Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

What is a short thesis? Any thoughts?

Nanosonics announced FDA De Novo Clearance. The journey has been so bloody long 18 years in making. screenshot from the 2007 prospectus ( how big was the machine back then :))

Does NAN consider that any measure of its statutory or underlying earnings for the full year ended 30 June 2024 as disclosed in the Results Announcements (‘Earnings Information’) differed materially from the market’s expectations?

please specify how NAN determined market expectations in relation to each relevant measure of its earnings

Does NAN consider that, at any point prior to the release of the Results Announcements, there was a variance between its expected earnings and its estimate of market expectations for the relevant reporting period of such a magnitude that a reasonable person would expect information about the variance to have a material effect on the price or value of NAN’s securities?

My thoughts on FY24 result:

Valuation for Nanosonics is difficult - you can easily prove it's expensive or cheap based on your different views.

https://www.growthgauge.com.au/p/nanosonics-asxnan-fy24-result

Full write up - https://www.growthgauge.com.au/p/nanosonics-asxnan-h2-fy24-updates

Summary:

Revenue in line with guidance and improving.

Install base better than 1H but still down compare to FY23

All my writing is here in various straws about Nanosonics. I have put together my current thinking here - Nothing new from what I have posted in strawman so far - this is just an amalgamation of all my straws and current thinking

https://growthgauge.substack.com/p/asxnan-nanosonicsbetting-on-innovation

Nanosonics provided a trading update for 1H24

- Revenue for 1H24 will reduce ~4% compared to PCP ( to $79.6m )

- Nanosonics revenue comprises 2 components (Capital sales and Consumables)

- Consumable would have increased by definition because of more installed base ( no figures provided)

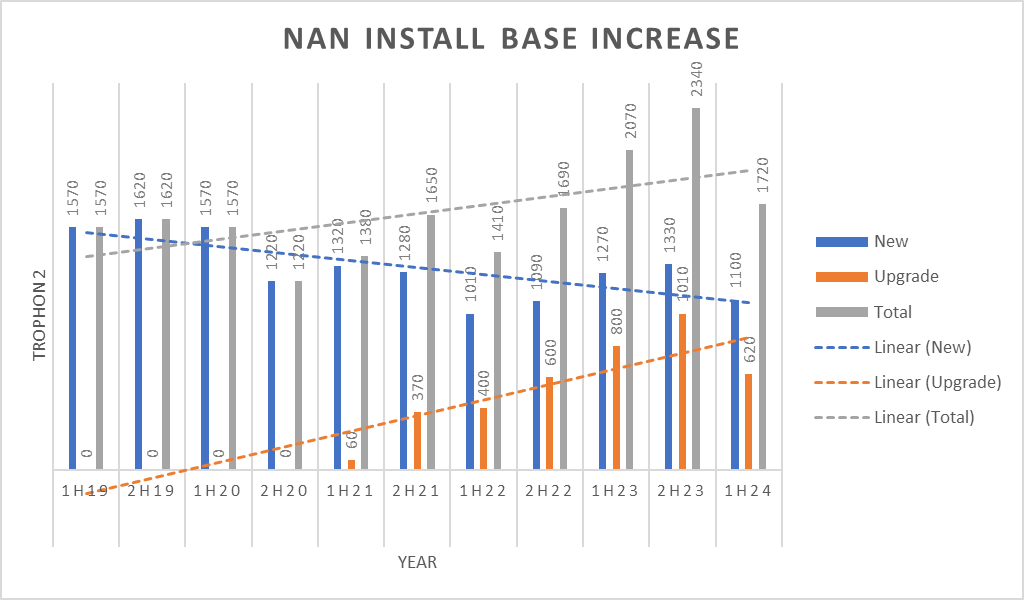

- In this half, Nanosonics only sold 1720 units ( 1100 new and 620 upgraded) compared to the 1H23 figure of 2070 (1270 new and 800 upgrades)

- Management is saying that the revenue miss is because of lower-than-expected capital sales ( I think management would have factored in around 2250 capital sales in this half i.e ~10% growth over pcp) so they are short of 530 units this half - reason given in the announcement is "Hospital capital budget pressure"

- The following chart shows historic capital sales for the last 5 years and trends.

Now the question for investors is, is this a structural issue, or Market penetration issue, or an economic cycle issue? More information will be provided in half year result at 26th feb.

One thing is for sure that I was wrong in expecting 25% growth this year - Market has slapped 35% of its market cap in a day and to be frank market is right in doing so - Nanosonics was ( and is) on high multiple and it can not afford to not grow and miss the guidance. So hopefully, I learn and grow from this experience ( like i did with EML and KME and others)

It seems that Nanosonics has started advertising Endoscope solutions in Australia/NZ and the UK/Ireland but not in the USA, Canada, France, and Germany ( based on their websites). Seems like an imminent launch is approaching near.

at the same time, short selling is increasing as well

I attended the Nanosonics AGM virtually - they have uploaded a recording to their website

https://www.nanosonics.com/investor-centre/investor-conference-calls

If you want to learn about their new Product CORIS and time poor - check from ~41min to ~56min

As Nanosonic is one of my big holdings, I keep an eye on all available public information.

My speculation is that Nanosonic will announce coris product along with 1st half 2024 report. All the signs are telling me that it is coming closer.

One of the mandatory compliance requirements for any electronic equipment is to complete FCC part 15 radio frequency test. which provides a CE mark here is the result of the test which has an issue date of 16th August 2023

https://apps.fcc.gov/eas/GetApplicationAttachment.html?calledFromFrame=Y&id=6739852

It was initially tested on 21-22nd March and then again on 31st July and 1st August ( Probably, something wasn't right in march but has been rectified and retested)

A few other indications in their FCC filing - a few things are permanent confidential and few things are short-term confidential i.e user manual, External photos until 13th Feb 2024. - which is around the time 1H result will be announced.

Nanosonic added more details about Trophon's business performance by excluding operating expenses related to the development and commercialization preparation of CORIS.

Why is this given now?

Nanosonic released FY23 results this morning.

Revenue:

Customer Receipts

Expense

Operating Cash

New Installed Base declined by 16%

Coris delayed (again)

Nanosonics products are now available via NHS Supply Chain

Latest updates from Morgans

https://www.morgans.com.au/Blog/2023/June/Nanosonics-Back-Into-Buying-Territory

I don't have access to full blog so not sure what has been written but it seems the target is raised to $5.49

NAN was constantly among the top 20 most shorted stocks last year. As of today, that short position is normalized with the historical level. It is just a reminder that shorter doesn't always get it right.

@Strawman has put together a nice summary of the result so I won't repeat anything here.

In any case, I was a little disappointed to be honest as I didn't get any new information that was not already disclosed prior to today.

I was hoping to get some information about AuditPro's progress - Nothing was mentioned in the call and no analyst asked as well and I didn't get a chance to ask questions for some reason.

Apart from Coris's picture in the presentation - nothing mentioned in the call was new information. No clear details about the process and timeline etc.

Regarding Valuation, I am still sticking with my assumption and calculation as per my valuation straw - even though, NAN will easily beat my FY23 forecast.

Nanosonics updated the market with its H1 FY23 performance and based on solid performance it upgraded the FY23 outlook.

and Revised FY23 Guidance

Based on this announcement, it is safe to say that the transition of the sales model to direct has been successful.

I will be keen to see the progress of the product portfolio expansion effort.

- AuditPro traction

- Coris update

But So far, all my assumptions are okay on the valuation front, so I will stick with it.

Solid update in AGM:

This was one of the thing missing for AuditPro adoption as per last few calls

- Higher USD

- Lower freight charges

Margin guidance given factored in very high freight charges. It can potentially surprise to upside for margins.

Interesting

An article from a decontamination specialist ( Published in the clinical services journal in May 2022 edition) - suggest that there is a trend toward wireless/compact probe near patients and that will require modification to existing devices. [ Nanosonic has developed a wireless Ultrasound Probe Holder for it)

Nanosonics did update the market prior to the result so there wasn't that much surprise - There were a few things that I didn't like and will need to monitor

- Management says that, there was roughly $13m impact on the 2H result because of sales model transition - If that's the case - should 20-25% revenue growth guidance for FY23 is bit low - is it a case of underpromising or should we read something into it?

- AuditPro was launched a year ago and has yet to contribute to revenue - is it too slow or normal? is it not a market fit? if that's the case, question can be raised about the process to select product/stream all the R&D $ they are spending - is it something to worry about?

- Coris launch will still take longer than I expected - (maybe I thought it was going to happen in FY23)

- From the outlook that they gave, I was expecting a margin increase because of the sales model transition but that's not the case - I wonder why?

However, there was quite a bit that I like as well. Nanasonic is no doubt a great quality company - and this report in no way changes that view. This is just an exercise to put all negative possibility that comes into mind so if any of them eventuate hopefully we can act a little faster than the rest.

Nanosonic updated the market about their Q4 performance, sales model transition progress, and FY22 unaudited result.

- Q4 performance

- At the end of Q4, the total install base had reached to 29850 (at the end of Q3 it was 28900) which means in Q4 they did 950 new units

- The expanded Direct team sold 91% of the newly installed base units

- Sales model transition progress

- Transition to revised sales model in NA substantially completed successfully with significant proportion of all consumables sales now going through direct channels

- All planned new headcount(15) associated with the expansion of direct operations now in place - total headcount 100 in North America

- Nanosonics and GE have extended the current Capital Reseller agreement for further 12 months from July 2022 ( not sure why? - probably GE hasn't completed its entire stock? or full transition hasn't been successful as announced? NAN and GE going conservative to resolve any teething issue or don't want to miss any opportunity?

- FY22 Results ( unaudited)

- At Q3 update they said total revenue for the year is anticipated to be in line with market consensus. ( which was ~116m)

- Today they said that they expect revenue of 120.3m

Nanosonic updated the market about their Q3 performance, sales model transition progress, and outlook.

- Q3 performance

- At the end of Q3, total install base has reached to 28900 ( at 1H it was 28160) which means in Q3 they did 740 new units

- They said the upgrade was also in line with Q2 ( which means it was better than FY2021)

- Sales model transition progress

- The majority of customer has been updated - customer data has been provided

- warehousing and logistics operation is set up for increased volumes

- New hires came from GE High-level Disinfection teams ( example below)

- Head of GE High-Level infection team

- GE Operation lead

- number of sales managers

- Outlook

- Total revenue for the year is anticipated to be in line with market consensus. ( what is market consensus?)

Lakehouse Capital February letter discusses the following about Nanosonics

Most of the things are documented by @Strawman so no point in me re-doing it here.

Few things to consider for poor cash flow

- They have made the following upfront investment ( on top of the R&D) for long-term benefit ( on the call, it was mentioned that in pass-through model nanosonic will get an extra US$2000 per trophon unit ( there were no mention of extra margin for consumable - I would think minimum 10% margin - even if you calculate 5% margin then it comes down to roughly ~ 3.5m)

- They have built up inventory ( 6m more than PCP) in preparation for the transition to the pass-through sales model

- Expanded warehouse capacity and established logistics facility/operation

- Established Sales and Clinical organization - increased sales & Clinical employees to 54 ( further 12 new roles being recruited)

One thing I was expecting was some sort of sales traction for AuditPro but it was mentioned that AuditPro integrates with Hospital's IT system and hence it requires a security clearance and currently going through ISO 27001 ( Security cert?) certification and expect it to contribute to revenue from FY23 onwards.

Nanosonics just released their plan for a revised sales model.

I have to go and write through what it means going forward but they also announced that NAN is expected to report revenue of $60.6m for H1 FY22 ( which is actually what I was looking for the first half - If you look at my earlier straw).

Good to know that there won't be any nasty surprises come H1 FY22 result

As preparation for the HY22 result, Going back and writing down what I will be happy to see ( at a very high level - not accurate numbers) from Nanasonics so I have something to compare to on the result day before being biased and getting affected by Share price movements.

- Global install base should be around ~28300 ( ~775 units in each Q)

- Total revenue ~60m ( 40m consumables + 20m capital)

- Would like to see Trophon2 upgrades

- Would like to see AuditPro adoption within customers

- some level of revenue and customer case studies

- Would like to see Coris development and probably some sort of ETA ( confirmation of commercial launch in 2023 CY - no more delay)

- Increase in Cash balance + commentary around potential acquisition or efforts around it.

- The business performed well in Q1 FY22

- Management could have easily compared Q1FY22 with Q1FY21 ( and shown high % growth) but they chose to select Q3FY21 to make a fair comparison

- All directors provided background information about themselves made me even more comfortable with the quality of the management

- One of the top 10 US hospitals went live with "AuditPro" recently -- a Major tick in my box for the product and market fit validation

- Product development on track to release CORIS in CY23

- Margin in FY22 will reduce little because of the product mix change

Overall happy holder -- bottom drawer closed -- will open again in February when they report 1HFY22 ( it will be compared against weak 1HFY21)

Nanosonic Current Snapshot (August 2021) :

- Shares on issues : 305.2m

- Insider ownership : 19.6m

- Market cap = 2198m ( $7.20 a Share)

- EV = 2100m

- Revenue = 103m

- Profit before tax = 11m

- FCF = 5.9m

- Cash = 96m

Looking just at the above numbers, you would be crazy not to sell at the current price.

Risks and How i think about it

- Valuation

- Nanosonic investing in headcount for growth and R&D is reducing profit on paper

- Probably suggest the Quality of the company and market expect high growth

- Customer concentration ( GE Health)

- GE Health is a distributor - one would argue if customer doesn't buy from GE, and need the device, other distributors can supply

- Currently only a Single proven Product in market

- The second one was just released and the third one is in development

- Execution

- The management team can be trusted based on past records and alignment

Growth Opportunities

- Trophon2 upgrade cycle

- The large addressable market for Trophon2 in current geography

- Current market penetration ( NA: 39%, EMEA: 4%, APAC: 4%)

- Market expansion

- Japan

- Foundation is established

- China

- Company registered and appointed qualified local consultant

- Developing regulatory stratergy

- ASEAN

- Received regulatory approval for Malaysia, Indonesia, Thailand, and the Philippines

- Japan

- New Products

- AuditPro

- CORIS

- Intellectual Property

- In FY21, Nanosonic filed an additional seven new provisional patent applications

- Established dedicated IP function that manages its active program of IP development

- In FY20, established separate business development function to identify and assess potential strategic acquisitions and investments in infection prevention opportunities

- The current cash reserve is building and sits at $96m.

- It is safe to assume, 1 acquisition in the next 2 years to justify investment in a new business function

Looking at Risks and Growth opportunities, I am more than happy to keep my money to Quality Company and Proven as well as Aligned management to execute the strategy they have put in front of us.

Post a valuation or endorse another member's valuation.