Notes following a closer look at NAN's 1HFY25 results.

Discl: Held IRL

OVERALL

The 1HFY2025 was a very good robust result YoY, but the HoH view, particularly the fall in the number of installed units from 2HFY24, tempered that enthusiasm back a bit. A re-rating was to be expected with this good result, but the huge ~37% rise of the share price was surprising, but most welcomed.

Thesis of (1) moat around Trophon being the standard of ultrasound disinfecting (2) capital sales driving strong recurring consumable revenue, is now back on track., after a challenging period of GE transition, then stagnant capital sales.

FINANCIALS

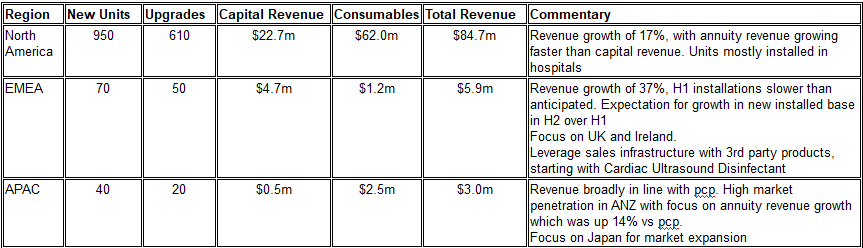

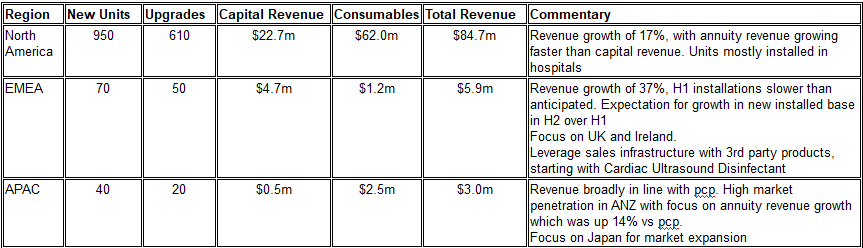

1,730 Trophon units installed in 1HFY25 - 1,050 New, 680 upgrade - some 10,000 Release 1 units still in operations today - upgrades drive new service contracts and service revenue

The YoY improvement was significant:

- Gross Profit up 15.8% , Expenses increasing by only 9.7%, NPAT increased by 58.2%

- This was driven by both Capital Revenue up 11.3% and Consumables/Services Revenue up 19.8%, from a 4.5% decrease in new Trophon units of 1,050 and a 9.7% increase in upgrade units of 680

The HoH view was very good, but less so:

- Gross Profit up 6.4%, Expenses up 3.0%, 43.4% increase in NPAT

- Capital revenue fell 7.3%, offset by Consumables/Services Revenue increasing 8.0%, from a HoH 15.3% fall in New Trophon units and a 23.6% fall in Upgrade units

- The 8.0% increase in Consumables/Services revenue was very encouraging

- The blip however, was in the reduced volume of New (down 190 units to 1,050) and Upgrade (down 210 units to 680) units which resulted in Capital Revenue falling 7.3% - would have liked to have seen both numbers sustain from FY24 to have full confidence that the capital sales recovery is not only under way, but also sustainable

Return to gross profit margin to 78.5% (76.3% in 2HFY24) was pleasing, reflecting a successful inventory management program, return to normal production volumes in H1, and the product sales mix

Operating expenses remain well under disciplined control - a 9.7% increase from 1HFY24, but only a 3.0% increase from 2HFY24 - this was impressive as it includes investment in the new ERP system which commenced in FY24 and further investment into Coris R&D and pre-commercialisation costs

Very healthy cash position:

- Cash flow of $13.8m for the period

- Cash and cash equivalent grew to $144.5m at 31 Dec 2024, with zero debt

REGIONAL PERFORMANCE

Continues to be heavily skewed towards North America

OPERATIONS

New manufacturing site for both Trophon and CORIS consumables being established in existing Indianapolis facility - completion and registration expected in 2H

Range of benefits expected to be delivered (1) margin improvements over time (2) sustainability benefits from reduced transportation (3) reduced exposure to the introduction of any potential tariffs on goods imported into the US

CORIS

Proceeding through the FDA’s de-novo review process with answers to the FDA questions received to date having been submitted

Continued preparations for supply chain and manufacturing readiness - targeting the commencement of the first stage of commercialisation in Q1 FY26, subject to the requisite regulatory approvals

Assuming a successful FDA de novo clearance of the CORIS system, marketing of the device will commence in the US. In parallel, it is expected that the first 510K for expanded scope indications will be submitted shortly thereafter

Outside of the US, the first commercial launch will likely take place in Europe in Q1 FY26 which is not contingent on the FDA de novo clearance

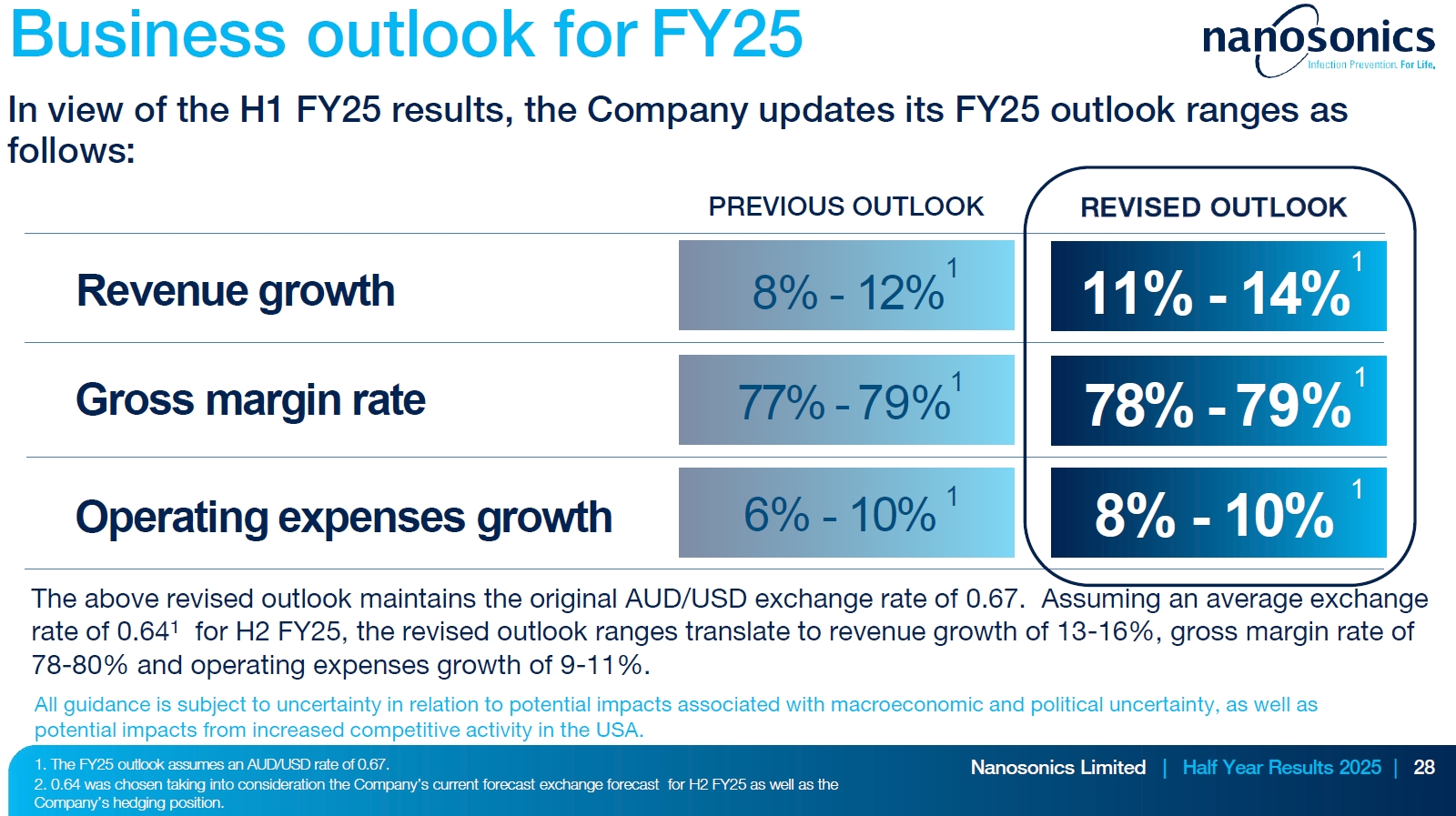

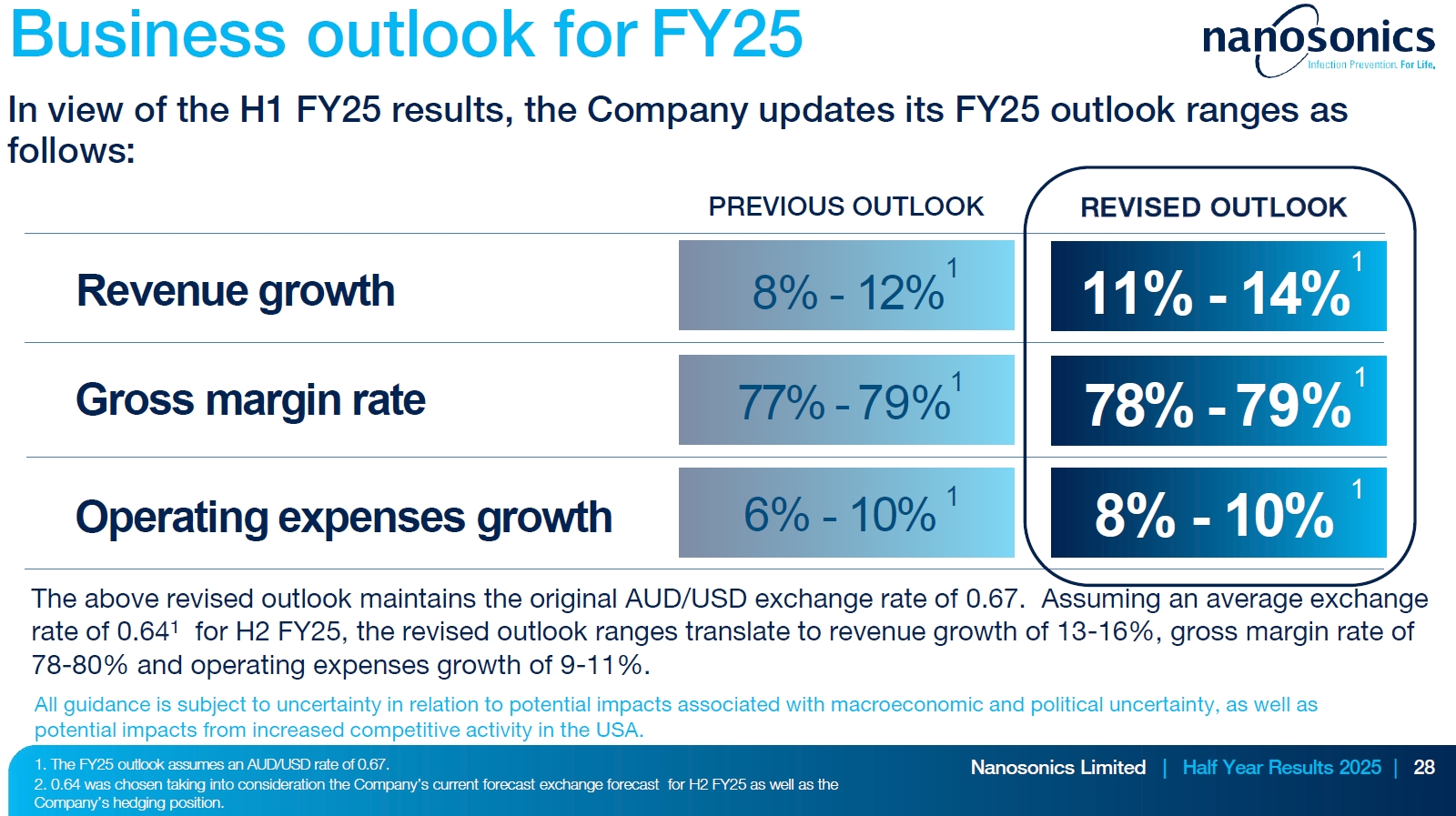

REVISED FY25 OUTLOOK

Will absolutely take this!