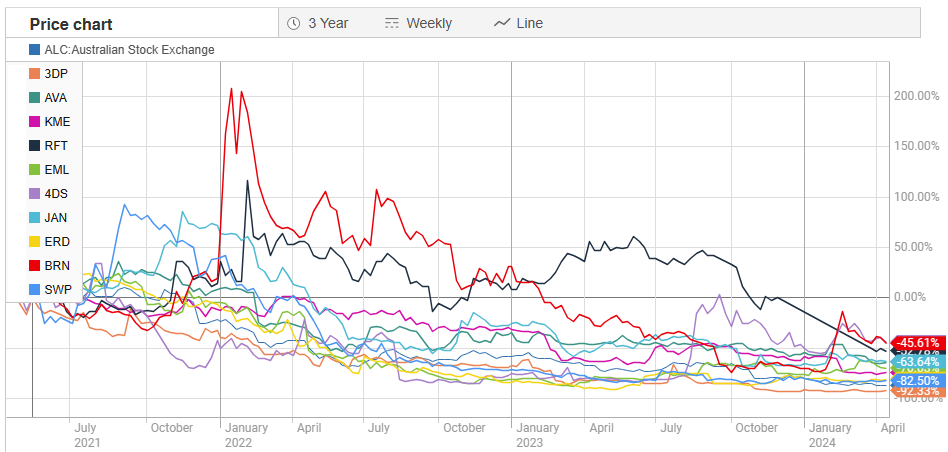

16-April-2024: As we approach June, I thought it might be instructive to have a look at a few ex-darlings - from earlier Strawman.com years - that have fallen from grace, in share price terms at least:

I've added one in there that only I hold - SWP - which is down -82.5%, so one of the worst performers for sure. The others are ones that have previously been in the Strawman Premium Index, and three of them still are in the index - AVA, ALC and EVS. - Except I forgot to put EVS in the graph, they were -47% over 3 years.

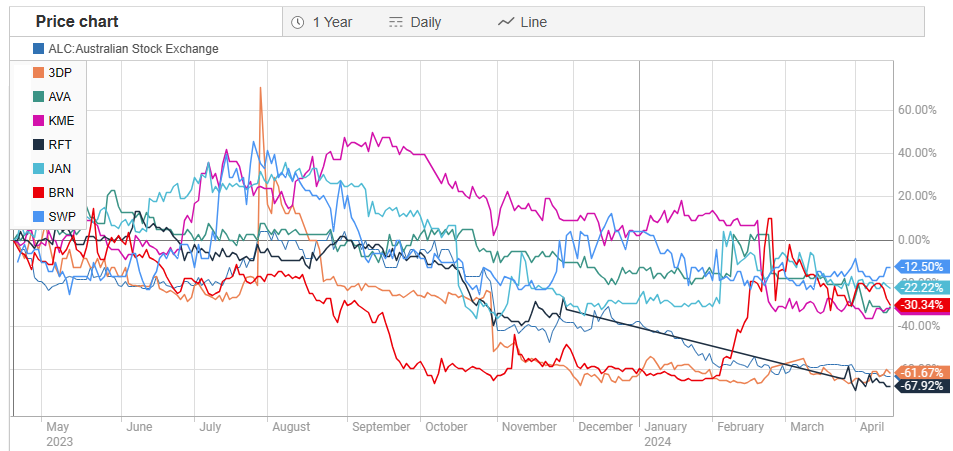

Now to bring that lot back from 3 years to 1 year, I found that three of them have actually done really well over the past one year:

- 4DS is up +187% over 1 year, despite being down -44% over 3 years.

- ERD is up +82% over 1 year, despite being down -81% over 3 years.

- EML is up +51% over 1 year, despite being down -70% over 3 years.

So removing those three, we're left with 8:

Plus EVS which is down -48% over 1 year.

And the worst of those are:

- RFT down -68% over 1 year (and -53% over 3)

- ALC down -63% over 1 year (and -87% over 3)

- 3DP down -62% over 1 year (and -92% over 3)

But then, I guess we have to ask if these companies are going to recover or not. If they bounce back after June 30, then they might be opportunities in terms of cheap pick-ups in June when they are likely to have fallen even further than where they are today - due to tax loss selling.

However, if they do not recover, or if they only recover after heavily dilutive capital raisings, then they might instead be value traps or capital killers/vacuums.

Some might still be good companies that just need a few things to go right for them from here, but others might be cheap and getting cheaper for good reason.

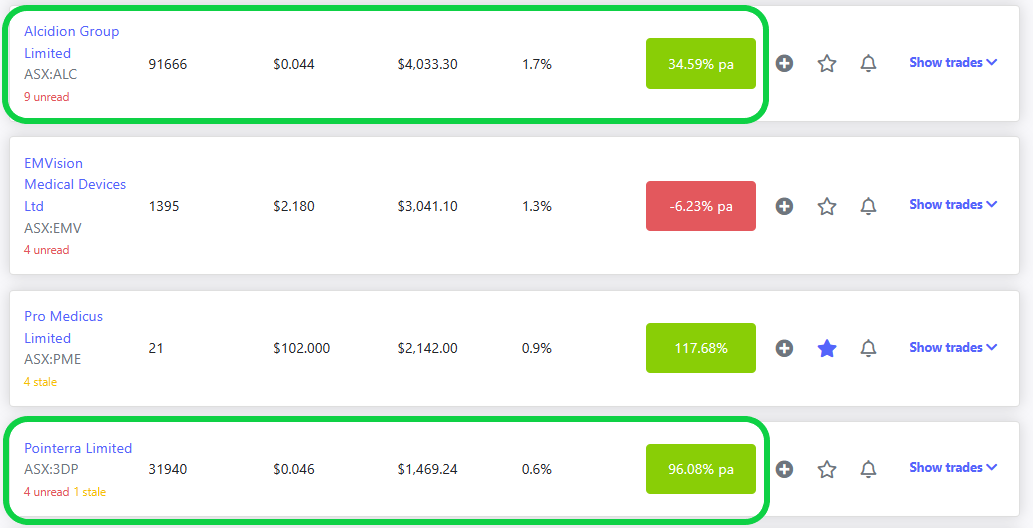

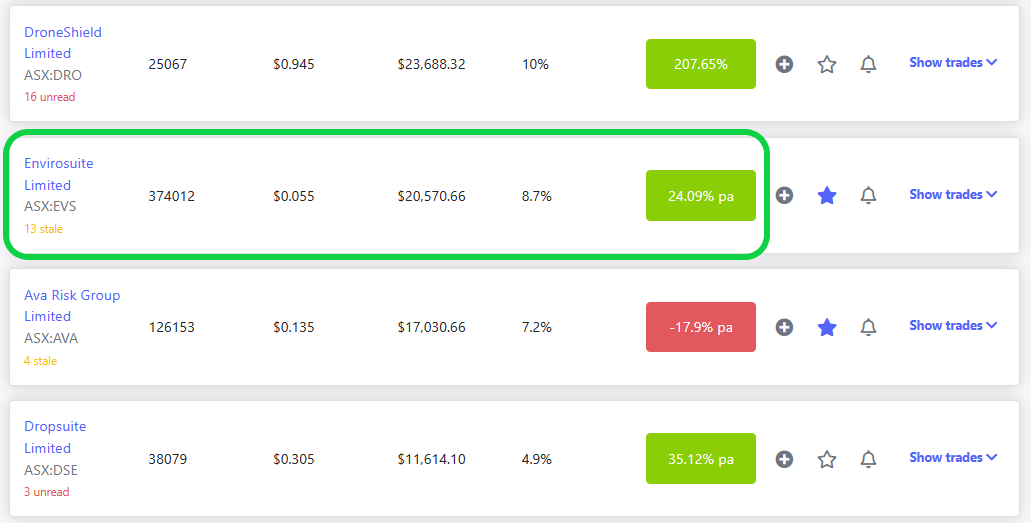

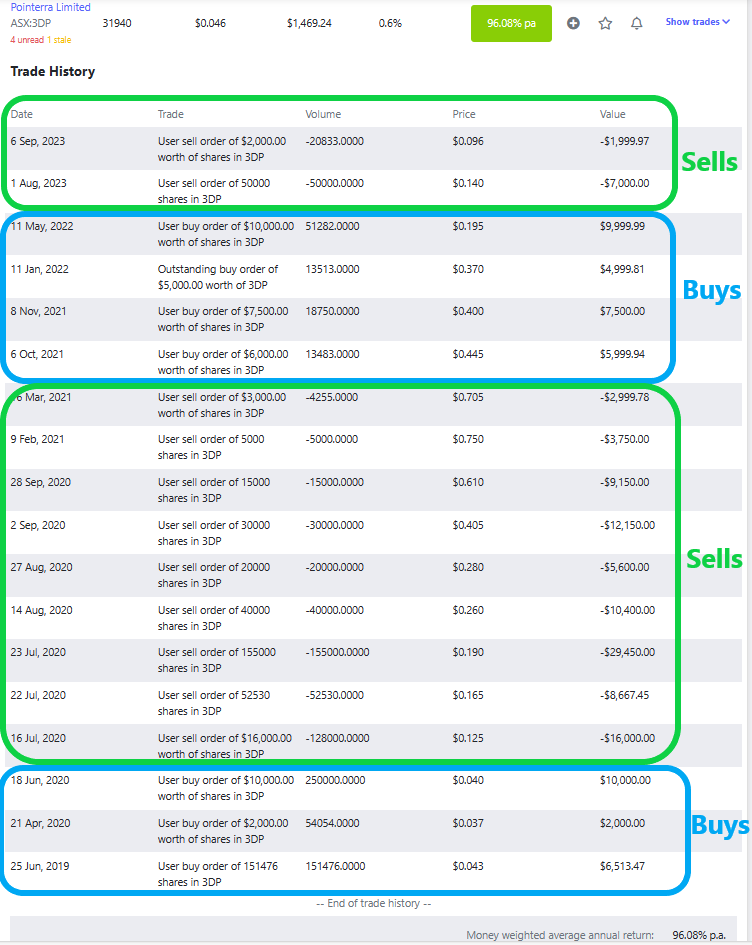

However, consider this - Our fearless leader (@Strawman ) holds ALC and 3DP on his scorecard here today, as well as EVS which is -48% over 1 year and -47% over 3 years (so I should have included EVS on those charts above also but only realised I'd missed them after I'd finished the charts and added them into this post) - and Andrew is UP on all three - and not just a little bit either - he's up a LOT - check it out:

So Andrew is +34.6%/year on ALC, +96%/year on 3DP and +24%/year on EVS, despite all three have falling share price over recent years. How is this possible? Buy low, sell high. Click here to see Andrew's portfolio then click on "show trades" on the right of one of those companies and you can see exactly what I'm talking about.

Here's just one example - Pointerra - 3DP:

It's in reverse chronological order, so read it from the bottom up. Buys at between 3.7 and 4.3 cents per share (cps) and sells up to 75 cps. That's where the money was made. Then further buys at between 19.5 cps and 44.5 cps (averaging down from 44.5 down to 19.5 cps) and then position trimming at lower levels (14 cps and 9.6 cps) when the investment thesis appeared to be shaky, to say the least, but the money had already been made, back in 2020 and 2021 with those sells.

The lesson here is that taking profits on the way up isn't always a bad thing. Sometimes it can prove to be a very good idea indeed. I do a fair bit of it myself. We can all be wise with the benefit of hindsight, such as saying to ourselves that we shouldn't have trimmed ProMedicus (PME) on the way up, but I tend to think trimming to both lock in profits and to resize an oversized position in a portfolio is usually a sensible course of action. You don't have to sell all of it. Just some of it. And even if it crashes and burns you could still be well in front overall, even if you still hold some. And if it just keeps rising, like PME, then you're still in front, just not as in front as you might have been if you'd kept the lot and never trimmed.

Trimming oversized positions is a form of risk management for me, and it usually does work out for the best. It certainly did there for @Strawman .

But in terms of whether those companies are opportunities to buy as we get towards June 30 with probably even lower prices... I have no advice on any of them specifically, but it's instructive to look at where they've come from, and how long they've been falling for, and why.

Disclosure: I hold SWP, but none of the others. I have held AVA and EVS in the past, and I think I even had a small RFT trade here on SM for a short time, but that was a few years back.

And I hold PME here, but unfortunately not in any real money portfolios any more.

A little bit early, but looking for some arbitrage opportunities or just buying at cheap prices from mindless selling. Does anyone have ideas on companies to watch for arbitrage opportunities? If looking to arbitrage existing holdings, being early is best.

I am looking EVS, PLS & AVA.

It's that time of year again, where some investors look to offset capital gains by realising their paper losses. Prime candidates are ones that are well below their all time highs or IPO listing prices. A few I can think of:

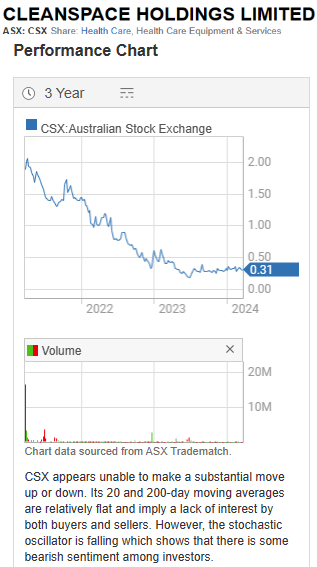

- Cleanspace Holdings (CSX) - Beaten down following big falls in US hospital demand, as focus is shifted to vaccine rollout.

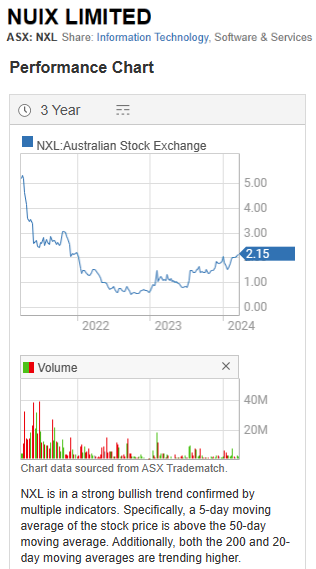

- Nuix (NXL) - rolling downgrades.

- Electro-Optic Systems (EOS) - 6 month delay in cash receipts piques short interest.

Any oher ideas people?

Tax loss selling is where investors sell their losers to offset capital gains. Sometimes it can lead to companies being oversold in May / June. Given it has been a volatile FY, this year may be throw up some good opportunities. A few quality business are worth keeping an eye on. Here are a few:

Idea #1: Jumbo Interactive (JIN)

Reaching an all time high in September of around $27.80 there will be plenty of paper losses for holders. However, with a market cap of around $800M, there may be sufficient liguidity, and this may limit volatility.

Idea #2: Electro Optic Systems (EOS)

Currenlty trading 50% below its all time highs, some shareholders may be sitting on paper losses they may wish to use. However, it may also enter the ASX 200 next month, and has resonable liquidity.

It anyone has other suggestions, I would love to here them.. Smaller companies with limited liquidity, will suffer potentially larger falls, and offer bigger opportunities. Happy hunting.