Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

I fully exited my JAN position today which was a 0.57% holding in my portfolio. Rationale:

- I think it was @Bear77 who said in a post maybe a year or so ago, that has stuck in my head, that you should not hang on to a position, however small the $ value of the position is, if there was a better opportunity available

- I do think that the JAN turnaround is in play and that good things should eventually come out of it but vis-a-vis AIM's prospects, my capital is better allocated to AIM

- I hence topped up AIM today @0.75, but only got 25% of what I was after, will get the rest tomorow to fully invest the JAN proceeds

It is a simple capital allocation rule, but one that is not as simple to execute against, particularly as I was resisting the crystallising of the paper loss on JAN.

So, while this will have been a no-brainer decision to many, am happy that I finally took the step to act ... it is another positive step in my investing journey.

Discl: Held IRL

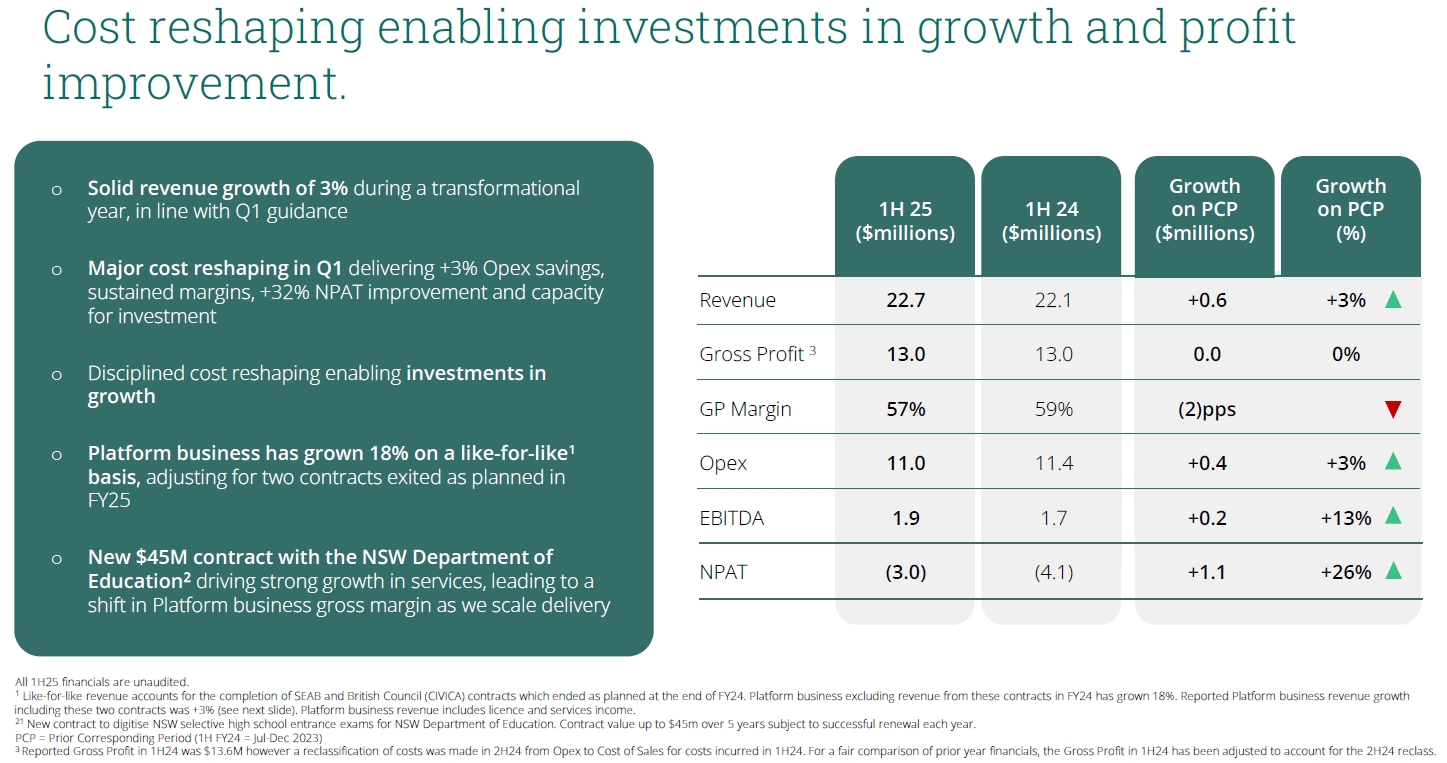

In Year 1 of its “Transformational”, go-back-to-basics year, JAN's 1HFY25 financial results were decent against this context - sustained revenue, GP, EBITDA and better NPAT - running while chewing gum, essentially.

Need to work through the Appendix 4D to work through how cost “reshaping” has changed the cost base - quite hard to see from these high-level numbers.

1 new contract - Australian Christian College, unlikely to be material in value - but its a start.

Management is doing what it said it would, under-the-hood, to get back to the basics in JAN’s core competence of the Assessments Platform:

- Reshape the cost base

- Build AI capabilities - operating, now in trial mode with customers

- Improve business operating processes to improve operating efficiency

- Restructure the organisation and bring in the key Executives - CTO, Chief Growth Office and new Board Member have come onboard very recently/about to come onboard

- Refocus and rebuild sales pipeline

- Continue to deliver against existing contracts including the new NSW DoE contract

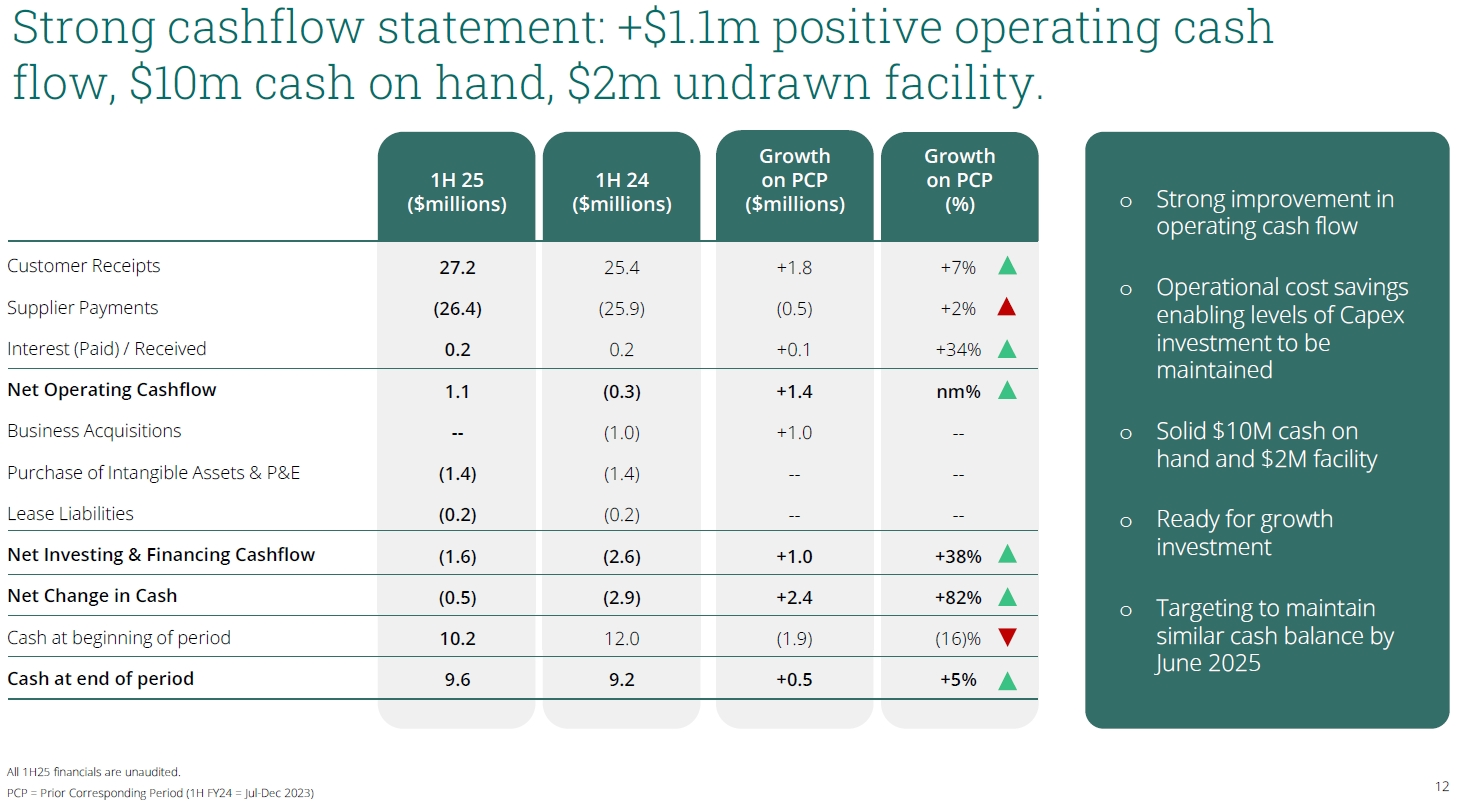

These actions, together with +$1.1m positive operating cashflow, $10m cash on hand and $2m undrawn facility, sets JAN up nicely for growth investment vs the market opportunity assessment digitisation

Ingredients for the next phase of growth are almost fully in place, the actual cooking is happening, but there is no food on the table just yet.

Need to give management time and have a lot of patience for these efforts to transform into revenue growth - market reaction yesterday (up ~8%) and recent increase in funds shareholding (see earlier post) suggests that JAN has shareholder support and appetite for this. But like everyone else, really need to see this growth ambition translated to real financial growth.

No burning reason to exit now as JAN is well into the turnaround, but I also have no immediate full-on strong conviction to top up now either as my portfolio allocation for JAN feels about right.

Hold and reassess in the next 6M

Interesting and pleasing fundie moves in the past week, ahead of the 1HFY2025 results announcements today.

- Ryder Capital increased its stake by 1.17% from 9.76%

- Australian Ethical Investment increased its stake by 3.04% from 8.34%

Attended this morning's call and am working through the results now - the phrase running through my head to sum up the earnings is "running while chewing gum".

It was a decent, solid result in the context of a lot of "going-back-to-basics-under-the-hood" progress. Reminiscent of EML 12-18M ago, EOS 12-18M ago and CAT 3+ years ago ...

From today's price action and these fundie moves, the market seems keen to give Sujata the time and lattitude she needs to work things through - promising from my perspective.

Will posts thoughts later today ...

Discl: Held IRL

Small 0.2%, $31k increase in stake @$0.2207 from W Houlden the founder.

Spare change for him and likely to be a planned signal to the market. But clearly better that he be buying than selling, thats for sure.

Following Aust Ethical adding 1.8% to its stake earlier this week, these are good and welcomed data points on the confidence in the trajectory of the JAN turnaround.

Discl: Held IRL

Have just reviewed the JAN FY2024 AGM slides and my action plan yesterday. Was not planning to post my thoughts as there is probably no interest in JAN, but seems like I may not be the only one planning on giving JAN more runway with this accouncement this morning:

My thoughts from yesterday:

KEY TAKEAWAYS

FY24 was clearly a “holding pattern” year while waiting for Sujata to come onboard.

Pre-FY24, JAN was all over the show, getting into areas outside of its core Janison Assessment Platform and losing focus.

FY25 Strategy has been reviewed and refreshed, org structure changes have mostly been made - at the core of it is the Janison Insights Assessment Platform, which is a world-leading platform in a big ~$21bn growing market for the digital transformation of global education.

Strategy is reinforcing the Assessments Platform as the asset and everything is built around maximising/leveraging that asset - consolidating current capabilities and going back to basics.

POSITIVES

Positive but tentative start to 1QFY25.

The turnaround is under way - what Sujata said she would do has been done and delivered - good start to earning credibility.

The Strategy refresh is underwhelming on the one hand, but the question then is, “what else could be expected” - the main asset is still the Assessment Platform, so going back and making that as the centre of JAN’s universe does make good business sense, even though it comes across as underwhelming.

The NSW DoE contract is a good opportunity to cement the strategy and further enhance the reputation of JAN’s Assessment Platform.

Sujata is under water with her stake at $0.25, so she is absolutely incentivised to grow the business.

Exiting now does not give the strategy and re-focus back to the basics, a chance to work .

The turnaround now has, in place:

- Leadership

- Ownership by Sujata and the Board

- A refreshed strategy with clear goals, aspirations and timelines

- New org structure with renewed sales focus

- Re-focus on the core product, a world class digital assessments platform

- The DoE contract which buys management some time to get new contracts

- Renewed focus on innovation and the adding of new capabilities into the platform - whether it is “AI” or not is really not that important so long as the new capabilities enhance the value of the platform for customers

- EBITDA positive

- Cash on hand

- Increasing push in education to digitise - TAM is still there

Can’t think of any turnaround ingredient that is NOT in place - what is needed is some contract wins to confirm that the refreshed strategy is working.

ACTION

Stay invested for another 6M and see if the revised strategy gains traction as all the ingredients for a successful turnaround appear to be in place. It just needs time now.

Discl: Held IRL

Feeling underwhelmed by the JAN Strategy update.

SUMMARY OF THOUGHTS

On the one hand, it was probably not realistic to expect too much - the platform is world class, but JAN seems to have been sitting on its reputation and current cohort of customers, has been all over the show, lost focus etc.

So, the New CEO is going back to basics, leveraging on the core strength, and actually SELLING JAN to the broader market. Not sure there is anything wrong with this approach - not sure what else she could do really.

There was a lot of use of big buzz phrases, particularly "AI", but there were no specifics as to what this actually meant from a new capability, area to focus efforts on, cost estimates etc.

What was needed, and was conspicuously missing, were clear measurable numbers/targets as to what good looks. That is troubling. I get that Sujata is 4M in the role, but she would have known that shareholders would be clamouring for something tangible to re-focus their investments on. While she has lived and breathed Assessments in her career, I am concerned that this was in a private company setting (OET is what her Linked-In profile says, 11 years+, decent length).

That she did not pro-actively address shareholder anxieties with more specifics could be telling of her lack of experience in a public company environment and the additional expectations management requirements that go with it.

BUT

The platform is still world class, is robust and there are some big contracts already in play and coming into play - there is a decent base to work from.

The actions, while lacking specifics, all make sense - going back to basics, repositioning the company, selling the company and its capabilities etc. All are needed, regardless of who ran JAN and what other things it does/does not do.

WHAT TO DO

Unlike my other turnaround holdings (EML, EOS, CAT etc), other than the CEO coming onboard, I can't quite see all the ingredients to make JAN successful being in place today.

But to be fair to JAN, I ignored those turnaround holdings while the new CEO got its ducks in a row and only revisited after they were in place for some time. So perhaps I should give Sujata the time to really get going rather than exit now - it could well be too early.

JAN is only 0.6% of my portfolio and I have too much cash as it is today, so crystallising the loss to raise more cash, does not help things.

The JAN price is already rock bottom - the only way from here is up really. But it will be an uncertain 12M or so until Suhata puts out clearer markers AND show tangible progress that we can see in the financials.

Going to sit on this for a few days before working out what to do.

Discl: Held IRL

STRATEGY SUMMARY

We've got a great assessments technology platform, not many know what we do, we have undersold ourselves - we need to double down on our core strength, let the market know who we are, what value we can deliver

We want to "AI" the platform - lots of "AI" thrown around, no specifics in terms of scope, timing, cost

Market is growing to USD21b by 2030, 10-12% CAGR projected, AI is driving assessment innovation/disrupting the assessment industry, the competitive landscape is evolving

Blueprint for Growth, the 3 Horizons

YEAR 1 FY2025, PRIORITIES AND OUTLOOK

Had a closer look at my JAN position these past few days.

Discl: Held IRL

SUMMARY

- Thesis appears intact but short-term headwinds to growth aspirations have appeared and are still being battled

- New CEO Sujata Stead is well regarded in the Assessments world, likely to be the catalyst to restart the growth engine - much will depend on how she views the business and her strategy going forward

- The Janison Insights platform is still a formidable moat and allows JAN to rapidly scale new contracts, but contracts need to be won

ACTION PLAN

- Stay invested as a turnaround from a decent base of average growth appears on the cards

- Opportunistically top up position from current 0.90% to max 1.25% if price falls below $0.25, ahead of results, on the expectation that 2HFY24 meets expectations and slightly improves on 1HFY24 and pcp, indicating that gains thus far in terms of platform enhancements, customer stickiness, cost containment can be sustained

- This sets up the platform for the new CEO to present the new strategy for the business

- Takes advantage of current prices at historical lows to average down cost

- This approach may well be too early to take, particularly as the new strategy is unknown - this is the risk, but the reward is higher upside for a thesis that appears very much intact, subject to understanding the new strategy.

- Risk mitigation is that the price is at all-time low levels, so downside and losses is expected to be limited from here

- Progressively top up to 2.0% max if the new strategy makes sense

- Review position after the FY24 results are announced and again when the new strategy is announced

EXIT PLAN

- The new CEO’s strategy does not make sense and/or lacks ambition or aggression to return JAN to a growth profile

- Loss or non-renewal of big contracts

ORIGINAL THESIS IN MID-2022

JAN’s Moat

- Janison Insights is JAN’s Digital Online Assessment platform - proven ability to deliver online assessments globally, at scale, (eg. National NAPLAN assessments)

- End-to-End capability in design, implementation and delivery of assessments for school-based clients

Competitors

Digital Assessment Platforms:

- Inspera Assessment

- Local Government- City of Lund, EICOM Institute, Norwegian Directorate for Education & Training, AQA Global Assessment Services

- Higher Education - Oxford University, UNSW, University of London, University of Cambridge, University of Queensland among others

- No national government clients highlighted

- JAN delivered 5x more assessments, 33m, this is significantly bigger delivery scale

- Caveon Scorpion - mostly corporate clients

- Rest appear to be much smaller assessments software

Others - much smaller competitors competing against individual product offerings

Review of Thesis

WHAT HAS HAPPENED SINCE

- Price fell to all-time low since listing of $0.24, still languishing ~$0.275

- Evolving into (1) an end-to-end Assessments provider with Assessment-related services to Janison Insights Assessment Platform and (2) a stronger JAN-parent relationship in its direct assessment product offerings - International Competitions and Assessment for Schools (ICAS), Academic Assessment Services (AAS), RISE+ etc

- CEO change - Sujata Stead replaced David Caspari in May 2024

- Revenue is a mixture of organic and acquisition-driven growth, margins around 63%

Negatives

- Still growing but growth slower than projected - growth aspirations/aggression seems to have eased off, could be one of the reasons for David Caspari’s departure

- Headwinds from (1) ICAS revenue flatlined in 1HFY24 (2) OECD/Pisa Based Test for Schools did not quite take off

- Acquisitions have made sense, but have mostly been smallish and lack the step-change ambition required to resume growth trajectory

- Going forward strategy is in limbo until Sujata develops the new strategy, expected in 1QFY25

Positives

- Reached cash flow positive goal in FY23, sustained into 1HFY24 - cash on hand $9m, no debt, significant improvement in free cash flow vs 1HFY24 Capex coming under $1.5m

- No immediate concern of capital raising, particularly as share price is not raising-conducive - no capital raising since Jul 2021, which raised $3m @ $0.82

- Further extension of NAPLAN contract to 2030, $24m across 6 year contract

- Big $45m over 5-Year win with NSW Dept of Education for 5 Year Selective Education Placement assessments, on track to a May 2025 startup

- Cost cuts have occurred in FY23/FY24 - $2m annualised cost taken out

- The products that JAN has acquired and launched have made sense and been well integrated - ICAS, AAS, QAT, RISE+ - product offerings appear clearer

Financials

My digesting of the clarification announcement from JAN this morning.

The biggest takeaways for me was (1) the change in the role of JAN in DOE services - from implied "sub-contractor", to prime contractor (2) the significantly expanded scope of services (3) the implementation of the JAN digital assessments platform and hopefully start of longer-term "sticky revenue" (4) 3x expansion of FY23 DOE revenue, once fully operational.

Agree with @lankypom on the JAN issues. There is a Trading Update this Mon 12 Feb, which will provide the next data point. And then there is the new CEO Sujita to lock forward to.

- Deal appoints JAN as the Lead Contractor to deliver the state’s selective education placement tests as computer-based tests via JAN’s digital assessment platform - prior to award, JAN delivered some DOE services (1) towards the paper delivery of the NSW Selective High School and Opportunity Class Placement Tests, but not as prime contractor (2) ran the physical services component only ($3.2m revenue in FY23) - deal is thus a big change in scope and role

- 5-year deal + option to extend for a further 5 years - hoping the implementation of the platform will make it a thy-kingdom-come customer ...

- Revenue profile:

- Year 1 - Transition, Implementation & Pilot commencing 2HFY24, $5m revenue across CY2024, will begin recording a portion of the total contract value as new platform license income from 2HFY25 onwards

- Year 2 - Initial Placement Test cycle on the JAN Digital Platform, May 2025 delivery, $10m revenue

- Years 3-5 - Subsequent Placement Test cycles for May 2026, 2027, 2028 , $10m revenue in each of the FY’s

- Revenue includes (1) services to develop, deliver and manage the tests and (2) digital technology platform to run online digital tests on JAN’s examination platform

- No material conditions precedent to proceed, termination clauses are standard

Looking back, I bought into both JAN and CET at the same time with similar portfolio allocations. Decided that JAN had a better chance of growing from the PISA deal and stayed with it, but it fell flat. Thought CET would struggle given economic headwinds impacting customer spend and sold out at ~$0.80 but CET took off instead. Can't win them all, but the sharp contrasts of fortunes is still painful each time CET spikes up, like it just did!

Perhaps this DOE deal is the boost of energy that JAN has long needed to move forward decisively.

Disc; Held IRL

JAN signed an agreement with the NSW Department of Education (the department) and Cambridge University Press & Assessment (Cambridge) to deliver the state’s selective education placement tests as computer-based test via Janison’s digital assessment platform

- Won via competitive tender

- Largest contract signed in JAN’s history

- Estimated 30,000 students take the test each year

- Scope includes delivery of: (1) Placement Tests (2) Computer-based test platform (3) Managing Test Centres including invigilation

- Extends 20+ years relationship with the NSW Dept of Education and bolsters JAN’s relationship with Cambridge

- Up to A$45m over the initial 5 year term, with option to extend a further 5 years

- Work to commence on new platform and services in early 2024, pilots to be concluded in 2024, full rollout of the digital assessment platform for the department will be completed in 2025

Very nice win and good to have some good news. Market popped 50% today!

Discl: Held IRL

Post a valuation or endorse another member's valuation.