About

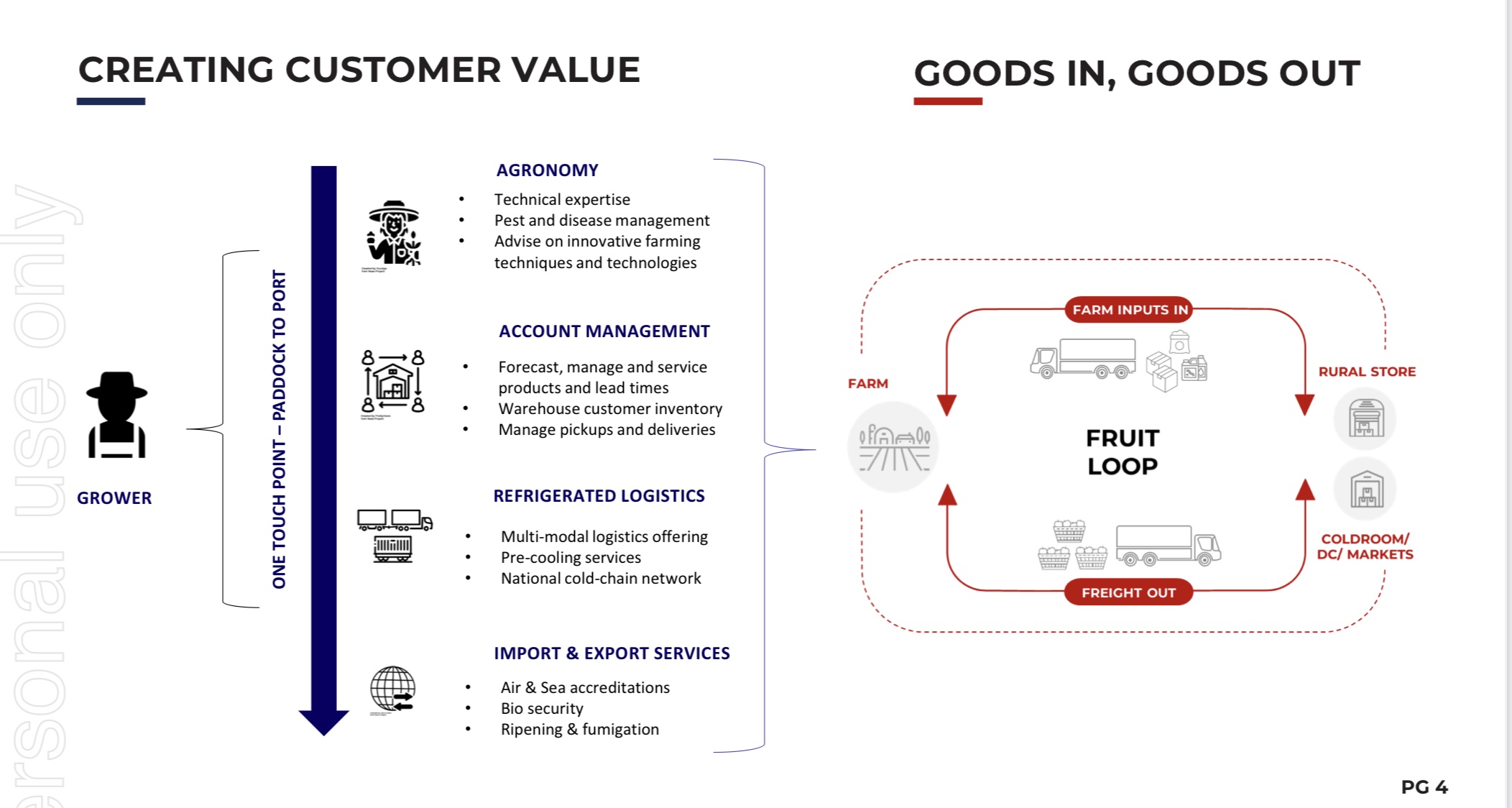

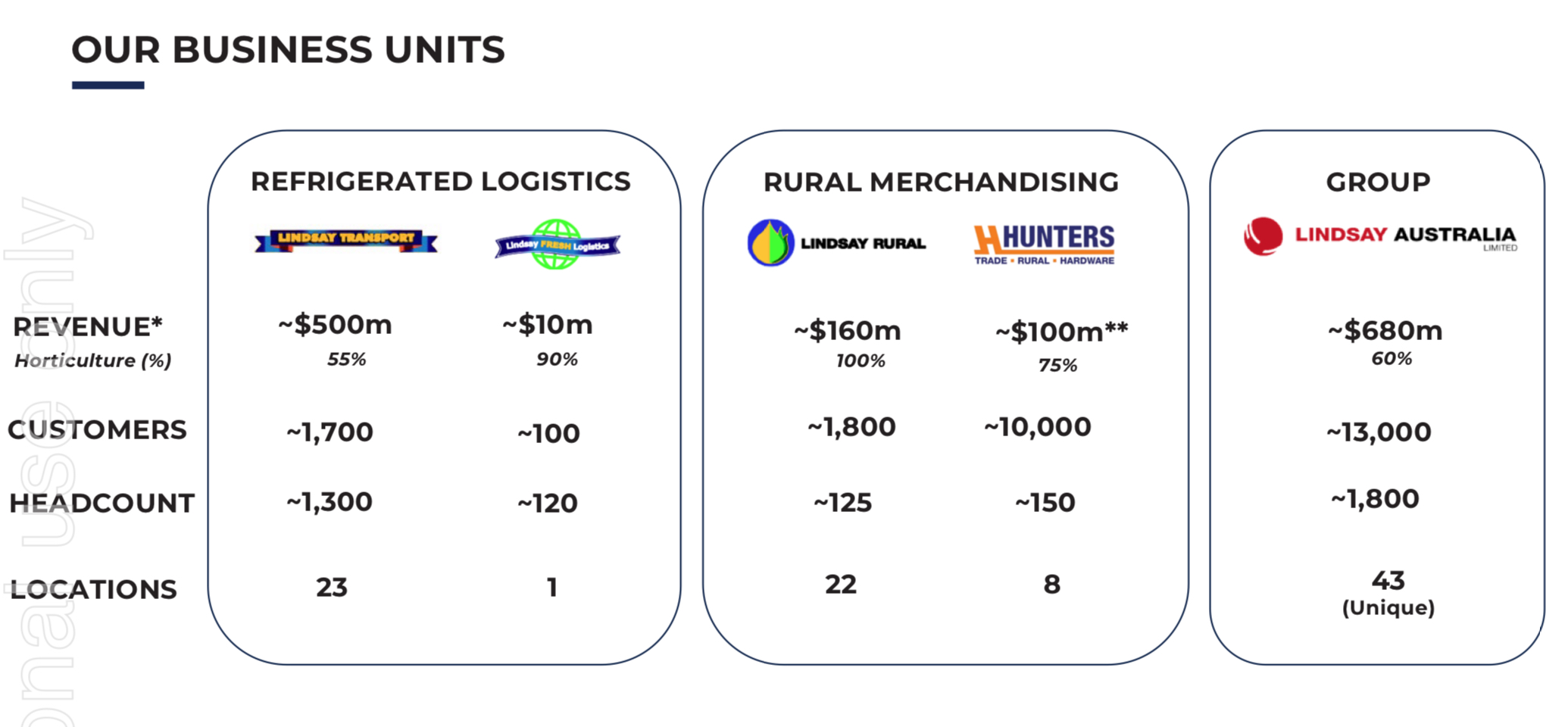

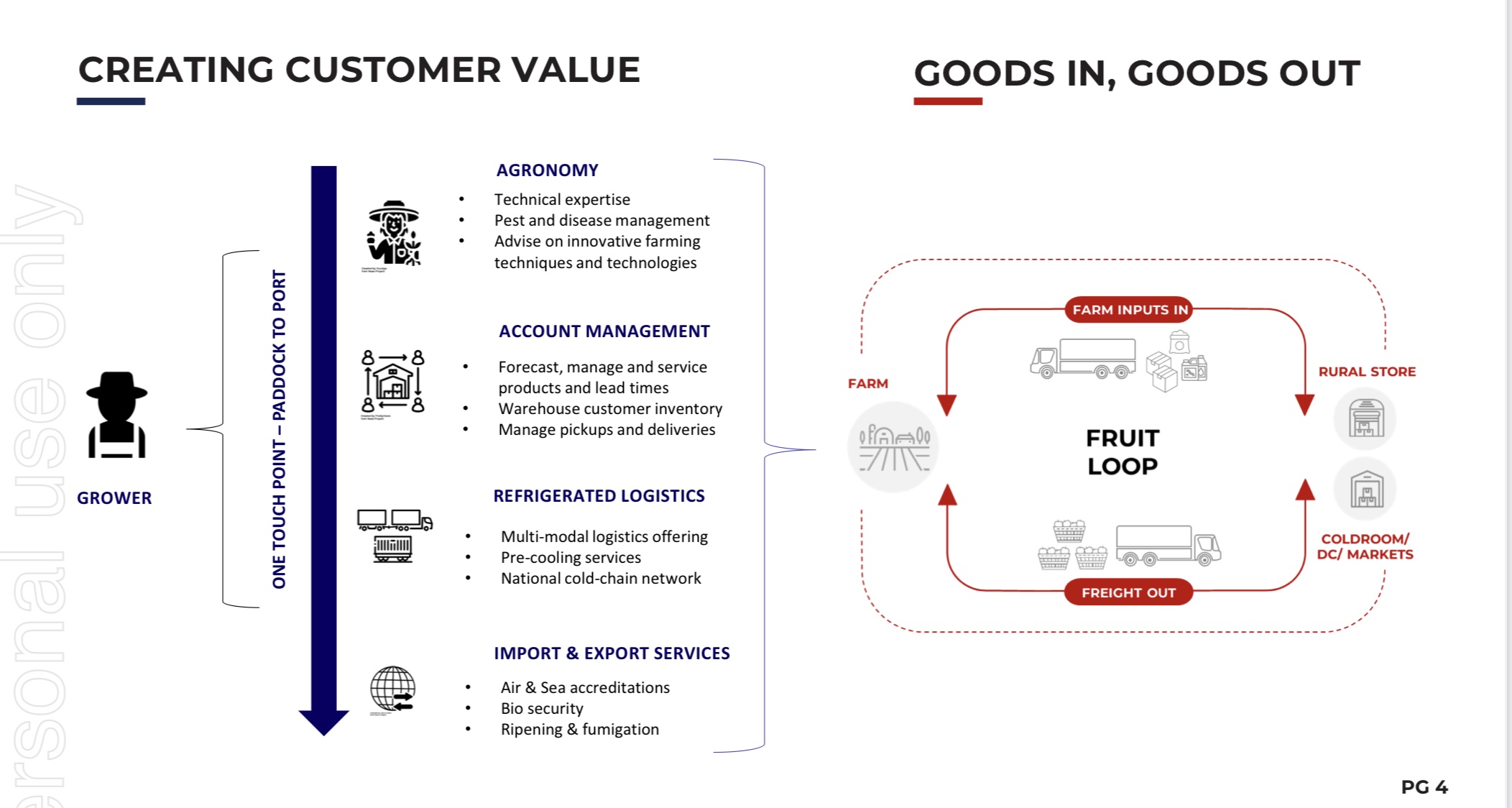

Lindsay Australia Limited is an integrated transport, logistics and rural supply company and a leading national service provider to the agriculture, horticulture and food-related industries. The Lindsay Australia Limited Group comprises the two core divisions of Rural and Transport (which includes Fresh Logistics). Combined, these divisions offer products and services covering customers' key needs throughout their production lifecycle.

The Lindsay end-to-end solution begins with offering expert agronomy advice and continues with a diverse range of products and services along the supply chain to help farmers grow, package, transport and distribute their produce throughout Australia and the world. Lindsay's end-to-end solution is unique and offers customers with a single point of contact and accountability (http://lindsayaustralia.com.au/).

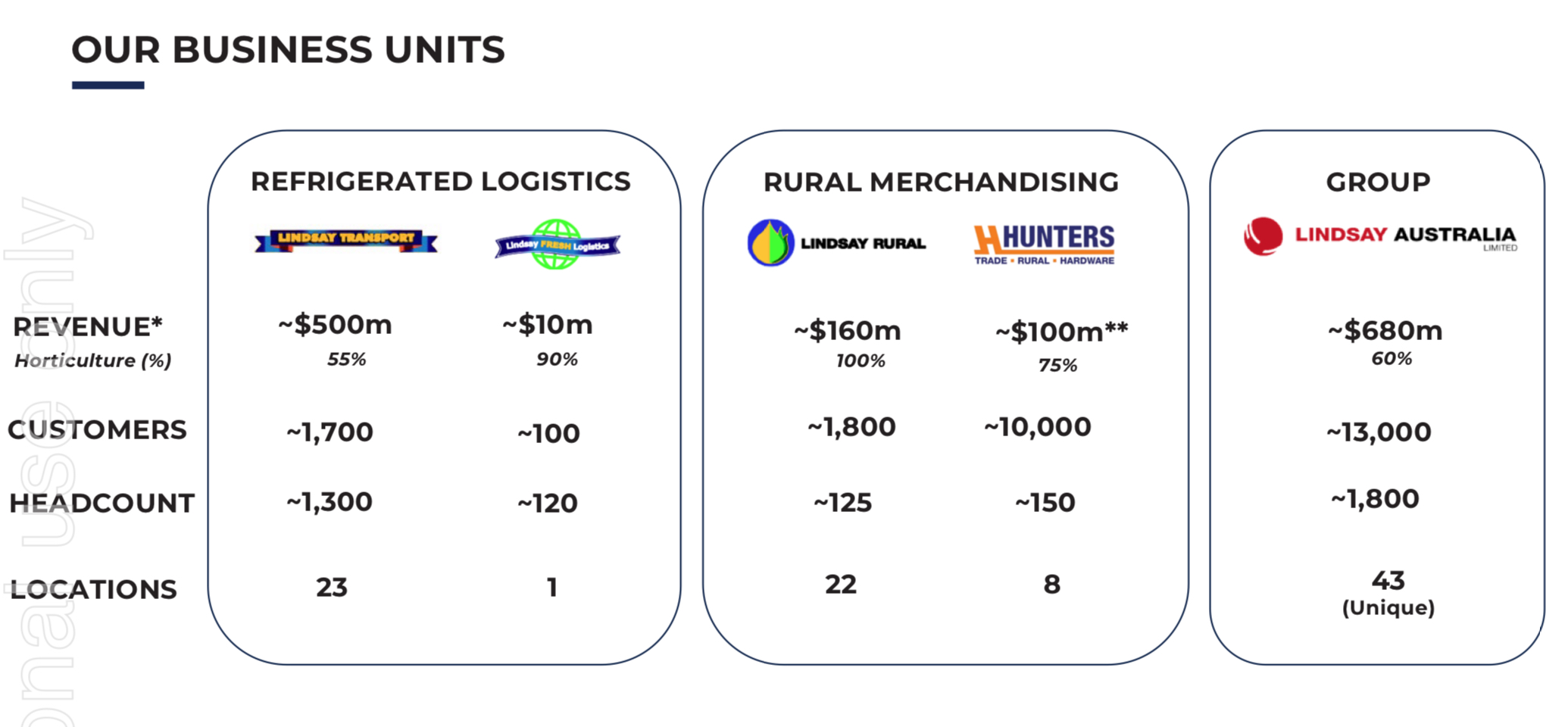

Seventy five percent of Lindsay Australia’s revenue is derived from the Refrigerated Logistics business and 25% is derived from the Rural Merchandising business (based on FY2023, including pro-forma revenue from the Hunters acquisition)

FY23 Investor Presentation

FY23 Investor Presentation

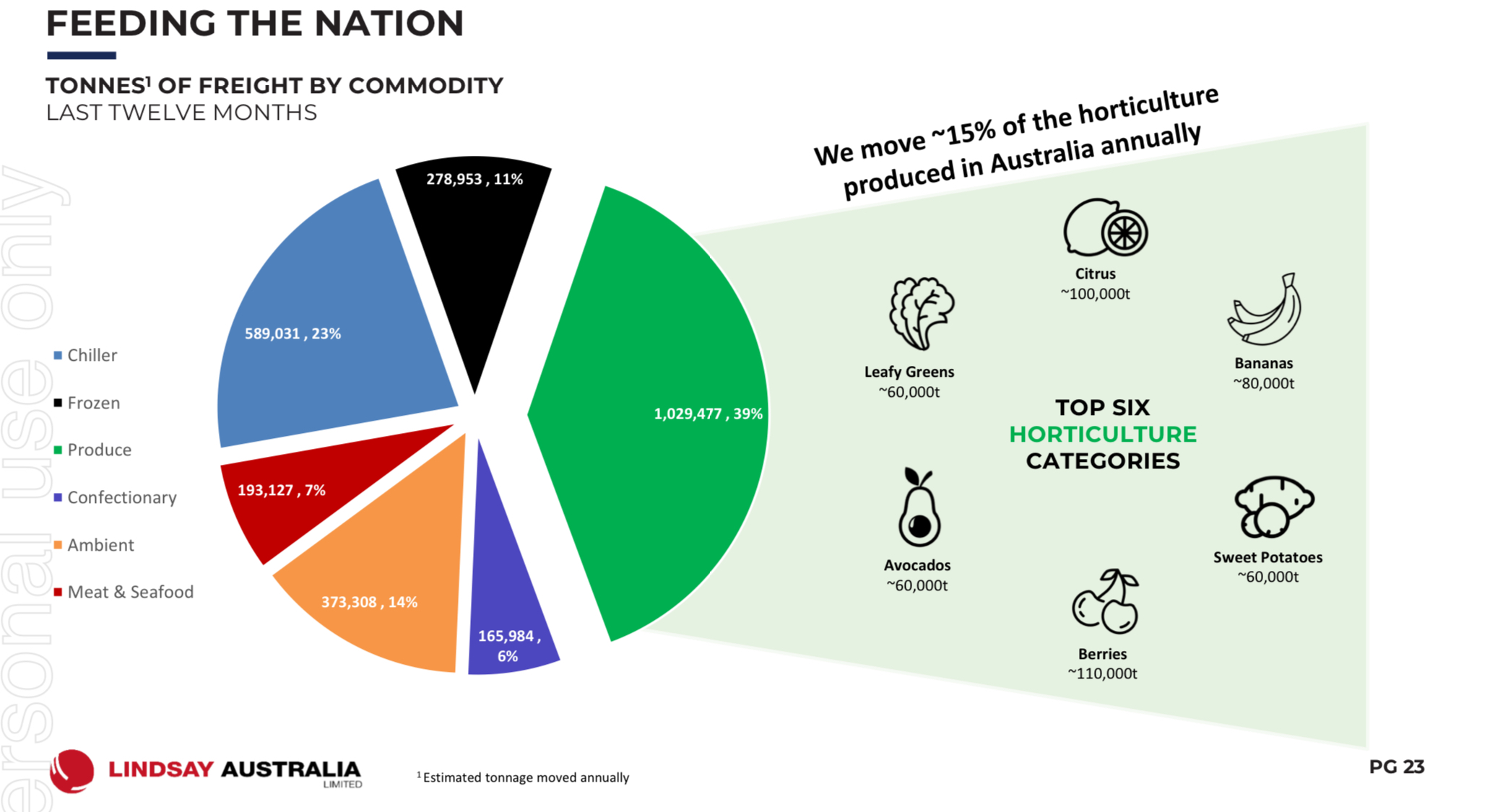

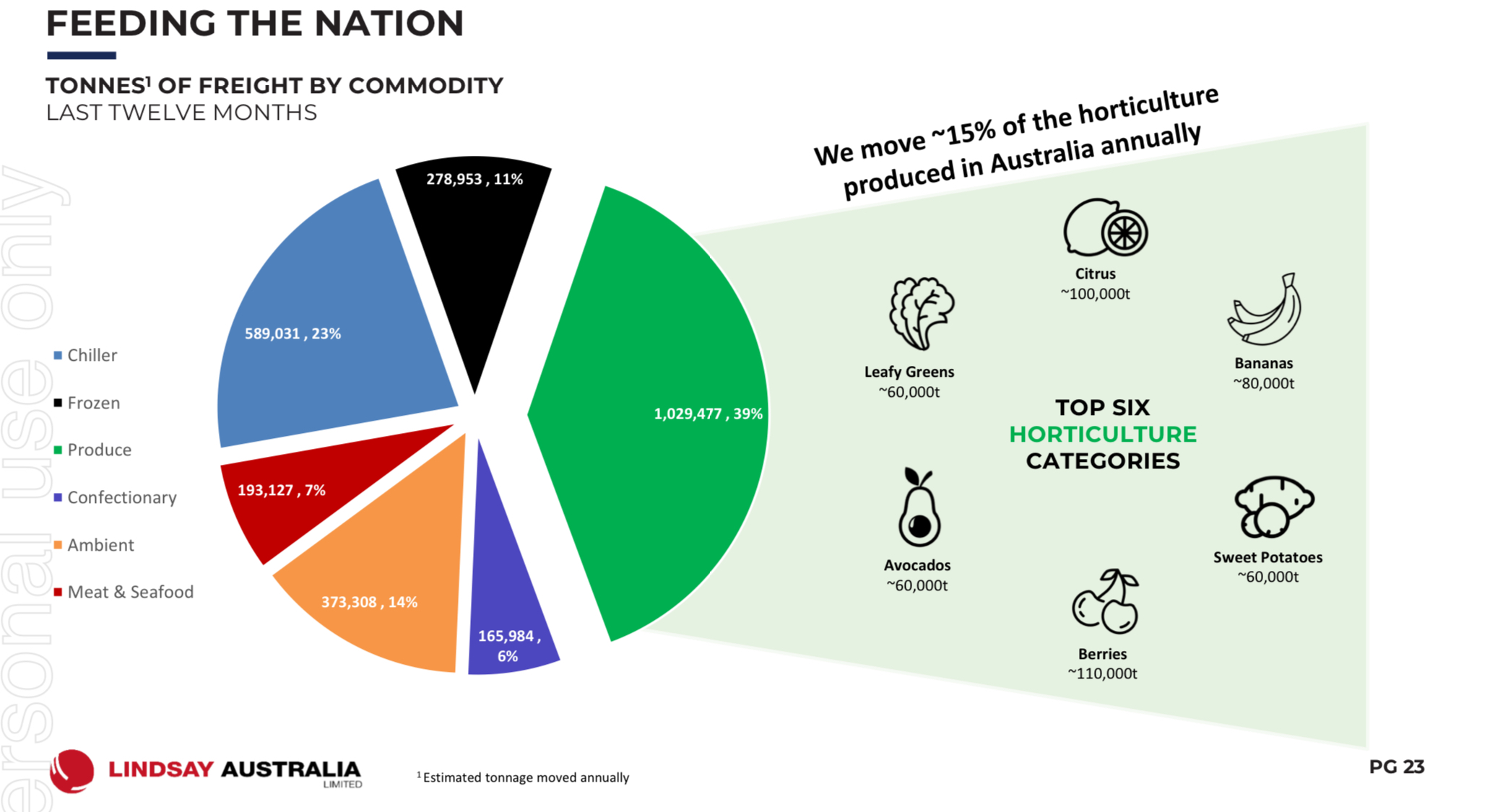

The majority of Lindsay Australia’s freight consists of produce, and the main categories are berries (110,000t), citrus (100,000t) and bananas (80,000t). They move approx. 15% of Australia’s horticultural products annually.

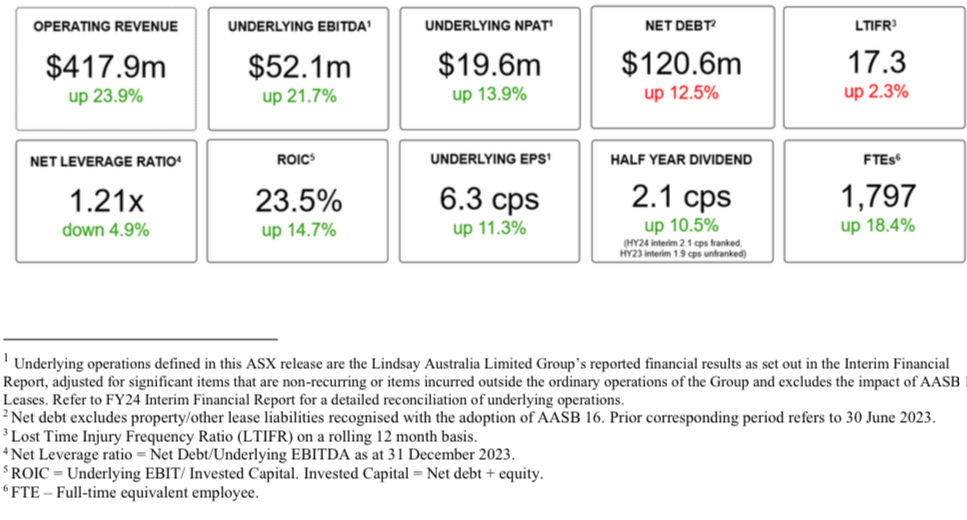

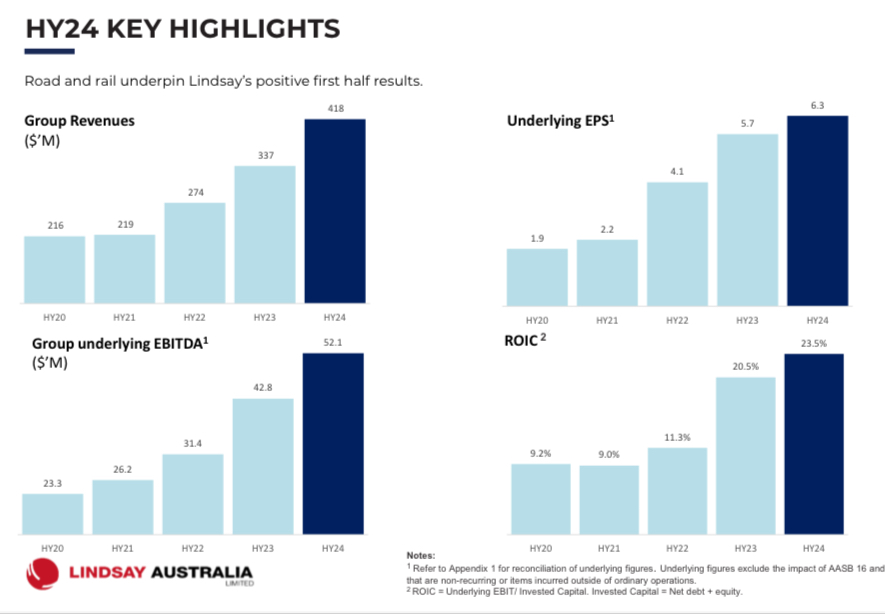

Record 1H24 Results

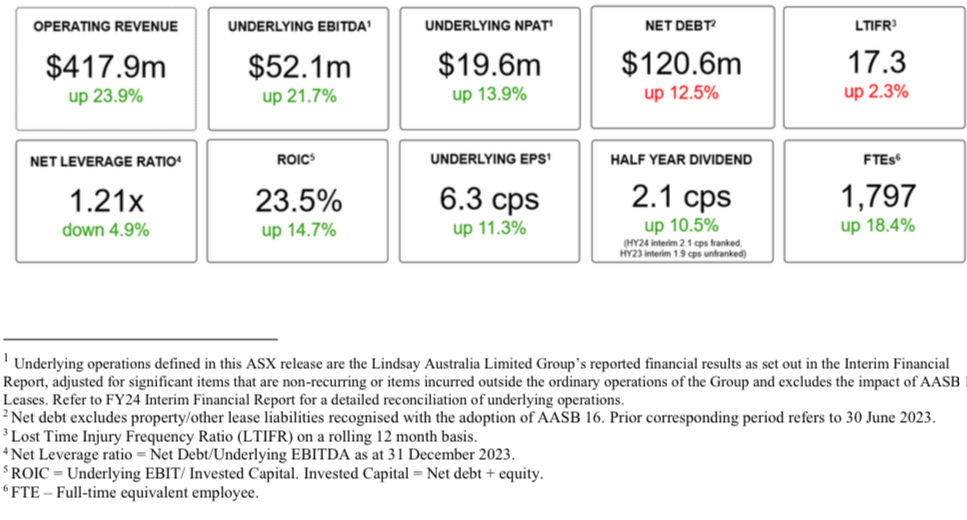

On the 25 February 2024 Lindsay Australia announced record revenue, underlying EBITDA and NPAT for 1H24. ASX Announcement.

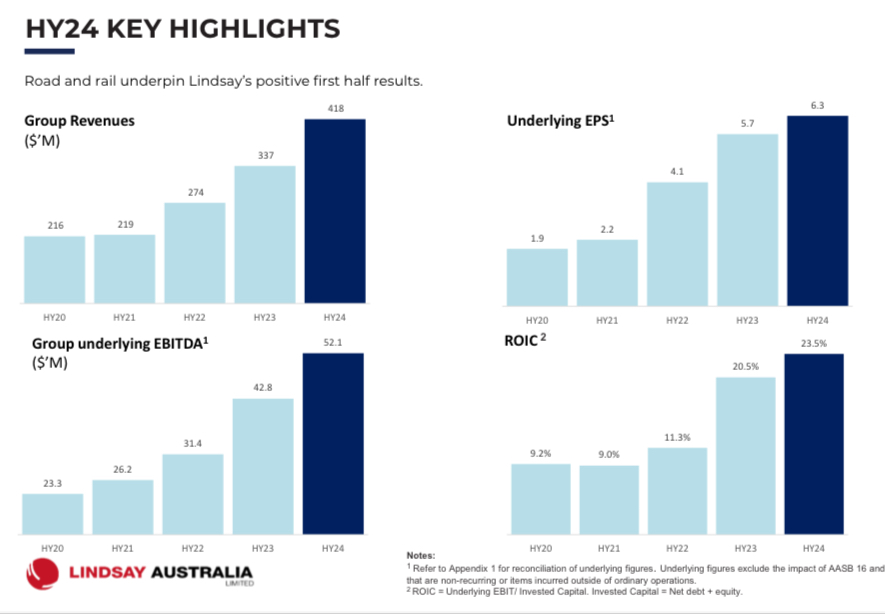

- First half FY24 operating revenue grew 23.9% from H1FY23 to $417.9 million, with underlying1 EBITDA up 21.7% to $52.1 million.

- The Company announced a first half fully franked dividend of 2.1 cents per share, up +10.5% on the same period last year.

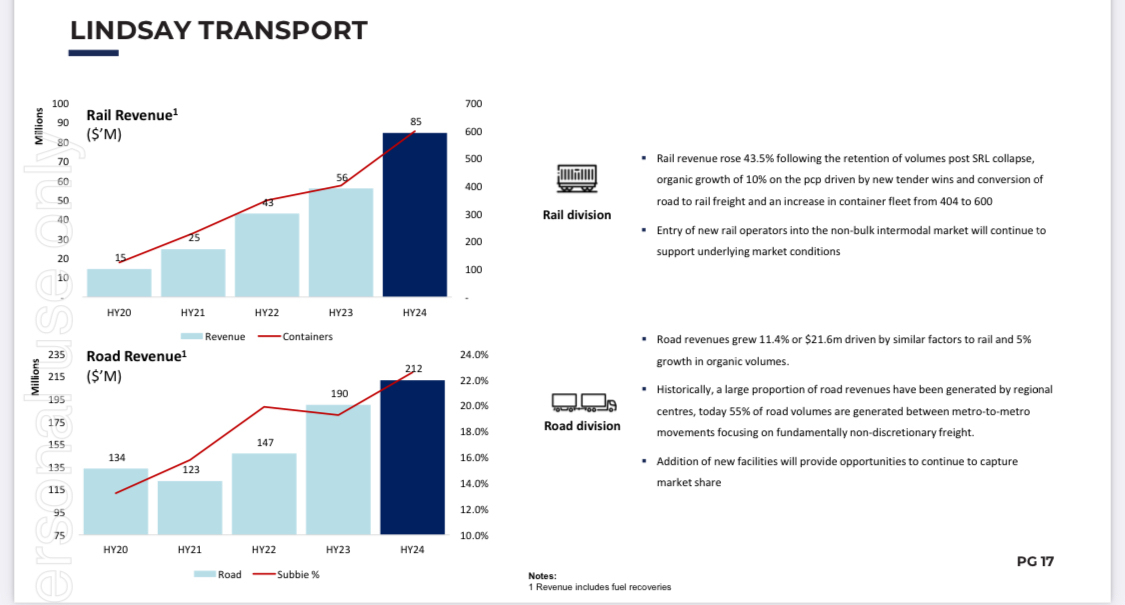

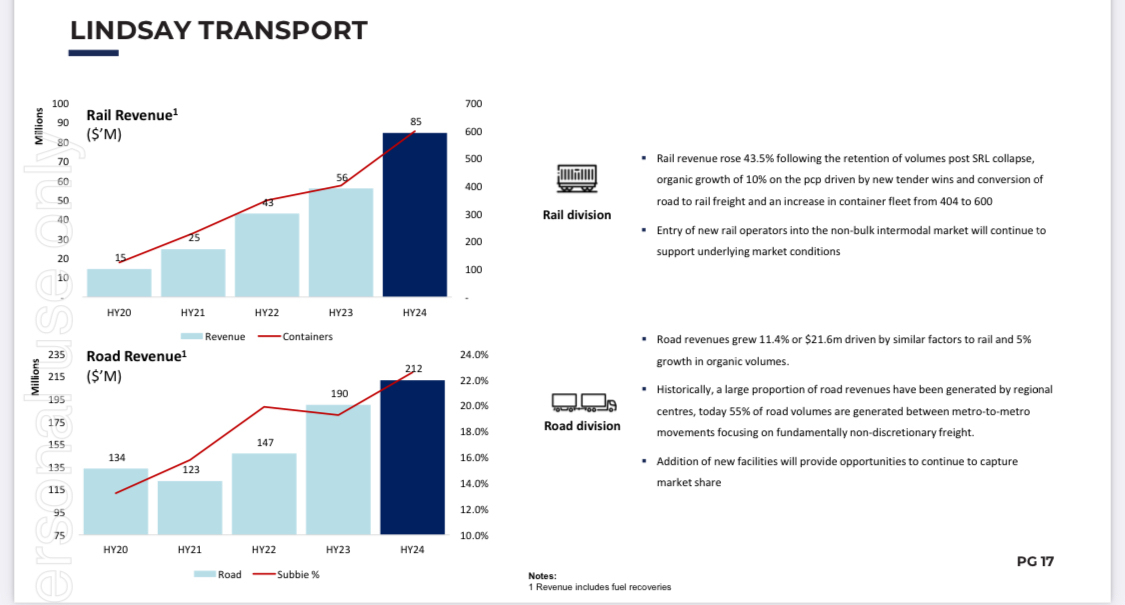

- Positive growth in rail operations continues with revenue up $26.2 million (+43.5%) compared to H1FY23.

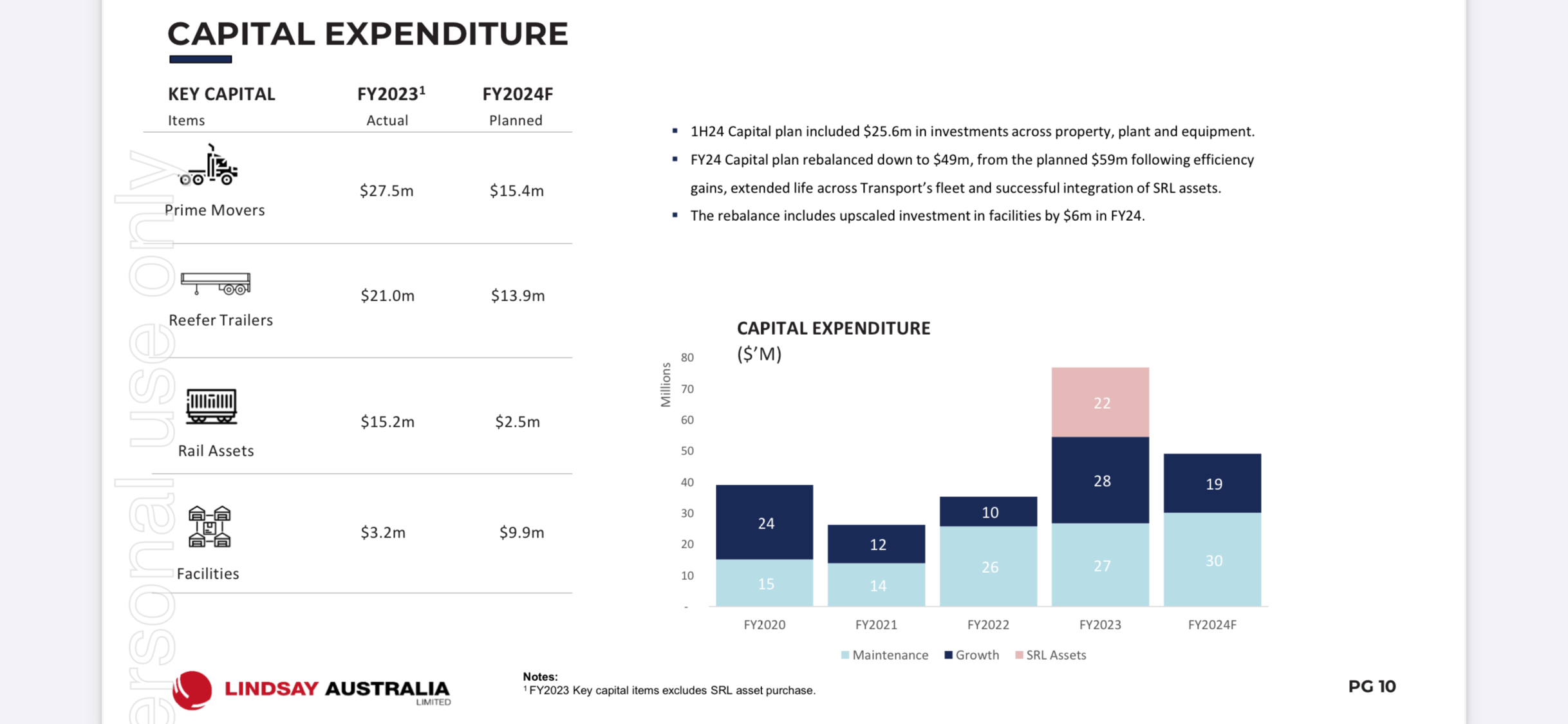

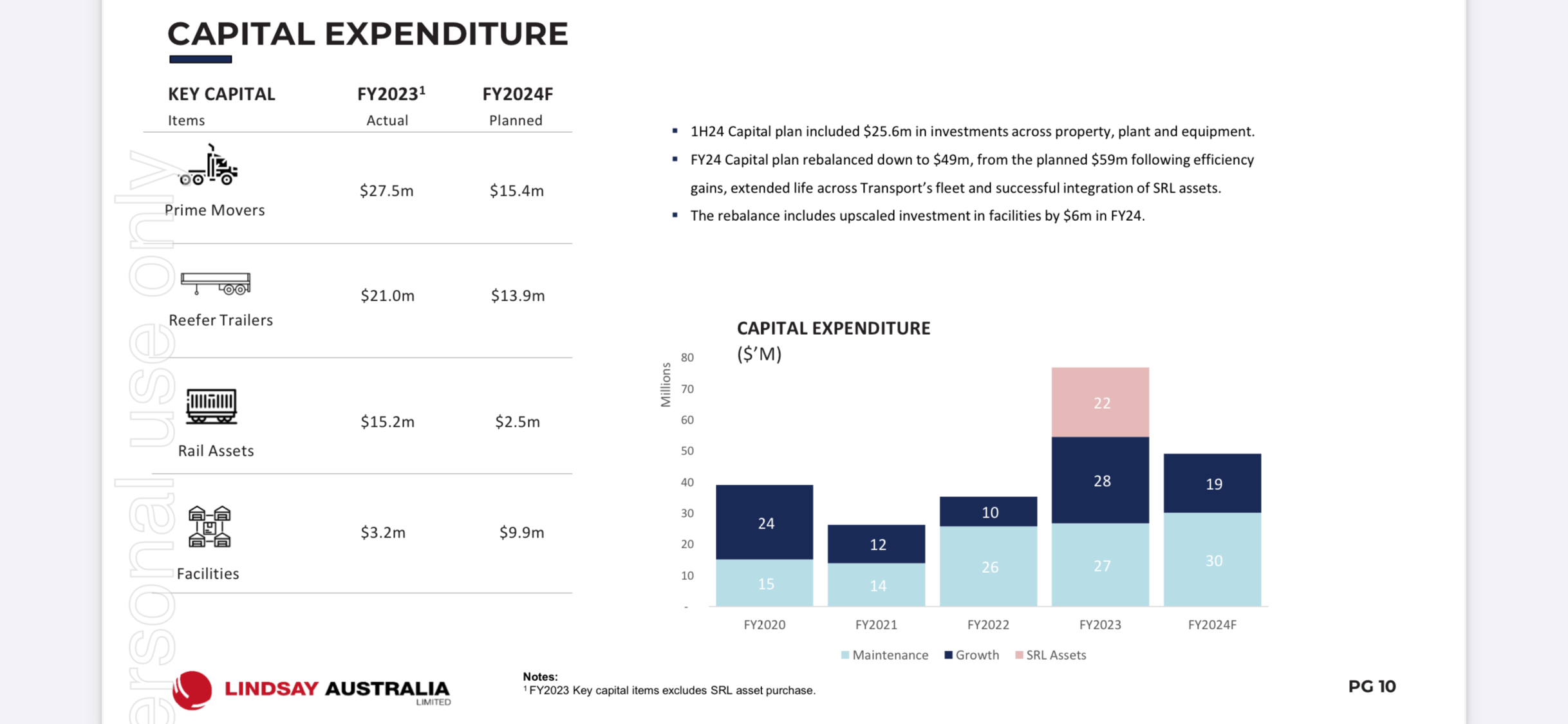

- Capital spend of $25.6 million was delivered in the first half of FY24 on new equipment and expanded facilities.

Statitory NPAT was $18.08 million, or 5.8 cps.

Increasing ROIC and ROE

What first caught my attention with Lindsay Australia was the rapid improvement in Return on Invested Capital (ROIC) over the past 3 years. The ROIC has improved from 9% in 1H21 to 23.5% in 1H24 (where ROIC = Underlying EBIT / Invested Capital and Invested Capital = Net debt + Equity).

Source: 1H24 Presentation

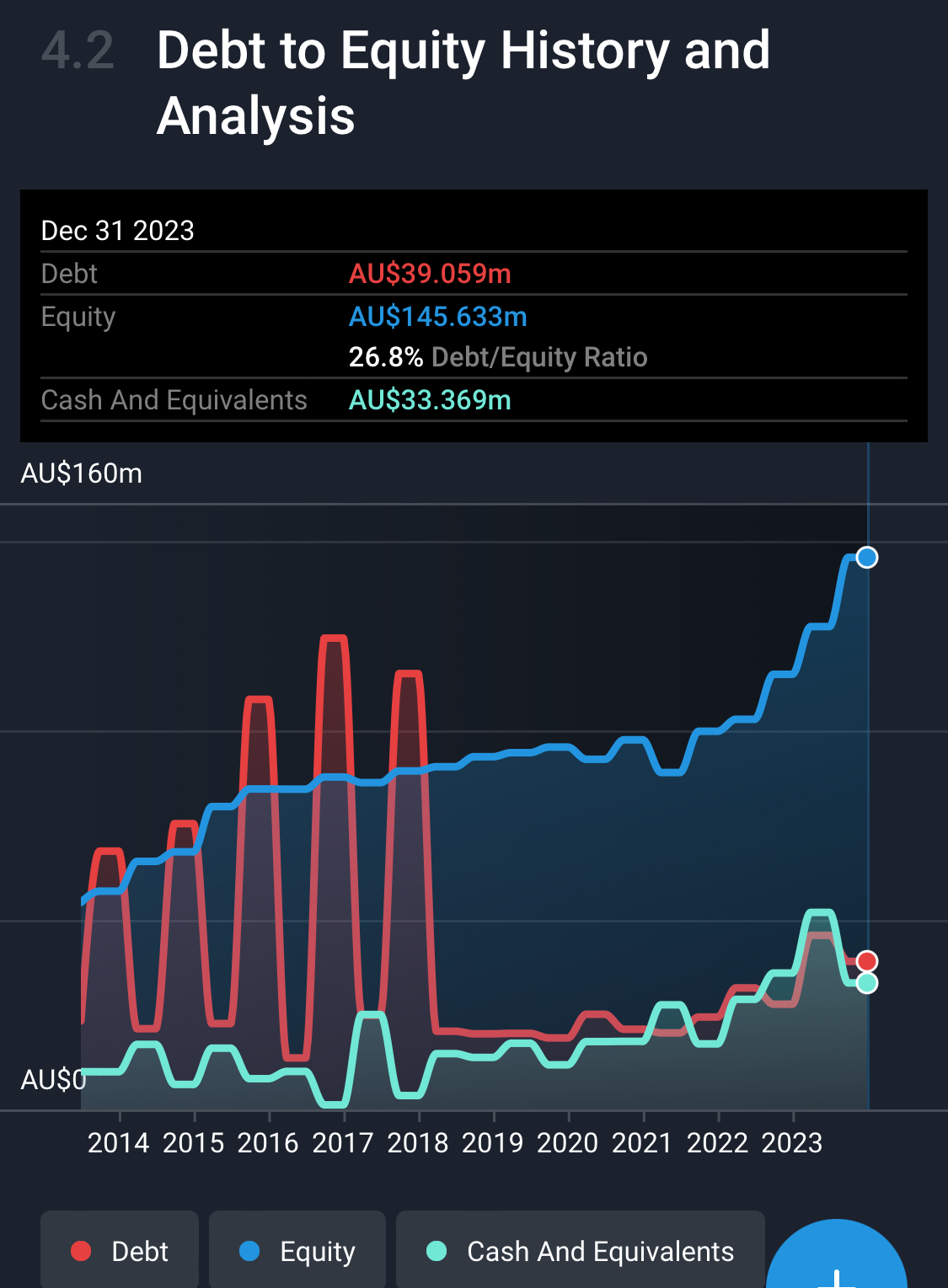

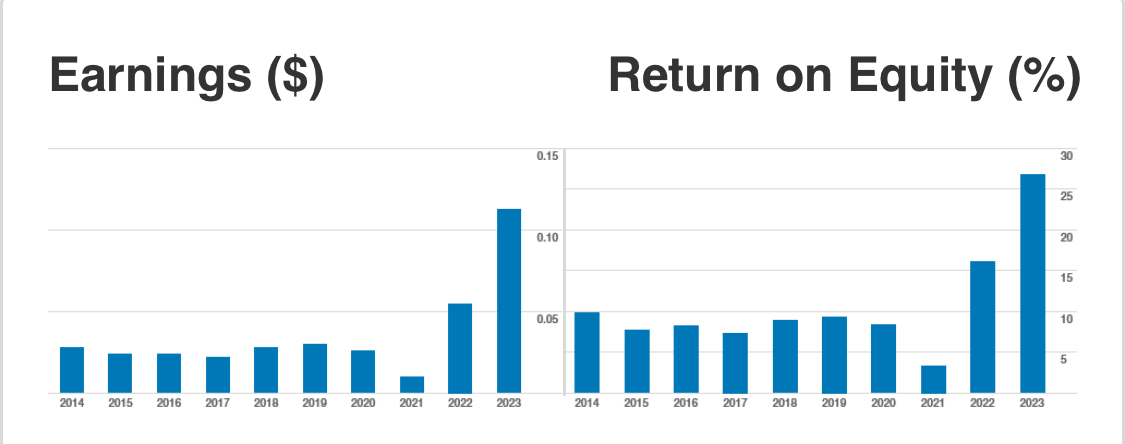

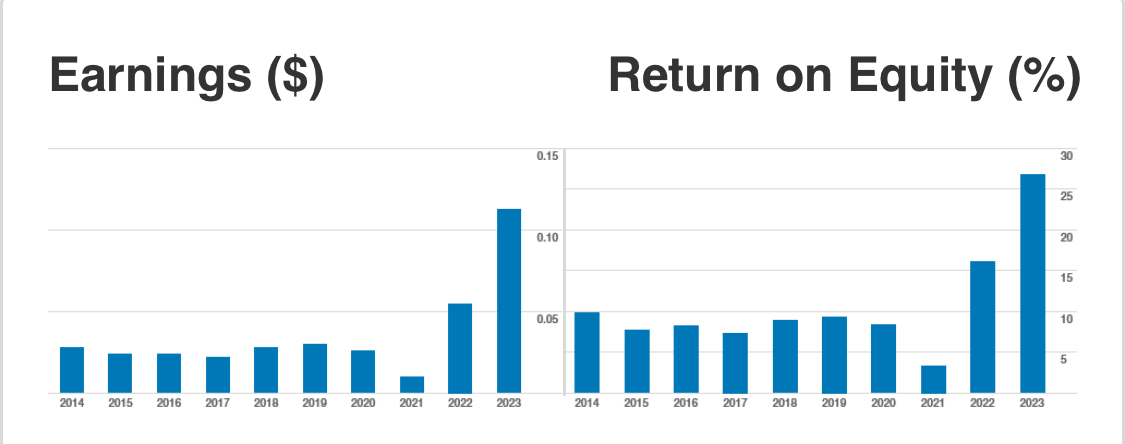

This is also reflected in the rapid increase in ROE from 8.4% in FY 2020 to 26.8% in FY2023.

Source: Commsec website

Source: Commsec website

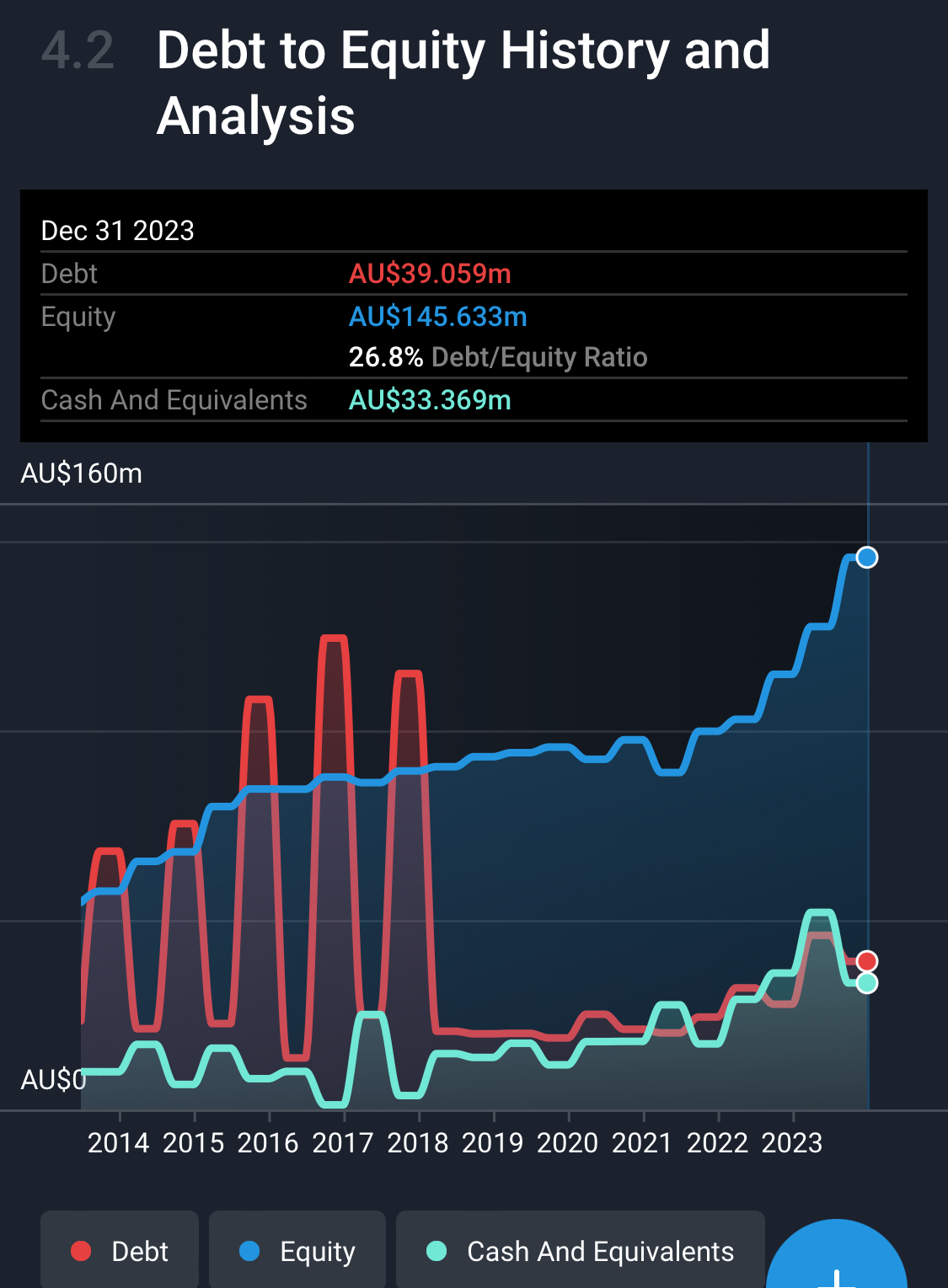

Looking forward, FY24 ROE based on forecast statutory NPAT of $36.16 million (doubling the statutory NPAT for 1H24 of $18.08 million) and shareholder equity of $145.6 million I get ROE of 24.8% for FY24.

While it’s nice to see Lindsay Australia’s ROIC and ROE improving, it made me wonder why profitability has improved so quickly, and more importantly, is the improvement sustainable?

Surge in demand following the collapse of Scott’s Refrigeration Logistics

I think this story “Surge in Demand” which appeared in “Prime Mover” on 19 April 2023 helps to explain why Lindsay Australia’s fortunes have changed so quickly.

“The transport services for Lindsay Australia have experienced a surge in recent demand following the publicised collapse of Scott’s Refrigerated Logistics (SRL).

The demise of the cold chain carrier, who went into liquidation last month, has provided Lindsay Australia with additional opportunities.

Scott’s provided refrigerated trucks and warehouses for businesses including supermarket giants Coles, IGA and Aldi.

The increased demand comes at a time of already tightening supply chain after the continued exit of smaller operators over the past two years.

The company said it had been able to accommodate the increased demand through its improved road and rail equipment utilisation; acquisition of equipment under the FY2023 growth capital expenditure plan; and acquisition of selective Scott’s equipment predominantly comprised of rail assets.

“Lindsay is well-positioned to meet the increased demand for our transport services following the unfortunate collapse of SRL,” said Lindsay Australia CEO Kim Lindsay.”

It appears that SRL’s collapse was perfect timing for Lindsay Australia. With a void in competition Lindsay selectively acquired SRL’s assets, predominantly rail assets, which has helped to improve overall efficiency of the business (https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02654801-2A1443757).

It has also allowed Lindsay Australia to reduce the FY24 Capital plan down to $49m, from the planned $59m due to efficiency gains, extended life across Transport’s fleet and successful integration of SRL assets.

Capital Expenditure

Rail revenue rose 43.5% following the retention of volumes post SRL collapse, organic growth of 10% on the pcp driven by new tender wins and conversion of road to rail freight and an increase in container fleet from 404 to 600.

While using more rail instead of road is improving margins and reducing capital expenditure, it may also increase risk. This has not been raised as a concern by Lindsay Australia. However, Linfox CEO Mark Mazurek said “In the 12 months to December 2023, there were 115 days when Linfox couldn’t rail goods on scheduled services followed by another 70 “lost” days this year due to floods, cyclones, bushfires, derailments and signalling problems, which Mr Mazurek blames on “underinvestment in rail infrastructure” (AFR)

Road revenues grew 11.4% or $21.6m driven by similar factors to rail and 5% growth in organic volumes. Historically, a large proportion of road revenues have been generated by regional centres, today 55% of road volumes are generated between metro-to-metro movements focusing on fundamentally non-discretionary freight.

Margins

Group EBITDA margins moderated slightly from 12.7% in 1H23 to 12.5% in 1H24. However, removing the impact of the Hunter’s acquisition EBITDA margins improved to 13.3%. The business remains focused on sustaining and improving margins.

The NPAT margin should come in at c. 4.33% ($36.1 million / $836 million x 100) compared to 4.77% for FY23.

Shareholder Equity and Earnings Growth

Over the last 8 years shareholder equity has grown from 28 cps to 42 cps (+150%) and NPAT has increased from 2 cps to 11 cps (+550%) - Commsec Data. Earnings have grown over 40% in the last 5 years. Analysts are forecasting lower EPS growth of c. 12% going forward.

Balance Sheet

Lindsay Australia had a solid balance sheet with net debt to equity of 3.9%. Debt is well covered by operating cash flow (231%)

Source: Simply Wall Street

Headwinds and Tailwinds

Lindsay Australia is currently operating with reduced completion in the refrigerated logistics business after the SRL collapse. However, this does not mean they are immune to increasing competition over time as other companies move in as the economics improve.

Lindsay Australia will do well when the rural sector does well. In the 1H24 report management said “Moving from H1 to H2, the regional transport and rural business may experience softer conditions due to the lag effect of wet weather and lighter plantings, whilst we expect metro volumes to remain relatively stable. In W.B Hunter we expect trading conditions to progressively return to normal levels.”

The Bureau of Meteorology is forecasting “April to June rainfall is likely to very likely to be below median for most of Australia. Much of the east has about an equal chance of above and below median rainfall for April to June.” It’s not a very definitive forecast at this stage. Climate research scientist Professor Roger Stone says we need to wait until May to get a better handle on the La Niña / El Niño influence. (Wetter or drier than average conditions) across Eastern Australia.

What farmers need is enough rain to plant their winter crops between May and July, but not too much rain that it prevents crops from being planted or harvested.There is currently sufficient subsoil moisture across most of eastern Australia’s growing regions for a reasonable winter crop without much follow up rain.

ABARES is forecasting winter crop production to be slightly above the 10 year average following record highs in 2023-2024.

Outlook and Guidance

“Moving from H1 to H2, the regional transport and rural business may experience softer conditions due to the lag effect of wet weather and lighter plantings, whilst we expect metro volumes to remain relatively stable. In W.B Hunter we expect trading conditions to progressively return to normal levels. Subject to no unforeseeable events, we expect full year underlying EBITDA to grow by 13% compared to FY23, coming in at the bottom end of our guidance” ($102 million - $108 million)

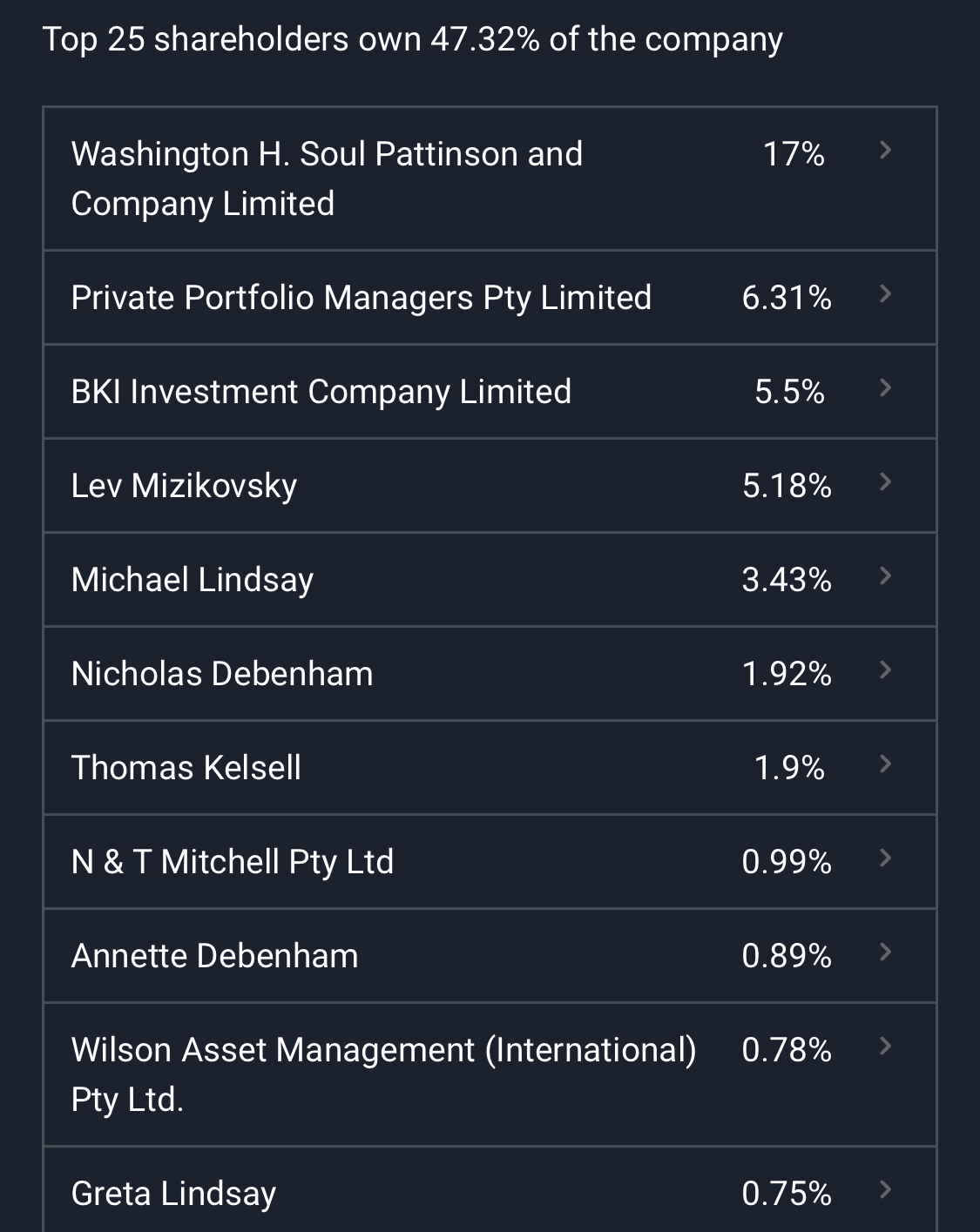

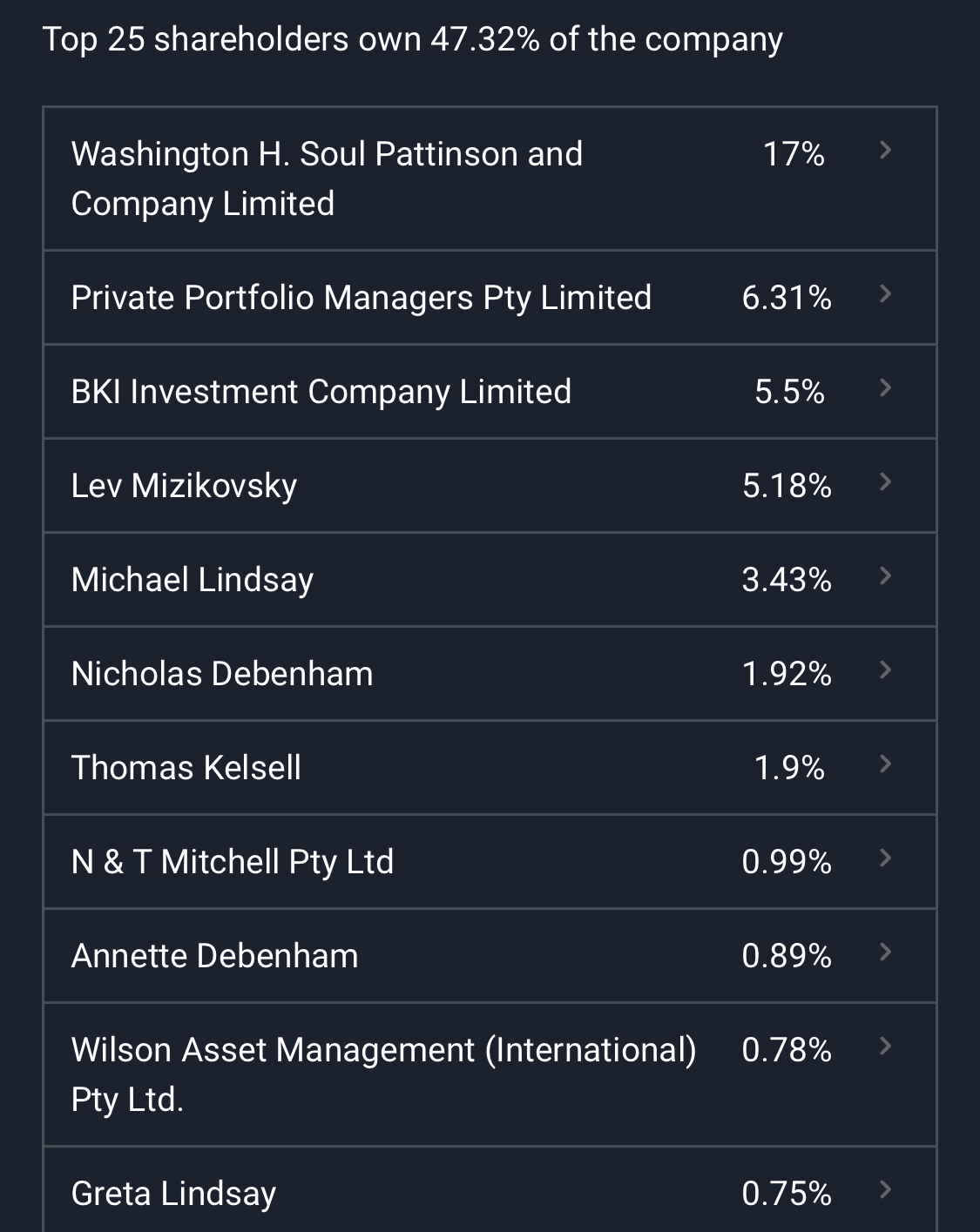

Ownership

@mikebrisy noted that Washington Soul Patts lightened off 2.85 million share this year averaging $1.20 per share, however this was about 5% of their holding in LAU and they still hold 17% of the business. Over the past 6 months 3 of the board directors have added approx. $170,000 in shares at an average of approx $1.10 per share.

Valuation

Shareholder Equity at the 31 December 2023 was $145.6 million. Assuming that 1H24 EBITDA to NPAT margin continues for the second half and FY2024 EBITDA comes in at $102 million (the lower end of guidance) NPAT could be as high as $38.4 million (12.3cps) for FY24.

Analyst consensus (4 analysts, Simply Wall Street) is NPAT of 11.2 cps (FY24), 13.7 cps (FY25) and 15.4 cps (FY26). Assuming consensus ROE over the next 3 years will be c. 24.8%.

Using McNiven's Formula and assuming Shareholder Equity of $0.47, ROE of 24.8%, 56% of earnings reinvested, and 44% of earnings paid out as fully franked dividends and a required annual return of 15% I get a valuation of $1.20. Working on a 12% annual return you could pay up to $1.72. At the current share price of $1.02, I am expecting a return of 16.7% per year, with about 7% of that coming from dividends (5% plus the franking credits).

PE multiple valuation

Working on analyst consensus earnings (NPAT) and the current share price of $1.02 Lindsay Australia is trading at 9 x FY24 earnings (11.6 cps), 7.6 x FY25 earnings, and 6.8 x FY26 earnings. At 9 x FY24 earnings Lindsay Australia is trading torward the lower end of the average annual PE ratio.

Analyst Consensus PT

Analyst consensus 12 month price target is $1.67 (5 analysts, Simply Wall Street).

Summary

Lindsay Australia seems to be benefiting from its end-to-end rural service business, with most of its revenue derived from refrigerated logistics in the horticultural industry.

The profitability of the business (ROE) has vastly improved over the last 3 years and based on guidance with be solid in FY24. Some of this improvement can be attributed to better than average seasons for farming. We have seen this across other rural businesses, including Elders.

Some improvement in profitability could be attributed to the timing of the collapse of Scott’s Refrigerated Logistics (SRL). Lindsay was in a position to selectively acquire assets that were synergistic with their current logistics business, mostly the refrigerated rail assets. This had the effect of reducing competition and at the same time improving freight efficiency.

If Lindsay Australia can continue forward with ROIC of over 20%, it will start to look cheap at a PE less than 9x. However, will the business continue to remain highly profitable? Given the nature of the rural industry which can swing from feast to famine depending on the season, natural disasters, the commodity prices, the value of the Aussie dollar etc etc. we might expect returns for Lindsay Australia to follow suit.

So while I think Lindsay Australia looks like excellent value with the current metrics, this could change rapidly. It’s probably not a stock you can put in the bottom drawer and forget about, and I don’t think it has a long enough track record of high ROIC to deserve a large position in a portfolio. However, I like what the business is doing and how it’s improving and I’ve decided to add it to our portfolio.

Held IRL (0.9%)

Source: Commsec website

Source: Commsec website