Electrical distribution and automation supplier $IPG announced their 1H Results this morning.

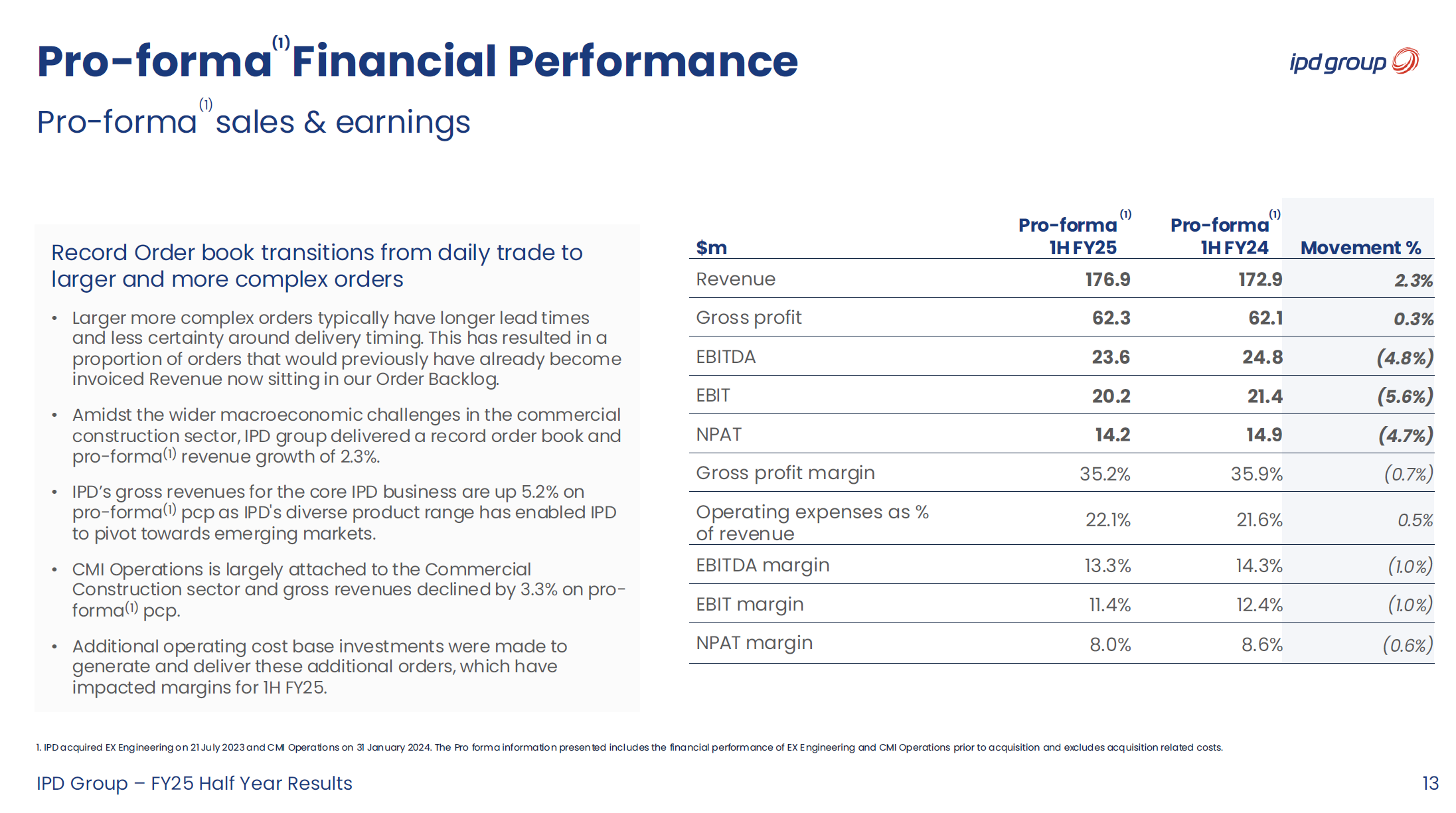

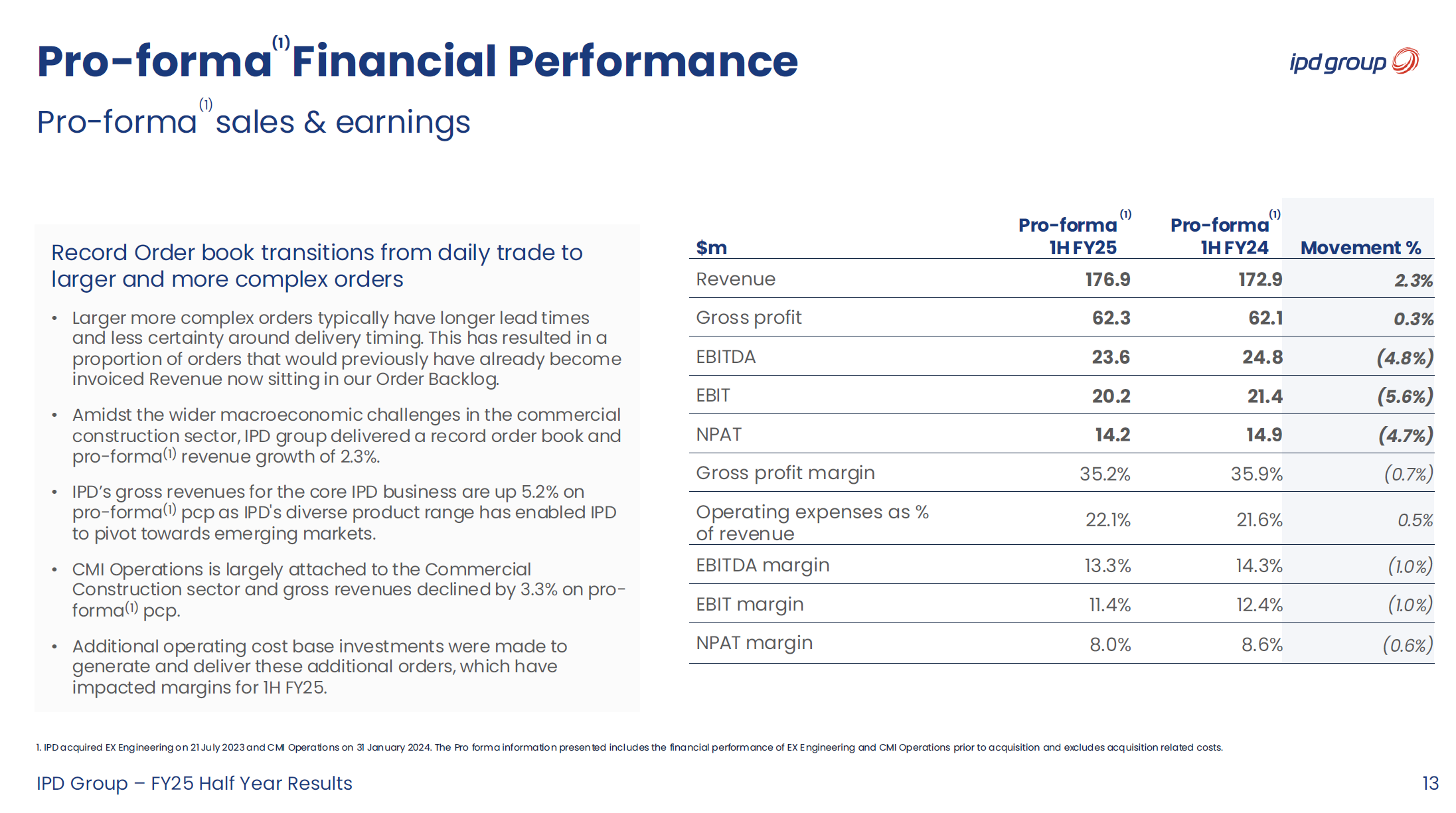

I've provided a full summary of the investor call this morning later in this straw. However, it is important to recognise that in this 1H result we have the first full inclusion of the major CMI acquisition, which had been absent from the PCP. And so, I want to focus on just one slide - probably the least flattering of the entire presentation. The pro forma comparison, which lets us see how the actual operating businesses performed.

Figure 1

So essentially, revenue and gross margin just inched ahead. And profit fell back, with management explanation that this is due to 1) CMI’s lower-margin impact, 2) shift to larger, lower-margin projects, 3) higher operating costs to support future growth, and 4) commercial construction weakness. Reading my summary below, you get a very different view of the business, which is why when M&A is at play, it is vital to look at the pro forma picture.

The commercial environment is tough, and CEO Michael Sainsbury reportdc that the result shows that $IPG is gaining market share.

He said:

" ... there are a number of our competitors that are reporting 8% and 10% and 15% revenue degradation as well because of the market conditions. So I think we've done better than the market. I certainly feel as though we've taken some share in these tough conditions, which will hold us in really good stead when the market does pick up again that you've secured that business and you move into more buoyant market with more share."

(I need to dig into some of this.)

Overall, the market responded positively to the result on the day with SP +4% on the day, but yet to claw back all the losses when it issued the underwhelming guidance at the AGM. Today's result just beat 1H guidance for EBITDA and EBIT.

Increasing the dividend by +40%, with the payout at 50% is a good result. The balance sheet is strong and operating cashflow was good. I think these helped encourage the market response.

My Overall Takeaway

Overall, I think the result is OK. It represents a starting point for the enlarged group and, over the next year, we should start to see business efficiencies come through, as well as revenue synergies between the individual business units.

Management have said a lot about each of the business units over the last year, and so I am happy to see how much of this pans out over the year ahead. I am still getting to know the business, management, and the sector. For today, I am content to stick with my valuation of $5.00 ($4.00 - $6.00) from the AGM.

----------------------------------------------------------------------------------------------

Full Summary of the Investor Call and Presentation

Overall

IPD Group delivered record revenue and profit growth in 1H FY25, exceeding guidance. Strong cash generation, debt reduction, and a record order backlog provide confidence for sustained performance in 2H FY25. While commercial construction remains weak, IPD is gaining market share, expanding into data centers, renewables, and EV infrastructure. Management remains optimistic about continued growth, supported by price increases, acquisitions, and product diversification.

1) Key Results Headlines (Comparison to 1H FY24)

- Revenue: A$176.9 million, up 46.6% from A$120.7 million.

- EBITDA: A$23.6 million, up 46.6%.

- EBIT: A$20.2 million, up 47.4%.

- Net Profit After Tax (NPAT): A$13.3 million, up 40.0%.

- Earnings per Share (EPS): A$0.129, up 19.4%.

- Operating Free Cash Flow: A$25.3 million, up from A$10.1 million, reflecting strong cash conversion (107.6%).

- Net Debt: A$2.2 million, a substantial reduction from A$8.8 million at June 30, 2024.

- Order Backlog: A$92.7 million, up 49%, ensuring strong revenue visibility.

- Interim Dividend: A$0.064 per share, up 39.1%, with a 50% payout ratio.

(Yeah - so, now you understand why I wanted to highlight the pro forma page!)

2) Operational Highlights by Sector

- Data Centers:

- Revenue from data centers grew 25% YoY, now representing 15% of total revenue.

- Strong order book with Amazon and NEXTDC data center projects.

- EV Charging & Public Transport Electrification:

- Continued expansion in EV infrastructure projects via Addelec Power Services.

- Notable wins include Perth Transit Authority ($10.9 million project pipeline) and NRMA (A$3.5 million opportunities).

- NSW Kingsgrove Bus Depot project officially commenced, with revenue expected in 2H FY25.

- Commercial Construction & Infrastructure:

- Remains largest revenue contributor, though facing headwinds in broader market.

- Successfully expanding into water & wastewater, contributing 13% of total revenue.

- Industrial & Mining:

- Hazardous area electrical equipment sales grew significantly via EX Engineering.

- Secured major contracts in oil & gas.

- Wholesale & Trade Sales:

- Outperformed market trends, gaining share from competitors despite construction slowdown.

- CMI Operations showed weakness in New South Wales and Victoria due to commercial construction softness but gained traction in WA and export markets.

3) Cash Flow Highlights

- Net Operating Cash Flow: A$25.3 million, up over 100%, reflecting strong conversion.

- Net Investing Cash Flow: -A$4.5 million, primarily due to capital expenditure and acquisitions.

- Net Financing Cash Flow: -A$2.2 million, driven by debt repayments.

- Cash Balance (End of Period): A$28.9 million.

- Debt Reduction: A$10 million in borrowings repaid post-half-year, reducing core debt by ~33%.

4) Balance Sheet

- Total Net Assets: A$158.1 million, strengthening the group's financial position.

- Net Debt: A$2.2 million, down from A$8.8 million.

- Inventory: Increased slightly by A$1.2 million, reflecting demand growth.

- Dividend: A$0.064 per share, fully franked (payout ratio: 50%). Increased by 40,

5) Industry Outlook & Competitive Landscape

- Market Conditions:

- Commercial construction remains challenging, but IPD is outperforming competitors.

- Interest rate cuts may boost sector activity in the next 6-12 months.

- Growing demand for data centers, renewable energy, and EV infrastructure supports future growth.

- Competitive Positioning:

- Taking market share in high-margin trade business, outperforming ASX-listed peers.

- Expanding ABB product range but not exclusively reliant on ABB.

- IPD currently only captures ~20% of the electrical contractor market, indicating significant growth potential.

6) Summary of Q&A with Analysts

- Order Backlog Conversion:

- Current backlog (~A$93M) represents 3-4 months of work, supporting 2H FY25 revenue.

- Some Amazon orders were pulled forward into 1H FY25, but pipeline remains strong.

- Market Share & Expansion Strategy:

- ABB partnership still has growth runway, but IPD is not limited to ABB products.

- Opportunity to expand into other electrical contractor product categories (beyond current 20% penetration).

- Daily Trade Business & Market Conditions:

- IPD has outperformed competitors, gaining share in a weak construction market.

- CEO expects the market has bottomed out, with gradual recovery over the next 6-12 months.

- Price Increases & Margins:

- No supplier price increases for 12 months, but IPD to implement a 3-4% price rise in March 2025.

- Due to contract structures, only ~50% of this price increase will flow through in 2H FY25.

Disc: Held in RL and SM