Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

@Strawman I really appreciate the "deep dive" on UK regulatory risk. Everything Paul said was consistent with my own research, other than his first hand view on it made me feel much more comfortable about the risks, i.e., low likelihood of an adverse outcome and the reasons for it.

Specifically, how the fines and recovery fees for local council car park escalate astronomically, as a strong reason why as adverse ruling is unlikely. Also, the shift in the consultation paper from referring to GBP50 PBNs historically now to GBP100 as a baseline.

It sounds like a change from 6 year recovery time to 3 years is one adverse outcome we might see, but I can't imagine the lost revenue would be material, unless it creates an incentive in the public to draw out their appeals / evasion of paying the PBN to run the clock down.

My bottom line is I have come out of the Strawman meeting reducing the likelihood of an adverse UK regulatory outcome. Which is a relief because, despite my selling down some, $SPZ remains my largest RL position.

Fascinated that Paul think US could surpass the UK in 1-2 years. Surely a slip of the tongue? But he did tease us referring to an update on the US in the New Year - presumably he'll reveal the metrics leading to the earnout result.

I was also really interested to hear Paul's accounting of the German experience. The country head appointment is a key decision, and it sounds like it took them some time to "remediate" a not-so-good decision. It will be interesting to see if the trajectory of Germany turns up going forward, as the market potential is significant.

Overall, a great meeting. Thanks!

At the recent $SPZ AGM, CEO Paul spoke about the latest round of Government consultation on the UK Code of Practice for Private Car Parking. Consultation completed in September 2025, and Paul indicated he expected a 3-4 month timeline for the Government to issue its response, which he expects would then lead to a further round of consultation.

In everything that follows in this Straw, it is important to recognise that $SPZ was key in shaping the existing, voluntary, industry-led Code of Practice, and that $SPZ aims to operate to the highest standards of compliance with this code.

Because of the importance of the UK market to the value of $SPZ, I have (with the help of my BA) undertaken a deep dive into what various UK consumer advoccay bodies have been publishing regarding their submissions to the consultation process.

Here are the key themes put forward by consumer advocates. Overall a common theme run through the consumer advovacy is a drive for a move from a voluntary code of practice, to a compulsory code with oversight and enforcement (i.e. Regulation).

1. Cap on Fines

- Strong calls to reduce the standard parking charge cap to £50 for minor or routine cases.

- Some support for retaining a £100 maximum only in the most serious cases, not as a default.

- Emphasis that fines should be proportionate to the breach.

2. Ban or Limit Excessive Fees

- Broad opposition to high debt recovery fees (e.g., £70 add-ons), viewed as punitive and unjustified.

- Warnings that such fees damage trust and should be banned or significantly restricted.

3. Transparency and Data Reporting

- Requests for mandatory publication of statistics on tickets, appeals, complaints, and cancellations.

- Advocacy for full transparency to build accountability and public confidence.

4. Fair Appeals Process

- Strong support for a single, independent appeals service to replace the current fragmented system.

- Appeals should be accessible, impartial, and offer fair resolution, including clear rules for mitigating circumstances.

- Recommendations that some types of tickets (e.g., minor keying errors or technical issues) should be automatically cancelled.

5. Oversight and Enforcement

- Demand for a robust and independent scrutiny and oversight body with enforcement powers.

- Suggestion that non-compliant operators should lose access to DVLA data.

6. Signage, Terms and Payment Clarity

- Calls for better, clearer signage and communication of terms to prevent drivers from unwittingly breaching rules.

- Emphasis on fair grace periods and allowances for minor or first-time mistakes.

- Concerns about confusing or exclusionary payment systems (e.g., requiring smartphone apps or exact change).

7. Protection for Disabled Drivers

- Support for strong enforcement against misuse of disabled bays.

- Concern that weakening penalties could undermine accessibility protections.

8. Consumer Education and Rights

- Proposals to include links to government guidance on parking rights in all notices sent to motorists.

- Aim to empower consumers with information to navigate the system confidently.

9. Prompt Implementation of the Code

- Frustration over delays in enacting the statutory Code of Practice despite it being legislated in 2019.

- Urging swift action to stop widespread consumer harm caused by current practices.

The above points are a summary of a much more comprehensive body of research, including sources linked back to key consumer advocacy groups incl. AA, RAC, Which? etc.

What strikes me is the commonality of the themes being advocated across bodies. Clearly there has either been coordination among groups, or collective learning from the last time this process was run, or both. A push for £50 fines for "minor or routine cases" is a common theme.

While many of these points are likley to already be followed by $SPZ. Some, if adopted, could materially impact business performance. E.g., 1. and 2.

Over the next week we will gain some insight into how "on-the-nose" the Starmer Government is with voters, when they issue a pre-Christmas Budget, which is seeking to plug a hole in the public finances. There is a lot of sensitivity in the UK at the moment about cost of living, as they got hit a lot harder than we did in Australia by the post-pandemic inflation spike. (I had an opportunity to "sample" this during my European visit in June/July this year! Ouch.)

Equally, there is quite a high profile among the general public about the PBN process. As a personal, anecdotal data point, I've recently had a visitor from the UK staying with me, and she was quick to point out that her family are careful in keeping all their parking records, so that they can appeal when they get "unjustified penalities". It is something "top of mind" for them.

Importantly, from May next year there are a swath of local government elections, as well as elections for the Welsh and Scottish devolved governments and, at the moment, Reform is leading in the polls. Clearly, the Government will be keen not to do anything to further antagonise the electorate or even to offer some "wins" for "working people".

I will continue to monitor this issue as the next milestone will be when the Government issues its response to the consultation process.

It will be really interesting to get Paul Gillespie's take on this at the upcoming SM Meeting. How much of what consumer advocates are requesting is either already in the code of, if implemented, would not have a material impact? How likely does he think PBN values could be cut? Or, is the Government likely to follow what is likely to emerge in the Budget as freezing the fines for a period of years?

I don't have a view on any of this, other that I think the next few months is a key window in which we should be alert to regulatory risk in the UK. Afterall, we've seen what can happen in QLD and, to a lesser extent, in Denmark.

Slightly surprised to have got this far into the day and not see any reports on $SPZ FY results. But, never fear, @mikebrisy was there!

With the help of my BA, I have summarised the results in some detail, including insights from the Q&A discussion.

As it is late in the day, I have not "corrected" managements various "underlying" measures, which extend into alternative presentations of the cash flow statement, which I find annoying. (I do all my analysis on statutory accounts - I'm old fashioned because I think these standards exist for a reason!!!!! Rant over.)

I'll structure my report as:

1) Financial Summary

2) Summary of Operational Performance by Country

3) Any Developments in the Business Environment

4) Future Outlook (spoiler - these guys will give guidance at H1)

5) My Overall Assessment

6) Conclusions

1) Financial Summary

- Revenue: $77.3m, up 41–42% on FY24 ($54.7m).

- Adjusted EBITDA: $20.5m, up 47% (FY24: $13.9m).

- EBITDA margin: 26.6%, up 110bps on FY24.

- Net Profit After Tax (NPAT): $5.4m, up 47% on FY24 ($3.7m).

- Earnings per Share (EPS): 1.45 cps, up 37%.

- Free Cash Flow: $13.3m, up 15%.

- Cash on Hand: $12.7m at June 30, 2025 (excl. customer funds) vs $7.2m FY24.

- Balance Sheet: Strengthened via $45m equity raise (Feb 2025) to fund Peak Parking acquisition; also secured new USD $10m + AUD $10m revolving/accordion facility.

From the Q&A: Management reiterated that the Peak Parking acquisition has already been EPS accretive (>25%) and is outperforming expectations, validating the equity raise strategy.

2) Summary of Operational Performance

Group Overall

- Sites under management: 1,799 ANPR sites (up 26% YoY). Including U.S. non-ANPR, total estate 1,938 sites.

- PBNs (Parking Breach Notices): >1.0m issued for first time, up 21%.

- Site additions: 437 new ANPR sites (gross), +45% vs FY24

From the Q&A: 71 QLD sites to be removed from the number in the "next 6 weeks".

Market by Market (My brief summaries in parentheses)

United Kingdom (Solid)

- Revenue: $52.5m, up 19%.

- EBITDA: $16.7m, up 17%; margin ~32%.

- Sites: 1,335 (+19%).

- PBNs: +13%.

- Comment: Remains largest market (c. 70%+ of group). Regulatory consultation in July 2025 viewed as supportive for higher compliance standards.

New Zealand (Going gangbusters)

- Revenue: $7.4m, up 62%.

- EBITDA: $3.2m, up 128%; margin 43% (highest in group).

- Sites: 238 (+47%); PBNs up 48%.

- Comment: Now scaled; strong inbound enquiries and strategic client wins with <1% market share, large runway ahead.

Germany (Now really starting to get going)

- Revenue: $4.0m, up 43%.

- Sites: 107 (+60%).

- PBNs: +37%.

- EBITDA: –$1.5m (loss narrowed; expected to turn profitable in CY25).

- Comment: Growth accelerating; won new multi-site contract (25 Burger King sites) in H2 FY25.

Denmark (Early days, and a backward step)

- Revenue: $1.3m (first full year since Feb 2024 launch).

- Sites: 48.

- Regulatory update: July 2025 law requires PBNs placed physically on vehicles. SPZ adapted with manual enforcement (supported by proprietary tech). This lowers PBN volumes per site, but increases per-PBN value (more infringement categories covered).

United States (Peak Parking acquisition – Feb 2025) (Gamechanger)

- Consideration: USD $36m (USD $32m upfront + up to $4m earnout), funded via $45m equity raise.

- Business: 139 sites across 7 states (Texas-mostly, Georgia, Washington, Florida, Indiana).

- FY25 contribution (4 months): Revenue $10.2m; EBITDA $3.1m.

- Performance: Revenue up 16%, EBITDA up 19% vs PCP; on track to exceed USD $4.5m CY25 earnout target.

- Integration: ANPR rollout underway; SmartCloud deployed; new sites opened in Indiana.

Australia (Dead)

- Operations ceased (Queensland regulatory issues). 71 sites remain in portfolio.

- Sites to be removed from numbers in next 6 week

- Equipment to be redeployed to New Zealand (“an NZ Capex holiday”)

3) Market and Business Environment

- Regulation:

- UK: July 2025 consultation paper on higher compliance standards expected to be favorable for private operators like SPZ. Good news.

- Denmark: New enforcement rules require manual PBN placement, prompting operational adjustment but also higher-value notices.

- Technology: Continued investment in proprietary ANPR and SmartCloud platforms; upgrades improving recognition accuracy and reducing site hardware costs.

- Acquisitions: FY25 marked entry into the U.S. via Peak Parking; prior years saw smaller deals in UK (Local Parking Security) and Germany (ParkInnovation).

From Q&A: Management highlighted that U.S. has potential to become SPZ’s largest market, surpassing the U.K. over time. They stressed integration discipline and strong local leadership as key success factors.

4) Future Outlook

- Growth Target: 3,000 ANPR sites under management by Dec 2028, affirmed. (Likely early).

- Momentum into FY26: July 2025 revenue +73% YoY, EBITDA +60% (seasonally strong month but illustrates earnings power of larger estate). But don't get too carried away by one month's data.

- Capital & Liquidity: $12.7m cash and new debt facility provide flexibility for further acquisitions and tech investment.

- Geographic Expansion:

- U.S. – integration and expansion beyond Peak’s footprint (Indiana entry completed).

- Germany to turn profitable in CY25.

- Denmark adapting to regulation.

- Switzerland – new business established July 2025.

- Technology Focus: Continue ANPR/SmartCloud rollout, improve compliance yields, reduce hardware costs.

From Q&A:

- Management suggested Germany is at an inflection point towards profitability.

- U.S. ambition: long-term plan is for it to outsize the U.K. business, but execution focus remains on integration.

- Management intend to adopt a more “regional approach” to geographic expansion, which are intended to limit overhead growth and leverage skills as new territories are added. Examples as follows:

- New US states from the US business

- Germany supporting Switzerland (DACH region, i.e., Ger., Austria, Swiss)

- Denmark supporting Sweden and Finland

- Dividend policy unchanged (no dividend declared; reinvestment in growth prioritized).

5) My Assessment

Overall, these are pretty good results.

US is transformational

Although it is early days and far to early to assess the success of the US acquisition, its inclusion represents a material broadening of the $SPZ portfolio. Pure is currently concentrated in Texas, but over 40 states provide access to “keeper details” and are therefore potentially amenable to the ANPR technology. While Paul says they don’t know how many potential sites there are in the US, he believes the country has "a billion parking spaces" and the business opportunity is “around 10x UK”.

And with $10.2m Revenue and $3.1m EBITDA from the first 4 months, Pure is already delivering an EBITDA margin contribution of 30% - clearly accretive to the $SPZ group.

I always find it challenging picking through the results after a significant acquisition. And with the inclusion of Peak Parking for 4 months, several aspects of the report are messy. But from what we can tell so far, it is looking positive.

UK and RoW is Growing Strongly – this is not just and M&A Story

At the headline level, backing out the US with $10.2m revenue and $3,1m EBITDA from 4-months of Peak Parking, means that on an organic basis:

· Organic Review growth was 23% (vs. 41%)

· Organic EBITDA growth was 17% (vs. 41%)

These are both decent numbers, representing an uptick in % revenue growth from last year (+21% last year), and % EBITDA growth (+8% last year).

All the countries are doing well. UK growth was strong, NZ is going gangbusters with a long runway ahead and some free capex coming in FY26 from the abandoned QLD business, and Germany seems to be sparking into life and will become profitable before the calendar year end.

The Setbacks

There are only two setbacks as far as I can see.

QLD

QLD was completely absent from the presentation and only in the Q&A did we learn that the sites are coming out of the site count in 6 weeks, and the equipment is being redeployed to NZ. (Now that’s disciplined capital allocation for you!)

But I do mark management down on not being up front and stating this more clearly in the presentation. Investors expect and need to hear the unvarnished story, and behaviour like that always puts me on alert.

Denmark

Denmark, where it is very early days, has passed some regulation which means that the first notification of a parking infringement has to be a physical notice on the vehicle windscreen. Paul seemed to say that they will cope with this, but it does sound like it presents some margin erosion at the very least for the fledgling Danish business.

And so that’s a timely reminder that this business will always be exposed to the whim of regulatory change and the social licence to operate with the community. Which again brings me back to the good news that $SPZ is diversifying its country / jurisdictional exposure.

6) My Conclusions

I updated my valuation for $SPZ at the half year to a “thumb suck” estimate of $1.00. I don’t think there is the basis to materially revise this, until we get to see what a full year of US performance looks like, and to see what kind of organic growth it can deliver.

HOWEVER, once reporting season is over, I will give this a hard look, because the stronger organic growth indicates to me that Paul and team are likely to blow their FY28 targets out of the water. And so it is possible my re-valuation will nudge closer to the analysts (3) who are at $1.25. But let's see when I've done the work.

Even though with the issuing of new equity for Pure and ROE goings backward again, the fact that it is 9% this early in the business’s growth journey, I find very encouraging indeed.

This business has a healthy balance sheet, has delivered its 5th consecutive NPAT positive year, and is delivering robust and growing operating cashflows. And multiple territories are growing rapidly with what appears to be rapid site investment payback economics.

I have been quietly accumulating $SPZ on any SP weakness over the last 6 months, and with it now standing at 7% of my RL portfolio, I am content to HOLD based on position size. Were I not in that position, I would be buying.

Each year, I get more positive about this business - which has quickly become a top 5 holding for me in RL!

Disc: Held in SM and RL

Another LinkedIn post announcing Smart Parking have opened for business in Switzerland.

I don’t recall hearing this being discussed in any investor presentation? (Or did I miss or forget something?)

Disc: Held in RL and SM

Just came across the post below on LinkedIn. $SPZ appears to be expanding via Peak Parking into the State of Indiana, US.

If this were Europe, it would be like adding a Denmark or a Finland.

Nice to see the business expanding its US footprint…. This is exactly what I expected to see and this is the first mention I think I’ve seen made to IN anywhere.

Disc: Held

Going back a couple of weeks, it is interesting to observe that with the SP fall in $SPZ following its lofty heights, it failed to raised the targeted total of $5m through its 1-for-24.35 Retail Entitlement Offer.

There were only 270 retail applications for about 1.35 million new shares, leaving underwriter Canaccord Genuity to pick up the balance as set out in its underwriting agreement (which of course it will have done for a handsome fee!) The price tag was $3.8m

In a rare lapse of process discipline (i.e., failing to wait until the closing date) I paid the full $0.88 for my entitlement. But then again, so did three-of-four of the Directors, including CEO Paul Gillespie.

Although details weren't given about the Institutional Placement(other than to say it was fully underwritten), it was claimed to be successful, which was unsurprising at the time given that the SP at the time was around $1.00, being ahead of the offer price of $0.88.

Of course, this was just before the "risk-off" correction we're having, driven largely by US-led trade uncertainty,

All that said, with today's price sitting below $0.70, I am thinking whether now is the time to top up. I'm a relative latecomer to the $SPZ party, having joined just over a year ago. $SPZ is a RL position for me of 2.5% (cost base), and 3.4% (today), so there is room for more and this looks like a good opportunity.

I've just posted my valuation ($1.00, range $0.75 - $1.25) with the caveat that you can get pretty much any number you want!

And of course, we can take no notice of the Canaccord Genuity hiking their Price Target by 14% to $1.25 on 18th March, as they would have that view, wouldn't they. (But it is interesting to note that their PT just clips the top end of my range so, while I see it as optimisitic, I don't see it beyond the realms of plausibility.)

Disc: Held in RL and SM

$SPZ announces the successful completion of the institutional component of the capital raise to fund the US acquisition of Peak Parking.

Paul Gillespie says: “We are delighted with the support for our growth strategy and H1 FY25 results. We appreciate the support from our shareholders for the raise and welcome new investors to SPZ. With these funds we will be able to complete the acquisition of Peak Parking and build a high quality business in the world’s largest parking management market.”

Market also seems positive..... as it should IMO.

Disc: Held

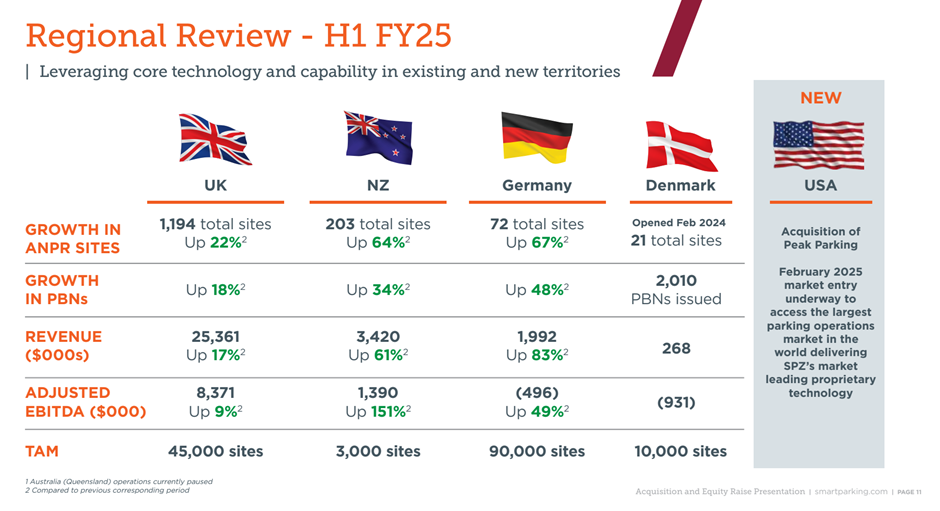

This morning $SPZ announced their 1H Results as well as the proposed acquisition of US-based Peak Parking LP for US$36.0m with an associated capital raising via an entitlement offer and a fully underwritten institutional placement.

It would be easy to focus on the acquisition – exciting that it is – however, in this straw I will focus on the operational performance for the half, leaving the proposed acquisition as a separate matter.

1H FY25 Highlights

Financial Highlights

- Revenue of $31.9m up 20.0% to pcp

- Adjusted EBITDA of $9.5m up 26% to PCP and Adjusted EBITDA Margin of 29.8% up 139 bps

- EBITDA of $9.19m up 34.6% to PCP

- "Adjusted free cash flow" (excluding growth capex) of $6.4m up 60% to PCP

- Cash of $8.5m up 17%

- EPS of $1.12 ($1.11 diluted) up 70%

Operational Highlights

Good growth in all markets, with accelerating PBN growth in the UK +18% (vs +13% in pcp) and strong growth in the profit contribution in NZ.

Losses in Germany continue to narrow, and a good start in Denmark.

My Observations

This is a good operating result. $SPZ have delivered another year of +20% revenue growth, with operating leverage driving strong EPS growth of +70%,

The UK continues to be the engine room driving almost 80% of revenue and 88% of adjusted EBITDA.

It is pleasing to see a meaningful contribution coming through from NZ, and it is still early days in Germany and Denmark, although German with sites up to 72 from 43 in the PCP, only added +5 from the EOFY 2024.

On the other hand, Denmark has gone from 11 contracts and no reported operating sites at EOFY24, to now have 21 up and running.

The new growth markets of NZ/Ger/Den are starting to make a more material contribution with aggregate PBNs growing +43% in the half vs. the PCP, compared with the more mature UK growing at a still decent (and in fact accelerating) +18%.

On cash generation, $SPZ’s curious “Free Cash Flow” of $6.4m (defined on slide 32), compares with the FY value of $12.2m – so it seems only a modest increase on a pro rate basis. The historical 1H/2H split for 1H FY24 was 49.3% of cash receipts, so their doesn’t seem to be a strong seasonal effect.

The seemingly impressive operating leverage and strong NPAT growth hides two factors. First, a currency tailwind giving a windfall of $0.74m, offsetting significant expenses growth: raw materials and consumables (+20% - in line with revenue growth), employee benefits expense (+28%), D&A (+35%), rent and leases (+52%) and other expenses (+18%).

In isolation, these cost increases might appear to be a cause for concern. However, it is important to understand that these expense lines include the impact of the expansions into Germany and Denmark, and doubtless too, the costs for a year of prospecting for acquisitions in the US.

Overall, then, the net cash generation of +$1.3m is a good result. Cash contributions from UK and NZ, more than covering the net costs of getting started in Germany and Denmark and the hunt for acquisitions.

My Key Takeaways

The business continues to allocate capital from profitable core operations into expanding the business. All markets are growing – UK and NZ strongly, Denmark is off to the races, and Germany is making slower progress.

CEO Paul Gillespie reiterated the strategic goal of achieving organic growth of doubling the business to 3,000 ANPR sites by December 2028. Achieving that from today’s total of 1561 (including the suspended 71 in QLD), represents a CAGR from end of 1H FY25 to 31 December 2028 of 18%. This can be considered in the context of the latest growth rate of 28% (to pcp) and with the US soon to provide a new beachhead for growth.

Tomorrow, I’ll write up my appraisal of the proposed US acquisition deal. But, operationally, the meter at $SPZ is ticking along nicely.

Disc: Held in RL and SM

Canaccord Genuity have published an update to their view on $SPZ ahead of Monday's HY Results (call at 11:30 AEDT).

Report gets issued as part of the Free ASX Equity Research Scheme.

Their PT at $1.10 unchanged from their last upgrade in November, which was from $0.75, following the announcement of he increased debt facility.

Basically, some things to watch: i) progress on the business in last 6 months, particularly recent market entries; ii) update on new market entry; and iii) any progress on discussion with QLD Government, now the new Government has been in place a few months.

I'm not expecting anything on ii) as that will likely be deal driven. So, when it happens, that's when we'll find out.

Key positive in the note is that things look quiet for now on the regulatory front in the UK, which is consistent with my media scan of the issue, although press stories do pop up from time to time. Guardian Article, January

I realised I haven't posted my valuation here. Will do next week.

Disc: Held

Looks like $SPZ is gearing up for its next market entry acquisition.

Pass the popcorn.

StrawPoll: where a) FL b)TX c) Other Scandinavia d) Other EU?

@Strawman - have you ever thought about developing a "StrawPoll" feature on the platform? It might not be that easy, but it could be fun!

$SPZ held their AGM this morning.

A few positive updates, with the two key slides added below:

- 1Q FY25 is off to a good start: revenue up 24% and Adjusted EBITDA up 30%, both to PCP

- The 1500 site YE target has been achieved ahead of plan (1529 at 15 Nov) - note this targt had been accelerated from EOFY25

- A new long term target to achieve 3000 organic sites, doubling the business, by December 2028

CEO Paul noted that it's taken them 10 years to get to 1500 sites, and they now aim to add the next 1500 in 4 years.

Work on new markets in Scandinavia and the US (Texas, Florida) is progressing. Focus is now on finding the right entry point.

Demark is off to the races with contracts being signed.

UK - single industry code of practice agreed, no issues flagged under the Labour Government - regualtory environment appears stable for now. Paul thinks the Government will now monitor and see how the industry functions under the unified code.

Churn remains low at 30-40 site p.a.: mix of site redevelopments, exits initiated by $SPZ, and some losses to competitors.

Conversations under way with the new QLD LNP Government - warm but non-specific noises. Expecting movement in the New Year. Paul said he is confident they will return.

Overall, this is a company that is continuing to deliver, with a management who appear confident across all markets, with a clear focus on both operational delivery and growth.

On Valuation:

Market likes today's update. With SP at time of writing at $0.82, getting towards the upper end of my valuation. So, at 3.8% in RL, I'm a hold here. Need to update valuation in the light of the 3000-Dec. 2028 growth target.

Disc: Held in Rl and SM

Post a valuation or endorse another member's valuation.