I've just started researching Chrysos in some detail and there's a decent amount of App 4C history which I am attempting to use in AI to collate and look for trends, instead of having to punch it all in manually.

However, this will have to be a one time thing because they've published their last App 4C - https://www.marketindex.com.au/asx/c79/announcements/cessation-of-quarterly-reporting-obligations-2A1588363.

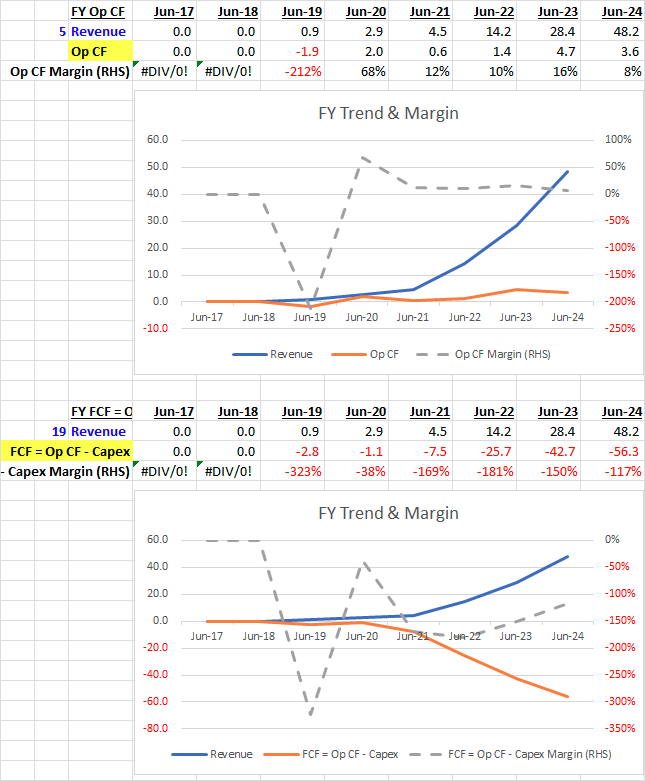

This is a bit disappointing because they are burning a lot of cash (FCF = Op CF less Capex) but the ASX requirements for App 4C apparently only relates to Op CF.

In FY24 they had Op CF of +3.6m but Capex of 59.9m (FCF = -56.3m). With a net Cash balance of 58.5m they have about 12 months left at this rate. Seems an odd time to stop publishing App 4C's.

To be clear, Chrysos are doing nothing wrong here as it's all within the listing rules but it's a little frustrating that companies are allowed to give less info on cash flows when they are burning so fast and have been relying on cap raises to fund themselves.

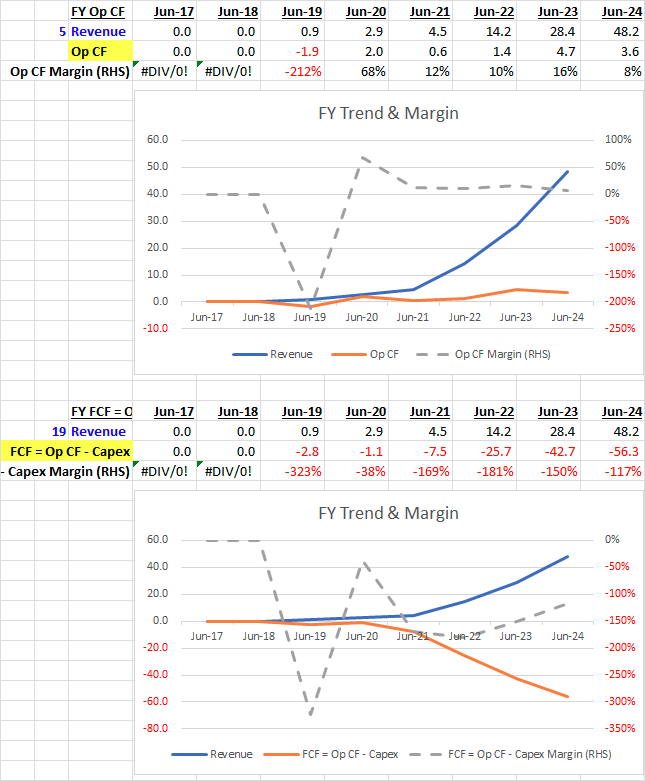

The below shows what I'm banging on about.

First diagram shows Op CF is low, relatively stable but positive.

Second diagram shows FCF is going in the opposite direction to Revenue.

Rant over.

Disc: Not Held