Electrical products distributor and service provider $IPG announced their 1H results last week.

ASX Announcement

The company which was listed in late-2021 has seen its SP on a tear, heading into the results up 5x since listing. (Max kudos to the early StrawPeople who got onboard!)

$IPG has been on my watch list for 6-9 months, and I took a starting position in it on the pullback following results, which saw SP fall from a peak of $5.43 to close on Friday at $4.75, a handy correction of 14%.

I'll write next week in further detail as to why I am investing in $IPG, and will here just discuss the results. For those wanting more detail, there are broker reports by Bell Potter (TP $5.95) and Taylor Collison (TP $5.00 - free on the ASX broker report service.)

Now, as a word of caution on analyst views, my understanding is that Bell Potter was the lead Manager and Underwriter of the November capital raising. Their very high TP should be considered in that context.

Their 1H FY24 Highlights

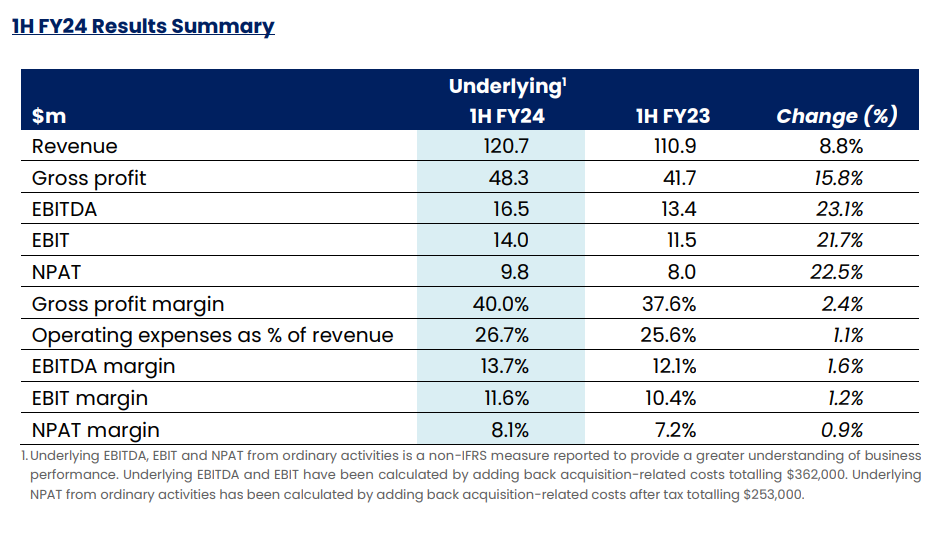

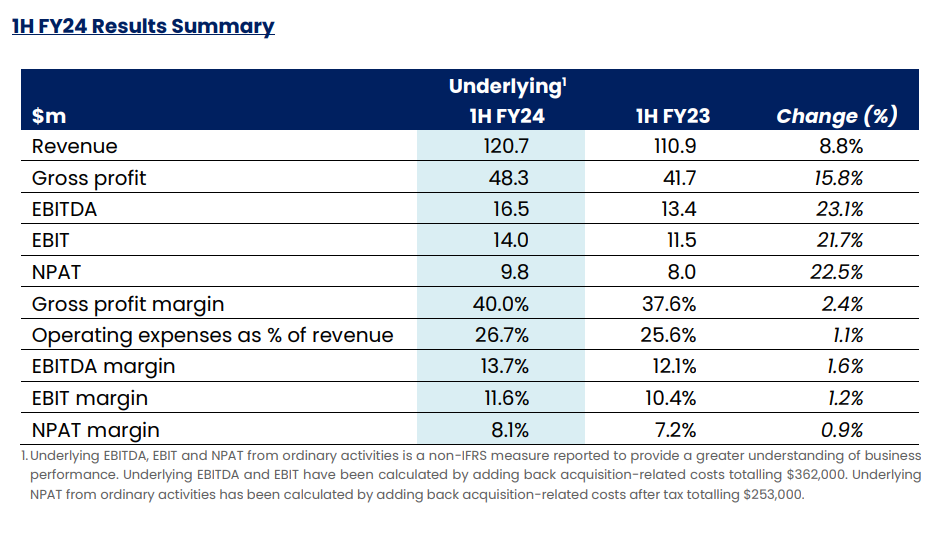

- Record half-year revenues and earnings at the top end of the guidance range

- Revenue of $120.7 million representing 8.8% growth on pcp

- EBIT of $14.0 million representing 21.7% growth on pcp

- NPAT of $9.8 million representing 22.5% growth on pcp

- Fully franked interim dividend of 4.6 cents per share declared

- Strong balance sheet, with $142.7 million of net assets at period-end (net debt of $23.7 million as at 31 January 2024)

- Successful completion of the acquisition of EX Engineering Pty Ltd (“EX Engineering”)

- Announced acquisition of 100% of CMI Operations Limited (“CMI Operations”), a leading distributor of electrical cables and manufacturer & distributor of plug brands in Australia, from ASX-listed Excelsior Capital Limited (ASX:ECL)

- Raised $65.0 million of new equity capital in December 2023

- Post financial year-end: Entered into new $40 million debt facility to partially fund acquisition of CMI Operations and Completed acquisition of CMI Operations on 31 January 2024

My Analysis

I was unable to attend the call and haven't looked at the transcript. So my analysis is a simple desktop exercise.

Expectations for $IPG were high. SP has been on a tear.

The 1H FY24 doesn't include the material CMI acquisition, although the EPS is lowered temporarily because the new shares were issued in late December, but the deal only closed in early 2H24. I'll pick through this in my preliminary valuation, which I'll post next week.

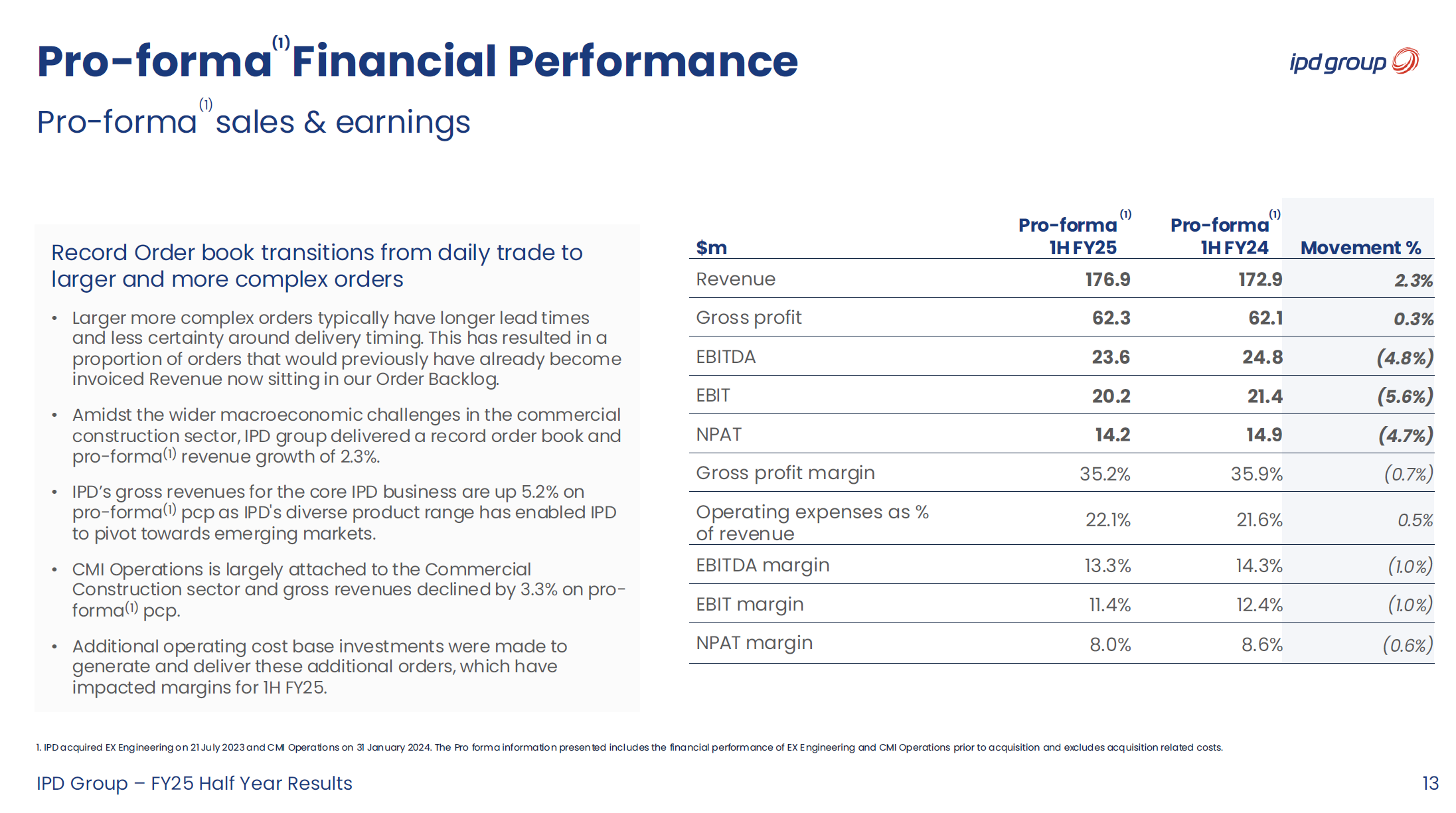

The table above shows why the market has reacted negatively and also why I think the results are not that bad.

Revenue growth at 8.8% is a softer result, compared to the trajectory over recent years (pre- and Post IPO). I think it is this softer result that perhaps triggered the SP correction. In the lead-up to results, the SP had run up hard, close to a stretching consensus, driven by Bell Potter's bullish view. However, despite low revenue growth (and short term revenue growth is not central to my investment thesis!), as we progress down the P&L, the results look pretty healthy.

%Gross Margin is a healthy 40%, up 2.4% from pcp.

EBITDA Margin is 13.7%, up 1.6%, drive by falling freight and distribution costs. (The marginal %EBITDA is actually 33% on a PCP comparison, which is not to be anchored on because the freight and distribution cost improvements cannot be sustained. I should also do the marginal analysis on the prior period.)

EBIT Margin was 12.0% up from 10.6%, and NPAT Margin was 7.9% up from 7.2%,

Note: My analysis is on the Statutory numbers and differs from the table above. I'm not prepared to consider the Underlying because M&A is an ongoing part of the business model, and core to my thesis, so I will not correct for the costs that arise from it.

These are pretty healthy numbers.

If we ignore the CMI acquisition, and assuming 2H and 1H are similar (there appears to be a slight historical weighting to 2H), then that would put $IPG on a annualised NPAT of $19,09. Backing out the new shares (because the result is not affected by the CMI acquistion), then by my calculation that puts $IPG on a p/e of 21.5 at its Friday close of $4.75.

This is a high p/e for a distributor. However, when I set out my investment thesis I explain why I am happy with this entry point.

I've had a quick look at cashflows, which were underwhelming, however movements in payables, receivables and inventories needs a deeper dive to make sense of it all, and therefore I am assuming the financials are a better guide. Cashflow and debt are not a concern based on a longer term historical view, so I'll leave this for another day.

My Key Takeways

In summary, there is no escaping that organic revenue growth was soft in the half, however the business was able to achieve good margin expansion, achieving what are pretty decent metrics for a 91% distributor / 9% services business.

Drivers of margin expansion have been moving more of the support activities of the individual businesses onto a share service model, consolidating their regional distribution networks, and favourable distribution costs in the PCP comparison.

From my selfish perspective, the down-trend in SP might continue for a while (gotta love technical traders), as I would like to increase my position here recognising I have paid more than I wanted to get started. More on that next week when I set out my investment thesis and valuation.

Disc: Held in RL and SM