Some scattered thoughts from my first pass on DDR FY24 release this morning. It’s drinking from a fire hose time in the dying days of earnings season…

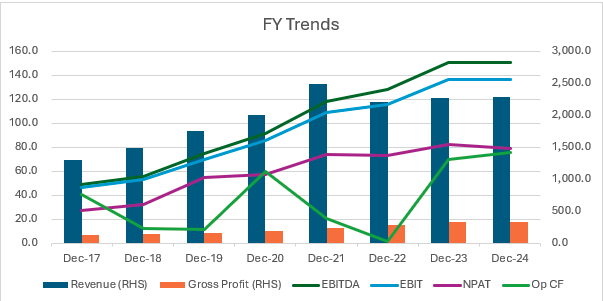

FY24 was flat and disappointing vs where they want to be but could have been worse as weak economy slowed sales to SMB & SME. A temporary pivot to (lower margin) Enterprise saved Revenue from declining but constrained margins.

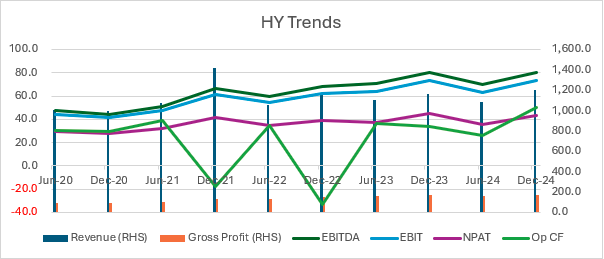

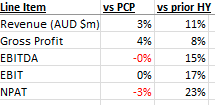

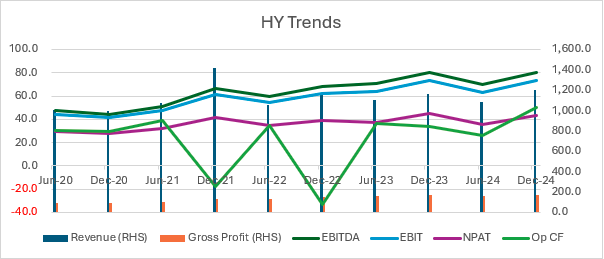

Better on a HY basis due to seasonality

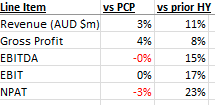

Here’s the numbers for the HY comparison showing stronger HY vs H1 24 per seasonal variation but pretty flat vs PCP (H2 23).

Outlook

Q1 24 was very weak, so will be easy to cycle comps in the current Quarter and probably even Half.

Interest costs are eating into bottom line margins and this will continue while interest rates remain stable, although this looks to be moderating (BBSY floating rate has fallen recently).

Economy is starting to improve, bad debts have risen but this should improve in FY25.

They expect FY25 to be a much better year, as do I and this is part of my thesis posted here previously.

Short story is that the PC Refresh is yet to hit full swing but that was always a FY25 story, mainly because of the Oct-25 Win 10 support sunset and the introduction of mid-level (affordable) AI PC’s.

AI picks and shovels

COO Vlad is a big AI bull – can see from the front row that AI will usher in more change in the next 5 years than the last 30 years in terms of innovation and how we do things.

They are internally using AI extensively to help educate customers on products and use cases.

This is also a part of my longer term thesis, that they become a picks and shovels play on the AI proliferation meaning AI becomes table stakes for businesses to stay competitive – especially for smaller businesses looking to keep up with better resourced larger competitors.

As a side note I’ve been anecdotally hearing that the biggest Gen AI use case today is Agentic AI being deployed in Enterprise to cut a lot of headcount. This makes intuitive sense to me - if you have 10 people in a team doing something that an AI Agent(s) can do, you can probably chop this whole department. But if you have 1 person doing this in a smaller business, Sandra can be hard to axe because she is probably covering holidays for other staff / the best barista in the office / friends with the CFO’s wife, etc and the cost of an AI Agent is probably not justified.

I know Westpac are going hard on this – trying to chip away at CBA’s tech supremacy I expect. There must be a lot of consultants pitching huge costs savings from deploying AI Agents in large enterprises. This should trickle down to medium and smaller competitors over time as they look to keep up. DDR will be waiting to help them when they do. This is largely speculation on my part but could provide some upside for DDR over the next couple of years.

Longer Term

DDR are still growing but they are bumping up against industry growth rates as their growing market dominance means they can’t take market share from others at the same rate as previously.

DDR have talked about geographic expansion in the past but are now looking more closely at opportunities in Singapore, etc.

Margins should hold up as they continue to be strong in higher margin SMB & SME. This makes sense as DDR being locally focused should give them an edge vs larger global competitors who are necessarily spread thinner but perhaps better placed to have global supplier agreements with local offices of global enterprise customers.

This should also insulate them from Microsoft efforts to go direct with Enterprise customers, etc.

I’ll add more as I digest this and other releases this and next week...