Price History

Premium Content

Premium Content

Premium Content

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Discl: Held IRL 2.60%

Have been watching the NAN daily buy backs closely as its the first time that one of my holdings has initiated a buy back program and I wanted to better understand what impact it will have on the price etc. The position after this morning’s announcement and the chart is per below.

- It feels like NAN’s brokers have instructions to flog up to ~$300k per trading day buying up whatever is on offer, so long as it does not breach the max permitted buy price

- This has provided some support to the price amidst the volatility of the past 1-2 weeks, but this is a sugar hit that ends when the buyback ends, so the current shoring up of the share price really counts for not much in the long run

- I still can’t see how removing ~1.6% of the Shares on Issue is going to benefit shareholders from an increased EPS perspective.

Still feels like someone who has too much money and don’t know what to do with it standing on street corner with $1m and handing out $100 to whoever that walks by ... makes the donor feel good, improves the life of the receipient for the next few days, then everything goes back to normal thereafter ...

Is this it with buy backs??

Discl: Held IRL 2.43%

NAN held their FY2025 AGM today. Only 2 things of note from the materials:

FY26 Guidance Unchanged but 1HFY26 Margins May Take a Temporary Hit

Doesn’t look to be a biggie, but good to have it flagged upfront.

Share BuyBack Announced

NAN is probably the first company that I hold that has an On-Market Share Buy Back Program and so this will be a good opportunity to have a detailed look as to how the buy back will actually benefit shareholders.

- At $161m with $32m cash generated in FY2025, clear plans on CORIS commercialisation and probably no immediate plans to acquire anything given the focus on CORIS, the $20m for the buy back program, as an absolute amount, looks sensible

- A simple back-of-envelope impact on the shares on issue doesn’t feel like this will make too much of a dent to reducing the volume of shares on issue, reducing supply and hence increasing EPS.

I conceptually get how I should benefit, but as I do not receive any direct tangible payment from it, I do still struggle to fully internalise and appreciate the “benefit”.

Am thus, a bit lukewarm on the buy back other than the potential for it to support the share price if there is sustained selling pressure. It does feel like management is throwing money into “nothing”, but this is admittedly potentially a naive and ill-informed view ..

Appreciate if anyone has any views on buy backs and whether this is a good or meh thing ...

Discl: Held IRL

Nice to see Vanguard become a substantial holder of NAN. Coming off the back of Director Gerard buying in, this is another data point of increasing confidence in NAN.

- They look to have been building the position from 10 June 2025 to 19 Sep 2025

- Lots of the purchases were around ~$3.95 to ~$4.15

I intend to add to NAN in a correction, but closer to ~$3.50.

Discl: Held IRL

Always nice to see a Director buying into one of my companies. Had a look at Gerard’s history:

- Not much in the overall scheme of things, but given his position, background, access to information, timing of appointment as a new insider, looks like a person building conviction and doubling down, with his own coin.

- He has gone from zero to 0.01% of NAN in 9 months

It sure adds to my confidence in NAN!

Discl: Held IRL

SUMMARY

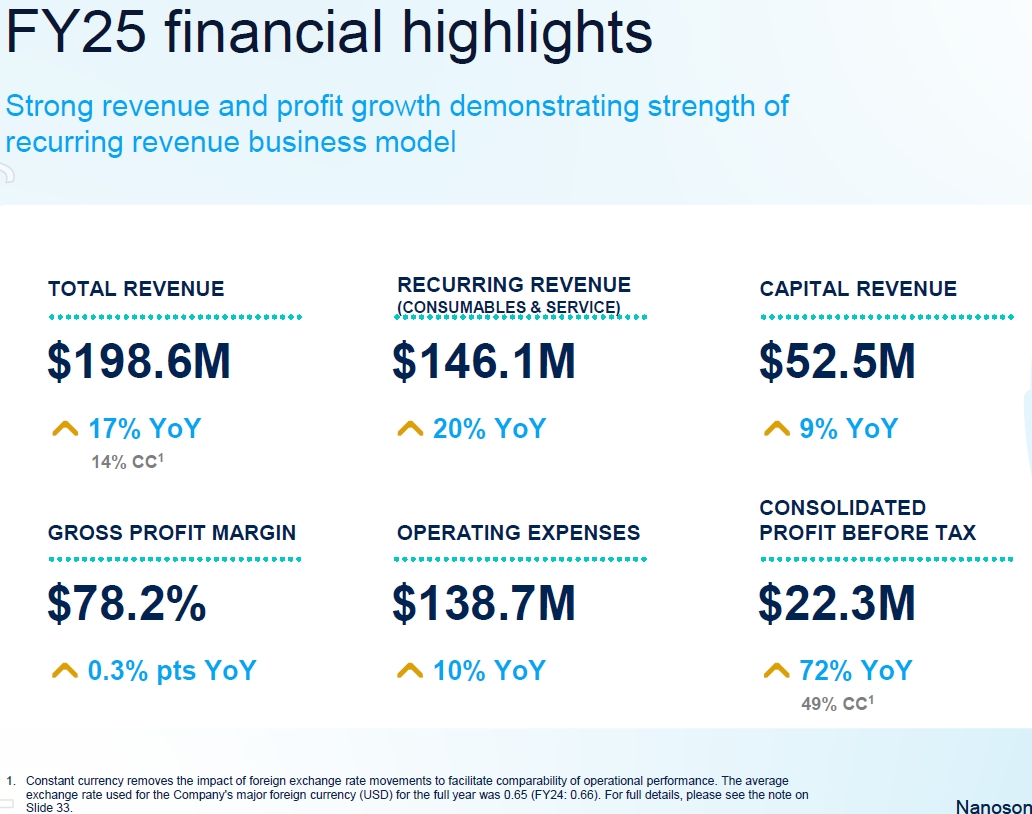

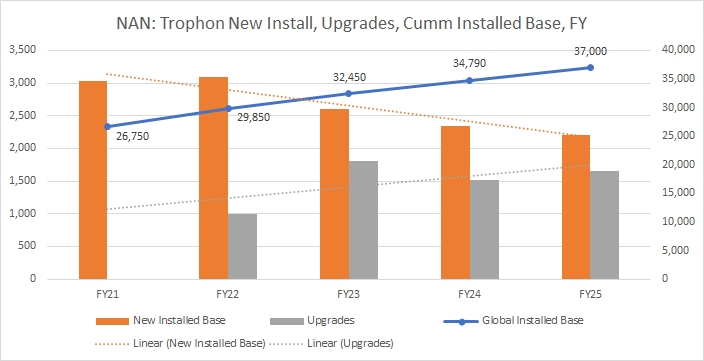

Solid 2HFY25 and FY25 result, meeting and exceeding guidance provided at the 1HFY25 results.

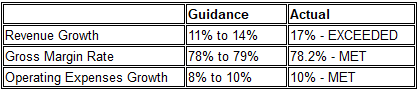

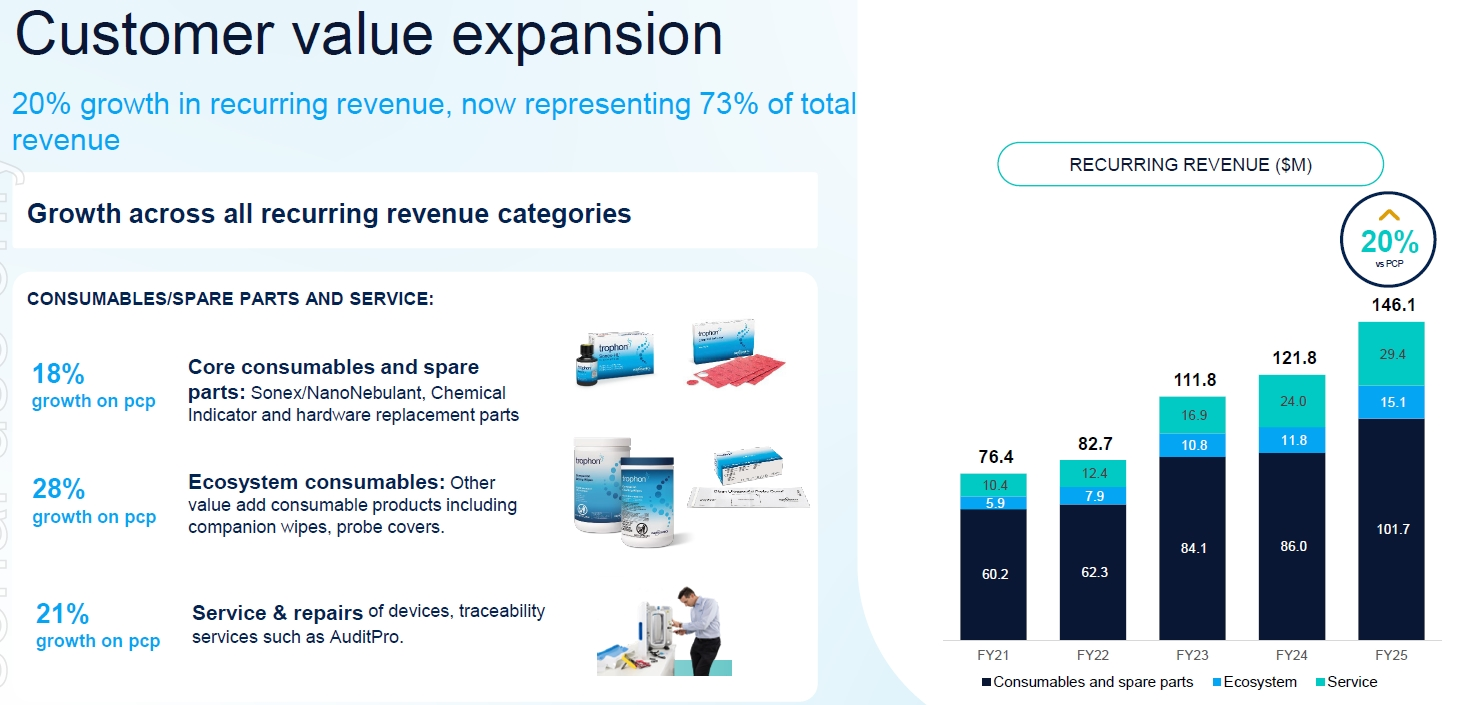

17% YoY Revenue increase was driven by 20% YoY increase in Consumables and Service Recurring revenue and 9% Capital Sales revenue - the regaining of revenue momentum in 1HFY25 was very much sustained in 2H, leading to the good overall FY25 result.

Operating leverage is now increasingly evident, especially in Consumables and Service recurring revenue.

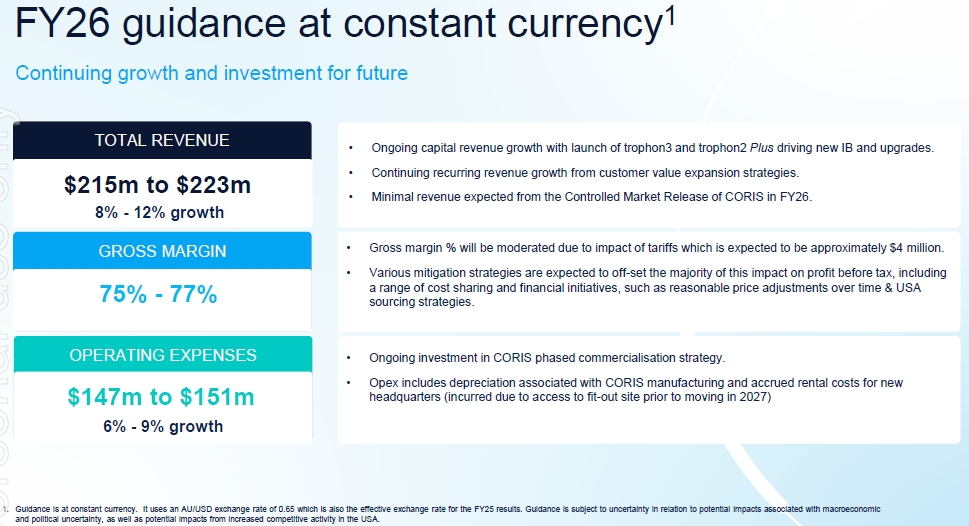

FY26 is guided to be “more of the same as FY25” - with upgrades to Trophon 3 being the focus in 1HFY26, followed by software upgrades to Trophon 2+ in 2HFY26, and the continuing of momentum from Trophon Consumables and Service recurring revenue.

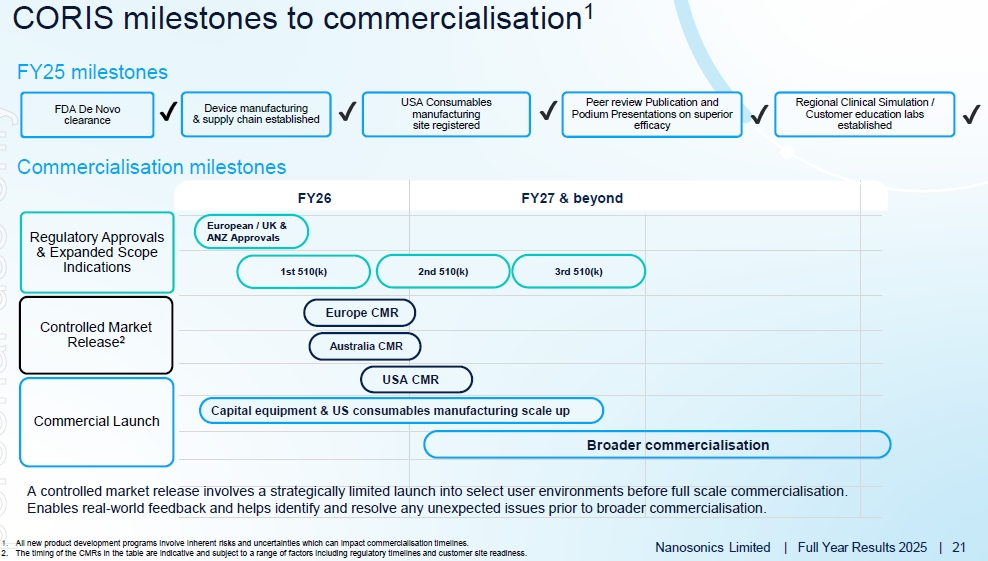

FY26 growth is with very minimal Coris contribution as NAN focuses on bring Coris to market, set up the operational supply chains, submitting 501k indication expansions to broaden the use of Coris to “all flexible end scopes” right throughout FY26.

The real kicker will come in FY27 where both Trophon and Coris should be firing all cylinders, creating a significant step up in NAN’s economics.

Key Risks to Watch Out For

- Trump and his bloody tariffs - the full impact of the tariffs, including the effectiveness of management mitigation actions, including the startup of the US manufacturing facility, will be experienced in FY26

- Issues with 501k Indication Expansion applications - nothing is approved, until it is approved

- Hiccups with the Controlled Market Release of Coris

- Slower than expected momentum in the uptake of Trophon 3 upgrades (in 1HFY26) and Trophon 2+ upgrades (in 2HFY26)

Have added my notes against the key preso slides from this morning’s call if anyone wants the detail. I really like the slide pack because, for me, it very clearly and logically tells the story of FY25 and has lots of insights as to how management expects FY26 to play out.

Overall

My bullishness in the longer-term outlook of NAN went up a notch today. I do not expect any significant movements in the NAN share price in FY26, if any, probably a sideways with an upside bias, and patience will absolutely be required for the full Coris commercial release to play out.

Action To Take

Accumulate on price weakness under ~$4.00 from hereon to position for FY2027.

Chart Review

The NAN price chart looks really nice - textbook retracement to about 60% since March 2024. This sets it up nicely for upwards price movements from here, with support coming from the 200 MA line and the medium-term uptrend line.

DETAILED NOTES

A solid 2HFY25 and FY25 result, meeting and exceeding guidance provided at the 1HFY25 results.

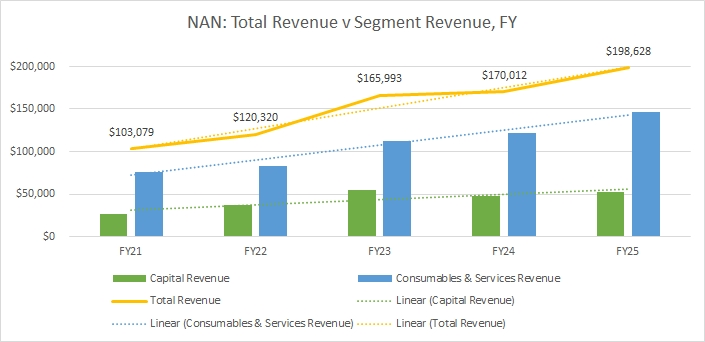

Installed base of 37,000 Trophon units is driving strong recurring revenue growth through customer value expansion - recurring revenue up 20% YoY - includes a small 3% price increase but is mostly volume-drive growth

FY25 delivered new installed base of 2,210 units & Upgrades of 1,660 units - driving capital revenue up 9% YoY to 52.5m

Growth in revenue and installed base was across all regions.

Trophon New Installed Base has been on the decline, Upgrades are increasing. Expecting to see both improve with Trophon 2+ and Trophon 3 in the next FY

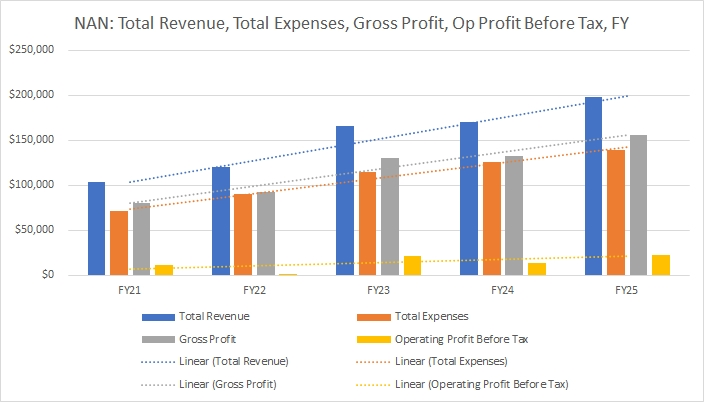

Operating leverage is showing with the increasing widening of the gap between revenue and expenses in the chart below

All components of recurring revenue are firing nicely - multiple drivers for Trophon which are highly profitable and generate good cash flow.

Core Consumables reflect the impact of a 3% pricing increase but growth was primarily volume driven.

Services revenue was up 21%, remains very promising - this was what got me excited as a 3rd recurring revenue stream when I last looked at NAN in June 2025 and topped up as a result.

Good all round operational achievements in FY25

Manufacturing facility established in Indianapolis, US for Coris and Trophon consumables

ERP implementation has completed

Cloud infrastructure established to support the integration to the DIFON platform for Trophon 2+ and Trophon 3

Really good to see ISO27001 cyber security re-certification achieved - this provides good confidence around NAN’s cyber security posture.

FINANCIALS

- Operating Expenses are falling as a percentage of revenue

- Admin expenses grew 19% but this included ERP investment which must be expensed in the year incurred - this ERP-related expense will not recur in FY26

- R&D expenses fell as a percentage of revenue by 2% to 17% - management has guided for “this trend to continue”

- Gross profit margin up 0.3% YoY to 78.2%

Tariff Impact

- Tariff impact was $0.5m, mitigated by high inventory levels already in the US

- FY26 tariff impact is expected to be circa $4m, expected to cause a drag on FY26 gross profit margin - guided to be between 75% to 77%

- Actions taken include sourcing from the US, price adjustments

Cash Position, M&A

- $32.0m cash generated in FY25, $161.6m cash balance, no debt

- Keeping a very open mind on M&A opportunities to put the available cash to best use, but acquisition must make sense

- Expect Coris to open the door to explore more M&A opportunities as the need will arise to build a Trophon-like ecosystem of consumables around Coris

- But focus in the coming year will be fully on bringing Coris to market

CORIS UPDATE

- Pursuing 510k scope indications to expand the use of Coris beyond initial De Novo approval for endoscope's to all flexible end scopes

- In parallel, pursuing regulatory approval in Europe and Australia

- Customers understand the need and the problems with the current cleaning methodology of cleaning and the resulting increase in adverse events from the risk of contamination - lots of ongoing education occurring

- Good slide which shows the multiple Coris revenue streams which other than the initial capital sale, are mostly recurring - very exciting

- Higher cleaning cycles per Coris machine (vs Trophon) are expected - lots of upside potential for recurring revenue to take off with Coris

- Did not announce the pricing for a Coris cleaning cycle - data point of $11 to $37 for CURRENT manual cleaning was given - hints point to something “around $10” ...

- EBIT margin for Coris consumables is likely to be “a little bit better than Trophon”

- Expecting the Coris model to be the same as Trophon - “more weighted to consumables”

New Manufacturing Facilities/Office in Macquarie Park

- Capex requirements to fit out new manufacturing facility/offices as lease for current premises runs out in 1QFY2026 and cannot be renewed

- Capex will straddle over FY26/FY27 for move in FY2027 - expected to be $10-$12m in total across FY26 and FY27, to be depreciated over 10 years

- Leasing costs will commence in April 2026 when access to the new premises is gained - expected to be circa $600-700k in FY26

FY26 GUIDANCE

- Revenue 8-12% growth, includes expected “reasonable” price adjustments

- Minimal Coris revenue baked into FY26, focus is to get Coris to the Controlled Market Release stage - will learn from this stage to better understand and quantify the FY27 impacts

- Not currently seeing major issues with hospital capital budget issues of 12M ago and not seeing any change in patient volumes going through hospitals - these observations is baked into the guidance

- Gross margin to fall from 78.2% to between 75% to 77% due to expected tariff impacts

- Minimal revenue from Coris which would only be in “Controlled Market Release” mode throughout FY2026 - this will set up FY2027 very, very nicely

- Continue to expect Opex to grow less than revenue

- Higher depreciation of around $2m was flagged for the fit out of the manufacturing facilities in the US

- R&D expenses as a % of revenue expected to fall in the ROM of 2% in FY26

- FY25 R&D cost was majority internal cost - bio scientists, clinical staff etc, not just engineering personnel

- Committed to ongoing internal innovation

- FY26 R&D will be focused on the broader Coris indications and Coris-related R&D

- Capex was guided to be circa $10m (FY25 was $9m) - 50% for the Facilities fit out, 50% will be the normal Capex run rate

Follow on from the 21 July 2025 announcement launching the 2 products, FDA approval has been received.

Follow on from the 21 July 2025 announcement launching the 2 products, FDA approval has been received.

The upgrade opportunities of 10,000 1st Gen to 3rd Gen and 20,000 2nd Gen to 2nd Gen Plus is not insignificant.

Will be keenly watching the impact of these next gen products on FY26 US Capital sales.

Discl: Held IRL

Digesting the 7 July 2025 NAN release.

My initial reaction to this announcement was that it was rather odd to offer a new v3 hardware device at the same time as a v2 software upgrade vs a full-on v3 release of hardware and software. But on reflection, it feels like NAN is learning from the challenges it has had in moving customers from Trophon v1 to Trophon v2. If I recall, there is still a decent installed base of Trophon 1 units that have not upgraded to v2 - cost considerations was cited as the main reason previously. This strategy allows for:

- New customers straight into Trophon 3

- Trophon 1 upgrades can bypass Trophon 2, straight to Trophon 3

- Trophon 2 upgraded customers can continue to sweat the v2 hardware for a bit longer, while accessing the new Trophon3 features via the software upgrade

This makes sense to provide different upgrade pathways to newer products to ALL customers and should boost capital sales and services revenue.

The downside though is that this will now likely encourage (1) the skipping of hardware upgrades, avoiding 1 version totally and (2) customers to stay longer on a given version via the software upgrade.

Will be interesting to understand how the revenue impact plays out in FY26 as these options become available to customers.

Discl: Held IRL

Summary of a short LiveWire article by Forager https://www.livewiremarkets.com/wires/nanosonics-from-darling-to-dud-and-back-again on NAN on 7 June 2025. Having lost interest in NAN in the past 1-2 years, this was a good recap of the NAN position and helped plug some gaps in my understanding of NAN. I am now having a closer look as the price trends below $4.00.

Discl: Held IRL

Trophon Services Contracts as a 2nd Recurring Revenue Base

- Since taking over sales from GE in 2019, NAN has been quietly building a 2nd high margin earnings stream with services contracts

- These services contracts are typically multi-year, paid upfront and recognised over time, creating a 2nd growing recurring revenue base and are now now latched on to roughly half of the Trophon units it sells

- Replacement of older Trophon 1 units with Trophon 2 opens up more opportunities to attach services contracts - ~10,000 Trophon 1 units are now more than 7 years old

- While not overtaking capital or consumables, services revenue should grow faster than the other revenue streams and represents more high-quality, annuity-like revenue

I really like must-have recurring revenue, so this highlight on the growth of Services Contracts is really attractive and was something I was not paying much attention to.

Coris Challenges are Now In The Past

While I understood the Coris drag on earnings, this graph very clearly shows how much of a drag it was and really puts that issue in good perspective.

- But these issues are now in the past and from FY26, Coris will start to contribute, so we will have the combination of the losses reducing rapidly and revenue rising progressively

- Potential to generate even more consumables revenue than Trophon - 60m endoscopic procedures performed annually worldwide - addressable market for Coris is substantial

- Coris is more complex than Trophon and requires plumbing, which means longer sales cycles and more hospital involvement, but it should offer more revenue per unit once installed

Chart

The price pullback from the recent highs of $5.09 on 21 Mar 2025 towards ~$4.00 is entering the 50% retracement zone - usually a nice price to start looking at topping up for me.

Notes following a closer look at NAN's 1HFY25 results.

Discl: Held IRL

OVERALL

The 1HFY2025 was a very good robust result YoY, but the HoH view, particularly the fall in the number of installed units from 2HFY24, tempered that enthusiasm back a bit. A re-rating was to be expected with this good result, but the huge ~37% rise of the share price was surprising, but most welcomed.

Thesis of (1) moat around Trophon being the standard of ultrasound disinfecting (2) capital sales driving strong recurring consumable revenue, is now back on track., after a challenging period of GE transition, then stagnant capital sales.

FINANCIALS

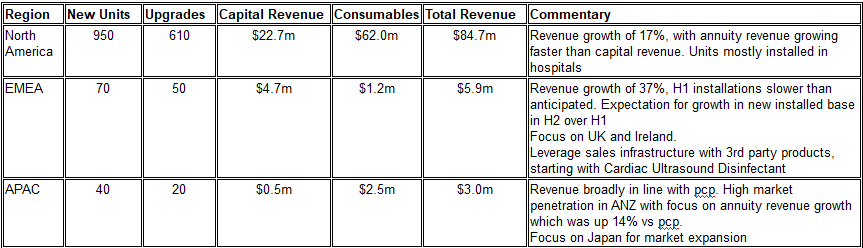

1,730 Trophon units installed in 1HFY25 - 1,050 New, 680 upgrade - some 10,000 Release 1 units still in operations today - upgrades drive new service contracts and service revenue

The YoY improvement was significant:

- Gross Profit up 15.8% , Expenses increasing by only 9.7%, NPAT increased by 58.2%

- This was driven by both Capital Revenue up 11.3% and Consumables/Services Revenue up 19.8%, from a 4.5% decrease in new Trophon units of 1,050 and a 9.7% increase in upgrade units of 680

The HoH view was very good, but less so:

- Gross Profit up 6.4%, Expenses up 3.0%, 43.4% increase in NPAT

- Capital revenue fell 7.3%, offset by Consumables/Services Revenue increasing 8.0%, from a HoH 15.3% fall in New Trophon units and a 23.6% fall in Upgrade units

- The 8.0% increase in Consumables/Services revenue was very encouraging

- The blip however, was in the reduced volume of New (down 190 units to 1,050) and Upgrade (down 210 units to 680) units which resulted in Capital Revenue falling 7.3% - would have liked to have seen both numbers sustain from FY24 to have full confidence that the capital sales recovery is not only under way, but also sustainable

Return to gross profit margin to 78.5% (76.3% in 2HFY24) was pleasing, reflecting a successful inventory management program, return to normal production volumes in H1, and the product sales mix

Operating expenses remain well under disciplined control - a 9.7% increase from 1HFY24, but only a 3.0% increase from 2HFY24 - this was impressive as it includes investment in the new ERP system which commenced in FY24 and further investment into Coris R&D and pre-commercialisation costs

Very healthy cash position:

- Cash flow of $13.8m for the period

- Cash and cash equivalent grew to $144.5m at 31 Dec 2024, with zero debt

REGIONAL PERFORMANCE

Continues to be heavily skewed towards North America

OPERATIONS

New manufacturing site for both Trophon and CORIS consumables being established in existing Indianapolis facility - completion and registration expected in 2H

Range of benefits expected to be delivered (1) margin improvements over time (2) sustainability benefits from reduced transportation (3) reduced exposure to the introduction of any potential tariffs on goods imported into the US

CORIS

Proceeding through the FDA’s de-novo review process with answers to the FDA questions received to date having been submitted

Continued preparations for supply chain and manufacturing readiness - targeting the commencement of the first stage of commercialisation in Q1 FY26, subject to the requisite regulatory approvals

Assuming a successful FDA de novo clearance of the CORIS system, marketing of the device will commence in the US. In parallel, it is expected that the first 510K for expanded scope indications will be submitted shortly thereafter

Outside of the US, the first commercial launch will likely take place in Europe in Q1 FY26 which is not contingent on the FDA de novo clearance

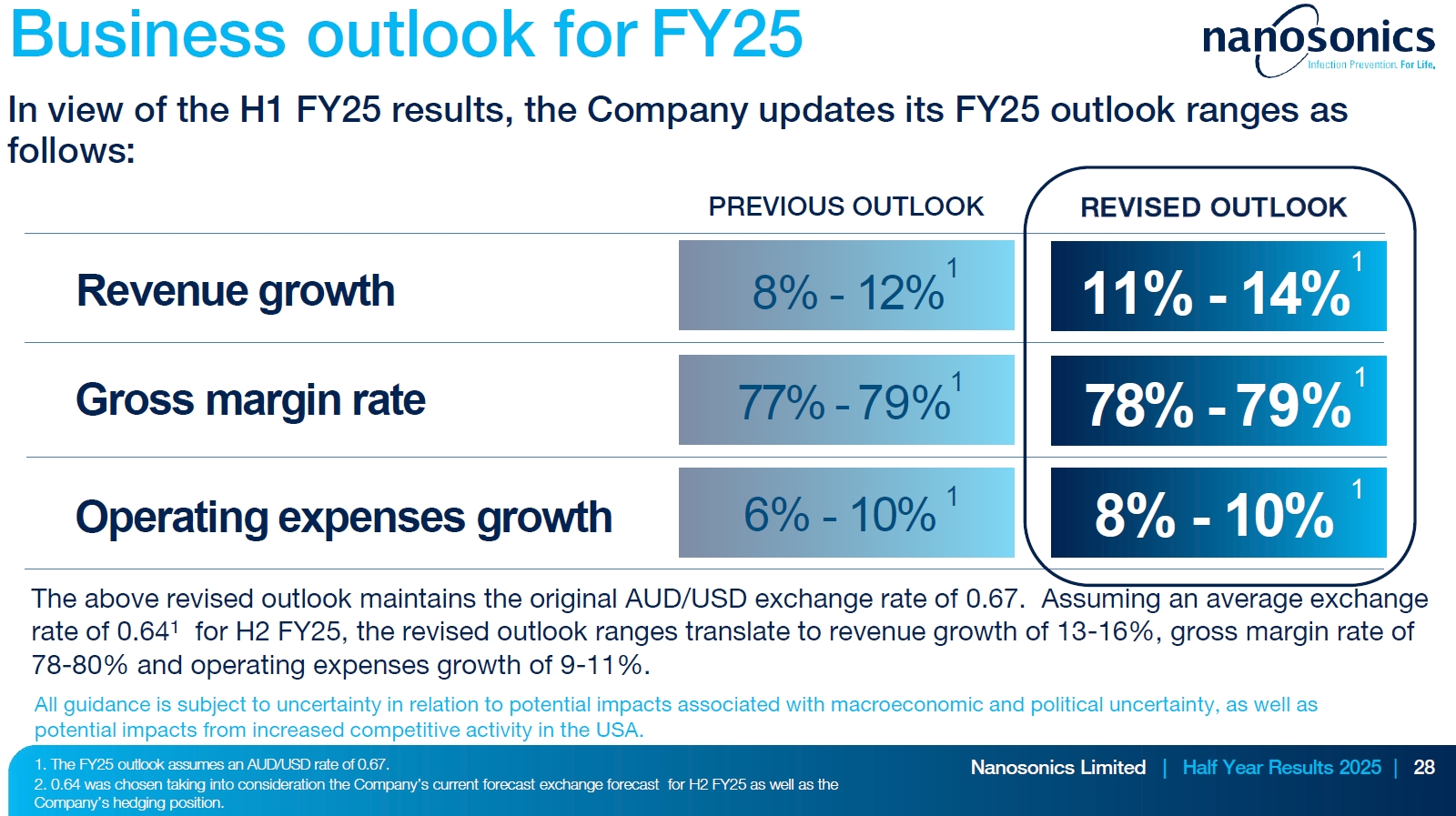

REVISED FY25 OUTLOOK

Will absolutely take this!

Headlines looked good at first glance, but capital sales/revenue feels flattish H on H if there was only a 11% increase in capital revenue vs 1HFY24, which was not a good half at all. Was wanting to see more follow-through capital sales momentum this half and suspect I might be a tad disappointed.

Market appears to have expected, and is OK with this, given the ~30% rerating since the mid-Dec 2024 low of $2.88 and the rather muted price movement today. I'll take that!

Discl: Held IRL

- Revenue growth driven by 20% growth pcp in consumables and service annuity revenue streams

- Total number of Trophon units sold in 1HFY25 was broadly in line with internal forecasts and was similar to the total number in the pcp, with overall capital revenue up 11% compared to pcp

- PBT result includes $1.3m unrealised forex gain

- Expects to achieve revenue, gross margin and operating expenses in FY25 at the top end of previous FY25 guidance

As part of reviewing the position with NAN, I learnt more about the US FDA De Novo submission, which is the submission category NAN has done for Coris. Thought it might be helpful, not only for NAN, but for other medical device companies.

An FDA De Novo submission is an application submitted to the FDA for creating a new device product classification, of which Coris is.

The link below provides a 13 or so minute video and written explanation of what a De Novo submission is and how long it takes to get one. This is from a company which helps companies submit FDA approvals, Medical Device Academy.

The stats below was interesting in terms of number of De Novo approvals granted per calendar year and the average submission duration in calendar days. The "150 day %" refers to "FDA days" which is calendar days minus the days the submission was placed on hold - that is the FDA's KPI for funding request to Congress.

In summary, based on actual history, my expectations for Coris FDA approval is a minimum 12-18M away, closer to 18M, at the absolute fastest, so Coris earnings will realistically only kick in deep into FY26, possibly FY27 if there are delays.

Discl: Held IRL, not in SM

Finally got round to taking stock of my NAN position.

The TLDR view is (1) softness to continue (2) stay invested (3) stuck in trading range with no clear immediate catalyst to re-rate (4) too early to top up!

SUMMARY OF P&L

KEY TAKEAWAYS

- Capital sales and Trophon 2 upgrades have slowed and are taking longer to convert - tight budgets are seeing hospitals stretch out use of Trophon 1 devices vs upgrading

- 1HFY24 revenue has fallen 2% vs PCP and 2HFY23 - sharp drop in capital revenue of 15% on PCP, partially offset by increase in consumable sales, up 4% from PCP

- 1HFY24 gross margins was 79.7%, up about 1% from FY23, driven by revenue mix and positive forex impact

- Expenses have increased $5m in 2HFY23 from 1HFY23, increased by a further ~$1.2m in 1HFY24 vs 2HFY23 (up 12% on PCP, up 2% HoH), includes Coris expenses

- 1HFY24 PBT halved from 2HFY23 $10.2m down to $4.9m

- Global installed base up 1,100 units to 33,550, up 3% last 6M, up 8% last 12M

- Trophon 2 upgrades of 620 units, down 23% from PCP with customers extending use of their existing Trophon 1 devices due to budgetary constraints

- Coris De Novo submission to the FDA occurred in Q3FY24, slightly delayed

Positives

- Margins have been sustained

- Some 9,000+ Tophon 1 units are >7 years old, and are ripe for an upgrade - immediate focus, ~26% of current installed base

- FCF 1HFY24 was $7.9m, Cash & Cash equivalents at 31 Dec 2023 of $118.3m, no debt - no funding or cash generation concerns

- TAM to chase for both Trophon and Coris is still very large - Trophon installed base ~140,000 units vs 33,550 installed, only 24% market penetration thus far

- Coris will be the next growth driver

- Significant medical benefits of reprocessing technology and first mover advantage in Coris enables NAN to define the clinical standard in the endoscope reprocessing space which creates and strengthens the overall moat

- Coris FDA Approval is a De Novo submission - to create a device product classification

Main Short-Medium Term Concerns

- Soft market conditions in 1HFY24 are expected to continue in 2HFY24, leading to a very soft FY24 result

- Coris is still at least 12-18M away to compensate for this softness, investment in Coris commercialisation and R&D will increase operating expenses in the interim

- Favourable forex gains are baked into revised expectations eg. reduced growth in FY24 expenses

What Will Drive Prices Upwards

- Continued progress and positive news on Coris FDA submission - medium to long term

- Signs of increased momentum in the growth of Trophon 2 upgrades in the US and the overall Trophon installed base - at least 6-12M

- Actual implementation of country guidelines requiring high-level disinfection

- Growth in capital sales in EMEA and APAC - this has been patchy

- Stronger growth momentum in consumables revenue to compensate for slower capital sales - at least 6-12M

Action To Take

- Will continue to stay invested as (1) the technology benefit is a strong moat (2) the TAM is still a big one (3) the outlook will brighten in 12-18M time once current Trophon upgrade hurdles are overcome and Coris gets close to FDA approval

- No immediate clear catalyst for re-rating as 2HFY24 and FY24 is being guided to be soft

- Chart shows NAN stuck between a $2.44 - $2.74 long term support zone but with a strong resistance zone between $3.22 to $3.48 and the 200 SMA, limiting immediate term upside - this broadly aligns with the fundamental position of the business ahead of the FY24 results

- Will need a stellar FY24 result above guidance to create upward price momentum - no clear evidence to suggest this will occur

- Current 1.72% allocation is appropriate for the immediate to medium term outlook and does not warrant adding until at least the release of the FY24 results

Discl: Held IRL, not in SM

Pre-results confession, not a pretty sight unfortunately ...

Post a valuation or endorse another member's valuation.