Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

This interview with Paul & Richard did a lot to assuage concerns over some of the regulatory risks, which is one of the bigger things (understandably) on many people's radar. Of course they are going to downplay them and we should never take management at face value, but the reasoning they offered made sense. Specifically:

The £50 cap is unlikely to happen: Paul argued that the risk of the standard parking charge being reduced to £50 is "very, very, very low". He noted that while earlier government consultations suggested aligning private charges with local government rates, these proposals were consistently withdrawn following industry pushback and legal challenges. Furthermore, the current rhetoric in government consultations has shifted from suggesting lower prices to asking if charges should be capped at the current £100 level.

Government acknowledgement of the need for deterrence: The government increasingly understands that private landowners require a mechanism to protect their land. Paul pointed out that data shows reducing the charge to £70 actually doubles the rate of non-compliance, proving that a higher charge is necessary to function as an effective deterrent.

The market trend is actually moving toward higher fines: Local councils in areas like Scotland, London, and Bournemouth are actually increasing their own parking fines to £100 because the lower £50 fines proved to be an insufficient deterrent against "carnage" on the streets (plus, if i'm being cynical, which politician doesnt like the potential for extra revenue)

Debt recovery bans are unlikely: While there is a potential risk that the statute of limitations for chasing debts could be reduced from six years to three , they do not believe debt recovery fees will be banned entirely because doing so removes the incentive for violators to pay. Additionally, Richard noted that the company already accounts for estimated write-offs monthly, meaning their financial modeling is robust.

Geographic diversification reduces the impact: The company has actively reduced its reliance on the UK market by expanding into New Zealand, Germany, Denmark, and the US. Paul projects that the US market will eventually overtake the UK in revenue generation, making UK-specific regulatory changes less existential to the wider business.

Outside of the regulatory stuff, it seems to be the same (and rather attractive) story. You have a very easy to understand business with a clear and compelling value proposition, one that aligns the company's interests with their customers, and where there is clear evidence of successful execution. Absolutely they have had challenges, but nothing that has short-circuited the general trajectory, and for which they seem to have drawn valuable lessons. Moreover, this is a business with a largely complete product and for which the focus is just on continued execution. There's minimal development requirements, a very scalable cost base, a successful go-to market strategy and an ever growing set of super sticky customers that generate a long tail of reliable, high margin revenues. What's more, organic expansion is relatively capital light and there is a VERY large addressable market -- even if you only count the geographies in which they operate.

They are very much on the hunt for more acquisitions, but they have mostly good form on that front (Germany the exception, although that seems to have turned around) and appear to be rather selective. Importantly, they have the cash flows and balance sheet that provides a good bot of optionality.

The PE is up there at 55x, but given the incremental margins and long growth runway, I dont think it's silly. Not a bargain, certainly, but not terrible if they can, as they suggest, achieve the growth they are talking about. Paul is aiming for sustained growth of over 20% year-on-year for both revenue and profit, noting they are actually currently growing at a clip of 40%. The long-term vision he painted (getting to 10 territories with 1,000 sites each generating $42k in annual revenue) would theoretically result in a business doing over $400 million in revenue with ~30%operating margins, based on their average site metrics. He also said they could reach a billion-dollar market cap within the next three years, but as we all know the market may not be so compliant!.

When you consider he estimates the US market opportunity is ten times the size of the UK , and that they've currently only captured fewer than 2,000 sites out of a potential 300,000 in their existing jurisdictions, that "long runway" argument feels like it has some serious weight behind it rather than just being corporate fluff.

For me, i'll be looking to see strong growth in the US and a recovery in Germany to help validate some of these comments at the next set of results.

@Strawman I really appreciate the "deep dive" on UK regulatory risk. Everything Paul said was consistent with my own research, other than his first hand view on it made me feel much more comfortable about the risks, i.e., low likelihood of an adverse outcome and the reasons for it.

Specifically, how the fines and recovery fees for local council car park escalate astronomically, as a strong reason why as adverse ruling is unlikely. Also, the shift in the consultation paper from referring to GBP50 PBNs historically now to GBP100 as a baseline.

It sounds like a change from 6 year recovery time to 3 years is one adverse outcome we might see, but I can't imagine the lost revenue would be material, unless it creates an incentive in the public to draw out their appeals / evasion of paying the PBN to run the clock down.

My bottom line is I have come out of the Strawman meeting reducing the likelihood of an adverse UK regulatory outcome. Which is a relief because, despite my selling down some, $SPZ remains my largest RL position.

Fascinated that Paul think US could surpass the UK in 1-2 years. Surely a slip of the tongue? But he did tease us referring to an update on the US in the New Year - presumably he'll reveal the metrics leading to the earnout result.

I was also really interested to hear Paul's accounting of the German experience. The country head appointment is a key decision, and it sounds like it took them some time to "remediate" a not-so-good decision. It will be interesting to see if the trajectory of Germany turns up going forward, as the market potential is significant.

Overall, a great meeting. Thanks!

At the recent $SPZ AGM, CEO Paul spoke about the latest round of Government consultation on the UK Code of Practice for Private Car Parking. Consultation completed in September 2025, and Paul indicated he expected a 3-4 month timeline for the Government to issue its response, which he expects would then lead to a further round of consultation.

In everything that follows in this Straw, it is important to recognise that $SPZ was key in shaping the existing, voluntary, industry-led Code of Practice, and that $SPZ aims to operate to the highest standards of compliance with this code.

Because of the importance of the UK market to the value of $SPZ, I have (with the help of my BA) undertaken a deep dive into what various UK consumer advoccay bodies have been publishing regarding their submissions to the consultation process.

Here are the key themes put forward by consumer advocates. Overall a common theme run through the consumer advovacy is a drive for a move from a voluntary code of practice, to a compulsory code with oversight and enforcement (i.e. Regulation).

1. Cap on Fines

- Strong calls to reduce the standard parking charge cap to £50 for minor or routine cases.

- Some support for retaining a £100 maximum only in the most serious cases, not as a default.

- Emphasis that fines should be proportionate to the breach.

2. Ban or Limit Excessive Fees

- Broad opposition to high debt recovery fees (e.g., £70 add-ons), viewed as punitive and unjustified.

- Warnings that such fees damage trust and should be banned or significantly restricted.

3. Transparency and Data Reporting

- Requests for mandatory publication of statistics on tickets, appeals, complaints, and cancellations.

- Advocacy for full transparency to build accountability and public confidence.

4. Fair Appeals Process

- Strong support for a single, independent appeals service to replace the current fragmented system.

- Appeals should be accessible, impartial, and offer fair resolution, including clear rules for mitigating circumstances.

- Recommendations that some types of tickets (e.g., minor keying errors or technical issues) should be automatically cancelled.

5. Oversight and Enforcement

- Demand for a robust and independent scrutiny and oversight body with enforcement powers.

- Suggestion that non-compliant operators should lose access to DVLA data.

6. Signage, Terms and Payment Clarity

- Calls for better, clearer signage and communication of terms to prevent drivers from unwittingly breaching rules.

- Emphasis on fair grace periods and allowances for minor or first-time mistakes.

- Concerns about confusing or exclusionary payment systems (e.g., requiring smartphone apps or exact change).

7. Protection for Disabled Drivers

- Support for strong enforcement against misuse of disabled bays.

- Concern that weakening penalties could undermine accessibility protections.

8. Consumer Education and Rights

- Proposals to include links to government guidance on parking rights in all notices sent to motorists.

- Aim to empower consumers with information to navigate the system confidently.

9. Prompt Implementation of the Code

- Frustration over delays in enacting the statutory Code of Practice despite it being legislated in 2019.

- Urging swift action to stop widespread consumer harm caused by current practices.

The above points are a summary of a much more comprehensive body of research, including sources linked back to key consumer advocacy groups incl. AA, RAC, Which? etc.

What strikes me is the commonality of the themes being advocated across bodies. Clearly there has either been coordination among groups, or collective learning from the last time this process was run, or both. A push for £50 fines for "minor or routine cases" is a common theme.

While many of these points are likley to already be followed by $SPZ. Some, if adopted, could materially impact business performance. E.g., 1. and 2.

Over the next week we will gain some insight into how "on-the-nose" the Starmer Government is with voters, when they issue a pre-Christmas Budget, which is seeking to plug a hole in the public finances. There is a lot of sensitivity in the UK at the moment about cost of living, as they got hit a lot harder than we did in Australia by the post-pandemic inflation spike. (I had an opportunity to "sample" this during my European visit in June/July this year! Ouch.)

Equally, there is quite a high profile among the general public about the PBN process. As a personal, anecdotal data point, I've recently had a visitor from the UK staying with me, and she was quick to point out that her family are careful in keeping all their parking records, so that they can appeal when they get "unjustified penalities". It is something "top of mind" for them.

Importantly, from May next year there are a swath of local government elections, as well as elections for the Welsh and Scottish devolved governments and, at the moment, Reform is leading in the polls. Clearly, the Government will be keen not to do anything to further antagonise the electorate or even to offer some "wins" for "working people".

I will continue to monitor this issue as the next milestone will be when the Government issues its response to the consultation process.

It will be really interesting to get Paul Gillespie's take on this at the upcoming SM Meeting. How much of what consumer advocates are requesting is either already in the code of, if implemented, would not have a material impact? How likely does he think PBN values could be cut? Or, is the Government likely to follow what is likely to emerge in the Budget as freezing the fines for a period of years?

I don't have a view on any of this, other that I think the next few months is a key window in which we should be alert to regulatory risk in the UK. Afterall, we've seen what can happen in QLD and, to a lesser extent, in Denmark.

New broker report out from Shaw and Partners today highlighting ongoing potential growth opportunities for SPZ that I found informative.

The detail on the new UK follow-up notices before an upcoming review into the private parking code due in March/April 2026 was a very interesting tidbit.

I was also under the belief that Peak Parking in the US had a different business model and wouldn't be able to bring the current SPZ PBN system in as easily to that market, but sounds like it is possible and they're testing it now.

We’ve been thinking about where further potential upside is in Smart Parking. The company is indeed growing very strongly already with projected EBITDA growth of ~60% in FY26 and ~30% FY27. Nevertheless, we explore a few avenues that can augment or extend the growth. No changes to earnings or target price with this research note.

• UK Incremental Yield Improvement: UK is SPZ’s largest earnings contributor today. SPZ has improved revenue/PBN (parking breach notice) over the last 12 months with the SepQ reporting a very strong, 19% increase vs pcp. Revenue/PBN, averages about £40, by our estimates. SPZ has indicated there is more upside potential. We understand SPZ has established a new procedure in its late payment/debt recovery process. From 1 October, SPZ will issue an additional request for payment at full breach value plus penalties (£155) prior to converting the breach into a “debt” and turning over to the debt recovery agents.

This is a well-considered management initiative that is also in the interest of motorists. As 30% of all breaches go unpaid there is the possibility of meaningful yield improvement because SPZ’s debt recovery procedure captures £142 out of a maximum £170 collectible. If 1/3 of breaches that were intended for debt recovery are collected internally by SPZ, we calculate SPZ’s yield can increase a further 10%. UK yield is the most impactful driver of SPZ EBITDA. An extra £3/PBN of gross profit in the UK can add nearly A$5mn of EBITDA (+17% on FY27E) according to our modelling.

The UK Government is undertaking a review of the private parking code of practice with a focus upon whether debt recovery charges are too high. It may be that SPZ preemptively addressing an issue by giving motorists a lower cost option to pay prior to turning over an unpaid parking breach to the debt recovery process. Further, we note that if the UK Gov’t recommends lowering the maximum recoverable parking debt (£170), this could potentially offset some of SPZ’s yield enhancers. An update from the UK Government may be forthcoming around March-April.

• USA: The blue sky in small surface lots. SPZ is entering the US market as a leader in providing cost-effective automated parking lot monitoring and enforcement technology. Its Smart Cloud system which identifies licence plates, interacts with motor vehicle data providers, and populates a customer dashboard is industry leading technology developed in Europe and NZ. This technology can transform small lots, adjacent to a retailer, hospitality venue, small office or medical centre into revenue generating assets in short payback times. The US opportunity for small lots is vast. Historically, the focus of parking management firms has been on higher value paid parking locations, such as garages.

SPZ is testing its technology across 10 automated sites it acquired as part of the Peak Parking USA acquisition. SPZ is encouraged by its system progress as it is now issuing breach notices and collecting payments. SPZ has been building its sales force and its operational systems/team. A key milestone for investors will be when SPZ begins contracting new sites: that would be evidence that the company’s offer is competitive.

• NZ very low churn/satisfied customers: In 2022 SPZ managed 20 parking sites. In FY26, we think SPZ will surpass 350. Naturally, investors should wonder about churn. If churn was high, then perhaps SPZ’s customer base would be susceptible to competition when it catches up. It turns out, SPZ management indicates that churn is very low, like 1%. Moreover, SPZ is winning awards as a trusted and valued supplier. There are at least 3,000 available parking sites to be managed in NZ. It is plausible that SPZ could capture 1/3 of the market, now that we understand churn is so low. Our SPZ financial model has NZ sites capping at 690 in 2032. If we remove our growth taper and extend the business to 1,000 sites by Dec 2032 (15% CAGR), our SPZ valuation would rise by 10% or 15c/shr

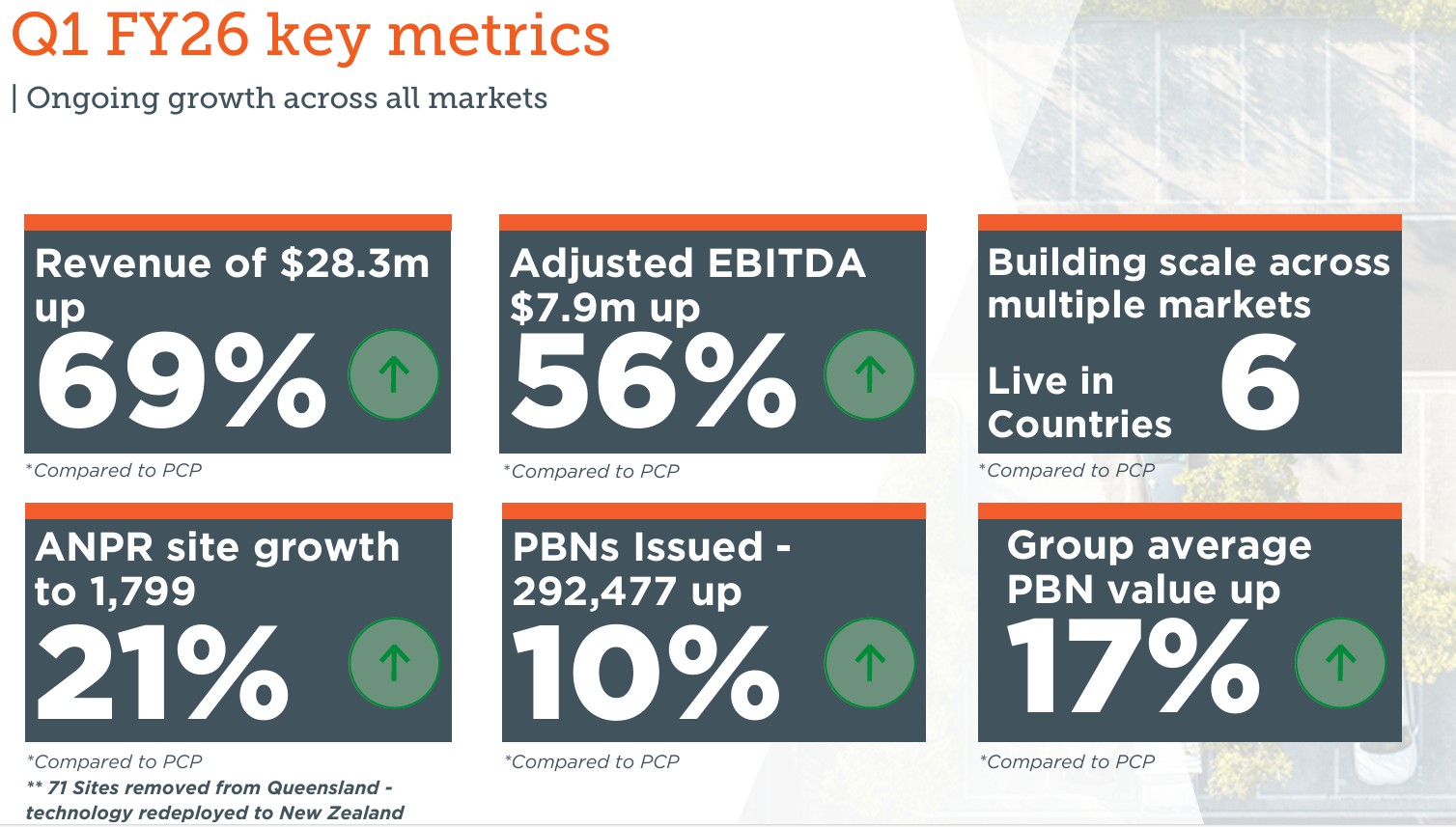

There was nothing new in the presentation compared with the Q1 update from a couple of weeks ago, but I did learn some interesting points from the Q&A.

In Q1, they added the 71 sites lost in Australia (shipped hardware to NZ). Management sounded very confident about their target of adding 500 to 700 sites. I missed whether this goal applies only to FY27 (as shown in the slides) or if FY26 is included as well. Most of the growth is expected to come from the UK (around 300 sites), with New Zealand and Germany contributing roughly 100 each.

There was an interesting discussion about the trade off in the US between sites that require no capex, which tend to be shorter term and less sticky, and the sites that do require capex, which typically have stickier customers, use SPZ's technology and analytics, and come with longer duration contracts.

In Denmark the payment amounts and payment rates are much higher than in the UK & NZ. They want to use Denmark as a base to get access to this profitable Scandinavian conscientiousness. For now, operations in Denmark are still manual rather than using automatic number plate recognition.

In Germany, they remain confident about reaching profitability soon. In Switzerland, they expect to have sites operating by the end of the year.

Overall, management was upbeat, and the chair reflected on the strong share price performance over the past decade.

My sense is that it is a well run business, but it may need some time for fundamentals to catch up with the recent share price gains. I am particularly interested to see how the US segment performs in H1 FY26.

Nice update from SPZ, condinuting to deliver and seems to be integrating the USA acquisition, as well as adding new sites there. UK, Germany and NZ going well. Pivoting in Denmark with regulation changes. Switzerland just started.

Another great quarter from Smart Parking

200k on market trade - like this as a holder

Going out to FY28

Annualising USA FY25 revenue of 10m to get 30m for FY26.

bear case, 10% revenue growth, 5% margin, 1.6eps ,PE 12 => $0.14

base case, 16% revenue growth, 10% margin, 3.6eps, PE 20 => $0.54

bull case, 20% rev growth, 15% margin, 6.1eps, PE 30 => $1.37

Weighing these equally gives $0.69.

Major uncertainty in profit margin, looks like economics of US business may be better than others.

Following @mikebrisy 's SPZ results update, am firming up thoughts to open a position on SPZ with excess cash from the unplanned exit from AD8.

Listened to the SM interview with Paul and Richard from Feb 2024. It is a bit dated, but still very useful to get an understanding of the business. Also went through @Strawman 's notes from 3 or so months go.

It is a very simple business to understand, thankfully! Have not fully digested the recent results, but wanted to document my initial thoughts and pause a bit prior to pulling the trigger on a starter position to get going.

Investment Thesis

- Huge TAM, theoretically "all car parks in the world in countries that have a friendly legislative regime around providing car/driver information" - SPZ is just starting in each of the countries that it is in, so growth ahead is huge

- Financials are very compelling - FCF $13.3m, cash $12.7m, revenue up 42% YoY, EBITDA up 47% YoY, EBITDA Margin a healthy 26.6%, already profitable with NPAT up 47% etc

- Sites have grown at a fast clip - 45% in FY25, across multiple countries

- US Peak Parking acquisition will accelerate the growth across the US

- Win-win for customer and SPZ - monetise car park assets at no/minimal capex cost to customer, in return for shared revenue to ensure "car parks are always available to genuine customer"

- Low-ish capex requirement per site (reminds me a lot of MTO!)

- Share price is now at the same price as the capital raise for the Peak Parking acquisition - not a bad time to join the party

The Risks

- Changes in regulatory framework can hurt - Qld, Denmark, de-risk by expanding to more countries

- Product is not super long-term sticky (as compared to say, SAAS software like XRO, SDR), customers can leave at the end of contract and go with someone else - de-risk with good service

- There are lots of competitors - de-risk with good service

- Technology does not appear to be uniquely proprietary to SPZ, feels like there are viable technical solutions which a competitor can provide - not a high entry barrier/insurmountable moat - - de-risk with good service

- High dependence on maintaining high human-based service to customers, it is not an install and leave situation like software - Paul talked about the need to constantly touch base with customers etc, ongoing dependence on good sales force

It looks like a very exciting business to own. But my niggling fear is that the moat is not as watertight as I would like it to be, which holds me back a bit, but hell I can be convinced!

Much appreciate if SPZ holders could glance through and point out anything missing or incorrect, particularly the risks.

Discl: Not Held, but looking to open position

Slightly surprised to have got this far into the day and not see any reports on $SPZ FY results. But, never fear, @mikebrisy was there!

With the help of my BA, I have summarised the results in some detail, including insights from the Q&A discussion.

As it is late in the day, I have not "corrected" managements various "underlying" measures, which extend into alternative presentations of the cash flow statement, which I find annoying. (I do all my analysis on statutory accounts - I'm old fashioned because I think these standards exist for a reason!!!!! Rant over.)

I'll structure my report as:

1) Financial Summary

2) Summary of Operational Performance by Country

3) Any Developments in the Business Environment

4) Future Outlook (spoiler - these guys will give guidance at H1)

5) My Overall Assessment

6) Conclusions

1) Financial Summary

- Revenue: $77.3m, up 41–42% on FY24 ($54.7m).

- Adjusted EBITDA: $20.5m, up 47% (FY24: $13.9m).

- EBITDA margin: 26.6%, up 110bps on FY24.

- Net Profit After Tax (NPAT): $5.4m, up 47% on FY24 ($3.7m).

- Earnings per Share (EPS): 1.45 cps, up 37%.

- Free Cash Flow: $13.3m, up 15%.

- Cash on Hand: $12.7m at June 30, 2025 (excl. customer funds) vs $7.2m FY24.

- Balance Sheet: Strengthened via $45m equity raise (Feb 2025) to fund Peak Parking acquisition; also secured new USD $10m + AUD $10m revolving/accordion facility.

From the Q&A: Management reiterated that the Peak Parking acquisition has already been EPS accretive (>25%) and is outperforming expectations, validating the equity raise strategy.

2) Summary of Operational Performance

Group Overall

- Sites under management: 1,799 ANPR sites (up 26% YoY). Including U.S. non-ANPR, total estate 1,938 sites.

- PBNs (Parking Breach Notices): >1.0m issued for first time, up 21%.

- Site additions: 437 new ANPR sites (gross), +45% vs FY24

From the Q&A: 71 QLD sites to be removed from the number in the "next 6 weeks".

Market by Market (My brief summaries in parentheses)

United Kingdom (Solid)

- Revenue: $52.5m, up 19%.

- EBITDA: $16.7m, up 17%; margin ~32%.

- Sites: 1,335 (+19%).

- PBNs: +13%.

- Comment: Remains largest market (c. 70%+ of group). Regulatory consultation in July 2025 viewed as supportive for higher compliance standards.

New Zealand (Going gangbusters)

- Revenue: $7.4m, up 62%.

- EBITDA: $3.2m, up 128%; margin 43% (highest in group).

- Sites: 238 (+47%); PBNs up 48%.

- Comment: Now scaled; strong inbound enquiries and strategic client wins with <1% market share, large runway ahead.

Germany (Now really starting to get going)

- Revenue: $4.0m, up 43%.

- Sites: 107 (+60%).

- PBNs: +37%.

- EBITDA: –$1.5m (loss narrowed; expected to turn profitable in CY25).

- Comment: Growth accelerating; won new multi-site contract (25 Burger King sites) in H2 FY25.

Denmark (Early days, and a backward step)

- Revenue: $1.3m (first full year since Feb 2024 launch).

- Sites: 48.

- Regulatory update: July 2025 law requires PBNs placed physically on vehicles. SPZ adapted with manual enforcement (supported by proprietary tech). This lowers PBN volumes per site, but increases per-PBN value (more infringement categories covered).

United States (Peak Parking acquisition – Feb 2025) (Gamechanger)

- Consideration: USD $36m (USD $32m upfront + up to $4m earnout), funded via $45m equity raise.

- Business: 139 sites across 7 states (Texas-mostly, Georgia, Washington, Florida, Indiana).

- FY25 contribution (4 months): Revenue $10.2m; EBITDA $3.1m.

- Performance: Revenue up 16%, EBITDA up 19% vs PCP; on track to exceed USD $4.5m CY25 earnout target.

- Integration: ANPR rollout underway; SmartCloud deployed; new sites opened in Indiana.

Australia (Dead)

- Operations ceased (Queensland regulatory issues). 71 sites remain in portfolio.

- Sites to be removed from numbers in next 6 week

- Equipment to be redeployed to New Zealand (“an NZ Capex holiday”)

3) Market and Business Environment

- Regulation:

- UK: July 2025 consultation paper on higher compliance standards expected to be favorable for private operators like SPZ. Good news.

- Denmark: New enforcement rules require manual PBN placement, prompting operational adjustment but also higher-value notices.

- Technology: Continued investment in proprietary ANPR and SmartCloud platforms; upgrades improving recognition accuracy and reducing site hardware costs.

- Acquisitions: FY25 marked entry into the U.S. via Peak Parking; prior years saw smaller deals in UK (Local Parking Security) and Germany (ParkInnovation).

From Q&A: Management highlighted that U.S. has potential to become SPZ’s largest market, surpassing the U.K. over time. They stressed integration discipline and strong local leadership as key success factors.

4) Future Outlook

- Growth Target: 3,000 ANPR sites under management by Dec 2028, affirmed. (Likely early).

- Momentum into FY26: July 2025 revenue +73% YoY, EBITDA +60% (seasonally strong month but illustrates earnings power of larger estate). But don't get too carried away by one month's data.

- Capital & Liquidity: $12.7m cash and new debt facility provide flexibility for further acquisitions and tech investment.

- Geographic Expansion:

- U.S. – integration and expansion beyond Peak’s footprint (Indiana entry completed).

- Germany to turn profitable in CY25.

- Denmark adapting to regulation.

- Switzerland – new business established July 2025.

- Technology Focus: Continue ANPR/SmartCloud rollout, improve compliance yields, reduce hardware costs.

From Q&A:

- Management suggested Germany is at an inflection point towards profitability.

- U.S. ambition: long-term plan is for it to outsize the U.K. business, but execution focus remains on integration.

- Management intend to adopt a more “regional approach” to geographic expansion, which are intended to limit overhead growth and leverage skills as new territories are added. Examples as follows:

- New US states from the US business

- Germany supporting Switzerland (DACH region, i.e., Ger., Austria, Swiss)

- Denmark supporting Sweden and Finland

- Dividend policy unchanged (no dividend declared; reinvestment in growth prioritized).

5) My Assessment

Overall, these are pretty good results.

US is transformational

Although it is early days and far to early to assess the success of the US acquisition, its inclusion represents a material broadening of the $SPZ portfolio. Pure is currently concentrated in Texas, but over 40 states provide access to “keeper details” and are therefore potentially amenable to the ANPR technology. While Paul says they don’t know how many potential sites there are in the US, he believes the country has "a billion parking spaces" and the business opportunity is “around 10x UK”.

And with $10.2m Revenue and $3.1m EBITDA from the first 4 months, Pure is already delivering an EBITDA margin contribution of 30% - clearly accretive to the $SPZ group.

I always find it challenging picking through the results after a significant acquisition. And with the inclusion of Peak Parking for 4 months, several aspects of the report are messy. But from what we can tell so far, it is looking positive.

UK and RoW is Growing Strongly – this is not just and M&A Story

At the headline level, backing out the US with $10.2m revenue and $3,1m EBITDA from 4-months of Peak Parking, means that on an organic basis:

· Organic Review growth was 23% (vs. 41%)

· Organic EBITDA growth was 17% (vs. 41%)

These are both decent numbers, representing an uptick in % revenue growth from last year (+21% last year), and % EBITDA growth (+8% last year).

All the countries are doing well. UK growth was strong, NZ is going gangbusters with a long runway ahead and some free capex coming in FY26 from the abandoned QLD business, and Germany seems to be sparking into life and will become profitable before the calendar year end.

The Setbacks

There are only two setbacks as far as I can see.

QLD

QLD was completely absent from the presentation and only in the Q&A did we learn that the sites are coming out of the site count in 6 weeks, and the equipment is being redeployed to NZ. (Now that’s disciplined capital allocation for you!)

But I do mark management down on not being up front and stating this more clearly in the presentation. Investors expect and need to hear the unvarnished story, and behaviour like that always puts me on alert.

Denmark

Denmark, where it is very early days, has passed some regulation which means that the first notification of a parking infringement has to be a physical notice on the vehicle windscreen. Paul seemed to say that they will cope with this, but it does sound like it presents some margin erosion at the very least for the fledgling Danish business.

And so that’s a timely reminder that this business will always be exposed to the whim of regulatory change and the social licence to operate with the community. Which again brings me back to the good news that $SPZ is diversifying its country / jurisdictional exposure.

6) My Conclusions

I updated my valuation for $SPZ at the half year to a “thumb suck” estimate of $1.00. I don’t think there is the basis to materially revise this, until we get to see what a full year of US performance looks like, and to see what kind of organic growth it can deliver.

HOWEVER, once reporting season is over, I will give this a hard look, because the stronger organic growth indicates to me that Paul and team are likely to blow their FY28 targets out of the water. And so it is possible my re-valuation will nudge closer to the analysts (3) who are at $1.25. But let's see when I've done the work.

Even though with the issuing of new equity for Pure and ROE goings backward again, the fact that it is 9% this early in the business’s growth journey, I find very encouraging indeed.

This business has a healthy balance sheet, has delivered its 5th consecutive NPAT positive year, and is delivering robust and growing operating cashflows. And multiple territories are growing rapidly with what appears to be rapid site investment payback economics.

I have been quietly accumulating $SPZ on any SP weakness over the last 6 months, and with it now standing at 7% of my RL portfolio, I am content to HOLD based on position size. Were I not in that position, I would be buying.

Each year, I get more positive about this business - which has quickly become a top 5 holding for me in RL!

Disc: Held in SM and RL

Another LinkedIn post announcing Smart Parking have opened for business in Switzerland.

I don’t recall hearing this being discussed in any investor presentation? (Or did I miss or forget something?)

Disc: Held in RL and SM

Just came across the post below on LinkedIn. $SPZ appears to be expanding via Peak Parking into the State of Indiana, US.

If this were Europe, it would be like adding a Denmark or a Finland.

Nice to see the business expanding its US footprint…. This is exactly what I expected to see and this is the first mention I think I’ve seen made to IN anywhere.

Disc: Held

Smart Parking is a lean, tech-driven operator with a proven model, solid fundamentals, and a genuinely scalable path to growth.

The business itself is nice and simple: it helps owners of parking assets (think shopping centres, hospitals, transport hubs etc) better manage and monetise their space. The pitch is straightforward: SPZ handles enforcement, ensures compliance, and increases space availability for actual customers, all while sharing in the revenue upside. In most cases, the client doesn't even foot the capex bill. It's win-win.

The engine behind this is Smart Parking's integrated tech platform: ANPR cameras, SmartCloud software, and automated enforcement via Parking Breach Notices (PBNs). The system tracks vehicles, detects overstays or breaches, and initiates enforcement. Critical to this model is access to vehicle registration data, which SPZ secures through legal agreements with government agencies. This end-to-end control allows for efficient scaling with minimal human intervention.

Importantly, it's working. Over the past four years, revenue has grown at a 21% CAGR, adjusted EBITDA margins have expanded to 27%, and free cash flow conversion remains high. FY24 delivered $54.3m in revenue and $14.7m in adjusted EBITDA, with $12.2m in free cash flow—an 83% conversion. The business model is capital-light post-installation, and new sites tend to pay back in under a year.

The strategic footprint is expanding. With 1,561 sites under management as of H1 FY25, Smart Parking has barely scratched the surface of a global opportunity: the company estimates over 240,000 addressable sites. It has already established operations in the UK, NZ, Germany, and Denmark, and entered the U.S. in 2025 via the acquisition of Peak Parking. The U.S. market is especially enticing—not only the largest in value terms but also deeply fragmented and inefficient.

The Peak Parking deal added more than 1,000 managed sites in markets like Texas, Florida, and Georgia, offering immediate scale and distribution for Smart Parking's tech. The AUD $38m acquisition was funded through a $30m equity raise at $0.88/share, demonstrating investor confidence and providing ample runway. With $7.2m in cash and $20m in undrawn debt capacity, the balance sheet remains conservative.

Operationally, the business is in rollout mode. Growth is both organic via direct wins of new sites and inorganic, through tuck-in acquisitions. The model is modular and replicable, and the company has demonstrated the ability to enter new geographies effectively, as evidenced by its rapid progress in Germany and Denmark. Management execution has been disciplined, with site growth averaging 31% per year since 2018.

While regulatory risk (especially access to vehicle data) exists, Smart Parking has a track record of navigating these hurdles. Queensland remains paused for now due to local policy, but other jurisdictions have proven workable, and the company continues to diversify.

This is not a winner-takes-all market. Despite some capable competition, the majority of the world’s car parks are still managed manually or with outdated systems. With a first-mover advantage in many regions, strong tech IP, and recurring revenue from long-term contracts, Smart Parking is positioned to capture share steadily over time.

At the current share price of $0.85, the company is valued at around $350 million. The trailing P/E ratio is high (~80x), but that reflects one-off impacts and a business in scaling mode. On a pro-forma basis including Peak, earnings per share are estimated to nearly double, suggesting a forward P/E under 40x. While still elevated, it's a more reasonable multiple given the company's capital efficiency, cash generation, and average profit growth of ~30% per annum. So it’s not cheap, but nor is it expensive if current trends continue.

This is a very easy to understand business, with excellent economics and a lovely track-record of disciplined execution. And there’s a lot of scope to grow. Happy to hold.

I've had SPZ on my watchlist for a while but have only had time to work on it today. The stock is pretty close to fairly valued at the moment. Based on the cash flows, margin expansion, and international rollout, my model puts the intrinsic value at around $0.76 per share, compared to the current market price of $0.77. So, it’s trading right on the money, maybe just a touch overvalued, depending on how you look at it (DCF margin of safety is –1.78%).

The median result in my simulation came in at $0.755, and the range between the 10th and 90th percentiles was $0.61 to $0.90. So there’s upside potential, but the odds are slightly tilted toward the stock being priced for perfection—about a 55% chance it’s overvalued, 23% fair, and 21% undervalued (with a 10% buffer)

That said, I like the business. It has solid cash flows and a decent moat around its compliance tech, data-driven enforcement model, and the network effect it’s building across cities. It’s both a hardware and software play, and the recurring revenue model makes it capital-light once the infrastructure is in place. They’ve scaled well in the UK and Europe and are now entering the US, which adds some asymmetry if they can execute.

Free cash flow is projected to grow over 20% annually, they're reinvesting efficiently, and it’s a 9.5% ROIC business with no debt.

I don’t own it — yet — but I’ll be watching closely. It’s not screamingly cheap at current levels, but it’s not expensive either. If it pulls back below $0.70, I’d be much more comfortable initiating a position. For now, I’d say it’s a high-quality business at a fair price — and worth keeping an eye on.

Some data and other valuation results

Market Cap: AUD $305 million

Shares Outstanding: 340 million

Debt: $0.0 million

Cash: $8.5 million

Tax Rate: 30%

Initial Revenue: AUD $54.7 million

Initial EBIT: AUD $6.88 million

Initial EBIT Margin: 12.6%

High Growth Rate: 15.5%

Stable Growth Rate: 3.0%

Average FCF Growth: 20.7%

Reinvestment Rate (avg): 51.9%

Return on Invested Capital (ROIC): 9.48%

Risk-Free Rate: 4.15%

Equity Risk Premium: 4.33%

Raw Beta / Adjusted Beta: 1.03 / 1.02

Cost of Equity: 8.55%

After-Tax Cost of Debt: 4.97%

WACC (High Growth / Stable): 8.55% / 7.78%

Enterprise Value: AUD $248.63 million

Equity Value: AUD $257.13 million

Intrinsic Value per Share: $0.7563

Current Market Price: $0.7700

DCF Margin of Safety: –1.78%

Going back a couple of weeks, it is interesting to observe that with the SP fall in $SPZ following its lofty heights, it failed to raised the targeted total of $5m through its 1-for-24.35 Retail Entitlement Offer.

There were only 270 retail applications for about 1.35 million new shares, leaving underwriter Canaccord Genuity to pick up the balance as set out in its underwriting agreement (which of course it will have done for a handsome fee!) The price tag was $3.8m

In a rare lapse of process discipline (i.e., failing to wait until the closing date) I paid the full $0.88 for my entitlement. But then again, so did three-of-four of the Directors, including CEO Paul Gillespie.

Although details weren't given about the Institutional Placement(other than to say it was fully underwritten), it was claimed to be successful, which was unsurprising at the time given that the SP at the time was around $1.00, being ahead of the offer price of $0.88.

Of course, this was just before the "risk-off" correction we're having, driven largely by US-led trade uncertainty,

All that said, with today's price sitting below $0.70, I am thinking whether now is the time to top up. I'm a relative latecomer to the $SPZ party, having joined just over a year ago. $SPZ is a RL position for me of 2.5% (cost base), and 3.4% (today), so there is room for more and this looks like a good opportunity.

I've just posted my valuation ($1.00, range $0.75 - $1.25) with the caveat that you can get pretty much any number you want!

And of course, we can take no notice of the Canaccord Genuity hiking their Price Target by 14% to $1.25 on 18th March, as they would have that view, wouldn't they. (But it is interesting to note that their PT just clips the top end of my range so, while I see it as optimisitic, I don't see it beyond the realms of plausibility.)

Disc: Held in RL and SM

26-Mar-2025

Valuation: $1.00 ($0.75 - $1.25)

I'm way overdue posting a valuation for $SPZ, having held in RL and SM for just over a year.

The basis for the valuation is the continuing business prior to the acquisition of Peak Parking, as I have no way of knowing how $SPZ will scale into the US, and I am treating this market entry as simply creating option value for $SPZ to continue to allocate capital to sustain revenue growth annually at 20%p.a. out to 2027, at favourable economics.

The range of uncertainty in valuation is probably higher than I've indicated. But that's because it is hard to pick apart the economics of the business between stable operations and growth. This is simply something to be fine-tuned over time with more history and (hopefully) fewer new territories, now the US is added. The business is still at a stage where, as an outside, you can get a very wide range of values. So the thesis is very much reliant on good capital discipline by management as they continue to grow - something they appear to be focused on.

Method 1: calculate EPS at 2027 and discount back to 2025

Range of results $0.75 to $1.25, with central case around $1.00

Assumptions:

- Revenue growth 20% p.a.

- Total (direct and operating) expenses growth: Case 1= 17.0% p,a, and Case 2 = 15.0% p.a. (see note below)

- Finance costs 1.9% revenue and Tax Rate = 30%

- Discount Rate 10%

- SOI constant

- P/Es applied in 2027 are 30, 35, 40 (reasonable given EPS growth rate in 2027 ranges from 38% to 53%)

- Big assumption: no regulatory shocks especially in the UK (i.e., like QLD!)

Results for discounted $/share at PEs selected

- Case 1: "lower operating leverage": $0.75, $0.87, $1.00

- Case 2: "higher operating leverage": $0.94, $1.10, $1.25

Notes:

- Clearly, in 1H FY25 expenses grew fater than revenue. However, as we discussed at the time, this is the result of expanding into several new territories simultaneously, while also pursuing US M&A.

- Fully expect expenses growth rate to fall looking across FY23 and FY24 results

- The extent of operating leverage will be key to monitor over the next couple of reports

Method 2: Sense checked result using EBITDA growth and EV/EBITDA multiples.

Similar ballpark, using EV/EBITDAs of 10, 13 and 16 for FY27.

Good to see 50k on market purchases by directors.

post hoc. Oh I was wrong this was participation in the entitlement offer… I guess that’s even better given it was at a higher share price than todays

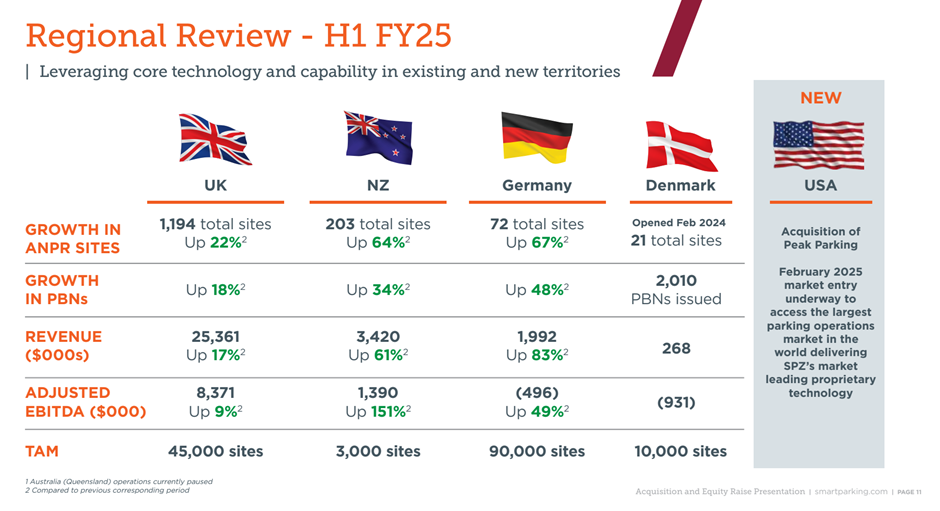

Smart Parking’s H1 results get a tick from me – a reasonably strong half. Acquisition excluded, we saw revenue increase 20% (vs pcp) and total sites increase from 1424 to 1561 (vs FY24), with modest growth seen in the UK, NZ and Denmark.

Germany continues to present problems, minimal improvement since H2 FY24 off a low base. I think this market in particular was a major learning curve for management that likely contributed in a big way to their approach in the US, making a significant acquisition to assist with entering the market.

In short, I think this result was more of the same for Smart Parking. No surprise that we are seeing increases in growth capex (almost double pcp) – but well and truly expected noting their trajectory/growth. Every half year and FY report that passes, concentration risk decreases (at least I hope so -- key to my thesis). In FY24, UK sites were 79% of total sites. This decreased to 76% post H1, or 70% including the US. That is positive.

The big talking point was the acquisition of Peak Parking. Plenty of great discussion already on here, so I wont repeat any of that – only to emphasise @Wini's point that this is out of character for the business. Valuation is on the exxy side, but it does sound like they are acquiring a high-quality business and management team. If this team stick around, this could be a real winner for Smart Parking and allow them to hit the ground running noting they are a developed, mature business that already manage 134 sites across various US states.

@Wini, agree with your point also that Smart Parking could shape up to be a fundie favourite in time. Ongoing diversification (i.e. the move into the US) as pointed out by @mikebrisy, will only help in this regard too. This acquisition might also allow them to position themselves as a key global player over time. I still maintain Smart Parking has the potential to be a business worth 1billion (plus) and this acquisition probably edges them forward slightly in achieving that.

As usual, time will be critical in determining if this acquisition is a winner, but I am left encouraged. Things to watch (I will revisit in 12 months):

1. The existing management team in the US (will they all remain?). Founder has been there since 2019, while Director and Controller have been there since 2021.

2. How Smart Parking incorporate their IP into what is a different business model and what changes they make, if any

3. If Smart Parking can maintain (or improve?) Peak Parking revenue/EBITDA growth, as seen over the past 24 months.

4. How they tackle growing into other states, noting Texas has 80% of total US sites.

Valuation update to follow.

$SPZ announces the successful completion of the institutional component of the capital raise to fund the US acquisition of Peak Parking.

Paul Gillespie says: “We are delighted with the support for our growth strategy and H1 FY25 results. We appreciate the support from our shareholders for the raise and welcome new investors to SPZ. With these funds we will be able to complete the acquisition of Peak Parking and build a high quality business in the world’s largest parking management market.”

Market also seems positive..... as it should IMO.

Disc: Held

I was doing some research a few weeks ago on Smart Parking to see if I would reinvest in the company after exiting during Covid to buy a house. I came across some pretty scathing reviews on Trustpilot (here), and I was a bit flummoxed.

Whilst I can appreciate that a fine enforcement company wouldn't be expecting glowing reviews from issuing fines, however most of the bad experiences listed on the website seem to be about incorrect fines, poor service, and engagement of debt collectors (even when fines are in dispute).

Outside of considering these reviews, the growth in the UK does not seem to be slowing down (up by 22% PCP) so it doesn't look like slowing down anytime soon. Lots of people have suggested they have written to their local politician for action, however I'm not expecting any changes implemented in the short term and I believe that the likelihood of this risk materialising is extremely low.

On the flip side, if there was some knee jerk regulatory changes or in the absolute worst case had their British parking association approved operator scheme revoked it would materially impact revenue generation.

I'm am keen to understand the Community's position on how much weighting they give to review pages like this (i.e. Customer Star ratings or workplace review sites such as Glassdoor), and if this has any bearing when they are putting together their investment case.

This morning $SPZ announced their 1H Results as well as the proposed acquisition of US-based Peak Parking LP for US$36.0m with an associated capital raising via an entitlement offer and a fully underwritten institutional placement.

It would be easy to focus on the acquisition – exciting that it is – however, in this straw I will focus on the operational performance for the half, leaving the proposed acquisition as a separate matter.

1H FY25 Highlights

Financial Highlights

- Revenue of $31.9m up 20.0% to pcp

- Adjusted EBITDA of $9.5m up 26% to PCP and Adjusted EBITDA Margin of 29.8% up 139 bps

- EBITDA of $9.19m up 34.6% to PCP

- "Adjusted free cash flow" (excluding growth capex) of $6.4m up 60% to PCP

- Cash of $8.5m up 17%

- EPS of $1.12 ($1.11 diluted) up 70%

Operational Highlights

Good growth in all markets, with accelerating PBN growth in the UK +18% (vs +13% in pcp) and strong growth in the profit contribution in NZ.

Losses in Germany continue to narrow, and a good start in Denmark.

My Observations

This is a good operating result. $SPZ have delivered another year of +20% revenue growth, with operating leverage driving strong EPS growth of +70%,

The UK continues to be the engine room driving almost 80% of revenue and 88% of adjusted EBITDA.

It is pleasing to see a meaningful contribution coming through from NZ, and it is still early days in Germany and Denmark, although German with sites up to 72 from 43 in the PCP, only added +5 from the EOFY 2024.

On the other hand, Denmark has gone from 11 contracts and no reported operating sites at EOFY24, to now have 21 up and running.

The new growth markets of NZ/Ger/Den are starting to make a more material contribution with aggregate PBNs growing +43% in the half vs. the PCP, compared with the more mature UK growing at a still decent (and in fact accelerating) +18%.

On cash generation, $SPZ’s curious “Free Cash Flow” of $6.4m (defined on slide 32), compares with the FY value of $12.2m – so it seems only a modest increase on a pro rate basis. The historical 1H/2H split for 1H FY24 was 49.3% of cash receipts, so their doesn’t seem to be a strong seasonal effect.

The seemingly impressive operating leverage and strong NPAT growth hides two factors. First, a currency tailwind giving a windfall of $0.74m, offsetting significant expenses growth: raw materials and consumables (+20% - in line with revenue growth), employee benefits expense (+28%), D&A (+35%), rent and leases (+52%) and other expenses (+18%).

In isolation, these cost increases might appear to be a cause for concern. However, it is important to understand that these expense lines include the impact of the expansions into Germany and Denmark, and doubtless too, the costs for a year of prospecting for acquisitions in the US.

Overall, then, the net cash generation of +$1.3m is a good result. Cash contributions from UK and NZ, more than covering the net costs of getting started in Germany and Denmark and the hunt for acquisitions.

My Key Takeaways

The business continues to allocate capital from profitable core operations into expanding the business. All markets are growing – UK and NZ strongly, Denmark is off to the races, and Germany is making slower progress.

CEO Paul Gillespie reiterated the strategic goal of achieving organic growth of doubling the business to 3,000 ANPR sites by December 2028. Achieving that from today’s total of 1561 (including the suspended 71 in QLD), represents a CAGR from end of 1H FY25 to 31 December 2028 of 18%. This can be considered in the context of the latest growth rate of 28% (to pcp) and with the US soon to provide a new beachhead for growth.

Tomorrow, I’ll write up my appraisal of the proposed US acquisition deal. But, operationally, the meter at $SPZ is ticking along nicely.

Disc: Held in RL and SM

SPZ released 1H25 results this morning which on balance were fine, a little weaker than I expected but largely due to operating losses in Denmark and Germany before those geographies scale up.

However what dominated the result and the conference call this morning was the acquisition of Peak Parking based in Texas for the measly sum of $56m. 8x forecast EBITDA is nothing to sneeze at either!

It is a step change from the previous acquisitions made by SPZ:

UK - NE Parking (517 manual sites) for $520k

UK - Enterprise Parking Solutions (68 ANPR sites) for $1.54m

Germany - ParkInnovation (46 manual sites) for $2m

UK - Local Parking Security (72 ANPR, 54 manual sites) for $5.8m

Of course everything is bigger in Texas, including acquisitions!

SPZ management has earned the benefit of the doubt and I'm sure the lofty multiple the business trades at made the decision to acquire an easier one. That said, there are things shareholders will need to keep an eye on because unlike the acquisitions above the integration of Peak won't be as simple.

The business doesn't operate with SPZ's traditional parking breach notice business model. They charge a management fee to customers to manage their complete parking solution including valet, event management and consulting services. SPZ disclosed 20 of Peak's existing 134 sites have already expressed a desire to implement breach notices in their existing parking solution so there should be some immediate synergies on that front.

However it requires a change to the Peak business model where currently customers pay for any capex installed on their sites (boom gates, ticketing machines, etc.). SPZ has seen great success with the no capex model for customer, installing their ANPR system for free but then collecting the full benefit of any parking breaches (the customer benefits from better turnover in their parking site). On the call, the SPZ CEO said there is no one in the US using that model and they will remain flexible and use the model that best suits the customer.

In the end it became clear that despite Peak not being a "plug and play" acquisition like others in the past, SPZ management are very excited for it as the business has grown very strongly over the last few years all organically with an entrepreneurial management team committed to staying on and driving that further. But realistically today's announcement is bigger than Peak, it is confirmation that SPZ is ready to take on the gigantic US market. It will be a challenge and we will have to wait and see whether the Peak acquisition was the right one but nonetheless it is exciting to see them attack the US opportunity.

Acquisitions in the pipeline??

Looks like $SPZ is gearing up for its next market entry acquisition.

Pass the popcorn.

StrawPoll: where a) FL b)TX c) Other Scandinavia d) Other EU?

@Strawman - have you ever thought about developing a "StrawPoll" feature on the platform? It might not be that easy, but it could be fun!

As already mentioned, we got a glimpse into Q1 FY25 and not surprisingly Smart Parking continues to kick goals. My thesis is that Smart Parking will be able to increase revenue YoY (like it has done since 2021), with a target of more than 15-20%, while getting an attractive return on capital employed. How? They invest their cash well and their business model is bloody attractive. In terms of a thesis check, things are going well here.

Historical data

I have been monitoring their progress over several years and I figured this was worth sharing. Since 2021, growth has been steady (arguably the best way to grow). I think this business will continue to flourish into the future with the exception of any major hiccups, mainly regulatory ones, along the way. Management's new target (3000 sites) in four years speaks to their confidence also. Should they continue on this current growth trajectory, they should achieve market-beating returns and then some.

What I am looking to see over the next few years is UK sites, as a % of total sites under management, decreasing -- suggesting they are growing in other jurisdictions but also helping to reduce key market risk in the UK.

Another risk worth highlighting relates to the current management team, specifically the CEO/MD and CFO. The current CEO and MD, Paul Gillespie, has been employed since 2013, while the current CFO, Richard Ludbrook, has been there nearly 14 years. Further, the current Chair, Christopher Morris, has been in his position since 2009. Under their direction, more recently in particular, Smart Parking has thrived. That said, there is no guarantee the business performs continues to perform this well under new management. Something to monitor.

Disc. held

$SPZ held their AGM this morning.

A few positive updates, with the two key slides added below:

- 1Q FY25 is off to a good start: revenue up 24% and Adjusted EBITDA up 30%, both to PCP

- The 1500 site YE target has been achieved ahead of plan (1529 at 15 Nov) - note this targt had been accelerated from EOFY25

- A new long term target to achieve 3000 organic sites, doubling the business, by December 2028

CEO Paul noted that it's taken them 10 years to get to 1500 sites, and they now aim to add the next 1500 in 4 years.

Work on new markets in Scandinavia and the US (Texas, Florida) is progressing. Focus is now on finding the right entry point.

Demark is off to the races with contracts being signed.

UK - single industry code of practice agreed, no issues flagged under the Labour Government - regualtory environment appears stable for now. Paul thinks the Government will now monitor and see how the industry functions under the unified code.

Churn remains low at 30-40 site p.a.: mix of site redevelopments, exits initiated by $SPZ, and some losses to competitors.

Conversations under way with the new QLD LNP Government - warm but non-specific noises. Expecting movement in the New Year. Paul said he is confident they will return.

Overall, this is a company that is continuing to deliver, with a management who appear confident across all markets, with a clear focus on both operational delivery and growth.

On Valuation:

Market likes today's update. With SP at time of writing at $0.82, getting towards the upper end of my valuation. So, at 3.8% in RL, I'm a hold here. Need to update valuation in the light of the 3000-Dec. 2028 growth target.

Disc: Held in Rl and SM

Welcome as it is I find a 14% jump in SP on no news in weeks a bit disconcerting… is this just a case of small volumes? (900,000 shares traded) or is an institution building a position? Or something else entirely?

*SEP 24 UPDATE

They just need to keep doing what they're doing.

The rate of site growth appears to be accelerating as they increase the number of markets they can access. In a recent Coffee Microcaps catchup this was confirmed by Richard (CFO), who said they expected sites under management to increase by around 400 in FY25 (UK 200-240, NZ 80-100, Germany/Denmark 100). I don't think they said that in the investor briefing. Should they do that I think they're a chance to go past $70 million revenue this year. Richard said to me a couple of years ago that 1500 sites should equate to $70-75 million in revenue - so that pretty much tracks. He also said at that level they should do $22-25 million EBITDA. I think that's looking heroic, given the level of investment in multiple markets, but on a normalised basis? Maybe.

And if you believe that, I'll tell you another. I think Adjusted EBITDA isn't a bad proxy for FCF for this company. I'd probably add one caveat that you should adjust for lease costs. But almost all the capex is discretionary. They couldn't grow without it but if they ever wanted, they could turn it off and just be a cash cow.

All of which means I think they're trading on about 8-10x forward normalised EBITDA. That doesn't seem too demanding to me. In fact, this valuation seems pretty conservative and if they get anywhere near those numbers, I'd bet they'll be trading a lot higher than 75 cents.

*SOME PREVIOUS UPDATE

DCF assumes they will hit their 1500 site target by June 2025. According to the CFO this will result in $70-75m revenue (my model assumes $71m) and $22-25m EBITDA (my model is a little lower than this at $21m). They're usually pretty good at converting this to cash.

I'm including growth capex of $6m/yr in the model - that's probably not the right thing to do but I'll worry about that if they ever get near the valuation.

Discounting back at 13%. It could probably be higher in the current environment and given some previous misteps but even at 20% the model gives a valuation of 38 cents.

I haven't been updating my valuations on Strawman recently as one key learning over the past few years are models can say whatever you want them to but thought I'd try something different and update this one.

@mikebrisy @Noddy74 @GazD some good thoughts already. My take: FY24 was yet another good year. Money where my mouth is: this company is by far my largest holding in my satellite portfolio (reflected on Strawman too – although my RL weighting is slightly higher). Are you insane, you ask? A weighting of 20%?! Perhaps, but my knowledge and conviction has continued to grow over a number of years, and in that time I have grown to appreciate management and their growth strategy. I have also become more comfortable with a significant weighting. That doesn't mean there aren't risks; there are several. But their journey reminds me somewhat of Codan – management recognised their reliance on the UK market (in Codan’s case, their detector biz) and in response moved to diversify operations to other markets. But they are doing this in a measured way and are choosing markets where the risks (as seen in the UK and AU) are much reduced. This theme continued in FY24 – UK obviously remains a massive part of their business (78% of total sites) but this is a reduction on last year’s 84% – and that’s with the Qld market currently paused! I forecast further reductions to this figure in FY25 as the business continues to grow in other markets.

Main highlights:

- Revenue up 21% YoY

- Total sites increased 28%, a combination of organic and acquisition growth.

- Cash flow from operating activities at 13.5m, up from FY23s 9.2m – a 46% increase.

- 12.9m outlay in investing activities – 7.7m on two acquisitions, 4.2m on investment in organic site expansion and 1m in repayments.

- Cash balance remains healthy at 7.2m despite going backwards due to above investment.

In isolation, H2 saw a small improvement to revenue vs H1, while sites under management was much improved. Net profit after tax wasn’t as strong due to a combination of FX movement, tax adjustments and ongoing investment.

Like @Noddy74 suggests, some might look at this result and think 'WTF'. But this is where we are potentially at an advantage against a good portion of the schmucks on HC but also those in the industry that monitor 745 companies. Lift up the bonnet. Overall, FY24 resulted in a strong improvement in earnings, higher cash flows and continued expansion to international operations. Perhaps most pleasing is the ongoing evidence of scaling -- key business costs represented 38% of revenue in FY23, whereas they dropped to 34% in FY4, despite continued expansion. For those that query the competitive advantage for a small mundane parking business, this is it -- the economics and ROE are fantastic and will continue to be so provided management keep their feet on the ground.

The current market cap is just under 190m, with a revenue multiple of 3.5x. In return I am getting ROCE of around 20% and a growing, profitable business with significant runway ahead of it. With the share price where it is, I don't think we are far away from fair value. I plan to update my DCF/valuation in the next 24 hrs.

Key risks remain regulation, particularly the ongoing discussions in the UK, in addition to poorly executed expansion. I anticipate a decent outcome for Smart Parking in the UK, but an unfavourable decision could result in a very ugly short to medium term impact. I don't think this is likely. Agree with @mikebrisy that Qld isn’t critical to the business but remains a nice to have.

So SPZ is being spanked for it's drop in NPAT. It's fallen 13% at time of writing despite:

Increasing revenue 21% year on year.

Really good growth in sites.

Increasing free cash flow.

I am confident in the business so for me this is an opportunity to top up. I just have... Does the increase in costs and drop in NPAT reflect a lack of discipline? To me, it's the cost of a growing business and there will be up years and down years while the business grows. I would expect as the business matures it's larger footprint will smooth some of that out.

The key thing here is I don't see a new regulatory risk which would be a real orange flag.

All of that said, always keen for alternate views.

On 13 March, CEO Paul Gillespie sold around 2m shares on-market at roughly A$0.44 cps. This equates to about 25% of his direct individual holding at the time of the trade.

With the share price trading close to all time high levels, I am not too alarmed by this.

Nice little acquisition by smart parking today in the UK sector.

I wonder if this is increased confidence that the UK segment regulation will be favourable or they have struck a deal with a competitor during a moment of concern. Seems like a well priced deal.

held

Thanks for organising the meeting this morning! Management took us through the presentation released to the market on monday and added some useful commentary and details around the edges. My main take home message is that on the surface they have a genuine opportunity to grow revenue and earnings for many years ahead. Mamagement appear competent and level headed. I had been watching this one for a while and have taken a position in real life today!

SPZ results were mixed and the market appears to agree.

Revenue result at $26.7M was ahead of my expectation.

Extra revenue has not resulted in the PBT I was hoping to see as expenses have increased:

Employee expenses up 15%

Depreciation up 24%

Other up 22%

Let's see what they have to say on the call.

1H24 Results due Monday 19 Feb.

Reviewing my expectations prior to the release to gauge company growth projections.

I expect to see the following as a minimum:

1H24 Rev $26M

1H24 NPBT $5M

Sites 1230

Expect costs to increase to accommodate German rollout but hopefully these costs are offset by increased revenue.

Anything less will be a disappointment. Better is a bonus.

Updated broker report from Capital Markets for Smart Parking. Not too many changes from previous report but all positive it seems.

SPZ report Capital Markets 10 Nov 2023.pdf

Nessy

This article by the Verge is a good read, relating to GM-backed robotaxis in California having their permits suspended due to the amount of problems they are causing.

Driverless vehicles are something I monitor with the Smart Parking thesis -- and will continue to do so -- but I don't think we are anywhere near having a decent portion of driverless vehicles operate. The issues being experienced in California reflect this to an extent.

Revenue announcement above forecast represents a 3 year CAGR of 28%.

Forecast forward 10 years (10% rev growth at 2033) revenue is $198M.

Nominal growth in SOI (say 1%) provides EPS of $0.33. Costs growing at 10%. Costs may increase as German growth accelerates or enter new territories.

Use a PE of 15. Discount rate of 15%. Fair value around $1.15.

On the downside there is still regulation risk in the UK and Australia (Queensland) which is unresolved at this time. Apply a risk factor (pick your own number) say 30% discount.

I wouldn't expect to see a full valuation until regulation issues are resolved.

Smart Parking (SPZ) are due to release FY23 results on Monday.

While there should be no surprises to the market (as the market is updated with quarterly results) I find the growth profile of SPZ quite compelling.

Expect FY23 Rev of at least $43.5M+ (3Q23 $32.5M cumulative) which equates to a 2 year compound growth of 45%.

Sites and breach notices have been growing at +30% over the previous year.

Will be looking for meaningful growth in Germany and some update on the Queensland regulatory issues.

Share price appears significantly undervalued for the growth achieved and outlook. Possibly some hesitation due to regulatory risk?

Will update valuation following release of results.

Overall it was a solid update from Smart Parking last week with strong topline growth and decent cash generation being partly offset by unfavourable FX movements and increased overheads.

The key driver of the results is, as always, sites under management and on this measure they continue to deliver. The Group held 984 sites at the reporting date, which was up from 839 sites six months prior. They were keen to highlight that they've since exceeded 1000 sites, although you could argue QLD sites should be backed out of that number. Although the 1000 site target has been replaced by a 1500 site by June 2025 target, longer term holders will remember that 1000 sites by June 2023 was an earlier target and it deserves mention that they have beaten this. On the earnings call they reaffirmed the 1500 site target and I asked them to clarify if that meant ex-QLD, which they confirmed was the case.

Revenue was up 18% vs pcp, but up 25% from a constant currency perspective. UK growth is impressive given its relative maturity but the real driver is APAC, half of which we now know is - at best - on pause. Germany doesn't yet make a material contribution and will be on watch going forwards to ensure it does do so.

At the same time operating expenses appear to have jumped significantly and permanently. They strike me as a little sensitive about the investment in Germany relative to the return they're getting and I'm not fully on board with their practice of backing out Germany's costs from Adjusted EBITDA. However, it's all fairly transparent so you can rework it as you see fit. Overall a reasonable level of explanation was given to the cost uplift but going forwards I'd like to see that increasing at a lower rate. I have asked for clarification about what the disclosed monthly exit opex rate of $1.7m includes as it's not entirely clear, but that equates to a six month number of $10.2m - not too much higher than the disclosed half yearly opex cost, suggesting that opex growth may have slowed.

Free cash flow was strong but again it should be noted they are excluding Germany's costs from their definition of this. It's all very transparent though so choose your own adventure on what you do there. It also doesn't include Growth Capex (almost all of their capex isn't ongoing). I'm ok with that, others won't be. The balance sheet continues to look good and they have flagged a continuation of their share buyback (which they announced to the market they had started acting on a few days later). They've also started talking about dividends. I assume they will be unfranked given their overseas operations so I don't much see the point of that unless they've completely run out of ideas, but it is another indication that they do seem to act in alignment with shareholders.

Kudos for them holding an investor briefing. One of the themes I felt this reporting season has delivered is somewhat less of those and credit goes out to management who front up when the news isn't necessarily all good. Based on the attendees they do seem to be getting a little more insto coverage, although some of the questions seem to suggest the analysts hadn't had alot of exposure to the business yet.

In summary

The good:

- Site growth is the key driver and is tracking nicely. I haven't even mentioned the Technology segment of the business here as it's become an increasingly immaterial part of the business.

- As expected Revenue growth is following sites under management. Previously the CFO has said they could deliver $70-75m at the topline with 1500 sites. My model also supports this, albeit at the bottom end of that range. At that kind of number and given their propensity to gush cash, they'll be hard for the market to miss.

The not so good:

- Germany isn't yet shooting the lights out but it's early days. @Wini highlighted an Aldi win they'd had in this market some time back and they disclosed they now manage two Aldi stores, in deals signed off at the northern Germany region head office. According to Wikipedia Aldi Nord is the bigger of the two Aldi regions and has 2298 stores.

- I think the market was a bit disappointed to see the Cost base jump as it did. It's fair to say I was a bit too and this is on watch going forwards.

The ugly

- I think the prudent thing to assume is Queensland is not coming back and be pleasantly surprised if it does. I asked management on the investor call what learnings they took from this and someone asked something similar on the Strawman call. Both times they highlighted the lack of a Code of Practice in Queensland that does exist in other markets they operate in and that this would prevent a recurrence. I think the fact they were blindsided like they were suggests they and the peak body didn't do nearly enough work with the government to advocate/educate/put a code in place etc. and being proactive should be a key learning.

Overall I'm still happy to hold. I took a little profit at higher levels but it's still a larger holding and I think closer to a buy than a sell given it's pulled back a bit and should be supported by the share buyback if that continues.

Non-Executive Director Fiona Pearse recently bought some shares on market, totalling $38,000. Fiona now holds 783,000 SPZ shares, having previously held 613,000.

Fiona has extensive commercial and financial expertise gained from a long career at global companies BHP and BlueScope Steel. She has had a position on the board since 2019, so she knows the business well.

Always good to see some insider buying following some share price weakness.

Heard on ABC radio this morning that the Qld Government will from next week prevent companies from access to private registration details of vehicle owners.

No announcement from SPZ though.

Coming so soon after a trading update, SPZ's AGM was held this morning without a great deal of fanfare or controversy. A couple of new updates were given though. Smart Parking held 930 sites under management as at 31 Oct. That's up from 839 from 30 Jun and puts them on track to meet and beat their target of 1500 sites by Jun 2025. To add some context to that, according to them there are 150,000 sites available in markets they currently operate in - so their target is to manage 1% of those sites.

It also appeared that cash had rebounded in October and management included a waterfall to show movement of cash in the first four months of this year. They also forecast capex spend to be $4.5-5.5m in FY23. The nice thing about that spend is that it immediately starts paying for itself; it's not building capacity that you then have to go out and try to get someone to pay for.

A couple of other notes from the meeting:

- About 20 sites from the NE Parking acquisition (517 manual sites) have been converted to ANPR. Even they acknowledge it's not going as quickly as they would like but they don't need much more than that to justify the acquisition. I don't think of NE Parking as an acquisition per se - it's more like they paid a nominal sum to add a lot of sites to their pipeline and it may be a couple of years before they exhaust the pipeline.

- They're not yet seeing more challenging economic conditions being reflected in either traffic volumes or delinquency rates. In fact, October was a record receipts month for the U.K.

[Held]

Smart Parking released its annual report on Friday and there were a couple of tidbits that signaled strong growth is continuing.

Sites under management (their key metric) grew from 839 on 30 Jun to 896 on 23 Sep. It's up 7% QoQ and 21% YoY. The number of breach notices issued for Jul and Aug was 119,663, up 26% compared to Jul/Aug 2021. Management "is seeing growth in the car count and contravention rates increasing".