I struggled with getting my head around this “its good, BUT ...”, set of results.

Discl: Held IRL and in SM

SUMMARY

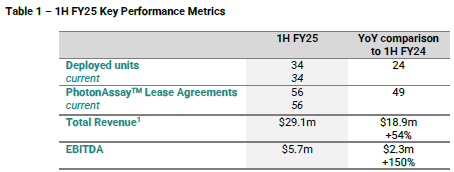

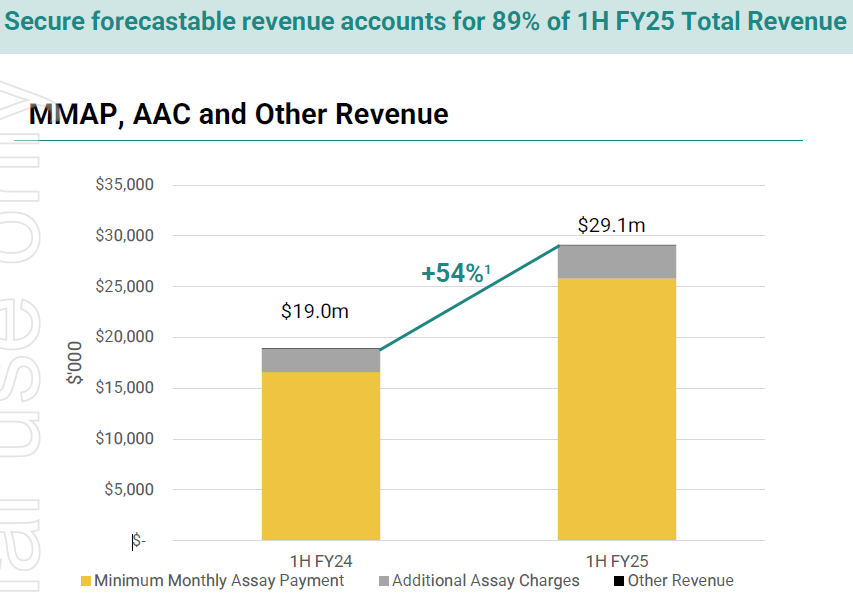

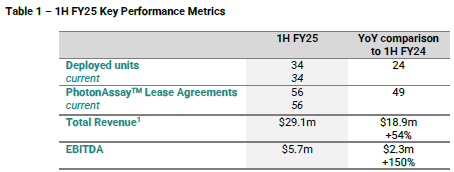

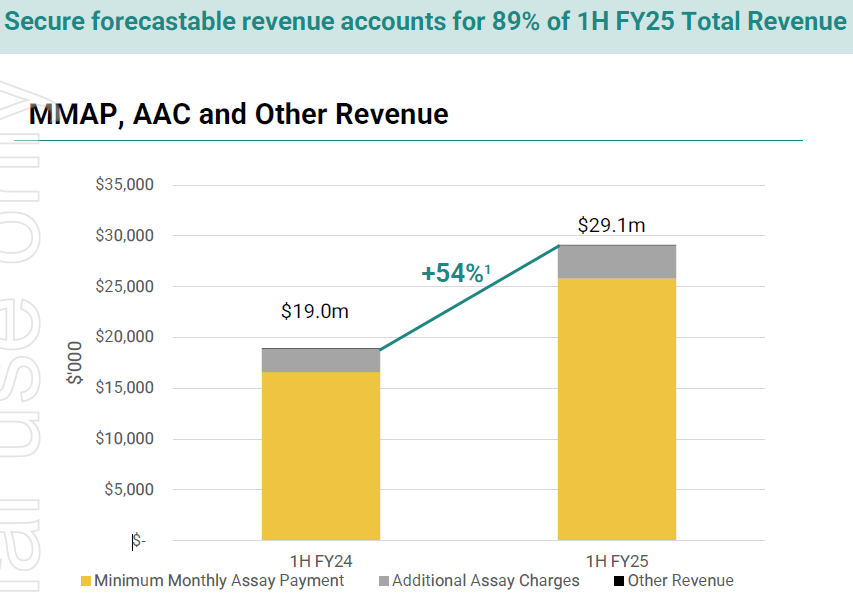

Impressive results when compared to 1HFY24 (+54% revenue growth, +152% EBITDA), but not so, when compared HoH with 2HFY2 (+15.0% revenue growth, -15.4% EBITDA).

As revenue steps up with each unit deployed, prior corresponding period comparisons are almost always going to be impressive if there are new units deployed in the 12 months period prior to the current reporting date from (1) full revenue contribution of all units deployed at the end of 1HFY24 (2) plus the large partial revenue contribution from the additional units deployed in 2H24 and (3) the small partial revenue from 1H25 units.

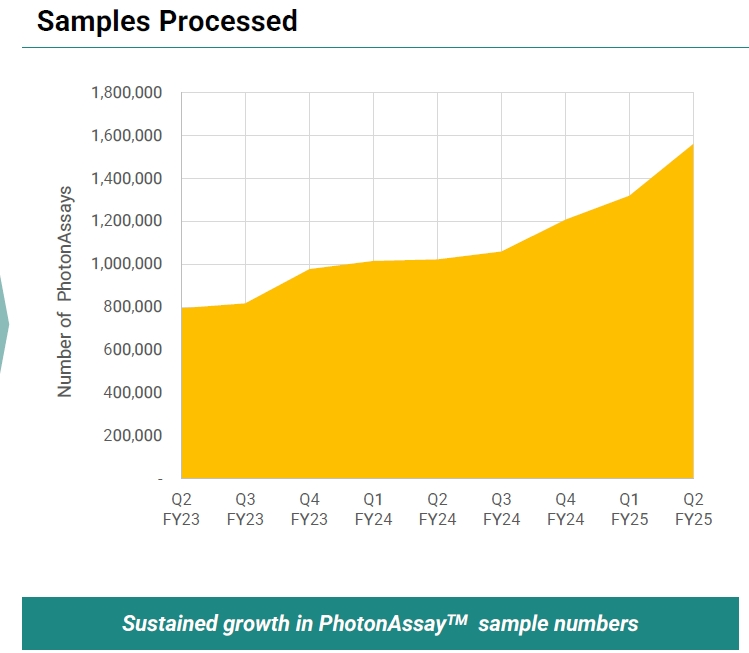

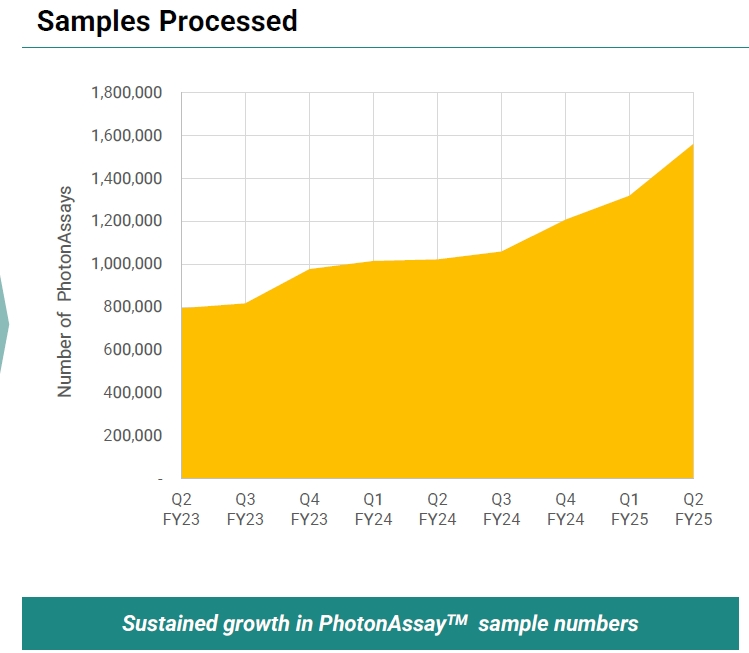

The samples processed volume continues to grow very nicely - the quarterly growth trajectory seems to be increasingly steeper, a really good indicator of both industry & customer adoption and Additional Assay Charge revenue upside. Dirk mentioned that there is still latent capacity for additional samples in the deployed units - revenue upside is huge - if units run at 100%, sample volume can increase 2x.

5 units deployed in the half - this is now about the BAU run rate of 2-3 units per quarter, these are to newly signed agreements - the 13 units in the shed (14 at EOFY24), suggests that there are still issues preventing the deployment to the older contracts - would like to understand why this is still the case and what is actually holding these units up.

Costs continue to incrementally rise as more units are deployed - this is expected. But need to keep a watch on operating expenses in 2H25 as the growth in expenses in 1H25 over 2H24 was higher than revenue growth - point to note for questions.

Capex is still elevated (1HFY25 $37.9m), elevated due to the timing of payments to major suppliers for long lead time items in alignment with payment terms, expect to normalise in 2H25 - normal capex cadence is expected to be $10-$12m per quarter. No concerns with this.

Cash from operations was positive and fully funded the first unit - a really good sign, $18m of the $95m CAB debt facility drawn down - funding looks comfortable for another year at least.

US is a very small market and have already shipped units to the US prior, so not expecting any US tariffs to have any financial impact

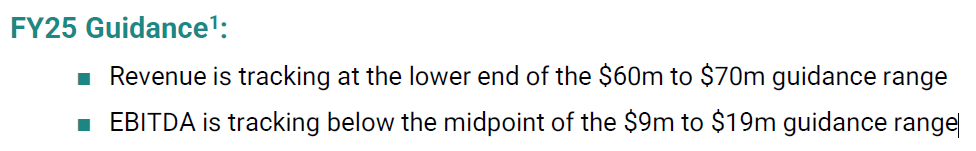

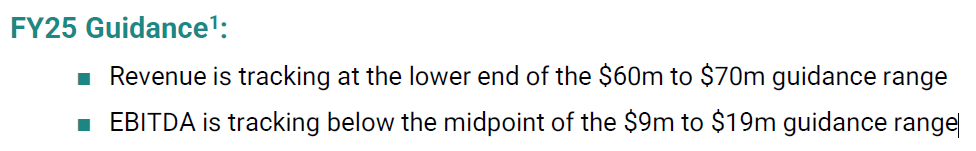

FY2025 guidance was a dampener (1) tracking at lower end of revenue guidance $60-$70m (2) EBITDA tracking below midpoint of $9m to $19m - current half-year run rate should see this being met, suspect management is building in some buffer for delays in deployment of 1-2 units into the back end of 4QFY25 - need to watch out for this in the 3QFY25 Appendix 4C in April.

Overall

No change to C79’s overall growth trajectory, moat, industry adoption, revenue growth/quality/sustainability etc. But the pace of that growth has slowed from the deployment frenzy of 18-24 months ago to a steady 2-3 units per quarter cadence. This slower pace is probably driving the range bound share price movements and today’s muted reaction to the results.

The rewards should await long-term patience as the business does it thing, one unit at a time, but patience is absolutely needed ....

Things to Look Out For/Ask in March Appendix 4C Call

- What the hell is still holding up deployment of units to the older contracts

- Expense growth vs revenue

Revenue guidance requires at least a repeat of 1HFY2025 revenue which should be comfortably met from (1) MMAP from current units in production (2) contribution from the 2 units currently being deployed from 4Q25 (3) revenue from continued AAC growth trajectory. This guidance suggests that the deployment of the next 2-3 units in 4Q25 may not be completely deployed come EOFY 25 or is heavily back-ended such that any revenue contribution in FY25 will be negligible - Dirk said that “guidance was reflective of deployment timing ...”

To meet ~$13-$14m EBITDA, ~$7.3m EBITDA will be required in 2H25 - this should be achievable given the revenue trajectory