Like in the story Goldilocks, Lindsay Australia thrives when the climate conditions are “just right”! Its annual profitability to some extent depends on the weather. It can’t be too wet, or too dry…it needs to be “just right”. After owning a farming and cattle business for 30 years and knowing what it’s like to be at the mercy of the weather, you’d think I’d know better than to be dabbling in a business that is influenced by weather, fuel prices, market values, AUD exchange rate, the rural economy etc etc. Then throw in the economics and consumer demand for refrigerated transport!

FY2024 Result

Last Year Lindsay saw a dip in earnings because it was too wet during Q324. Unusual wet conditions disrupted earnings in both the road and rail transport, and the rural business.

Despite adverse conditions in Q324 Lindsay posted revenues of $804.4m, up 18.9% on FY23. Like-for-like operations grew 6% to $717m, with Hunter's 11 months of operations contributing $87m. Underlying earnings before interest, tax, depreciation and amortisation (EBITDA) was up 2.1% to $92.1 million. Profit after tax of $30.4 million was 17% down on FY23, also impacted by a $10m increase in interest and depreciation charges associated with the $128m capital investment over the previous two years (FY24 Annual Report)

Transport Division

Despite a difficult Q324, the Transport division grew sales by $52 million over FY23. The division performed well in disrupted conditions, benefiting from investment in fleet and facilities. Rail continued to grow with revenue increasing by $26m, and now represents 27% of transport sales, up from 24% last year. The majority of transport growth came from metro-to-metro lanes compared to a softening in regional lanes.

Rural Division

In FY24 the Rural division's sales were down by 6.6% to $152 million. Lower grower confidence, lower cost prices, and sales competition on major commodities impacted prices on most of the large volume lines. Alternatively, packaging sales were positive compared to FY23, which was driven by new customers. In the Rural business, volumes commenced recovering in Q424 with EBITDA landing at $9.1m, only $868k less than FY23.

Lindsay reported that the Hunters team settled in well with the business being part of Lindsay for 11 months at the end of FY24. Hunters provide geographical and product diversification to the Lindsay Rural business. Rural revenue has shifted from a ~80% concentration in Queensland to a more balanced ~50%. Comparable full-year retail sales of $69.2m were down $4.9m on FY23. Hunters contributed $3.3m in EBITDA for the year.

In August 2024, Lindsay added two more rural stores to the Hunter portfolio by acquiring ex-CRT stores in Nagambie and Seymour. The Nagambie and Seymour stores were purchased off-market and operate in a fast-growing equine and hobby farm corridor. These stores provide additional scale and reach to the Hunter business whilst the store operations benefit from improved product range, buying power and supply chain optimisation.

Outlook

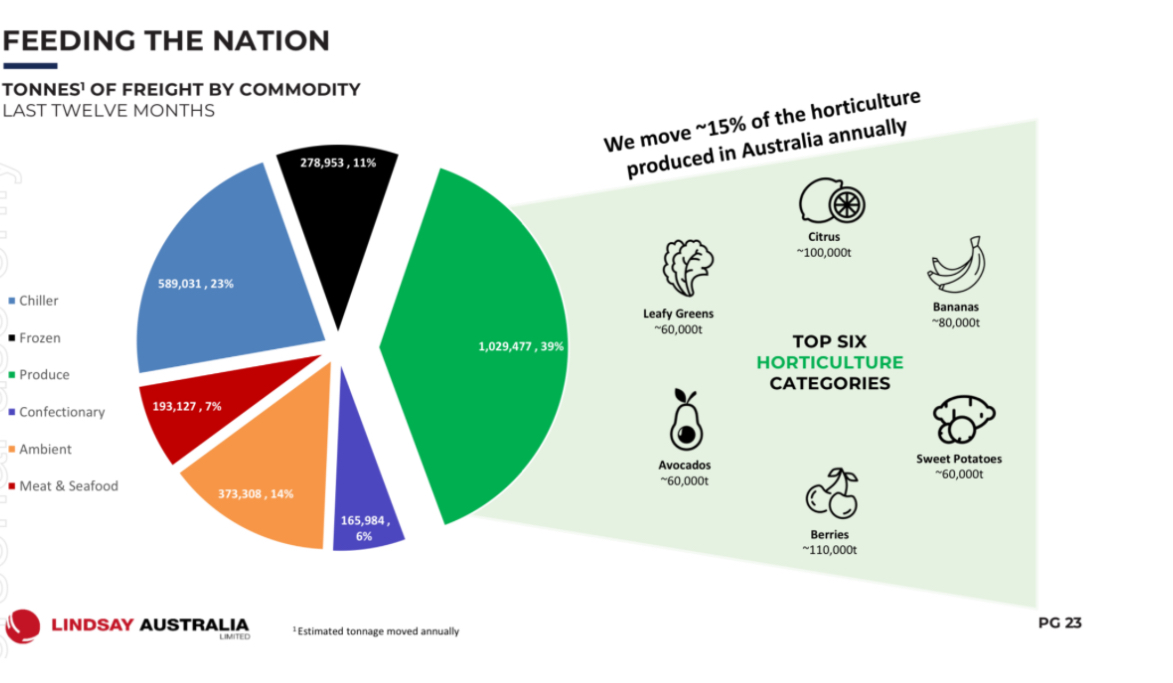

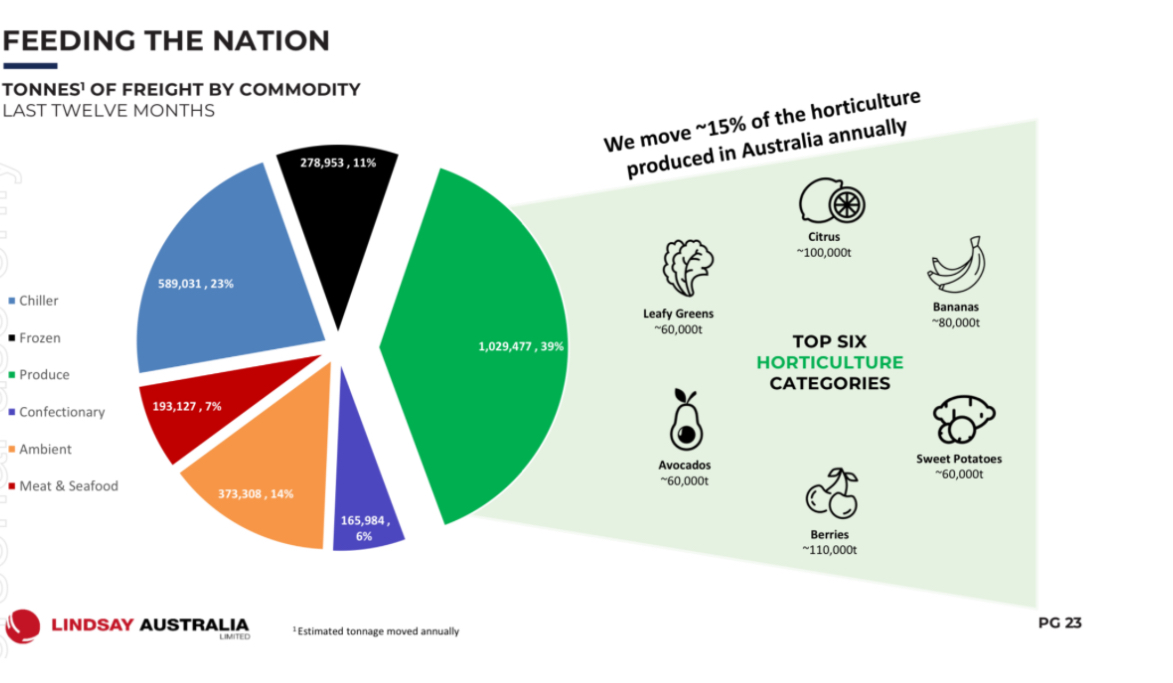

The Lindsay business model is unique and faces two large and growing markets – The horticultural sector of the agricultural market and the refrigerated cold chain sector of the transport market.

After 4 months into FY25 trading, Lindsay was experiencing a gradual improvement in horticultural market conditions in the rural and regional transport business, a lift in metro-to-metro commercial transport volumes and a slow recovery in Hunters trading conditions.

In transport, horticultural volumes are down 6% compared to last year; however, grocery and commercial volumes were up 5%, resulting in transport revenue, excluding fuel recoveries, being 3.5% ahead of FY24.

Rural sales were also up 3.5% from last year, which Lindsay said provides a positive indicator for future horticultural volumes, weather permitting.

There is expected to be a gradual lift in horticultural volumes and rural sales as growing conditions improve and farmers benefit from plentiful water supplies.

FY2023 - Breakdown of freight by commodity (Lindsay Australia)

The long term prospects

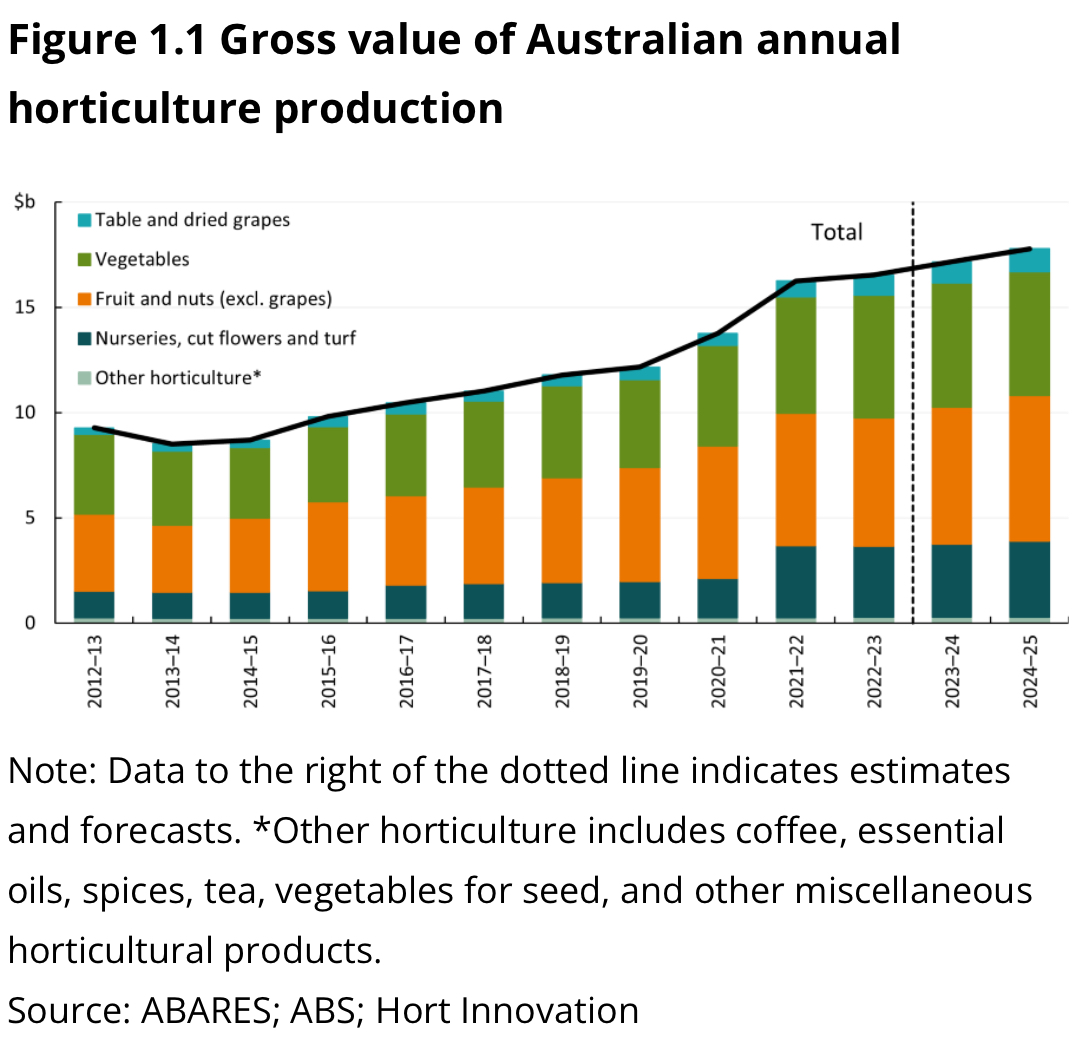

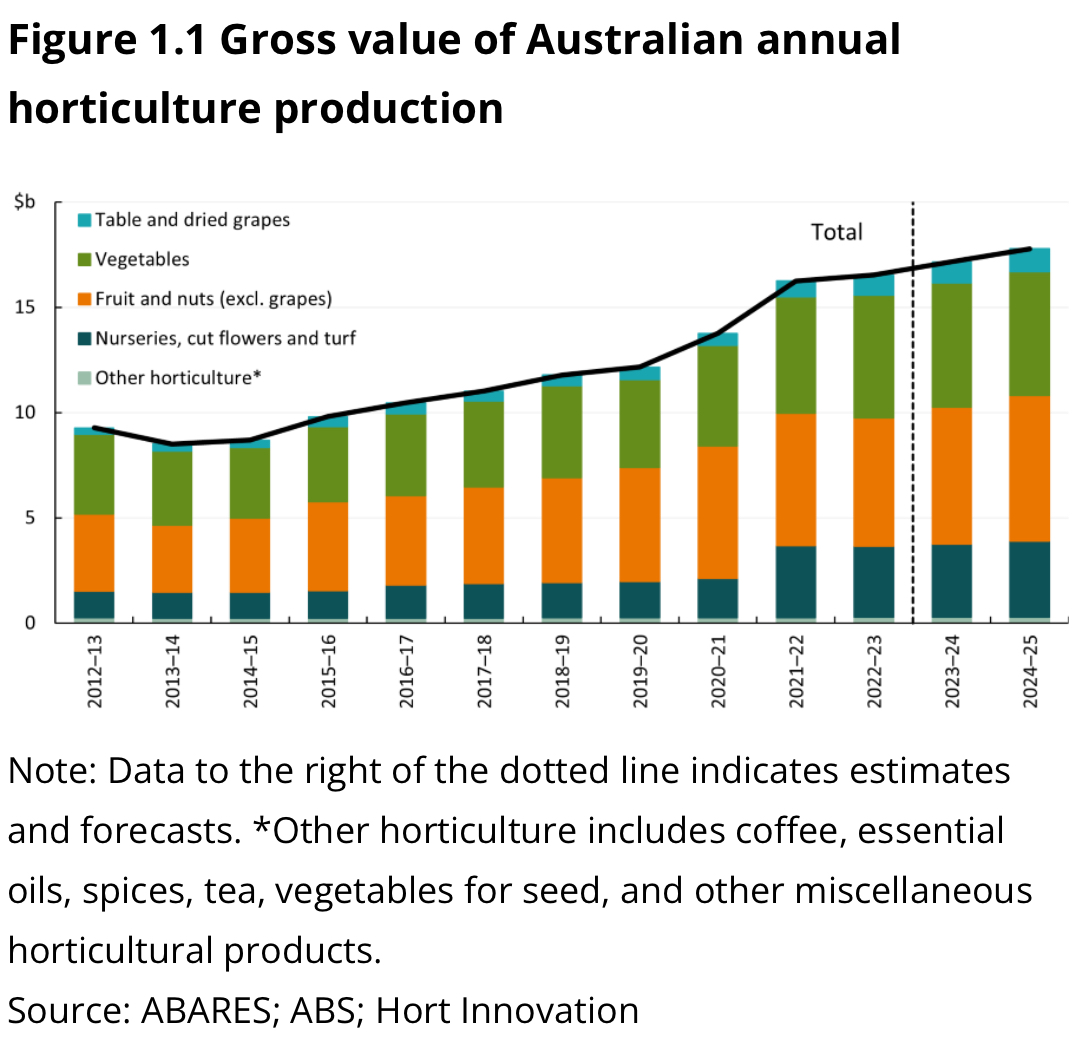

Lindsay should benefit from a growing Australian Horticulture industry (https://www.agriculture.gov.au/abases/research-topics/agricultural-outlook/horticulture#value-of-production-to-reach-a-record-high)

“The gross value of horticulture production is forecast to rise to a record $17.8 billion in 2024–25, up 4% from the previous record of $17.2 billion in 2023–24 (Figure 1.1). Rising production values reflect increased production volumes and higher prices for export focussed industries. Average to above-average seasonal conditions in key growing regions and more trees reaching maturity are forecast to lead to higher yields of fruit and nuts. Prices for export focussed industries such as citrus, nuts, and table grapes are expected to increase, driven by rising global demand from high value markets such as China, Japan and Korea. However, growth in horticultural demand is expected to outpace modest growth in global supply, increasing global prices.

The gross value of horticulture production in 2024–25 is forecast to be around $330 million higher than the forecast in the June 2024 Agricultural Commodities Report. This reflects an upward revision to production volumes for fruit and nuts.

Valuation

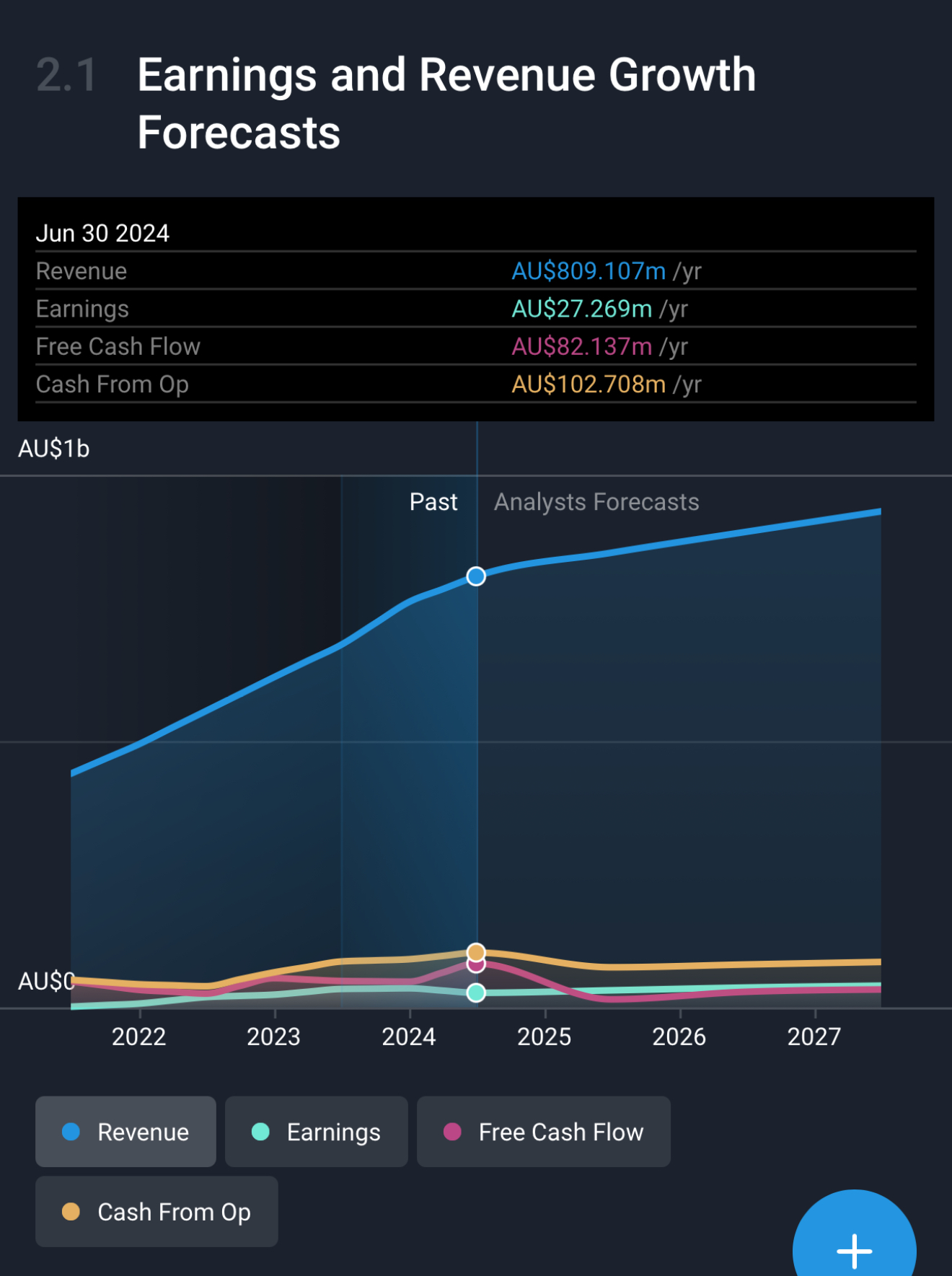

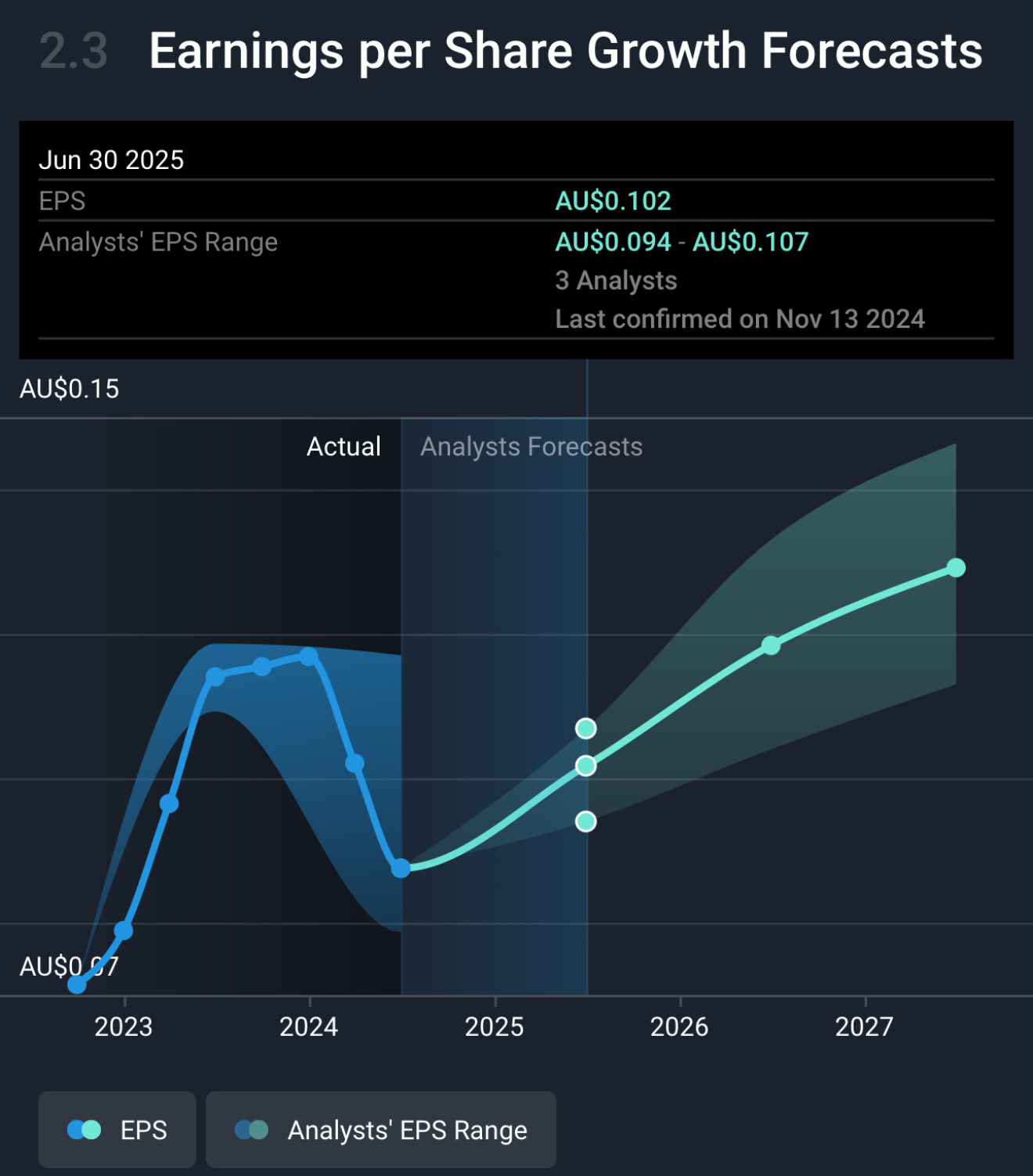

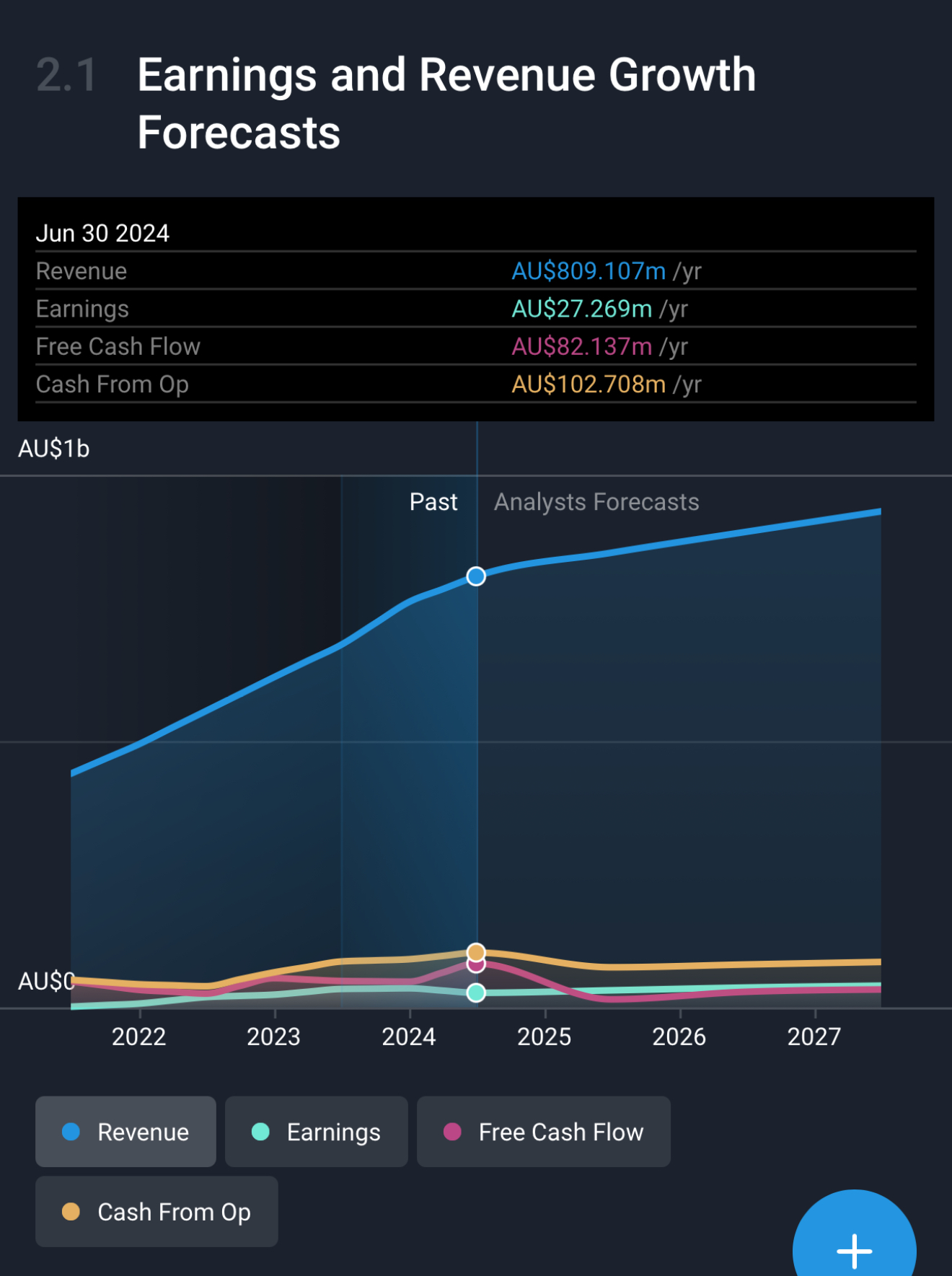

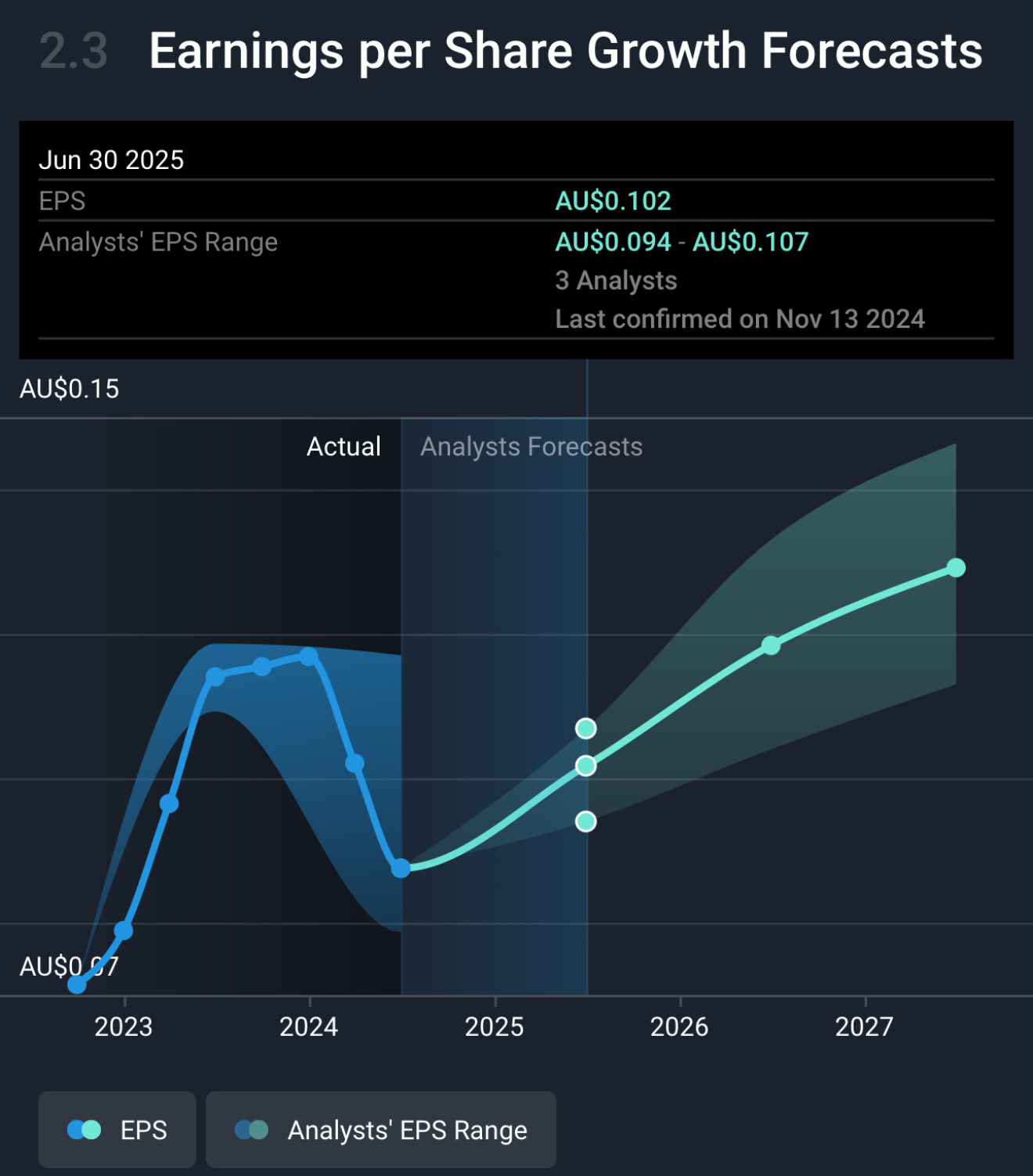

Analyst consensus on Simply Wall Street is for Lindsay’s earnings to grow by 13% per year over the next few years. Given there was a set back last year due to adverse wet weather, and the horticultural industry has a 4% growth tailwind, this could be possible. Assuming analyst consensus, future ROE would be over 21%. I’m going to pull this back slightly to 20% for valuation purposes.

Source: Simply Wall Street

Using McNiven’s Formula and assuming future ROE of 20%, current shareholder equity of $0.48 per share, 44% of earnings reinvested, 56% of earnings returned to shareholders as fully franked dividends (approx 8% gross yield, including franking credits), and requiring a 13% total annual return, I get a valuation of $1.10. This is down from my previous valuation of $1.20 in April 2024. I’ve added some on weakness lately below 85cps. I think it’s good buying at that price!

Held IRL (2.4%)