doors of D2L customers if they want to win any business from this channel. This year’s annual report doesn’t provide any insight into the revenue from this channel.

What About The Management?

There seems to be a rather turbulent leadership history. Tom Richardson resigned as CEO in 2020 after 5 years as CEO, which included taking the company public in 2017. Previously he founded a small training / learning consultancy but that no longer seems to exist. With no strong credentials in either education or IT he perhaps wasn’t the right fit to lead the company in its current growth trajectory.

David Caspari took over as CEO in 2020, an external hire. He has had market-facing leadership positions (VP and similar) with IT companies since at least 2004, including Cisco, HP, EDS, Singtel then Optus. I like the fact that he has worked in India, Singapore and Hong Kong. He seems to be a good communicator, and has a 90% approval rating on Glassdoor.

George Gorman the CTO also joined in 2020, and previously worked as a technology consultant, specialising in ‘program recovery’. It sounds like he was brought in to reshape the IT organisation, or as the press announcement had it at the time “to establish the technology vision for the Company and to work closely with the CEO and executive team on delivering this vision as the business continues to further productise its offering and focus on growing recurring revenue in its target markets.”

Software development is managed by David Irvine, who joined in 2017, and previously held CTO roles. Daniel Berkovitch, the sales director, joined in 2019.

Wayne Houlden who founded the company in 1997 is still around, but in what sounds like primarily an honorary role of Vice Chair.

Risks

- With so many levers for growth, how can Janisson fail?

- The OECD may not renew the exclusive agreement with Janisson to deliver the PISA test in 2024;

- There may be a very public performance failure in executing NAPLAN online tests, causing the commonwealth government to look at another partner for future test delivery (NAPLAN is a 7-year deal 2016-2023);

- With so many avenues to explore for the creation and delivery of tests, Janisson may spread its resources too thinly, rather than focussing on the high stakes, high volume tests for which it is building a hard-won reputation;

- It may run out of cash. Growth has been funded by numerous capital raisings, the company is not yet consistently generating free cash flow, and expenses will continue to rise particularly in sales and marketing;

- Competition may depress margins and profitability - a very brief survey of the market for educational assessment products revealed almost 50 competitors (https://sourceforge.net/software/product/Janison-Insights/alternatives)

- The leadership team is relatively new and unproven, although the continuing involvement of the founder gives some comfort

Revenue Projections for 2025

Learning segment - $5m, assuming gradual decline

PISA tests -$15m, pure guesswork, the TAM must be at least 10x this, Janisson ‘horizon target’ is $30m

ICAS tests - $15m, Janisson ‘horizon target’ is $20m

NAPLAN tests - there doesn't seem to be any information in the public domain, but let's say $2m

Other tests - $5m

SaaS subscriptions - $5m, assuming 5 more deals like the CFAA

Services revenue - $10m, assuming moderate growth from current $7m

It is pretty easy to project total revenue of $50m + in 2025. Janisson’s own ‘horizon target’ is $80-$100m. With a TAM of $40B (if you believe market researchers) that doesn’t seem much of stretch.

Comparables

KME enterprise value $44.12m, revenue $19.28m, EV/revenue = 2.3

IDP enterprise value $8778m, revenue $528.7m, EV/revenue = 16.6

JAN enterprise value $205m, revenue $30.2m, EV/revenue = 6.8

US Comparables (from https://www.raymondjames.com/-/media/rj/dotcom/files/corporations-and-institutions/investment-banking/industry-insight/education-technology-quarterly.pdf)

See attachment (I wish I knew how to get inline images into a straw). This shows EV/revenue ratios for 10 EdTech companies, with Coursera at the high end (17.9) and 2U Inc at the low end (3.3).

Listened to JAn on Reach markets briefing. very confident and bullish preso by CEO/CFO, which is consistent for JAN for some time. My q on renewal of PISA in 3 years was answered. no guarantees. it appears to be one of those small chance of big disaster type risks. they have three years, mgt should renew this asap, ususally a year out from close. so no concern at thsi stage. disclosure not held

News just released on the renewal of Janison’s agreement to be the US National Service Provider (NSP) for a further three years.

Recent CEO signing, David Caspari will be awarded 700 000 perforamcne rights if the share price exceeds $1.00 by April 2022.

Long term incentive plans target the following thresholds:

Index linked total shareholder return: Threshold: Index TSR; Target: Index TSR + 10% CAGR; Stretch: Index TSR + 20% CAGR

ROE THRESHOLD: 10%; Target of 12.5%; Stretch: 15%.