Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Discl: Held IRL 2.60%

Have been watching the NAN daily buy backs closely as its the first time that one of my holdings has initiated a buy back program and I wanted to better understand what impact it will have on the price etc. The position after this morning’s announcement and the chart is per below.

- It feels like NAN’s brokers have instructions to flog up to ~$300k per trading day buying up whatever is on offer, so long as it does not breach the max permitted buy price

- This has provided some support to the price amidst the volatility of the past 1-2 weeks, but this is a sugar hit that ends when the buyback ends, so the current shoring up of the share price really counts for not much in the long run

- I still can’t see how removing ~1.6% of the Shares on Issue is going to benefit shareholders from an increased EPS perspective.

Still feels like someone who has too much money and don’t know what to do with it standing on street corner with $1m and handing out $100 to whoever that walks by ... makes the donor feel good, improves the life of the receipient for the next few days, then everything goes back to normal thereafter ...

Is this it with buy backs??

Discl: Held IRL 2.43%

One of the points raised on Share Buy Backs on the Stocktake podcast flagged by @UncleWally is that a share buy back is a “good one” if the shares are undervalued.

Knocked up a quick valuation for NAN to test that thought. Have taken a more conservative approach than what Chat is saying are analyst consensus. Have essentially used growth rates which are a notch lower than the suggestions ie Chats Base Case = my Growth case, Chats Pessimistic Case = my Base Case, which makes my Pessimistic Case that much more conservative.

With these more conservative parameters, the NAN price appears to be “in the zone” based on the price movements in the last 2 or so months.

INPUTS

EPS Growth from Chat

- Nanosonics’ EPS jumped from approx A$0.043 to A$0.068 in one year (~59%) per one source.

- Analyst consensus: about ~19.6% p.a. EPS growth over next few years.

- Half-year result: revenue +18% in H1 FY25, with capital sales +11% and consumables/service +20% on year-ago.

- P/E / valuation context

- Current trailing P/E ~ ≈ 63–70×.

- Industry benchmark for “Medical Devices / Instruments & Supplies” globally around ~30×.

- Some commentary (Simply Wall St) suggests a “fair” P/E for NAN might be ~36× compared to current ~66×

So the company is growing rapidly (though from a low base) and the market is paying a high multiple relative to peers and industry average.

Discl: Held IRL 2.43%

NAN held their FY2025 AGM today. Only 2 things of note from the materials:

FY26 Guidance Unchanged but 1HFY26 Margins May Take a Temporary Hit

Doesn’t look to be a biggie, but good to have it flagged upfront.

Share BuyBack Announced

NAN is probably the first company that I hold that has an On-Market Share Buy Back Program and so this will be a good opportunity to have a detailed look as to how the buy back will actually benefit shareholders.

- At $161m with $32m cash generated in FY2025, clear plans on CORIS commercialisation and probably no immediate plans to acquire anything given the focus on CORIS, the $20m for the buy back program, as an absolute amount, looks sensible

- A simple back-of-envelope impact on the shares on issue doesn’t feel like this will make too much of a dent to reducing the volume of shares on issue, reducing supply and hence increasing EPS.

I conceptually get how I should benefit, but as I do not receive any direct tangible payment from it, I do still struggle to fully internalise and appreciate the “benefit”.

Am thus, a bit lukewarm on the buy back other than the potential for it to support the share price if there is sustained selling pressure. It does feel like management is throwing money into “nothing”, but this is admittedly potentially a naive and ill-informed view ..

Appreciate if anyone has any views on buy backs and whether this is a good or meh thing ...

What is a short thesis? Any thoughts?

Discl: Held IRL

Nice to see Vanguard become a substantial holder of NAN. Coming off the back of Director Gerard buying in, this is another data point of increasing confidence in NAN.

- They look to have been building the position from 10 June 2025 to 19 Sep 2025

- Lots of the purchases were around ~$3.95 to ~$4.15

I intend to add to NAN in a correction, but closer to ~$3.50.

Discl: Held IRL

Always nice to see a Director buying into one of my companies. Had a look at Gerard’s history:

- Not much in the overall scheme of things, but given his position, background, access to information, timing of appointment as a new insider, looks like a person building conviction and doubling down, with his own coin.

- He has gone from zero to 0.01% of NAN in 9 months

It sure adds to my confidence in NAN!

Discl: Held IRL

SUMMARY

Solid 2HFY25 and FY25 result, meeting and exceeding guidance provided at the 1HFY25 results.

17% YoY Revenue increase was driven by 20% YoY increase in Consumables and Service Recurring revenue and 9% Capital Sales revenue - the regaining of revenue momentum in 1HFY25 was very much sustained in 2H, leading to the good overall FY25 result.

Operating leverage is now increasingly evident, especially in Consumables and Service recurring revenue.

FY26 is guided to be “more of the same as FY25” - with upgrades to Trophon 3 being the focus in 1HFY26, followed by software upgrades to Trophon 2+ in 2HFY26, and the continuing of momentum from Trophon Consumables and Service recurring revenue.

FY26 growth is with very minimal Coris contribution as NAN focuses on bring Coris to market, set up the operational supply chains, submitting 501k indication expansions to broaden the use of Coris to “all flexible end scopes” right throughout FY26.

The real kicker will come in FY27 where both Trophon and Coris should be firing all cylinders, creating a significant step up in NAN’s economics.

Key Risks to Watch Out For

- Trump and his bloody tariffs - the full impact of the tariffs, including the effectiveness of management mitigation actions, including the startup of the US manufacturing facility, will be experienced in FY26

- Issues with 501k Indication Expansion applications - nothing is approved, until it is approved

- Hiccups with the Controlled Market Release of Coris

- Slower than expected momentum in the uptake of Trophon 3 upgrades (in 1HFY26) and Trophon 2+ upgrades (in 2HFY26)

Have added my notes against the key preso slides from this morning’s call if anyone wants the detail. I really like the slide pack because, for me, it very clearly and logically tells the story of FY25 and has lots of insights as to how management expects FY26 to play out.

Overall

My bullishness in the longer-term outlook of NAN went up a notch today. I do not expect any significant movements in the NAN share price in FY26, if any, probably a sideways with an upside bias, and patience will absolutely be required for the full Coris commercial release to play out.

Action To Take

Accumulate on price weakness under ~$4.00 from hereon to position for FY2027.

Chart Review

The NAN price chart looks really nice - textbook retracement to about 60% since March 2024. This sets it up nicely for upwards price movements from here, with support coming from the 200 MA line and the medium-term uptrend line.

DETAILED NOTES

A solid 2HFY25 and FY25 result, meeting and exceeding guidance provided at the 1HFY25 results.

Installed base of 37,000 Trophon units is driving strong recurring revenue growth through customer value expansion - recurring revenue up 20% YoY - includes a small 3% price increase but is mostly volume-drive growth

FY25 delivered new installed base of 2,210 units & Upgrades of 1,660 units - driving capital revenue up 9% YoY to 52.5m

Growth in revenue and installed base was across all regions.

Trophon New Installed Base has been on the decline, Upgrades are increasing. Expecting to see both improve with Trophon 2+ and Trophon 3 in the next FY

Operating leverage is showing with the increasing widening of the gap between revenue and expenses in the chart below

All components of recurring revenue are firing nicely - multiple drivers for Trophon which are highly profitable and generate good cash flow.

Core Consumables reflect the impact of a 3% pricing increase but growth was primarily volume driven.

Services revenue was up 21%, remains very promising - this was what got me excited as a 3rd recurring revenue stream when I last looked at NAN in June 2025 and topped up as a result.

Good all round operational achievements in FY25

Manufacturing facility established in Indianapolis, US for Coris and Trophon consumables

ERP implementation has completed

Cloud infrastructure established to support the integration to the DIFON platform for Trophon 2+ and Trophon 3

Really good to see ISO27001 cyber security re-certification achieved - this provides good confidence around NAN’s cyber security posture.

FINANCIALS

- Operating Expenses are falling as a percentage of revenue

- Admin expenses grew 19% but this included ERP investment which must be expensed in the year incurred - this ERP-related expense will not recur in FY26

- R&D expenses fell as a percentage of revenue by 2% to 17% - management has guided for “this trend to continue”

- Gross profit margin up 0.3% YoY to 78.2%

Tariff Impact

- Tariff impact was $0.5m, mitigated by high inventory levels already in the US

- FY26 tariff impact is expected to be circa $4m, expected to cause a drag on FY26 gross profit margin - guided to be between 75% to 77%

- Actions taken include sourcing from the US, price adjustments

Cash Position, M&A

- $32.0m cash generated in FY25, $161.6m cash balance, no debt

- Keeping a very open mind on M&A opportunities to put the available cash to best use, but acquisition must make sense

- Expect Coris to open the door to explore more M&A opportunities as the need will arise to build a Trophon-like ecosystem of consumables around Coris

- But focus in the coming year will be fully on bringing Coris to market

CORIS UPDATE

- Pursuing 510k scope indications to expand the use of Coris beyond initial De Novo approval for endoscope's to all flexible end scopes

- In parallel, pursuing regulatory approval in Europe and Australia

- Customers understand the need and the problems with the current cleaning methodology of cleaning and the resulting increase in adverse events from the risk of contamination - lots of ongoing education occurring

- Good slide which shows the multiple Coris revenue streams which other than the initial capital sale, are mostly recurring - very exciting

- Higher cleaning cycles per Coris machine (vs Trophon) are expected - lots of upside potential for recurring revenue to take off with Coris

- Did not announce the pricing for a Coris cleaning cycle - data point of $11 to $37 for CURRENT manual cleaning was given - hints point to something “around $10” ...

- EBIT margin for Coris consumables is likely to be “a little bit better than Trophon”

- Expecting the Coris model to be the same as Trophon - “more weighted to consumables”

New Manufacturing Facilities/Office in Macquarie Park

- Capex requirements to fit out new manufacturing facility/offices as lease for current premises runs out in 1QFY2026 and cannot be renewed

- Capex will straddle over FY26/FY27 for move in FY2027 - expected to be $10-$12m in total across FY26 and FY27, to be depreciated over 10 years

- Leasing costs will commence in April 2026 when access to the new premises is gained - expected to be circa $600-700k in FY26

FY26 GUIDANCE

- Revenue 8-12% growth, includes expected “reasonable” price adjustments

- Minimal Coris revenue baked into FY26, focus is to get Coris to the Controlled Market Release stage - will learn from this stage to better understand and quantify the FY27 impacts

- Not currently seeing major issues with hospital capital budget issues of 12M ago and not seeing any change in patient volumes going through hospitals - these observations is baked into the guidance

- Gross margin to fall from 78.2% to between 75% to 77% due to expected tariff impacts

- Minimal revenue from Coris which would only be in “Controlled Market Release” mode throughout FY2026 - this will set up FY2027 very, very nicely

- Continue to expect Opex to grow less than revenue

- Higher depreciation of around $2m was flagged for the fit out of the manufacturing facilities in the US

- R&D expenses as a % of revenue expected to fall in the ROM of 2% in FY26

- FY25 R&D cost was majority internal cost - bio scientists, clinical staff etc, not just engineering personnel

- Committed to ongoing internal innovation

- FY26 R&D will be focused on the broader Coris indications and Coris-related R&D

- Capex was guided to be circa $10m (FY25 was $9m) - 50% for the Facilities fit out, 50% will be the normal Capex run rate

Thanks to Gemini for assistance to review the financials released today from Nanosonics!!

Nanosonics 2025 Full-Year Financial Results:

Based on the company's full-year financial report for the period ending June 30, 2025, Nanosonics delivered a strong financial performance, though some key metrics warrant a closer look.

Key Financial Highlights (Pros)

The report demonstrates several positive trends:

- Strong Revenue and Profit Growth: Total revenue for the year reached $198.6 million, marking a significant 17% increase compared to the previous year. This growth led to an even more impressive boost in profitability, with Earnings Before Interest and Tax (EBIT) soaring by 95% to $17.8 million, and profit before tax increasing by 72% to $22.3 million.

- Robust Business Model: A key driver of this success is the company's scalable business model. The cumulative installed base of its flagship product, the trophon, grew by 6% to 37,000 devices. This expansion fueled a 20% increase in "recurring revenue" from consumables and services, which reached $146.1 million.

- Strategic Product Development: Nanosonics achieved critical milestones by securing US FDA clearance for its next-generation trophon technology and a new system called CORIS. These regulatory successes are expected to be catalysts for future growth, enabling the company to expand its product portfolio and revenue streams.

- Healthy Balance Sheet: The company maintains a strong financial position, with a positive cash flow of $32 million and a cash and cash equivalents balance of $161.6 million. The company reports having no debt, which provides financial stability and flexibility for future investments.

Areas of Concern (Cons)

While the report is largely positive, a deeper analysis of certain metrics reveals potential risks and challenges:

- High Price-to-Earnings (P/E) Ratio: The company's P/E ratio stands at 73.32, which is exceptionally high. This metric indicates that the market has very high expectations for Nanosonics' future earnings growth. While a high P/E ratio signals strong investor confidence, it also makes the stock price highly sensitive to any failure to meet these growth expectations. If the company's profit growth slows down, the stock could experience a significant correction.

- Low Return on Equity (ROE): The company's Return on Equity (ROE) is 8.8%, which is considered low and falls below the medical equipment industry average of 9.9%. This suggests that Nanosonics is not as efficient as its peers in generating profits from the capital invested by its shareholders. While the company is profitable, the low ROE raises questions about its capital management and its ability to generate superior returns for its investors.

- Future Gross Margin Pressure: The company's guidance for the next fiscal year projects a gross margin of 75-77%, a slight decrease from the 78.5% margin reported in the first half of the 2025 fiscal year. This could indicate potential cost pressures or changes in product mix that may impact overall profitability.

- No Dividends: Nanosonics does not pay dividends. This means that shareholder returns are entirely reliant on the appreciation of the company's share price, which can be volatile, especially for a stock with a high P/E ratio.

Overall Impact on Shareholders

The Nanosonics 2025 full-year report presents a mixed but generally positive picture for shareholders. The company's robust financial performance, driven by a scalable business model and key product launches, has been well-received by the market. This is evidenced by a recent 7.4% stock price gain and a 29% one-year return on investment.

The high level of institutional ownership (63%) and insider ownership (15%) suggests strong confidence from both professional investors and company leadership. However, the high concentration of institutional ownership also means the stock price is sensitive to large-scale trading activities. Ultimately, the company's value for shareholders will depend on its ability to sustain its high growth trajectory and improve its efficiency, thereby justifying its premium valuation and addressing the concerns raised by its relatively low ROE.

Follow on from the 21 July 2025 announcement launching the 2 products, FDA approval has been received.

Follow on from the 21 July 2025 announcement launching the 2 products, FDA approval has been received.

The upgrade opportunities of 10,000 1st Gen to 3rd Gen and 20,000 2nd Gen to 2nd Gen Plus is not insignificant.

Will be keenly watching the impact of these next gen products on FY26 US Capital sales.

Discl: Held IRL

Digesting the 7 July 2025 NAN release.

My initial reaction to this announcement was that it was rather odd to offer a new v3 hardware device at the same time as a v2 software upgrade vs a full-on v3 release of hardware and software. But on reflection, it feels like NAN is learning from the challenges it has had in moving customers from Trophon v1 to Trophon v2. If I recall, there is still a decent installed base of Trophon 1 units that have not upgraded to v2 - cost considerations was cited as the main reason previously. This strategy allows for:

- New customers straight into Trophon 3

- Trophon 1 upgrades can bypass Trophon 2, straight to Trophon 3

- Trophon 2 upgraded customers can continue to sweat the v2 hardware for a bit longer, while accessing the new Trophon3 features via the software upgrade

This makes sense to provide different upgrade pathways to newer products to ALL customers and should boost capital sales and services revenue.

The downside though is that this will now likely encourage (1) the skipping of hardware upgrades, avoiding 1 version totally and (2) customers to stay longer on a given version via the software upgrade.

Will be interesting to understand how the revenue impact plays out in FY26 as these options become available to customers.

Discl: Held IRL

Summary of a short LiveWire article by Forager https://www.livewiremarkets.com/wires/nanosonics-from-darling-to-dud-and-back-again on NAN on 7 June 2025. Having lost interest in NAN in the past 1-2 years, this was a good recap of the NAN position and helped plug some gaps in my understanding of NAN. I am now having a closer look as the price trends below $4.00.

Discl: Held IRL

Trophon Services Contracts as a 2nd Recurring Revenue Base

- Since taking over sales from GE in 2019, NAN has been quietly building a 2nd high margin earnings stream with services contracts

- These services contracts are typically multi-year, paid upfront and recognised over time, creating a 2nd growing recurring revenue base and are now now latched on to roughly half of the Trophon units it sells

- Replacement of older Trophon 1 units with Trophon 2 opens up more opportunities to attach services contracts - ~10,000 Trophon 1 units are now more than 7 years old

- While not overtaking capital or consumables, services revenue should grow faster than the other revenue streams and represents more high-quality, annuity-like revenue

I really like must-have recurring revenue, so this highlight on the growth of Services Contracts is really attractive and was something I was not paying much attention to.

Coris Challenges are Now In The Past

While I understood the Coris drag on earnings, this graph very clearly shows how much of a drag it was and really puts that issue in good perspective.

- But these issues are now in the past and from FY26, Coris will start to contribute, so we will have the combination of the losses reducing rapidly and revenue rising progressively

- Potential to generate even more consumables revenue than Trophon - 60m endoscopic procedures performed annually worldwide - addressable market for Coris is substantial

- Coris is more complex than Trophon and requires plumbing, which means longer sales cycles and more hospital involvement, but it should offer more revenue per unit once installed

Chart

The price pullback from the recent highs of $5.09 on 21 Mar 2025 towards ~$4.00 is entering the 50% retracement zone - usually a nice price to start looking at topping up for me.

Nanosonics announced FDA De Novo Clearance. The journey has been so bloody long 18 years in making. screenshot from the 2007 prospectus ( how big was the machine back then :))

Notes following a closer look at NAN's 1HFY25 results.

Discl: Held IRL

OVERALL

The 1HFY2025 was a very good robust result YoY, but the HoH view, particularly the fall in the number of installed units from 2HFY24, tempered that enthusiasm back a bit. A re-rating was to be expected with this good result, but the huge ~37% rise of the share price was surprising, but most welcomed.

Thesis of (1) moat around Trophon being the standard of ultrasound disinfecting (2) capital sales driving strong recurring consumable revenue, is now back on track., after a challenging period of GE transition, then stagnant capital sales.

FINANCIALS

1,730 Trophon units installed in 1HFY25 - 1,050 New, 680 upgrade - some 10,000 Release 1 units still in operations today - upgrades drive new service contracts and service revenue

The YoY improvement was significant:

- Gross Profit up 15.8% , Expenses increasing by only 9.7%, NPAT increased by 58.2%

- This was driven by both Capital Revenue up 11.3% and Consumables/Services Revenue up 19.8%, from a 4.5% decrease in new Trophon units of 1,050 and a 9.7% increase in upgrade units of 680

The HoH view was very good, but less so:

- Gross Profit up 6.4%, Expenses up 3.0%, 43.4% increase in NPAT

- Capital revenue fell 7.3%, offset by Consumables/Services Revenue increasing 8.0%, from a HoH 15.3% fall in New Trophon units and a 23.6% fall in Upgrade units

- The 8.0% increase in Consumables/Services revenue was very encouraging

- The blip however, was in the reduced volume of New (down 190 units to 1,050) and Upgrade (down 210 units to 680) units which resulted in Capital Revenue falling 7.3% - would have liked to have seen both numbers sustain from FY24 to have full confidence that the capital sales recovery is not only under way, but also sustainable

Return to gross profit margin to 78.5% (76.3% in 2HFY24) was pleasing, reflecting a successful inventory management program, return to normal production volumes in H1, and the product sales mix

Operating expenses remain well under disciplined control - a 9.7% increase from 1HFY24, but only a 3.0% increase from 2HFY24 - this was impressive as it includes investment in the new ERP system which commenced in FY24 and further investment into Coris R&D and pre-commercialisation costs

Very healthy cash position:

- Cash flow of $13.8m for the period

- Cash and cash equivalent grew to $144.5m at 31 Dec 2024, with zero debt

REGIONAL PERFORMANCE

Continues to be heavily skewed towards North America

OPERATIONS

New manufacturing site for both Trophon and CORIS consumables being established in existing Indianapolis facility - completion and registration expected in 2H

Range of benefits expected to be delivered (1) margin improvements over time (2) sustainability benefits from reduced transportation (3) reduced exposure to the introduction of any potential tariffs on goods imported into the US

CORIS

Proceeding through the FDA’s de-novo review process with answers to the FDA questions received to date having been submitted

Continued preparations for supply chain and manufacturing readiness - targeting the commencement of the first stage of commercialisation in Q1 FY26, subject to the requisite regulatory approvals

Assuming a successful FDA de novo clearance of the CORIS system, marketing of the device will commence in the US. In parallel, it is expected that the first 510K for expanded scope indications will be submitted shortly thereafter

Outside of the US, the first commercial launch will likely take place in Europe in Q1 FY26 which is not contingent on the FDA de novo clearance

REVISED FY25 OUTLOOK

Will absolutely take this!

Results attached. More green shoots for NAN. Tons of cash in the bank. Good to see more sales of units and upgrades of units. Market seems to like the news too.

The next step is obviously getting Coris through, which wont be till next year. Happy to sit and wait while it continues to generate pretty good cash.

Nessy

Held

Headlines looked good at first glance, but capital sales/revenue feels flattish H on H if there was only a 11% increase in capital revenue vs 1HFY24, which was not a good half at all. Was wanting to see more follow-through capital sales momentum this half and suspect I might be a tad disappointed.

Market appears to have expected, and is OK with this, given the ~30% rerating since the mid-Dec 2024 low of $2.88 and the rather muted price movement today. I'll take that!

Discl: Held IRL

- Revenue growth driven by 20% growth pcp in consumables and service annuity revenue streams

- Total number of Trophon units sold in 1HFY25 was broadly in line with internal forecasts and was similar to the total number in the pcp, with overall capital revenue up 11% compared to pcp

- PBT result includes $1.3m unrealised forex gain

- Expects to achieve revenue, gross margin and operating expenses in FY25 at the top end of previous FY25 guidance

Does NAN consider that any measure of its statutory or underlying earnings for the full year ended 30 June 2024 as disclosed in the Results Announcements (‘Earnings Information’) differed materially from the market’s expectations?

please specify how NAN determined market expectations in relation to each relevant measure of its earnings

Does NAN consider that, at any point prior to the release of the Results Announcements, there was a variance between its expected earnings and its estimate of market expectations for the relevant reporting period of such a magnitude that a reasonable person would expect information about the variance to have a material effect on the price or value of NAN’s securities?

My thoughts on FY24 result:

Valuation for Nanosonics is difficult - you can easily prove it's expensive or cheap based on your different views.

https://www.growthgauge.com.au/p/nanosonics-asxnan-fy24-result

Technically, the shares have caught some updraft after reporting, and are trading above key moving averages after quite a while.

If these conditions persist, there seems to be some more upside left, to $4 and perhaps even $4.50 before that big drop after the HY report in Feb.

Full write up - https://www.growthgauge.com.au/p/nanosonics-asxnan-h2-fy24-updates

Summary:

Revenue in line with guidance and improving.

Install base better than 1H but still down compare to FY23

As part of reviewing the position with NAN, I learnt more about the US FDA De Novo submission, which is the submission category NAN has done for Coris. Thought it might be helpful, not only for NAN, but for other medical device companies.

An FDA De Novo submission is an application submitted to the FDA for creating a new device product classification, of which Coris is.

The link below provides a 13 or so minute video and written explanation of what a De Novo submission is and how long it takes to get one. This is from a company which helps companies submit FDA approvals, Medical Device Academy.

The stats below was interesting in terms of number of De Novo approvals granted per calendar year and the average submission duration in calendar days. The "150 day %" refers to "FDA days" which is calendar days minus the days the submission was placed on hold - that is the FDA's KPI for funding request to Congress.

In summary, based on actual history, my expectations for Coris FDA approval is a minimum 12-18M away, closer to 18M, at the absolute fastest, so Coris earnings will realistically only kick in deep into FY26, possibly FY27 if there are delays.

Discl: Held IRL, not in SM

Finally got round to taking stock of my NAN position.

The TLDR view is (1) softness to continue (2) stay invested (3) stuck in trading range with no clear immediate catalyst to re-rate (4) too early to top up!

SUMMARY OF P&L

KEY TAKEAWAYS

- Capital sales and Trophon 2 upgrades have slowed and are taking longer to convert - tight budgets are seeing hospitals stretch out use of Trophon 1 devices vs upgrading

- 1HFY24 revenue has fallen 2% vs PCP and 2HFY23 - sharp drop in capital revenue of 15% on PCP, partially offset by increase in consumable sales, up 4% from PCP

- 1HFY24 gross margins was 79.7%, up about 1% from FY23, driven by revenue mix and positive forex impact

- Expenses have increased $5m in 2HFY23 from 1HFY23, increased by a further ~$1.2m in 1HFY24 vs 2HFY23 (up 12% on PCP, up 2% HoH), includes Coris expenses

- 1HFY24 PBT halved from 2HFY23 $10.2m down to $4.9m

- Global installed base up 1,100 units to 33,550, up 3% last 6M, up 8% last 12M

- Trophon 2 upgrades of 620 units, down 23% from PCP with customers extending use of their existing Trophon 1 devices due to budgetary constraints

- Coris De Novo submission to the FDA occurred in Q3FY24, slightly delayed

Positives

- Margins have been sustained

- Some 9,000+ Tophon 1 units are >7 years old, and are ripe for an upgrade - immediate focus, ~26% of current installed base

- FCF 1HFY24 was $7.9m, Cash & Cash equivalents at 31 Dec 2023 of $118.3m, no debt - no funding or cash generation concerns

- TAM to chase for both Trophon and Coris is still very large - Trophon installed base ~140,000 units vs 33,550 installed, only 24% market penetration thus far

- Coris will be the next growth driver

- Significant medical benefits of reprocessing technology and first mover advantage in Coris enables NAN to define the clinical standard in the endoscope reprocessing space which creates and strengthens the overall moat

- Coris FDA Approval is a De Novo submission - to create a device product classification

Main Short-Medium Term Concerns

- Soft market conditions in 1HFY24 are expected to continue in 2HFY24, leading to a very soft FY24 result

- Coris is still at least 12-18M away to compensate for this softness, investment in Coris commercialisation and R&D will increase operating expenses in the interim

- Favourable forex gains are baked into revised expectations eg. reduced growth in FY24 expenses

What Will Drive Prices Upwards

- Continued progress and positive news on Coris FDA submission - medium to long term

- Signs of increased momentum in the growth of Trophon 2 upgrades in the US and the overall Trophon installed base - at least 6-12M

- Actual implementation of country guidelines requiring high-level disinfection

- Growth in capital sales in EMEA and APAC - this has been patchy

- Stronger growth momentum in consumables revenue to compensate for slower capital sales - at least 6-12M

Action To Take

- Will continue to stay invested as (1) the technology benefit is a strong moat (2) the TAM is still a big one (3) the outlook will brighten in 12-18M time once current Trophon upgrade hurdles are overcome and Coris gets close to FDA approval

- No immediate clear catalyst for re-rating as 2HFY24 and FY24 is being guided to be soft

- Chart shows NAN stuck between a $2.44 - $2.74 long term support zone but with a strong resistance zone between $3.22 to $3.48 and the 200 SMA, limiting immediate term upside - this broadly aligns with the fundamental position of the business ahead of the FY24 results

- Will need a stellar FY24 result above guidance to create upward price momentum - no clear evidence to suggest this will occur

- Current 1.72% allocation is appropriate for the immediate to medium term outlook and does not warrant adding until at least the release of the FY24 results

Discl: Held IRL, not in SM

All my writing is here in various straws about Nanosonics. I have put together my current thinking here - Nothing new from what I have posted in strawman so far - this is just an amalgamation of all my straws and current thinking

https://growthgauge.substack.com/p/asxnan-nanosonicsbetting-on-innovation

Nanosonics provided a trading update for 1H24

- Revenue for 1H24 will reduce ~4% compared to PCP ( to $79.6m )

- Nanosonics revenue comprises 2 components (Capital sales and Consumables)

- Consumable would have increased by definition because of more installed base ( no figures provided)

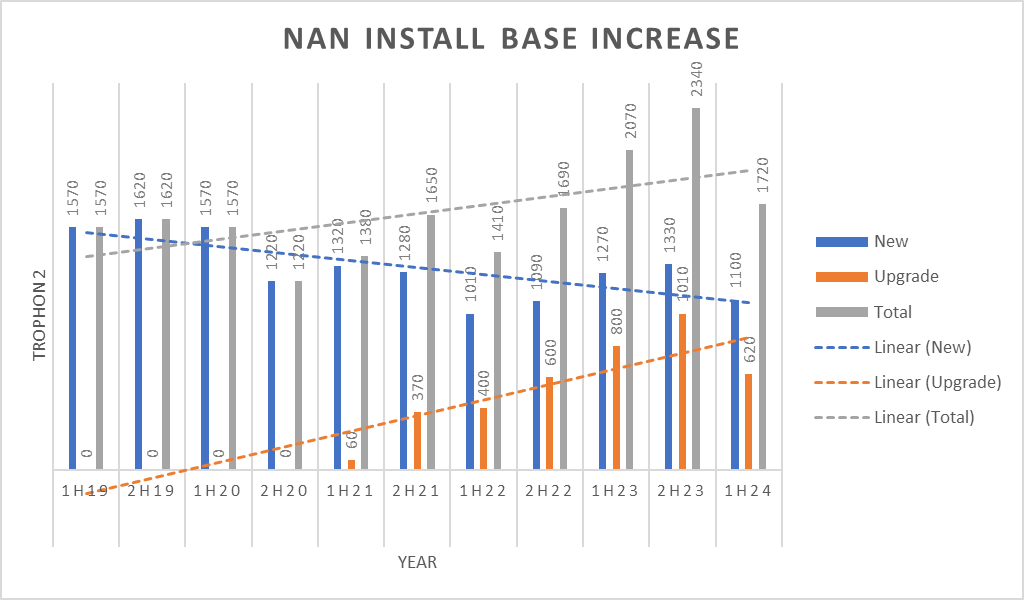

- In this half, Nanosonics only sold 1720 units ( 1100 new and 620 upgraded) compared to the 1H23 figure of 2070 (1270 new and 800 upgrades)

- Management is saying that the revenue miss is because of lower-than-expected capital sales ( I think management would have factored in around 2250 capital sales in this half i.e ~10% growth over pcp) so they are short of 530 units this half - reason given in the announcement is "Hospital capital budget pressure"

- The following chart shows historic capital sales for the last 5 years and trends.

Now the question for investors is, is this a structural issue, or Market penetration issue, or an economic cycle issue? More information will be provided in half year result at 26th feb.

One thing is for sure that I was wrong in expecting 25% growth this year - Market has slapped 35% of its market cap in a day and to be frank market is right in doing so - Nanosonics was ( and is) on high multiple and it can not afford to not grow and miss the guidance. So hopefully, I learn and grow from this experience ( like i did with EML and KME and others)

Pre-results confession, not a pretty sight unfortunately ...

It seems that Nanosonics has started advertising Endoscope solutions in Australia/NZ and the UK/Ireland but not in the USA, Canada, France, and Germany ( based on their websites). Seems like an imminent launch is approaching near.

at the same time, short selling is increasing as well

Assumed a variety of growth outcomes ranging from 20% - 10% over next 5 years giving valuation range $3.22 - $5.17. Assumed share count of 322m in FY28. Conservative numbers Net Margin of 10% in FY28 discounted back todays numbers.

I attended the Nanosonics AGM virtually - they have uploaded a recording to their website

https://www.nanosonics.com/investor-centre/investor-conference-calls

If you want to learn about their new Product CORIS and time poor - check from ~41min to ~56min

As Nanosonic is one of my big holdings, I keep an eye on all available public information.

My speculation is that Nanosonic will announce coris product along with 1st half 2024 report. All the signs are telling me that it is coming closer.

One of the mandatory compliance requirements for any electronic equipment is to complete FCC part 15 radio frequency test. which provides a CE mark here is the result of the test which has an issue date of 16th August 2023

https://apps.fcc.gov/eas/GetApplicationAttachment.html?calledFromFrame=Y&id=6739852

It was initially tested on 21-22nd March and then again on 31st July and 1st August ( Probably, something wasn't right in march but has been rectified and retested)

A few other indications in their FCC filing - a few things are permanent confidential and few things are short-term confidential i.e user manual, External photos until 13th Feb 2024. - which is around the time 1H result will be announced.

Nanosonic added more details about Trophon's business performance by excluding operating expenses related to the development and commercialization preparation of CORIS.

Why is this given now?

Nanosonic released FY23 results this morning.

Revenue:

Customer Receipts

Expense

Operating Cash

New Installed Base declined by 16%

Coris delayed (again)

Nanosonics products are now available via NHS Supply Chain

Latest updates from Morgans

https://www.morgans.com.au/Blog/2023/June/Nanosonics-Back-Into-Buying-Territory

I don't have access to full blog so not sure what has been written but it seems the target is raised to $5.49

NAN was constantly among the top 20 most shorted stocks last year. As of today, that short position is normalized with the historical level. It is just a reminder that shorter doesn't always get it right.

@Strawman has put together a nice summary of the result so I won't repeat anything here.

In any case, I was a little disappointed to be honest as I didn't get any new information that was not already disclosed prior to today.

I was hoping to get some information about AuditPro's progress - Nothing was mentioned in the call and no analyst asked as well and I didn't get a chance to ask questions for some reason.

Apart from Coris's picture in the presentation - nothing mentioned in the call was new information. No clear details about the process and timeline etc.

Regarding Valuation, I am still sticking with my assumption and calculation as per my valuation straw - even though, NAN will easily beat my FY23 forecast.

Hard to fault Nanosonic's latest numbers (see full results preso here)

Installed base up 10%, with the new installed count bouncing back strongly. Revenue up 35% (27% in constant currency), and an improved gross margin (exactly what you'd want to see after transitioning to a direct sales model). Pre-tax profit jumped from $3,3m to $11.4m, of which $6.1m was free cash flow.

The balance sheet is a fortress: $99m in cold hard cash.

The new Coris product seems to have some supply chain disruption, but on track for release towards the end of 2023.

All told, the company lifted the FY revenue guidance from 20-25% growth, to 36-41%. The gross margin may moderate a bit in the second half due to a higher proportion of capital revenue, but the FY guidance here was lifted from 75-76% to 77-79%.

FX and additional investment will also see a bigger than previously indicated increase in operating costs, which are now expected to grow between 22-27% for the full year (prev. 15-18%)

At the lower end of those ranges, we should see a FY revenue of $163m and gross profit of $126m (compared to $91m in FY22). That's at least $12m in EBIT.

Still, shares are on a forward EBIT multiple of around 100. I really like this company, but that's quite a lot... Still, probably justified if Coris sees similar success to Trophon. Of course, a lot of profitability being masked by the $26m they're spending each year on R&D too.

I retain a small position in RL, and none on Strawman. It's just a question of price for me, although it's probably not something I should be too fussy with.

Nanosonics updated the market with its H1 FY23 performance and based on solid performance it upgraded the FY23 outlook.

and Revised FY23 Guidance

Based on this announcement, it is safe to say that the transition of the sales model to direct has been successful.

I will be keen to see the progress of the product portfolio expansion effort.

- AuditPro traction

- Coris update

But So far, all my assumptions are okay on the valuation front, so I will stick with it.

FY26 Revenue = $293 ( 25% growth)

77% margin

226m Gross margin

149m total expenses

76m profit

Assume PE of 35 will give market cap 2664m

Assume Share count 311m

Share price (FY26) = $8.56

10% discount it to FY23 = $6.25

Nanosonics was asked yesterday by the ASX if they had any information that would explain yesterday's 11% share price drop and increase in volume.

Predictably their REPLY indicated they had no information that might explain it though the fact a substantial share holder (State Street Corporation) sold 3.5M shares last week may have contributed to the volatility. It's possible a few short sellers may have snapped up a few shares in the process to reduce their exposure.

Nanosonics according to Shortman is the 7th most shorted stock on the ASX as of the 7th December at 8.4%.

Being a few days behind it will be interesting to see if yesterday's shenanigans have had any impact.

Thanks to @Valueinvestor0909 for the NAN post as for some inexplicable reason had been dropped off my watch list. Nonetheless your post bought them back to my attention and I was able to buy a parcel soon after.....cheers once again.

Solid update in AGM:

Good insight from the Lakehouse guys.

We caught up with representatives of the Nanosonics board during the month to discuss voting resolutions ahead of the AGM. A key focus of our conversation was their framework to assess return on investment for the company’s increasing research and development (R&D) spend. We came away with a better understanding of the board’s focus on delivering the CORIS platform in the year ahead after a very drawn out expectation-setting with the market. Launch of CORIS will be an important milestone for the business after years of R&D spend as it will move the business toward its ambition of being a genuine multi-product Lakehouse Small Companies Fund Monthly Letter Page 4 company. In the meantime, we expect the existing trophon platform to continue growing at a healthy clip and generating a satisfactory annuity-like income stream.

This was one of the thing missing for AuditPro adoption as per last few calls

- Higher USD

- Lower freight charges

Margin guidance given factored in very high freight charges. It can potentially surprise to upside for margins.

Interesting

An article from a decontamination specialist ( Published in the clinical services journal in May 2022 edition) - suggest that there is a trend toward wireless/compact probe near patients and that will require modification to existing devices. [ Nanosonic has developed a wireless Ultrasound Probe Holder for it)

Nanosonics did update the market prior to the result so there wasn't that much surprise - There were a few things that I didn't like and will need to monitor

- Management says that, there was roughly $13m impact on the 2H result because of sales model transition - If that's the case - should 20-25% revenue growth guidance for FY23 is bit low - is it a case of underpromising or should we read something into it?

- AuditPro was launched a year ago and has yet to contribute to revenue - is it too slow or normal? is it not a market fit? if that's the case, question can be raised about the process to select product/stream all the R&D $ they are spending - is it something to worry about?

- Coris launch will still take longer than I expected - (maybe I thought it was going to happen in FY23)

- From the outlook that they gave, I was expecting a margin increase because of the sales model transition but that's not the case - I wonder why?

However, there was quite a bit that I like as well. Nanasonic is no doubt a great quality company - and this report in no way changes that view. This is just an exercise to put all negative possibility that comes into mind so if any of them eventuate hopefully we can act a little faster than the rest.

Not getting much love from brokers following results.

@Valueinvestor0909 thanks for sharing your valuation model. It gives me confidence to show my calculation for Nanosonics.

What I wanted to highlight is how the valuation can vary substantially by just minor variations in the input assumptions: For example:

1. Rev growth: Your model 25% . My model 19% reducing to 10% over 10 years.

2. Cost growth: Your model 12%. My model 19% reducing to 5% over 10 years.

3. Share count growth: Both 1%

4. PE: Your model 35. My model 25 based on 10% at 10 years.

5. Discount rate: Your model 10%. My model 15%.

6. Valuation: Your model $6.25. My model $2.17.

@Strawman has just posted a valuation of $3.88. Who is correct?

FYI if I adjust my PE to 35 and discount rate to 10% I get a valuation of $4.54.

This just highlights the difficulty of predicting future valuations.

*EDIT* (Turns out I couldn't add five years to FY22...d'oh!!)

I'll keep this simple.

FY22 revenue is expected to be around $120m in revenue.

Grow that at (roughly) 15%pa to get FY27 revenue of $250m. (new products could boost this further, but let's not count those chickens just yet)

I'll give that a net margin of (roughly) 15% to get a NPAT of $38m (this could also be a lot higher if they pull back on growth initiatives, but not convinced they would or should.)

Assume 305m shares on issue to get EPS of 12.5cps.

Give that a PE of 50 to get target FY27 price of $6.25. (that's a high PE, but there's a mountain of cash here and they'd still hopefully have a lot of runway in a very large global market, and with plenty of traction)

Discount that by 10%pa to get IV of $3.88

Like I said, pretty simple. But it shows that you either need even high sales growth, margins or market multiples to do well at a higher entry price.

fwiw, i really like the business.

Nanosonic updated the market about their Q4 performance, sales model transition progress, and FY22 unaudited result.

- Q4 performance

- At the end of Q4, the total install base had reached to 29850 (at the end of Q3 it was 28900) which means in Q4 they did 950 new units

- The expanded Direct team sold 91% of the newly installed base units

- Sales model transition progress

- Transition to revised sales model in NA substantially completed successfully with significant proportion of all consumables sales now going through direct channels

- All planned new headcount(15) associated with the expansion of direct operations now in place - total headcount 100 in North America

- Nanosonics and GE have extended the current Capital Reseller agreement for further 12 months from July 2022 ( not sure why? - probably GE hasn't completed its entire stock? or full transition hasn't been successful as announced? NAN and GE going conservative to resolve any teething issue or don't want to miss any opportunity?

- FY22 Results ( unaudited)

- At Q3 update they said total revenue for the year is anticipated to be in line with market consensus. ( which was ~116m)

- Today they said that they expect revenue of 120.3m

Looks like a strong updated from NAN - 45c402x7vskr60.pdf (asx.com.au)

Sales of $120M beating market consensus of $116M for FY22 - some 3% beat.

Narrative around transition to direct seller from GE distriutor appears to be negative whereas it really seems it should be a positive. GE continuing to sell Tophon units as well with extended 12 month agreement.

NAN is not cheap at today at over 10x revenue but large short postion of 11.6% from Shortman - today's trade will be interesting given slight market beat.

Charts look a lot better now

Yesterdays big sell off corrected all the issues I had with the charts. Obviously now you probably all realise I need all the lines in my Stochastic indicator to be heading in the same general direction and keeping relative pace with each other across all 3 time frames (1D, 3D, 9D). You will note however that across all time frames they are still pointing down as well as the MacD (next indicator below with lines changing from red to green etc) also pointing down. In my last post I mentioned I thought it would drop to 3.18 (Tick) and possibly further down to 3.00 (Tick). The next targets are 2.83 (Yellow rising T.Line) - 2.77 ($ Support). Will it go straight there? no probably not. It will probably correct after last couple of trading days for a wave up (as my blue arrows show on the 1D) however following @Rocket6 analysis which I feel to be on the money, NAN still trades at lofty multiples. On that note, Im still holding out for further declines as market sentiment medium term is terrible. If one was to trade in after days like yesterday then be aware it should only be for the short term trade (make a little coin) and leave again. Yes I feel it will go down to the Yellow T.Line Support of 2.83, however as @Rocket6 said, the multiples are still looking inflated so NAN definatly could see lower $. We all try to time the bottom regardless if we say we arent, thats what we wish for. I think it will bottom and go side ways for a while within a range before we see some kind of medium term bullishness appear. Idealy you would want to see the 3D chart indicators turning up before participate in a decent upswing. If your really conservative, you would wait to see the 9D turning up.

So Here's how the charts look now after the recent drop

and the 4hr below.

I beleive its still got a way to drop yet.

I thought some may like to see an update on the chart Analysis from my post recently. As you can see on the 9D its still ahead of itself even after the recent drop I forcasted in my past post, has been confirmed. So it dropped to test the recent bottom it made approx 3 weeks ago on the 1D and has stalled there. It is re-testing that bottom as I write this post.

Below in the 4hr chart, you can see the Yellow long term indicator is still declining (denoted by the yellow 6.32) with the white indicator (Current action) chasing it down. My thoughts are it will probably go down to at least the next Support level approx $3.18. Once there I will re evaluate. I have a bad feeling though it may drop as far as ?a ($3 ish) or ?b ($2.85 -2.90 ish) as shown on the 1D chart above. FYI the Yellow Line on the Chart is the historic Trend Line from way back. When it gets within ear shot of it, it usually goes all the way to it to test it out. I dont think we are close enough yet to test that one though who knows. I see the only thing to turn this around would be a great end FY22 report.

I will keep you posted if something changes my mind and results in myself taking a position in NAN.

Sorry for any spelling or Grammer mistakes. Short on time today.

Be careful, I see weekness. I have noticed over the last month many Starclub members buying nanosonics. I have held out buying in even though it has had a run up of its most recent bottom of $3.37 bottom as my charts tell. You will note that on its recent high (on the 25th May, high volume day) off the so called bottom, it hit 2 of my resistance trend lines and failed to push above. It has since come back a couple of days later to test those same 2 resistance T.Lines and so far today failed again on weak volume (making a possible double top pattern).

The reason I have stayed out was due to its weak volume on the Daily chart and also you will note by the 9day Chart on the far left, its indicator line (the white one) in the Yellow highlighted circle is way ahead of its long term indicator line (the Yellow line, also in the Yellow highlighted circle) . When this happens it tends to revert back towards the Yellow which currently has only kicked up a little and hasnt gained as much pace as I would like to see.

Three things can happen here obviously. 1st_price action could now go side ways for some time in a range until the longer term Yellow line catches up some what (not likely though possible until this finacial years result come out to verify direction), 2nd it could retrace towards its yellow longer term line (I think this is the most probable according to my chart analysis) and 3rd it may drop to the recent Support line (the red dotted line on the daily) bounce of and continue on its way up slowly with volatility until the result for the year come out and then who knows what. For me, Im taking the second scenario, however I cant stress enough make your own decisions.

Below in 240m chart it is also showing a change in direction. Stochastic curling over, momentum indcator is week and chaikin money flow is pointing down or weakening. The $3.69 - $3.74 support and the 50DMA & 15DMA is going to be critical. If it breaks below this range, Look out. Hopefully this all helps with your current thoughts and actions or maybe just creates more confusion.

Nanosonic updated the market about their Q3 performance, sales model transition progress, and outlook.

- Q3 performance

- At the end of Q3, total install base has reached to 28900 ( at 1H it was 28160) which means in Q3 they did 740 new units

- They said the upgrade was also in line with Q2 ( which means it was better than FY2021)

- Sales model transition progress

- The majority of customer has been updated - customer data has been provided

- warehousing and logistics operation is set up for increased volumes

- New hires came from GE High-level Disinfection teams ( example below)

- Head of GE High-Level infection team

- GE Operation lead

- number of sales managers

- Outlook

- Total revenue for the year is anticipated to be in line with market consensus. ( what is market consensus?)

H1 FY22 saw revenue increase to 60.6m, up 41% pcp – a revenue increase of around 17m, while cost of sales increased by 8.9m. This reflects NAN’s ability to scale effectively. But we also saw cash flow from operating activities in the minus range (-887,000) partly due to increases to selling expenses (5m increase) and admin expenses (2m increase). R&D expenses also increased by approx. 3m vs pcp – but with a war chest of 90m at their disposal and no debt whatsoever, I think its sensible investing in R&D to (hopefully) achieve further growth.

That said, accountability is important here. NAN and their management team continue to cite increases in R&D like it’s a positive thing. But from a shareholder point of view, we need to see ongoing innovation and competitive advantage stem from such investment. An ROE of 7.8% doesn't reflect particularly well on management. I consider this one of the primary bear cases for NAN. I think we can all agree that if the company isn’t sufficiently using funds to generate profits, questions need to be asked. Their low ROE, in conjunction with what many consider a disappointing second product, is something I want to monitor closely going forward.

It would also be fair to suggest NAN has a lumpy history re: FCF (noting that Covid obviously disrupted their operations significantly). This makes forecasting future FCF more difficult than I would have hoped. But in more positive news, since FY18, gross profit margins have increased while CapEx has remained steady at around 3-4m per year. The below helps articulate some of the lumpiness I refer to above:

With cash inflows in the minus range in H1, and a one-off impact to NAN’s H2 revenue in the range of 13-16m, FY22 will likely look even more mediocre than last year – particularly if investors don’t do their due diligence and look under the bonnet. This might cause further short-term pain to NAN’s share price over the next half a year.

Based on expected impacts, I will conservatively estimate that FY22 FCF will come in at 1-2m. Again, its difficult to forecast future years and how R&D might impact future profits, but I think forecasting increases of 5m per year up until FY25 is a reasonable assumption.

The recent decline in share price has provided investors like me – who initially sat on the side-lines citing valuation concerns – with an opportunity to start taking a position. But alas, there is still some risk here. The business still attracts significant multiples (P/E ratio 104x) – in fact my traditional DCF returned a low-ball valuation of $1.50 (which is unfair but provides insight into the expectations priced in). While there is next to no risk in terms of NAN’s significant cash holdings and no debt, there is with failing to impress a market that wants to see growth from the market leader. As mentioned above, the underlying business is impressive. @Strawman’s recent straw re: HY results touches on this in more detail – there is lots to like. But stalling growth, disappointing product updates and a management team that isn’t using capital as efficiently as it could mean I am treading carefully here. As it stands I think a valuation of $3.50 is fair value, noting the risks highlighted above.

Lakehouse Capital February letter discusses the following about Nanosonics

One of Nanosonic's non-executive directors (Marie McDonald) bought 19,600 shares on market on the 4 March. This was just over 49k.

Good to see I am not the only one sniffing around at these share price levels..

Most of the things are documented by @Strawman so no point in me re-doing it here.

Few things to consider for poor cash flow

- They have made the following upfront investment ( on top of the R&D) for long-term benefit ( on the call, it was mentioned that in pass-through model nanosonic will get an extra US$2000 per trophon unit ( there were no mention of extra margin for consumable - I would think minimum 10% margin - even if you calculate 5% margin then it comes down to roughly ~ 3.5m)

- They have built up inventory ( 6m more than PCP) in preparation for the transition to the pass-through sales model

- Expanded warehouse capacity and established logistics facility/operation

- Established Sales and Clinical organization - increased sales & Clinical employees to 54 ( further 12 new roles being recruited)

One thing I was expecting was some sort of sales traction for AuditPro but it was mentioned that AuditPro integrates with Hospital's IT system and hence it requires a security clearance and currently going through ISO 27001 ( Security cert?) certification and expect it to contribute to revenue from FY23 onwards.

The market isn't impressed with Nanosonics' latest half-yearly numbers -- shares are down 12% at the time of writing and now sit at their lowest level since 2019. In fact, shares are down roughly 50% from their all time high of $8.25 reached at the start of last year.

I think this is mainly due to valuation concerns, and let's face it, shares aren't that cheap according to traditional measures. At the current price of $4.15 (a market cap $1.25b), the company trades on over 10x sales (trailing 12m basis), or a trailing PE of 111x. And this is after a 50% fall from all time highs!

But let's put valuation aside for now, and see how the underlying business is doing.

The installed base of Trophon units continues to grow -- up 12% in the past 12 months and up 5% in the last 6 months.

The pace of growth here has clearly slowed. The company highlighted a 14% improvement from Q1 to Q2, as covid impacts waned, but compared to the first half of last year you're looking at only a 2% lift in new installed units added. Given the circumstances, i think that's far from terrible, but we certainly need to see improved new installed unit growth in the coming periods.

Covid likewise had an impact on ultrasound volumes, so little surprise to see consumables revenue (the juiciest, high-margin revenue) down 3% on the preceding half. Still, compared to the prior corresponding first half you're looking at a very decent 23% lift.

Add to that a very decent doubling in capital revenue, which was also 10% higher from the preceding half and you're left with a overall top line result that came in at $60.6m -- 41% higher than the pcp (but essentially flat from the preceding half).

A big part of this was the upgrade cycle of customers switching to the new and improved Trophon 2 unit. More than a 1/4 of their fleet represents units that are over 7 years old and will need to be replaced in coming years. That's about 7000 units.

So at this stage, although there was a loss of revenue momentum from H2 FY21 to H1 FY22, which i think is reasonably explained by the delta and omicron impact, i think the result is pretty good. But things look worse as you move down the income statement.

Operating expense increased 29% over the year, and R&D costs were up by 41% as the business continues to develop new products and build out its team. Added with some expenditure on the new corporate digs, and free cash flow dropped into the red by $3.8m. That's dropped the cash balance to $92m -- but, let's be honest, there are few ASX companies of this size that can boast such an impressive war chest.

Still, combine it all together and net profit was down 45% from the previous first half. And the market is also still not impressed with the revised sales agreement with GE (but I think it's actually a very good thing in the long run) -- that's going to have a $13-16m impact in the next half.

When I stand back, i see a market leader with a lot of runway, a very attractive "razor & blade" revenue model with super high customer retention, new products on the way, a fortress balance sheet and (eventually) improved operating margins.

Yes, there's a lot of uncertainty with their new product roll outs. They could well flop. But the new areas build on their core skillset and have a lot of parallels with the trophon product.

Yes, the transition to a direct sales model is going to have a nasty one off hit, and perhaps they'll be less effective with direct sales. But they know have enough important reference sites and relationship (especially for consumables sales) that make me optimistic they'll be better off long term here.

Yes, the price multiple is still eye watering, but added growth investments are depressing this. They could step back massively on this expenditure and the multiple would correspondingly drop rapidly, but that'd be a mistake longer term in my opinion.

Nevertheless, while i understand the need for added costs, i also want to see this expenditure justified by accelerating sales. It's definitely one of the main things to watch.

So it's really just about valuation -- something i need to revisit -- and not quality to my mind.

Full results presentation is here

As NAN approaches its half year results on 22 February, I was researching reasons to top up or not pre-result.

I jumped on shortman and discovered almost 10% of shares are shorted, and that had increased since NAN flagged its revenue hit due to change of business model.

NAN has pre-warned the market that half year results will be impacted (more details in other straws!) and assuming "Mr Market" knows best, then based on the volume traded around the 08 February and the change in price, that has been factored into the share price (ie was $5.05, and is now $4.71).

Yet... shorts are up, implying the expectation that "Mr Market" will react again on results day (22 February) and drive the price lower, and stay lower once combined with other macro-market factors (inflation, threat of war, tech sell off, etc).

If I was to anchor to price:

- The March 2020 covid low was $4.61

- The most recent low was $4.50

I hold IRL and am looking to top up. I think the short-sightedness of Mr Market will occur, and NAN will dip again on report day. I will wait until pre-close on the 22 February or pre-open the 23 February.

Others have outlined the key details with Nanosonics' update on it's revised sales model with GE (ASX announcement here), but a few thoughts:

- The inventory unwind from GE will impact sales in the second half of FY22, somewhere in the order of $13-16m for FY22. With the company expecting H1 Revenue of $60m, this will be a material one-off hit.

- The required boost to Nanosonics direct sales operations will increase expenses by around $1m in H2 FY22

- The direct sales model will result in higher margins over time, and with North America accounting for 88% of the installed base (and 76% of revenue there is consumables), it should be a big positive over time (assuming Nanosonics can at least match GE's sales efficiency of trophon units)

The market is down 13% on the news, but I cant help think it's being a bit short sighted here

Nanosonics just released their plan for a revised sales model.

I have to go and write through what it means going forward but they also announced that NAN is expected to report revenue of $60.6m for H1 FY22 ( which is actually what I was looking for the first half - If you look at my earlier straw).

Good to know that there won't be any nasty surprises come H1 FY22 result

As preparation for the HY22 result, Going back and writing down what I will be happy to see ( at a very high level - not accurate numbers) from Nanasonics so I have something to compare to on the result day before being biased and getting affected by Share price movements.

- Global install base should be around ~28300 ( ~775 units in each Q)

- Total revenue ~60m ( 40m consumables + 20m capital)

- Would like to see Trophon2 upgrades

- Would like to see AuditPro adoption within customers

- some level of revenue and customer case studies

- Would like to see Coris development and probably some sort of ETA ( confirmation of commercial launch in 2023 CY - no more delay)

- Increase in Cash balance + commentary around potential acquisition or efforts around it.

- The business performed well in Q1 FY22

- Management could have easily compared Q1FY22 with Q1FY21 ( and shown high % growth) but they chose to select Q3FY21 to make a fair comparison

- All directors provided background information about themselves made me even more comfortable with the quality of the management

- One of the top 10 US hospitals went live with "AuditPro" recently -- a Major tick in my box for the product and market fit validation

- Product development on track to release CORIS in CY23

- Margin in FY22 will reduce little because of the product mix change

Overall happy holder -- bottom drawer closed -- will open again in February when they report 1HFY22 ( it will be compared against weak 1HFY21)

Nanosonic Current Snapshot (August 2021) :

- Shares on issues : 305.2m

- Insider ownership : 19.6m

- Market cap = 2198m ( $7.20 a Share)

- EV = 2100m

- Revenue = 103m

- Profit before tax = 11m

- FCF = 5.9m

- Cash = 96m

Looking just at the above numbers, you would be crazy not to sell at the current price.

Risks and How i think about it

- Valuation

- Nanosonic investing in headcount for growth and R&D is reducing profit on paper

- Probably suggest the Quality of the company and market expect high growth

- Customer concentration ( GE Health)

- GE Health is a distributor - one would argue if customer doesn't buy from GE, and need the device, other distributors can supply

- Currently only a Single proven Product in market

- The second one was just released and the third one is in development

- Execution

- The management team can be trusted based on past records and alignment

Growth Opportunities

- Trophon2 upgrade cycle

- The large addressable market for Trophon2 in current geography

- Current market penetration ( NA: 39%, EMEA: 4%, APAC: 4%)

- Market expansion

- Japan

- Foundation is established

- China

- Company registered and appointed qualified local consultant

- Developing regulatory stratergy

- ASEAN

- Received regulatory approval for Malaysia, Indonesia, Thailand, and the Philippines

- Japan

- New Products

- AuditPro

- CORIS

- Intellectual Property

- In FY21, Nanosonic filed an additional seven new provisional patent applications

- Established dedicated IP function that manages its active program of IP development

- In FY20, established separate business development function to identify and assess potential strategic acquisitions and investments in infection prevention opportunities

- The current cash reserve is building and sits at $96m.

- It is safe to assume, 1 acquisition in the next 2 years to justify investment in a new business function

Looking at Risks and Growth opportunities, I am more than happy to keep my money to Quality Company and Proven as well as Aligned management to execute the strategy they have put in front of us.

On the conference call the management were questioned about what to expect for FY 2022. The analyst suggested "Approx doubling of exit rate in 21 wouldn’t be a bad start for 22"

And management agreed, though it wasn't clear if they were talking about revenue or profit or both.

Either way, that would imply revenue growth of about 16%.

Not in rhyme this time,

but thought you might want to know,

though earnings call tidbits can be tastey,

or they may just be for show.

As per today’s presentation here (slides 41-46).

What stood out to me most, was all the detail (i.e. greater than zero) around future products. Someone in marketing has finally gotten their way is my guess! It was marketing style detail, but it was detail!

The constant vague and ethereal promises of another product or product line has long been a complaint against NAN. Additionally, the recent release of AuditPro, whilst seemingly a value-add, just wasn’t want long term holders wanted! (Well, I wanted more!!) To use Peter Lynch’s classifications; NAN in my opinion was trending as a stalwart, and not a fast grower, but with this new detail, I must reconsider this view.

Assessment: I am excited to see this level of detail regarding their future potential products lines, starting with Coris. NAN has been a long-term winner for me IRL, and this new detail provides lots of consideration for at the very least a HOLD at todays prices, and probably to a BUY should the opportunity arise with a pull back in price. I always seem to win the most when I hold and do nothing except top-up, and I think I’ll keep to that plan for NAN at least for the next three years.

Wow, what a jump for Nanosonics today.

Not bad for a business that just reported 3% revenue growth and a 15% drop in net profit!

(ASX results here)

As usual, there's a lot going on under the hood.

For starters, FX movements were not favourable. In constant currency terms, sales were actually 12% higher. And this was a tale of two halves, with second half sales 50% improved on the first, and an all time record result.

The installed base was 13% improved over the year, and consumable revenue was up 20% in constant currency.

We have seen the launch of their new audit product, and they're getting closer to releasing a platform for strerilising flexible endoscopes -- hopefully by calendar 2023. There's been a lot of investment here, but the market opportunity does seem compelling.

The drop in profit was due to an increase in R&D and sales resources. That being said, Nanosonics still threw off $6m in free cash flow and increased it's cash balance to a very formidable $96m (with zero debt)

With growth across all regions, lots of reliable recurring consumable revenue, new revenue opprtunities and a fortress balance sheet -- there's just so much to like about Nanosonics. Having first bought at 92c in 2014, it's served me very well (although, once again, would have been better if i didnt sell a few down along the way..)

The question again is one of price. On today's numbers, shares are on a PE of over 240x! Or a P/S of 17.

Then again, there's a lot of growth to be had if the company executes well. Having revised up the estimated addressable market, NAN reckons it has only 39% penetration in the US, but only 4% each in Europe and Asia (19% globally). And that's just for the trophon product.

Shares are very expensive, but bear in mind the company could easily, if it chose to, boost EPS up 3-4 times this year if they cut back on headcount and R&D and just focsued on the core. The underlying economics are very impressive, just masked by all the growth investment, and that could well prove to be money very well spent.

So i'm prepared to maintain my holding, even though i think a lot of growth is baked in. This is one for the bottom draw for me.

Nanasonics has released there FY2021 results, key highlights include:

- Revenue 103.1m - up 3% (or 12% in constant currency).

- Second half revenue 60m (up 60% in constant currency).

- Earnings before interest and tax 10.7m (down 7.8%)

- USA total addressable market revised from 40K to 60K Trophon units

- Consumable and service revenue of 42.7m (up 27% compared to first half)

- Cash & cash equivilence 96m

Although, the initial results read poorly (with only 3% revenue growth and EBIT down 7.8%). There, were some positives coming out of the report with the announcement of a new product platform - Nanasonics Coris which sounds like it is a decontamination device for disinfecting endoscopes.

This device would fit in line well with the Trophon product which disinfects ultrasound probes for early stage pregnancy.

My assumption is both products would have a similar "razor blade" model with recurring revenue for disenfectant consumables.

With PE over 200x it is difficult to give it a buy. I do own shares in my strawman & real portfolio but purchased around the $2.50, I would like to add more at a more reasonable multiple.

Nanosonics has been talking of new products for a while -- to date it's been a one product company -- but they have always kept the specifics close to their chest.

Today they revealed the first new product offering; a digital compliance management system called AuditPro.

Consisting of a handheld scanning device which links to a browser-based SaaS application, AuditPro allows clinics to keep track of what instruments have been used & disinfected, providing traceability and compliance data.

Initially it will be focused on ultrasound probes (Nanosonics' core area of focus), but is applicable across a broad range of devices.

It will generate subscription revenue, but pricing levels and the exact sales model were not disclosed. Presumably it will also be offered as a bundle with the Trophon unit.

The product will be launched at the US APIC conference today. Other new products are exected to be revealed over the course of FY22.

Hard to infer too much from this announcement -- details were very scant. Obviously the potential is attractive, but it's all about execution and whether or not they get a good ROI on their investment.

Hopefully will get more details soon.

Disc. Held.

ASX announcement here

While the pandemic probably helps Nanosonics longer term (increased awareness of infection control), it did knock the business around in the first quarter of FY21, sending revenue for the half down 11%.

In part, GE Healthcare (a major wholesaler) reduced purchases due to "impacts of covid on its inventory", which basically says lower sales through that channel. And that's due to a big drop in ultrasound proceedure volumes, with hospital resources -- particularly in US -- focused on the Covid-19 response.

Most of the damage was borne in the first quarter, though, with the company bouncing back strongly in the last few months of 2020.

The much stronger AUD also had an impact.

Geographically, it was North America that really floundered, with revenue dropping 38% in the first quarter, before largely recovering in the next. Interestingly, Europe & Middle East and Asia PAcific both saw growth over both quarters, with revenue in these regions up 50% and 8%, respectively, for the entire half. (though these segments represent only ~14% of total revenue.)

Despite the challenging half, Nanosonics continued to invest in its growth strategy, with operating expenses up 8% to $33m in H1. For the full year they are expected to come in around $75-$78m -- a ~20% increase on 2020.

Combined with the lower revenue, pre-tax profit was all but wiped out, coming in at just $0.2m vs $6.7m in the previous corresponding half.

Free cash flow also took a hit, down $2.4m compared to an inflow of $10m in the last first half, due appraently to timing effects of payments and receipts. Still, the company has a genuine fortress balance sheet -- almost $88m in cash with no real debt.

Part of the added costs were associated with R&D, something the company has invested over $50m in since 2017. It was up another 12% this year. That's fine, but we've been waiting for new products for a while now and it would be good to see some more progress here. There's a lot of intangible value to write down if they dont get a good return on all that money.

At any rate, it's good to see the impacts of covid appear to have been short-lived. Total revenue grew 48% in Q2 relative to Q1, and i-MED's 200+ unit upgrade will occur in the current half. GE has also resumed purchases. Revenue from consumables was up 29% in the same period, and in constant currency terms was a new company record.

Importantly, the Global installed base was up 12%, and 6% in the last 6m to just over 25,000 units. Q2 installs were up 38% on the first quarter.