Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Discl: Held IRL 7.22% and in SM

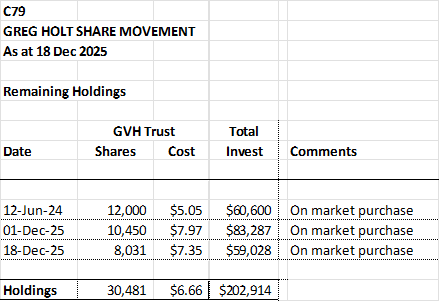

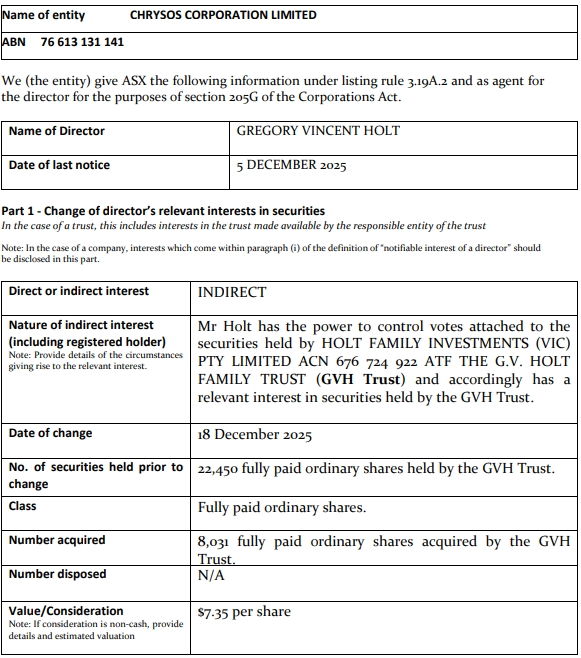

Greg Holt appears to be mighty bullish on C79 ... He has topped up his C79 holdings by a further 35%, investing $59.0k of his own coin.

This is coming on the back of his (then) 50% top up of C79 on 2 Dec 2025, investing $83.3k then.

This is a real good sign of confidence in the business.

Looks like a nice entry point from a chart perspective - the price has retraced ~62% from the paek of this current move.

Discl: Held IRL 7.67% and in SM

Nice to see Gary Holt, C79 Director, almost doubling his holdings of shares and averaging up.

He was appointed a Director in 2023 and 1st bought 12,000 shares at $5.05.

Coming off the back of the CSIRO block sale to Macquarie Capital last week, this for me, is good from a confidence-in-the-business perspective.

Discl: Held IRL 8.31% and in SM

The AFR has reported that the CSIRO, via a block trade, is this evening, selling 10.75m shares, about half of its 18% stake in C79, at $7.90 per share, a 6.7% discount to the last traded price of $8.47 today.

That probably helps explain the sharp drop yesterday, then the partial recovery today.

Discl: Held IRL 8.03% and in SM

A lot to like in the C79 Trading Update during the FY25 AGM. Could not quite see the driver for the sharp downward price reaction, other than perhaps it was time for a consolidation after the big price run up.

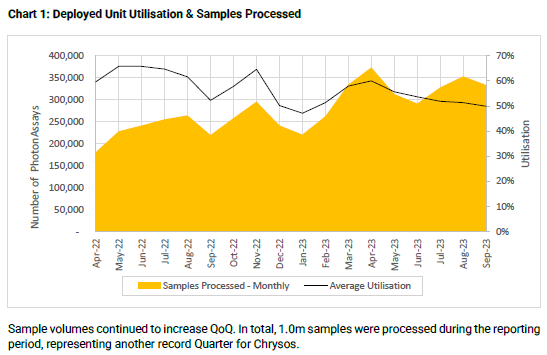

SAMPLE VOLUMES

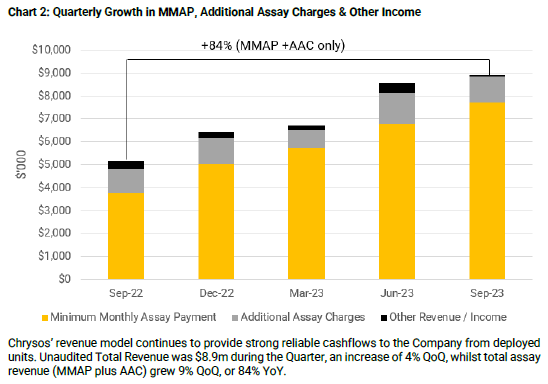

This has really run up very nicely for Additional Assay Charges (AAC) to now be 26.4% of revenue.

It was not long ago that AAC was mostly positioned as “potential upside” to C79’s significantly more stable Minimum Monthly Payments - this growth is very positive from an uptake and revenue upside perspective.

PHOTON ASSAY UNIT DEPLOYMENT

- Nice momentum - 2 deployed in FY26, 2 WIP, 4 upcoming - total of at least 8 in FY26, closer to half-year

- Compares favourably with 5 in 1HFY25, 6 in FY25 for a total of 11 in FY2025

- 2 new lease agreements, sustaining the momentum on this front

- New Allied Gold MOU

FY2026 GUIDANCE REITERATED

R&D UPDATE

The AGM Pack contained a raft of slides which show off the R&D that C79 is undertaking in the background. There was no accompanying text in the MD & CEO address to make better sense of the content. But from what I can superficially tell, C79 is focused on:

1. Improving the the quality and supply chain resilience for critical components

2. Broadening the offering into new PhotonAssay services to “allow more to be done with existing units, often with no more than a software upgrade”, new technologies to expand analysis capabilities beyond PhotonAssay, building on C79’s strength of bulk analysis of large, unprepared samples.

3. Expanding upstream and downstream to reduce bottlenecks in sample preparation, data quality control and reporting.

These initiatives look very positive in terms of adding more capabilities to the existing PhotonAssay units, to add value and further entrench the use and criticality of the PhotonAssay units. These look like incremental improvements rather than wholesale changes.

Discl: Held IRL and in SM

The C79 Co-Founder and Chair, Rob Adamson, sold 250,000 shares on the market on 30 Sept 2025, netting a nice $1.9m.

- This is only the 3rd time that Rob has sold shares since founding C79 in June 2016

- The sale was 0.21% of his stake in C79, reducing it from 2.92% to 2.70%, post the sale

- Given the infrequent pattern of sale and the duration of his holdings, no concerns at all - Rob still has good skin in the game

Discl: Held IRL and in SM

C79 announced last Friday that Dirk Treasure, C79’s CEO and Director, sold 200,000 shares @7.42205 between 11-12 Sept 2025, on market.

Simply Wall Street had this to say over the weekend:

Decided to have a poke around to see if this was worrying:

- Dirk has been Founding CEO of C79 since the company started operations in 2017, so he is 8 years into the gig from day dot

- Went through and summarised Dirk’s Appendix 3X and 3Y notices going back to when he was appointed Director in May 2022 - see table below

- When he made Director, he was awarded 814,273 shares + a raft of options maturing at different times, with strike prices of $1, $2 and $4.50

- He has had a consistent record of exercising his options prior to maturity and selling immediately after, other than in June 2025 where he did not sell - that made sense as the exercise price was $4.50 and he would have been underwater-ish

To put this latest sale in perspective:

- When he was made MD, he was granted 814,273 shares - this was 0.70% of C79’s issued capital today (the % would be higher in 2022 because of dilution since)

- Post the sale of all exercised options (he has no options left) and this latest 200k share sale, he still holds 784,411 shares, which is 0.67% of C79’s issued capital AND a further 398,294 Performance Rights

- While has has consistently exercised and sold off his options, the net effect drop in his shareholding from 3 May 2022, is 29,862 shares or 3.67% of the original allotment in the past ~3.5 years, based on today's issued capital

MY VIEW

- Am not worried

- Share Options are part of Dirk’s rem and rem is only good if he can exercise the options and take the money - think he has earned his money, as he has for me and all other shareholders.

- The net effect is that Dirk still holds 0.67% of C79’s issued capital today, down from 0.70% - not terribly newsworthy, plus a further ~50% in Performance Rights

- Given that C79 is now hitting its stride with good momentum, and the days ahead look happier than sad, my view is that Dirk still has enough excitement and skin in the game to stay in the tent and grow C79, despite him selling the 200k shares

Discl: Held IRL and in SM

C79 released its full FY2025 results today - this was held up because the international tax portion of the report was not ready prior to the last call 1-2 weeks back.

- The final FY25 tax impact came in at $5.3m, almost at the lowest end of the tax expense guidance of "$5 to $10m"

- There were no other changes

- The only impact was that Statutory Net Loss After Tax dipped from FY24 ($0.704m) to FY25 ($8.223m)

Will dig deeper into the Annual Report once reporting season dies down!

Discl: Held IRL and in SM

SUMMARY

- Very nice Trading Update from C79!

- There is a delay to the finalising of its audited accounts due to “delays associated with completing the audit of international tax positions”. Does not sound sinister with a noted $5-10m deferred tax impact flagged.

- 1HFY25 was a meh half, and so C79 needed to deliver a good 2HFY25 to meet revised down guidance, and I think this was well delivered.

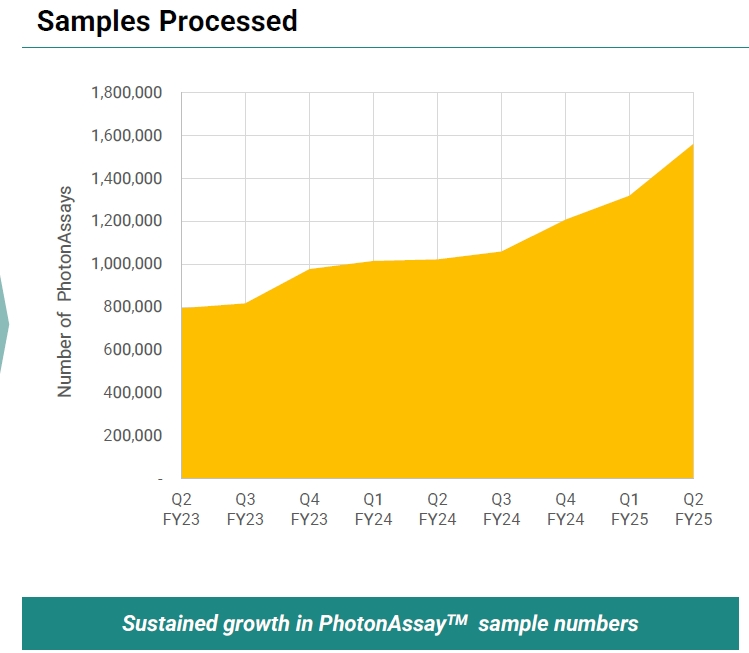

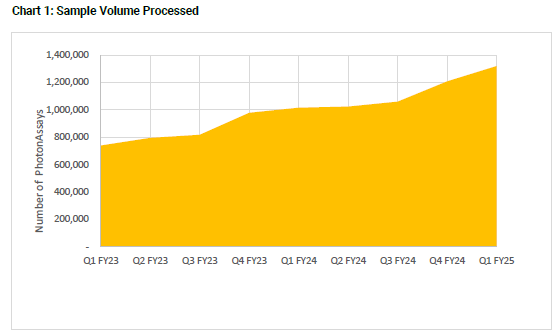

- Technology uptake is gaining momentum - the 4QFY25 samples processed spiked up sharply

- Liking very much, the traction going into FY2026 with the contracts from Bureau Veritas and MSA NEM both looking to provide good growth in both new units and Samples Processed

- Onward and upward!

KEY RESULTS

Very nice upward trajectory of Total Deployed Units and new PA Lease Agreements, anchored by a steady delivery cadence and 9 units on hand for quick deployments - this is a much more comfortable and settled overall cadence than the frenzy of 2+ years ago.

Noticeable spike in the 4QFY25 Samples Processed - fact-based evidence of the uptake of the deployed units and the overall PA technology.

OTHER VERY POSITIVE SIGNS

- Post EOFY signing of strategic partnership with Bureau Veritas (BV) for deployment of PA technology to South Americas

- BV is the last of the 4 Lab majors to get onboard PA, so all 4 major Labs are now onboard PA

- ALS and BV are the 2 Lab majors in South America - ALS has raced ahead in PA, BV is behind the curve in South America and has to catch up

- A beachead which enables the establishment of a South America C79 hub in Chile - now established in all global regions

- MSA with Newmont has broadened:

- New contracted unit in NEM’s Merian gold mine in Suriname for FY26 deployment, the biggest mine in the country

- 2nd adopted unit shows NEM’s confidence in the technology - 13 mines in total, 3 in the bag, 10 more to chase

- NEM has been more aggressive in adoption following the MSA - Barrick took a one-unit at a time approach vs NEM’s quick-successive unit approach (Ahafo, then Merian)

- Contract signed for first deployment on next-gen “XN” units with SGS

- Same analysis approach, but with smaller footprint, greater user efficiencies/easier to use and cheaper to install and maintain

- XN’s automation which is the key driver of the improved XN efficiencies have been running for 6-8 weeks in the Perth SKS unit

- First XN unit will land in 3M time

- The BV deal is the last regional hub to be set up - costs from hereon are only going to be incremental

FY26 GUIDANCE

- Conservative view of Additional Assay Charges and MMAP

- Does not bake in signs that gold industry exploration cycle “is on the up” - upside potential from AAC sample growth rate

Nice Yeah Baby announcement this morning from several fronts:

- 1 new Photon Assay unit actually contracted for - this one is in the NW of Ghana, ~370km NW of the capital Accra, which may explain the longer 1HFY26 deployment timeline

- Similar to the Barrick MSA, the Newmont MSA paves the paves the way for more units to be contracted throughout Newmont’s operations in the coming years - this is a huge tick for Photon Assay technology and C79

- Any C79 success with contracts/deployments also trickles down to XRF who supplies the Orbis crushers for use with the Photon Assay units

- C79 now has the top 2 global miners onboard with Photon Assay.

What is nice about new contracts is that C79 has 9 units on hand to immediately start deployment. While not how they would have liked it to have played out with delays to deployment of the original cohort of contracts, the benefit of that capex pain in the last 18M or so is now putting C79 in a nice position to be able to deploy as soon as a deal is signed AND still have a backlog of about ~15 units to deploy.

Discl: Held IRL and in SM

Discl: Held IRL and in SM

OVERALL

Really pleased that C79 is still issuing these Trading Updates despite it being no longer required to submit the Appendix 4C

Steady-as-she-goes, typical of C79 quarterly updates in recent quarters, but there are good signs of a decent bang end to the FY come 4Q

Over the last 18M or so, C79 has gradually morphed from being a “potential hot growth company” to a “steady compounder” - market expectations have been rewired, the market appears to have re-rated and it it now just patience to let management execute - the revenue and EBITDA over time, must, almost by definition, increase, as each unit is deployed and more samples are taken using fire assay

Very happy with how things are tracking against this new expectation

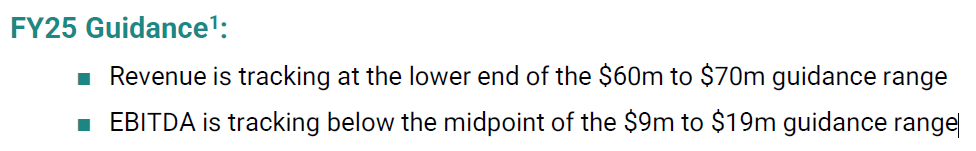

The Not So Good

- Only 1 deployment this quarter

- On track to FY25 guidance but no change/improvement to the “lower end revenue” and “below mid point EBITDA” guidance

The Good

- 2 new units contracted - always a good thing!

- 5 deployments are WIP - if all 5 can be deployed in 4Q, this would be huge - for context, the average deployed units since FY2023 is 2, the highest deployed per quarter is 4 in 3QFY23, and 3 deployed units was achieved twice - 3QFY24 and 2QFY25.

- 4 deployments look like in established sites, the one at most risk is the first install in Namibia, so my expectations for 4Q deployment is 4 base case, stretch of 5 units, this would still be a good result

- Cash $35.1m, undrawn debt $77.1m, total funding $112.2m vs $121.6m at the end of Q2, implying 3QFY25 cash draw down of approx ($9.4m) vs draw downs of ($10.7m) 1QFY25 and ($23.2m) 1QFY25, which confirms management commentary that PPE costs have normalised back to 1QFY25 levels - this is good

- Both quarterly revenue and samples processed continue to trend upwards nicely

This was an interesting view on the breakdown of the source of the samples:

I struggled with getting my head around this “its good, BUT ...”, set of results.

Discl: Held IRL and in SM

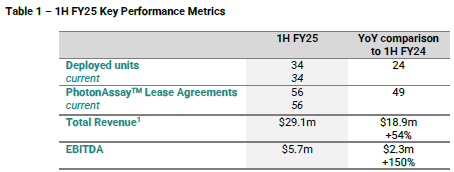

SUMMARY

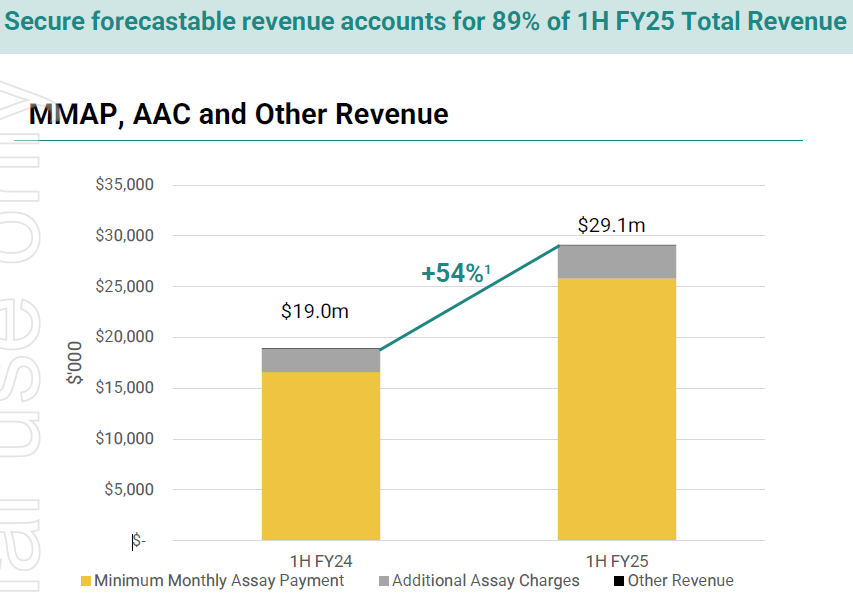

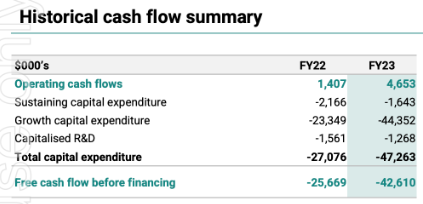

Impressive results when compared to 1HFY24 (+54% revenue growth, +152% EBITDA), but not so, when compared HoH with 2HFY2 (+15.0% revenue growth, -15.4% EBITDA).

As revenue steps up with each unit deployed, prior corresponding period comparisons are almost always going to be impressive if there are new units deployed in the 12 months period prior to the current reporting date from (1) full revenue contribution of all units deployed at the end of 1HFY24 (2) plus the large partial revenue contribution from the additional units deployed in 2H24 and (3) the small partial revenue from 1H25 units.

The samples processed volume continues to grow very nicely - the quarterly growth trajectory seems to be increasingly steeper, a really good indicator of both industry & customer adoption and Additional Assay Charge revenue upside. Dirk mentioned that there is still latent capacity for additional samples in the deployed units - revenue upside is huge - if units run at 100%, sample volume can increase 2x.

5 units deployed in the half - this is now about the BAU run rate of 2-3 units per quarter, these are to newly signed agreements - the 13 units in the shed (14 at EOFY24), suggests that there are still issues preventing the deployment to the older contracts - would like to understand why this is still the case and what is actually holding these units up.

Costs continue to incrementally rise as more units are deployed - this is expected. But need to keep a watch on operating expenses in 2H25 as the growth in expenses in 1H25 over 2H24 was higher than revenue growth - point to note for questions.

Capex is still elevated (1HFY25 $37.9m), elevated due to the timing of payments to major suppliers for long lead time items in alignment with payment terms, expect to normalise in 2H25 - normal capex cadence is expected to be $10-$12m per quarter. No concerns with this.

Cash from operations was positive and fully funded the first unit - a really good sign, $18m of the $95m CAB debt facility drawn down - funding looks comfortable for another year at least.

US is a very small market and have already shipped units to the US prior, so not expecting any US tariffs to have any financial impact

FY2025 guidance was a dampener (1) tracking at lower end of revenue guidance $60-$70m (2) EBITDA tracking below midpoint of $9m to $19m - current half-year run rate should see this being met, suspect management is building in some buffer for delays in deployment of 1-2 units into the back end of 4QFY25 - need to watch out for this in the 3QFY25 Appendix 4C in April.

Overall

No change to C79’s overall growth trajectory, moat, industry adoption, revenue growth/quality/sustainability etc. But the pace of that growth has slowed from the deployment frenzy of 18-24 months ago to a steady 2-3 units per quarter cadence. This slower pace is probably driving the range bound share price movements and today’s muted reaction to the results.

The rewards should await long-term patience as the business does it thing, one unit at a time, but patience is absolutely needed ....

Things to Look Out For/Ask in March Appendix 4C Call

- What the hell is still holding up deployment of units to the older contracts

- Expense growth vs revenue

Revenue guidance requires at least a repeat of 1HFY2025 revenue which should be comfortably met from (1) MMAP from current units in production (2) contribution from the 2 units currently being deployed from 4Q25 (3) revenue from continued AAC growth trajectory. This guidance suggests that the deployment of the next 2-3 units in 4Q25 may not be completely deployed come EOFY 25 or is heavily back-ended such that any revenue contribution in FY25 will be negligible - Dirk said that “guidance was reflective of deployment timing ...”

To meet ~$13-$14m EBITDA, ~$7.3m EBITDA will be required in 2H25 - this should be achievable given the revenue trajectory

My more detailed notes after a late listen to the investor call.

Discl: Held IRL in SM

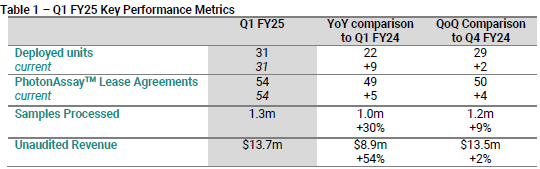

SUMMARY TAKEAWAYS

Nothing to not like about this update, continue to remain long-term bullish on C79, and much more comfortable with this more steady and balanced-operating cadence.

- Good steady growth all round - Revenue, Samples Processed, Deployed Units, Lease Agreements

- Reaffirmed FY25 Revenue and EBITDA guidance - after 2Q, appears on track to meet

- Sample Processed growth continues to grow impressively, 18% QoQ, indicating continued strong uptake of Photon Assay technology

- Settled into a good cadence of 2-4 units deployed and 2-3 lease agreements per Quarter - feels like a good balance vs previous hit and misses

- Bigger outflow of capex this Qtr, flagged imminent drawdown of debt facility in the coming quarter - still well funded for the next 1-2 years at least

- Significantly more Q&A in this quarters call which drew out more operational and sales insights which were very helpful in providing an overall view of how things are tracking

FINANCIALS

- Revenue grew 12% QoQ - increasing contribution from international operations and USD exposure

- Samples processed up 18% QoQ - 24th consecutive Quarter of record PA volumes despite gold exploration activity trending sideways/downwards

- 3 units deployed, total units deployed 31 - steady cadence of 2-3 units deployed per quarter (1) 1st unit in Alaska (2) Orange NSW for SGS (3) 2nd unit in Barrick-Newmont NGM complex in Nevada - continued Barrick adoption

- 2 new Lease Agreements signed, total 56 units deployed or contractually committed, continued steady cadence of new lease agreements (1) OceanaGold NZ (2) SGS in Kalgoorlie WA

- 12 units in inventory, ready for deployment - about a year’s worth of inventory, goal is to hold a handful of units on hand in the long run

- Broadening relationship with SGS

- Oceania Gold contract is the 1st contract where the Lease Agreement is with the miner but the unit is operated by a lab, SGS

On track for FY2025 guidance - should have no trouble meeting revenue guidance at least, given current trajectory - 1H revenue is $29.0m, and revenue steps up with each deployed unit.

CASH FLOW

- Big outflow of Capex this quarter

- Drained cash balance from $47.5m to $26.6m

- $3.5m infrastructure R&D payment

- Timing of warranty payment terms for units deployed

- General supplier payment terms

- Nothing of concern, expect this to normalise in the next quarter

- Slower cash collection vs last 2 quarters

- Collections in 2Q traditionally lower, expect to return to normal in 3Q

- Strong start to collections in January

- Operational cash flow positive for the 4th consecutive quarter

- Flagged likelihood that drawdown of CBA $95m debt facility will commence in 3Q

OPERATIONAL INSIGHTS

Sales

4 Lease and Operating models offered to customers - the transparency of the cost models within each of these models allows miners to choose what works best for them

Change of Sales approach 18M ago, from working through labs to working directly with miners with own sales force, is now paying off:

- Facilitates direct relationship with miners and moves to value-proposition based sales approach/focus vs the previous approach of like-for-like replacement of fire assay - ensure the miners get the maximum value on the way through rather than just reducing the direct costs from Fire Assay

- Different operating models ensure that there is no revenue cannibalising between miners and labs - miner-contract-lab-operate is a clear win-win model for all

- Direct engagement minimises the instances of labs getting a premium from miners for using PA over FireAssay

- Have completed a large number of successful paid studies with non-customers to demonstrate PA capabilities

- Comfortable with current sales team setup with a handful of sales people in each key region, at or near miners, supported by technical staff of geologists, metallurgists etc - Africa, North America, South America

- Pipeline is strong especially as C79 gains more access to mine site personnel with each mine site deployment eg. Nevada mine gives more access to Newmont, supported by growing relationship with Labs

- Seeing more sample processing growth come through from miners where C79 technical services have direct engagement

Industry challenges which are hurdles to sales:

- PA has only been around for 6 years, in an industry that is slow to uptake new technology

- Mines are managed and operated quite separately from each other, even though they belong to the same company - need to go through the same due diligence, testwork regime at a new mine site even though other sites in the same company are already operating PA units - the bigger the miner, the more slow moving it is

- Have less sales focus on smaller miners and exploration companies as the lab companies are already there banging the PA drum to convert these companies to PA

Business Development with Labs:

- Already working with 3 of the 4 biggest labs today - talk of a merger between SGS and BV could make the 4 biggest, the 3 biggest

- Relationship with SGS is ongoing and growing

- Likely to end up with a lab partner in South America as well

- Lab sales will be mostly driven by conversions of mining projects, especially near lab hubs

- Labs are at the behest of the miner as each of the labs can provide the same PA service and the playing field is thus even - it is up to the miner to work out operational risk/cost in determining the best least and operating model

- Shifts conversation from C79 vs Lab or C79 vs Miner to one of Miner vs Lab

- Miners have pushed C79 to come up with the Miner leased-Lab operated operating model to achieve the best results for the miner

TAM is heavily skewed towards miners - 400 (2/3) Miners, 200 (1/3) Labs

Rate of contracting leases has increased this year - miners appear to be positioning for upturn in exploration activity - feels like exploration spend is going sideways/up, but certainly not down

Deployment Progress

- Rate of deployment has improved as timeline from landing the unit through to installing in shed has definitively shortened

- Made improvements to compress previous bottleneck of licensing - previously licensing could take as long as 270 days, now, with increased local operating knowledge, licensing can be achieved in the same 8-week installation window

- Offset by deploying in new countries for the first time - NZ, Namibia. Have got better at preparation - in-country corporate setup, licensing etc

Manufacturing Capacity

- 20 units per annum

- Working to get deployment cadence up to this level via sales relationships with miners, predominantly

Continuous Improvement

- Continued access to minesite personnel throughout the entire sales/deployment/BAU cycle has provided good inputs to improving the performance of the units

- Operational experience thus far has been better than expected in terms of useful life of the unit

- No need to change current useful life model - likely to err on side of conservative estimates

- Eg. The experience of the 1st deployed unit in 2018 suggests that there is likely to be no need to re-build the units linear accelerator in 2028 when it reaches 10 years, as initially expected

Cost Base, USD Exposure

Forecasts are based on USD xrate of 65c

- Cost base and unit capex costs are mostly denominated in AUD, but moving increasingly to USD as more units are deployed overseas

- Revenue is now significantly in USD

Cost base is becoming increasingly incremental

- Sales & Technical Support has grown from 1 to 20, likely to add 1-2 more FTE only

- Finance headcount will also grow incrementally - no need to double headcount as the business scales

C79 signed a new customer contract with OceanaGold Corporation (TSX:OGC) for a PhotonAssayTM unit installation at OceanaGold’s Macraes Operation in New Zealand. OceanaGold has a portfolio of four operating mines: the Haile Gold Mine in the USA, the Didipio Mine in the Philippines, and the Macraes and Waihi operations in New Zealand. The Macraes Operation on New Zealand’s South Island is the country’s largest active gold producing mine, having produced over five million ounces of gold since 1990.

The Macraes unit will be operated by existing Chrysos customer SGS; signifying the first PhotonAssayTM unit to be leased by a miner and operated onsite by a laboratory.

Expected to be deployed in the second half of FY25

Grows PhotonAssay’s footprint in the Asia-Pacific region, but increases relationship with one of the world’s leading laboratory companies

What is pleasing:

- Adds a new C79 customer operating model where the miner leases the PA unit, but a Lab operates the unit on its behalf, onsite

- OceanaGold looks to be a mid-tier gold miner - that it has sufficient volume to make the economics of an onsite unit to work in this new operating model augurs well for C79’s penetration of the mid-tier of Gold miners.

- Adds to steady new unit sale momentum, expands customer base

- C79 has sufficient inventory to immediately deploy units to new customers who are site-ready vs being held “deployment hostage” by existing contract commitments by customers who are not site ready

Discl: Held IRL and in SM

Nice update today.

Glad I topped up IRL yesterday at ~$4.58 as the price fell back into and successfully tested the now-strongish support zone of around $4.38-$4.75, which is also C79's 52-week lows. With no news driving the price falls to 52-week lows, it seemed like a good risk to take.

Big ticks this Quarter - (1) 4 new lease agreements signed (2) 2 units deployed (3) 9% uptick in sample volumes (4) 1st US-based installation, one more WIP in Alaska - all are signs of increasing technology penetration and global reach

Highlights

- Two units deployed during the Quarter, including the first unit at the Barrick-Newmont NGM complex, marking Chrysos’ first USA-based installation. A total of 31 units now deployed.

- Four new lease agreements signed during the Quarter comprising two new agreements with SGS in Africa and Australia, and two new agreements for deployment into African-based laboratories, bringing the total number of contracted units to 54.

- Unaudited Revenue of $13.7m, reflecting 2% growth Quarter-on-Quarter (QoQ) and 54% growth Year-on-Year (YoY).

- Sample volumes totalled 1.3m, reflecting 9% growth QoQ and 30% growth YoY, with latent capacity available to capture industry cycle upturn.

- Well-funded to support continued PhotonAssayTM unit growth, with cash position of $47.5m as of 30 September 2024 and $95m in undrawn debt available.

- Continuing revenue growth, along with ongoing market penetration across key mining hubs, sees the business on track to achieve its FY25 guidance of $60-$70m of revenue and $9-$19m EBITDA

- 13 units ready to be shipped and installed in support of Chrysos’ FY25 deployment schedule, including two new units that passed factory acceptance testing during the Quarter.

Price Action

Price yesterday testing again the floor around ~$4.38, on no news, which is the 52-week low - now unjustifiably so given today’s update.

Over and above the usual familiar results content that C79 puts out, picked up a few interesting points in the Annual Report and Rem Review which gave me confidence that C79 were/are very much focused on the deployment issues and the operational risks around counterparties, risks of conflicts etc.

Thesis and high-conviction very much intact!

Disc: Held IRL and in SM

FY24 felt like a year of customer, deployment and operational consolidation/reality check/learnings followed by a deliberate re-base lining of market expectations of the pace of deployment to ensure a more sustainable cadence vs the FY23 over-excitement of “straight-line”-like deployment plans. This is a good thing from a long-term investment perspective.

Despite this, C79 grew significantly in terms of revenue (69%) and EBITDA (156%) and Photon Assay technology uptake via growth in samples undertaken.

Starting to see more traction in securing sales for new units - 4 new sales, post EOFY - very good to see - this also spreads out the customer base and allows for acceleration of parallel installations

No funding issues in the horizon - strong balance sheet, cash $61.1m, undrawn debt of $95m, ensuring funding for ~39 units

14 units ready-to-be-deployed removes any supply chain risk for FY25 deployments

FY25 guidance is for (1) 25% to 45% YoY revenue growth and (2) a potential doubling of EBITDA

Review of Annual Report provides evidence that the Board is very focused on the deployment of units, CEO was not awarded STI’s relating rate of deployment units. While you would expect this focus, good to see clear evidence in the Annual Report.

Expecting a controlled, deployment-focused FY2025 which will then translate directly to revenue and EBITDA growth - this will be much more sustainable going forward - “steady high growth”

Upside could well come from (1) a faster rate of units deployed as the company learns and adapts to the site-related challenges faced in FY24 (2) Continued traction in samples as technology uptake further embeds, directly leading to Additional Assay Charges

FINANCIALS

- Met Mar 2024 Revised FY24 Forecast of $48m-$58m, with total revenue at $48.1m, 69% growth on FY23 but note that PhotonAssay Income was only $45.4m, short of guidance - this impacted the STI’s of the Executives

- EBITDA of $9.0m met revised guidance of mid-to-lower of $7m-$17m range, 156% growth on FY23

- Gross Profit Margin 76%, EBITDA margin 19.8%, up from 13.1% FY23

- Operating cash-flow positive: $3.6m

- Operating expenses grew 49% reflective of expanded global footprint, but revenue continued to grow faster than expenses

- Headcount has grown from 116 to 163, commensurate with a growing, hub-centric global perational footprint

BALANCE SHEET, FUNDING

Cash $61.1m, $95m CBA debt facility undrawn - enough funding to deploy about ~39 units

DEPLOYMENT

- 9 units deployed and 2 units re-deployed in FY24 - met revised guidance but far was only 50% of initially planned 18 units, total 29 units deployed

- 14 units ready to be shipped and installed to support FY2025 deployment schedule

- Continued Management and Board focus on deployment:

- No STI incentive relating to the deployment rate of units was awarded

- Note below in Chairman’s Statement

NEW SALES

4 more units contracted post period - good to see some traction in new sales - ongoing focus on diversifying the customer base to accelerate installations.

Deepening relationship with one of the world’s biggest lab, SGS, following last year’s partnership with Barrick Gold

OPERATIONS, TECHNOLOGY UPTAKE

Sample volume growth continues to grow indicating increasing uptake of Photon Assay technology - 4.31m samples in FY24, 29% increase over FY23

22 consecutive quarters of record sample volumes

Unit costs have decreased by 10% YoY - impact of hubbing strategy, increased in-house maintenance, less reliance on 3rd party providers - reflected in gross margin of ~76%

Non-APAC revenue now 55% of revenue, up from 33% in FY23 - reflects increased global market penetration

EMERGING RISKS

Counterparty risk - non-performance of counterparty, concentration risk around counterparty, operating in some jurisdictions which are at a higher risk of geopolitical unrest, bribery, corruption, modern slavery and crime

Risks of Conflict - Chrysos operates in countries adjacent to or where conflicts may occur between nations or other entities, encompassing the possibility of diplomatic breakdowns, territorial disputes, ideological conflicts, and resource competition that may escalate into armed confrontations. This means Chrysos’ ability to control and operate its assets in these territories may be impacted, which may, in turn, lead to impacts on profitability and loss of assets.

FY25 GUIDANCE

Total Revenue range of $60m to $70m - between 25% to 45% growth from FY24 $48.1m

EBITDA range of $9m to $19m - between 0% to 110% growth from FY24 $9.0m - this is a wide range

My thoughts on C79's Appendix 4C and the Friday SM Meeting:

SM MEETING SUMMARY

- Reinforced thinking that long-term opportunity ahead and strong moat for C79 ahead is very much intact - disruptive technology that is defining the new sampling process standard, free run due to no competition, long TAM ahead, clear evidence of increasing adoption

- But the reality is that this journey to market and industry domination is not going to go in a linear straight line - time and effort is needed to keep pushing the technology forward, to overcome the deployment challenges etc - walk away with the sense that C79 management is acutely aware of, and is under no illusion of the effort and focus required - have to readjust expectations of this operational reality

- Need to reduce expectations of the share price and be more patient as the market also adjusts to this reality and C79 works through the operational realities - my expectation was that the deployments will march forward in a straight line which is clearly not realistic

APPENDIX 4C

Positives

- 2 new units deployed

- 2 new contracts signed - the first additions since 1QFY23 - big thesis tick!

- $13.5m revenue Q4, total revenue FY24 = $45.4m vs $26.8m FY23, 69% FY revenue growth - steady quarterly revenue increase trajectory since FYY23

- Non-APAC revenue > 50%, growing nicely in EMEA and America’s

- Continued growth in samples processed, 27% YoY - 22nd consecutive quarter of PA volumes - continued increasing uptake of the new PA technology

- 14 units ready to be shipped and installed while customer base and site selection has been broadened to overcome site-related deployment obstacles/bottlenecks - underpins FY25 deployment schedule

- $156m of cash and debt available to fund future deployments - at $4m per unit this is funding for ~40 units

- Decisively operational cash flow positive this quarter

Disappointments

- Only 2 new units deployed this quarter - as per revised management guidance, but slower than initial FY24 expectations

Takeaways

In taking a step back and looking at the last 2 FY's, there is:

- A very clear and steady step increase in quarterly revenue

- Continued positive increase in Samples Processed as Photon Assay uptake increases globally

- The number of units deployed per quarter has only been 2-4 per quarter in FY23 which has continued into FY24

- Available Funding has improved via Debt Facilities and the recent Capital Raise

- Cashflow from Operating Activities has also steadily improved

I think the mistake that management made was to set up overly unrealistic expectations of a rapid deployment of units. This may got the market overly-excited as revenue and EBITDA would similarly follow and the market got ahead of itself. Since management tempered expectations earlier this year, the market and share price has similar cooled.

Interestingly also, since 2QFY24, management has no longer provided clear guidance on how many units it intends to deploy in the upcoming quarter and FY and has now switched focus to revenue, EBITDA and industry technology uptake metrics.

But taking this step back and in digesting Dirk's comments in the Friday SM meeting, other than the earlier unrealistic expectations, I remain very comfortable that C79 is actually travelling very nicely and that my thesis is actually very much intact and is currently playing out.

The only change is in my expectations is that the deployment of new units will continue to be a steady 1-unit-at-a-time march, rather than a multi-unit rapid deployment that I thought would be the approach a year or so ago.

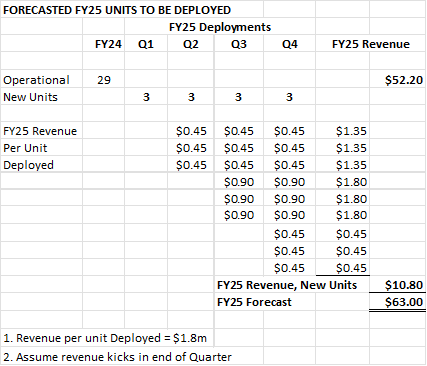

FY25 GUIDANCE

- FY25 revenue guided for $60-70m, between 32%-54% growth YoY

- This back-of-envelope forecast of units that are likely to be deployed in FY25, based on the revenue guidance, suggests that a cadence of 2-3 units per quarter is more realistic.

- This cadence is roughly consistent with the 14 units currently already ready for installation, taking away one big "controllable risk" of missing guidance

- FY25 revenue guidance could thus be conservative as there is upside from (1) additional units deployed (there ARE available units on hand to achieve this) and (2) further sample growth

ACTION

The C79 price is now in the middle of a decent buying zone and will look to be topping up on weakness below $5.00 in the coming weeks. Will keep some powder dry to top up further if the price falls below $4.00, although I can't quite see this happening given that the FY24 results to be released should not provide any surprises following the recent Appendix C.

Reviewing the C79 chart position:

- Bounced nicely from the 61.8% Fibonacci level of 5.07, which looks to also be a reasonable medium term support level

- 6.06 is likely to provide some resistance in the short term, followed by the 200 SMA around 6.68 currently

- A decisive crossing above 6.06, then the 200 SMA therefter, would be very nice to confirm the start of a new short term uptrend

Timing is interesting as we are not far away from a Trading Update, then the Appendix 4C. The price feels like it is "neutrally positioned" for the results given that C79 has downgraded guidance for the number of deployments in FY24, and hence revenue.

Any negativity against guidance could see a drop towards 3.96-4.27 (I would be topping up at that level). A better than expected deployment update could see it spike upwards towards ~7.29. If it goes as guided, the price will probably bounce around ~6.00, I suspect

Discl: Held IRL and in SM

SUMMARY

- Headline revenue numbers look good QoQ and YoY but are disappointing against guidance and deployment plan - only 3 units deployed thus far and total units deployed for FY24 is only 9 vs planned 18, a 50% miss

- New contract signed, bring total contracted units to 50

- Continue to be impacted and delayed by site deployment issues but what is positive is (1) the high rate of C79 Factory Acceptance Testing units - 11 are ready for deployment (2) labour costs this quarter have come off 20% QoQ, suggesting that issues are indeed on the customer end which C79 cannot throw labour at to mitigate (3) diversifying of the customer base allows for acceleration of unit deployments in CY25

- Buoyant gold price is expected to drive an increased number of samples

- FY24 guidance updated - revenue has been lowered to $45m but EBITDA of $8.5m remains within guided range - both are impressive YoY growth numbers, but are disappointing against earlier guidance

- As units are already contracted, the delays in deployment is a timing rather than permanent difference - each deployed unit adds ~$20m projected Lifetime revenue - This is perhaps a customer-end reality check as to what is practically deployable in an FY

- Price weakness is an opportunity to top up

GOOD

- Added 3 deployed units, 2 new and 1 redeployment - 1st deployment into Europe (England)

- 1 additional unit contracted, total contracted units now at 50 - MSALABS for deployment of a second unit to Barrick Gold’s Kibali mine

- Topline Revenue of $12.9m continues to grow, 28% QoQ, 92% YoY

- Continued growth of samples processed, sustaining of Additional Assay Charges (AAC) revenue - 29% YoY growth, 3% QoQ, 21st consecutive quarter of PhotonAssay volumes

- Unit costs continue to decrease from hubbing strategy and deeper engagement in maintenance by C79 team members - gross margin 70-80% achieved

- Projected LifeTime return of more than $20m per unit creating an infrastructure-like asset fleet

- Well funded to support unit growth - $70m cash, $95m CBA facility untouched

- Good manufacturing progress which C79 controls - 11 units past Factory Acceptance Testing, pending customer site readiness, 5 units manufactured during quarter

- Employee costs have decreased $1.2m, or 20% QoQ - perhaps reflecting reduced size of flexible labour as deployment obstacles are client site related vs C79 controllable?

- Cash collection back to positive this quarter vs negative in Q2, continues to operate cash-flow positive this FY

NOT GOOD

- Only 3 units deployed in Q3 means that efforts to clawback delays in deployment have not been sufficiently successful to bring the delayed schedule back on track

- Final deployments for FY24 are expected to total 9 new units and 2 redeployments, bringing Chrysos total number of operating units to 29, an increase of 45% on FY23 but vs FY2024 target of 18 units

RISKS

- Risk of deployment challenges at mine sites impacting the overall FY24 deployment plan and delaying deployments into FY25, have clearly manifested

- The 50% miss in deployed units is disappointing - while a miss was clearly telegraphed, the extent of the miss is higher than expected

- Will impact FY25 guidance as 18 deployed units per year appears overly bullish.

GUIDANCE FY24

BETTER FINANCIAL GRANULARITY

- 12M rolling unit revenue is ~$1.8m

- 12M rolling unit cost is ~$450k

Had a quick look through the C79 preso pack for a Site Visit in PER, released today. There are some new slides which provide more insights on the PhotonAssay technology, the ESG benefits and the typical economics lifecycle, which I found very useful.

Discl: Held IRL and in SM

How Does PhotonAssay Work

Hitting samples with high-energy X-rays, PhotonAssayTM causes excitation of atomic nuclei allowing enhanced analysis of gold, silver, copper and other elements in as little as two minutes.

Speed and ESG benefits of PhotonAssay are quite stark.

Unit Economics

This is a really good slide on the per-unit Capex spend cycle which will improve the understanding of the cashflow profile and underlying economics.

Future Opportunities

Not the immediate focus. Lots of yet-to-be-tapped pathways for future growth once the gold-related TAM shrinks over time.

My notes from the Investor call this morning and the announcements. Overall, nothing really new as most were already revealed during the release of the Appendix 4C in Jan. Its all about getting the FY24 deployment of 18 units back on track.

- 27 units deployed in total, 4 new units in 1HFY24, 3 post the period vs planned 18 for the FY - to make up for this, need 6 units deployed in Q3 (of which 3 is already deployed), and 8 in Q4

- Risk continues to be flagged that 18 units may not be fully deployed this FY, with some pushed over to early 1Q25, so nothing new - it was mentioned that overlapping deployments is no longer an issue

- Issues around contractor availability experienced in 2Q have mostly gone back to normal, continued to engage the customer in planning early to mitigate risk of delays

- 27 deployed units provides a baseline annualised MMAP of $50m per year

Expense watch items:

- Depreciation & Amortisation - jump from $3.8m 2HFY23 to $5.3m was raised on the call - no concerns, step-up is in line with increase in deployed units, depreciated on a 10 year straight line basis. D&A expense is not linked to revenue and is all related to PhotonAssay, no other assets

- Employee cost has gone up from $7.9m to $10.1m, H-on-H and 86% up on pcp - expanded deployment capability and building of in-house maintenance capability, offset by a drop in Maintenance Costs from 1HFY23 of about $0.5m, aligned to Group’s strategy of global growth

- Management is finding ways to provide better visibility of the savings arising from operational leverage from the global hubs strategy

- -ve working capital of ($2.8m) is a timing issue between receivable collections and payment for purchases of parts etc - no issues of note with both customers and suppliers

Discl: Held IRL and in SM

Built the attached xls to line up the Statutory P&L and the Management View side-by-side as I found myself getting knotted up with the movement in the numbers from Half-to-Half, Qtr to Qtr and some of the numbers in the preso. Building the sheet also forced a deeper dive into the P&L which I found very helpful.

My notes, including points raised on the brief-as-usual investor call this morning. I have had direct experience as a customer having customer-end contractual responsibility to prepare a site for a big installation of equipment by vendors - power, network, fire suppression, level concrete floors etc.. So I relate very much to the challenges that C79 are having at mine-site deployments and believe they will be sorted/pre-empted as C79 gains more experience deploying at mine sites.

Discl: Held IRL and in SM

SUMMARY

- Revenue MMAP and AAC and samples processed growth momentum continued, very strong funding position for future deployments

- Barrick Gold partnership a big endorsement for the PA technology, de-risks the technology for other miners who are “not early adopters but are fast followers”

- Manufacturing remains on track

- Emerging risk that 18 planned units may not be fully deployed in FY2024, with some units likely to be finalised in 1QFY25 - startup issues - mine site readiness, contractor availability issues encountered as C79 transitions from lab-site installations to mine-site installations, learning from these early experiences to adapt and mitigate these risks for future deployments. Not great, but deployment issues almost always pop up when changing deployment environments - see this as a temporary issue that will be ironed out in the current and upcoming deployments.

- FY24 revenue guided to the lower end of previous forecast, EBITDA in the middle to lower of previous forecast - this appears to be a timing issue, not a step down, not great but no concerns

- A good result despite the flagging of the risk of delays - much prefer the upfront flag than a nasty surprise later

- Remain bullish - will look to top up if the price falls further

GOOD

- Topline Revenue continues to grow, 13% QoQ, 88% of Q2 revenue is predictable and sustainable minimum revenue

- Continued growth of samples processed, sustaining of Additional Assay Charges (AAC) revenue - 12% of Q2 revenue, grew 3% QoQ

- Very strong cash position following Capital Raise and additional $65m debt facility with CBA, $180m to fund upcoming deployments

- Added 2 deployed units, 1 deployed post quarter, 2 installations currently in process

- Manufacturing remains on track

WATCH ITEMS

- Cash collections fell QoQ, marginal negative working capital for the quarter - seasonal, timing difference in collections from the holiday season, no concerns, continues to operate cashflow positive year to date and expect this to remain for the rest of the FY

- Employee costs continue to grow - 47% growth to $5.9m from $4.0m in 1QFY24 - grew in line with global expansion strategy and increased operational structure required to deliver additional PA units

NEW RISK

- Encountering deployment challenges at mine site deployments as C79 transitions from lab-based installations to mine site installations, a new deployment scenario - may delay some deployments into Q1 FY25

- Mine sites have not been as ready as the lab sites for deployment to commence, causing delays - building to house the units, properly concreted, availability of suitable power, contractor availability challenges

- Learning from these early deployments and partnering earlier with clients to ensure site readiness does not hold up deployments

- Also impacted by the African rainy season

- Benefits of working directly with miners far outweigh the delays

GUIDANCE FY24

Lower-end of forecast range of $48m to $58m - adopting a conservative approach and flagging the emerging risk that 18 units may not be deployed in FY24, some of these deployments may only be finalised in 1QFY25, expect to increase deployment at the tail end of the FY

Confident with retaining FY24 EBITDA forecast of $7m to $17m, middle to lower of that range - expecting operational efficiencies from operational hubs, costs are saved when deployments are delayed

OTHER POINTS

- MSA Lab units are likely to be deployed into Barrick mine sites

- Mine site deployments give C79 direct access to the mines, opportunity to expand use of technology within the mine

- Continue to work with Barrick on global deployment

- Deployments are typically 8 weeks, a maximum of 12 weeks to become fully operational

- Mud map of potential adjacent use of PA technology - not much focus on this now as the focus is very much on deploying the machines, but as more units are deployed at mines, C79 interacts more with mine site personnel, this could be a nearer term growth opportunity to look out for

SECURES ADDITIONAL $65m DEBT FACILITY

- $65m loan with Commonwealth Bank, adding to its $30m facility with the bank

- Paid down outstanding $8m on the original $30m facility

- Together with new loan, has (1) total debt available of $95m (2) $75m from recent capital raise and (3) strong cash balance from operating cash flows.

Can't help but feel that some big announcements are in the pipeline following the recent partnership announcement with Barrick Gold as this amount of secured funding allows from some big things to happen ...

Discl: Held IRL and in SM

Following the post from @Bear77 on the soaring gold price, the ABS released this quarters Australian Mineral Exploration spend today.

Gold exploration spend is on a roll which can only be good news for C79 as additional sampling over and above the minimum contracted photon-assay unit monthly cost is all upside revenue and profitability.

Discl: Held IRL and in SM

Australian Super has been busy accumulating 1.47% of C79 between Aug 2023 and mid-Nov 2023 at very attractive prices ranging from $4.91 to $6.29.

Ah ... if only I had bought more back then ...

Discl: Held IRL and in SM

Having gone through a flurry of capital raises over the years, I finally looked up ASX Listing Rule 7.1 which governs capital raises and learnt something new. This is probably nothing new for the more experienced members, but posting in case it helps anyone - it certainly opened my eyes!

Am forced to enter a company name for this post as there is no "general" category ...

To raise more than 15%, rule 7.1A kicks in and is significantly more onerous:

Full document: https://www.asx.com.au/documents/rules/gn21_chapter_7_restrictions.pdf

Takeaways for me:

- If a company has not requested for a 7.1A Mandate at an AGM, then the max dilution for any capital placement/raise during a FY is 15%

- For every AGM notice, at least read the special resolutions and look for a 7.1A mandate - this is especially relevant for the WSP AGM Notice - I missed the 7.1A Mandate resolution as I ignored the notice - not a smart thing to do!

Like many retail investors, I am admittedly wired up to "dislike capital raises", almost by default. However, having experienced 4 capital placements in the last 2-ish months, I can sense my thinking and emotions gradually changing to not instinctively dislike, but to assess each raise on its own merits.

Being the cricket tragic that I am, to use cricketing analogies:

- ALC and WSP was not great - "fairly severe batting collapse after a good solid start by the openers, required run rate is accelerating to worrying levels"

- AD8 and now C79 - both feel like "a good understanding and use of the conditions, opening partnership is flourishing and platform is being set for a huge innings and subsequent win .."

The C79 Placement

- 11.4m shares at an offer price of $6.60, a 7.7% discount to the last closing price of $7.15 on Fri 3 Nov 2023 - I was expecting a $6.50 raise, at the time of writing, C79 is trading ~$6.70-ish, so pricing seems good

- New shares represent 11% of existing shares on issue and was not underwritten

- Placement raises C79’s funds available to $108m - $75m Placement + $33m Cash, excludes untapped debt facilities

Use of Funds

- Support the deployment of new PhotonAssayTM units - ~90%

- Development of (1) PhotonAssay Gen II (2) Application Development (3) Supply Chain resilience - ~10%

- Includes, subject to the provision of new debt, the potential expansion of manufacturing capacity beyond 18 units per year over the medium-term - this would result in a positive step up of earnings growth

- Strengthen the Company’s balance sheet, which in turn is expected to assist with its discussions with lenders, ensuring that it is best placed to optimise its capital structure moving forward.

- The Company is already in a position of generating positive operating cash flows from its existing 22 deployed units and therefore funds raised from the Placement can be applied primarily towards growth.

My Thoughts

- Clearly defined and focused use of funds for Deployment Growth and Development of Improvements - a good place to be as the units deployed moves closer to positive operating cash flow

- The recent Barrick & MSALABS partnership provided strong technology validation and appears to be a pivotal moment which will now drive momentum acceleration of deployment, manufacturing and further Gen II improvements - funding is now in place to drive that momentum via the placement, which will inevitably be followed up by increased debt facilities on more favourable terms

- No additional sales have been formally announced, but appears inevitable

- The placement reflects management’s long-term 360 degree thinking and business confidence

Things are coming together very nicely for C79 - sales conversion, deployment momentum, product improvements, improving of manufacturing capacity, supply chain resilience.

Discl: Held IRL

Very positive ASX announcement this morning. The market was and still is clearly excited (as am I!):

What is Significant

- Barrick Gold is the 2nd largest global gold producer

- The partnership is a big tick to (1) the PhotonAssay technology itself (2) increasing momentum in the transition from FireAssay to PhotonAssay among the major gold miners (3) the embedding of the PhotonAssay technology within Barrick’s significant global operations

- The partnership will be a really good mine-site platform with operational scale for further R&D to expand the scope and effectiveness of the PhotonAssay units - “Development has continued with copper assaying and innovations in sample logistics and robotics, extending the capability, safety and productivity of the entire system.”

What Is Unclear

- Whether the “10 more units” ... is (1) over and above the 49 units already deployed or contractually committed - this would be a very decent dent in the TAM OR (2) is already part of the 49 and the partnership deepens/embeds the already-existing relationship into something more tangible but does not result in new unit contractual commitments.

- There is mention of due diligence, so it could mean that this announcement is step 1 of 2 steps, with a potential future step 2 announcement to announce the actual contractual commitment once due diligence is completed and the actual sales deal is done

Have written to C79 Investor Relations seeking clarification on this topic - I suspect the wording was left somewhat vague given that the deal (if there is to be a deal), is very much in the mix, but not committed yet. This may explain why this was not price sensitive news today.

Discl: High Conviction Holding IRL

Attended the C79 call on their 1QFY24 Appendix 4C. It was the usual short call as C79 has a standard set of clear slides with changed numbers each quarter ... a good thing!

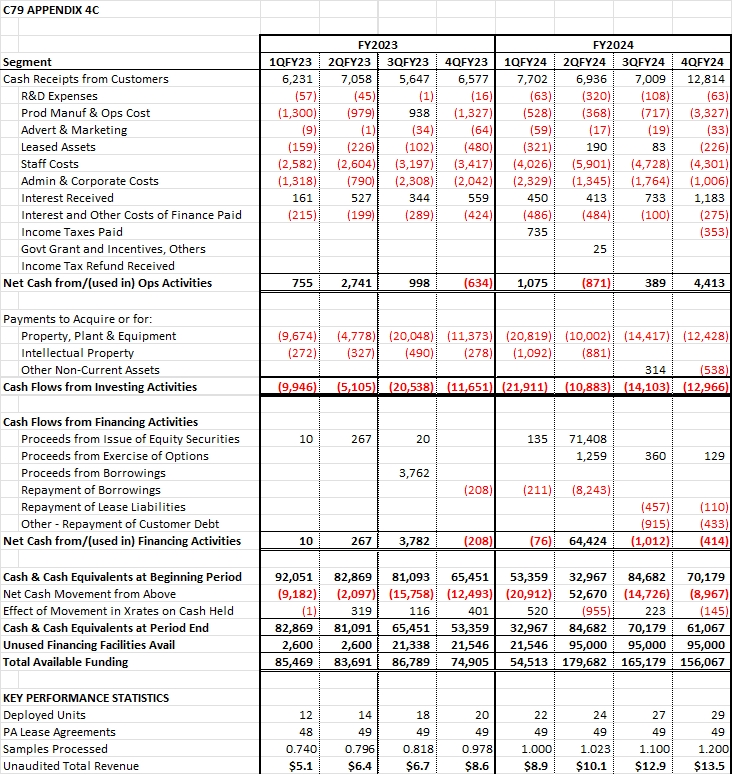

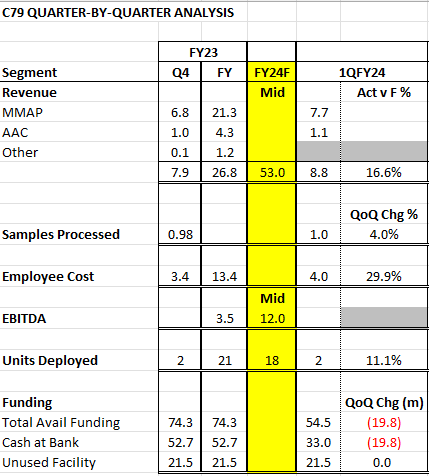

Built a simple xls to summarise the key metrics from the 4C that I need to watch, based on the various discussions here. Rather than take a YoY comparison, which for C79, is really no longer impressive or relvant, really, as it is marching forward in a clearly defined trajectory, have taken (1) a forward looking view against the mid-point of FY24 guidance, where the guidance was provided (2) QoQ trend for those metrics which provide a "rule-thy-world with PhotonAssay" perspective eg. Samples processed and (3) QoQ trend of key watch areas - funding and employment cost.

It does give a more balanced perspective of the risks as @RhinoInvestor rightfully pointed out, vs merely focusing on the wonderful by-definition revenue % increases, which masks future issues. The call with Dirk also provided valuable background context which makes these figures that much more meaningful.

Discl: High conviction holding IRL

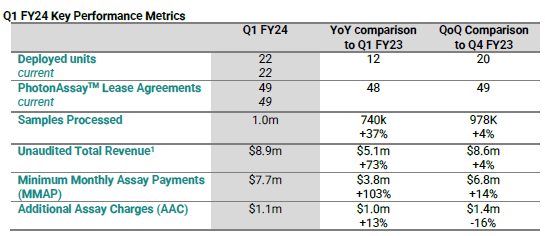

GOOD

- Solid result, key operational and financial metrics on track

- 2 units deployed, 4 units are currently being installed (3 in Canada, 1 in Ghana) - on track

- Successfully re-deployed one unit - a technical first, proving that the units can be moved, learnings etc

- Sample volumes continued to increase QoQ from 978k Q4FY23 to 1.0m this quarter - revenue upside but also an indicator of the uptake of Photon Assay technology

- 15% increase in gold exploration in 4QFY23 over 3QFY23 - augurs well for growth of samples, and hence AAC upside revenue in the coming quarters as this is what drives the range variability in the FY revenue guidance

- Revenue increase is as expected - $8.8m revenue is ~16.6% of the mid-point of the FY24 Revenue Guidance of $48.0m to $58.0m

- Well funded - $54.5m available funding, $33.0 of which is cash at bank - noted comment that “broader debt discussions progressing” which was also mentioned in the Investor call

- In response to a question around the sales approach between Labs and Mines, Dirk reiterated that C79’s focus at the moment is to convert the mining industry to Photon Assay technology, so the Lab vs Minesite equation is less important as the TAM of Labs and Mines is already very concentrated

NOT SO GOOD

Nothing to not like

TO WATCH

- Employee cost has gone up $0.6m QoQ to $4.0m, which is 29.9% of total FY23 employee cost - watch the QoQ increase in this cost

- Available funding has dropped $19.8m from Q4 - the drawdown feels a bit higher given (1) back-end nature of capex payments (2) 3 units deployed this Qtr (3) 4 are in deployment - need to watch this vs funding-related announcements

My notes from the very good conversation with Dirk Treasure, Founder and CEO of C79. I walked away with a much deeper understanding of the business, financially and operationally, which has made me further appreciate the quality of the business in terms of TAM/customers, moat and economics.

One new risk that crystallised for me is geo-political risk. Some of the units are being deployed in nasty reas of the world - if trouble brews, the carefully laid out deployment schedules and associated revenue impacts will be impacted.

Discl: My conviction on C79 has increased further and I topped up IRL a bit after the meeting as the price dipped closer to $6 today. In topping up, I was taking a leaf from Ian Cassel's wisdom where he said that he has fared better when he averages UP on his high conviction companies then averaging down. Have held C79 since Dec 2022, price has done very well since, so averaging up is not as painful now vs starting a new position altogether.

HISTORY

- Bought IP and the background know-how of that technology - C79 packaged and commercialised the technology

- Analysis is a non-discretionary spend for the mining industry

- Incumbent technology is Fire-Assay, 2,500 years old

- Photon Assay (PA) is a faster, greener, safer, more accurate, more precise X’Ray-based technique, larger sample, non-destructive

OVERVIEW OF PHOTON-ASSAY UNIT

- System has 7m x 6m footprint, weighing 80-90 tonnes - fixed infrastructure at site

- System can do 40,000 samples per month, size of a reasonable-sized mine, 15-20% Additional Assay Charges extra per month upside

- Lease-take-or-pay model, pay on a per-sample basis, pay roughly aligned to what they are paying for FA today but with all the benefits of PA over FA

- Deals have a fixed lease cost with a minimum contracted sample volume, then additional per-sample charge once contracted volume is exceeded

- Lab deals have tiered rates, higher volume, higher discounts to incentivise the customers to run more samples - intent is to incentivise labs to move from FireAssay across into Photon Assay to improve Lab profits as volume increases. Lower price per sample for C79 but higher overall revenue for the unit is higher

- Running costs are generally fixed - higher the sample volume, higher the revenue, higher the profitability of the unit

- $3.7-$3.8m capex to build 1 unit

- Once deployed, Annual ROIC is 50-80%, with payback period of between 1-2 years

- 20 year lifespan - refurbishment is expected after 10 years, and is depreciated over 10 years - aligns to very long life of a mine site

TOTAL ADDRESSABLE MARKET

- 610 TAM is the ACTUAL addressable market, made up of 2 parts

- Labs that run a Fire Assay business with volumes at least that of 1 PA unit - 200 customers, hub-and-spoke approach

- Mining companies which can benefit from equal or better economics from use of PA technology, onsite - 410 mines

- The more Labs and Miners use the Photon-Assay technology, the less technology risk there is for new customers - feeds into sales cycle

- 1st unit took 3- 5 years to sell

- Volume has since leapfrogged as PA is used by 3 of the 4 big labs and the top 2 gold miners - global adoption of the technology

- XRF - not a competitor - their machines can analyse base metals and have been around for a long time, but they cannot analyse gold quantitatively

PATENTS, TECHNOLOGY/IP MOAT

- Main patents run to 2036 but incremental improvements have also been patented, meaning that there will be a raft of patents that will run quite a bit past 2036

- Keep a very close watch on competition - see nothing on the horizon

- Alternative technology options during the patent protection period will likely be inferior, plus, it will take at least 6-7 years to get the technology to the point of inflection point of global mass adoption of PA - this is the time it has taken C79 to get approvals, certification, ISO accreditation etc

- C79 sees itself within mining and within the assay-space, being an analysis company that has novel, new ways of undertaking analysis

- Need to be in a dominant market position that when new technology emerges, the competition is competing with C79’s PA technology, not archaic Fire-Assay

- Horizon 2 opportunities to leverage very deep counterparty relationships and deep company knowledge in the nuclear physics space

SCALABILITY

- Company has doubled in size every year in terms of revenue, headcount, units deployed

- C79 thinks of growth in terms of 3 growth pillars:

- Manufacturing capability/capacity, capex

- Demand/Pricing - control demand through pricing

- Operational Capability - focus of last 18M

- Market is very concentrated to the 4 Lab companies and top 2 miners - each customer thus has the potential to be a repeat customer - want to give customers the best experience, need ecosystem in each operating region to support this - people on the ground, sales capacity, marketing etc - build the foundation for future growth

- “Clustering Strategy” - position the units as close to each (200-300km) other to optimise the support team for that location to support other deployed units in the area

- Headcount trajectory - based on 3 scenario’s:

- Open New Region - most complex, need headcount to establish

- Open New Country - need country-specific administration support for payroll, tax etc.

- Incremental growth, each additional unit in established country - 1-2 direct FTE per unit, maintenance engineers

- Trends move from headcount growth related to the number of units to incremental growth for everything else, apart from the growth per unit

- Do not expect to double headcount this FY, but expect fair amount of increase in headcount still because of increase in manufacturing capacity

FINANCING

- Current ~$70m will see C79 through to FY25

- Tier-1 Australian bank has appetite to lend a fair amount of money after looking at Tier 1 counter-parties, contract risk etc - have access to that debt channel on an ongoing basis

- C79 is a cashflow positive business excluding growth capex - all the cash generated is going to growth capex

R&D IMPROVEMENTS

- Do not need to grow the TAM at the moment as it will take ~30 years to work through the TAM at 18 units per year - within the TAM how do you upsell, cross-sell, increase profitability

- Focus is on iterative improvements to ensure that the PA technology remains the absolute best in what C79 does ie. analysing gold

- Then looking at adjacent's, analysing other elements in and around the analysis of gold - currently can analyse copper, silver and moisture (for quick turnaround of process control samples), looking at other elements that co-present geologically that could benefit the customer

UTILISATION OF TECHNOLOGY

- Prospectus forecasted FY23 utilisation at 55%, final FY23 utilisation was 56%, in line with expectations

- Ramp up period when rolling out new units in new regions - low utilisation, creeping up to higher utilisation

- Do not expect miners to reach 100% utilisation on mine-site units - these are treated as critical mine site infrastructure - miners have much better visibility of future volumes from longer-term planning of say drilling campaigns - focus is thus on revenue/return on unit instead of utilisation. Miners generally have a lower committed sample but higher price per sample. More consistent revenue model where utilisation is not as important

- With labs - expect much higher utilisation but lower price per sample, utilisation is also overlayed by macro factors - increase exploration spending drives more samples through labs etc

- Returns end up being roughly on par between the 2 customer groups

- There is thus a fixed downside from take-or-pay, but have exposure to increased exploration spend through the increase of samples through labs

MACRO INFLUENCES

- Mining exploration has trended upwards, influenced by the price of gold, exploration volume has increased

- Exploration spend in Australia is trending upwards again after contracting about 30% in the last 18 or so months - despite this, PA sample volumes have grown via increased PA adoption above and beyond the amount that industry spend has contracted

DEPLOYMENT CYCLE

- 18M out - order long-lead-time equipment

- 12M out - order machine

- Factory Acceptance Testing, then 1M shipping, 8 weeks installation

- A lot of capex payments are back-ended - only pay significant chunk of the capex cost when the units commence earning revenue

RISKS

- Biggest risk and focus area - building the right team of people around the world to support customers where there is no competition.

- Want to grow as fast as possible, but in a sustainable manner around the world, in some challenging regions

KEY TAKEAWAY THAT MARKET STRUGGLES WITH

- Market struggles to wrap its head around the longevity of the units deployed, the creation of a 20-year long-term annuity revenue stream for each of the deployed units - ~$2m profit per unit deployed per annum over 20 years step increase

- Essentially becoming an infrastructure asset post deployment, but earning very good returns on those assets

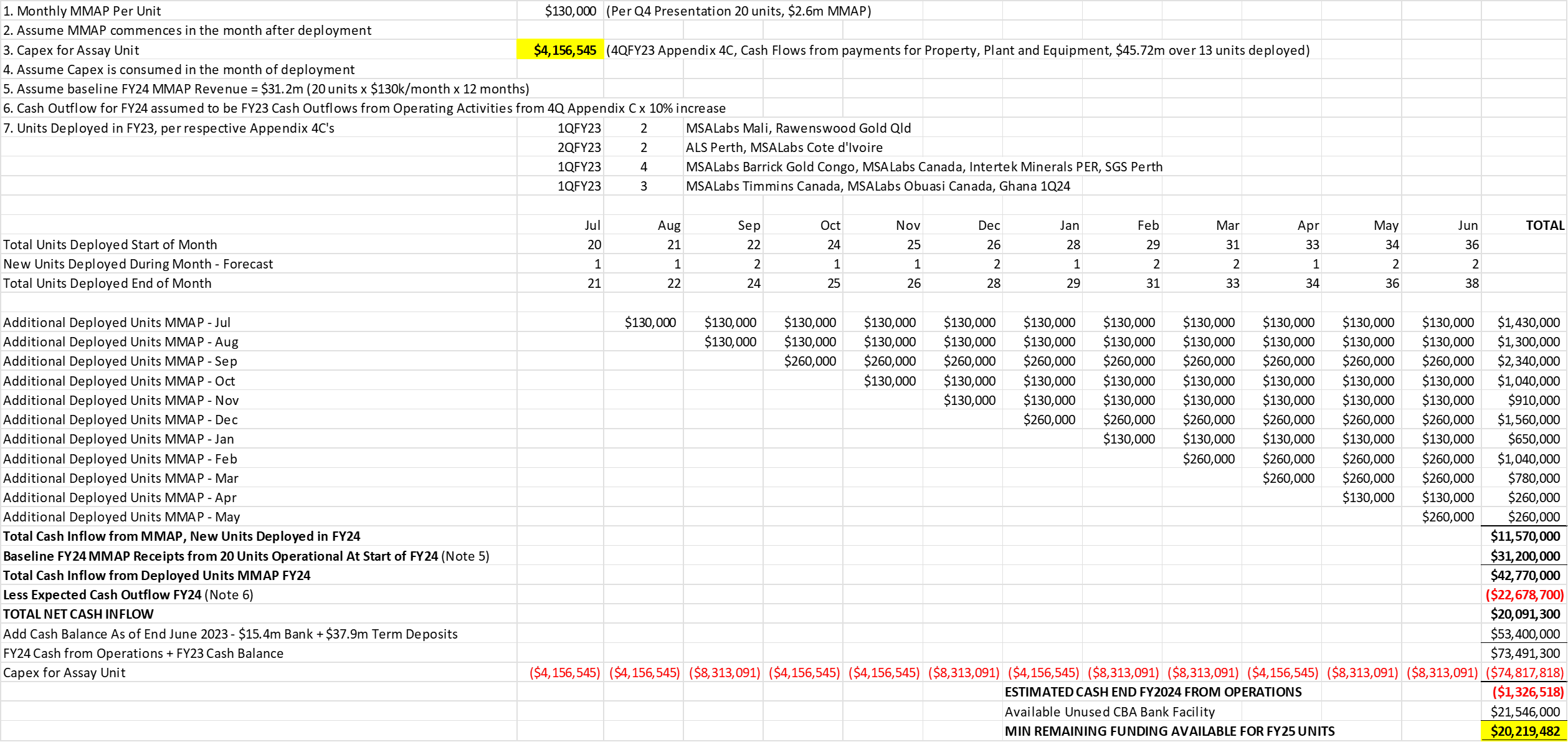

Did a bit more work this evening and updated the C79 cashflow outlook for FY24

Made the following changes to the cash flow xls of 3 weeks ago:

- @RhinoInvestor is correct around the capex per unit. It is looking to be ~$4.16m. Used the Appendix 4C full year capex for PPE, divided by the 11 units deployed during FY23.

- Went through each of the 4 Appendix 4Cs to work out how many units were deployed in FY23 - 10 units in FY23 itself, 1 was due in 1QFY24, have simplistically assumed that they will have spent capex on 11 units, not just the 10, in FY23.

- Added a line for the baseline MMAP cash inflow for the 20 units deployed in FY23 - this is $31.2m

- For FY24 cash outflows, took the full year FY23 Cash Outflow from Operating Activities in the Appendix 4C, bumped up by 10% - C79 expects operational leverage as more units are deployed, not sure how good this estimate is

- Took the exact Cash Balances from the 4C - Bank Balance + Term Deposits

- C79 has available unused CBA Bank Facility of $21.5m as at end FY23.

The cash position at end-FY24 is now looking to be a SHORTFALL of ($1.3m) vs the earlier calculated cash surplus of $29.8m.

There will be ~$20.2m of debt still available at the end of FY24. This can fund ~4.9 FY25 deployment units, which given the FY24 plan, is ~1 Quarter's worth of FY25 deployment.

Funding is thus in place for ~42.9 (20 FY23 + 18 FY24 + 4.9 FY25) of the 49 contracted units.

The CBA facility size thus seems to make good sense, noting that it is contracted when the interest rate cycle has been on the up. A new loan facility sometime mid-FY24 is probably on the cards when the interest rate cycle should hopefully be on its way down. This should cover FY25 + new contracts beyond the current 49.

I do not see any capital raise occurring due purely to operational funding gaps. Indeed, given the high visibility of revenue, costs and funding needs, it will probably be a huge management red flag if they do not get the funding right ...

An opportunistic capital raise, similar to AD8, could be something to look out for in 3Q/4Q FY24, if the share price spikes to say $10-12 from the current ~$6 as a cheaper/more effective way of raising capital vs debt. This could be based on a better-than-expected revenue trajectory and/or a surge in newly contracted sales or expanded breadth of use of the Assay units.

Am happy that I now have a simplistic cash flow model against which to track the cash position during FY24!

Hope this makes sense.

Remaining very bullish on C79 and looking for the opportunity to top up.

@RhinoInvestor , your post got me thinking a bit more deeply about the cashflow for C79 and challenged my bullishness! I knocked up a back-of-envelope cash flow xls to clarify my thought process, hoping it helps answer some of your questions/thoughts.

- The Capex for each unit was derived from the 12M Capex in the Appendix 4C - for 18 units, the calculated Capex is about $39.2m, which sort of lines up with the FY23 Growth Capital Expenditure below which was for 20 units, so I think this $2.17m capex per unit feels "about right"

- I assumed how many units will be deployed by month to make up the 18 planned units in FY24. The deployment is back-ended to make it more cashflow conservative, capex is spent in the month of deployment, and MMAP flows the month after @ $130k per deployed unit - the cash inflow increases each month depending on the number of new units deployed

- Cash Inflow from Ops - I took 3QFY23's Net cash inflow of ~$1m per Q - this is a proxy for cash flow in from the already-deployed 20 units less operating expenses - noting 4QFY23 was net outflow of ($0.6m), but allows for increases in Additional Assay Charges etc.

This super raw calcs point to the min cash surplus end-FY2024 to be shy of $30m, meaning, there should be no need for further drawdown of the CBA facility in FY2024.

Extrapolating into FY25, the Cash surplus of $29.8m should fund roughly 13.67 units in FY2025 without the need for debt. As of now, C79 has 11 units contracted to be deployed in FY2025 (49 contracted less 20 deployed less 18 FY24). Assuming no further sales (highly improbable), C79's cash balance will fund the remaining 11 units for FY25 without resorting to debt.

The $21.5m undrawn facility will, on its own, fund slightly under 10 units. If these 10 units were contracted for delivery in FY2025, total units that need to be deployed in FY25 will be 21 - more or less the same as FY23 and FY24, very much in the ball park.

So, as of now, it appears that it is not unreasonable to conclude that C79 is well funded up to end FY2025 to deploy 21 units through a mixture of debt and cash. With locked in contracts, clear visibility of revenue and cash inflows that stretch into FY25, with funding available for 10 new contracts, I think this is as certain as it will get that C79 will have no reason to capital raise.

I think the key point is the progressive increase in MMAP which flows through as soon as a unit is deployed, so each deployment results in a contracted step up of revenue and cash flow. This is what makes C79 highly attractive in my view.

Completely happy to be corrected on the thought process and assumptions. It helped clear my head a bit anyway!

Discl: Held IRL, looking to top up on weakness

A good set of results from C79. My conviction has increased with each quarter and will be looking to top up on weakness.

Discl: Held IRL (trade did not close on SM)

GOOD

Financials

- FY23 Revenue and EBITDA Prospectus forecasts achieved

- Revenue of $26.8m (vs $26.6m Prospectus forecast); +89% growth on FY22 ($14.2m)

- Total revenue was comprised of Minimum Monthly Assay Payments (MMAP) of $21.3m (FY22: $10.6m) and Additional Assay Charges (AAC) of $4.3m (FY22: $2.9m), with the balance made up from other revenue including the supply of consumable sample jars.

- EBITDA of $3.5m (vs $3.2m Prospectus forecast); +70% growth on FY22 ($2.1m)

- Reflecting Chrysos’ expanding deployment capacity and global footprint.

Cash Position

- Well positioned for ongoing global growth with $53.4m cash in bank and access to $21.5m of undrawn capital from Chrysos’ debt facility with the Commonwealth Bank of Australia (CBA)

- Operating cashflow positive during the year with $4.7m in Net Operating Cash Flow, enabling reinvestment in growth, and the ongoing global deployment of PhotonAssayTM units.

Operations

- 21 PhotonAssayTM units currently deployed, following the installation of one unit in Ghana in Q1 FY24

- 11 new contracts signed in FY23, deepening customer relationships while retaining deployment timing flexibility - total 49 contracts

- Average PhotonAssayTM unit Utilisation was 56%; above Prospectus forecast of 55%

- PhotonAssayTM unit deployments contracted out to 2025

- Chrysos continues to cluster its operations in key regions, with co-located units leading to improved cost efficiencies.

FY24 Guidance

- Total Revenue range of $48m to $58m - wide range is due to variable Additional Assay Charges

- EBITDA range of $7m to $17m - Clustering strategy expected to decrease average unit costs over time

- At least 18 PhotonAssayTM units forecast to be deployed in FY24 - Supported by enhanced deployment and manufacturing capability

NOT SO GOOD

Nothing to not like - it was a solid result and guidance, with a good degree of certainty of being achievable

WHAT TO LOOK OUT FOR

- Position with debt drawdown from the current $8.5m already drawn down to date - cashflow positive in FY23 of $4.7m, additional deployments will add to cashflow, reducing the need to draw down further debt

- PhotonAssay units is driving further site-based improvement opportunities which increase sample volumes - extent of these improvements on sample volumes/revenue and average unit utilisation in FY24

- Proportion of Mine-Site wins vs Lab wins in new contracts

SUMMARY

Solid result with good forward visibility

It is all about deployment excellence in deploying the new PhotonAssay units - everything else follows from that - good momentum and track record thus far inspires confidence

C79 came out of a 2 day Trading Halt followed by a 1 day Voluntary Suspension in response to the ASX Speeding Ticket as the price rocketed from from a close of $4.95 on Wednesday, 9 August 2023 to a high of $6.10 on Tuesday, 15 August 2023 following daily increases starting on Thursday, 10 August 2023.

Was super pleased with this price rocket as I topped up at $4.95 on Wed 9 Aug ...

No new news or announcements in C79’s response to the ASX speeding ticket. Not unsurprising as C79 is well capitalised, so there was little risk of a capital raise or share placement.

2 points that I took away from the announcement, that I did not fully appreciate before, in italics:

- Historically, the Company’s units have mainly been deployed to laboratory customers. Recently, the Company’s focus has shifted towards deployment at mining sites and the Company is discussing proposals to this effect. The significance of direct deployment to mining sites is that it demonstrates gold miners’ increasing confidence in the Company’s PhotonAssayTM technology over traditional assay methods (such as fire assay). Increased engagement with direct to mine site customers has the ability to significantly accelerate the rate of adoption of PhotonAssayTM.

Any minesite deployment/re-deployment or sales win will be more positive news vs a laboratory-win.