Have watched the recording of the Friday 26th July meeting which was quite informative and helpful in outlining some of the financials, business strategy and challenges faced in selling the photon assay product. Thanks to @Strawman for organising this session

Although Dirk presented well, my overall feeling is that there is still more work to do in terms of converting people's mindsets and getting the right customer mix.

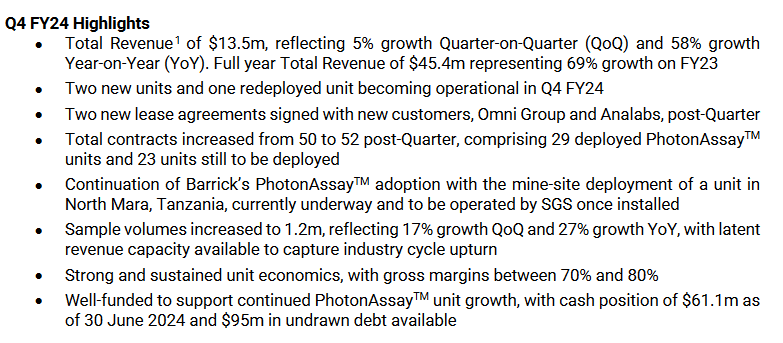

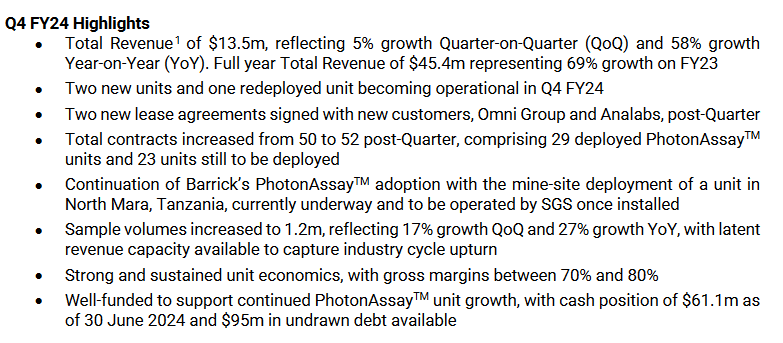

In regards my question on EBITDA guidance, while I agree the redeployment from Perth to the goldfields would improve margins by being closer to the action, my question was more about the guidance given in April 3 months ago ....

versus the actual result (no EBITDA mentioned in FY24 highlights, just the revenue)

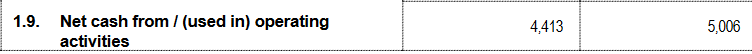

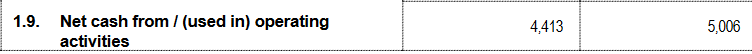

So I assume from checking 1.9 and the summary, the EBITDA result fell below guidance stated in Q3FY24 as a result of the redeployment which probably was a one-off, it would have been good to confirm. Or maybe this Q3FY24 guidance was a typo and meant for FY25?

I took the opportunity to exit on Friday after the price recovered and use this to offset returns from ALU, CMM and DXB while needing the cash for other reasons - as usual did not time my trade well. But will continue to watch.