Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

What a horrible 2HFY25 – it truly demonstrated the impact of natural weather events on companies like LAU with its heavy emphasis on horticulture, agriculture and a big need to use the road system where costs pressures exist big time in fuel and labour.

1HFY25 NPAT of $14.655m or $0.047 eps versus @H of just $2.735m or $0.01 eps! Ironically on much the same Revenue ($422m in 2H and $427m in 1H).

No question about the culprits – cost blow outs (as a % of revenue) have occurred in materials/transport and labour (including subcontractors)- these being the major costs. As a group, these costs as a % of revenue have increased from 78% in 1H23 to now 83.1% in 2HFY25. That 5% ‘nosebleed’ accounts for some $42m in lost NPBT in FY25!

I don’t doubt for a minute the right of the company to blame competition for an inability to pass on cost increases & natural weather events. Bring on their diversification plan and greater use of intermodal freight, particularly rail.

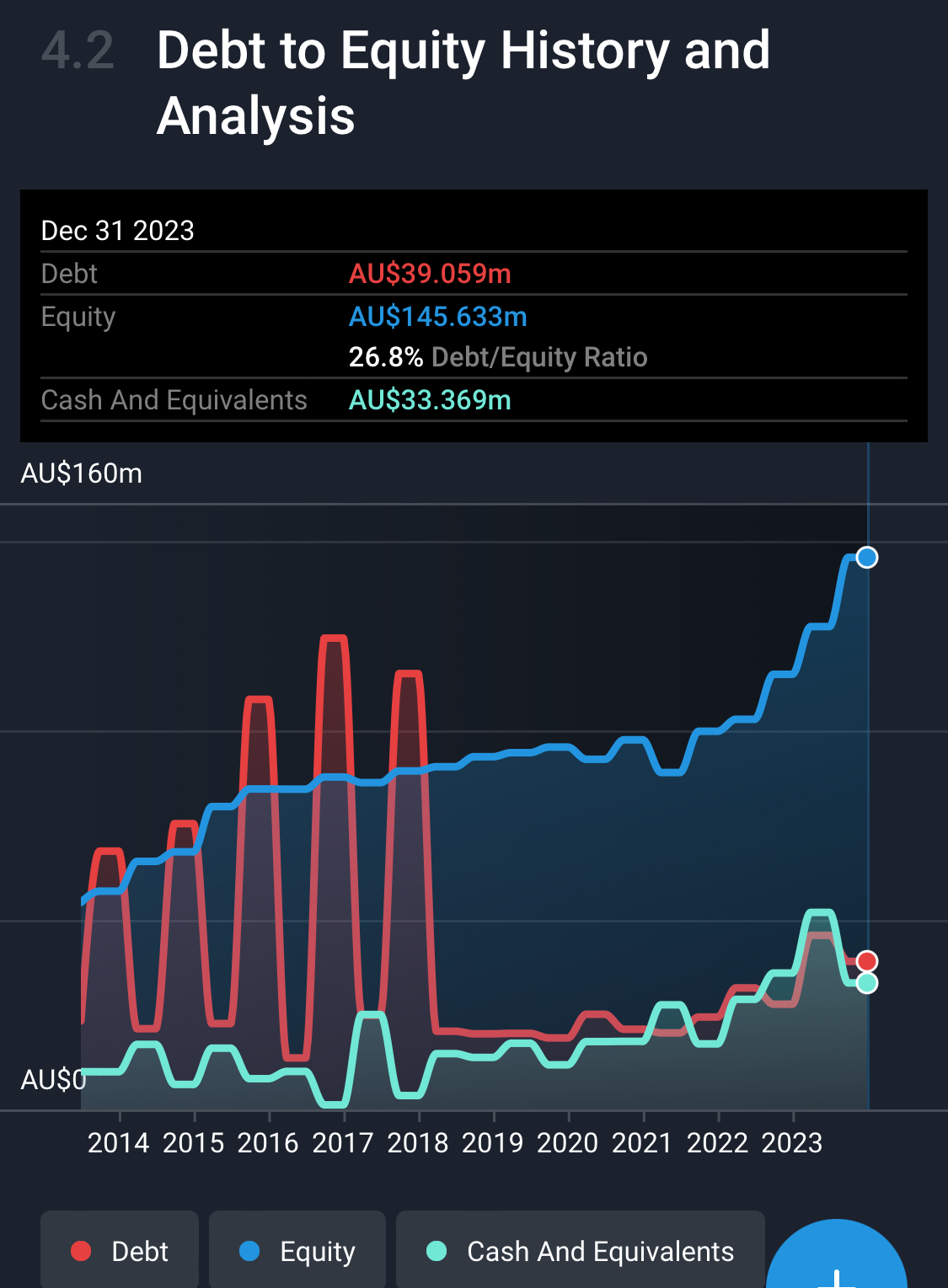

The only kind thing that can be said about 2H was their ability to bring in the cash (Cash Ops 2H were $46m v just $24m in 1H). Overall, the company is good at capital allocation with net debt to equity at just 3% and this after a massive $76m debt build.

Overall, FY25 for mine, costs LAU the title of a consistently good earner as demonstrated by ROE which has dropped from 18% to just 11% and ROA from a paltry 5% to a very, very underwhelming 2.8%. Maybe LAU is just another agricultural style business reliant on 1 fabulous year out of 7.

That said, LAU do have some things going for them.

Their #1 position in refrigeration and their scale and diversity of usage (road, rail and sea) gives them some competitive distinction and a small moat.

Equally their push into ‘value add’ via packaging & rural wholesaling/retailing via WB Hunter gives them an edge.

Plus, I like their push across the continent to WA and their intermodal use of rail. So I’m hoping FY26 will bring more sunshine, fewer cyclones and rain forced road closures. Also, I’ll be super keen to see them roll out their diversification plan and specifically the bedding down of the SRT acquisition as well as getting costs (materials, transport and labour costs) under control – hopefully less than 82% of revenue!

The key metric for mine is the FY26 improvement in underlying ROIC from FY25 of 14% back up to 20%+

Overall, I can see LAU (with the benefit of SRT for a full year) churning out an FY26 eps of between 9.5c and 12c – but watch the clouds.

Like in the story Goldilocks, Lindsay Australia thrives when the climate conditions are “just right”! Its annual profitability to some extent depends on the weather. It can’t be too wet, or too dry…it needs to be “just right”. After owning a farming and cattle business for 30 years and knowing what it’s like to be at the mercy of the weather, you’d think I’d know better than to be dabbling in a business that is influenced by weather, fuel prices, market values, AUD exchange rate, the rural economy etc etc. Then throw in the economics and consumer demand for refrigerated transport!

FY2024 Result

Last Year Lindsay saw a dip in earnings because it was too wet during Q324. Unusual wet conditions disrupted earnings in both the road and rail transport, and the rural business.

Despite adverse conditions in Q324 Lindsay posted revenues of $804.4m, up 18.9% on FY23. Like-for-like operations grew 6% to $717m, with Hunter's 11 months of operations contributing $87m. Underlying earnings before interest, tax, depreciation and amortisation (EBITDA) was up 2.1% to $92.1 million. Profit after tax of $30.4 million was 17% down on FY23, also impacted by a $10m increase in interest and depreciation charges associated with the $128m capital investment over the previous two years (FY24 Annual Report)

Transport Division

Despite a difficult Q324, the Transport division grew sales by $52 million over FY23. The division performed well in disrupted conditions, benefiting from investment in fleet and facilities. Rail continued to grow with revenue increasing by $26m, and now represents 27% of transport sales, up from 24% last year. The majority of transport growth came from metro-to-metro lanes compared to a softening in regional lanes.

Rural Division

In FY24 the Rural division's sales were down by 6.6% to $152 million. Lower grower confidence, lower cost prices, and sales competition on major commodities impacted prices on most of the large volume lines. Alternatively, packaging sales were positive compared to FY23, which was driven by new customers. In the Rural business, volumes commenced recovering in Q424 with EBITDA landing at $9.1m, only $868k less than FY23.

Lindsay reported that the Hunters team settled in well with the business being part of Lindsay for 11 months at the end of FY24. Hunters provide geographical and product diversification to the Lindsay Rural business. Rural revenue has shifted from a ~80% concentration in Queensland to a more balanced ~50%. Comparable full-year retail sales of $69.2m were down $4.9m on FY23. Hunters contributed $3.3m in EBITDA for the year.

In August 2024, Lindsay added two more rural stores to the Hunter portfolio by acquiring ex-CRT stores in Nagambie and Seymour. The Nagambie and Seymour stores were purchased off-market and operate in a fast-growing equine and hobby farm corridor. These stores provide additional scale and reach to the Hunter business whilst the store operations benefit from improved product range, buying power and supply chain optimisation.

Outlook

The Lindsay business model is unique and faces two large and growing markets – The horticultural sector of the agricultural market and the refrigerated cold chain sector of the transport market.

After 4 months into FY25 trading, Lindsay was experiencing a gradual improvement in horticultural market conditions in the rural and regional transport business, a lift in metro-to-metro commercial transport volumes and a slow recovery in Hunters trading conditions.

In transport, horticultural volumes are down 6% compared to last year; however, grocery and commercial volumes were up 5%, resulting in transport revenue, excluding fuel recoveries, being 3.5% ahead of FY24.

Rural sales were also up 3.5% from last year, which Lindsay said provides a positive indicator for future horticultural volumes, weather permitting.

There is expected to be a gradual lift in horticultural volumes and rural sales as growing conditions improve and farmers benefit from plentiful water supplies.

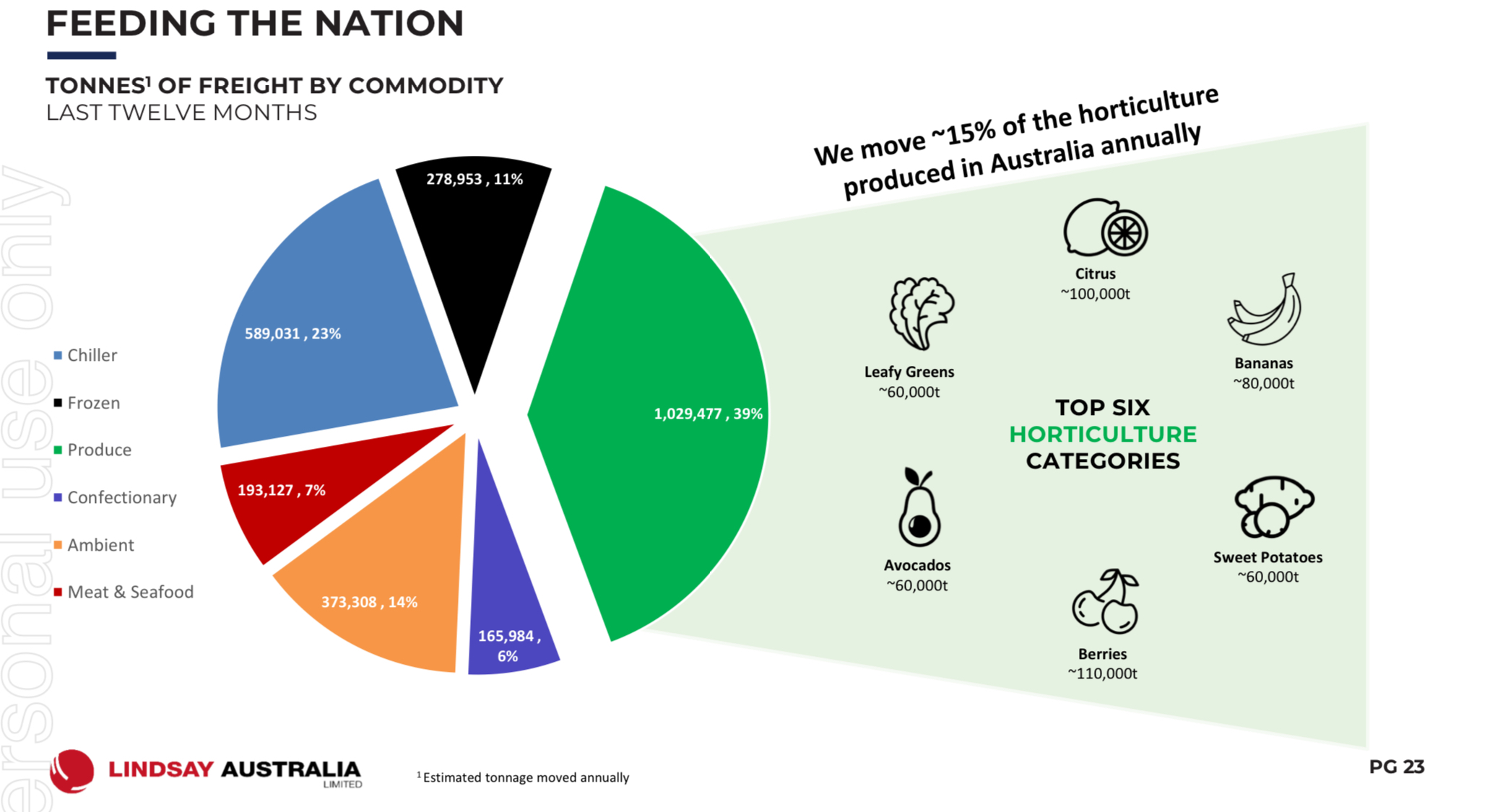

FY2023 - Breakdown of freight by commodity (Lindsay Australia)

The long term prospects

Lindsay should benefit from a growing Australian Horticulture industry (https://www.agriculture.gov.au/abases/research-topics/agricultural-outlook/horticulture#value-of-production-to-reach-a-record-high)

“The gross value of horticulture production is forecast to rise to a record $17.8 billion in 2024–25, up 4% from the previous record of $17.2 billion in 2023–24 (Figure 1.1). Rising production values reflect increased production volumes and higher prices for export focussed industries. Average to above-average seasonal conditions in key growing regions and more trees reaching maturity are forecast to lead to higher yields of fruit and nuts. Prices for export focussed industries such as citrus, nuts, and table grapes are expected to increase, driven by rising global demand from high value markets such as China, Japan and Korea. However, growth in horticultural demand is expected to outpace modest growth in global supply, increasing global prices.

The gross value of horticulture production in 2024–25 is forecast to be around $330 million higher than the forecast in the June 2024 Agricultural Commodities Report. This reflects an upward revision to production volumes for fruit and nuts.

Valuation

Analyst consensus on Simply Wall Street is for Lindsay’s earnings to grow by 13% per year over the next few years. Given there was a set back last year due to adverse wet weather, and the horticultural industry has a 4% growth tailwind, this could be possible. Assuming analyst consensus, future ROE would be over 21%. I’m going to pull this back slightly to 20% for valuation purposes.

Source: Simply Wall Street

Using McNiven’s Formula and assuming future ROE of 20%, current shareholder equity of $0.48 per share, 44% of earnings reinvested, 56% of earnings returned to shareholders as fully franked dividends (approx 8% gross yield, including franking credits), and requiring a 13% total annual return, I get a valuation of $1.10. This is down from my previous valuation of $1.20 in April 2024. I’ve added some on weakness lately below 85cps. I think it’s good buying at that price!

Held IRL (2.4%)

About

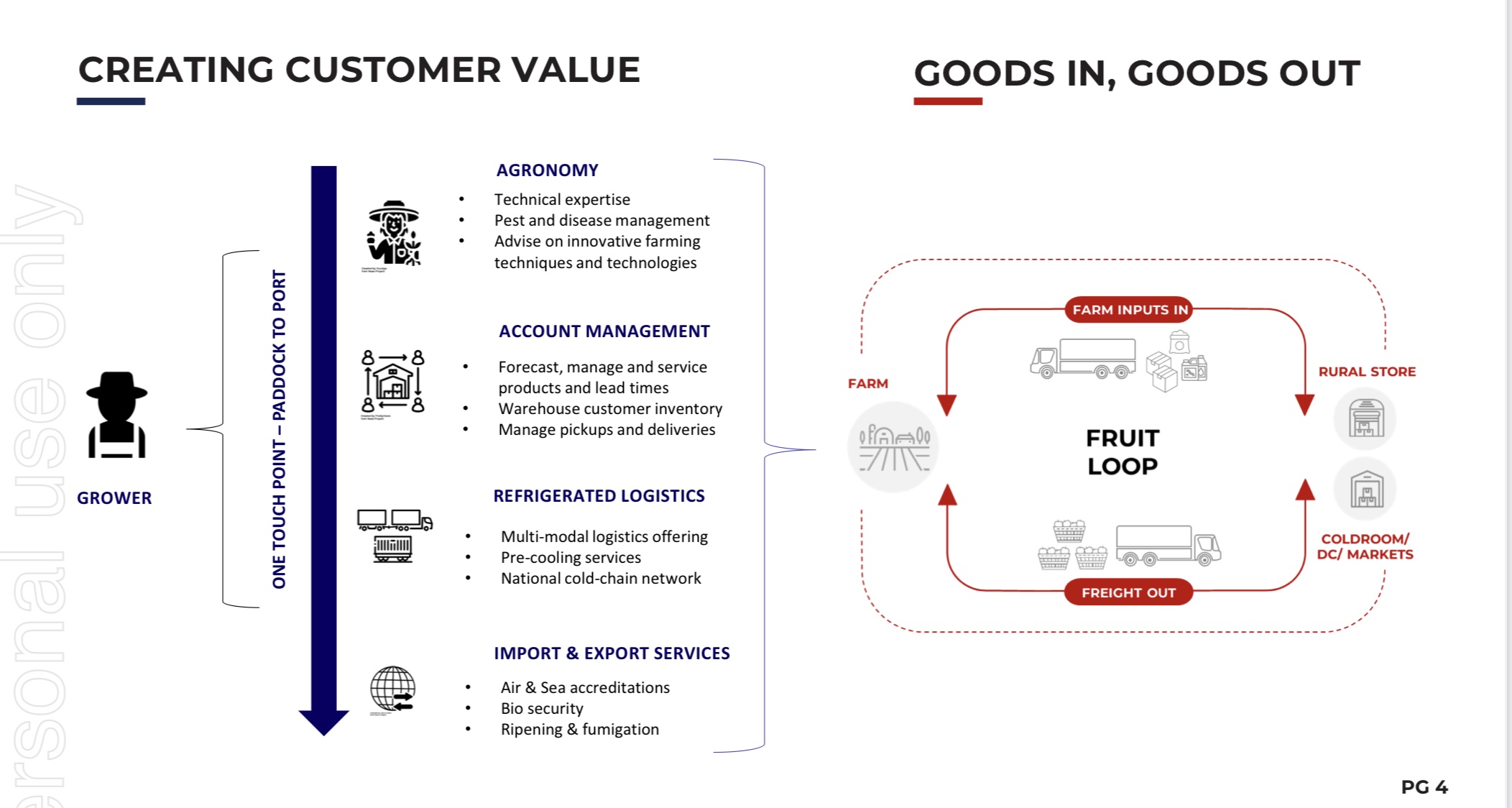

Lindsay Australia Limited is an integrated transport, logistics and rural supply company and a leading national service provider to the agriculture, horticulture and food-related industries. The Lindsay Australia Limited Group comprises the two core divisions of Rural and Transport (which includes Fresh Logistics). Combined, these divisions offer products and services covering customers' key needs throughout their production lifecycle.

The Lindsay end-to-end solution begins with offering expert agronomy advice and continues with a diverse range of products and services along the supply chain to help farmers grow, package, transport and distribute their produce throughout Australia and the world. Lindsay's end-to-end solution is unique and offers customers with a single point of contact and accountability (http://lindsayaustralia.com.au/).

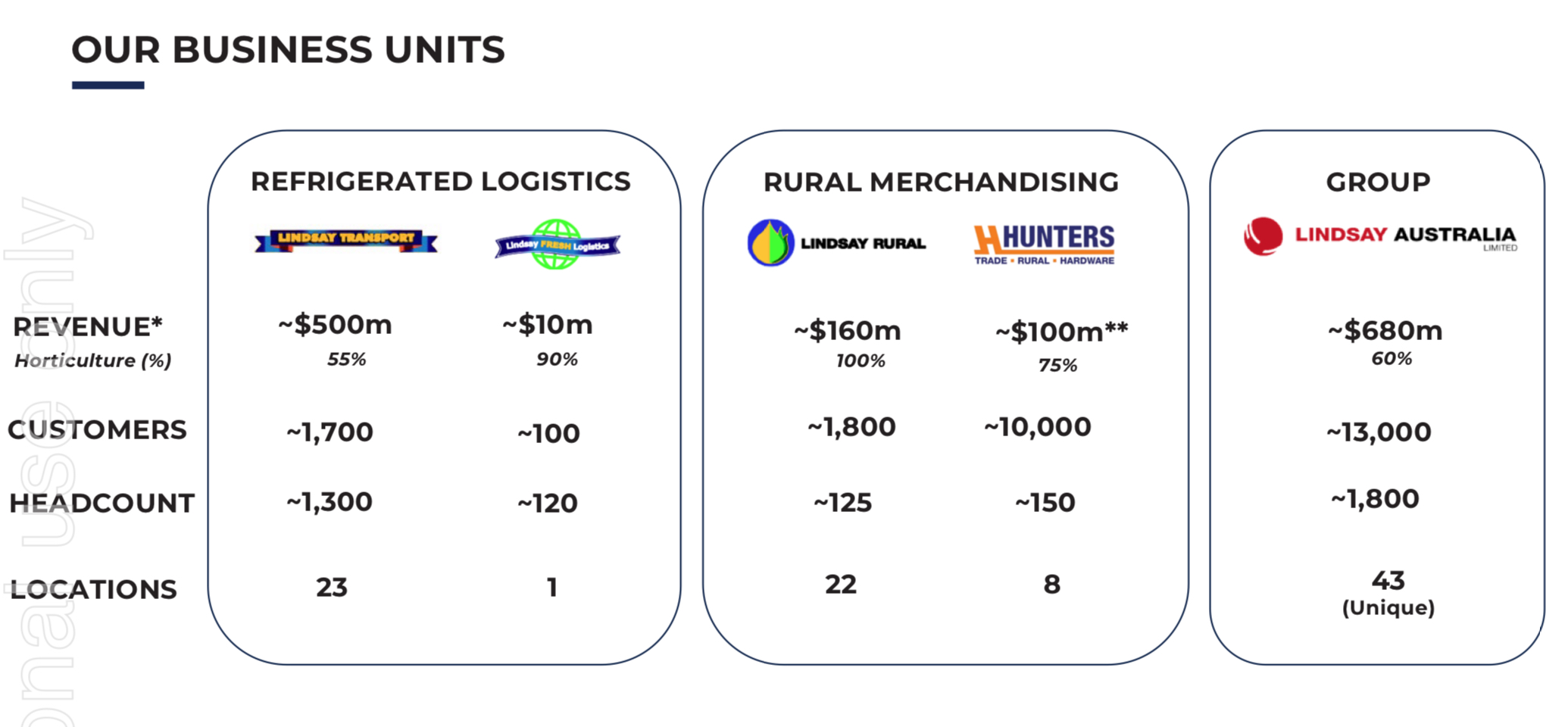

Seventy five percent of Lindsay Australia’s revenue is derived from the Refrigerated Logistics business and 25% is derived from the Rural Merchandising business (based on FY2023, including pro-forma revenue from the Hunters acquisition)

The majority of Lindsay Australia’s freight consists of produce, and the main categories are berries (110,000t), citrus (100,000t) and bananas (80,000t). They move approx. 15% of Australia’s horticultural products annually.

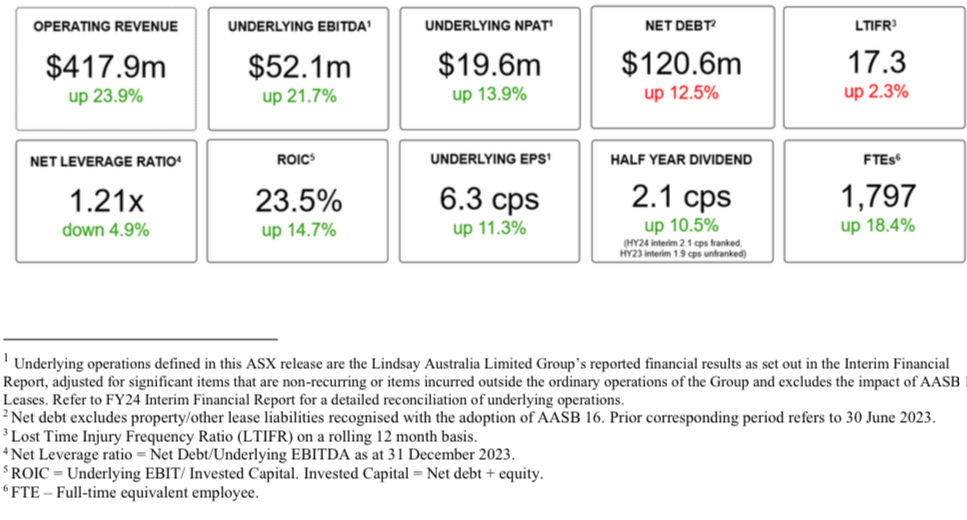

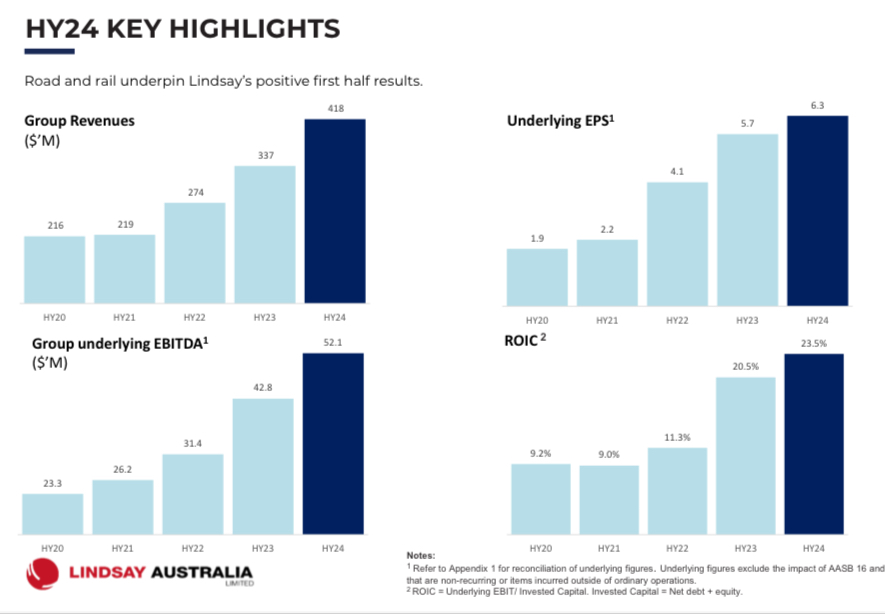

Record 1H24 Results

On the 25 February 2024 Lindsay Australia announced record revenue, underlying EBITDA and NPAT for 1H24. ASX Announcement.

- First half FY24 operating revenue grew 23.9% from H1FY23 to $417.9 million, with underlying1 EBITDA up 21.7% to $52.1 million.

- The Company announced a first half fully franked dividend of 2.1 cents per share, up +10.5% on the same period last year.

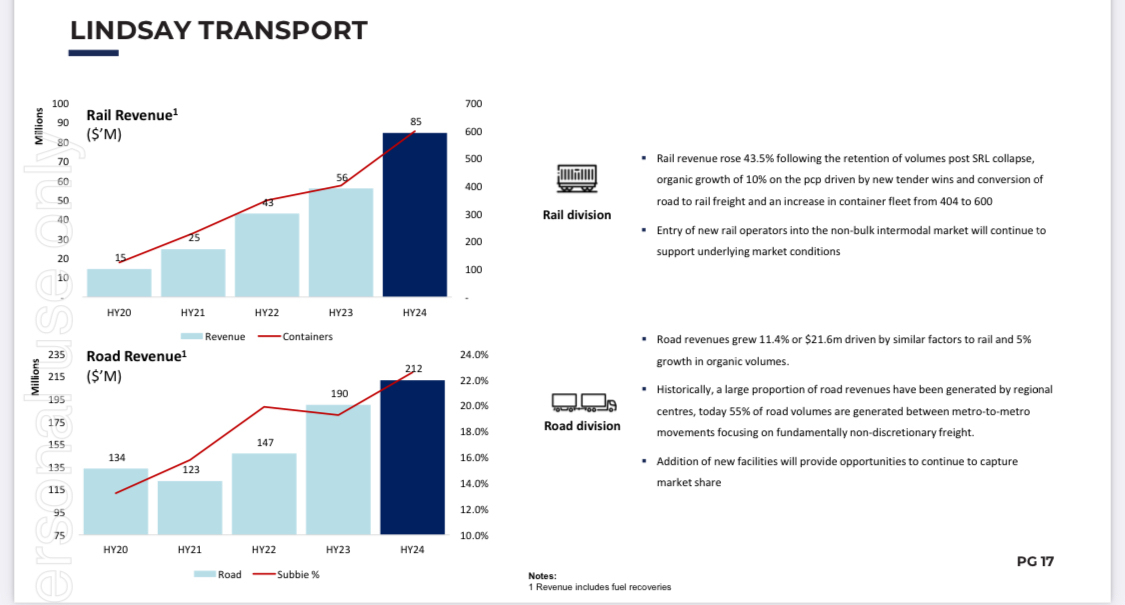

- Positive growth in rail operations continues with revenue up $26.2 million (+43.5%) compared to H1FY23.

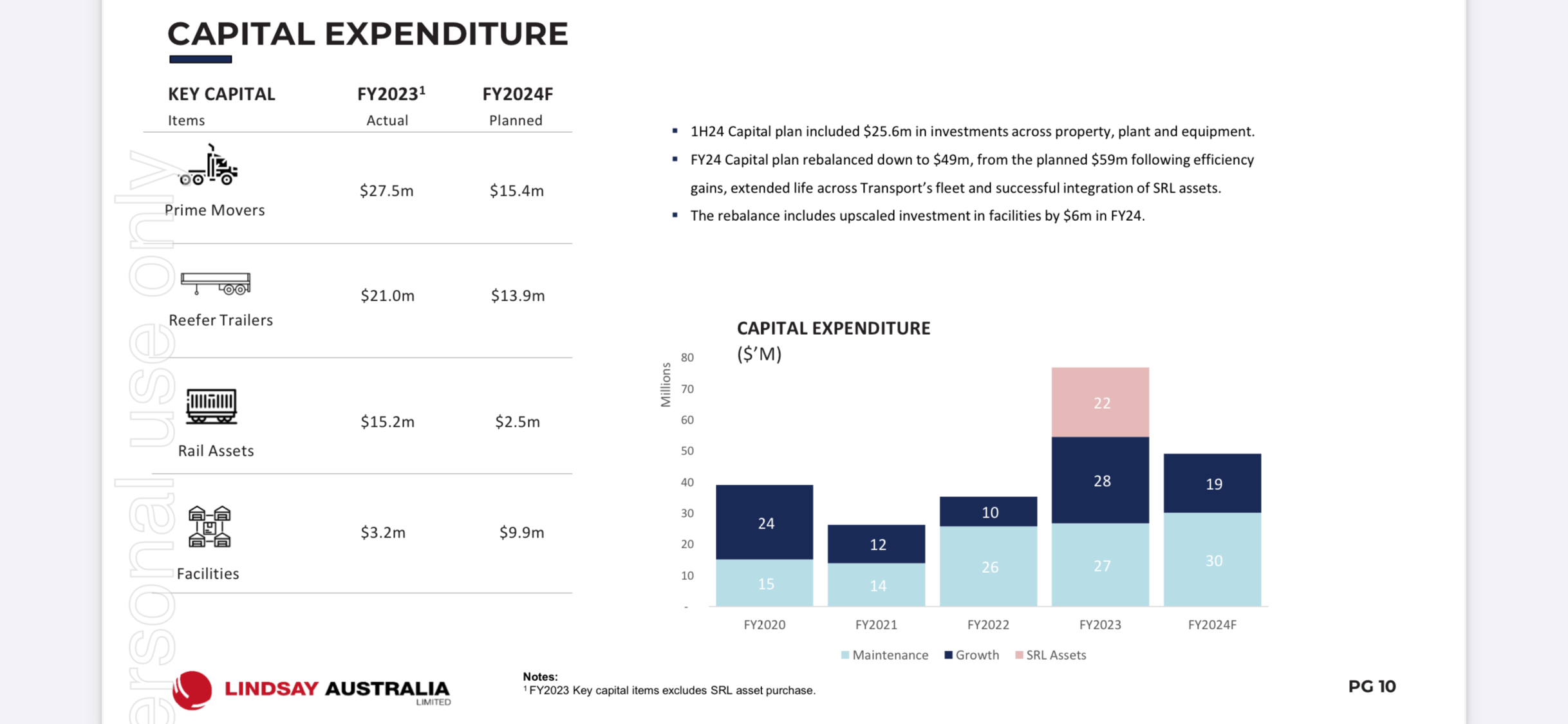

- Capital spend of $25.6 million was delivered in the first half of FY24 on new equipment and expanded facilities.

Statitory NPAT was $18.08 million, or 5.8 cps.

Increasing ROIC and ROE

What first caught my attention with Lindsay Australia was the rapid improvement in Return on Invested Capital (ROIC) over the past 3 years. The ROIC has improved from 9% in 1H21 to 23.5% in 1H24 (where ROIC = Underlying EBIT / Invested Capital and Invested Capital = Net debt + Equity).

Source: 1H24 Presentation

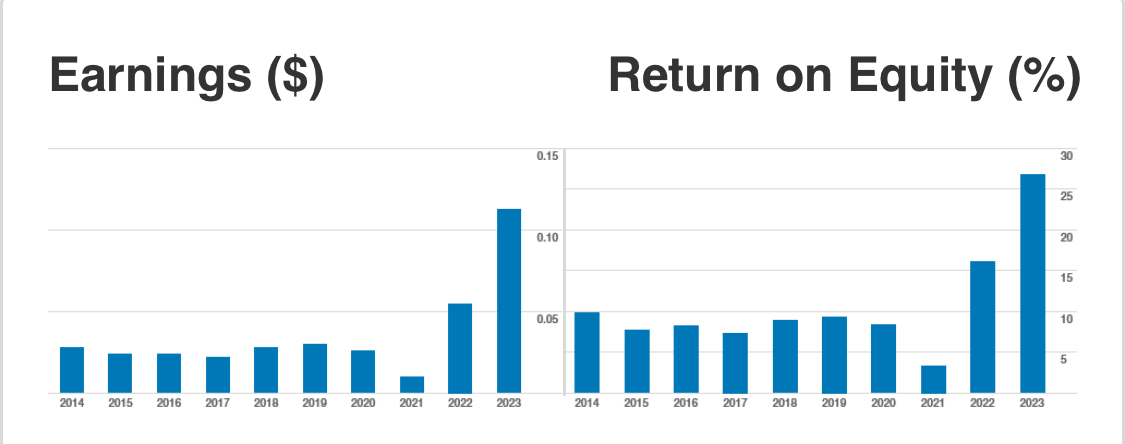

This is also reflected in the rapid increase in ROE from 8.4% in FY 2020 to 26.8% in FY2023.

Source: Commsec website

Source: Commsec website

Looking forward, FY24 ROE based on forecast statutory NPAT of $36.16 million (doubling the statutory NPAT for 1H24 of $18.08 million) and shareholder equity of $145.6 million I get ROE of 24.8% for FY24.

While it’s nice to see Lindsay Australia’s ROIC and ROE improving, it made me wonder why profitability has improved so quickly, and more importantly, is the improvement sustainable?

Surge in demand following the collapse of Scott’s Refrigeration Logistics

I think this story “Surge in Demand” which appeared in “Prime Mover” on 19 April 2023 helps to explain why Lindsay Australia’s fortunes have changed so quickly.

“The transport services for Lindsay Australia have experienced a surge in recent demand following the publicised collapse of Scott’s Refrigerated Logistics (SRL).

The demise of the cold chain carrier, who went into liquidation last month, has provided Lindsay Australia with additional opportunities.

Scott’s provided refrigerated trucks and warehouses for businesses including supermarket giants Coles, IGA and Aldi.

The increased demand comes at a time of already tightening supply chain after the continued exit of smaller operators over the past two years.

The company said it had been able to accommodate the increased demand through its improved road and rail equipment utilisation; acquisition of equipment under the FY2023 growth capital expenditure plan; and acquisition of selective Scott’s equipment predominantly comprised of rail assets.

“Lindsay is well-positioned to meet the increased demand for our transport services following the unfortunate collapse of SRL,” said Lindsay Australia CEO Kim Lindsay.”

It appears that SRL’s collapse was perfect timing for Lindsay Australia. With a void in competition Lindsay selectively acquired SRL’s assets, predominantly rail assets, which has helped to improve overall efficiency of the business (https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02654801-2A1443757).

It has also allowed Lindsay Australia to reduce the FY24 Capital plan down to $49m, from the planned $59m due to efficiency gains, extended life across Transport’s fleet and successful integration of SRL assets.

Capital Expenditure

Rail revenue rose 43.5% following the retention of volumes post SRL collapse, organic growth of 10% on the pcp driven by new tender wins and conversion of road to rail freight and an increase in container fleet from 404 to 600.

While using more rail instead of road is improving margins and reducing capital expenditure, it may also increase risk. This has not been raised as a concern by Lindsay Australia. However, Linfox CEO Mark Mazurek said “In the 12 months to December 2023, there were 115 days when Linfox couldn’t rail goods on scheduled services followed by another 70 “lost” days this year due to floods, cyclones, bushfires, derailments and signalling problems, which Mr Mazurek blames on “underinvestment in rail infrastructure” (AFR)

Road revenues grew 11.4% or $21.6m driven by similar factors to rail and 5% growth in organic volumes. Historically, a large proportion of road revenues have been generated by regional centres, today 55% of road volumes are generated between metro-to-metro movements focusing on fundamentally non-discretionary freight.

Margins

Group EBITDA margins moderated slightly from 12.7% in 1H23 to 12.5% in 1H24. However, removing the impact of the Hunter’s acquisition EBITDA margins improved to 13.3%. The business remains focused on sustaining and improving margins.

The NPAT margin should come in at c. 4.33% ($36.1 million / $836 million x 100) compared to 4.77% for FY23.

Shareholder Equity and Earnings Growth

Over the last 8 years shareholder equity has grown from 28 cps to 42 cps (+150%) and NPAT has increased from 2 cps to 11 cps (+550%) - Commsec Data. Earnings have grown over 40% in the last 5 years. Analysts are forecasting lower EPS growth of c. 12% going forward.

Balance Sheet

Lindsay Australia had a solid balance sheet with net debt to equity of 3.9%. Debt is well covered by operating cash flow (231%)

Source: Simply Wall Street

Headwinds and Tailwinds

Lindsay Australia is currently operating with reduced completion in the refrigerated logistics business after the SRL collapse. However, this does not mean they are immune to increasing competition over time as other companies move in as the economics improve.

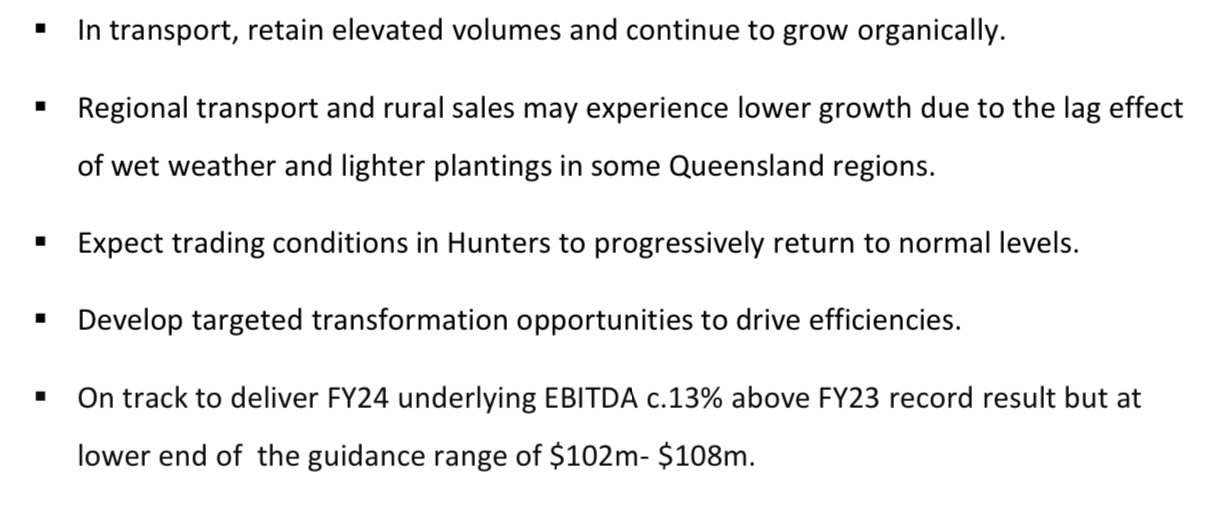

Lindsay Australia will do well when the rural sector does well. In the 1H24 report management said “Moving from H1 to H2, the regional transport and rural business may experience softer conditions due to the lag effect of wet weather and lighter plantings, whilst we expect metro volumes to remain relatively stable. In W.B Hunter we expect trading conditions to progressively return to normal levels.”

The Bureau of Meteorology is forecasting “April to June rainfall is likely to very likely to be below median for most of Australia. Much of the east has about an equal chance of above and below median rainfall for April to June.” It’s not a very definitive forecast at this stage. Climate research scientist Professor Roger Stone says we need to wait until May to get a better handle on the La Niña / El Niño influence. (Wetter or drier than average conditions) across Eastern Australia.

What farmers need is enough rain to plant their winter crops between May and July, but not too much rain that it prevents crops from being planted or harvested.There is currently sufficient subsoil moisture across most of eastern Australia’s growing regions for a reasonable winter crop without much follow up rain.

ABARES is forecasting winter crop production to be slightly above the 10 year average following record highs in 2023-2024.

Outlook and Guidance

“Moving from H1 to H2, the regional transport and rural business may experience softer conditions due to the lag effect of wet weather and lighter plantings, whilst we expect metro volumes to remain relatively stable. In W.B Hunter we expect trading conditions to progressively return to normal levels. Subject to no unforeseeable events, we expect full year underlying EBITDA to grow by 13% compared to FY23, coming in at the bottom end of our guidance” ($102 million - $108 million)

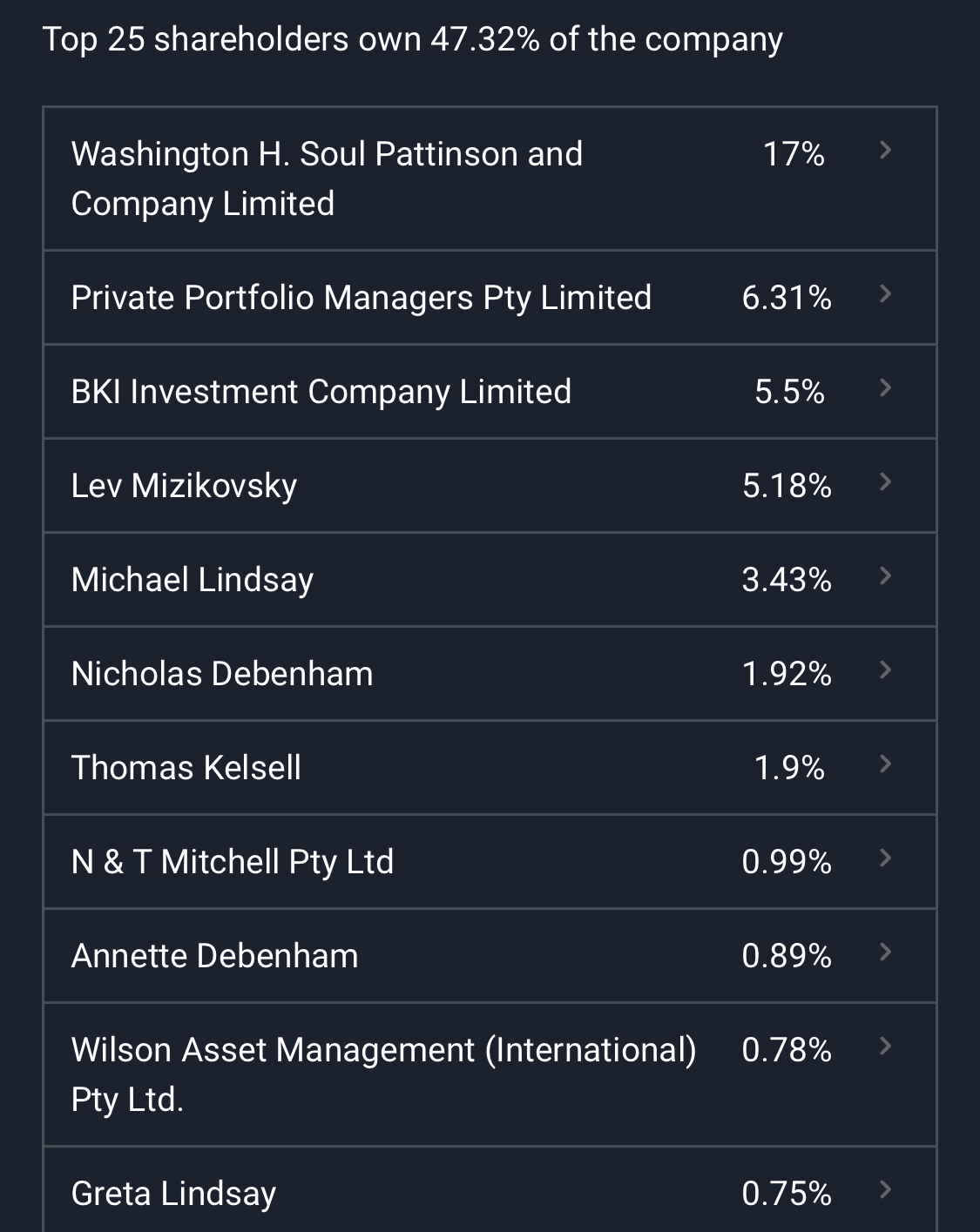

Ownership

@mikebrisy noted that Washington Soul Patts lightened off 2.85 million share this year averaging $1.20 per share, however this was about 5% of their holding in LAU and they still hold 17% of the business. Over the past 6 months 3 of the board directors have added approx. $170,000 in shares at an average of approx $1.10 per share.

Valuation

Shareholder Equity at the 31 December 2023 was $145.6 million. Assuming that 1H24 EBITDA to NPAT margin continues for the second half and FY2024 EBITDA comes in at $102 million (the lower end of guidance) NPAT could be as high as $38.4 million (12.3cps) for FY24.

Analyst consensus (4 analysts, Simply Wall Street) is NPAT of 11.2 cps (FY24), 13.7 cps (FY25) and 15.4 cps (FY26). Assuming consensus ROE over the next 3 years will be c. 24.8%.

Using McNiven's Formula and assuming Shareholder Equity of $0.47, ROE of 24.8%, 56% of earnings reinvested, and 44% of earnings paid out as fully franked dividends and a required annual return of 15% I get a valuation of $1.20. Working on a 12% annual return you could pay up to $1.72. At the current share price of $1.02, I am expecting a return of 16.7% per year, with about 7% of that coming from dividends (5% plus the franking credits).

PE multiple valuation

Working on analyst consensus earnings (NPAT) and the current share price of $1.02 Lindsay Australia is trading at 9 x FY24 earnings (11.6 cps), 7.6 x FY25 earnings, and 6.8 x FY26 earnings. At 9 x FY24 earnings Lindsay Australia is trading torward the lower end of the average annual PE ratio.

Analyst Consensus PT

Analyst consensus 12 month price target is $1.67 (5 analysts, Simply Wall Street).

Summary

Lindsay Australia seems to be benefiting from its end-to-end rural service business, with most of its revenue derived from refrigerated logistics in the horticultural industry.

The profitability of the business (ROE) has vastly improved over the last 3 years and based on guidance with be solid in FY24. Some of this improvement can be attributed to better than average seasons for farming. We have seen this across other rural businesses, including Elders.

Some improvement in profitability could be attributed to the timing of the collapse of Scott’s Refrigerated Logistics (SRL). Lindsay was in a position to selectively acquire assets that were synergistic with their current logistics business, mostly the refrigerated rail assets. This had the effect of reducing competition and at the same time improving freight efficiency.

If Lindsay Australia can continue forward with ROIC of over 20%, it will start to look cheap at a PE less than 9x. However, will the business continue to remain highly profitable? Given the nature of the rural industry which can swing from feast to famine depending on the season, natural disasters, the commodity prices, the value of the Aussie dollar etc etc. we might expect returns for Lindsay Australia to follow suit.

So while I think Lindsay Australia looks like excellent value with the current metrics, this could change rapidly. It’s probably not a stock you can put in the bottom drawer and forget about, and I don’t think it has a long enough track record of high ROIC to deserve a large position in a portfolio. However, I like what the business is doing and how it’s improving and I’ve decided to add it to our portfolio.

Held IRL (0.9%)

This morning Lindsay Australia posted a decent set of numbers. But the share market does not approve and is currently thumbing it’s nose at my Straw from last Thursday. What I don’t approve from this morning’s release is the use of “underlying” numbers as, for me, it instantly lowers management’s credibility as I assume they are trying to hide something, in this case for absolutely no real reason at all.

The new CEO spoke very well on the call, answered questions well and seems like a decent guy... so why use a fake set of numbers!

It is impossible to really know why the short term voting machine behaves as it does, but I hold ABB in real life which had a wonderful reaction to it’s earnings release on Friday but not so for LAU today. They are currently similar sized businesses from a Revenue perspective, but the market sees them so dramatically different I’d thought I’d compare the numbers.

Clearly Mr Market likes the future prospects of ABB a whole lot more than LAU.

Or is it a management credibility issue?

Why on earth would you use a set of underlying numbers when there is F’all difference and in the case of your headline statutory EBITDA number (which I’m not a fan of) is actually $7m higher.

I’m a long term investor so happy hold while I wipe the egg off my face, in fact if it keeps dropping I’ll buy some more.

I should add the caveat that the comparison with ABB isn't obviously apples for apples with the recent acquisitions for both companies making the comparison hard.

For my first post on Strawman since joining I’m writing about an interesting transport company Lindsay Australia (LAU) which is hopefully about to post a decent result.

Full disclosure, I only recently came across LAU via a standard value stock screener which was simply PE<10, 5Yr PEG>10%, Divi Yield >5%, Debt/Equity <60%. I don't know anyone who works at Lindsay, I've never worked for a customer or supplier, and I haven't attended any of their meetings (yet), rather this analysis has all been online, from Singapore, and a few conversations with people who have delt with the company.

Lindsay will report H1 next Monday (26th Feb) hence my timing for posting this article. I have purchased LAU in real life and with my Strawmoney.

LAU is a Road and Rail logistics provider leveraging its strong relationships in the agricultural sector via its Rural supplies business. Despite sounding a bit like LinFox, it is not as foxy!

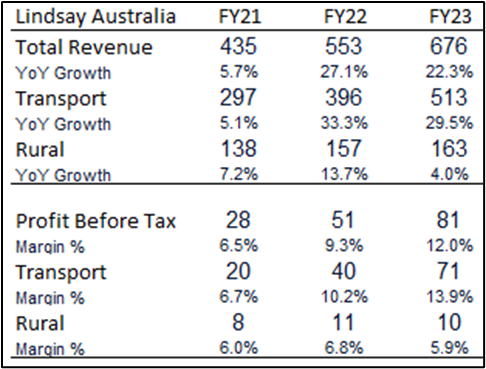

In the twenty years since listing, LAU has managed to grow revenue a respectable 12% CAGR. In the last two years it has averaged 31.5% growth in the higher margin Transport business which accelerated ROCE to 15.9% up from 5.2% 3 years ago. Lindsay doesn’t boast comparative growth metrics, or the unique culture of a competitor like NZ’s Mainfreight but it isn’t priced at 24x forward earnings either. In FY23 Lindsay delivered $676m in Revenue and $81m in PBT and is now trading at ~10x earnings. That multiple is ~50% cheaper than its relative PE multiple over the last decade (excluding the COVID years).

Looking forward, what I think makes Lindsay attractive is two timely acquisitions. In August 2023, Lindsay acquired WB Hunters, a rural supplies business, dramatically expanding Lindsay’s footprint along the NSW - VIC border. That acquisition should add ~$90m in product sales and ~$5m in EBITDA in FY24. More importantly that acquisition grows Lindsay’s network with Horticultural customers in a new geography. Lindsay has been successful at creating one touch point for Farmers to get their product to port. In FY23 farming customers drove 55% of Lindsay’s transport revenue. This acquisition positions LAU to cross sell it’s higher margin transport services into Hunter’s rural customer base.

With interest rates rising sharply the tide of business is on the way out, luckily, Lindsay has improved its balance sheet over recent years and won’t be caught swimming naked. That is not the case for all logistics players, in March 2023 Lindsay acquired $22m of Road and Rail assets from the disorderly liquidation of Scott’s Refrigerated Logistics. The acquisition included 44 Prime Movers and 350 rail containers, effectively doubling LAU’s presence in Rail. Those two acquisitions should boost FY24 results, particularly the upcoming H1 results.

Unfortunately, there are some unknowns which make this opportunity more speculative that I would otherwise like. After 20 years as CEO, Kim Lindsay retired just before the end of FY23 having delivered a cracking result. LAU isn’t a fan of publishing too many operational metrics like Asset Utilisation, so we will only get a clearer view of the quality and sustainability of recent earnings over time, which is disappointing.

It is also worrying that after 20 years as CEO there wasn’t an internal succession candidate that shareholders could have become familiar with as part of a smooth handover. Clay McDonald was appointed CEO in July. Clay appears to have a good operational background from years at Aurizon and Toll, which bodes well for the Rail business and Australia’s future Inland Rail corridor.

His wealth of experience should help him get on top of Lindsay’s largest cost challenge, which is that Australia’s tight labour market that is skewing the mix of permanent employees and flexible but expensive subcontractors. In FY23 Revenue grew 22% but Subcontractor costs grew 44%.

The biggest risk to me is simply that Clay is an unknown. I’ll tune in for the H1 report on Monday and that should throw light on how the Hunters and Scott’s acquisitions have settled in and how the new CEO is seeing the future.

LAU isn’t covered by many analysts, my feeling is that LAU’s share price has been supressed by economic uncertainty and is lumped in with the consumer discretionary vibe that the sky is about to fall in. Food isn’t that discretionary!

For now, the margin of safety afforded by the current valuation allows for a smallish position, which I have taken up.

BTW, Soul Patts is the largest shareholder, so there is some comfort knowing you’re investing alongside Australia’s best.

My favourite quote from Andrew, you can borrow my idea, but you can’t borrow my conviction. I would appreciate feedback and insights on LAU and the rural / transport industry in general if any of our members deal with them. I’m an Aussie from Darwin but between London and Singapore I haven’t lived in Aus for 20 years so worry I'm not 100% in touch with the vibe.

I’m happy to be proven wrong. It won’t be the first time!

Cheers

JM

Lindsay Delivers H1 FY21 Growth in Revenue, Profit and Dividends Highlights:

- Lindsay has delivered strong performance driven by the Company's Transport and Rural Services segments, achieving H1 FY21 growth in underlying1 EBITDA of 12.1% to $26.1 million on record half?yearly revenue of $219 million.

- Rail expansion remains Lindsay's primary organic growth strategy in Transport, with the Company planning to expand its fleet by 110 refrigerated containers in FY21 (59%).

- Lindsay continues to invest in operational efficiency and cost controls, achieving positive EBITDA contributions from all divisions alongside reductions in corporate overheads.

- Lindsay Board of Directors have declared an interim fully franked dividend of 1.2 cents per ordinary share (H1 FY20: 1.0 cent per share).

- Lindsay retains a strong position to drive continued profitable growth both organically and positioning to take advantage of opportunities as they arise.

04-Feb-2021: Ord Minnett Research: Lindsay Australia Limited: Earnings outlook freshens up

- Analysts: Ian Munro, Senior Research Analyst, (03) 9608 4127, [email protected]

- Joshua Goodwill, Research Associate, (03) 9608 4121, [email protected]

Lindsay Australia has upgraded 1H guidance to $26-$27m underlying EBITDA, +14% at the mid-point versus pcp. The prior guidance was for +8% underlying EBITDA growth. We attribute the upgrade to better than expected volumes in the growing rail segment and margin benefits tied with the regionally focussed rural strategy. The upgrade is a positive indicator for earnings momentum into the second half and FY22e. We have increased FY21e EPS forecasts by 4% to reflect the upgrade. Our DCF based valuation increases to $0.42 (from $0.40). LAU trades on an FY21e P/E ratio of 12x versus the peer set of 15x P/E. We expect this valuation gap to narrow as the company delivers to the growth strategy. Next catalysts: 1H result.

1HFY21e guidance $26m-$27m EBITDA

- 1H EBITDA upgrade has likely be driven by: A) growth in the share of horticultural volumes transported on rail, which is accretive to profit margins and B) expansion of the rural store footprint within high growth horticultural areas across Northern QLD. The rail and rural outperformance is likely to have more than offset softness in import/export volumes, due to COVID related reduction in international air freight

Earnings momentum building

- We believe that the earnings outlook is supported by three key factors. Firstly, freight facilities in Sydney and Perth, opened during 2020, are beginning to reach a point of critical mass in throughput, which is likely to support earnings margins. Secondly, the share of group revenues handled on rail is likely to double to 16% in FY22e (from 6% in FY20), underpinned by new corporate and horticultural contracts on the Perth-Brisbane and Cairns-Brisbane rail legs. Thirdly, domestic freight conditions remain solid during FY21e, as evidenced by positive commentary and outlook statements from listed transport sector peers.

Profit outlook freshens up by 4% in FY21e

- The company is tracking ahead of our profit expectations and we have upgraded FY21e EPS by 4%. With the greater share of profit captured during the 1H due to seasonal factors, this announcement largely de-risks our FY21e forecasts and provides upside risk to free cash flow and dividend projections.

--- click on the link above for the full OM report on LAU --- [I do not hold LAU shares.]

- Last Price: A$0.34 (A$0.35 on 05-Feb-2021)

- Target Price: A$0.42 (Previously A$0.40)

- Recommendation: Buy

- Risk: Higher

- ASX Code: LAU

- 52 Week Range ($): 0.30 - 0.37

- Market Cap ($m): 101.8

- Shares Outstanding (m): 299.5

- Av Daily Turnover ($m): 0.0 3

- Month Total Return (%): 0.0

- 12 Month Total Return (%): -5.6

- Benchmark 12 Month Return (%): -2.6

- NTA FY21E (¢ per share): 30.4

- Net Debt FY21E ($m): 99.7

- Index Participation: None