Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Discl: Held IRL 7.22% and in SM

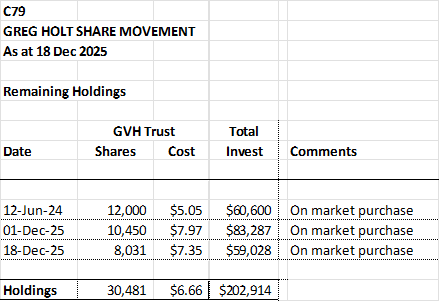

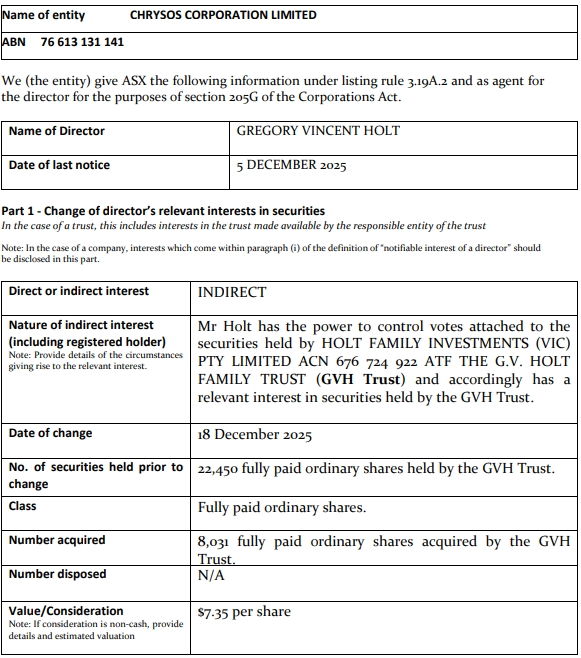

Greg Holt appears to be mighty bullish on C79 ... He has topped up his C79 holdings by a further 35%, investing $59.0k of his own coin.

This is coming on the back of his (then) 50% top up of C79 on 2 Dec 2025, investing $83.3k then.

This is a real good sign of confidence in the business.

Looks like a nice entry point from a chart perspective - the price has retraced ~62% from the paek of this current move.

Discl: Held IRL 7.67% and in SM

Nice to see Gary Holt, C79 Director, almost doubling his holdings of shares and averaging up.

He was appointed a Director in 2023 and 1st bought 12,000 shares at $5.05.

Coming off the back of the CSIRO block sale to Macquarie Capital last week, this for me, is good from a confidence-in-the-business perspective.

Discl: Held IRL 8.31% and in SM

The AFR has reported that the CSIRO, via a block trade, is this evening, selling 10.75m shares, about half of its 18% stake in C79, at $7.90 per share, a 6.7% discount to the last traded price of $8.47 today.

That probably helps explain the sharp drop yesterday, then the partial recovery today.

Discl: Held IRL 8.03% and in SM

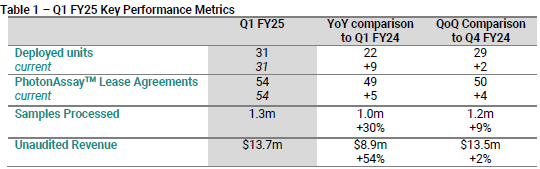

A lot to like in the C79 Trading Update during the FY25 AGM. Could not quite see the driver for the sharp downward price reaction, other than perhaps it was time for a consolidation after the big price run up.

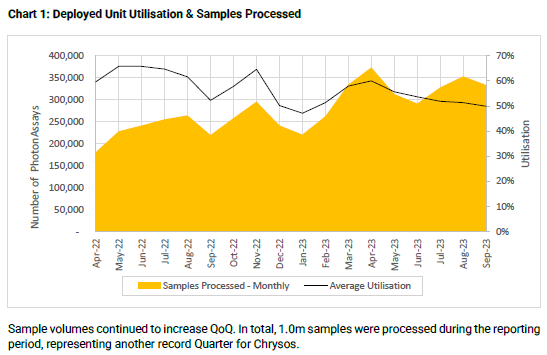

SAMPLE VOLUMES

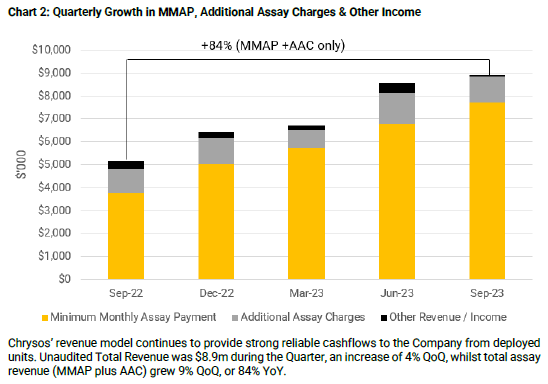

This has really run up very nicely for Additional Assay Charges (AAC) to now be 26.4% of revenue.

It was not long ago that AAC was mostly positioned as “potential upside” to C79’s significantly more stable Minimum Monthly Payments - this growth is very positive from an uptake and revenue upside perspective.

PHOTON ASSAY UNIT DEPLOYMENT

- Nice momentum - 2 deployed in FY26, 2 WIP, 4 upcoming - total of at least 8 in FY26, closer to half-year

- Compares favourably with 5 in 1HFY25, 6 in FY25 for a total of 11 in FY2025

- 2 new lease agreements, sustaining the momentum on this front

- New Allied Gold MOU

FY2026 GUIDANCE REITERATED

R&D UPDATE

The AGM Pack contained a raft of slides which show off the R&D that C79 is undertaking in the background. There was no accompanying text in the MD & CEO address to make better sense of the content. But from what I can superficially tell, C79 is focused on:

1. Improving the the quality and supply chain resilience for critical components

2. Broadening the offering into new PhotonAssay services to “allow more to be done with existing units, often with no more than a software upgrade”, new technologies to expand analysis capabilities beyond PhotonAssay, building on C79’s strength of bulk analysis of large, unprepared samples.

3. Expanding upstream and downstream to reduce bottlenecks in sample preparation, data quality control and reporting.

These initiatives look very positive in terms of adding more capabilities to the existing PhotonAssay units, to add value and further entrench the use and criticality of the PhotonAssay units. These look like incremental improvements rather than wholesale changes.

Not sure if people will find this useful, but I was taking my youngest son for a bike ride and went past Chrysos' Tonsley HQ on Saturday. He wasn't really in the mood to poke around (2 year olds just dont get investing!), but my quick takeaways...

Looked well organised and clean. A few safety signs around, but not over zealous.

It's nice and new!

2 buildings. Looks like an admin building and a workshop, which still has office space attached so wouldn't be surprised if they started with one building and grown into the main admin building pretty quick. They could have fit 100 people, maybe 150 if I had to guess

Workshop looked clean and secure from the outside.

Dirk doesn't work the Saturday shift! It was deserted, which is not the worst thing on a Saturday, bloody nice weather :)

Main Admin (south side)

Workshop and offices (west side)

Workshop and offices north side (admin in background)

Discl: Held IRL and in SM

The C79 Co-Founder and Chair, Rob Adamson, sold 250,000 shares on the market on 30 Sept 2025, netting a nice $1.9m.

- This is only the 3rd time that Rob has sold shares since founding C79 in June 2016

- The sale was 0.21% of his stake in C79, reducing it from 2.92% to 2.70%, post the sale

- Given the infrequent pattern of sale and the duration of his holdings, no concerns at all - Rob still has good skin in the game

I haven't watch but presentations on this channel are technically orientated so I suspect it will be a good breakdown on the technicals of the technology etc..

https://www.youtube.com/watch?v=Rrs9pR1heYs

Discl: Held IRL and in SM

C79 announced last Friday that Dirk Treasure, C79’s CEO and Director, sold 200,000 shares @7.42205 between 11-12 Sept 2025, on market.

Simply Wall Street had this to say over the weekend:

Decided to have a poke around to see if this was worrying:

- Dirk has been Founding CEO of C79 since the company started operations in 2017, so he is 8 years into the gig from day dot

- Went through and summarised Dirk’s Appendix 3X and 3Y notices going back to when he was appointed Director in May 2022 - see table below

- When he made Director, he was awarded 814,273 shares + a raft of options maturing at different times, with strike prices of $1, $2 and $4.50

- He has had a consistent record of exercising his options prior to maturity and selling immediately after, other than in June 2025 where he did not sell - that made sense as the exercise price was $4.50 and he would have been underwater-ish

To put this latest sale in perspective:

- When he was made MD, he was granted 814,273 shares - this was 0.70% of C79’s issued capital today (the % would be higher in 2022 because of dilution since)

- Post the sale of all exercised options (he has no options left) and this latest 200k share sale, he still holds 784,411 shares, which is 0.67% of C79’s issued capital AND a further 398,294 Performance Rights

- While has has consistently exercised and sold off his options, the net effect drop in his shareholding from 3 May 2022, is 29,862 shares or 3.67% of the original allotment in the past ~3.5 years, based on today's issued capital

MY VIEW

- Am not worried

- Share Options are part of Dirk’s rem and rem is only good if he can exercise the options and take the money - think he has earned his money, as he has for me and all other shareholders.

- The net effect is that Dirk still holds 0.67% of C79’s issued capital today, down from 0.70% - not terribly newsworthy, plus a further ~50% in Performance Rights

- Given that C79 is now hitting its stride with good momentum, and the days ahead look happier than sad, my view is that Dirk still has enough excitement and skin in the game to stay in the tent and grow C79, despite him selling the 200k shares

Discl: Held IRL and in SM

C79 released its full FY2025 results today - this was held up because the international tax portion of the report was not ready prior to the last call 1-2 weeks back.

- The final FY25 tax impact came in at $5.3m, almost at the lowest end of the tax expense guidance of "$5 to $10m"

- There were no other changes

- The only impact was that Statutory Net Loss After Tax dipped from FY24 ($0.704m) to FY25 ($8.223m)

Will dig deeper into the Annual Report once reporting season dies down!

Discl: Held IRL and in SM

SUMMARY

- Very nice Trading Update from C79!

- There is a delay to the finalising of its audited accounts due to “delays associated with completing the audit of international tax positions”. Does not sound sinister with a noted $5-10m deferred tax impact flagged.

- 1HFY25 was a meh half, and so C79 needed to deliver a good 2HFY25 to meet revised down guidance, and I think this was well delivered.

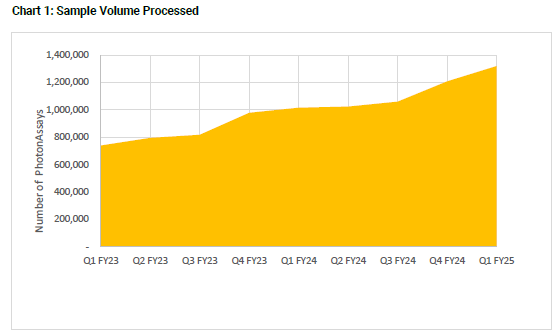

- Technology uptake is gaining momentum - the 4QFY25 samples processed spiked up sharply

- Liking very much, the traction going into FY2026 with the contracts from Bureau Veritas and MSA NEM both looking to provide good growth in both new units and Samples Processed

- Onward and upward!

KEY RESULTS

Very nice upward trajectory of Total Deployed Units and new PA Lease Agreements, anchored by a steady delivery cadence and 9 units on hand for quick deployments - this is a much more comfortable and settled overall cadence than the frenzy of 2+ years ago.

Noticeable spike in the 4QFY25 Samples Processed - fact-based evidence of the uptake of the deployed units and the overall PA technology.

OTHER VERY POSITIVE SIGNS

- Post EOFY signing of strategic partnership with Bureau Veritas (BV) for deployment of PA technology to South Americas

- BV is the last of the 4 Lab majors to get onboard PA, so all 4 major Labs are now onboard PA

- ALS and BV are the 2 Lab majors in South America - ALS has raced ahead in PA, BV is behind the curve in South America and has to catch up

- A beachead which enables the establishment of a South America C79 hub in Chile - now established in all global regions

- MSA with Newmont has broadened:

- New contracted unit in NEM’s Merian gold mine in Suriname for FY26 deployment, the biggest mine in the country

- 2nd adopted unit shows NEM’s confidence in the technology - 13 mines in total, 3 in the bag, 10 more to chase

- NEM has been more aggressive in adoption following the MSA - Barrick took a one-unit at a time approach vs NEM’s quick-successive unit approach (Ahafo, then Merian)

- Contract signed for first deployment on next-gen “XN” units with SGS

- Same analysis approach, but with smaller footprint, greater user efficiencies/easier to use and cheaper to install and maintain

- XN’s automation which is the key driver of the improved XN efficiencies have been running for 6-8 weeks in the Perth SKS unit

- First XN unit will land in 3M time

- The BV deal is the last regional hub to be set up - costs from hereon are only going to be incremental

FY26 GUIDANCE

- Conservative view of Additional Assay Charges and MMAP

- Does not bake in signs that gold industry exploration cycle “is on the up” - upside potential from AAC sample growth rate

Nice Yeah Baby announcement this morning from several fronts:

- 1 new Photon Assay unit actually contracted for - this one is in the NW of Ghana, ~370km NW of the capital Accra, which may explain the longer 1HFY26 deployment timeline

- Similar to the Barrick MSA, the Newmont MSA paves the paves the way for more units to be contracted throughout Newmont’s operations in the coming years - this is a huge tick for Photon Assay technology and C79

- Any C79 success with contracts/deployments also trickles down to XRF who supplies the Orbis crushers for use with the Photon Assay units

- C79 now has the top 2 global miners onboard with Photon Assay.

What is nice about new contracts is that C79 has 9 units on hand to immediately start deployment. While not how they would have liked it to have played out with delays to deployment of the original cohort of contracts, the benefit of that capex pain in the last 18M or so is now putting C79 in a nice position to be able to deploy as soon as a deal is signed AND still have a backlog of about ~15 units to deploy.

Discl: Held IRL and in SM

Discl: Held IRL and in SM

OVERALL

Really pleased that C79 is still issuing these Trading Updates despite it being no longer required to submit the Appendix 4C

Steady-as-she-goes, typical of C79 quarterly updates in recent quarters, but there are good signs of a decent bang end to the FY come 4Q

Over the last 18M or so, C79 has gradually morphed from being a “potential hot growth company” to a “steady compounder” - market expectations have been rewired, the market appears to have re-rated and it it now just patience to let management execute - the revenue and EBITDA over time, must, almost by definition, increase, as each unit is deployed and more samples are taken using fire assay

Very happy with how things are tracking against this new expectation

The Not So Good

- Only 1 deployment this quarter

- On track to FY25 guidance but no change/improvement to the “lower end revenue” and “below mid point EBITDA” guidance

The Good

- 2 new units contracted - always a good thing!

- 5 deployments are WIP - if all 5 can be deployed in 4Q, this would be huge - for context, the average deployed units since FY2023 is 2, the highest deployed per quarter is 4 in 3QFY23, and 3 deployed units was achieved twice - 3QFY24 and 2QFY25.

- 4 deployments look like in established sites, the one at most risk is the first install in Namibia, so my expectations for 4Q deployment is 4 base case, stretch of 5 units, this would still be a good result

- Cash $35.1m, undrawn debt $77.1m, total funding $112.2m vs $121.6m at the end of Q2, implying 3QFY25 cash draw down of approx ($9.4m) vs draw downs of ($10.7m) 1QFY25 and ($23.2m) 1QFY25, which confirms management commentary that PPE costs have normalised back to 1QFY25 levels - this is good

- Both quarterly revenue and samples processed continue to trend upwards nicely

This was an interesting view on the breakdown of the source of the samples:

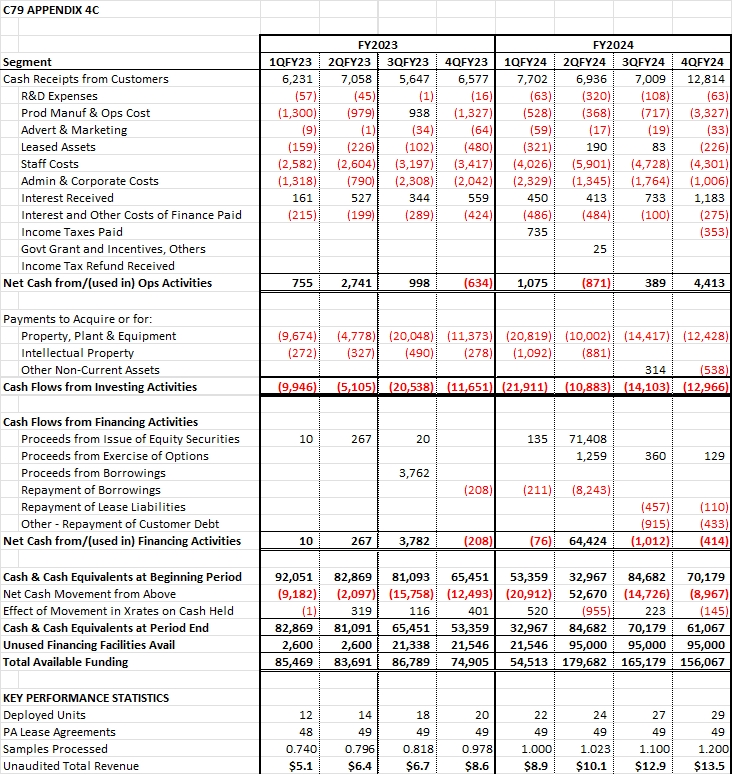

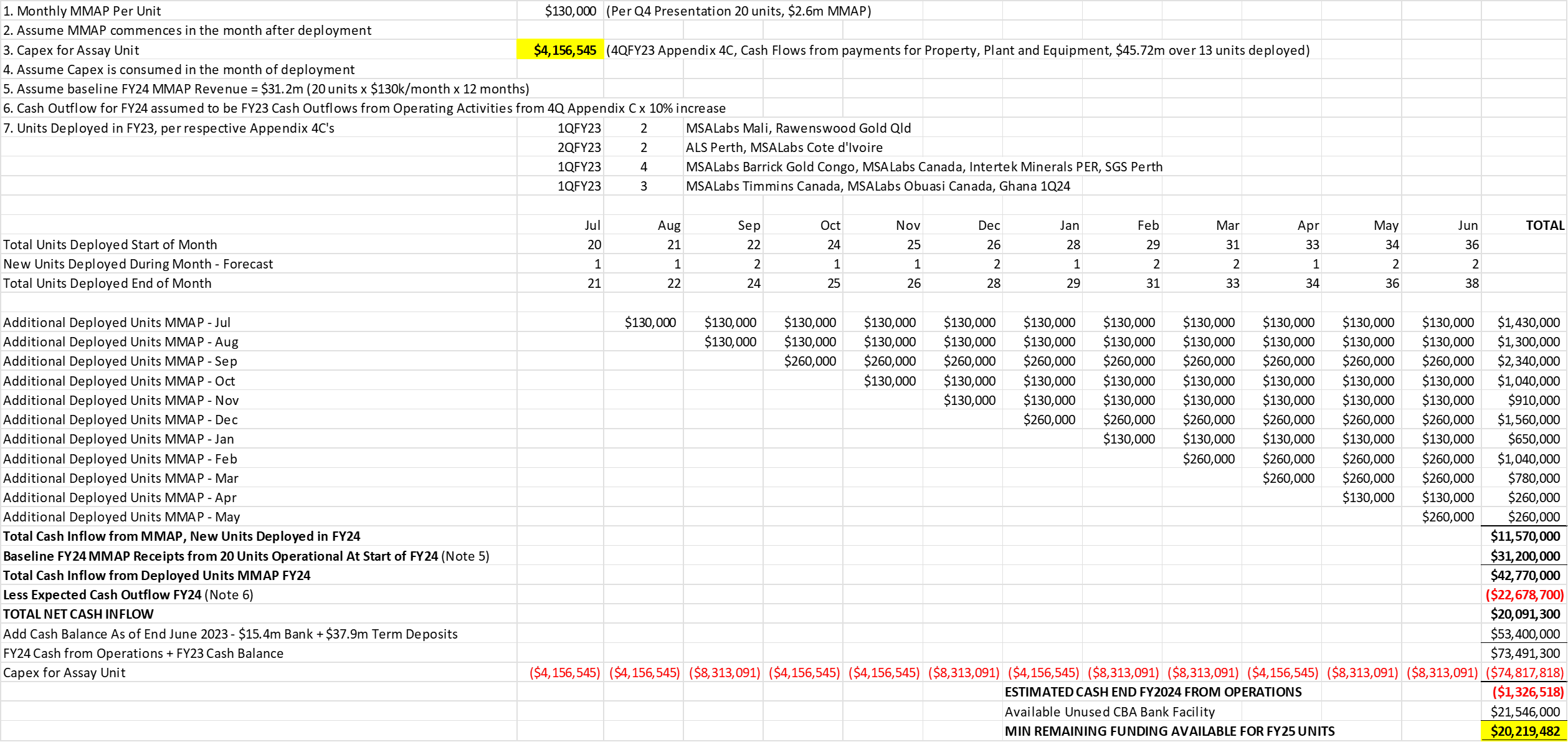

I've just started researching Chrysos in some detail and there's a decent amount of App 4C history which I am attempting to use in AI to collate and look for trends, instead of having to punch it all in manually.

However, this will have to be a one time thing because they've published their last App 4C - https://www.marketindex.com.au/asx/c79/announcements/cessation-of-quarterly-reporting-obligations-2A1588363.

This is a bit disappointing because they are burning a lot of cash (FCF = Op CF less Capex) but the ASX requirements for App 4C apparently only relates to Op CF.

In FY24 they had Op CF of +3.6m but Capex of 59.9m (FCF = -56.3m). With a net Cash balance of 58.5m they have about 12 months left at this rate. Seems an odd time to stop publishing App 4C's.

To be clear, Chrysos are doing nothing wrong here as it's all within the listing rules but it's a little frustrating that companies are allowed to give less info on cash flows when they are burning so fast and have been relying on cap raises to fund themselves.

The below shows what I'm banging on about.

First diagram shows Op CF is low, relatively stable but positive.

Second diagram shows FCF is going in the opposite direction to Revenue.

Rant over.

Disc: Not Held

I struggled with getting my head around this “its good, BUT ...”, set of results.

Discl: Held IRL and in SM

SUMMARY

Impressive results when compared to 1HFY24 (+54% revenue growth, +152% EBITDA), but not so, when compared HoH with 2HFY2 (+15.0% revenue growth, -15.4% EBITDA).

As revenue steps up with each unit deployed, prior corresponding period comparisons are almost always going to be impressive if there are new units deployed in the 12 months period prior to the current reporting date from (1) full revenue contribution of all units deployed at the end of 1HFY24 (2) plus the large partial revenue contribution from the additional units deployed in 2H24 and (3) the small partial revenue from 1H25 units.

The samples processed volume continues to grow very nicely - the quarterly growth trajectory seems to be increasingly steeper, a really good indicator of both industry & customer adoption and Additional Assay Charge revenue upside. Dirk mentioned that there is still latent capacity for additional samples in the deployed units - revenue upside is huge - if units run at 100%, sample volume can increase 2x.

5 units deployed in the half - this is now about the BAU run rate of 2-3 units per quarter, these are to newly signed agreements - the 13 units in the shed (14 at EOFY24), suggests that there are still issues preventing the deployment to the older contracts - would like to understand why this is still the case and what is actually holding these units up.

Costs continue to incrementally rise as more units are deployed - this is expected. But need to keep a watch on operating expenses in 2H25 as the growth in expenses in 1H25 over 2H24 was higher than revenue growth - point to note for questions.

Capex is still elevated (1HFY25 $37.9m), elevated due to the timing of payments to major suppliers for long lead time items in alignment with payment terms, expect to normalise in 2H25 - normal capex cadence is expected to be $10-$12m per quarter. No concerns with this.

Cash from operations was positive and fully funded the first unit - a really good sign, $18m of the $95m CAB debt facility drawn down - funding looks comfortable for another year at least.

US is a very small market and have already shipped units to the US prior, so not expecting any US tariffs to have any financial impact

FY2025 guidance was a dampener (1) tracking at lower end of revenue guidance $60-$70m (2) EBITDA tracking below midpoint of $9m to $19m - current half-year run rate should see this being met, suspect management is building in some buffer for delays in deployment of 1-2 units into the back end of 4QFY25 - need to watch out for this in the 3QFY25 Appendix 4C in April.

Overall

No change to C79’s overall growth trajectory, moat, industry adoption, revenue growth/quality/sustainability etc. But the pace of that growth has slowed from the deployment frenzy of 18-24 months ago to a steady 2-3 units per quarter cadence. This slower pace is probably driving the range bound share price movements and today’s muted reaction to the results.

The rewards should await long-term patience as the business does it thing, one unit at a time, but patience is absolutely needed ....

Things to Look Out For/Ask in March Appendix 4C Call

- What the hell is still holding up deployment of units to the older contracts

- Expense growth vs revenue

Revenue guidance requires at least a repeat of 1HFY2025 revenue which should be comfortably met from (1) MMAP from current units in production (2) contribution from the 2 units currently being deployed from 4Q25 (3) revenue from continued AAC growth trajectory. This guidance suggests that the deployment of the next 2-3 units in 4Q25 may not be completely deployed come EOFY 25 or is heavily back-ended such that any revenue contribution in FY25 will be negligible - Dirk said that “guidance was reflective of deployment timing ...”

To meet ~$13-$14m EBITDA, ~$7.3m EBITDA will be required in 2H25 - this should be achievable given the revenue trajectory

My more detailed notes after a late listen to the investor call.

Discl: Held IRL in SM

SUMMARY TAKEAWAYS

Nothing to not like about this update, continue to remain long-term bullish on C79, and much more comfortable with this more steady and balanced-operating cadence.

- Good steady growth all round - Revenue, Samples Processed, Deployed Units, Lease Agreements

- Reaffirmed FY25 Revenue and EBITDA guidance - after 2Q, appears on track to meet

- Sample Processed growth continues to grow impressively, 18% QoQ, indicating continued strong uptake of Photon Assay technology

- Settled into a good cadence of 2-4 units deployed and 2-3 lease agreements per Quarter - feels like a good balance vs previous hit and misses

- Bigger outflow of capex this Qtr, flagged imminent drawdown of debt facility in the coming quarter - still well funded for the next 1-2 years at least

- Significantly more Q&A in this quarters call which drew out more operational and sales insights which were very helpful in providing an overall view of how things are tracking

FINANCIALS

- Revenue grew 12% QoQ - increasing contribution from international operations and USD exposure

- Samples processed up 18% QoQ - 24th consecutive Quarter of record PA volumes despite gold exploration activity trending sideways/downwards

- 3 units deployed, total units deployed 31 - steady cadence of 2-3 units deployed per quarter (1) 1st unit in Alaska (2) Orange NSW for SGS (3) 2nd unit in Barrick-Newmont NGM complex in Nevada - continued Barrick adoption

- 2 new Lease Agreements signed, total 56 units deployed or contractually committed, continued steady cadence of new lease agreements (1) OceanaGold NZ (2) SGS in Kalgoorlie WA

- 12 units in inventory, ready for deployment - about a year’s worth of inventory, goal is to hold a handful of units on hand in the long run

- Broadening relationship with SGS

- Oceania Gold contract is the 1st contract where the Lease Agreement is with the miner but the unit is operated by a lab, SGS

On track for FY2025 guidance - should have no trouble meeting revenue guidance at least, given current trajectory - 1H revenue is $29.0m, and revenue steps up with each deployed unit.

CASH FLOW

- Big outflow of Capex this quarter

- Drained cash balance from $47.5m to $26.6m

- $3.5m infrastructure R&D payment

- Timing of warranty payment terms for units deployed

- General supplier payment terms

- Nothing of concern, expect this to normalise in the next quarter

- Slower cash collection vs last 2 quarters

- Collections in 2Q traditionally lower, expect to return to normal in 3Q

- Strong start to collections in January

- Operational cash flow positive for the 4th consecutive quarter

- Flagged likelihood that drawdown of CBA $95m debt facility will commence in 3Q

OPERATIONAL INSIGHTS

Sales

4 Lease and Operating models offered to customers - the transparency of the cost models within each of these models allows miners to choose what works best for them

Change of Sales approach 18M ago, from working through labs to working directly with miners with own sales force, is now paying off:

- Facilitates direct relationship with miners and moves to value-proposition based sales approach/focus vs the previous approach of like-for-like replacement of fire assay - ensure the miners get the maximum value on the way through rather than just reducing the direct costs from Fire Assay

- Different operating models ensure that there is no revenue cannibalising between miners and labs - miner-contract-lab-operate is a clear win-win model for all

- Direct engagement minimises the instances of labs getting a premium from miners for using PA over FireAssay

- Have completed a large number of successful paid studies with non-customers to demonstrate PA capabilities

- Comfortable with current sales team setup with a handful of sales people in each key region, at or near miners, supported by technical staff of geologists, metallurgists etc - Africa, North America, South America

- Pipeline is strong especially as C79 gains more access to mine site personnel with each mine site deployment eg. Nevada mine gives more access to Newmont, supported by growing relationship with Labs

- Seeing more sample processing growth come through from miners where C79 technical services have direct engagement

Industry challenges which are hurdles to sales:

- PA has only been around for 6 years, in an industry that is slow to uptake new technology

- Mines are managed and operated quite separately from each other, even though they belong to the same company - need to go through the same due diligence, testwork regime at a new mine site even though other sites in the same company are already operating PA units - the bigger the miner, the more slow moving it is

- Have less sales focus on smaller miners and exploration companies as the lab companies are already there banging the PA drum to convert these companies to PA

Business Development with Labs:

- Already working with 3 of the 4 biggest labs today - talk of a merger between SGS and BV could make the 4 biggest, the 3 biggest

- Relationship with SGS is ongoing and growing

- Likely to end up with a lab partner in South America as well

- Lab sales will be mostly driven by conversions of mining projects, especially near lab hubs

- Labs are at the behest of the miner as each of the labs can provide the same PA service and the playing field is thus even - it is up to the miner to work out operational risk/cost in determining the best least and operating model

- Shifts conversation from C79 vs Lab or C79 vs Miner to one of Miner vs Lab

- Miners have pushed C79 to come up with the Miner leased-Lab operated operating model to achieve the best results for the miner

TAM is heavily skewed towards miners - 400 (2/3) Miners, 200 (1/3) Labs

Rate of contracting leases has increased this year - miners appear to be positioning for upturn in exploration activity - feels like exploration spend is going sideways/up, but certainly not down

Deployment Progress

- Rate of deployment has improved as timeline from landing the unit through to installing in shed has definitively shortened

- Made improvements to compress previous bottleneck of licensing - previously licensing could take as long as 270 days, now, with increased local operating knowledge, licensing can be achieved in the same 8-week installation window

- Offset by deploying in new countries for the first time - NZ, Namibia. Have got better at preparation - in-country corporate setup, licensing etc

Manufacturing Capacity

- 20 units per annum

- Working to get deployment cadence up to this level via sales relationships with miners, predominantly

Continuous Improvement

- Continued access to minesite personnel throughout the entire sales/deployment/BAU cycle has provided good inputs to improving the performance of the units

- Operational experience thus far has been better than expected in terms of useful life of the unit

- No need to change current useful life model - likely to err on side of conservative estimates

- Eg. The experience of the 1st deployed unit in 2018 suggests that there is likely to be no need to re-build the units linear accelerator in 2028 when it reaches 10 years, as initially expected

Cost Base, USD Exposure

Forecasts are based on USD xrate of 65c

- Cost base and unit capex costs are mostly denominated in AUD, but moving increasingly to USD as more units are deployed overseas

- Revenue is now significantly in USD

Cost base is becoming increasingly incremental

- Sales & Technical Support has grown from 1 to 20, likely to add 1-2 more FTE only

- Finance headcount will also grow incrementally - no need to double headcount as the business scales

C79 signed a new customer contract with OceanaGold Corporation (TSX:OGC) for a PhotonAssayTM unit installation at OceanaGold’s Macraes Operation in New Zealand. OceanaGold has a portfolio of four operating mines: the Haile Gold Mine in the USA, the Didipio Mine in the Philippines, and the Macraes and Waihi operations in New Zealand. The Macraes Operation on New Zealand’s South Island is the country’s largest active gold producing mine, having produced over five million ounces of gold since 1990.

The Macraes unit will be operated by existing Chrysos customer SGS; signifying the first PhotonAssayTM unit to be leased by a miner and operated onsite by a laboratory.

Expected to be deployed in the second half of FY25

Grows PhotonAssay’s footprint in the Asia-Pacific region, but increases relationship with one of the world’s leading laboratory companies

What is pleasing:

- Adds a new C79 customer operating model where the miner leases the PA unit, but a Lab operates the unit on its behalf, onsite

- OceanaGold looks to be a mid-tier gold miner - that it has sufficient volume to make the economics of an onsite unit to work in this new operating model augurs well for C79’s penetration of the mid-tier of Gold miners.

- Adds to steady new unit sale momentum, expands customer base

- C79 has sufficient inventory to immediately deploy units to new customers who are site-ready vs being held “deployment hostage” by existing contract commitments by customers who are not site ready

Discl: Held IRL and in SM

C79—a speculative investment---changing gold assay sampling

First, C79 is a speculative investment. Broadly, I define these as having a likely large dispersion of outcomes around my base case, which could include permanent capital loss. For this reason, the positions are below 1%, usually well below, and could be described as tracker positions. The story will become more certain as we get more data points, and if the SP remains attractive I will be willing to increase the position. That said my record in speculative investments is well below investing in the more mature record. The potential reasons for that I will leave to another post! Lol

C79 (Chrysos Corporation) began as a CSIRO-funded venture to develop an alternative to fire assays that sample the attractiveness of gold deposits. The inventor, James Tickner is still with C79. The CSIRO involvement does give me some confidence that the technology has some substance.

The company has moved on and listed in 2022. The aim is to replace as much of the fire-based assay technology currently used by gold miners and lab operators. The technology is promoted as safer, quicker and more accurate. The pricing is to match the existing fire assays and the customer has the benefit of the other advantages.

Total Addressable Market (TAM)

C79 identifies 610 possible sites for its units. These are split between 200 lab-based units and 410 site-based units. The labs are the large testing operators such as SGS and ALS, there are four major labs. The site-based units are directed to the larger mines that can sustain a unit on their own (defined as 40kg/pa). Management has indicated that they wish to capture 100% of the market. There are several issues with this likelihood. Firstly the units are $4m each and are leased out by C79. That means they are on the C79 balance sheet, for the time being anyway. There is the logistical process of building, selling and locating these units, some in remote areas. Secondly, the patents associated with the technology expire in 2032. Possibly that could see a competitor enter the market, although as would be expected C79 are already patenting more ancillary technologies and processes. The ability to keep out competition is unknown in the medium term. 100% replacement is possible but probably not likely and I have ended up assuming 60% (360 odd) in 20 odd years. Which sets a doable but not easily achievable limit. The number of units deployed so far is 31.

Unit Economics

Management has stated that the ROI they are experiencing and pricing for their units is 50-80%. That is a very attractive return. The leases are long-term and designed to offer good and safe returns for C79 through take-or-pay arrangements. The upside comes through extra volumes. These are priced at lower marginal pricing. The marginal cost for C79 is very low. The ability to capture that upside gives the range in the ROI. C79 is exposed to the overall health of the gold mining industry although not explicitly exposed to the gold price. GMs are in the 70-80% range, very attractive. On the last call management indicated that since fire assays are exposed to labour, energy and consumables costs, that will increase over time, C79 will follow. Management also indicated that as they assess the increase in mine productivity that is expected over time using their technology, those gains are expected to be shared with C79. we shall see.

Overheads

A perennial issue with smaller companies is the level of overhead required to sustain and grow the business. that overhead has to be deployed ahead of profits therefore delaying profitability. Secondly, overheads, at some point must stop growing as fast as the top line for operating leverage to occur. C79 has stated that the S&M, product development and G&A costs have largely been put in place and increases should be incremental from here. C79 has also stated that when they enter a new geography diseconomies occur due to service levels (costs) needing to be put in place before units are deployed to cover the cost. The overhead run rate is about $30m pa. the costs will increase but are now expected to lag revenue growth and with the high GM’s, overhead coverage or fractionalization of the cost base should occur from about now.

Funding

C79 has about $45m in cash and $95m in debt facilities (undrawn) from CBA. We can see a race between the capex involving $4m per unit and increases in overhead to expand the business offset by the high incremental return on capital deployed. There is a cadence in which the deployment of units becomes self-funding. If everything goes well there may not be any further requirement for equity, however, clearly, there is a large build required if all 610 units are deployed at $4m each of $2.4b. It will take some careful timing and some luck will be involved. I am not overly concerned with the funding if the requirement is due to huge demand for the units but not, for example, if funding is required to cover a blowout in overheads. I have assumed debt running at $45m average for ten years, 8% pretax cost. This is a guess and it is not significant to the valuation. A large equity raising would be impactful for the valuation.

VALUATION

The critical drivers are 1. Units deployed 2. Unit economics holding and 3. Overhead cost stabilisation. If units are deployed as management expects, the value balloons out if unit returns hold and overhead growth slows. My valuation is $11-12. Maybe you could say the same for every speculative investment. The above are the main factors to monitor, IMO.

Inverting the current SP means almost no growth is assumed but the current ROI holds.

The C79 is mostly dependent on maintaining a high ROI. If it is reduced to 25% (halves), there is little extra value apparent in my numbers. If ROI falls it opens up a whole range of issues. One of the main risks is that as the business expands it encounters customers who don’t see the value and either want a discount or don’t participate, either is bad but lower returns are a much larger issue.

Disclaimer – This is not advice and could contain errors. My success rate in speculative investments is below my average, beware. lol

Nice update today.

Glad I topped up IRL yesterday at ~$4.58 as the price fell back into and successfully tested the now-strongish support zone of around $4.38-$4.75, which is also C79's 52-week lows. With no news driving the price falls to 52-week lows, it seemed like a good risk to take.

Big ticks this Quarter - (1) 4 new lease agreements signed (2) 2 units deployed (3) 9% uptick in sample volumes (4) 1st US-based installation, one more WIP in Alaska - all are signs of increasing technology penetration and global reach

Highlights

- Two units deployed during the Quarter, including the first unit at the Barrick-Newmont NGM complex, marking Chrysos’ first USA-based installation. A total of 31 units now deployed.

- Four new lease agreements signed during the Quarter comprising two new agreements with SGS in Africa and Australia, and two new agreements for deployment into African-based laboratories, bringing the total number of contracted units to 54.

- Unaudited Revenue of $13.7m, reflecting 2% growth Quarter-on-Quarter (QoQ) and 54% growth Year-on-Year (YoY).

- Sample volumes totalled 1.3m, reflecting 9% growth QoQ and 30% growth YoY, with latent capacity available to capture industry cycle upturn.

- Well-funded to support continued PhotonAssayTM unit growth, with cash position of $47.5m as of 30 September 2024 and $95m in undrawn debt available.

- Continuing revenue growth, along with ongoing market penetration across key mining hubs, sees the business on track to achieve its FY25 guidance of $60-$70m of revenue and $9-$19m EBITDA

- 13 units ready to be shipped and installed in support of Chrysos’ FY25 deployment schedule, including two new units that passed factory acceptance testing during the Quarter.

Price Action

Price yesterday testing again the floor around ~$4.38, on no news, which is the 52-week low - now unjustifiably so given today’s update.

Over and above the usual familiar results content that C79 puts out, picked up a few interesting points in the Annual Report and Rem Review which gave me confidence that C79 were/are very much focused on the deployment issues and the operational risks around counterparties, risks of conflicts etc.

Thesis and high-conviction very much intact!

Disc: Held IRL and in SM

FY24 felt like a year of customer, deployment and operational consolidation/reality check/learnings followed by a deliberate re-base lining of market expectations of the pace of deployment to ensure a more sustainable cadence vs the FY23 over-excitement of “straight-line”-like deployment plans. This is a good thing from a long-term investment perspective.

Despite this, C79 grew significantly in terms of revenue (69%) and EBITDA (156%) and Photon Assay technology uptake via growth in samples undertaken.

Starting to see more traction in securing sales for new units - 4 new sales, post EOFY - very good to see - this also spreads out the customer base and allows for acceleration of parallel installations

No funding issues in the horizon - strong balance sheet, cash $61.1m, undrawn debt of $95m, ensuring funding for ~39 units

14 units ready-to-be-deployed removes any supply chain risk for FY25 deployments

FY25 guidance is for (1) 25% to 45% YoY revenue growth and (2) a potential doubling of EBITDA

Review of Annual Report provides evidence that the Board is very focused on the deployment of units, CEO was not awarded STI’s relating rate of deployment units. While you would expect this focus, good to see clear evidence in the Annual Report.

Expecting a controlled, deployment-focused FY2025 which will then translate directly to revenue and EBITDA growth - this will be much more sustainable going forward - “steady high growth”

Upside could well come from (1) a faster rate of units deployed as the company learns and adapts to the site-related challenges faced in FY24 (2) Continued traction in samples as technology uptake further embeds, directly leading to Additional Assay Charges

FINANCIALS

- Met Mar 2024 Revised FY24 Forecast of $48m-$58m, with total revenue at $48.1m, 69% growth on FY23 but note that PhotonAssay Income was only $45.4m, short of guidance - this impacted the STI’s of the Executives

- EBITDA of $9.0m met revised guidance of mid-to-lower of $7m-$17m range, 156% growth on FY23

- Gross Profit Margin 76%, EBITDA margin 19.8%, up from 13.1% FY23

- Operating cash-flow positive: $3.6m

- Operating expenses grew 49% reflective of expanded global footprint, but revenue continued to grow faster than expenses

- Headcount has grown from 116 to 163, commensurate with a growing, hub-centric global perational footprint

BALANCE SHEET, FUNDING

Cash $61.1m, $95m CBA debt facility undrawn - enough funding to deploy about ~39 units

DEPLOYMENT

- 9 units deployed and 2 units re-deployed in FY24 - met revised guidance but far was only 50% of initially planned 18 units, total 29 units deployed

- 14 units ready to be shipped and installed to support FY2025 deployment schedule

- Continued Management and Board focus on deployment:

- No STI incentive relating to the deployment rate of units was awarded

- Note below in Chairman’s Statement

NEW SALES

4 more units contracted post period - good to see some traction in new sales - ongoing focus on diversifying the customer base to accelerate installations.

Deepening relationship with one of the world’s biggest lab, SGS, following last year’s partnership with Barrick Gold

OPERATIONS, TECHNOLOGY UPTAKE

Sample volume growth continues to grow indicating increasing uptake of Photon Assay technology - 4.31m samples in FY24, 29% increase over FY23

22 consecutive quarters of record sample volumes

Unit costs have decreased by 10% YoY - impact of hubbing strategy, increased in-house maintenance, less reliance on 3rd party providers - reflected in gross margin of ~76%

Non-APAC revenue now 55% of revenue, up from 33% in FY23 - reflects increased global market penetration

EMERGING RISKS

Counterparty risk - non-performance of counterparty, concentration risk around counterparty, operating in some jurisdictions which are at a higher risk of geopolitical unrest, bribery, corruption, modern slavery and crime

Risks of Conflict - Chrysos operates in countries adjacent to or where conflicts may occur between nations or other entities, encompassing the possibility of diplomatic breakdowns, territorial disputes, ideological conflicts, and resource competition that may escalate into armed confrontations. This means Chrysos’ ability to control and operate its assets in these territories may be impacted, which may, in turn, lead to impacts on profitability and loss of assets.

FY25 GUIDANCE

Total Revenue range of $60m to $70m - between 25% to 45% growth from FY24 $48.1m

EBITDA range of $9m to $19m - between 0% to 110% growth from FY24 $9.0m - this is a wide range

My thoughts on C79's Appendix 4C and the Friday SM Meeting:

SM MEETING SUMMARY

- Reinforced thinking that long-term opportunity ahead and strong moat for C79 ahead is very much intact - disruptive technology that is defining the new sampling process standard, free run due to no competition, long TAM ahead, clear evidence of increasing adoption

- But the reality is that this journey to market and industry domination is not going to go in a linear straight line - time and effort is needed to keep pushing the technology forward, to overcome the deployment challenges etc - walk away with the sense that C79 management is acutely aware of, and is under no illusion of the effort and focus required - have to readjust expectations of this operational reality

- Need to reduce expectations of the share price and be more patient as the market also adjusts to this reality and C79 works through the operational realities - my expectation was that the deployments will march forward in a straight line which is clearly not realistic

APPENDIX 4C

Positives

- 2 new units deployed

- 2 new contracts signed - the first additions since 1QFY23 - big thesis tick!

- $13.5m revenue Q4, total revenue FY24 = $45.4m vs $26.8m FY23, 69% FY revenue growth - steady quarterly revenue increase trajectory since FYY23

- Non-APAC revenue > 50%, growing nicely in EMEA and America’s

- Continued growth in samples processed, 27% YoY - 22nd consecutive quarter of PA volumes - continued increasing uptake of the new PA technology

- 14 units ready to be shipped and installed while customer base and site selection has been broadened to overcome site-related deployment obstacles/bottlenecks - underpins FY25 deployment schedule

- $156m of cash and debt available to fund future deployments - at $4m per unit this is funding for ~40 units

- Decisively operational cash flow positive this quarter

Disappointments

- Only 2 new units deployed this quarter - as per revised management guidance, but slower than initial FY24 expectations

Takeaways

In taking a step back and looking at the last 2 FY's, there is:

- A very clear and steady step increase in quarterly revenue

- Continued positive increase in Samples Processed as Photon Assay uptake increases globally

- The number of units deployed per quarter has only been 2-4 per quarter in FY23 which has continued into FY24

- Available Funding has improved via Debt Facilities and the recent Capital Raise

- Cashflow from Operating Activities has also steadily improved

I think the mistake that management made was to set up overly unrealistic expectations of a rapid deployment of units. This may got the market overly-excited as revenue and EBITDA would similarly follow and the market got ahead of itself. Since management tempered expectations earlier this year, the market and share price has similar cooled.

Interestingly also, since 2QFY24, management has no longer provided clear guidance on how many units it intends to deploy in the upcoming quarter and FY and has now switched focus to revenue, EBITDA and industry technology uptake metrics.

But taking this step back and in digesting Dirk's comments in the Friday SM meeting, other than the earlier unrealistic expectations, I remain very comfortable that C79 is actually travelling very nicely and that my thesis is actually very much intact and is currently playing out.

The only change is in my expectations is that the deployment of new units will continue to be a steady 1-unit-at-a-time march, rather than a multi-unit rapid deployment that I thought would be the approach a year or so ago.

FY25 GUIDANCE

- FY25 revenue guided for $60-70m, between 32%-54% growth YoY

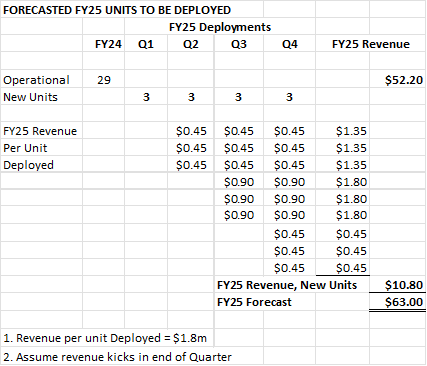

- This back-of-envelope forecast of units that are likely to be deployed in FY25, based on the revenue guidance, suggests that a cadence of 2-3 units per quarter is more realistic.

- This cadence is roughly consistent with the 14 units currently already ready for installation, taking away one big "controllable risk" of missing guidance

- FY25 revenue guidance could thus be conservative as there is upside from (1) additional units deployed (there ARE available units on hand to achieve this) and (2) further sample growth

ACTION

The C79 price is now in the middle of a decent buying zone and will look to be topping up on weakness below $5.00 in the coming weeks. Will keep some powder dry to top up further if the price falls below $4.00, although I can't quite see this happening given that the FY24 results to be released should not provide any surprises following the recent Appendix C.

Have watched the recording of the Friday 26th July meeting which was quite informative and helpful in outlining some of the financials, business strategy and challenges faced in selling the photon assay product. Thanks to @Strawman for organising this session

Although Dirk presented well, my overall feeling is that there is still more work to do in terms of converting people's mindsets and getting the right customer mix.

In regards my question on EBITDA guidance, while I agree the redeployment from Perth to the goldfields would improve margins by being closer to the action, my question was more about the guidance given in April 3 months ago ....

versus the actual result (no EBITDA mentioned in FY24 highlights, just the revenue)

So I assume from checking 1.9 and the summary, the EBITDA result fell below guidance stated in Q3FY24 as a result of the redeployment which probably was a one-off, it would have been good to confirm. Or maybe this Q3FY24 guidance was a typo and meant for FY25?

I took the opportunity to exit on Friday after the price recovered and use this to offset returns from ALU, CMM and DXB while needing the cash for other reasons - as usual did not time my trade well. But will continue to watch.

Quite timely that we have a meeting tomorrow just when the quarterly came out which was below expectations. I think we were expecting +ive ebitda of 8m but looks like this fell short?

Will submit a few questions in the slido.

[held]

Reviewing the C79 chart position:

- Bounced nicely from the 61.8% Fibonacci level of 5.07, which looks to also be a reasonable medium term support level

- 6.06 is likely to provide some resistance in the short term, followed by the 200 SMA around 6.68 currently

- A decisive crossing above 6.06, then the 200 SMA therefter, would be very nice to confirm the start of a new short term uptrend

Timing is interesting as we are not far away from a Trading Update, then the Appendix 4C. The price feels like it is "neutrally positioned" for the results given that C79 has downgraded guidance for the number of deployments in FY24, and hence revenue.

Any negativity against guidance could see a drop towards 3.96-4.27 (I would be topping up at that level). A better than expected deployment update could see it spike upwards towards ~7.29. If it goes as guided, the price will probably bounce around ~6.00, I suspect

Discl: Held IRL and in SM

C79 has a new friend in Regal Funds Management increasing their holdings

Buying what the CEO is selling

Also noticed that Regal has been selling Gentrack (GTK) although that has not really done much

[held]

Board

Inside Ownership Ordinary Shares %C79 Issued Net Value at $5.70

Rob Adamson 7,586,500 6.60% $43.243m

Ivan Mellado 200,000 0.17% $1.140m

Brett Boynton 207,820 0.18% $1.184m

Eric Ford 148,000 0.13% $843.6K

Kerry Gleeson 8,193 0.01% $46.7K

Greg Holt 0 0 0

Dirk Treasure 896,911 0.79% $5.112m

Total 9,047,424 7.87% $51.570m

Board Bio's

Rob Adamson - Chairman

Mr Rob Adamson spent the early part of his career as an engineer on mine sites working for Anglo American, before moving into a corporate advisory and investment role at RFC Ambrian Group where he is currently Executive Chairman. Longevity, transactional experience, due diligence exercises, strategic reviews, and experience developing commercial operating plans for large resources businesses, has given him a deep understanding of the resources sector. He has used this deep industry knowledge and commercial nous and combined it with the outstanding technology developed by the CSIRO to co-found Chrysos Corporation.

Rob also serves as Chairman of NextOre, Conveyor Manufacturers Australia and RFC Ambrian’s ESVCLP Basic Industries Venture Fund 1, an RFC Ambrian Impact Fund, and is passionate about supporting Australia’s emerging technologies in heavy industries. Rob has made it RFC Ambrian Group’s mission to continue investing in disruptive technologies, and to be an Impact Investor making a difference on a global scale.

Ivan Mellado - Director

Mr Ivan Mellado is a specialist in technology commercialisation, new venture development and strategic intellectual property management. He works with entrepreneurs in high growth companies, universities and scientific institutions to build business opportunities around novel technologies and intellectual property. Mr Mellado is well regarded for negotiating technology licenses, divestitures, and acquisitions, leading and financing early stage commercialisation ventures, and supporting early stage/growth companies with capital raising and M&A expertise.

With 25 years’ experience, Mr Mellado has developed executive and board level expertise across several sectors. He is currently Managing Director of Mellado & Co Pty Limited, Executive Chairman of Nimblic Pty Limited and a senior corporate advisor with Fawkner Capital Management Pty Limited.

Brett Boynton - Director

Mr Brett Boynton is the co-founder and Managing Director of Signature Gold Limited. Highly qualified in the field of finance, Mr Boynton has an international investment banking background with UBS in London and New York, and Credit Suisse in Australia. He has raised capital for a number of energy and resource companies, both at IPO and on the secondary markets, and managed acquisition, joint venture and divestiture of a number of projects and assets. Mr Boynton is currently Chairman of London listed Stratmin Global Holdings Plc and sits of the board of a number of private companies.

Mr Boynton has an undergraduate degree in Economics and Accounting and an MBA from the Fuqua School of Business at Duke University. He is also a CFA Charter Holder.

Eric Ford - Director

Mr Eric Ford has led, built, and turned around complex businesses encompassing large workforces in diverse geographies, cultures, currencies, and languages. This has included all lifecycle phases from feasibility through to closure and final rehabilitation in highly regulated and unionized environments across three continents. With a deep passion for mentoring and coaching, his reputation is one of creating high performing businesses founded on a culture of achievement, accountability and trust that span a diversity of cultures, customs, generations, skills, practices and beliefs. He is considered an influential executive team member and thought leader in the global industry with previous participation in the Coal Industry Advisory Board to the International Energy Agency as well as current local industry associations including the Minerals Council of Australia.

Mr Ford’s prior experience includes numerous executive roles within globally recognised mining companies during a career that spans almost 50 years in the industry.

Kerry Gleeson - Director

Ms Kerry Gleeson is an experienced Non-Executive Director with a 30-year career as a senior executive and lawyer, and brings to the Chrysos Board experience in the mining and chemicals industries across both Australia and the UK. She is a Non-Executive Director of St Barbara Limited (ASX: SBM) and of New Century Limited (ASX:NCR) both of which follow her career as a Group Executive member at Incitec Pivot Limited (ASX:IPL) where she was General Counsel and Company Secretary, overseeing its international operations in explosives and chemicals, mining, transport and logistics.

Ms Gleeson also has experience in international governance, mergers and acquisitions, complex corporate finance transactions, and risk and crisis management. She has also led the Corporate Affairs function dealing in government, media and regulatory affairs including in relation to major environmental remediation projects. Earlier in her career, Ms Gleeson practised as a corporate lawyer in both Australia and the UK, where as a partner she focused on corporate M&A transactions, IPOs, plus debt and equity issues; including acting for early-stage technology companies in the areas of technology commercialisation and financing.

Greg Holt - Director

Mr Holt is a senior executive with an international career spanning over 40 years across the logistics, industrial services, mining contracting and engineering industries. He is also an experienced company Director (GAICD) and Board member, having previously held Board positions with Brambles companies in the United Kingdom, and Swire companies in Australia and the United States. Mr Holt’s strong track record includes driving and finalising successful global expansion and business optimisation projects.

Mr Holt is currently the CEO of Swire Water Holdings, which is a member of the Swire Group of Companies, a business with which Mr Holt has held Managing Director or Chief Executive Officer positions since 2010. Prior to Swire, Mr Holt worked within Brambles in senior executive positions across several of its subsidiaries and helped lead the transition of Brambles into BIS as part of the KKR acquisition.

Dirk Treasure - Managing Director and Chief Executive Officer

Mr Dirk Treasure is a metallurgist with both technical and corporate experience. He has a Bachelor of Mineral Science from Murdoch University in Perth and has been an active member of the mining industry since 2006. He is a member of AusIMM and AICD and was recently awarded the Komatsu-sponsored Emerging Leader of the Year Award by Australian Mining Monthly. Mr Treasure spent seven years in novel metallurgical process design employed by service providers and mining companies directly. He has designed, built, and managed pilot plants across various deployment scales for hydrometallurgical, pyrometallurgical and electrolytic technologies. His technical experience includes working as the Principle HPAL/Leach Metallurgist for Ravensthorpe Nickel Operations and, during his time as Operations Manager of ABR Process Development, he oversaw development of technology from conceptual design to commercial reality.

Prior to joining Chrysos, Mr Treasure worked within the financial and commercial side of the mining industry. During his time in corporate finance at RFC Ambrian, he oversaw Chrysos’ seed capital raising and company formation. He also managed the transaction for acquisition of the underlying PhotonAssay technology from CSIRO. He has joined Chrysos Corporation as the company’s Chief Executive Officer, a role he has held since the company began operations in January 2017.

SUMMARY

- Headline revenue numbers look good QoQ and YoY but are disappointing against guidance and deployment plan - only 3 units deployed thus far and total units deployed for FY24 is only 9 vs planned 18, a 50% miss

- New contract signed, bring total contracted units to 50

- Continue to be impacted and delayed by site deployment issues but what is positive is (1) the high rate of C79 Factory Acceptance Testing units - 11 are ready for deployment (2) labour costs this quarter have come off 20% QoQ, suggesting that issues are indeed on the customer end which C79 cannot throw labour at to mitigate (3) diversifying of the customer base allows for acceleration of unit deployments in CY25

- Buoyant gold price is expected to drive an increased number of samples

- FY24 guidance updated - revenue has been lowered to $45m but EBITDA of $8.5m remains within guided range - both are impressive YoY growth numbers, but are disappointing against earlier guidance

- As units are already contracted, the delays in deployment is a timing rather than permanent difference - each deployed unit adds ~$20m projected Lifetime revenue - This is perhaps a customer-end reality check as to what is practically deployable in an FY

- Price weakness is an opportunity to top up

GOOD

- Added 3 deployed units, 2 new and 1 redeployment - 1st deployment into Europe (England)

- 1 additional unit contracted, total contracted units now at 50 - MSALABS for deployment of a second unit to Barrick Gold’s Kibali mine

- Topline Revenue of $12.9m continues to grow, 28% QoQ, 92% YoY

- Continued growth of samples processed, sustaining of Additional Assay Charges (AAC) revenue - 29% YoY growth, 3% QoQ, 21st consecutive quarter of PhotonAssay volumes

- Unit costs continue to decrease from hubbing strategy and deeper engagement in maintenance by C79 team members - gross margin 70-80% achieved

- Projected LifeTime return of more than $20m per unit creating an infrastructure-like asset fleet

- Well funded to support unit growth - $70m cash, $95m CBA facility untouched

- Good manufacturing progress which C79 controls - 11 units past Factory Acceptance Testing, pending customer site readiness, 5 units manufactured during quarter

- Employee costs have decreased $1.2m, or 20% QoQ - perhaps reflecting reduced size of flexible labour as deployment obstacles are client site related vs C79 controllable?

- Cash collection back to positive this quarter vs negative in Q2, continues to operate cash-flow positive this FY

NOT GOOD

- Only 3 units deployed in Q3 means that efforts to clawback delays in deployment have not been sufficiently successful to bring the delayed schedule back on track

- Final deployments for FY24 are expected to total 9 new units and 2 redeployments, bringing Chrysos total number of operating units to 29, an increase of 45% on FY23 but vs FY2024 target of 18 units

RISKS

- Risk of deployment challenges at mine sites impacting the overall FY24 deployment plan and delaying deployments into FY25, have clearly manifested

- The 50% miss in deployed units is disappointing - while a miss was clearly telegraphed, the extent of the miss is higher than expected

- Will impact FY25 guidance as 18 deployed units per year appears overly bullish.

GUIDANCE FY24

BETTER FINANCIAL GRANULARITY

- 12M rolling unit revenue is ~$1.8m

- 12M rolling unit cost is ~$450k

Had a quick look through the C79 preso pack for a Site Visit in PER, released today. There are some new slides which provide more insights on the PhotonAssay technology, the ESG benefits and the typical economics lifecycle, which I found very useful.

Discl: Held IRL and in SM

How Does PhotonAssay Work

Hitting samples with high-energy X-rays, PhotonAssayTM causes excitation of atomic nuclei allowing enhanced analysis of gold, silver, copper and other elements in as little as two minutes.

Speed and ESG benefits of PhotonAssay are quite stark.

Unit Economics

This is a really good slide on the per-unit Capex spend cycle which will improve the understanding of the cashflow profile and underlying economics.

Future Opportunities

Not the immediate focus. Lots of yet-to-be-tapped pathways for future growth once the gold-related TAM shrinks over time.

For a still loss-making company I was surprised at the level of institutional ownership with the well know fundies and even the LICs in there. Seems to have some very exciting possibilities but wonder who the incremental buyer is going to be before they reach CF breakeven which still looks some time away. Tempted to buy but looks like it could trade sideways for a fair while after the cap raising. A bit surprised this has a larger market cap than RUL which has proven tech, scaling and profitable.

The SP has drifted downwards from it's peak of 8.72 to a more attractive 6.56...

But is it reasonable to buy based on unit economics? Which sorts of models are best used to value this kind of business? Is it reasonable to think of it as a future infrastructure style business? It would seem that in a few years time gold miners will be in a position where they either mine and pay for this service or they don't mine (given their competitors will likely be using the best assay technology available)

My notes from the Investor call this morning and the announcements. Overall, nothing really new as most were already revealed during the release of the Appendix 4C in Jan. Its all about getting the FY24 deployment of 18 units back on track.

- 27 units deployed in total, 4 new units in 1HFY24, 3 post the period vs planned 18 for the FY - to make up for this, need 6 units deployed in Q3 (of which 3 is already deployed), and 8 in Q4

- Risk continues to be flagged that 18 units may not be fully deployed this FY, with some pushed over to early 1Q25, so nothing new - it was mentioned that overlapping deployments is no longer an issue

- Issues around contractor availability experienced in 2Q have mostly gone back to normal, continued to engage the customer in planning early to mitigate risk of delays

- 27 deployed units provides a baseline annualised MMAP of $50m per year

Expense watch items:

- Depreciation & Amortisation - jump from $3.8m 2HFY23 to $5.3m was raised on the call - no concerns, step-up is in line with increase in deployed units, depreciated on a 10 year straight line basis. D&A expense is not linked to revenue and is all related to PhotonAssay, no other assets

- Employee cost has gone up from $7.9m to $10.1m, H-on-H and 86% up on pcp - expanded deployment capability and building of in-house maintenance capability, offset by a drop in Maintenance Costs from 1HFY23 of about $0.5m, aligned to Group’s strategy of global growth

- Management is finding ways to provide better visibility of the savings arising from operational leverage from the global hubs strategy

- -ve working capital of ($2.8m) is a timing issue between receivable collections and payment for purchases of parts etc - no issues of note with both customers and suppliers

Discl: Held IRL and in SM

Built the attached xls to line up the Statutory P&L and the Management View side-by-side as I found myself getting knotted up with the movement in the numbers from Half-to-Half, Qtr to Qtr and some of the numbers in the preso. Building the sheet also forced a deeper dive into the P&L which I found very helpful.

I still can’t value this. I really have no idea where to start.

But.

a lot of people clearly saw value the last year. A large cap raise has them well funded and was priced $6.50 a share. Since that shares have soared roughly 27% up and back again. So if we make the assumption that far value is near, or at $6.50.

Others on this have commented that the earnings potential of this is bigger than they can comprehend, sentiment I agree with. Other key points have been at execution risk of deploying more units to meet the TAM they have outlined.

My view on this will be along those lines, how well can they execute, and how many units do they roll out annually moving forward? Additionally, how much perfection on those two assumptions are currently cooked into the share price.

I am tempted IRL to use $6.50 as a floor price of value, and make a small investment. With my thesis being based around those 2 points. I will also be keeping a keen eye on the mining cycles to see if that has an affect.

My notes, including points raised on the brief-as-usual investor call this morning. I have had direct experience as a customer having customer-end contractual responsibility to prepare a site for a big installation of equipment by vendors - power, network, fire suppression, level concrete floors etc.. So I relate very much to the challenges that C79 are having at mine-site deployments and believe they will be sorted/pre-empted as C79 gains more experience deploying at mine sites.

Discl: Held IRL and in SM

SUMMARY

- Revenue MMAP and AAC and samples processed growth momentum continued, very strong funding position for future deployments

- Barrick Gold partnership a big endorsement for the PA technology, de-risks the technology for other miners who are “not early adopters but are fast followers”

- Manufacturing remains on track

- Emerging risk that 18 planned units may not be fully deployed in FY2024, with some units likely to be finalised in 1QFY25 - startup issues - mine site readiness, contractor availability issues encountered as C79 transitions from lab-site installations to mine-site installations, learning from these early experiences to adapt and mitigate these risks for future deployments. Not great, but deployment issues almost always pop up when changing deployment environments - see this as a temporary issue that will be ironed out in the current and upcoming deployments.

- FY24 revenue guided to the lower end of previous forecast, EBITDA in the middle to lower of previous forecast - this appears to be a timing issue, not a step down, not great but no concerns

- A good result despite the flagging of the risk of delays - much prefer the upfront flag than a nasty surprise later

- Remain bullish - will look to top up if the price falls further

GOOD

- Topline Revenue continues to grow, 13% QoQ, 88% of Q2 revenue is predictable and sustainable minimum revenue

- Continued growth of samples processed, sustaining of Additional Assay Charges (AAC) revenue - 12% of Q2 revenue, grew 3% QoQ

- Very strong cash position following Capital Raise and additional $65m debt facility with CBA, $180m to fund upcoming deployments

- Added 2 deployed units, 1 deployed post quarter, 2 installations currently in process

- Manufacturing remains on track

WATCH ITEMS

- Cash collections fell QoQ, marginal negative working capital for the quarter - seasonal, timing difference in collections from the holiday season, no concerns, continues to operate cashflow positive year to date and expect this to remain for the rest of the FY

- Employee costs continue to grow - 47% growth to $5.9m from $4.0m in 1QFY24 - grew in line with global expansion strategy and increased operational structure required to deliver additional PA units

NEW RISK

- Encountering deployment challenges at mine site deployments as C79 transitions from lab-based installations to mine site installations, a new deployment scenario - may delay some deployments into Q1 FY25

- Mine sites have not been as ready as the lab sites for deployment to commence, causing delays - building to house the units, properly concreted, availability of suitable power, contractor availability challenges

- Learning from these early deployments and partnering earlier with clients to ensure site readiness does not hold up deployments

- Also impacted by the African rainy season

- Benefits of working directly with miners far outweigh the delays

GUIDANCE FY24

Lower-end of forecast range of $48m to $58m - adopting a conservative approach and flagging the emerging risk that 18 units may not be deployed in FY24, some of these deployments may only be finalised in 1QFY25, expect to increase deployment at the tail end of the FY

Confident with retaining FY24 EBITDA forecast of $7m to $17m, middle to lower of that range - expecting operational efficiencies from operational hubs, costs are saved when deployments are delayed

OTHER POINTS

- MSA Lab units are likely to be deployed into Barrick mine sites

- Mine site deployments give C79 direct access to the mines, opportunity to expand use of technology within the mine

- Continue to work with Barrick on global deployment

- Deployments are typically 8 weeks, a maximum of 12 weeks to become fully operational

- Mud map of potential adjacent use of PA technology - not much focus on this now as the focus is very much on deploying the machines, but as more units are deployed at mines, C79 interacts more with mine site personnel, this could be a nearer term growth opportunity to look out for

Source: FNArena.com [https://fnarena.com/index.php/analysis-data/consensus-forecasts/stock-analysis/?code=c79]

Disclosure: I hold C79 here in my Strawman.com virtual portfolio, but not in any real money portfolios at this point.

SECURES ADDITIONAL $65m DEBT FACILITY

- $65m loan with Commonwealth Bank, adding to its $30m facility with the bank

- Paid down outstanding $8m on the original $30m facility

- Together with new loan, has (1) total debt available of $95m (2) $75m from recent capital raise and (3) strong cash balance from operating cash flows.

Can't help but feel that some big announcements are in the pipeline following the recent partnership announcement with Barrick Gold as this amount of secured funding allows from some big things to happen ...

Discl: Held IRL and in SM

Following the post from @Bear77 on the soaring gold price, the ABS released this quarters Australian Mineral Exploration spend today.

Gold exploration spend is on a roll which can only be good news for C79 as additional sampling over and above the minimum contracted photon-assay unit monthly cost is all upside revenue and profitability.

Discl: Held IRL and in SM

Australian Super has been busy accumulating 1.47% of C79 between Aug 2023 and mid-Nov 2023 at very attractive prices ranging from $4.91 to $6.29.

Ah ... if only I had bought more back then ...

Discl: Held IRL and in SM

Having gone through a flurry of capital raises over the years, I finally looked up ASX Listing Rule 7.1 which governs capital raises and learnt something new. This is probably nothing new for the more experienced members, but posting in case it helps anyone - it certainly opened my eyes!

Am forced to enter a company name for this post as there is no "general" category ...

To raise more than 15%, rule 7.1A kicks in and is significantly more onerous:

Full document: https://www.asx.com.au/documents/rules/gn21_chapter_7_restrictions.pdf

Takeaways for me:

- If a company has not requested for a 7.1A Mandate at an AGM, then the max dilution for any capital placement/raise during a FY is 15%

- For every AGM notice, at least read the special resolutions and look for a 7.1A mandate - this is especially relevant for the WSP AGM Notice - I missed the 7.1A Mandate resolution as I ignored the notice - not a smart thing to do!

Like many retail investors, I am admittedly wired up to "dislike capital raises", almost by default. However, having experienced 4 capital placements in the last 2-ish months, I can sense my thinking and emotions gradually changing to not instinctively dislike, but to assess each raise on its own merits.

Being the cricket tragic that I am, to use cricketing analogies:

- ALC and WSP was not great - "fairly severe batting collapse after a good solid start by the openers, required run rate is accelerating to worrying levels"

- AD8 and now C79 - both feel like "a good understanding and use of the conditions, opening partnership is flourishing and platform is being set for a huge innings and subsequent win .."

The C79 Placement

- 11.4m shares at an offer price of $6.60, a 7.7% discount to the last closing price of $7.15 on Fri 3 Nov 2023 - I was expecting a $6.50 raise, at the time of writing, C79 is trading ~$6.70-ish, so pricing seems good

- New shares represent 11% of existing shares on issue and was not underwritten

- Placement raises C79’s funds available to $108m - $75m Placement + $33m Cash, excludes untapped debt facilities

Use of Funds

- Support the deployment of new PhotonAssayTM units - ~90%

- Development of (1) PhotonAssay Gen II (2) Application Development (3) Supply Chain resilience - ~10%

- Includes, subject to the provision of new debt, the potential expansion of manufacturing capacity beyond 18 units per year over the medium-term - this would result in a positive step up of earnings growth

- Strengthen the Company’s balance sheet, which in turn is expected to assist with its discussions with lenders, ensuring that it is best placed to optimise its capital structure moving forward.

- The Company is already in a position of generating positive operating cash flows from its existing 22 deployed units and therefore funds raised from the Placement can be applied primarily towards growth.

My Thoughts

- Clearly defined and focused use of funds for Deployment Growth and Development of Improvements - a good place to be as the units deployed moves closer to positive operating cash flow

- The recent Barrick & MSALABS partnership provided strong technology validation and appears to be a pivotal moment which will now drive momentum acceleration of deployment, manufacturing and further Gen II improvements - funding is now in place to drive that momentum via the placement, which will inevitably be followed up by increased debt facilities on more favourable terms

- No additional sales have been formally announced, but appears inevitable

- The placement reflects management’s long-term 360 degree thinking and business confidence

Things are coming together very nicely for C79 - sales conversion, deployment momentum, product improvements, improving of manufacturing capacity, supply chain resilience.

Discl: Held IRL

Attended the C79 call on their 1QFY24 Appendix 4C. It was the usual short call as C79 has a standard set of clear slides with changed numbers each quarter ... a good thing!

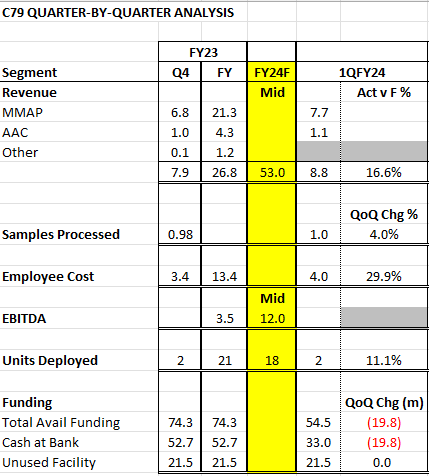

Built a simple xls to summarise the key metrics from the 4C that I need to watch, based on the various discussions here. Rather than take a YoY comparison, which for C79, is really no longer impressive or relvant, really, as it is marching forward in a clearly defined trajectory, have taken (1) a forward looking view against the mid-point of FY24 guidance, where the guidance was provided (2) QoQ trend for those metrics which provide a "rule-thy-world with PhotonAssay" perspective eg. Samples processed and (3) QoQ trend of key watch areas - funding and employment cost.

It does give a more balanced perspective of the risks as @RhinoInvestor rightfully pointed out, vs merely focusing on the wonderful by-definition revenue % increases, which masks future issues. The call with Dirk also provided valuable background context which makes these figures that much more meaningful.

Discl: High conviction holding IRL

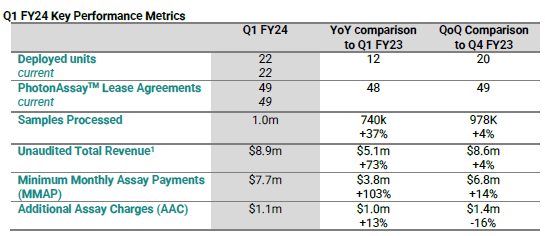

GOOD

- Solid result, key operational and financial metrics on track

- 2 units deployed, 4 units are currently being installed (3 in Canada, 1 in Ghana) - on track

- Successfully re-deployed one unit - a technical first, proving that the units can be moved, learnings etc

- Sample volumes continued to increase QoQ from 978k Q4FY23 to 1.0m this quarter - revenue upside but also an indicator of the uptake of Photon Assay technology

- 15% increase in gold exploration in 4QFY23 over 3QFY23 - augurs well for growth of samples, and hence AAC upside revenue in the coming quarters as this is what drives the range variability in the FY revenue guidance

- Revenue increase is as expected - $8.8m revenue is ~16.6% of the mid-point of the FY24 Revenue Guidance of $48.0m to $58.0m

- Well funded - $54.5m available funding, $33.0 of which is cash at bank - noted comment that “broader debt discussions progressing” which was also mentioned in the Investor call

- In response to a question around the sales approach between Labs and Mines, Dirk reiterated that C79’s focus at the moment is to convert the mining industry to Photon Assay technology, so the Lab vs Minesite equation is less important as the TAM of Labs and Mines is already very concentrated

NOT SO GOOD

Nothing to not like

TO WATCH

- Employee cost has gone up $0.6m QoQ to $4.0m, which is 29.9% of total FY23 employee cost - watch the QoQ increase in this cost

- Available funding has dropped $19.8m from Q4 - the drawdown feels a bit higher given (1) back-end nature of capex payments (2) 3 units deployed this Qtr (3) 4 are in deployment - need to watch this vs funding-related announcements

My notes from the very good conversation with Dirk Treasure, Founder and CEO of C79. I walked away with a much deeper understanding of the business, financially and operationally, which has made me further appreciate the quality of the business in terms of TAM/customers, moat and economics.