For my first post on Strawman since joining I’m writing about an interesting transport company Lindsay Australia (LAU) which is hopefully about to post a decent result.

Full disclosure, I only recently came across LAU via a standard value stock screener which was simply PE<10, 5Yr PEG>10%, Divi Yield >5%, Debt/Equity <60%. I don't know anyone who works at Lindsay, I've never worked for a customer or supplier, and I haven't attended any of their meetings (yet), rather this analysis has all been online, from Singapore, and a few conversations with people who have delt with the company.

Lindsay will report H1 next Monday (26th Feb) hence my timing for posting this article. I have purchased LAU in real life and with my Strawmoney.

LAU is a Road and Rail logistics provider leveraging its strong relationships in the agricultural sector via its Rural supplies business. Despite sounding a bit like LinFox, it is not as foxy!

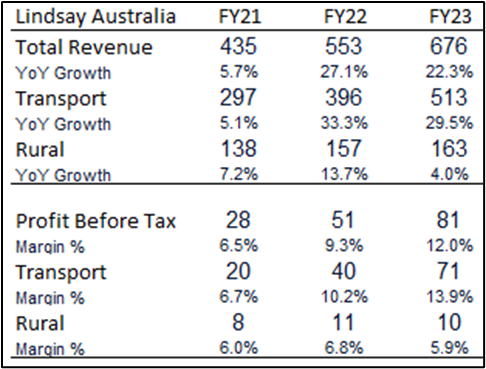

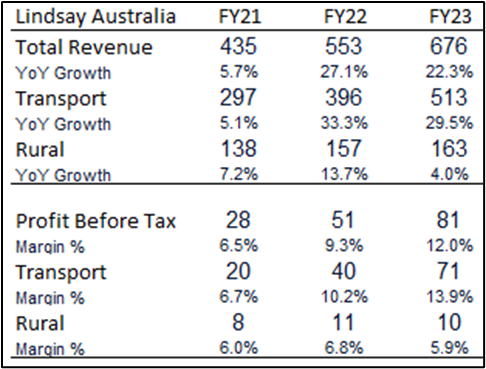

In the twenty years since listing, LAU has managed to grow revenue a respectable 12% CAGR. In the last two years it has averaged 31.5% growth in the higher margin Transport business which accelerated ROCE to 15.9% up from 5.2% 3 years ago. Lindsay doesn’t boast comparative growth metrics, or the unique culture of a competitor like NZ’s Mainfreight but it isn’t priced at 24x forward earnings either. In FY23 Lindsay delivered $676m in Revenue and $81m in PBT and is now trading at ~10x earnings. That multiple is ~50% cheaper than its relative PE multiple over the last decade (excluding the COVID years).

Looking forward, what I think makes Lindsay attractive is two timely acquisitions. In August 2023, Lindsay acquired WB Hunters, a rural supplies business, dramatically expanding Lindsay’s footprint along the NSW - VIC border. That acquisition should add ~$90m in product sales and ~$5m in EBITDA in FY24. More importantly that acquisition grows Lindsay’s network with Horticultural customers in a new geography. Lindsay has been successful at creating one touch point for Farmers to get their product to port. In FY23 farming customers drove 55% of Lindsay’s transport revenue. This acquisition positions LAU to cross sell it’s higher margin transport services into Hunter’s rural customer base.

With interest rates rising sharply the tide of business is on the way out, luckily, Lindsay has improved its balance sheet over recent years and won’t be caught swimming naked. That is not the case for all logistics players, in March 2023 Lindsay acquired $22m of Road and Rail assets from the disorderly liquidation of Scott’s Refrigerated Logistics. The acquisition included 44 Prime Movers and 350 rail containers, effectively doubling LAU’s presence in Rail. Those two acquisitions should boost FY24 results, particularly the upcoming H1 results.

Unfortunately, there are some unknowns which make this opportunity more speculative that I would otherwise like. After 20 years as CEO, Kim Lindsay retired just before the end of FY23 having delivered a cracking result. LAU isn’t a fan of publishing too many operational metrics like Asset Utilisation, so we will only get a clearer view of the quality and sustainability of recent earnings over time, which is disappointing.

It is also worrying that after 20 years as CEO there wasn’t an internal succession candidate that shareholders could have become familiar with as part of a smooth handover. Clay McDonald was appointed CEO in July. Clay appears to have a good operational background from years at Aurizon and Toll, which bodes well for the Rail business and Australia’s future Inland Rail corridor.

His wealth of experience should help him get on top of Lindsay’s largest cost challenge, which is that Australia’s tight labour market that is skewing the mix of permanent employees and flexible but expensive subcontractors. In FY23 Revenue grew 22% but Subcontractor costs grew 44%.

The biggest risk to me is simply that Clay is an unknown. I’ll tune in for the H1 report on Monday and that should throw light on how the Hunters and Scott’s acquisitions have settled in and how the new CEO is seeing the future.

LAU isn’t covered by many analysts, my feeling is that LAU’s share price has been supressed by economic uncertainty and is lumped in with the consumer discretionary vibe that the sky is about to fall in. Food isn’t that discretionary!

For now, the margin of safety afforded by the current valuation allows for a smallish position, which I have taken up.

BTW, Soul Patts is the largest shareholder, so there is some comfort knowing you’re investing alongside Australia’s best.

My favourite quote from Andrew, you can borrow my idea, but you can’t borrow my conviction. I would appreciate feedback and insights on LAU and the rural / transport industry in general if any of our members deal with them. I’m an Aussie from Darwin but between London and Singapore I haven’t lived in Aus for 20 years so worry I'm not 100% in touch with the vibe.

I’m happy to be proven wrong. It won’t be the first time!

Cheers

JM