Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

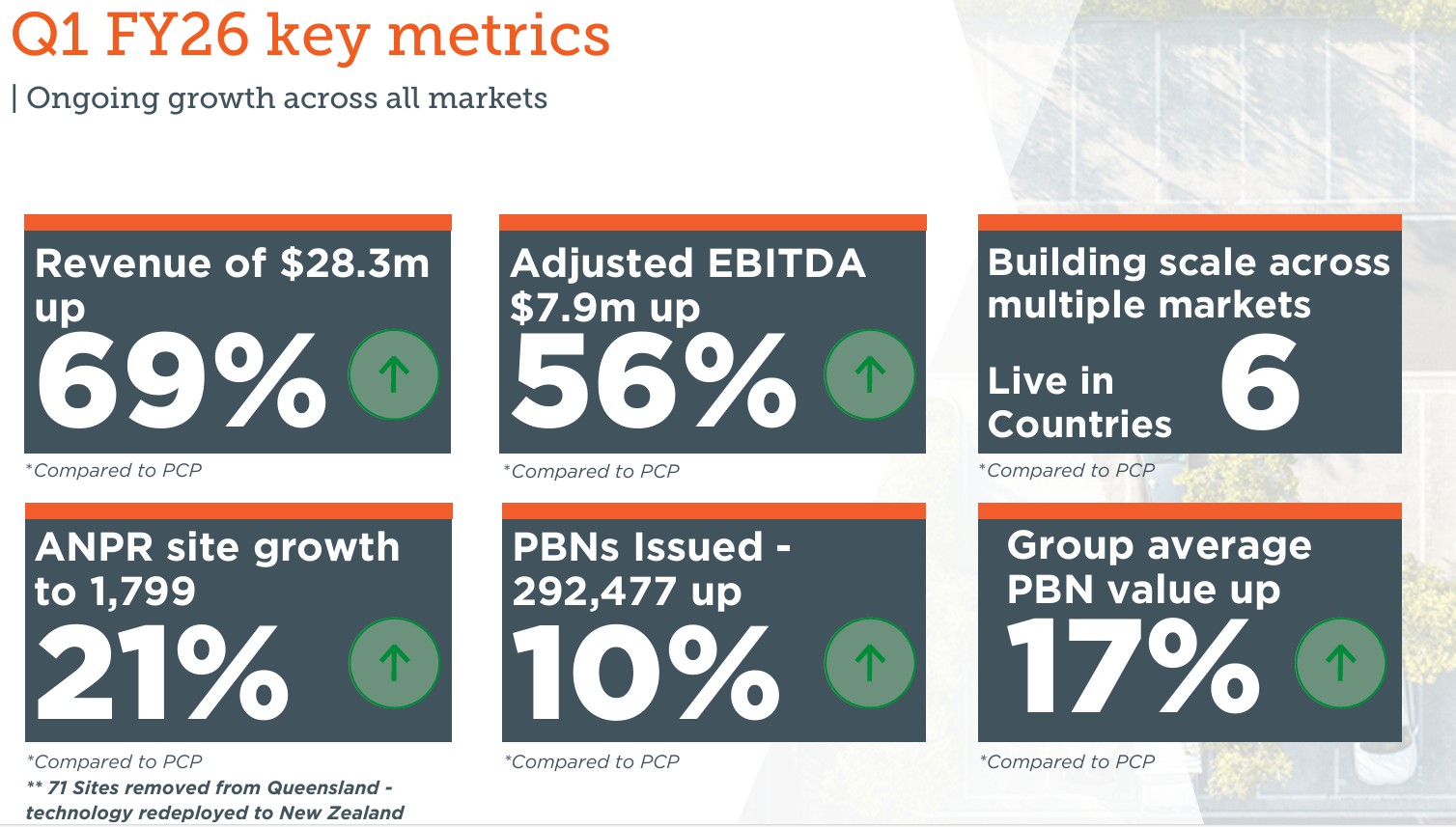

Nice update from SPZ, condinuting to deliver and seems to be integrating the USA acquisition, as well as adding new sites there. UK, Germany and NZ going well. Pivoting in Denmark with regulation changes. Switzerland just started.

Another great quarter from Smart Parking

200k on market trade - like this as a holder

Going back a couple of weeks, it is interesting to observe that with the SP fall in $SPZ following its lofty heights, it failed to raised the targeted total of $5m through its 1-for-24.35 Retail Entitlement Offer.

There were only 270 retail applications for about 1.35 million new shares, leaving underwriter Canaccord Genuity to pick up the balance as set out in its underwriting agreement (which of course it will have done for a handsome fee!) The price tag was $3.8m

In a rare lapse of process discipline (i.e., failing to wait until the closing date) I paid the full $0.88 for my entitlement. But then again, so did three-of-four of the Directors, including CEO Paul Gillespie.

Although details weren't given about the Institutional Placement(other than to say it was fully underwritten), it was claimed to be successful, which was unsurprising at the time given that the SP at the time was around $1.00, being ahead of the offer price of $0.88.

Of course, this was just before the "risk-off" correction we're having, driven largely by US-led trade uncertainty,

All that said, with today's price sitting below $0.70, I am thinking whether now is the time to top up. I'm a relative latecomer to the $SPZ party, having joined just over a year ago. $SPZ is a RL position for me of 2.5% (cost base), and 3.4% (today), so there is room for more and this looks like a good opportunity.

I've just posted my valuation ($1.00, range $0.75 - $1.25) with the caveat that you can get pretty much any number you want!

And of course, we can take no notice of the Canaccord Genuity hiking their Price Target by 14% to $1.25 on 18th March, as they would have that view, wouldn't they. (But it is interesting to note that their PT just clips the top end of my range so, while I see it as optimisitic, I don't see it beyond the realms of plausibility.)

Disc: Held in RL and SM

This morning $SPZ announced their 1H Results as well as the proposed acquisition of US-based Peak Parking LP for US$36.0m with an associated capital raising via an entitlement offer and a fully underwritten institutional placement.

It would be easy to focus on the acquisition – exciting that it is – however, in this straw I will focus on the operational performance for the half, leaving the proposed acquisition as a separate matter.

1H FY25 Highlights

Financial Highlights

- Revenue of $31.9m up 20.0% to pcp

- Adjusted EBITDA of $9.5m up 26% to PCP and Adjusted EBITDA Margin of 29.8% up 139 bps

- EBITDA of $9.19m up 34.6% to PCP

- "Adjusted free cash flow" (excluding growth capex) of $6.4m up 60% to PCP

- Cash of $8.5m up 17%

- EPS of $1.12 ($1.11 diluted) up 70%

Operational Highlights

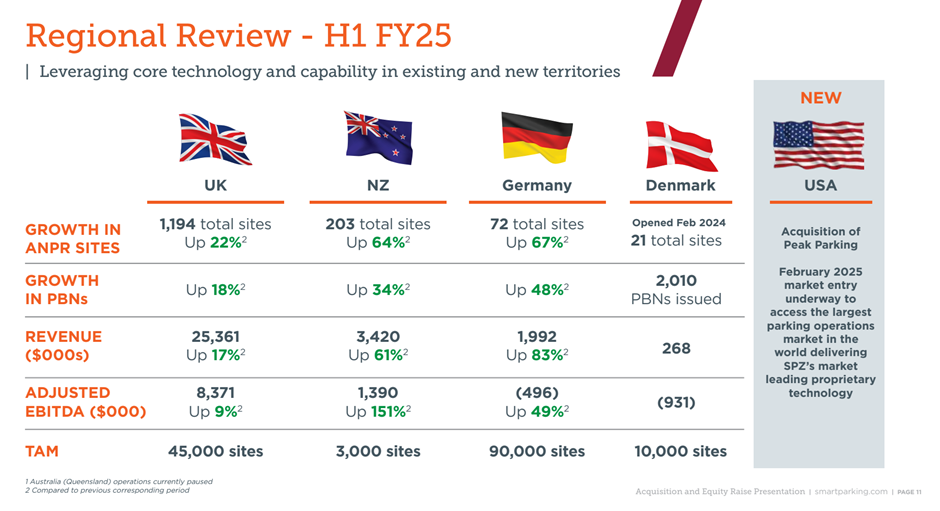

Good growth in all markets, with accelerating PBN growth in the UK +18% (vs +13% in pcp) and strong growth in the profit contribution in NZ.

Losses in Germany continue to narrow, and a good start in Denmark.

My Observations

This is a good operating result. $SPZ have delivered another year of +20% revenue growth, with operating leverage driving strong EPS growth of +70%,

The UK continues to be the engine room driving almost 80% of revenue and 88% of adjusted EBITDA.

It is pleasing to see a meaningful contribution coming through from NZ, and it is still early days in Germany and Denmark, although German with sites up to 72 from 43 in the PCP, only added +5 from the EOFY 2024.

On the other hand, Denmark has gone from 11 contracts and no reported operating sites at EOFY24, to now have 21 up and running.

The new growth markets of NZ/Ger/Den are starting to make a more material contribution with aggregate PBNs growing +43% in the half vs. the PCP, compared with the more mature UK growing at a still decent (and in fact accelerating) +18%.

On cash generation, $SPZ’s curious “Free Cash Flow” of $6.4m (defined on slide 32), compares with the FY value of $12.2m – so it seems only a modest increase on a pro rate basis. The historical 1H/2H split for 1H FY24 was 49.3% of cash receipts, so their doesn’t seem to be a strong seasonal effect.

The seemingly impressive operating leverage and strong NPAT growth hides two factors. First, a currency tailwind giving a windfall of $0.74m, offsetting significant expenses growth: raw materials and consumables (+20% - in line with revenue growth), employee benefits expense (+28%), D&A (+35%), rent and leases (+52%) and other expenses (+18%).

In isolation, these cost increases might appear to be a cause for concern. However, it is important to understand that these expense lines include the impact of the expansions into Germany and Denmark, and doubtless too, the costs for a year of prospecting for acquisitions in the US.

Overall, then, the net cash generation of +$1.3m is a good result. Cash contributions from UK and NZ, more than covering the net costs of getting started in Germany and Denmark and the hunt for acquisitions.

My Key Takeaways

The business continues to allocate capital from profitable core operations into expanding the business. All markets are growing – UK and NZ strongly, Denmark is off to the races, and Germany is making slower progress.

CEO Paul Gillespie reiterated the strategic goal of achieving organic growth of doubling the business to 3,000 ANPR sites by December 2028. Achieving that from today’s total of 1561 (including the suspended 71 in QLD), represents a CAGR from end of 1H FY25 to 31 December 2028 of 18%. This can be considered in the context of the latest growth rate of 28% (to pcp) and with the US soon to provide a new beachhead for growth.

Tomorrow, I’ll write up my appraisal of the proposed US acquisition deal. But, operationally, the meter at $SPZ is ticking along nicely.

Disc: Held in RL and SM

SPZ released 1H25 results this morning which on balance were fine, a little weaker than I expected but largely due to operating losses in Denmark and Germany before those geographies scale up.

However what dominated the result and the conference call this morning was the acquisition of Peak Parking based in Texas for the measly sum of $56m. 8x forecast EBITDA is nothing to sneeze at either!

It is a step change from the previous acquisitions made by SPZ:

UK - NE Parking (517 manual sites) for $520k

UK - Enterprise Parking Solutions (68 ANPR sites) for $1.54m

Germany - ParkInnovation (46 manual sites) for $2m

UK - Local Parking Security (72 ANPR, 54 manual sites) for $5.8m

Of course everything is bigger in Texas, including acquisitions!

SPZ management has earned the benefit of the doubt and I'm sure the lofty multiple the business trades at made the decision to acquire an easier one. That said, there are things shareholders will need to keep an eye on because unlike the acquisitions above the integration of Peak won't be as simple.

The business doesn't operate with SPZ's traditional parking breach notice business model. They charge a management fee to customers to manage their complete parking solution including valet, event management and consulting services. SPZ disclosed 20 of Peak's existing 134 sites have already expressed a desire to implement breach notices in their existing parking solution so there should be some immediate synergies on that front.

However it requires a change to the Peak business model where currently customers pay for any capex installed on their sites (boom gates, ticketing machines, etc.). SPZ has seen great success with the no capex model for customer, installing their ANPR system for free but then collecting the full benefit of any parking breaches (the customer benefits from better turnover in their parking site). On the call, the SPZ CEO said there is no one in the US using that model and they will remain flexible and use the model that best suits the customer.

In the end it became clear that despite Peak not being a "plug and play" acquisition like others in the past, SPZ management are very excited for it as the business has grown very strongly over the last few years all organically with an entrepreneurial management team committed to staying on and driving that further. But realistically today's announcement is bigger than Peak, it is confirmation that SPZ is ready to take on the gigantic US market. It will be a challenge and we will have to wait and see whether the Peak acquisition was the right one but nonetheless it is exciting to see them attack the US opportunity.

18-Nov-2024: Canaccord Genuity: Raising SPZ Target Price to $1.10/share (prev. $0.75/share)

Source: https://canaccordgenuity.bluematrix.com/sellside/EmailDocViewer?encrypt=f277778a-b556-4617-9adc-dcf160310b70&mime=pdf&co=Canaccordgenuity&[email protected]&source=mail

That was page 1 of that CG broker report - click on the link at the top (or copy and paste that plain text link above) to access the full report.

[not held]

As already mentioned, we got a glimpse into Q1 FY25 and not surprisingly Smart Parking continues to kick goals. My thesis is that Smart Parking will be able to increase revenue YoY (like it has done since 2021), with a target of more than 15-20%, while getting an attractive return on capital employed. How? They invest their cash well and their business model is bloody attractive. In terms of a thesis check, things are going well here.

Historical data

I have been monitoring their progress over several years and I figured this was worth sharing. Since 2021, growth has been steady (arguably the best way to grow). I think this business will continue to flourish into the future with the exception of any major hiccups, mainly regulatory ones, along the way. Management's new target (3000 sites) in four years speaks to their confidence also. Should they continue on this current growth trajectory, they should achieve market-beating returns and then some.

What I am looking to see over the next few years is UK sites, as a % of total sites under management, decreasing -- suggesting they are growing in other jurisdictions but also helping to reduce key market risk in the UK.

Another risk worth highlighting relates to the current management team, specifically the CEO/MD and CFO. The current CEO and MD, Paul Gillespie, has been employed since 2013, while the current CFO, Richard Ludbrook, has been there nearly 14 years. Further, the current Chair, Christopher Morris, has been in his position since 2009. Under their direction, more recently in particular, Smart Parking has thrived. That said, there is no guarantee the business performs continues to perform this well under new management. Something to monitor.

Disc. held

$SPZ held their AGM this morning.

A few positive updates, with the two key slides added below:

- 1Q FY25 is off to a good start: revenue up 24% and Adjusted EBITDA up 30%, both to PCP

- The 1500 site YE target has been achieved ahead of plan (1529 at 15 Nov) - note this targt had been accelerated from EOFY25

- A new long term target to achieve 3000 organic sites, doubling the business, by December 2028

CEO Paul noted that it's taken them 10 years to get to 1500 sites, and they now aim to add the next 1500 in 4 years.

Work on new markets in Scandinavia and the US (Texas, Florida) is progressing. Focus is now on finding the right entry point.

Demark is off to the races with contracts being signed.

UK - single industry code of practice agreed, no issues flagged under the Labour Government - regualtory environment appears stable for now. Paul thinks the Government will now monitor and see how the industry functions under the unified code.

Churn remains low at 30-40 site p.a.: mix of site redevelopments, exits initiated by $SPZ, and some losses to competitors.

Conversations under way with the new QLD LNP Government - warm but non-specific noises. Expecting movement in the New Year. Paul said he is confident they will return.

Overall, this is a company that is continuing to deliver, with a management who appear confident across all markets, with a clear focus on both operational delivery and growth.

On Valuation:

Market likes today's update. With SP at time of writing at $0.82, getting towards the upper end of my valuation. So, at 3.8% in RL, I'm a hold here. Need to update valuation in the light of the 3000-Dec. 2028 growth target.

Disc: Held in Rl and SM

I have been thinking about taking a position in Smart Parking for the last couple of months. I think among private investors looking to beat the market via small cap stocks it has been a bit of a darling in 2024. The management seem reasoanble and its financials are pretty solid. I found the presentations on Strawman quite insightful in this regard.

But there was just something that was gnawing at the back of my mind about this company and why I couldn't pull the trigger on it. This will sound absurd, but I think my reservations about this company are that I just philosophically don't like the business model, it is essentially collecting fines for various companies. And I understand the other side to that equation, for society to function car spots have to be available. Imposing restrictions and fines on people is about as strong an incentive as it gets to have people move their parked car. But I couldn't shake the inherent prejudice (or bias whichever way you want to look at it) I had for the underlying philosophy of the business. Maybe it's because I'm the kind of guy that (irrationally) likes to drive around for additional 5 minutes in order to avoid paying for parking in the first place, I don't know.

But then I had another thought.

I am not a professional investor. I am private individual that invests the majority of my real life funds in index funds. To the extent I am investing in individual stocks, and small caps at that, I am really playing a much riskier game. And in order for the risks I take to be worth it, the pay-off has to be significant. And as my Dad used to say, "the only rich guy I ever knew told me one thing, you get rich slowly, son". And so the time horizon for those significant profits to materalise is going to be decades. When you broaden out your time horizon, the financials of the business are important. The daily charts have a place, I am not knocking technical analysis or even short-term fundamental analysis. But implicit in your investment is an overall thesis about where society and the particular sector you are investing into is going. This is why I have come to believe that investing requires a large degree of humility to admit that luck plays a significant role as nobody can predict the future.

And as Lenin said, "there are decades where nothin happens and week where decades happen". And so the question I have about this business, particularly if it's based in UK cities, is whether the use of carparks is going to increase overtime. I have been (and remain to be fair) very sceptical about the driverless car movement. But in recent weeks, you'd have to have been living under a rock to not see the prevalance of these things increasing. My instagram feed is full of people I know test driving these cars in the US etc. And while I will support arguments about people always wanting to own their own car, their specific car and needing to park etc. I do feel investing in something as simple as car par collection fees for the long-term is asking for trouble. That's not to say people won't see decent capital returns in the next 2-5 years potentially and so if that's your time horizon, who am I to stop you. But if you are more of the 'coffee can', 20+ year time horizon investor, I would question whether this business is for you.

For those reasons I've held off investing even though the fundamentals and the short-term looks to be pretty positive.

On 13 March, CEO Paul Gillespie sold around 2m shares on-market at roughly A$0.44 cps. This equates to about 25% of his direct individual holding at the time of the trade.

With the share price trading close to all time high levels, I am not too alarmed by this.

Nice little acquisition by smart parking today in the UK sector.

I wonder if this is increased confidence that the UK segment regulation will be favourable or they have struck a deal with a competitor during a moment of concern. Seems like a well priced deal.

held

Canacords thoughts

Thanks for organising the meeting this morning! Management took us through the presentation released to the market on monday and added some useful commentary and details around the edges. My main take home message is that on the surface they have a genuine opportunity to grow revenue and earnings for many years ahead. Mamagement appear competent and level headed. I had been watching this one for a while and have taken a position in real life today!

SPZ results were mixed and the market appears to agree.

Revenue result at $26.7M was ahead of my expectation.

Extra revenue has not resulted in the PBT I was hoping to see as expenses have increased:

Employee expenses up 15%

Depreciation up 24%

Other up 22%

Let's see what they have to say on the call.

1H24 Results due Monday 19 Feb.

Reviewing my expectations prior to the release to gauge company growth projections.

I expect to see the following as a minimum:

1H24 Rev $26M

1H24 NPBT $5M

Sites 1230

Expect costs to increase to accommodate German rollout but hopefully these costs are offset by increased revenue.

Anything less will be a disappointment. Better is a bonus.

Updated broker report from Capital Markets for Smart Parking. Not too many changes from previous report but all positive it seems.

SPZ report Capital Markets 10 Nov 2023.pdf

Nessy

Smart Parking yesterday held their AGM and gave a comprehensive trading update (they're also meeting with us on Monday). There was a lot to like. It's a seasonal business and Q1 is usually a good quarter but comps to pcp are relevant and these all looked good. Fines were up 26% versus pcp and up 15% in the mature/not-really-mature UK business. Record revenue. Looks to be gaining operating leverage, although admittedly that is relying on an unaudited adjusted EBITDA number.

Site growth wasn't as rapid as previous quarters but look to have reaccelerated over the past 5-6 weeks to stand at 1193 sites. Even using the quarter end number site growth was 29% higher than pcp and 16% higher in the UK. They brought forward their 1500 site target by 6 months to 31 December 2024 and in so doing continued their happy habit of beating what initially look like aspirational site targets. Importantly the site target is based on organic growth only and so is likely now a conservative target.

When I've spoken to them in the past they think at 1500 sites they're a $70-75 million revenue company, generating $22-25 million EBITDA. That seems about right at the topline, although I'm not modelling quite so much to fall to EBITDA and hoping to get a pleasant surprise. But 1500 sites is just the start. When you consider there are 140,000 sites just in the territories they operate in, you start to get an idea of how long the runway is.

They spoke at length about wanting to move into new territories. I like the way they go about this. They prepare the ground by mentioning it to shareholders without a lot of detail. Six to 12 months later they're getting more specific about where they're focus is (Europe and the US). They talk about not biting off more than they can chew and just moving into one territory at a time. They talk about learning from the Queensland sojourn and focusing on territories that not only allow third party access to licensing information, but also have a code of practice or similar legislation in place. All good things in my view.

The negatives? They're all regulatory. It doesn't sound like there has been much movement on the Queensland side of things. That's not all that surprising given how negatively the government came out against the industry. Their best bet may be a change of government next year, which the polls suggest is likely. In the UK the government is considering submissions to its proposed new legislation and is not expected to give its verdict for at least six months. On the plus side that means a longer period of status quo, but on the downside the dark clouds loom for longer.

There's a good-ish argument that a microcap that has been a microcap for many years will always stay a microcap. I've said similar things in the past, particularly when you have the same people in charge. There's also an argument that change doesn't happen overnight and takes longer and will be harder than you first envisage. Smart Parking is evidence for the latter argument. Current CEO Paul Gillespie took the reigns in FY13 when revenue was $20.6 million. In FY21 revenue was...$20.6 million*. Roll forward two years to FY23 and revenue was $45.2 million and the momentum appears to be continuing. It's not vain growth either - they're increasingly profitable and cash generating. Sometimes it just takes time to get things humming.

[Held]

*admittedly COVID impacted but let's not the truth get in the way of a good story

For those following SPZ this is quite a good read from Capital Markets.

SPZ report Capital Markets 18 Sept.pdf

Happy reading.

Nessy

Another excellent year for Smart Parking with all key metrics moving in the direction we want to see. Revenue came in slightly ahead of my forecast, but perhaps most impressively net income was double what I forecasted, primarily due to gross margin increasing.

Highlights

- Revenue of 45.1m, an increase of 21%, above my forecast of 43m

- Cash inflow of 9.2m, just below my forecast of 10.5m

- Adjusted EBITDA 11.5m, up 35%

- Adjusted EBITDA margin, up 25.5%

- Net income of 6.7m, around double my forecast of 3.3m

- Sites under management (the estate) grew 33% from 839 to 1112. This is a CAGR of 31% since 2018.

- More than 800k spent on share buybacks during the year – 3m shares – at an average price of 0.22c.

- Cash of 10.7m – bloody impressive considering a recent acquisition, continued investment in Germany and share buy backs throughout the year.

- New Zealand deserves a special mention – sites increased to 84 (320% pcp) growth in breach notices increased 258%, with revenue just under 3m – noting all are off a low base this is really impressive for what is still a reasonably new market.

- Qld market remains in a holding state pending a review around regulation.

- 1.3m debt – manageable and not a concern.

Re: their expansion into Germany – this remains in capex/investment stage. In the call management indicated they are starting to invest more aggressively in this market due to the opportunities/pipeline and large area they can cover. Will be interesting what lies ahead for Germany in FY24; this has the potential to be a hugely profitable market for Smart Parking.

To elaborate on the increase in gross margin, this is the result of new sites following the initial period of investment – a great example of operating leverage, demonstrating just how attractive this business model is when operating under a regulative-friendly framework.

Outlook

- Unless I misheard, re: new sites under management from the recent German acquisition – they are hoping to convert 2/3 of these to ANPR technology.

- Some interesting discussion around regulation in the UK on the call, specifically the establishment of a code of practice which remains ongoing. They don't expect any decision in FY24. This is by far and away SPZ's key market, and any regulation changes will have a significant impact (positive or negative) on the business. Management did emphasise that this is very different to Qld – UK is more concerned with establishing a code of practice to govern those that already exist; they are far more open to parking regulation and the requirement/reason for operators to function (unlike Qld which removed the ability of parking operators to access data altogether). Both NZ and Germany for instance already have established a code of practice, but this remains one to watch closely and is a key risk for the business. @Noddy74 @Wini @Byrnesty and others -- anything else to add that I missed or any disagreements?

- They will continue to focus on growth in core markets moving into FY24 – UK, Germany and NZ – both through organic growth and attractive acquisition opportunities.

- During the call management mentioned they are looking to enter new markets in FY24 (most likely in northern Europe) – but have lots of work to do and still in the research stage. They note they need to find the right leader, people and market and need to get that right – refreshing to hear but they need to be cautious not to overdo it, particularly with lots of work to do in Germany and plenty of growth ahead of them still in NZ, the UK and to a lesser extent Australia. This is another risk; we don’t want them biting off more than they can chew, particularly with the business currently performing so well.

I will update my valuation in the coming days – @Byrnesty with operating leverage starting to come through and net income coming in much higher than I expected, I am guessing my DCF will reflect an increased company value. I still think a large discount is required until we know more about the regulation risks in the UK.

Just got back from a Mauritian beach yesterday and catching up on a few updates and the like. Smart Parking delivered not the worst update of the pack. For these guys it's all about sites under management - what they call "the estate". Sites are up 13% on the previous quarter to 1043 (up 24% YoY) and they remain on track for their 1500 site target by the end of FY25. I imagine we'll see a new target in the next 12 months for FY27 or FY28.

Currency is a headwind given they make most of their money in the UK, but their cost base is largely overseas too so forms a natural hedge. They present an Adjusted EBITDA number, which excludes Germany's setup costs. I imagine this irits some people but they are transparent about the amount they're excluding and it is useful to know what the German investment is so I'm ok with it on balance. For what it's worth Adjusted EBITDA is $8.5m Q3 YTD ($8.9m in constant currency). This excludes $1.2m of Germany's costs. EBITDA grew slower in Q3 but it's traditionally a quieter period, with the current quarter being the bigger maker of bank.

On a regional front the UK is still the engine room and despite being the most mature region it is still growing at a decent clip organically. APAC (really just NZ) appears to continue to be growing rapidly (and profitably) despite the loss of new sales in Queensland. Germany is growing quickly off a low base but not at the speed they had hoped, resulting in some sales team remediation. It's a slightly mixed message as they have also suggested the rampup has been similar to New Zealand at the same stage. Germany remains on watch with the sales intervention hopefully gaining traction in Q4.

Cash on hand is down a little but Q3 is the quietest quarter and it's difficult to make conclusions without knowing how working capital and debt have moved. Overall the thesis remains intact and a key question will be what they do with what I expect will be a growing cash pile. Any dividends they pay would be unfranked so more aggressive buybacks and/or M&A appear to be the more likely options. Not a bad problem to have.

[Held]

Overall it was a solid update from Smart Parking last week with strong topline growth and decent cash generation being partly offset by unfavourable FX movements and increased overheads.

The key driver of the results is, as always, sites under management and on this measure they continue to deliver. The Group held 984 sites at the reporting date, which was up from 839 sites six months prior. They were keen to highlight that they've since exceeded 1000 sites, although you could argue QLD sites should be backed out of that number. Although the 1000 site target has been replaced by a 1500 site by June 2025 target, longer term holders will remember that 1000 sites by June 2023 was an earlier target and it deserves mention that they have beaten this. On the earnings call they reaffirmed the 1500 site target and I asked them to clarify if that meant ex-QLD, which they confirmed was the case.

Revenue was up 18% vs pcp, but up 25% from a constant currency perspective. UK growth is impressive given its relative maturity but the real driver is APAC, half of which we now know is - at best - on pause. Germany doesn't yet make a material contribution and will be on watch going forwards to ensure it does do so.

At the same time operating expenses appear to have jumped significantly and permanently. They strike me as a little sensitive about the investment in Germany relative to the return they're getting and I'm not fully on board with their practice of backing out Germany's costs from Adjusted EBITDA. However, it's all fairly transparent so you can rework it as you see fit. Overall a reasonable level of explanation was given to the cost uplift but going forwards I'd like to see that increasing at a lower rate. I have asked for clarification about what the disclosed monthly exit opex rate of $1.7m includes as it's not entirely clear, but that equates to a six month number of $10.2m - not too much higher than the disclosed half yearly opex cost, suggesting that opex growth may have slowed.

Free cash flow was strong but again it should be noted they are excluding Germany's costs from their definition of this. It's all very transparent though so choose your own adventure on what you do there. It also doesn't include Growth Capex (almost all of their capex isn't ongoing). I'm ok with that, others won't be. The balance sheet continues to look good and they have flagged a continuation of their share buyback (which they announced to the market they had started acting on a few days later). They've also started talking about dividends. I assume they will be unfranked given their overseas operations so I don't much see the point of that unless they've completely run out of ideas, but it is another indication that they do seem to act in alignment with shareholders.

Kudos for them holding an investor briefing. One of the themes I felt this reporting season has delivered is somewhat less of those and credit goes out to management who front up when the news isn't necessarily all good. Based on the attendees they do seem to be getting a little more insto coverage, although some of the questions seem to suggest the analysts hadn't had alot of exposure to the business yet.

In summary

The good:

- Site growth is the key driver and is tracking nicely. I haven't even mentioned the Technology segment of the business here as it's become an increasingly immaterial part of the business.

- As expected Revenue growth is following sites under management. Previously the CFO has said they could deliver $70-75m at the topline with 1500 sites. My model also supports this, albeit at the bottom end of that range. At that kind of number and given their propensity to gush cash, they'll be hard for the market to miss.

The not so good:

- Germany isn't yet shooting the lights out but it's early days. @Wini highlighted an Aldi win they'd had in this market some time back and they disclosed they now manage two Aldi stores, in deals signed off at the northern Germany region head office. According to Wikipedia Aldi Nord is the bigger of the two Aldi regions and has 2298 stores.

- I think the market was a bit disappointed to see the Cost base jump as it did. It's fair to say I was a bit too and this is on watch going forwards.

The ugly

- I think the prudent thing to assume is Queensland is not coming back and be pleasantly surprised if it does. I asked management on the investor call what learnings they took from this and someone asked something similar on the Strawman call. Both times they highlighted the lack of a Code of Practice in Queensland that does exist in other markets they operate in and that this would prevent a recurrence. I think the fact they were blindsided like they were suggests they and the peak body didn't do nearly enough work with the government to advocate/educate/put a code in place etc. and being proactive should be a key learning.

Overall I'm still happy to hold. I took a little profit at higher levels but it's still a larger holding and I think closer to a buy than a sell given it's pulled back a bit and should be supported by the share buyback if that continues.

Non-Executive Director Fiona Pearse recently bought some shares on market, totalling $38,000. Fiona now holds 783,000 SPZ shares, having previously held 613,000.

Fiona has extensive commercial and financial expertise gained from a long career at global companies BHP and BlueScope Steel. She has had a position on the board since 2019, so she knows the business well.

Always good to see some insider buying following some share price weakness.

An announcement made in relation to the Queensland Government's change.

https://hotcopper.com.au/threads/ann-response-to-press-articles-in-queensland.7228318/

Points of note.

- They don't seem happy.

- QLD is less than 5% of revenue, which suggests to me it's around 4.

- QLD is not yet profitable.

- They operate nearly 1000 centres.

The way the Government and press treat SPZ is interesting. In the UK it seemed like there was an initial negative response, but then the Government after thinking about it realises that not being able to enforce parking fines is a bad idea because then people can just park in ungated business carparks wherever. I'll be interested to see how QLD develops.

I do wonder if the issue of privacy concerns is starting to become a bigger issue.

Heard on ABC radio this morning that the Qld Government will from next week prevent companies from access to private registration details of vehicle owners.

No announcement from SPZ though.

Smart Parking released a presentation this morning prior to going on Coffee Microcaps. I don't think Mark has posted the videos yet but when he does it will be worth a watch as it includes a roll call of Strawman member favourites, including Alcidion (ALC), Spectur (SP3), Symbio (SYM) and AVA Risk (AVA). Anyway, the SPZ presentation included site and financial updates.

The good

- They continue to gain sites and were managing 900 as at 30 Sep (vs 839 at 30 Jun)

- Revenue for the quarter of $10.8m, up 21% vs pcp

- Substantial new record of breach notices issued

- APAC growth appears to be strong, at least in terms of breach notices, with PBNs in Q1 only slightly less than the first 3 quarters of last year combined

Not so good

- Cash is not so good. Cash is down from $11.4m at year end to $9.3m at 30 Sep. In part this can be explained by $1.8m of capex and $0.4m of share buy backs, but they also reported $2.7m of 'adjusted' EBITDA - where's that? Hopefully just some temporary working capital movements that will resolve by 30 Dec.

- Technology segment didn't really get a look in but the combined revenue numbers suggest it didn't contribute much to the total

- Also, despite the growth in revenue, the PBN number growth suggests they're not recovering as much per breach. FX will be playing a role here.

On Watch

- Definitely cash. I'd want to see a decent turn around in Q2.

- The UK macro and FX

On balance I think the message is still the same; they're delivering profitable growth. I expect them to be able to scale pretty efficiently too, with top line growth falling pretty efficiently to the bottom line. That last bit isn't as apparent yet as I might of originally hoped but I think you can give them a bit of a leave pass considering how early they are rolling out in Germany, QLD and NZ and the investment that will require.

[Held]

Smart Parking released its annual report on Friday and there were a couple of tidbits that signaled strong growth is continuing.

Sites under management (their key metric) grew from 839 on 30 Jun to 896 on 23 Sep. It's up 7% QoQ and 21% YoY. The number of breach notices issued for Jul and Aug was 119,663, up 26% compared to Jul/Aug 2021. Management "is seeing growth in the car count and contravention rates increasing".

Offsetting that is the bloody new UK conservative government, who are making Boris Johnson's regime look competent. Expansive fiscal policy, while the BoE is implementing contractionary monetary policy, has sparked fears of a longer and deeper recession. I view SPZ as somewhat defensive but not immune to such an event. Of more immediate concern is the impact it's having on the pound, which like all currencies is getting smashed against the USD but is also deteriorating against AUD. It's worth bearing in mind that most of SPZ's revenue AND costs are in GBP, but the downside of it being a profitable business is they don't offset. Truss & co have started walking back some of their more egregious policies in recent days and this has eased pressure on the pound, but they're not exactly inspiring confidence.

The UK Parking Code of Conduct is still withdrawn for further consultation.

Bottom line - bottom up it still looks good to me but I did take a little a little profit in my real life portfolio to reflect the risks above. It is still an outsized position for me.

[Held SM and IRL]

Thanks @Strawman. I really enjoyed this meeting. First of all, let me start by saying I am a fan of management; they are doing a great job. Paul in particular has turned around what was once an unfavourable business with lots of problems in the UK. They really appear to be hitting their stride now.

I found both transparent, no bullshit -- even if Paul's initial pitch was very scripted. When @Strawman started to prod, both loosened up a little and this is where the meeting got interesting. The elaboration into their business model was fascinating. A lot of this I had obviously come across before, but there were bits and pieces that were new to me -- even as an investor in SPZ for the last few years.

Some of my notes are recorded below:

Business model expanded

Smart Parking will approach sites and offer them their services. For a business, this is normally beneficial -- it frees up parking for genuine customers/members. For shopping centres and the like, this should in turn enhance customer satisfaction and bring more shoppers through the door -- you are much more likely to shop when you can find a convenient park outside. The real benefit for the site owners is Smart Parking own the product and take on all the CapEx costs. The business won't have to pay Smark Parking a fee, nor do they get lumped with installation, signage fees etc. As I understand it, the site owners pay nothing. In fact, the business will normally get to keep the parking fees from the parking machines and the like. The catch for Smart Parking is they will typically take all the revenues obtained from PBNs associated with the sites. In more competitive markets (some areas of the UK), Smart Parking might reach an agreement to take a certain cut of the revenues. You can see how the business are able to bring site owners onboard. In the majority of cases you would expect it is a no brainer for them -- more regulated parking spaces, enhanced foot traffic and on top of that parking revenue -- all for no outlay! For Smart Parking, they don't have to pay the overheads associated with the parking sites, only the small CapEx costs associated with their technology, sensors and the like. This reduces a lot of the usual significant costs for SPZ and enables them to be incredibly 'capital light'. That is a great business model. A win/win for both site owners and Smart Parking.

Cost structure

A typical site installation costs somewhere around 8000-10,000 pounds. The business tends to recap CapEx investment after approximately 7-9 months of running the site, with minimal costs incurred from this point onwards.

A typical site will issue around 80 tickets (breaches) per month, at an average of £31.50 per ticket. It costs around 5 dollars per ticket to source the drivers details (name, address etc), print and then post the ticket. This fee is cheaper in NZ, but more expensive in Australia.

The average contract term with new sites is three years.

Churn is often initiated from SPZ's end -- the company might not be making the money it wants, or the margins might not be competitive enough, so they are often prepared to walk away. For instance, SPZ lost 40 sites in H1 FY22 due to a margin battle. This isn't the end of the world for the company. They can simply use the technology elsewhere, but management stress it is also not a CapEx holiday. They still have to organise the signage, staff to install etc. I like the fact they are prepared to cut losses on investments deemed too difficult or surplus to requirements. Even if this impacts sites under management (short term). They really seem focused on shareholder return here.

Fines

- Collection rates: in the UK, tickets are 100 pounds. If paid within 14 days this gets reduced to 60 pounds. The fine is referred to a debt collection agency after 28 days, whereby the fine increases to 170 pounds. SPZ retain 130 pounds of this.

- Ticket average: of 100 tickets, 15-18 are cancelled for whatever reason - appeal, actual customer etc. 55 out of 100 would actually result in fines. This is where SPZ make the bulk of their revenue.

Competition

Management acknowledged their competition, but noted their technology was the key differentiator in most markets -- essentially their moat. This is the case in the Australian and German markets in particular -- especially the latter. While there is other competitors, they lack the technology of SPZ or the money to implement similar technology.

Thanks again for hosting @Strawman.

Snap @Rocket6 you just beat me to it

***

Busy day...start of a busy week...

Smart Parking's result this morning was better than I expected on most measures. Revenue was up 68% on FY21, mainly in the parking services business (i.e. fines) due to a 36% increase in sites under management and considerably higher yield per site. Adjusted EBITDA was $8.8m in FY22, compared to $2.2m in FY21 despite considerable investments and additional headcount for future growth and normalisation of other opex items which benefitted from COVID in the prior year. Adjusted NPAT went from a loss of $1.7m in FY21 to a profit of $2.2m I normally don't like to see an Adjusted NPAT but given the $6.9m one-off VAT win the company had over the HMRC in FY21 I think it does make sense in this case.

The company claims a free cash flow of $8.1m but they do exclude capex from this (but do include lease payments) on the basis that they classify this all of this as growth. Given the nature of their business I think it probably makes sense that they wouldn't incur maintenance capex and I can accept their reasoning (Claude is shaking his fist at the monitor right now) but if you don't just add it back - I think the valuation stacks up even if you do.

Some notes from the call and releases this morning:

- Sites under management (being a key metric) are scaling up nicely and on track for previous target of 1000 by end of FY23 and new target of 1500 by end of FY25

- New markets:

- NZ - 20 sites, EBITDA and cashflow positive. Target of 75 by June 2023. 3000 potential sites.

- QLD - 27 sites. Target of 80 by June 2023. 2000 potential sites.

- Germany - foothold of 4 sites. Target of 70 by June 2023. Dunno how many potential sites, lots - possibly twice that of the UK, which has 45,000 potential sites.

- Share buyback to continue while share price remains depressed

- Overheads grew substantially but management have indicated this was due to some investments for growth (e.g. Germany) and end of furlough schemes etc. and shouldn't grow at the same rate going forwards

- Acquisitions are performing at (NE Parking) or ahead (Enterprise) of targets

- Technology segment was EBITDA positive. This was a bit of a surprise to me. In previous conversations management's commentary wasn't that bullish in relation to that business.

- July and August to date have been record months

- Regulatory overhead of Parking Code of Practice is still on hold and government hasn't provided update (they've understandably been busy giving Boris the arse). Interestingly Paul stated Smart Parking and the majority of the industry would like to see most of the code implemented - just not the bits that cap their fines.

- Are seeking more acquisitions or markets. They are limited to juristictions that allow number plate owner databases to be accessed, which is why QLD is the only state in Australia they have thus far entered.

So overall very positive. I mentioned to someone this morning that there are some things I don't love. In particular I think they could do a better job of presenting the statutory accounts to be somewhat more aligned to the management accounts. I get they serve different purposes but GAAPs aren't completely prescriptive and other companies manage that better than they do.

I also don't love the word Adjusted in front of EBITDA and NPAT but I've always found them pretty transparent about what has been adjusted and you can backwork it if you want to. Those are relatively minor quibbles compared to keeping the business on track and delivering on the promises they've been making, which so far they seem to be doing.

Held here and IRL

Highlights

- Revenue 38.1m, an increase of 68%

- Total sites under management: 839 – an increase of 36%

- Parking breach notices increased by 81%, largely due to increased sites under management and recovery from Covid restrictions.

- Cash holdings 10.8m

- Inflow from operating activities – 10.1m, an increase on last year’s 7m.

- Free cash flow of 8.1m, an increase of 624%

- FY22 was profitable for the business, with NPAT coming in just under 1m. This is a decrease on last year due to a one-off VAT payment, which bolstered FY21 earnings.

I still need to do a more thorough deep dive on this one, but it looks to have been another impressive year for one my highest conviction holdings. Management has done remarkably well in managing the business during a tough period. While many parking operators struggle, Smart Parking is now a stronger, more resilient business than it was 24 months ago.

We are also starting to see some scaling take place. Essentially we have seen revenue increase by around 16m, while other costs (excluding D&A) increased by around 3.5m:

- Materials/consumables: increase of 500k

- Employee expense: increase of 2.7m

- Depreciation/amortisation: increase of 900k

- Rental/lease costs: Increase of 170k

The business doesn’t shy away from increasing overheads either, noting a ‘51% increase’ in their investor presentation. But with a gross margin of 60%> and the business seemingly using its cash well, I worry very little about an increase in costs when revenue is outpacing that increase by more than 4x.

When you consider they are trying to break into new markets in Germany, Australia, and New Zealand, the costs look even more impressive. And pleasingly, they are funding this growth themselves without having to tap shareholders on the shoulder. And for an added bonus, New Zealand is already operating cash flow positive despite only recently entering this market.

In short, this is a capital light business that requires minimal maintenance CapEx to fund operating activities. This is starting to reflect in their financials. My confidence continues to grow as a result. I will update my valuation in the coming weeks.

FY23 outlook

- The business provided an update re: early FY23 activity, with 878 sites as of 22 August.

- They have also set some targets: 80 Australian sites, 75 NZ sites and 70 German sites by June 2023.

- They believe the current market in Germany is very manual/employee orientated. SPZ's tech-led solutions should provide them with a competitive advantage in this market, and result in additional client wins.

- Scope for further accretive acquisitions -- which seems pragmatic given their strong balance sheet and history of sensible acquisitions.

- They expect further profitable growth in the coming FY.

We weren't provided with any revenue or profit figures, but still get some insight into SPZ's H2 period.

- Parking breach notices (PBN) are forecast to increase by around 70% vs PCP. While this figure hasn’t moved much since the H1 increase, it marks a strong year for SPZ. Q3 was the slowest quarter of the year for PBNs issued, while Q4 is forecast to be an improved one (second highest).

- Sites under management was recorded at 816 (as at 31 May), an increase of 32% PCP. A total of 99 sites have been added thus far in H2, noting June figures still need to be added. A breakdown based on region (and churn) is recorded below. While total sites under management (99) wasn’t anywhere near as high as H1 (176), churn in H2 has been much more respectable – 20 in H2 vs 58 in H1.

- 42 sites are now up and running in the APAC region, while the sales team was doubled to ‘capitalise on market opportunity’. If my calculations are correct, total sites under management has effectively doubled in H2 (from 21 to 42). PBNs in the region continues to trend upwards nicely (below).

- As for their push into Germany, four customer contracts were signed, with two locations live and generating revenue. 0.5m OPEX costs for the half suggests they aren’t throwing lots of money down the drain as they try and shift into a new market. This is obviously pleasing in this current environment.

Smart Parking continues to be one of my higher conviction holdings. Pending the release of the FY result (where I will have a proper dig into the financials) SPZ is high on my 'top up' list at the moment. They continue to grow at impressive levels, they are profitable (based on H1 reporting) and have a solid balance sheet -- the latter provides them with stability and an ability to fund their growth strategy inhouse. They aren't impacted by supply shortages and are in a good position to make strategic acquisitions when the opportunity arises. Provided the FY report reflects more of the same, management continue to demonstrate that they are solid capital managers.

@Noddy74, any differing thoughts?

I keep tabs on the same @Noddy74. I also monitor the use of vehicles (vs other forms of transport) and as expected, statistics suggest UK residents are less inclined to use public transport at the moment - with use well below what the UK was experiencing pre-covid. As it stands, vehicles are the most common form of transportation in the UK by some distance. This wasn't previously the case and obviously bodes well for Smart Parking.

UK retail foot traffic is a metric I keep a close eye as an owner of Smart Parking and since 'Freedom Day' UK shoppers have shown a propensity to want to get back to the shops. Foot traffic has comfortably sat at 80+% of 2019 levels since Aug/Sep, with the most recent survey recording 83%.

Having said that I am wary of the risk any further COVID lockdowns would have on this company, notwithstanding the reluctance the government would have on imposing them. I do note cases remain high at 40-50k cases a day.

However, crucially severe symptoms and deaths remain nowhere near the levels of previous outbreaks giving me confidence the risk of further lockdowns remain muted, Omicron impacts aside.

In their most recent update management provided a 1H outlook, which although buoyant appeared to indicate not just a quieter 2Q at the top line (expected due to seasonality) but also a lower EBITDA conversion percentage. I wrote to the CFO to ask him about this and to his credit I got an answer back within a couple of hours that it reflected lower contribution from breach notices, which is a higher margin revenue source. Q1 and Q4 are historically strong in terms of seasonality.

[Held]

You never know what you're going to get with AGMs. Sometimes they say virtually nothing about trading conditions and outlook and other times it's a feast. Smart Parking gave a fair bit of the latter, spending most of the meeting discussing FY22 YTD, 1H outlook and setting a new FY25 target. Highlights included:

- Oct YTD revenue of $11.4m (up 53% vs PCP - they are cycling versus a heavily COVID impacted comparable)

- Oct YTD EBITDA of $3.4m (up 130% vs PCP)

- Record EBITDA % margin - a fair bit made of the operating leverage they're generating

- 1H guidance of $16.4 to $16.9m revenue. I had them on $34m FY revenue so I suspect they'll exceed that comfortably.

- 1H guidance of $4.4 to $4.7m EBITDA. That implies EBITDA conversion will slow - not sure why. I think I'll ask them.

- On track to meet previously stated goal of 1000 sites under management by Jun 2023

- Gained another 20 sites organically just in October

- New target of 1500 sites under management by Jun 2025 (double what they are now)

- Looking to move into new territories/countries, with Germany being mentioned.

Overall extremely bullish. I think the 1000 site target is becoming more of a probability than a possibility. The 1500 site target is more aspirational (but there's nothing wrong with that). If they met both of those targets I think they're closer to a 60 cents company - the market seems to have been burnt by this company and very slow to give any credit for the turnaround.

[Held]

Credit goes to Rocket6 for posting about this one. After looking into it I took a position in RL and SM some months back and looking at today's update am glad I did. I think the market is underestimating how much that top line can grow as they get back to the sort of revenue/site they were doing pre-pandemic. On top of which they are rapidly expanding the number of sites under management with a target of 1000 by Jun-23, which they are tracking well to achieve.

I always try to find something to criticise but there's a hell of a lot to like. They seem to be responsible capital managers as evidenced by the price they paid for their recent acquisition (EV/EBITDA multiple of 1.0 to 1.3x) plus the way they're converting top line growth to bottom line growth. They seem quite transparent as evidenced by their disclosure of churn (sites lost) and the fact they're disclosing similar metrics now to what they were 12 months ago when things weren't looking nearly as rosy. Plus to my eye the valuation looks really approachable considering the speed of their growth and the fact they're profitable and churning out cash.

I would have no hesitation in recommending others to have a look.

FY21 Results

Highlights

• 5.3 million profit

• Total sites under management (where SPZ has parking technology installed) increased to 619. A total of 123 sites were added in FY21, an increase of 25% YoY.

• Revenue reported at 20.7 million, a slight decrease from FY20 figures (21.5 million). More on this below.

• Completed acquisition of Enterprise Parking Solutions, with 68 new sites (see my previous Straw).

• 278% increase in growth in parking breach notices.

• Cash reserves of 10.7 million

All things considering, FY21 was a decent year for SPZ. Despite the decrease in revenue (which was expected due to the pandemic severely impacting operations in the UK – SPZ’s primary market), the company posted a 5.3 million profit. This was largely due to the reduction in overheads, which decreased from 13.1 to 10.5 million, in addition to a one-off benefit due to a VAT resolution/dispute.

Expansion in the NZ market appears to be progressing well. This is an attractive market with a large number of site opportunities. SPZ has acquired access to NZ’s national car owner numberplate database, which provides the company with the ability to deploy remote camera technology and more. A total of 10 sites currently under management in the NZ market (March Launch) – performing ahead of expectations. Nevertheless, I want to see gradual expansion in NZ QoQ, something I think the company can achieve.

Similar to NZ, I am looking forward to seeing how SPZ expand throughout Australia in FY22 (where there are three sites currently installed). Having started in Qld, SPZ’s strategy is to pursue expanding operations into WA, SA and NT due to the regulatory environment in those states. I think the company is well placed to disrupt this market. Another bonus is these states/territories haven’t been impacted by the pandemic (to the extent of NSW and Vic), so this bodes well for SPZ’s strategy heading into FY22.

The company reported 720 total sites under management as of 20 August 2021 – the company is on track to meet their goal of 1000 sites by June 2023. There has been some nice growth in FY22 thus far (both from an acquisition and organic), so FY22 figures are looking healthy already.

There are some notable risks heading into the year though, specifically the pandemic. Lockdowns have a negative impact on the company. Any extended lockdown in particular will impact SPZ’s growth strategy.

Mr Market likes the result – SPZ are up 10% today at the time of writing. I think this is primarily due to the tailwinds looking into FY22. With a healthy balance sheet, SPZ is well placed to expand their operations into NZ and Australia.

Smart Parking acquires Enterprise Parking Solutions (EPS)

SPZ has acquired EPS – a profitable and cash flow positive UK parking management business – for a total of $1.54m. The purchase has been funded entirely from existing cash reserves.

SPZ noted in H2 FY21 that it would look to make strategic acquisitions where the price was right, particularly with the impact of the pandemic on smaller business. This looks to be a shrewd bit of business - noting that full details are yet to be released. The company have stated that they shouldn’t have any issue integrating EPS to its back office system, which seems fair enough given the similarities between the two.

The acquisition will include EPS’ 68 sites under management. This accelerates SPZ’s growth to its target of 1000 sites under management by June 2023 – with this total now standing at 693. SPZ initially reported 612 sites in its H2 FY21 update, so without the acquisition sites under management would have increased by 13 since June 2021.

Other tailwinds for SPZ

- UK is out of lockdown, where the bulk of SPZ’s business is.

- General preference to use personal transport (driving), as opposed to public transport, during and after the pandemic.

- No barriers for SPZ to continue its gradual expansion into NZ, which remains largely unaffected by the pandemic.

I still consider this one a bit of a sleeper – it can be a slow burn at times, but I have maintained a long term focus (which has seen me be rewarded in recent months). I still think there is some upside here.

SPZ received acquisition offers/interest a few years ago (which were all turned down), including a 28.4c-per-share offer from British car park manager Parking Eye. It wouldn’t surprise me if additional takeover offers are received in the future, particularly with SPZ anticipated to become profitable in the next 12 months or so.

Additionally Microequities Asset Management have established a sizeable position in SPZ this year, purchasing in March 2021, and adding to its holdings in early June and late June 2021. I think this is a good show of support if anything.

Full year results should be released in the next month. A few things I will be looking closely for:

- How growth/expansion is going in NZ

- Cashburn over the last year, with the acquisition cost included.

- Forecasts around when the company will become profitable.

DISC: I hold in RL portfolio. I won't be looking to take any profits off the table here and will instead let this one (hopefully) run.

Following movement to Smart Parking’s (SPZ) share price in the last month, I figured now would be a good time to post a straw and share a few thoughts about my interest in the company and thesis.

Overview

SPZ is a global company concerned with the sale of technology, hardware, and software for parking solutions. Some of their technology consists of automatic number plate recognition, digital guidance signage and in-ground occupancy sensors. There is also an R&D component to the business (to ensure they can continue to develop innovative parking solutions). They operate in 17 countries and have offices in Australia, NZ, and the UK.

Their target customers include shopping centres, hospitals, supermarkets, airports, commercial parking sites, universities, and large-scale municipal street environments. Gatwick Airport – UK’s second largest airport – is an example of a reputable/prominent customer. More information on this here.

Like many industries, the pandemic has had a significant impact on SPZ – which relies on vehicle use, subsequent parking, and parking breaches/fines. Fortunately for the company and shareholders SPZ is showing signs of recovery, with revenues increasing again and delayed projects resuming.

As a company, SPZ is not particularly ‘sexy’. The share has traditionally traded with limited interest or trading volume. I think it was Noddy who recently mentioned they really like when companies, particularly those with self-declared conviction, continue to meet corporate objectives and grow – but do so relatively unnoticed. SPZ is a similar story for me in the last 3 years.

Thesis

- Management have steadily grown the business over several years, achieving continued expansion and growth in ‘sites under management’ (SPZ’s key metric – parking facilities where technology has been installed).

- In the last two company updates SPZ reported technology rolling out at 85 and 123 sites respectively, with removal of tech occurring at 5 and 13 sites. As of 31 May 2021, they were operating at 612 sites in total, up 23% from the previous year. SPZ is installing technology (and maintaining customers) at a much higher rate than removal/customer churn is occurring.

- SPZ have recently rolled out operations in NZ, with 6 sites installed (performing ahead of expectations).

- Growth tailwinds for the ‘smart’ parking industry: with real estate and parking becoming increasingly more expensive, I think their is merit in businesses wanting to better manage and monitor parking using identification technology. This assists with monitoring consumer trends and movement and facilitates enhanced accountability/enforcement for fines etc. Other tailwinds for the industry include:

- further easing of restrictions.

- growing vaccination rates across UK and other markets adding to consumer confidence.

- ‘staycations’ in the UK and other markets encouraging driver motorist behaviour.

- continued expansion in NZ and AUS.

- In the last reporting period, the company reported cash holdings of 9.3 million. They are unlikely to need additional capital over the next 12 months. The company also commenced a share buy back in Feb 2021, with 1 million bought back thus far – however yet to scratch the surface of their proposed 5m.

- Lots of insider buying in the last 6 months, with no selling recorded (Simply Wall St). Microequities Asset Management recently purchased over $2million worth of shares (split across June and March 2021) at 0.17c.

- Experienced management team and BOD, led by Paul Gillespie who has been CEO since 2013. Insider ownership is recorded at 7% according to Simply Wall St.

Monitor

- I want to see sites under management continue to tick along at growth rates around 15%>, with removal of tech occurring <15% mark – achieving this confirms customer retention/stickiness and suggests continued value in their product.

- The NZ and Australian markets are significant growth opportunities for SPZ – continued expansion in both countries is important for the thesis to remain intact.

- Cash burn rate - history of churning through cash quickly, particularly last year.

- The last reporting period was impressive, with net profit increasing to 4.5 million (compared to 1.5 million in previous reporting period). This result is a little misleading and due to a one-off benefit of 6.9 million relating to a VAT dispute.

Risks

- SPZ is still unprofitable. This is likely to remain the case for another 12 months.

- They are highly vulnerable to any lockdown measures. Any extended lockdown period, particularly in the UK, will have a significant impact on SPZ’s growth trajectory.

- Finico owns 33% of the company (Simply Wall St) – removing/selling a large portion of their position would put SPZ’s share price under considerable pressure.

Disclaimer, hold in RL portfolio – purchased a small holding at 12c.

SPZ - pre-release comms on new Tessera app / platform

2021-03-23

SPZ have circulated an early heads up of their new platform named Tessera, aimed at not just streamlining the back end processes of Car Park management for local Councils, but also the new platform lays the foundations to be expanded into other services offerred by the municipality

The overview video is here

It does seem like a sensible idea to leverage the already in place relationships with respects to Car Parking and simulate those efficiences and processes over into the other services of the already customer base.

Post a valuation or endorse another member's valuation.