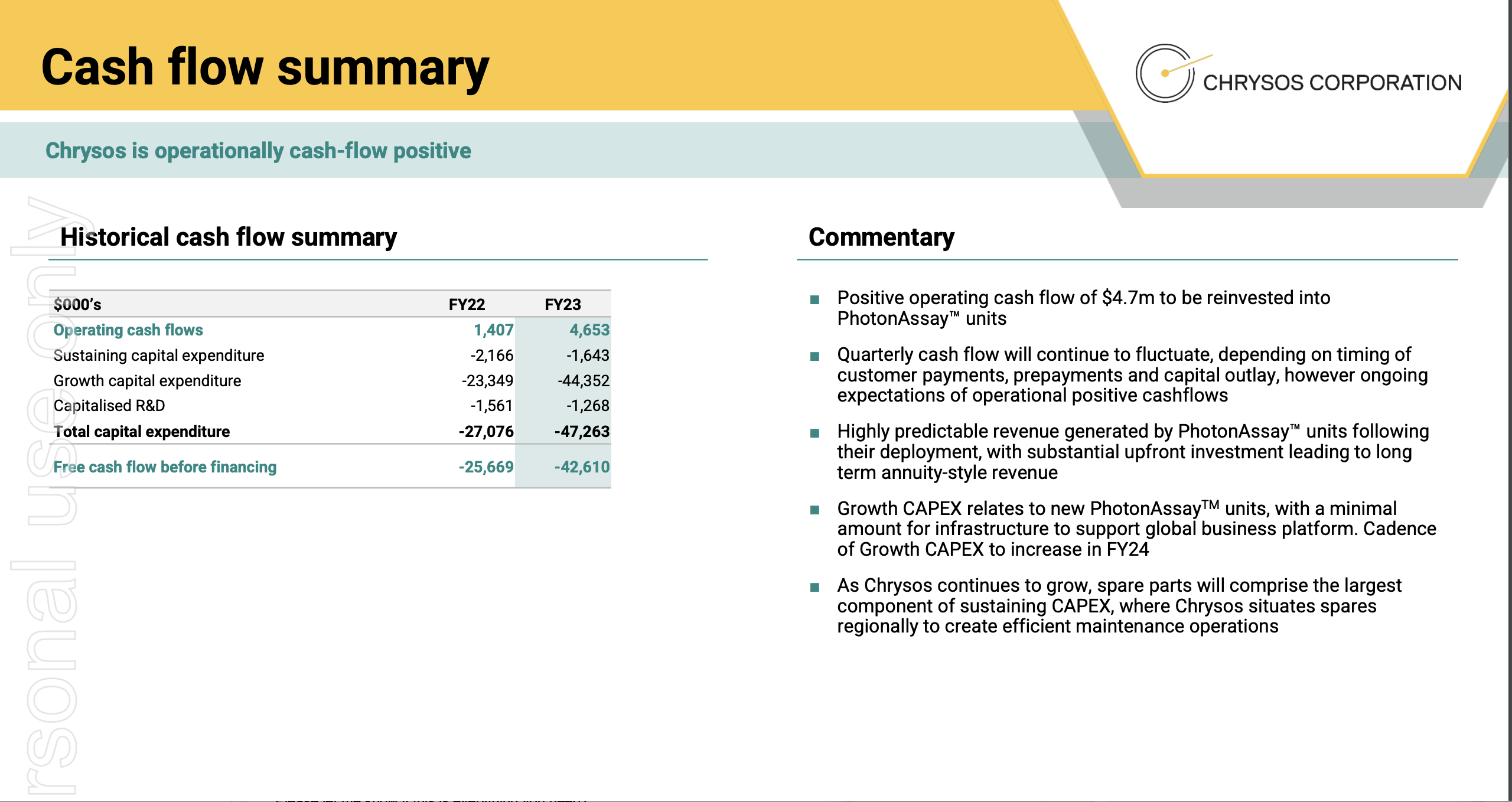

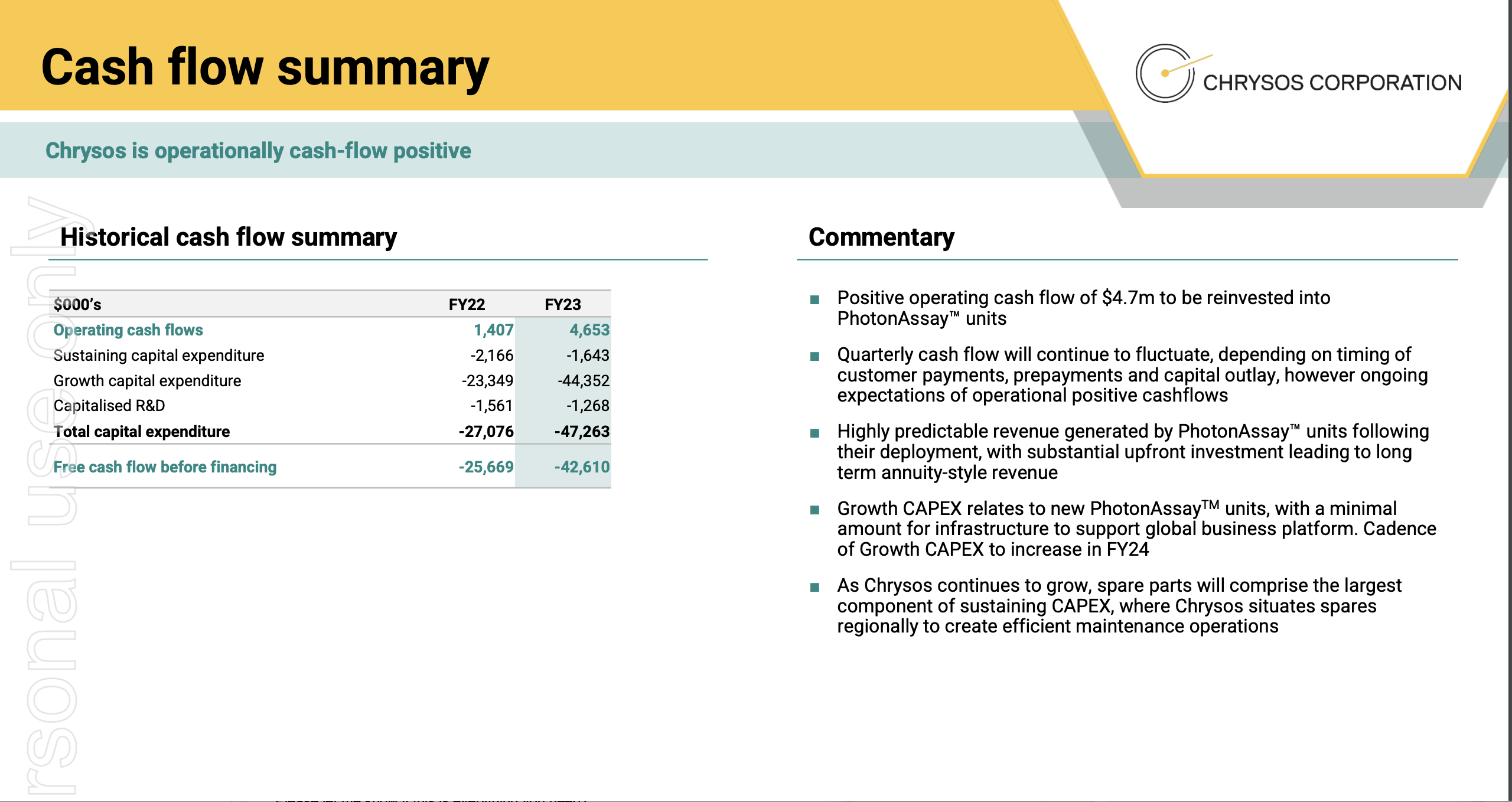

Is C79 going to need to raise "Growth CAPEX" in FY24?

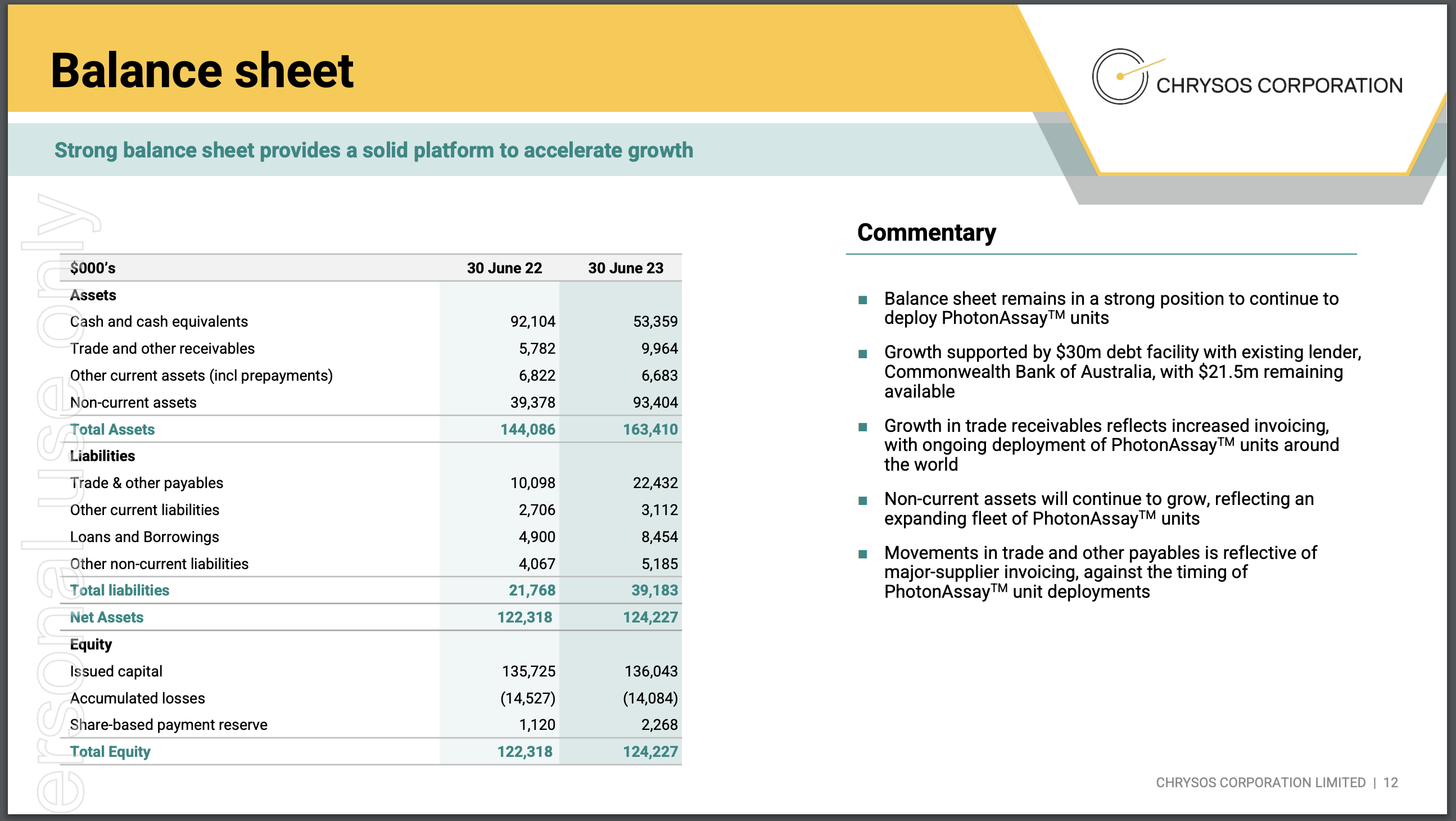

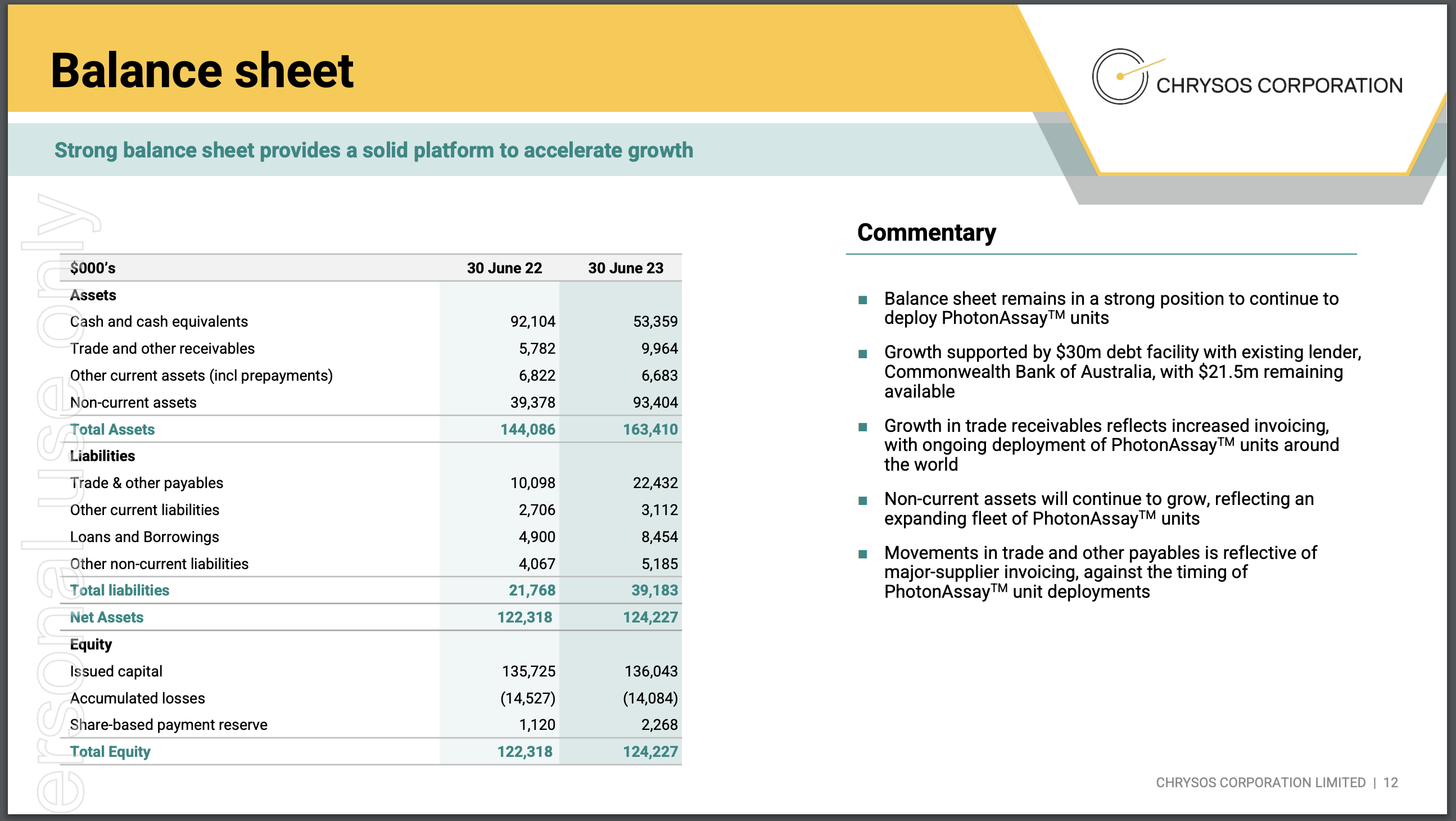

- Given their balance sheet shows 93m for 20 or 21 machines thats ~$4.65m per machine.

- With plans to deploy 18 machines this year they need ~$84m capital.

- It looks like this could be a close shave given they have access to 54m cash + 21m undrawn loan facility plus 7-17m EBITDA forecast. (~82-92m)

I'm hoping these guys can manage their cash flow so they don't have to shake the tin again with investors to be able to meet FY25 plans ...

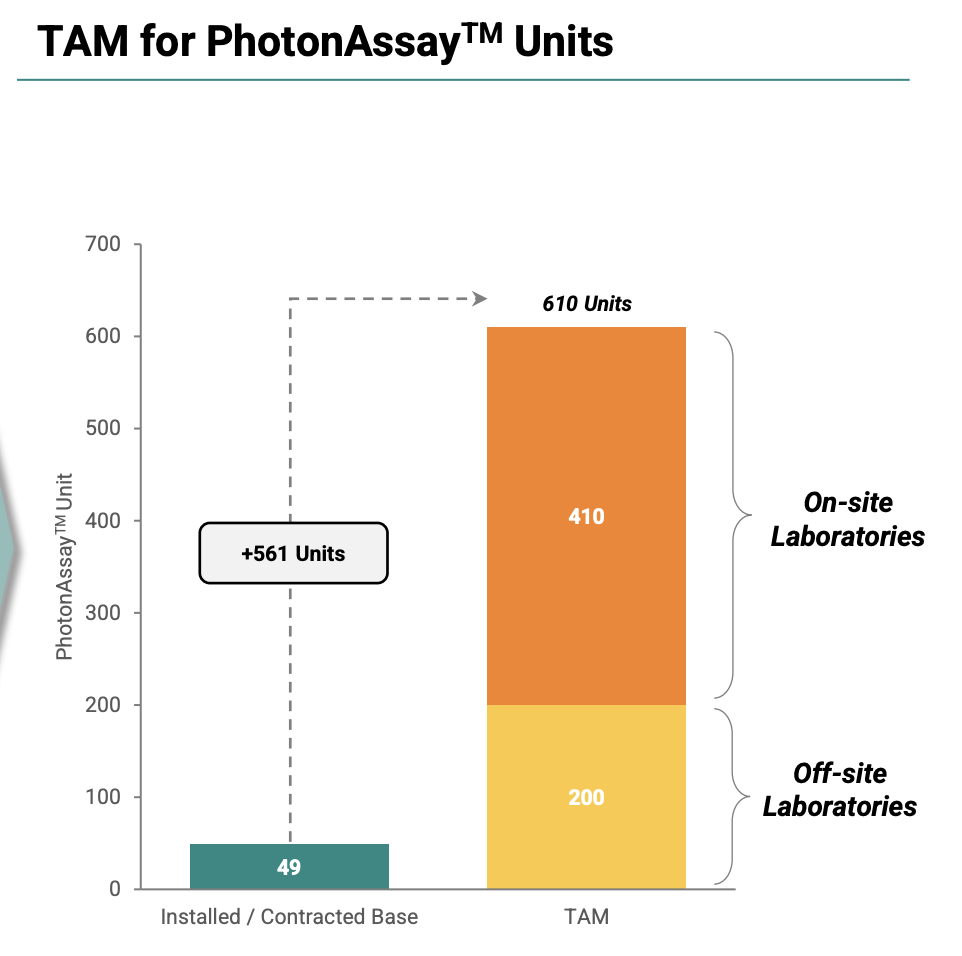

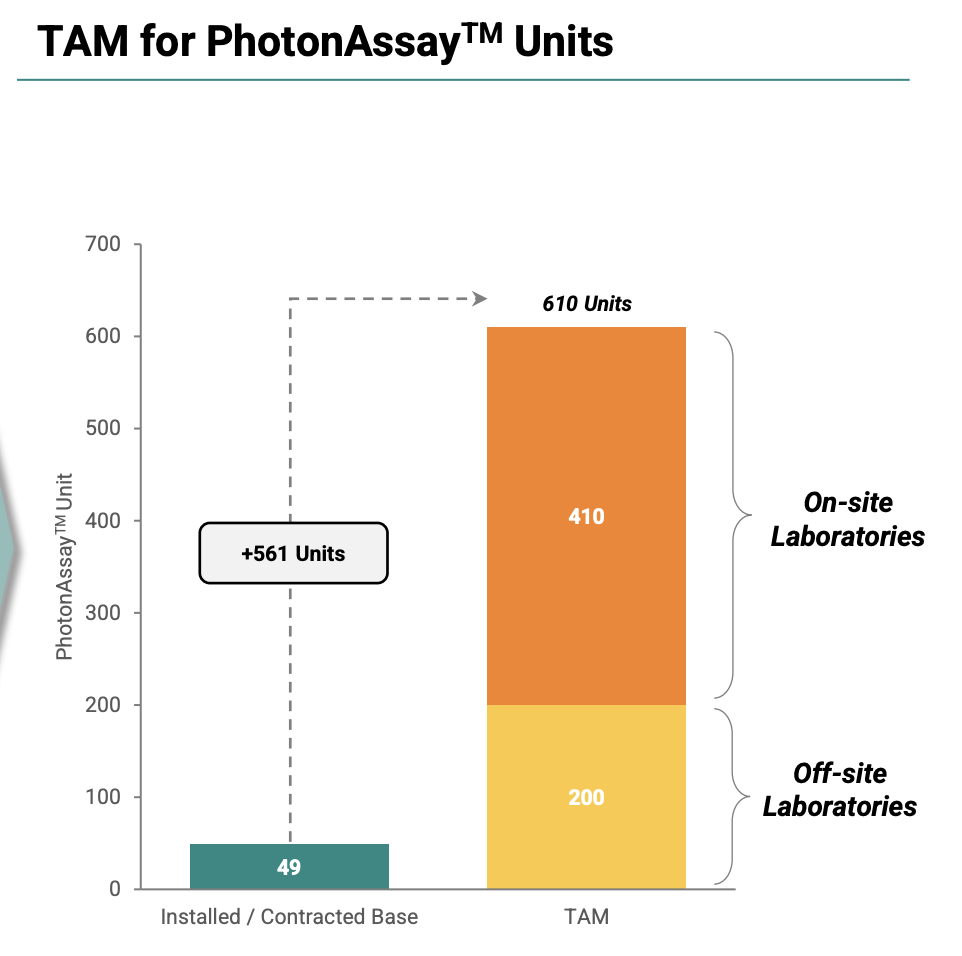

- Looks like 10 more machines in the backlog for FY25 (to get to the 49 contracted machines less the 21 already deployed and 18 to deploy in FY24) so another ~45m capital required from somewhere

- That's before they even sell any additional machines this year to grow their backlog further towards the TAM.

The prospect of further dilution is my biggest fear with this company to support what they describe as "Cadence of Growth CAPEX to increase in FY24" ... anyone able to share their opinion?

Its a very capital intensive business if they are going to be able to grow into their TAM. Looks to me like they are going to run out of capital before they get to 10% of the way there.

Unit economics still look pretty good but I'm struggling to see when the Operating Expenses might tail off.

- about 4.5m capex per machines

- about 1.55m revenue per annum per machine (just the Minimum monthly payments based on 2.6m per month for 20 machines 2.6 / 20 * 12)

- What I can't work out is the personnel costs and whether the 19.44m of Operating expenses is scaled to support deployment of 10 machines per annum (FY23) or 18 machines per annum (FY24). The team seems to have scaled from 55 to 116 according to the annual report.

- Just going back through the last few years

- FY21 7 machines and 32 staff = 4.6 staff/machine

- FY22 11 machines and 52 staff = 4.7 staff/machine

- FY23 21 machines and 116 staff = 5.5 staff/machine

- FY24 39 machines and ??? staff = ??? staff/machine