This morning $SPZ announced their 1H Results as well as the proposed acquisition of US-based Peak Parking LP for US$36.0m with an associated capital raising via an entitlement offer and a fully underwritten institutional placement.

It would be easy to focus on the acquisition – exciting that it is – however, in this straw I will focus on the operational performance for the half, leaving the proposed acquisition as a separate matter.

1H FY25 Highlights

Financial Highlights

- Revenue of $31.9m up 20.0% to pcp

- Adjusted EBITDA of $9.5m up 26% to PCP and Adjusted EBITDA Margin of 29.8% up 139 bps

- EBITDA of $9.19m up 34.6% to PCP

- "Adjusted free cash flow" (excluding growth capex) of $6.4m up 60% to PCP

- Cash of $8.5m up 17%

- EPS of $1.12 ($1.11 diluted) up 70%

Operational Highlights

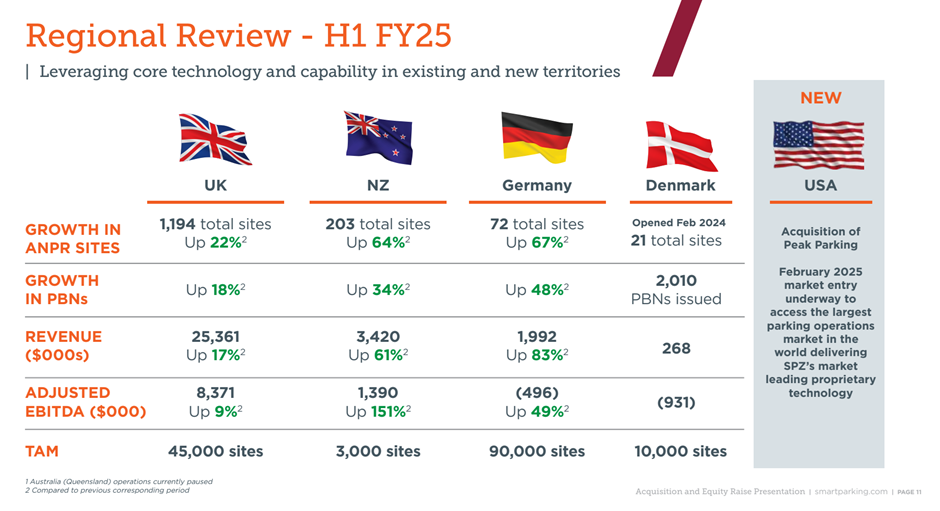

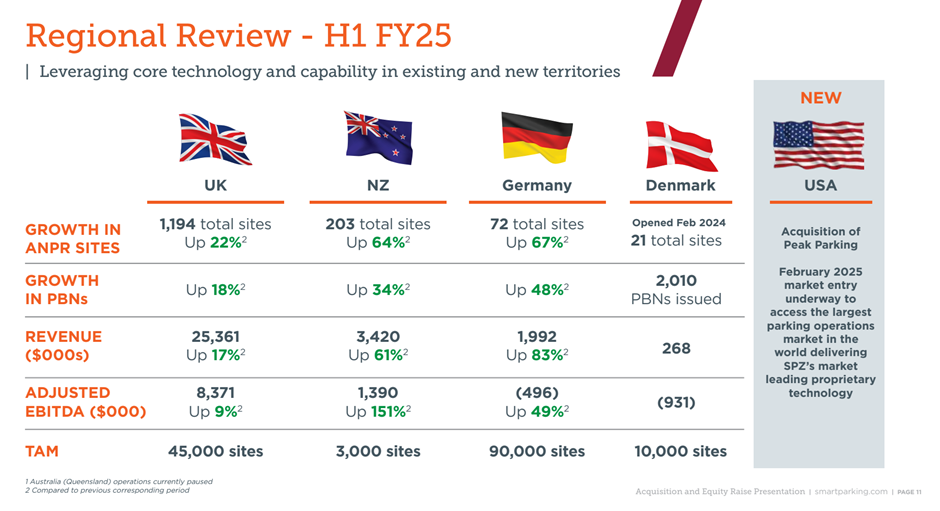

Good growth in all markets, with accelerating PBN growth in the UK +18% (vs +13% in pcp) and strong growth in the profit contribution in NZ.

Losses in Germany continue to narrow, and a good start in Denmark.

My Observations

This is a good operating result. $SPZ have delivered another year of +20% revenue growth, with operating leverage driving strong EPS growth of +70%,

The UK continues to be the engine room driving almost 80% of revenue and 88% of adjusted EBITDA.

It is pleasing to see a meaningful contribution coming through from NZ, and it is still early days in Germany and Denmark, although German with sites up to 72 from 43 in the PCP, only added +5 from the EOFY 2024.

On the other hand, Denmark has gone from 11 contracts and no reported operating sites at EOFY24, to now have 21 up and running.

The new growth markets of NZ/Ger/Den are starting to make a more material contribution with aggregate PBNs growing +43% in the half vs. the PCP, compared with the more mature UK growing at a still decent (and in fact accelerating) +18%.

On cash generation, $SPZ’s curious “Free Cash Flow” of $6.4m (defined on slide 32), compares with the FY value of $12.2m – so it seems only a modest increase on a pro rate basis. The historical 1H/2H split for 1H FY24 was 49.3% of cash receipts, so their doesn’t seem to be a strong seasonal effect.

The seemingly impressive operating leverage and strong NPAT growth hides two factors. First, a currency tailwind giving a windfall of $0.74m, offsetting significant expenses growth: raw materials and consumables (+20% - in line with revenue growth), employee benefits expense (+28%), D&A (+35%), rent and leases (+52%) and other expenses (+18%).

In isolation, these cost increases might appear to be a cause for concern. However, it is important to understand that these expense lines include the impact of the expansions into Germany and Denmark, and doubtless too, the costs for a year of prospecting for acquisitions in the US.

Overall, then, the net cash generation of +$1.3m is a good result. Cash contributions from UK and NZ, more than covering the net costs of getting started in Germany and Denmark and the hunt for acquisitions.

My Key Takeaways

The business continues to allocate capital from profitable core operations into expanding the business. All markets are growing – UK and NZ strongly, Denmark is off to the races, and Germany is making slower progress.

CEO Paul Gillespie reiterated the strategic goal of achieving organic growth of doubling the business to 3,000 ANPR sites by December 2028. Achieving that from today’s total of 1561 (including the suspended 71 in QLD), represents a CAGR from end of 1H FY25 to 31 December 2028 of 18%. This can be considered in the context of the latest growth rate of 28% (to pcp) and with the US soon to provide a new beachhead for growth.

Tomorrow, I’ll write up my appraisal of the proposed US acquisition deal. But, operationally, the meter at $SPZ is ticking along nicely.

Disc: Held in RL and SM