Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

As those of you who read my report on $IPD's FY25 Result might not be surprised to learn, I caught up with the $IPD AGM with a clear bias that I was looking for reasons for why I should stay invested with this firm.

TLDR: I couldn't find these reasons, and I have exited my entire holding.

To complete the record here, I am highlighting the key insights from the AGM that led me to decide to take advantage of the +9% price kick (at time of selling in RL). To be clear this is not a balanced report on the business, as conveyed by CEO Mike Sainsbury. I'll leave it to continuing holders to provide a more balanced view.

A common thread to my concerns is what I would call "management spin" and less than clear reporting on the status of the business.

Again, to be clear, I am not alleging anything improper. Rather my expectations for clarity and transparency are higher than management seem either willing or able to give.

My specific bug bears from the AGM:

1. The recap of the strong renenue and profit growth performance in FY25 over FY24 made no reference of the major contribution of the CMI acqusition to these figures. It is a red line for me that when businesses rely on M&A to drive growth, they have to be fully transparent on the organic contribution to progression on metrics - even if it is a footnote, small print, or an appendix. M&A on its own does not create economic value and, more often than not, large M&A destroys value.

2. We were told that while having success with locally-sponsored datacentres, apart from Amazon, $IPG is not winning work for Hyperscaler datacentres because the ABB parts list is not included in the global standards for the other hyperscalers. Apparently, ABB are upping their game having recognised they were slow off the mark offering equipment for data-centres. As $IPG's exposure to datacentres is a core part of my thesis, learning about this current competitive disadvantage is a real blow to the thesis.

3. While there was much talk about expected changes to building codes due next year to require EV chargers in new commercial buildings, there was nothing said about about the current progress of this segment. Another thesis challenge.

4. Having decided at the FY25 Results to stop reporting Order Book, MIke spoke at length in qualitative terms about how strong the pipeline is. I'm sorry, but if it is such an important metric to warrant this airtime, please back it up factually. Otherwise, as far as I am concerned, it is more "word salad".

5. In addition to my comment in 1., when addressing efficiency improvements and citing the falling Opex/Revenue ratio, there was no mention of the contribution of the CMI acquisition to the favourable comparison. CMI is more of a plain vanilla distributor, providing fewer services than other IPD Group business. As such, its addition to the portfolio favourably impact the Opex/Revenue ratio. This is not an efficiency improvement, it is a portfolio combination effect, and it is material.

6. Finally, though actually less critically given where we are in the commercial property cycle, I was underwhelmed by the 1H FY26 guidance update - it being below the trajectory of my valuation low case.

These are the main but by no means only areas of concern for me.

Therefore, I have sold my remaining RL position for $3.68.

Having seen my updated valuation this morning, you will note that this is well below my valuation. And you'll also see I missed the oppportunity to sell for a lot more several weeks back. (Yeah that sucks.)

While that's unfortunate, I want the capital available to deploy into stocks for which I have a high conviction.

Another reason to update my valuation is to be clear that I do believe this business is a reasonable business, and much of the basis of my investment thesis remains intact. I also recognise that should the commercial sector see a cyclical upturn (as Mike predicted at the AGM), we will likely see $IPD re-rate positively, leading to a significant SP appreciation. (My valuations are based on through-cycle average expectationss). So, I fully appreciate that I might not be selling at a good time.

However, I no longer have the conviction in $IPD nor the trust in management to hold it for the long term. (@Karmast I got there, eventually!)

Disc: Not held

26-Nov-2025

Valuation $4.20 ($3.20 - $$5.20)

Assumptions

Quick update following the AGM presentation and 1H FY26 guidance, just adjusting P/E scenarios to 12/14/16, and nudging down Revenue CAGR scenarios and narrowing the range to 6.0%/6.75%/7.50%.

See straw for discussion.

26-Aug-2025

Valuation $4.75 ($3.60 - $6.00)

Assumptions

Results of my first independent valuation of $IPG, given (mostly) clean FY25 results.

Method: Projection of EPS to FY30 and discounted back at 10% p.a.

Range of scenarios covering the following input variables:

- Revenue growth: 6%, 7%, 8% p.a.

- %GM starting at 34.5% improving progressively to up to 37.5% in FY30

- Expenses growth 5%, 5.5% and 6% p.a.

Other Parameters (Fixed)

- Other Income and Finance Cost, fixed as % of revenue

- Growth of SOI at 0.3% p.a.

- Tax Rate = 30%

Assumed P/Es in FY30

Although $IPG's PEs since IPO have ranged from 12 to 22, the period of elevated PE's was, in my view, unsustainable exuberance with the market failing to value M&A-driven growth correctly. Upper PE's are therefore ignored. PE's for a decent distribution business are assumed to be 14 to 18. Management are yet to earn the right for a higher premium, and this will be reconsidered at each update.

An upside risk is that $IPG PE's and earnings growth could accelerate if it increases exposure to fast growing industry segements (datacentres, EV charging if this accelerates!, electrification).

Other Assumptions

I have assumed no further M&A, which is both an opportunity and a risk, so I've treated it as net neutral. Clearly, this is NOT going to happen.

Graphical Output

25-Nov-24

$5.00 ($4.00 - $6.00) based on today's soft guidance for 1H FY25.

Thesis fully intact, as I consider this to be purely cycical.

16-Jul-24

See my related straw:

I don't yet have any unique insights on $IPG. I think the three covering analysts are generous / bullish with an average TP of $5.58 and a very narrow range ($5.50 - $5.65) versus today's close of $4.81. I'll therefore be a tad more conservative and post an inital Strawman valuation of $5.40.

I'll have a go at my own model, once I get to see a clean 6-months for the combination of IPG+CMI in Feb 2025.

AGM today for IPD group and they have an earnings guidance for 1H26:

This looks to be a small beat over the Taylor Collison broker forecast of $24.5m EBITDA from August.

Further commentary from the chairman below:

"IPD enters FY26 from a position of strength. Demand for integrated electrical solutions continues to grow, driven by infrastructure upgrades, data centre expansion and decarbonisation objectives across the economy. We are positive the Group’s strategic direction is sound and remain focused on innovation, disciplined execution and shareholder returns. As CEO Michael Sainsbury will shortly detail in his presentation, year to date trading is showing positive momentum across all Group businesses and we are pleased to announce guidance for the first half of FY26 in the range of 5.1%-7.2% for EBITDA growth over the FY25 pcp."

The other important detail I'm seeing is that founding director and ex-CFO Mohamed Yoosuff will step down from his executive role and assume a non-executive director role from 31 December. He currently owns ~11% of the company. I've included the chairman's comments about his transition below. Notably, he states that Mohamed has no current plans to reduce his holdings, but we've all heard that one before.

"To close, I would like to thank my fellow Directors for their considerable input and guidance across the financial year. I’m particularly pleased that Founding Director and major shareholder Mohamed Yoosuff will continue his long standing connection with IPD Group as a Non-Executive Director following his retirement from his current executive role at the end of December. As disclosed in October, Mohamed has made an indelible mark on IPD Group over the past two decades, a period of significant growth, multiple acquisitions, and a successful ASX listing. I also note his commentary at the time that he will remain actively engaged as a Non-Executive Director and long-term shareholder, with no current intention of reducing his shareholding. Thank you to all our shareholders, staff and supply chain partners for your continued support and belief in IPD’s future."

Overall, IPD is probably the shareholding I have weakest confidence in, as I don't necessarily trust their governance based on past behaviours. But this is a solid print and they are still a key supplier to a sector growing strongly, right as the construction industry starts to rebound as well. Please no one remind me of this when Mohamed Yoosuff sells off 50% of his holdings in January.

Disc - Held

12m PT of $4.50

https://www.taylorcollison.com.au/wp-content/uploads/2025/08/IPG-FY25-Result-TCResearch.pdf?utm_medium=email&_hsmi=12354855&utm_content=12354855&utm_source=hs_email

IPD Group released earnings today, with results coming in ever so slightly above the downgraded guidance from the end of May. Mr. Market has digested this OK news and rewarded them with a 14% share price pop at the time of writing!

Looking through the numbers released on the PDF, I thought there might be a bullish market outlook statement driving this move, but it's pretty standard stuff about being well-placed for new work and they removed any mentions relating to the size of their order-book which has been common previously. On the call, the CFO explained that they've decided to stop regularly reporting the order-book size as it jumps around due to revenue recognition requirements, but it is currently at a similar level to previous. Not sure what to think about that. He's technically correct, but you wouldn't call removing the order book figure a bullish change.

The key positive news on the call that didn't really make the results announcement was around data centres and commercial construction. Data centre revenue was expected to be up 25% yoy in May, but actually finished the year 33% up on FY24. Beyond this they're forecasting a further 25% growth in data centre business for FY26 which would be an additional $15m of revenue. For commercial construction, in the CMI electrical business they are starting to see green shoots of demand and are hopeful of an improved year in FY26.

So in general, a steady result in competitive market conditions, and a positive outlook seems to have been just what the market wanted to see. But I can't quite get to a 14% jump based off these figures myself.

Keen to hear the thoughts of our resident expert @mikebrisy when he finds the time amongst a sea of other reports!

Key information from the release

• Revenue of $354.7 million representing 22.1% growth on pcp

• Continued revenue growth across the core IPD business (+5.2% on the pcp), CMI’s Minto Plugs (+6.4% on the pro-forma pcp), and EX Engineering (+5.2% on the pro-forma pcp), with all ahead of guidance on strength in key infrastructure sectors (i.e. Data Centres, Water & Waste Water)

• Addelec (revenue -12.8% on the pcp) was impacted by previously-disclosed project delays, while CMI Cables (revenue -10.2% on the pro-forma pcp) was lower than previously guided, driven by a major project order being realised in July (instead of prior to 30 June).

• Data Centre revenue growing strongly, up 33% on FY24, now representing 16% of group revenue

• EBITDA of $46.4 million, up 19.3% on pcp and NPAT of $26.2 million, up 17.0% on pcp

• EPS of 25.3 cents for FY25, up 8.6% on pcp, demonstrating the success of accretive acquisitions made in FY24

• Operating free cash flow (before interest and tax outflows) has continued to increase, rising to $52.7 million for FY25 with Operating free cash flow conversion (before interest and tax outflows) of 113.6% for FY25 (up from 91.3% in the pcp)

• Net Cash of $9.8 million as at 30 June 2025 (vs a Net Debt position of $8.8 million at 30 June 2024) after repaying $20.0 million of core debt during the year

• Total fully franked dividends of 12.6 cents per share declared for FY25, up 16.7% on pcp

Following a surprising 12.5% fall on no news since the start of May, IPD came out today with a reduced FY25 earnings guidance. EBITDA was initially forecast at $49.8m and will now fall between $45.7-$46.3m (7.5% reduction).

Given that current market conditions are somewhat tight I'm not overly shocked to see a downgrade and am willing to cut management some slack given the long-term growth story is still intact, however the leaky share price drop seems to confirm earlier concerns on here about management behaviour / reliability.

The good news to takeaway from my perspective is that firstly, the order book is more or less unchanged, with $91.5m in backlog orders currently and secondly, data centre revenues have grown 25% on the pro-forma pcp. Should market conditions open up a little with the latest RBA rate cut, IPD seem well placed to continue strong growth in FY26.

Information from the release

• Revenue for FY25 is forecast to exceed the pcp (Pro Forma), with continued revenue growth forecasted across the core IPD business (+4.9% on the pcp), CMI’s Minto Plugs (+5.2% on the pro-forma pcp), and EX Engineering (+4.6% on the pro-forma pcp)

• CMI’s Cables (forecasted revenue -7.6% on the pro-forma pcp) remains affected by headwinds across its key end-market (Commercial Construction/Buildings), while Addelec (forecasted revenue -12.6% on the pcp) has experienced project delays

• Data Centre Revenues have grown 25% on the pro-forma pcp

• Order Backlog (as at mid-May 2025) remains elevated at $91.5m

• Gross Profit Margins have seen downward pressure as the order book transitions from daily trade to larger, more complex and competitive orders

• Operating Expenses as a % of Revenue has improved on successful completion of additional investment in the operating cost base, leaving the Group well placed to efficiently service future growth

• Cash flow conversion (before interest and tax outflows) is expected to remain above 100%, with the Board of Directors approving an additional $10m repayment of core debt

Electrical distribution and automation supplier $IPG announced their 1H Results this morning.

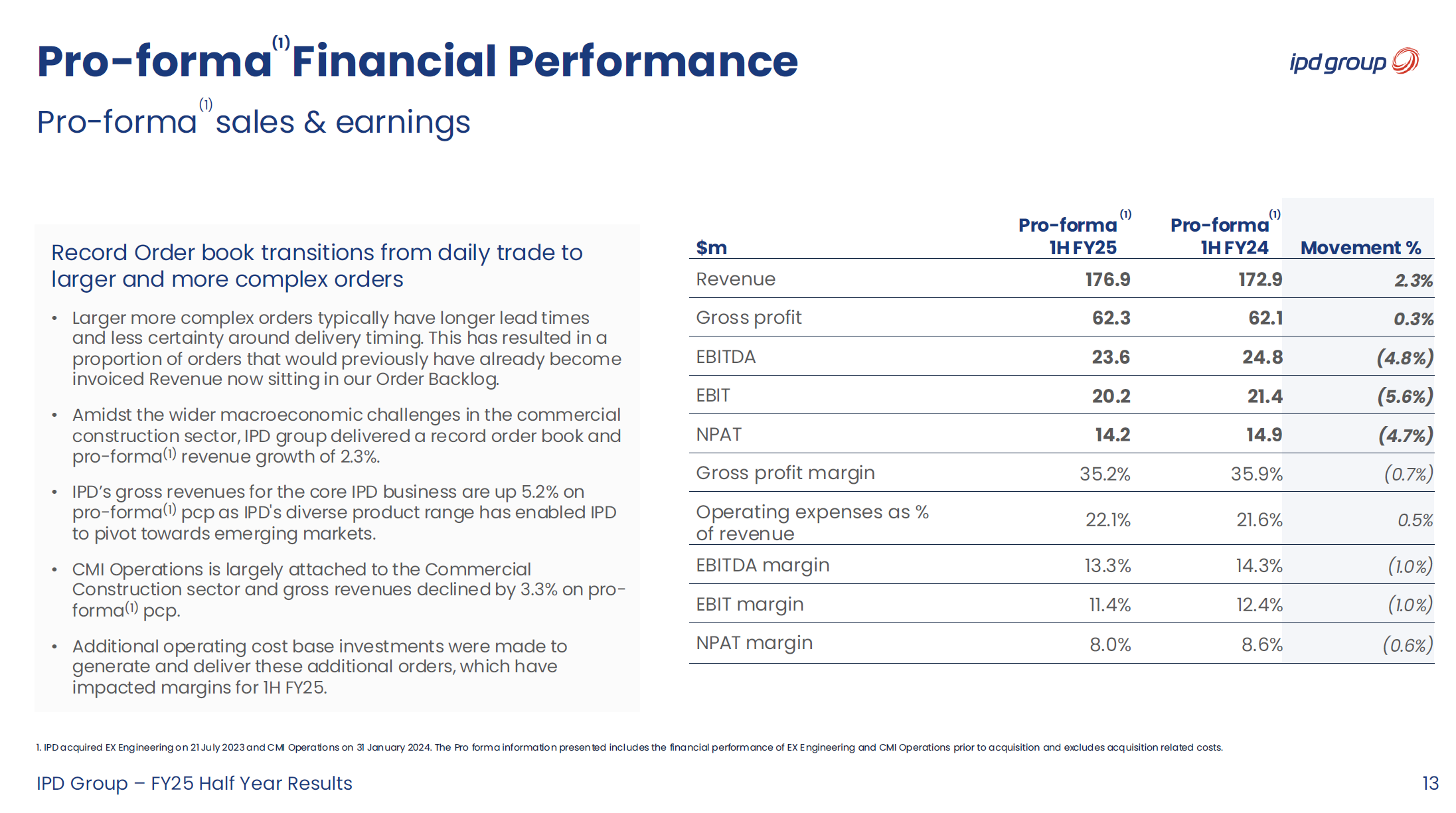

I've provided a full summary of the investor call this morning later in this straw. However, it is important to recognise that in this 1H result we have the first full inclusion of the major CMI acquisition, which had been absent from the PCP. And so, I want to focus on just one slide - probably the least flattering of the entire presentation. The pro forma comparison, which lets us see how the actual operating businesses performed.

Figure 1

So essentially, revenue and gross margin just inched ahead. And profit fell back, with management explanation that this is due to 1) CMI’s lower-margin impact, 2) shift to larger, lower-margin projects, 3) higher operating costs to support future growth, and 4) commercial construction weakness. Reading my summary below, you get a very different view of the business, which is why when M&A is at play, it is vital to look at the pro forma picture.

The commercial environment is tough, and CEO Michael Sainsbury reportdc that the result shows that $IPG is gaining market share.

He said:

" ... there are a number of our competitors that are reporting 8% and 10% and 15% revenue degradation as well because of the market conditions. So I think we've done better than the market. I certainly feel as though we've taken some share in these tough conditions, which will hold us in really good stead when the market does pick up again that you've secured that business and you move into more buoyant market with more share."

(I need to dig into some of this.)

Overall, the market responded positively to the result on the day with SP +4% on the day, but yet to claw back all the losses when it issued the underwhelming guidance at the AGM. Today's result just beat 1H guidance for EBITDA and EBIT.

Increasing the dividend by +40%, with the payout at 50% is a good result. The balance sheet is strong and operating cashflow was good. I think these helped encourage the market response.

My Overall Takeaway

Overall, I think the result is OK. It represents a starting point for the enlarged group and, over the next year, we should start to see business efficiencies come through, as well as revenue synergies between the individual business units.

Management have said a lot about each of the business units over the last year, and so I am happy to see how much of this pans out over the year ahead. I am still getting to know the business, management, and the sector. For today, I am content to stick with my valuation of $5.00 ($4.00 - $6.00) from the AGM.

----------------------------------------------------------------------------------------------

Full Summary of the Investor Call and Presentation

Overall

IPD Group delivered record revenue and profit growth in 1H FY25, exceeding guidance. Strong cash generation, debt reduction, and a record order backlog provide confidence for sustained performance in 2H FY25. While commercial construction remains weak, IPD is gaining market share, expanding into data centers, renewables, and EV infrastructure. Management remains optimistic about continued growth, supported by price increases, acquisitions, and product diversification.

1) Key Results Headlines (Comparison to 1H FY24)

- Revenue: A$176.9 million, up 46.6% from A$120.7 million.

- EBITDA: A$23.6 million, up 46.6%.

- EBIT: A$20.2 million, up 47.4%.

- Net Profit After Tax (NPAT): A$13.3 million, up 40.0%.

- Earnings per Share (EPS): A$0.129, up 19.4%.

- Operating Free Cash Flow: A$25.3 million, up from A$10.1 million, reflecting strong cash conversion (107.6%).

- Net Debt: A$2.2 million, a substantial reduction from A$8.8 million at June 30, 2024.

- Order Backlog: A$92.7 million, up 49%, ensuring strong revenue visibility.

- Interim Dividend: A$0.064 per share, up 39.1%, with a 50% payout ratio.

(Yeah - so, now you understand why I wanted to highlight the pro forma page!)

2) Operational Highlights by Sector

- Data Centers:

- Revenue from data centers grew 25% YoY, now representing 15% of total revenue.

- Strong order book with Amazon and NEXTDC data center projects.

- EV Charging & Public Transport Electrification:

- Continued expansion in EV infrastructure projects via Addelec Power Services.

- Notable wins include Perth Transit Authority ($10.9 million project pipeline) and NRMA (A$3.5 million opportunities).

- NSW Kingsgrove Bus Depot project officially commenced, with revenue expected in 2H FY25.

- Commercial Construction & Infrastructure:

- Remains largest revenue contributor, though facing headwinds in broader market.

- Successfully expanding into water & wastewater, contributing 13% of total revenue.

- Industrial & Mining:

- Hazardous area electrical equipment sales grew significantly via EX Engineering.

- Secured major contracts in oil & gas.

- Wholesale & Trade Sales:

- Outperformed market trends, gaining share from competitors despite construction slowdown.

- CMI Operations showed weakness in New South Wales and Victoria due to commercial construction softness but gained traction in WA and export markets.

3) Cash Flow Highlights

- Net Operating Cash Flow: A$25.3 million, up over 100%, reflecting strong conversion.

- Net Investing Cash Flow: -A$4.5 million, primarily due to capital expenditure and acquisitions.

- Net Financing Cash Flow: -A$2.2 million, driven by debt repayments.

- Cash Balance (End of Period): A$28.9 million.

- Debt Reduction: A$10 million in borrowings repaid post-half-year, reducing core debt by ~33%.

4) Balance Sheet

- Total Net Assets: A$158.1 million, strengthening the group's financial position.

- Net Debt: A$2.2 million, down from A$8.8 million.

- Inventory: Increased slightly by A$1.2 million, reflecting demand growth.

- Dividend: A$0.064 per share, fully franked (payout ratio: 50%). Increased by 40,

5) Industry Outlook & Competitive Landscape

- Market Conditions:

- Commercial construction remains challenging, but IPD is outperforming competitors.

- Interest rate cuts may boost sector activity in the next 6-12 months.

- Growing demand for data centers, renewable energy, and EV infrastructure supports future growth.

- Competitive Positioning:

- Taking market share in high-margin trade business, outperforming ASX-listed peers.

- Expanding ABB product range but not exclusively reliant on ABB.

- IPD currently only captures ~20% of the electrical contractor market, indicating significant growth potential.

6) Summary of Q&A with Analysts

- Order Backlog Conversion:

- Current backlog (~A$93M) represents 3-4 months of work, supporting 2H FY25 revenue.

- Some Amazon orders were pulled forward into 1H FY25, but pipeline remains strong.

- Market Share & Expansion Strategy:

- ABB partnership still has growth runway, but IPD is not limited to ABB products.

- Opportunity to expand into other electrical contractor product categories (beyond current 20% penetration).

- Daily Trade Business & Market Conditions:

- IPD has outperformed competitors, gaining share in a weak construction market.

- CEO expects the market has bottomed out, with gradual recovery over the next 6-12 months.

- Price Increases & Margins:

- No supplier price increases for 12 months, but IPD to implement a 3-4% price rise in March 2025.

- Due to contract structures, only ~50% of this price increase will flow through in 2H FY25.

Disc: Held in RL and SM

Big dump of 764k shares yesterday

Doing wonders for my holding

Time to buy more?

Held

Founder Mohamed Yoosuff has purchased 1,000,000 shares on market at $3.78 on 28 November total value $3.78m.

That takes his holding from 7,702,849 ordinary fully paid shares to 8,702,849. He also holds 2,628,590 ordinary fully paid shares indirectly so he increased his total holding by just under 10%.

No one knows the business better than him.

The biggest takeaway from the AGM was this slide from the CEO, Michael Sainsbury’s, Presentation:

Michael said the business model is changing from day to day projects to larger projects with longer time frames. He said the order backlog has grown from $62 million to $92 million in the 12 months from October 2023, up 50%, and the average monthly orders are up 39% compared to 1H24. These orders will be eventually invoiced and come through in the revenue. He expects 2H24 to be much stronger than 1H25.

His said construction has slowed but will come back (sort of contradicts the order book story) but will come back. He did have a little slip of the tongue when talking about the cost base relative to sales revenue, saying “we have controlled the bleed”. He quickly covered up by saying that was a poor choice of words. Did the truth slip out? I guess we’ll find out in about 10 months time.

Interesting that Data Centre revenue is growing at 25% per year and currently makes up 12% of the revenue.

i come away thinking the business seems to have enormous potential. I’ve come away with a bit more confidence the business is on the right track. If the order book backlog does converts to invoices and revenue we should see good growth return. However, we need to trust management on this and take a big leap of faith. I’d like to see the order book included in each trading update going forward if this is the “new” business model. If we don’t hear about the order book backlog going forward, that won’t be a good sign.

Held IRL (tiny)

25/11/2024

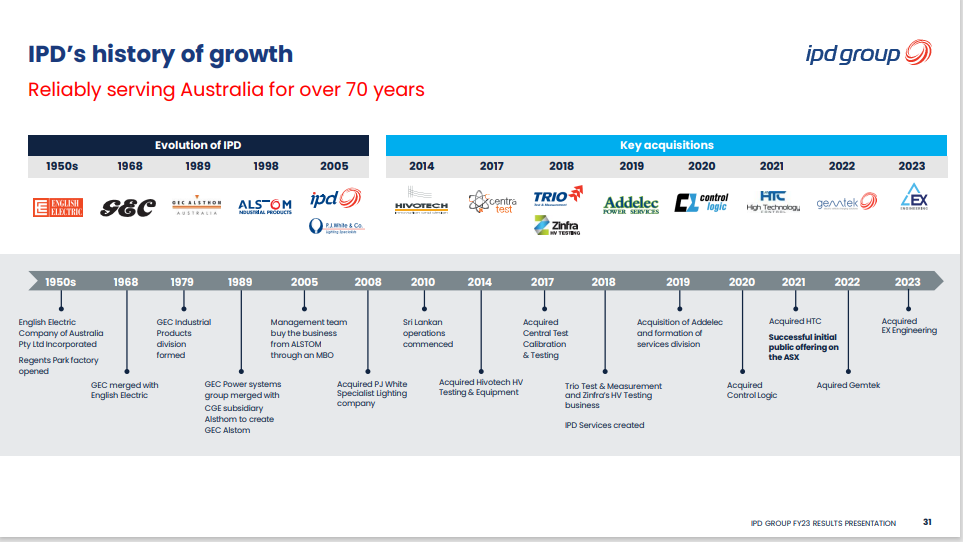

I’m new to IPD Group (ASX: IPG) after taking a nibble today. The business was listed on the ASX in December 2021, so there’s only 3 years of historical data to go on, and we’re still getting to know management. Specialising in supplying products and services for Australia’s growing electrical infrastructure, the businesses should have tailwinds as Australia moves forward with renewable energy and data centres.

Until FY24 the business has performed well, growing revenue at 26.2% per year, and NPAT at 35.8% per year. ROE has averaged 18% (FY22 17.5%, FY23 22.1% and FY24 15.4%).

Source: Commsec

Following the updated guidance for 1HFY25, I’m expecting FY25 NPAT to be c.$25 million, up 10% on FY24 (similar to @mikebrisy’s assumptions). Shareholder equity at 30 June 2024 was $151 million, so I expect FY25 ROE to be c. 16.5%. This would bring the average 4 year ROE to c. 18%. For valuation purposes I’m going to assume IPG goes forward with ROE of 17% and hope that I’m being too conservative.

Using McNiven’s Formula and assuming ROE of 17%, shareholder equity of $1.46 per share, 54% of earnings reinvested, 46% of earnings paid as fully franked dividends, and requiring a minimum annual return of 10%, I get a valuation of $3.90. At the current share price ($3.69) I think the shares are reasonable value, but they’re not exceptionally cheap. I’d be happy to add more on further share price weakness.

Held IRL (starter position)

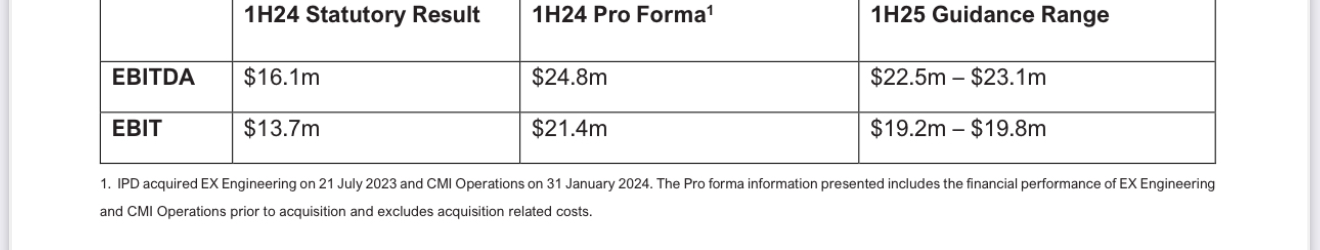

The market has reacted very negatively to IPD Group’s Earnings guidance today, down over 11%. Is this an overreaction, or is it warranted?

1H25 EBIT guidance is $19.2 million to $19.8 million, mid-point $19.5 million. Assuming a 30% tax rate, that’s $13.6 million net profit before interest. Assuming 2H is similar that’s about $25 million before interest for FY25 which is a miss on analyst expectations of c. $30 million.

CEO, Michael Sainsbury, said margins will be impacted in 1HFY25.

What do others think?

Not held.

Based on unaudited results for the 4 months ending October 2024, and management forecasts for November and December, the Company provides the following earnings guidance range for 1H25:

The Company also notes that:

• Revenue for 1H25 is forecast to exceed the pcp (Pro Forma);

• Average monthly orders received has grown 39% in Jul-Oct 2024 Vs 1H24 (Pro Forma); and

• Order Backlog (as at end October 2024) has grown to $93.1m, a 50% increase on the pcp (Pro Forma).

Michael Sainsbury, IPD Group Limited CEO, said: “We are pleased to remain on track to deliver another half of revenue growth in a challenging environment. Amidst the wider macroeconomic challenges in the commercial construction sector, we have seen our order book transition from daily trade to larger and more complex orders, which typically have longer lead times and less certainty around delivery timing. This has resulted in a proportion of orders that would previously have already become invoiced Revenue now sitting in our Order Backlog. We have made additional investments into our operating cost base to generate and deliver these additional orders, which will impact margins for 1HFY25. Our operating cost base however is well placed to service future growth. We remain excited by IPD’s ongoing evolution and the continued improvements to our overall value proposition and look forward to providing more details around today’s update at the Company’s AGM on Tuesday, 26 November 2024.”

Bell special if you need to find the source of the recent price declines

[held]

From investor presentation 30/8/24

Growth for the year was great by acquisition, but not pro forma which was +3% NPAT. Also EPS growth was 30% because of share issue.

Reported growth.

Pro

06-Sep-2024: "IPD Group (IPG): Record Orders Fuel the Recovery in Organic Growth", Taylor Collison, Update [BUY, 12m TP=$5.80, published by TC on 02-Sep-2024]

I don't hold this one, but there's a free broker report (courtesy of the ASX free Friday broker reports email) on them by TC, FWIW. They reported on the 30th August, and the market liked it enough to send their SP up +9.23% on the day, and they're now trading at just over $5, so there's still some upside between here and TC's 12-month target price (TP) for IPG of $5.80, IF TC are right.

Most brokers tend to be bullish on the companies they cover, because the companies are either already clients or are potential clients of that broker, so take it all with a grain or three of salt, but there are sometimes some interesting details in these reports, like an overview of what the company does for instance, and their various divisions, and how those divisions have traditionally contributed to group earnings, that sort of thing. It's the "forward looking statements" that you have to watch out for.

TC's update starts off bullish, as you would expect: Revenue growth of 28% and adj. EBIT growth of 47% included recent acquisitions. Like-for-like (LFL) revenue and EBIT growth was 2 and 3 percent respectively. Disappointing, and down on IPD’s recent record, but no big deal. The devil is in the detail. Core IPD and Ex Engineering grew by double-digits, whilst CMI (5-month benefit) had LFL EBIT declines. Issues at CMI look mostly temporary. IPD carries a record order book, has new products launching and project wins, plus FY25 gets a full period of earnings from CMI. Growth ahead.

--- end of excerpt ---

I'll have a look at them over the next week if I get time. Here's their results announcement - idp-group-FY24-Results-Announcement.PDF

Everything appears to be trending up at a good clip except for a smallish decline in gross margin - but no biggy when their NPAT was up +44.7% on Revenue that was up +28%. One of the most important metrics, EPS, was up a very healthy +30.1% from 18.6 cps to 24.2 cps. Not sure what sort of base this is coming off - have to have a look at that during the week, but not horrible, so far. Their 30th June closing share price was $4.69 - now $5.02. Might be something there.

Looks good on preopen

[Held]

I am still catching up on all the newslfow from my portfolio during my recent vacation, and have finally reviewed a presentation from $IPG - the electrical distributor and services company, from 21 June. It wasn't price sensitive so I almost missed it.

My reason for sharing this, is that it does a good job of explaing how $IPG is positioned to supply the Datacentre and EV Charging Sectors, with slides 6 and 9 showing how the different business units serve data-centre and EV-charging clients, respectively.

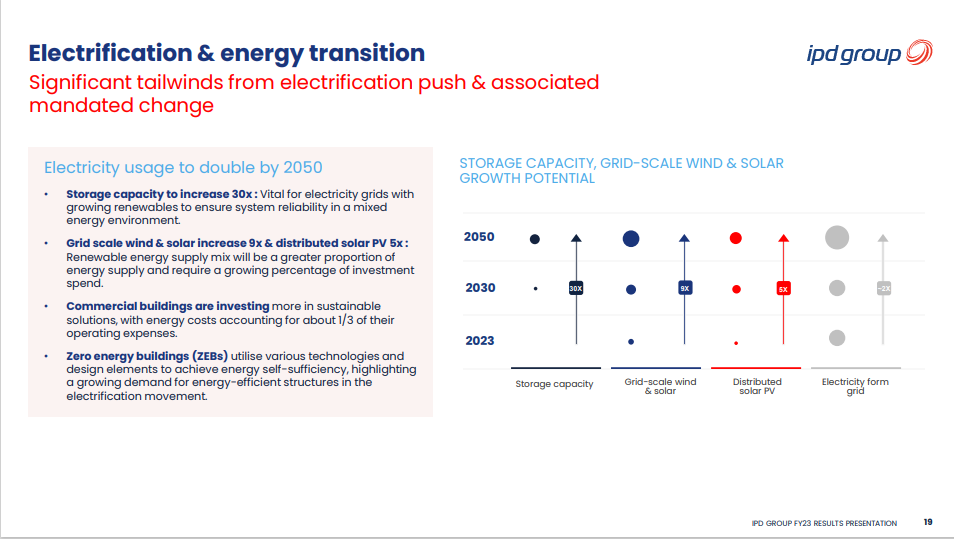

While exposure to data centres and EV charging is certainly a part of my investment thesis, it is by no means the sole basis. $IPG is an electrical equipment distributor, with a portfolio of leading global brands (including some exclusive Australian distributorships), supported by a number of design and asset services offerings.

Importantly, they picked up CMI - another distributor that was stranded in what appears to be a wanna/nascent private equity business (supported by a capital raising) late last year, completing early this year - and they secured it for a very good price.

$IPG is founder-led and appears to be well-managed. Their SP went on a tear after IPO at the end of 2021. It has been range bound for the last year and - I speculate idly - whether this was part of the impetus to put out this presentation.

I'm very happy to be patient with this one. The FY24 guidance update provided in May was OK, and of course FY25 will have the full year contribution from CMI.

Notwithstanding the FY24 and FY25 inorganic uplift that will come from CMI, my reason for holding this business is that it is exposed to the broader re-wiring of the Australian economy, which goes far beyond EV's and datacentres. This multi-decadal macro tailwind will - in my estimation - expose it to a rate of growth at a mulitple of economic growth, and that's before any potential premium that might come from good management. Of course, it is too early for me to call it on whether management are good. The track record certainly looks impressive, going back before IPO.

I took an initial RL position of 4%, and depending on performance will consider adding more over the next 12 months. I wrote up its HY24 results in an earlier straw.

Valuation

I don't yet have any unique insights on $IPG. I think the three covering analysts are generous / bullish with an average TP of $5.58 and a very narrow range ($5.50 - $5.65) versus today's close of $4.81. I'll therefore be a tad more conservative and post an inital Strawman valuation of $5.40. I'll have a go at my own model, once I get to see a clean 6-months for the combination of IPG+CMI in Feb 2025.

I have commented before that its forward P/E of 27x is a bit spicey for a distributor, but I believe this is justifiable given its sector exposure. (If you do you own calculations rolling forward earning growth at 25-30% p.a., you'll probably end up agreeing with the analysts,)

@Strawman - it would be great to get CEO Michael Sainsbury along to a SM Meeting. Have you ever approached him before? (I can't recall if this has been requested before- apologies it if has.)

Disc: Held in RL and SM

Based on unaudited results for the 10 months ending April 2024, and management forecasts for May and June, the Company provides the following earnings guidance range for the FY24 full year:

EBIDA FY23 v Fy24 range: up 44%

Return (inc div) 1yr: 20.03% 3yr: N/A 5yr: N/A

Net Profit Margin: 7.5% (Thats good for this industry)

Automation and electrical distributor $IPG announced their FY24 guidance, following 10 months' results.

The guidance for EBITDA ($39.0-$39.5m) and EBIT ($33.5-$34.0m) is bang on consensus - give or take - and in line with my model.

At midpoint, EBITDA growth is 42% and EBIT growth is 44% to pcp ... albeit with a significant inorganic element, which I'll discuss below.

From the Release

Michael Sainsbury, IPD Group Limited CEO, said: “It has been a transformative year for IPD with the completion of two strategic acquisitions, EX Engineering and CMI Operations. Merging our Addelec and Gemtek businesses has significantly enhanced our EV infrastructure team and we are capitalising on the growth in the market by securing a number of major projects during the year, including the electrification of Australia’s largest bus depot. We are excited by IPD’s evolution, with our extended product and service offering strengthening our overall value proposition to our existing customers and broadening our customer reach.”

My Analysis

With the SP at a 29% discount to consensus, having been on a slide since shortly after HY results for no apparent reason, we might start to see the result close the gap.

FY24 will include only 5 months contribution of the material acquisition of CMI Operations, so the deal bakes in a favourable comparison for FY25. Now, while the market should discount that, it is worth remembering that $IPG picked up CMI Operations for a very good price. The $101m price tag (including a maximum $8.9m contingent payment) represented around a p/e of 10 and an EV/EBITDA of about 6. With good category synergies, and some valuable distributorship arrangements, the CMI Operations deal was a smart acquisition. That's before we even consider cost synergies.

A new holder of $IPG, I probably initiated my position prematurely, given the chart trend (always easy to say in hindsight, but I knew I was buying against the short term technicals), but today's result gives further confidence that the business is on track. We probably will have to wait until the FY25 result to see the value of the CMI Operations playing through - at this stage the metrics will just show 1+1=2.

$IPG is my way of playing the themes of 1) electrification of the economy and 2) investment in power infrastructure for datacentres.

This appears to be a well-run business, with smart acquisitions building out the product offering, bring leading brands under their umbrella, focusing on developing key capabilities (e.g. hazardous area equipment and related services), as well as continuing to build out the geographic footprint.

At a superficial glance, it looks expensive for a distributor at a p/e of 24 (FY24), however, when you dig deeper there is a lot to like about this distributor and the industries it supplies.

Disc: Held in RL and SM

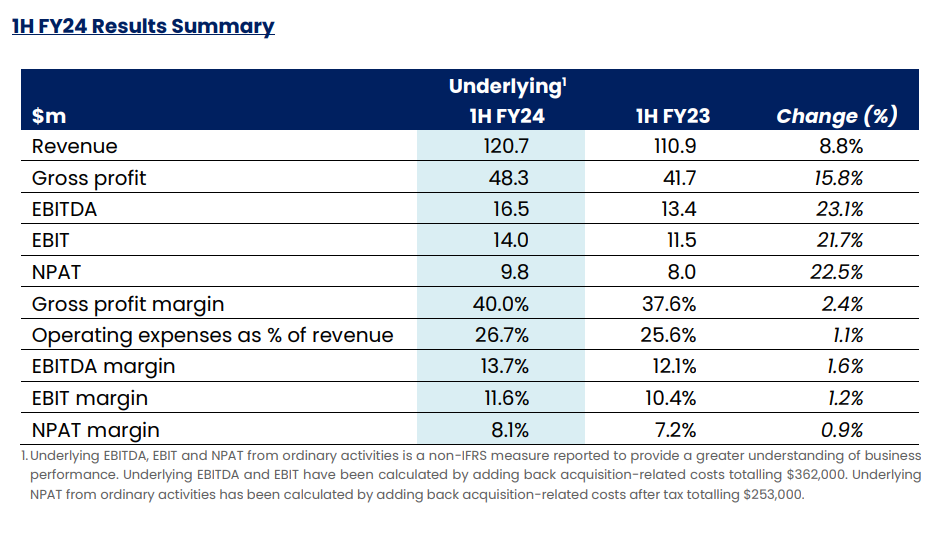

Electrical products distributor and service provider $IPG announced their 1H results last week.

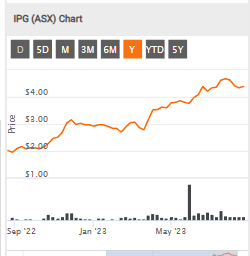

The company which was listed in late-2021 has seen its SP on a tear, heading into the results up 5x since listing. (Max kudos to the early StrawPeople who got onboard!)

$IPG has been on my watch list for 6-9 months, and I took a starting position in it on the pullback following results, which saw SP fall from a peak of $5.43 to close on Friday at $4.75, a handy correction of 14%.

I'll write next week in further detail as to why I am investing in $IPG, and will here just discuss the results. For those wanting more detail, there are broker reports by Bell Potter (TP $5.95) and Taylor Collison (TP $5.00 - free on the ASX broker report service.)

Now, as a word of caution on analyst views, my understanding is that Bell Potter was the lead Manager and Underwriter of the November capital raising. Their very high TP should be considered in that context.

Their 1H FY24 Highlights

- Record half-year revenues and earnings at the top end of the guidance range

- Revenue of $120.7 million representing 8.8% growth on pcp

- EBIT of $14.0 million representing 21.7% growth on pcp

- NPAT of $9.8 million representing 22.5% growth on pcp

- Fully franked interim dividend of 4.6 cents per share declared

- Strong balance sheet, with $142.7 million of net assets at period-end (net debt of $23.7 million as at 31 January 2024)

- Successful completion of the acquisition of EX Engineering Pty Ltd (“EX Engineering”)

- Announced acquisition of 100% of CMI Operations Limited (“CMI Operations”), a leading distributor of electrical cables and manufacturer & distributor of plug brands in Australia, from ASX-listed Excelsior Capital Limited (ASX:ECL)

- Raised $65.0 million of new equity capital in December 2023

- Post financial year-end: Entered into new $40 million debt facility to partially fund acquisition of CMI Operations and Completed acquisition of CMI Operations on 31 January 2024

My Analysis

I was unable to attend the call and haven't looked at the transcript. So my analysis is a simple desktop exercise.

Expectations for $IPG were high. SP has been on a tear.

The 1H FY24 doesn't include the material CMI acquisition, although the EPS is lowered temporarily because the new shares were issued in late December, but the deal only closed in early 2H24. I'll pick through this in my preliminary valuation, which I'll post next week.

The table above shows why the market has reacted negatively and also why I think the results are not that bad.

Revenue growth at 8.8% is a softer result, compared to the trajectory over recent years (pre- and Post IPO). I think it is this softer result that perhaps triggered the SP correction. In the lead-up to results, the SP had run up hard, close to a stretching consensus, driven by Bell Potter's bullish view. However, despite low revenue growth (and short term revenue growth is not central to my investment thesis!), as we progress down the P&L, the results look pretty healthy.

%Gross Margin is a healthy 40%, up 2.4% from pcp.

EBITDA Margin is 13.7%, up 1.6%, drive by falling freight and distribution costs. (The marginal %EBITDA is actually 33% on a PCP comparison, which is not to be anchored on because the freight and distribution cost improvements cannot be sustained. I should also do the marginal analysis on the prior period.)

EBIT Margin was 12.0% up from 10.6%, and NPAT Margin was 7.9% up from 7.2%,

Note: My analysis is on the Statutory numbers and differs from the table above. I'm not prepared to consider the Underlying because M&A is an ongoing part of the business model, and core to my thesis, so I will not correct for the costs that arise from it.

These are pretty healthy numbers.

If we ignore the CMI acquisition, and assuming 2H and 1H are similar (there appears to be a slight historical weighting to 2H), then that would put $IPG on a annualised NPAT of $19,09. Backing out the new shares (because the result is not affected by the CMI acquistion), then by my calculation that puts $IPG on a p/e of 21.5 at its Friday close of $4.75.

This is a high p/e for a distributor. However, when I set out my investment thesis I explain why I am happy with this entry point.

I've had a quick look at cashflows, which were underwhelming, however movements in payables, receivables and inventories needs a deeper dive to make sense of it all, and therefore I am assuming the financials are a better guide. Cashflow and debt are not a concern based on a longer term historical view, so I'll leave this for another day.

My Key Takeways

In summary, there is no escaping that organic revenue growth was soft in the half, however the business was able to achieve good margin expansion, achieving what are pretty decent metrics for a 91% distributor / 9% services business.

Drivers of margin expansion have been moving more of the support activities of the individual businesses onto a share service model, consolidating their regional distribution networks, and favourable distribution costs in the PCP comparison.

From my selfish perspective, the down-trend in SP might continue for a while (gotta love technical traders), as I would like to increase my position here recognising I have paid more than I wanted to get started. More on that next week when I set out my investment thesis and valuation.

Disc: Held in RL and SM

IPD released its results yesterday. It’s steady as she goes with a combination of organic and inorganic growth. They continue to mention demand is strong and are well stocked to meet this demand.

Once some of the synergies are extracted from the recent acquisitions it will be interesting to see the types of margins that can be attained.

Note the price has run up in recent weeks so a pull back on earnings was expected. It’s now back in my 2024 trading range of 4.50-5.00 and FY NPAT is tracking around my midpoint target of ~20m.

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02777053-2A1507314

Full text from behind the paywall of the Weekend Australian.

Interesting article that highlights the valuation gap of the CMI sale vs the book value of CMI from Excelsior but not getting any answers why this has happened.

Excelsior’s valuation perplexity - 16dec23

[held]

IPD Group retail component completes slightly oversubscribed

Although 66% took up the rights, the ones who participated top-up facility had to get their application scaled back

The Retail Entitlement Offer closed at 5:00pm (Sydney time) on Thursday, 14 December 2023 and raised approximately $7.7 million at an issue price of $3.93 per New Share (“Offer Price”). Together with the Placement and Institutional Entitlement Offer (“Equity Raising”), to total an amount raised under the Equity Raising as approximately $65 million.

Funds raised under the Equity Raising will assist with the funding of IPD’s acquisition of CMI Operations Pty Ltd (“CMI”) from ASX listed Excelsior Capital Limited (ASX:ECL) (the “Acquisition”), which will further enhance IPD’s position as a leading distributor to the Australian electrical market.

The Company received valid applications under the Retail Entitlement Offer of approximately $5.1 million, representing a take up rate of approximately 66%. Eligible retail shareholders were also offered the opportunity to apply for additional New Shares in excess of their entitlement, up to a maximum amount of 100% of their entitlement, at the Offer Price (”Top Up Facility”). When combined with the Top Up Facility, valid applications from eligible retail shareholders were approximately $8.1 million, representing an overall take up rate of approximately 105%. Applications under the Top-up Facility have been scaled back accordingly

I didn't take the top-up facility as IPD Group is already a top holding and don't want to go too overboard.

Should be interesting day tomorrow when the new shares start trading this Friday 22 Dec

[held]

Tuesday Trades at $4.47 will this price give way to the Offer Price of $3.93 (price normally will fall to the Offer price)

All New Shares offered under the Equity Raising will be issued at a price of $3.93 (“Offer Price”)

A decent rally today closed at $4.77 up 13.57%

IPG way above the Cap raising of $3.93 ( 1 for 13.65 shares held )

Return (inc div) 1yr: 55.96% 3yr: N/A 5yr: N/A

IPD Group is undergoing a capital raising.

Funds raised: $65m

Extra shares: 16.5m

Synergies: Expected but not included

Because I don't have time, hopefully someone can do an exact valuation. If you are inclined go to fightfinance for the methodology after clicking the answers.

Roughly we should expect a market cap from 364m to 429m and SOI of 103m shares.

Some important slides that will help

But I'm sure the market will try and drag this below $4.

As I already topped up at the recent lows, I think I have enough shares already - not sure if I take up the rights issue.

[held]

AGM is today.

Will be interesting how the share price performs given that guidance had been withdrawn from the last update in August and no updates since.

One to watch carefully.

https://www.drive.com.au/news/rollout-of-electric-vehicle-chargers-for-rural-australia-hits-a-snag/

Perhaps explains the recent weakness.

Think we might be seeing value again now the EV charger hype is going away.

[Held]

Updated valuation to use average PE of 25 on reported EPS of 0.19 - 20 Sep 23

Initiated Buy - Shaw and Partners. 15 Jul 22

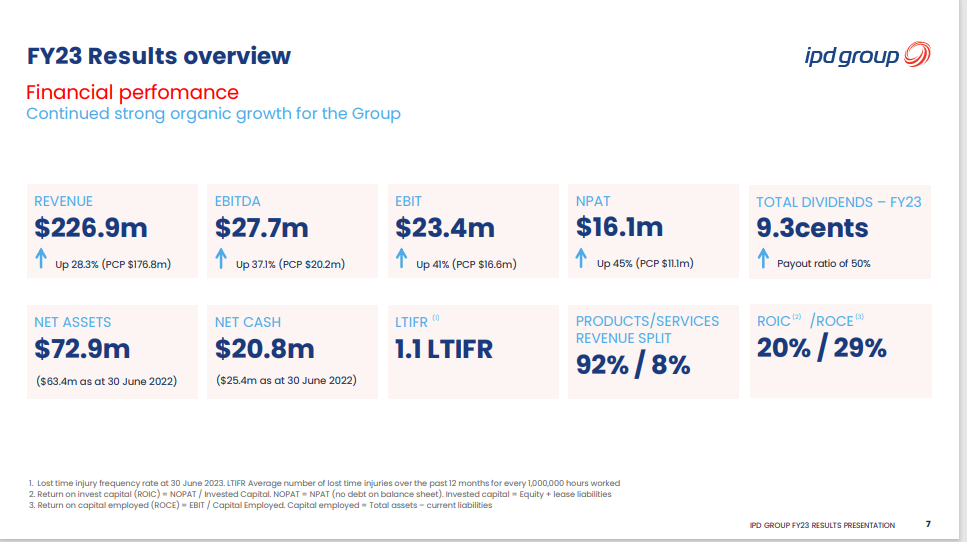

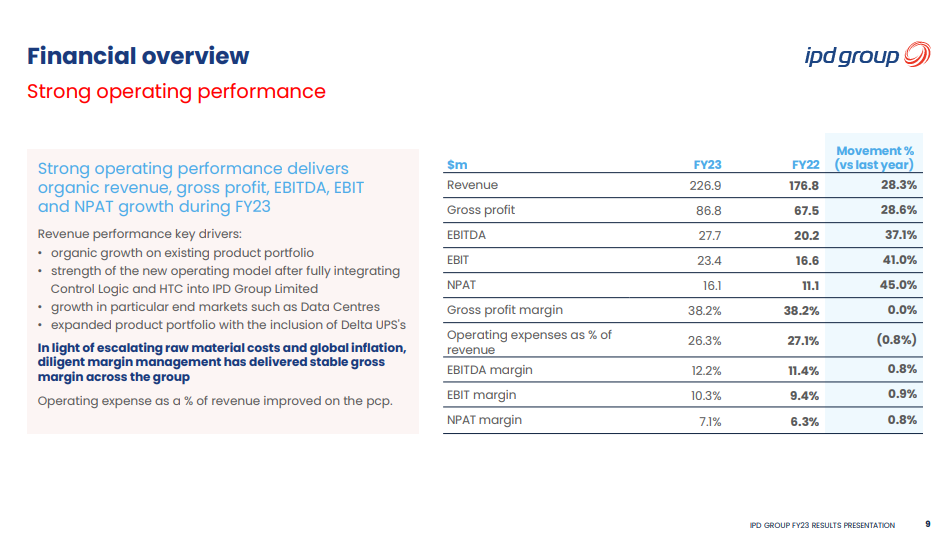

Revenue of $226.9million, up 28.3% on pcp – Strong organic growth has been delivered predominantly by the existing product portfolio and growing market share – Strong statutory growth displayed by a 37.4% CAGR

EBITDA of $27.7 million, up 37.1% on pcp – There have been ongoing strategic investments made during the year, some of which include: • Expansion of the Gemtek team

• Recruitment of specification focused business development managers across the country

• Operational expansion with a new 4,000sqm warehouse – While the Group has invested into these strategic initiatives during the financial year, the Group continued to deliver strengthening EBITDA margins, and a 44.9% EBITDA CAGR over the past four financial years

So Check out IPG a steady pathway to growth. could add some units today with the expected bearish market..

Return (inc div) 1yr: 132.35% 3yr: N/A 5yr: N/A

Annualise out the HY results

Double the NPAT (8.0m) = 16.0m.

16.0m / 86.5m shares = 18.7c

Assign a PE of 20 to match its growth profile.

20 x 18.7c = 3.74

I think this is conservative with management already reporting Jan and Feb results were strong.

... and I heard from a mate tonight that MF are now recommending IPG, I think I understood for the first time, today at a buy price of $3.05

Shaw and Partners IPD Group Ltd (IPG)

Rating: Buy | Risk: High | Price Target: $3.53. Charging Ahead

Event: IPD Group held its inaugural AGM as a listed company yesterday, with three key developments: 1) 1H23 earnings guidance indicated the company is (once again) running well ahead of Shaw’s forecasts; 2) 2H23 commentary indicates rising investment in long-term growth initiatives; and 3) Long-time executive, board member, and substantial shareholder Mohamed Yoosuff is transitioning from CFO to Director of Strategic Development. After upgrading Shaw’s earnings estimates and revisiting Shaw’s valuation approach, Shaw’s price target has increased from $2.52 to $3.53 (19% TSR), and Shaw’s reiterate their Buy rating.

Recommendation: IPD is a high-quality business with strong growth prospects, ample cash generation, and a rock-solid balance sheet. Management’s track record includes ongoing operating improvements, consistent dividend payments, and multiple guidance upgrades post-listing. Shaw’s conservative (upgraded) forecasts the valuation remains attractive, with IPD trading on 17.8x FY23 PE (22% premium to peers’ 14.6x) and 9.2x FY23 EV/EBITDA (3% premium to peers’ 9.0x). Shaw’s believe a premium to peers is appropriate and Shaw’s also note the clear potential for accretive and/or strategic acquisitions. After upgrading Shaw’s earnings forecasts and updating Shaw’s valuation approach, Shaw’s target price rises from $2.52 to $3.53, and Shaw’s reiterate their Buy recommendation.

Since my mention of IPD Group here, I've seen the following brokers/fund managers start coverage:

Bell Potter

Shaw and Partners

1851 Capital

and finally Tamim Asset Management (ie: Ron Shamgar aka rocket emoji fund manager)

Definitely no longer under the radar.

[held]

Annualise out the Guidance revenue of 105.3-108.0 = 210.6-216.00.

Split the difference 213.3m

Using 7% NPAT margin achieved in FY2022.

213.3m x 7% = 14.93m

14.9m / 86,400,000 shares = 17.2c

3.00 / 0.172 = PE17.5

Based on earnings of 14.9m (22) v 12.6m (21) that’s a growth rate of 18%.

If they can grow at 15-20% over the next 5 years then a PE ratio on forwards earnings closer to 20 can be justified = $3.44.