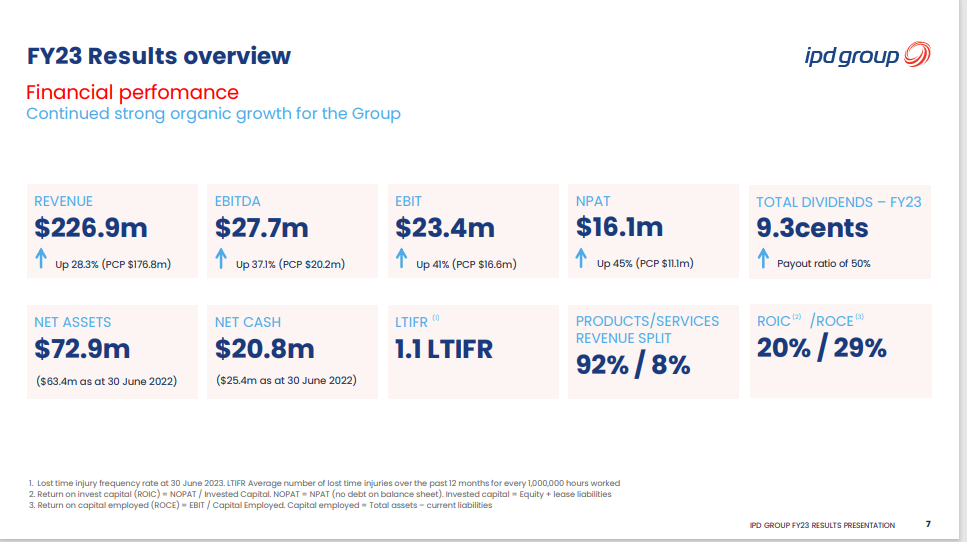

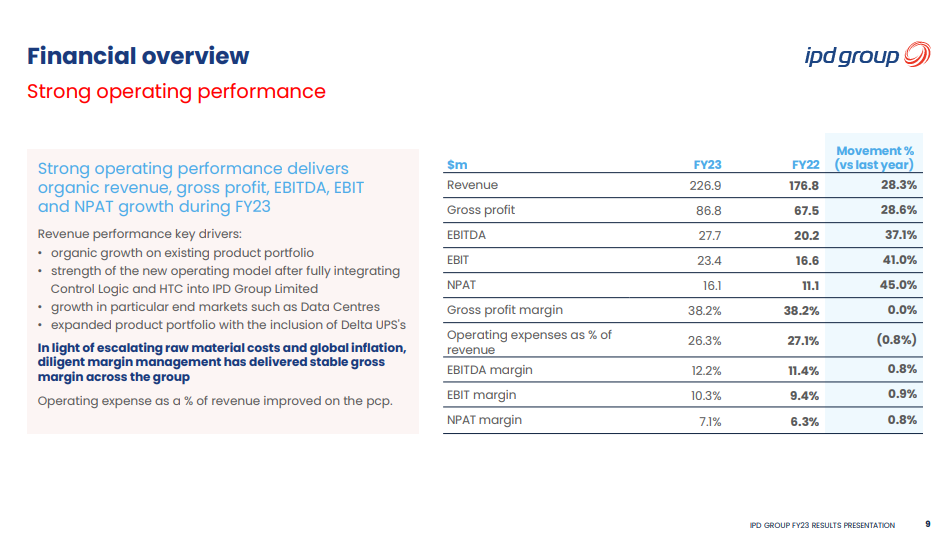

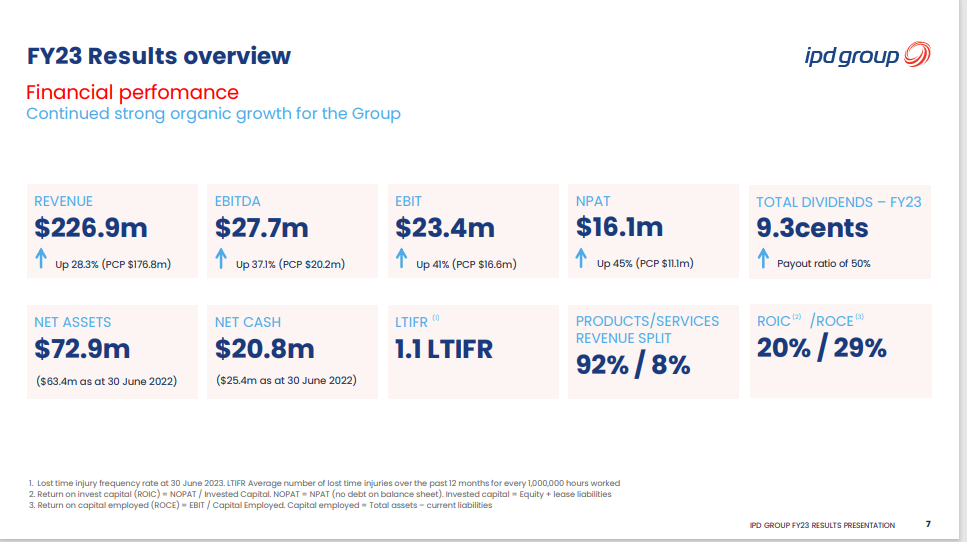

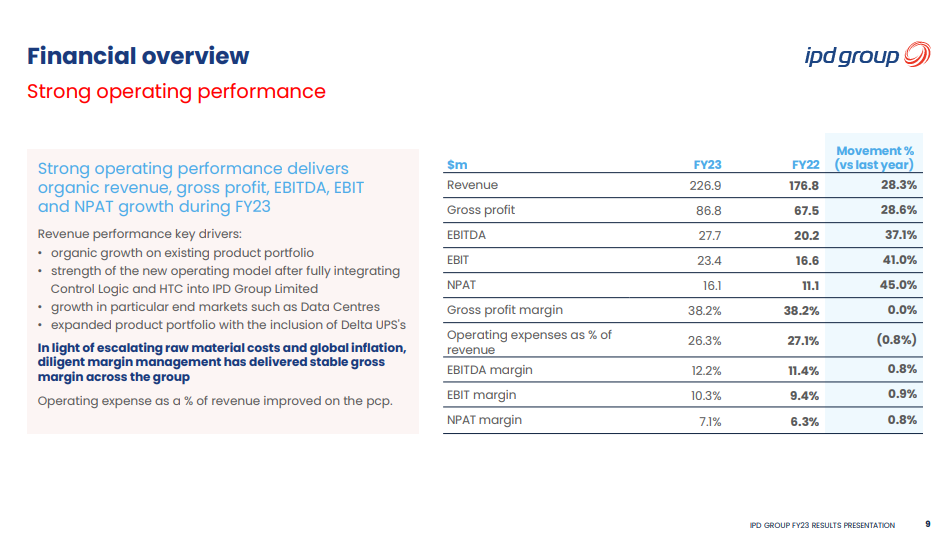

Revenue of $226.9million, up 28.3% on pcp – Strong organic growth has been delivered predominantly by the existing product portfolio and growing market share – Strong statutory growth displayed by a 37.4% CAGR

EBITDA of $27.7 million, up 37.1% on pcp – There have been ongoing strategic investments made during the year, some of which include: • Expansion of the Gemtek team

• Recruitment of specification focused business development managers across the country

• Operational expansion with a new 4,000sqm warehouse – While the Group has invested into these strategic initiatives during the financial year, the Group continued to deliver strengthening EBITDA margins, and a 44.9% EBITDA CAGR over the past four financial years

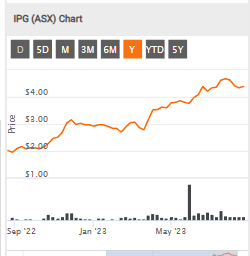

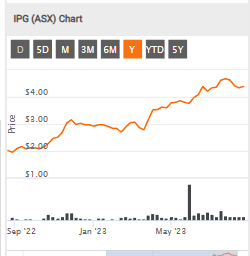

So Check out IPG a steady pathway to growth. could add some units today with the expected bearish market..

Return (inc div) 1yr: 132.35% 3yr: N/A 5yr: N/A