Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

The company responds to the ASX Aware letter about the disclosures related to DD's suspension. The company has confirmed he was indeed suspended.

Former Dicker Data CEO David Dicker claims he was forced out by ex-wife Fiona Brown in board battle

Billionaire David Dicker was turfed from his IT distribution business by ex-wife Fiona Brown and a board that he claims suspended him for “false” bullying allegations after he tried to implement an executive reshuffle designed to arrest declining growth.

Mr Dicker left Dicker Data in sudden and previously unreported circumstances in May, stepping down from his chairman and chief executive role after founding the company in 1978 and building it into a $1.8bn ASX success story.

He says the move happened after an emergency board meeting was called by Ms Brown and other Dicker Data directors in late April, immediately after which he says he was blocked from his company email account and had his corporate credit cards frozen.

Mr Dicker says this was due to bullying allegations against him relating to long-time Dicker Data chief operating officer and executive director Vlad Mitnovetski, and came three days after he, as then chairman and CEO, attempted to make executive changes.

Mr Dicker’s suspension was never announced to the ASX.

He denies bullying any Dicker Data executives or board members.

On May 16, Dicker Data said Mr Dicker was stepping down “to pursue other interests” and that Ms Brown - now the company’s biggest shareholder and also a member of The List - Australia’s Richest 250 - would become executive chair.

On September 3, Mr Dicker sold his remaining shareholding for $250m, ending a 47-year connection with the company that still bears his name.

“They didn’t want someone coming in every month saying, ‘look, we’re not doing well enough. We have to do better’,” Mr Dicker told The Australian.

“But the thing that really pisses me off is I had about 16 per cent of the company by then and they could have said, ‘we’ve had enough of you, we don’t like you and you’re out.’ They could have voted me [off the board], and I would have had to accept that. But they went for this other stuff instead,” meaning the bullying allegation.

Mr Dicker says the issues he had at the company stem back to early 2024, when at a January board meeting he raised concerns about the company’s relatively poor sales and profit performance.

“The bargain you make when you go to the public markets is growth in sales and profits. In a business like Dicker Data that means about 10 per cent each and every year. If you don’t do that, you will be punished,” Mr Dicker said.

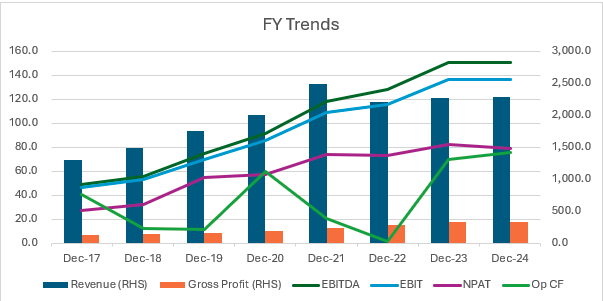

For 2024, Dicker Data posted a 2.9 per cent increase in annual revenue to $3.4bn and $150.4m in EBITDA, down 0.2 per cent. Revenue in 2023 of $3.3bn was a 5.6 per cent increase, and EBITDA of $150.7m represented a 16 per cent rise.

Dicker Data’s share price hit a record $15.46 in November 2021, but had slid for much of the next 18 months before picking up in the second half of 2023.

Mr Dicker says he raised concerns with his board constantly throughout 2024. “I expressed frustration at these meetings. It wasn’t very pleasant. Although at no time did I raise my voice or abuse anyone personally, or individually. My thoughts were always addressed to the entire board.”

David Dicker now spends much of his time in New Zealand, where he has his Rodin Cars business. Picture: Kurt Langer

By April this year, Dicker says he decided to make changes.

He says he emailed Ben Johnson, the company’s general manager for marketing and strategy, to make him sales and marketing manager, and moved Yasser Elgammal from his vendor, sales and customer facing roles into a position as Mr Mitnovetski’s operations assistant.

Dicker also alleged Mr Mitnovetski and Mr Elgammal had been running a property business together on the side. Property records show Mr Mitnovetski and Mr Elgammal have spent almost $11m buying properties together in Sydney’s Randwick in the past five years.

Ms Brown, Dicker Data and public relations representatives of the company did not respond to a list of questions sent by The Australian.

Mr Dicker says he has unsuccessfully tried to access the minutes of the late April board meeting he was locked out of. He claims he was never told on what grounds he was suspended. “I was completely cut off with no explanation or reason.”

Ms Brown rejoined the company in a management role for the first time in two decades - she maintained a non-executive director position for that entire time.

She helped Mr Dicker found the business in 1978, and was general manager for more than 25 years, running day-to-day operations through to 2004.

In hindsight, Mr Dicker says the maneuvering may go back to the deal he had with Ms Brown before they floated the company on the ASX in January 2011. A block agreement they struck allowed him to vote her shares, meaning he always had a majority say.

But what he calls a “technical infringement” - he sold some shares on the market and supposedly did not give Ms Brown the first right to buy them - allowed her to end the arrangement.

It was to prove costly to him this year.

Dicker founded Dicker Data in 1978 and listed it on the ASX in 2011. Picture: Sam Mooy

Dicker Data was formed in 1978 after Mr Dicker had dropped out of school and worked in refrigeration mechanics and at his father’s business building roof trusses, where Ms Brown had also been hired.

The pair later married and formed their computer business after he travelled to America and sourced a supply of new microcomputers from a now defunct company called Vector Graphic. They had an initial aim of selling 10 computers a month in Australia and even spent part of the 1980s trying to build their own personal computer business.

That did not work, but Dicker Data picked up business by selling and distributing technology hardware, software and later cloud products in Australia for big names such as Cisco, Citrix, Dell, Lenovo, and Microsoft.

Ms Brown left her full-time role at Dicker Data in 2004 when revenue was about $120m and net profit roughly $1m, and Mr Dicker claims she was opposed to the ASX float.

Growth was steady after the listing but the share price trebled in 2019 and doubled again by the end of 2021 as demand for computers and IT equipment surged.

As Dicker Data’s shares began to rise, so did the value of Ms Brown’s shareholding, which she maintained while Mr Dicker sold portions over the years.

In 2021, he sold a $42m parcel used to fund buying a second-hand Bombardier Global Express XRS private jet and in March 2024 offloaded a $200m stake to help fund his divorce from another ex-wife, Delwyn Dicker.

A further $67m sale this year was also attributed to that divorce, by which time he had 16 per cent of the company. Ms Brown holds 47 per cent.

Dicker Data’s annual revenue is more than $3.5bn. Picture: Monique Harmer

Mr Dicker says he and Ms Brown had at least been on speaking terms before the crucial April board meeting, though had not always seen eye-to-eye on company strategy and executive pay.

In an ASX statement released when it was revealed he was stepping down in May, Mr Dicker said in part: “As I embark on new ventures, I have full confidence that the leadership team that we put together some years ago will continue to drive the company forward with the same passion and dedication.”

In Ms Brown’s chair’s address to shareholders at the company’s annual meeting on May 21, she took “the opportunity … to thank my predecessor and co-founder, David Dicker, for his leadership and contribution”.

Ms Brown also noted Dicker Data had relatively strong year to date sales compared with a “soft” period a year earlier but that was expected to “moderate over the remainder of FY25”.

As for Mr Dicker himself, he chooses his words carefully when describing what the company will be without him. “Dicker Data is a very big company. It is not going to fall apart. But look, we should be pretty close to $5bn revenue now. They were talking about $3.6bn this year.”

When asked if he feels hurt about his departure, Mr Dicker says: “Well, obviously I was kind of pissed off at the time. But one of the advantages you get when you’re older is that it gets easier to deal with crap.”

He says he will now concentrate on his Rodin racing and high performance cars business in New Zealand, is trading shares on Wall Street where he says he made a $50m profit last year and plans some data centre investments.

He has no plans to speak to Ms Brown again.

“I’ll just carry on. As they say, the best revenge is living well. And I live well.”

DD seems to be winding down his association with the company he founded and led for a long time quickly.

He is no longer a substantial holder, and sold nearly $250m worth at $8.35 in a single block trade last week.

Taking a cue from the @mikebrisy playbook to write up expectations ahead of companies reporting. This seems like a nice device to prepare for updates ahead of time, set your own expectations and help support independent thinking in the face of management speak once results drop.

Here I’m checking in on DDR to see what competitors are saying in case this helps prep me for their AGM on Wednesday.

I’m thinking there may be an opportunity from the recent CEO exit and potentially softer sales numbers from companies not investing as much in IT due to uncertainty from AUS election and US Tariff uncertainty.

If these conspire to send the share price down far enough, could be a chance to pick up some more – as long as my LT thesis remains intact.

This could be a nice set up if the PC refresh cycle looks delayed again or at least off to a slow start. It can’t be delayed indefinitely and I think there could be good reasons why it may be slow to gather pace. Ditto AI PC Sales, and these could well be related.

I expect these potential impacts to hit SME & SMB segments hardest if at all. Lower margin Enterprise will likely not be as impacted, seeing IT (particularly AI focused) investment as less discretionary.

I put the last few quarterly transcripts for US competitors and counterparts (TD Sennex, Ingram Micro and CDW) through NotebookLM and asked it for trends and themes especially related to PC refresh and AI PC sales.

Unfortunately these companies are not as useful a comparison as usual due to US tariffs hitting their customers with some potential pull forward to beat the tariffs. I wouldn’t expect AUS to see this effect. Comps have been saying that the PC Refresh cycle looks to have kicked off now but they’re unsure how much of this is pulled forward to beat tariffs.

Anecdotally there has been a lot of pre-tariff purchases in the US so this could be a decent part of it. Also that they generally experienced better PC sales in Q1 than they are forecasting for Q2 and beyond.

IDC are saying the relatively strong Q1 in PC sales was likely due to pre-tariff purchasing too saying “The primary catalyst for the growth in personal computing devices was the heightened uncertainty around tariff negotiations between the USA and trading partners.” - https://my.idc.com/getdoc.jsp?containerId=prUS53355825

Still, this is a useful reference point. As a result I expect the DDR outlook to be relatively strong even if PC sales are not significantly on the rise here yet. If it is, the question will be how much are they seeing in Q1 numbers (assuming they provide some) and how does the market take this and mgmt. restructure alongside whatever else they release on Wednesday.

Ideally Q1 is weak, outlook is strong, market doesn’t buy this due to management restructure and poor communication around this (along with David’s recent share sales, etc). Let’s see…

Disc: Held

David Dicker has left the building...https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02947520-2A1596991&v=7bc42bd11d853ed5e8c28f2ffcd6a069ee5cd6b4

This is not a surprise as he has been edging out the door to spend more time on hobbies for a while now.

A few things about this announcement seem a little odd tho

Timing - Doesn't say when this is effective. I assume this is immediate and if so this seems sudden. He's not a young man so could be health related. Didn't give a reason except "to pursue other interests". Their AGM is next week, so not sure who will be there for it - I assume Fiona a new Chair will run it but David may Zoom in from Dubai like last time? Results haven't been great recently and 2025 was supposed to be a better year, maybe not?

Succession - seems obvious but no mention of who (if anyone will be the new CEO). Has to be Vlad, the current COO. Unless he says no for whatever reason, I can't think of anyone who could possibly be better. No mention of a process to find a CEO.

Shareholding - no commitment for escrow of David's 50% holding (including his effective control over Fiona's holding).

Will need to see what's said at the AGM which will be IRL only I believe so should be well attended and more interesting than usual...

https://fnarena.com/index.php/2025/03/27/refreshing-outlook-for-dicker-data/

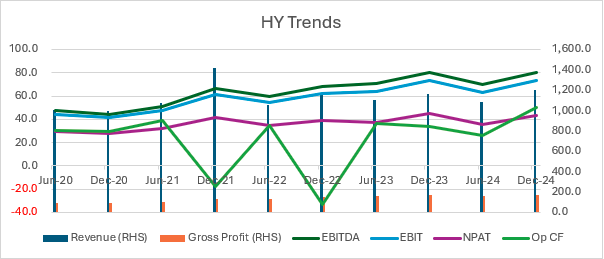

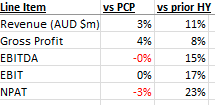

Some scattered thoughts from my first pass on DDR FY24 release this morning. It’s drinking from a fire hose time in the dying days of earnings season…

FY24 was flat and disappointing vs where they want to be but could have been worse as weak economy slowed sales to SMB & SME. A temporary pivot to (lower margin) Enterprise saved Revenue from declining but constrained margins.

Better on a HY basis due to seasonality

Here’s the numbers for the HY comparison showing stronger HY vs H1 24 per seasonal variation but pretty flat vs PCP (H2 23).

Outlook

Q1 24 was very weak, so will be easy to cycle comps in the current Quarter and probably even Half.

Interest costs are eating into bottom line margins and this will continue while interest rates remain stable, although this looks to be moderating (BBSY floating rate has fallen recently).

Economy is starting to improve, bad debts have risen but this should improve in FY25.

They expect FY25 to be a much better year, as do I and this is part of my thesis posted here previously.

Short story is that the PC Refresh is yet to hit full swing but that was always a FY25 story, mainly because of the Oct-25 Win 10 support sunset and the introduction of mid-level (affordable) AI PC’s.

AI picks and shovels

COO Vlad is a big AI bull – can see from the front row that AI will usher in more change in the next 5 years than the last 30 years in terms of innovation and how we do things.

They are internally using AI extensively to help educate customers on products and use cases.

This is also a part of my longer term thesis, that they become a picks and shovels play on the AI proliferation meaning AI becomes table stakes for businesses to stay competitive – especially for smaller businesses looking to keep up with better resourced larger competitors.

As a side note I’ve been anecdotally hearing that the biggest Gen AI use case today is Agentic AI being deployed in Enterprise to cut a lot of headcount. This makes intuitive sense to me - if you have 10 people in a team doing something that an AI Agent(s) can do, you can probably chop this whole department. But if you have 1 person doing this in a smaller business, Sandra can be hard to axe because she is probably covering holidays for other staff / the best barista in the office / friends with the CFO’s wife, etc and the cost of an AI Agent is probably not justified.

I know Westpac are going hard on this – trying to chip away at CBA’s tech supremacy I expect. There must be a lot of consultants pitching huge costs savings from deploying AI Agents in large enterprises. This should trickle down to medium and smaller competitors over time as they look to keep up. DDR will be waiting to help them when they do. This is largely speculation on my part but could provide some upside for DDR over the next couple of years.

Longer Term

DDR are still growing but they are bumping up against industry growth rates as their growing market dominance means they can’t take market share from others at the same rate as previously.

DDR have talked about geographic expansion in the past but are now looking more closely at opportunities in Singapore, etc.

Margins should hold up as they continue to be strong in higher margin SMB & SME. This makes sense as DDR being locally focused should give them an edge vs larger global competitors who are necessarily spread thinner but perhaps better placed to have global supplier agreements with local offices of global enterprise customers.

This should also insulate them from Microsoft efforts to go direct with Enterprise customers, etc.

I’ll add more as I digest this and other releases this and next week...

This is a subset of my full DDR Thesis which is here https://strawman.com/reports/DDR/Slomo?view-straw=27568.

The cornerstone of that thesis is that DDR is a high quality (but low margin) compounder that dominates a competitive, cyclical industry so volatility in their financials and share price may throw up opportunities from time to time.

This is the PC Refresh part of the Thesis which looks at the structural (AI PC’s), cyclical (Refresh cycle, Windows support) and seasonal (Q3 weak, Q4 strong?) factors that may be presenting an opportunity at current price / Mkt Cap.

PC Sales Background

PC Sales made up 19% of Revenue for DDR in FY23.

This is down from ‘normal times’ in FY19 when it was 25%. It grew to 27% and 28% in the covid years of FY20 and FY21 before flattening to 23% in FY23 and then 19% most recently.

Covid saw a big bring forward of demand due to a combination of factors including WFH and free money. In those years FY20 and FY21 PC Sales Revenue jumped 25% and 26% respectively. FY22 and FY23 normalised to a 5% increase and then a 13% decrease.

Given the size of this segment, recent PC sales falling has had a negative impact on revenues and profits.

There is now an expectation of a large increase in PC sales will occur due to – replacement of aged PC bought in the Covid years, Windows 10 support expiring in Oct-25 and the introduction of AI PC’s.

Questions

The big questions now are how big will this be and when will it occur?

DDR has been spruiking this Refresh cycle for a while and it makes good sense.

The last time they talked about this was 1H24 results in August.

I was expecting an update based on Q3 24 (Sep-24) in Oct but none was given.

Their competitors and comparables are mainly listed in the US so they report quarterly and might give us a better sense of where this Refresh cycle is up to.

If we assume the ANZ market is not far behind the US this might give some clues as to timing and potential size.

US Comps

I looked at Ingram Micro (INGM) and TD Synnex (SNX) on the NASDAQ as they are many multiples bigger than DDR (35x and 42x bigger by revenue respectively), have a similar business model and are the biggest DDR competitors in ANZ.

INGM’s last report for Q3 24 was on 13-Nov-24 and SNX reported Q4 24 on 10-Jan-25.

INGM and SNX are essentially singing the same song as DDR – that the PC Refresh cycle should be starting up by about now and should be big when it gets here, but it’s running late... should be here any quarter now…

Ingram Micro on 13-Nov-24: “PC refresh cycle starting to happen, although it may not be at the pace that industry analysts had predicted”

SYNNEX on 10-Jan-25: “TD SYNNEX observed a recovery in the PC market in Q3 and Q4, with high-single digit growth in the PC category.” And

“For the full fiscal year 2025, TD SYNNEX expects gross billings to grow in the mid-single-digit percentage year-over-year, partly due to the anticipated PC and server refresh cycle.”

This may be why DDR did not release a Q3 result – because there was nothing good to say on the hotly anticipated PC refresh cycle or more broadly?

Other forecasts

I also looked at the forecasts from IDC (https://www.idc.com/getdoc.jsp?containerId=prUS53061925) who claim to be “the premier global market intelligence, data, and events provider for the information technology, telecommunications, and consumer technology markets.”

On 8-Jan-25 they said “The PC Market Closed out 2024 with Slight Growth and Mixed Views on What 2025 Will Bring”

Further, that:

Looking ahead to 2025, the PC industry has several tailwinds and headwinds, which makes for a challenging outlook and difficult demand planning.

Enterprises continuing on the path of upgrading hardware before the end of support for Windows 10 which is scheduled for October 2025.

The impact that on-device AI will have on the industry will be positive, even if the inflection point is delayed.

On-device AI for PCs is inevitable, but suppliers trying to be patient as their customers are dealing with macro headwinds.

Conclusions

The PC Refresh is surely a thing and is due soon but as not started yet. This is likely for a few reasons.

Firstly the Windows 10 Support End Date is not until Oct-25, still plenty of time.

AI PC’s are in their infancy and more affordable mid tier models will be released through 2025.

End customers of DDR’s customers are still doing it tough with persistent inflation keeping interest rates higher for longer than expected – NZ is in a second recession, AUS is in a per capital recession.

AUS election cycle due to start (often capex decisions get delayed in times of policy uncertainty – this has been noted in the US market).

Things should be a lot clearer by mid-2025.

If I had to guess

The PC refresh cycle has only been delayed as it can’t be cancelled.

There may be a confluence of waiting for affordable mid range AI PC’s in mid 2025 and not needing to get onto Windows 11 (Win 12 is expected later in 2025) until mid 2025 or later.

Opportunity: This could see a long awaited surge in PC sales to corporates and a big bump in revenues in H2 25 if not sooner.

Risk: This also has the potential to cause inventory build up and write / mark downs if distributors over prepare for a cycle that is delayed and seeks different inventory (AI PC’s) than what they have in store.

The best distributors should be able to benefit by positioning appropriately for this now and as 2025 unfolds.

Next Steps

These findings are not what I had expected but are understandable.

So PC refresh part of the thesis is delayed at this stage, rather than broken.

I don’t expect a strong H2 24 for DDR but do expect better clarity on the outlook for FY25.

This may present a buying opportunity if the market is ST and marks DDR down on FY24 results as it’s been doing after recent stumbles.

I'll also be keeping an eye on the INGM Q4 24 result which is due mid-Feb, just before the DDR FY24 one.

Disc: Held

My DDR Thesis is as follows.

Very keen to hear from anyone with a different view / other insights!

It's a bit wordy / long winded as these are effectively notes to myself and it's a live document, so may be a little rough, hopefully it makes sense to others who know the business.

Summary

I see Dicker Data (DDR) as a high quality business with Short Term issues and limited downside.

For this reason I see significant potential upside from the current share price of ~$8.50 (Mkt Cap of $1.5bn).

I expect returns to come from improving fundamentals driving NPAT (and DPS) growth leading to an improvement in sentiment (multiple expansion) over the medium term (1-2 years).

Quality

The quality aspects include the longevity of a business that has been built over 4 decades by a founder CEO & Chair (intelligent fanatic) and run by empowered, aligned deputies – mainly Vlad, COO (14 years) and Mary (CFO).

Other indicators are niche market leadership in AUS, and gaining on this in NZ.

Sources of moat mainly scale, some network effects (more vendors are better for customers and vice versa) and probably cultural moat. All evidenced by sustained high ROE & ROIC (> WACC). The IP of LT vendor relationships, customer contacts, deep industry experience, etc also hard to replicate by others.

Niche market should keep bigger well resourced operators out (eg. Amazon is unlikely to enter).

Low NPAT Margins on the surface suggest low quality but they’re much higher than competitors (DDR 3%+ vs Competitors ~1%) and a significant barrier to entry so I see their margins as indicative of quality.

Market share growth - Vlad has mentioned that they take more market share in tougher economic conditions. I see this as a great indicator of business quality and long term, opportunistic thinking by management (as long as they are not overly sacrificing margins to do it).

Short Term Issues

PC refresh cycle low, business cyclical low w bad debt provision hitting NPAT and slower collections hitting Op CF, loss of vendors (mainly Autodesk), founder (forced) selling stock at higher prices hitting sentiment, weaker financials with flat FY revenue, first fall in FY DPS in 7 years and 21% fall in 1H NPAT (the worst HoH in >4 years).

Vendor loss. Losing Autodesk was significant – but that has now happened and they can’t lose them again (could lose others though). It was not a loss to a competitor, as Autodesk now going direct. Would be concerning if this becomes a trend – especially with big vendors. This concern partly offset with the addition of Adobe and being the only full suite reseller of Nvidia.

Mgmt - Concerns from David selling down shares to settle (another!) divorce, only zooming into the AGM (due to death threats!) and not showing up to the 1H 24 Call.

Potential reversal of fortunes?

Business cycle at a low? Interest rates stabilised from the fastest rise in history. Potential for cuts – other economies already cutting w RBA to follow in FY25 all else being equal.

For DDR internally this means financing costs should have stabilised and may even fall if they manage debt down over time, but I expect them to maintain some debt (for funding inventory).

Natural PC refresh cycle to be aided by Windows 10 support expiry, and AI optimised PC’s hitting the market. This should turn a recent headwind into a decent tailwind as 30% of sales are PC related.

I’m not expecting boom times, but also not expecting a deep or protracted recession (noting the per capita recession we’ve been in).

NZ market share and margins growing – to become a more meaningful contributor to NPAT growth – especially at the margin.

Investing for growth largely done via additional headcount and warehouse expansion with optionality for more space if required.

Growing contribution from higher margin software sales (although a concern that distributors could be cut out in time – see Autodesk).

NPAT and Dividends

The policy to pay out 100% of NPAT as dividends provides dividend yield support.

This provides a strong incentive to mgmt. to grow NPAT through direct incentives (STI) and their personal holdings – especially Exec Chair and CEO, David Dicker who remains a significant shareholder and does not draw a material salary so is reliant on dividends to fund his expensive lifestyle.

I asked about the dividend policy at the FY23 AGM and came away with the impression that this is rusted on – as long as David remains Chair / CEO / on the board.

So I expect that dividends are likely to grow over time in line with Mgmt being strongly incentivised to grow NPAT and pay out 100% of NPAT as Dividends.

Except for last year (-13%), DPS has compounded between 13-21% p.a. for the last 7 years.

Limited Downside

At $8.50 share price, the expected dividend of ~ $0.45 ($0.52 in FY22 and $0.45 in FY23) equates to a prospective Fully Franked Dividend Yield of 5.3%. Grossed up this 7.6% return is about 50% more than you can get in a Term Deposit.

The most recent Quarterly Dividend was $0.11 per share ($0.44 annualised).

I expect TD rates to fall and dividends to rise over time, so this gap should widen providing additional share price support.

Some Mgmt buying after recent price weakness from a result showing ST results were average but LT expected to improve. Management are eating their own cooking and running the business like the long term owner operators that they are.

Management

Trust is management is key for my thesis – partly because they are saying things about the future (bright) that are different from the past (dim).

David stepping down / sideways would likely cause investor concern but I expect this will happen sooner rather than later and I would be more worried about losing Vlad, or if David stepped back and Vlad was not promoted to CEO.

Other potential catalysts

ASX200 inclusion would attract passive flows but I don’t expect this any time soon. Sitting at the ~260th largest stock by market cap makes this seem possible with a 30% rise in the share price to $11 (all else remaining equal) but I expect liquidity / free float issues from NED Fiona Brown and others may stymie this.

The ASX 200 is “The 200 largest and most liquid stocks listed on the ASX by float-adjusted market capitalization“. Note that: “Stocks require a minimum Relative Liquidity of 50% for inclusion in the S&P/ASX 200” whereas this is only 30% for ASX300 inclusion which DDR is currently in. Source: https://www.spglobal.com/spdji/en/documents/methodologies/methodology-sp-asx-australian-indices.pdf

If the emerging AI opportunity sees DDR operate as a key ‘picks and shovels’ seller where AI is becoming table stakes for SME’s & SMB’s, there may be a material uptick in sales (may not be sustained though?). This may significantly boost sentiment / multiples. There’s been some buzz about the opportunity for JBH & Officeworks from selling AI capable hardware, so DDR will likely catch some of this at some point, especially as the pipeline comes into clearer view.

More broadly on AI – as this functionality gets embedded in most / all vendor offerings there may be a rush to buy / or shortened refresh cycle for the enhanced products (be they hardware, software or hardware capable of optimising AI enabled software).

NZ growth as a leading indicator for AUS cyclical recovery? It was noted by Vlad at the FY23 AGM that NZ’s downturn was more severe than AUS and NZ underperformed in 2023 as a result. This makes sense given NZ followed a steeper rate tightening cycle to AUS (as did most developed economies). If NZ’s current recovery (in 1H 24) is leading AUS as would make sense, a cyclical trough may be in or close by with a stabilisation / upswing over the next 12-24 months.

M&A into other verticals / geographies – NZ is working out nicely after M&A there. I see a risk that if DDR continue to approach ANZ market saturation this may be a handbrake on organic growth, so they may need to look elsewhere. It might then make sense to utilise their capabilities and relationships to extend their offering into new markets (generally lower risk) or new products / verticals (generally higher risk) via M&A. Not expecting this any time soon though.

Continued growth in NZ market share and margins sees more benefits of scale as DDR are able to negotiate ANZ wide deals with vendors (not just AUS & NZ siloed deals). This improved scale may also benefit inventory management across the region.

Risks

Increased willingness for vendors to go direct (like Autodesk). This may make sense if the vendor is big enough to deploy their own sales capability and if they want to get closer to their end customers. This is probably more likely at the competitive, lower margin enterprise end of the market.

Threats from AI – could an AI app or capability provide a procurement department in an app? Could this circumvent distributors via a seamless discovery / procurement consultant capability? Anything seems possible with AI these days but if this threat or similar did emerge, DDR is well placed to see it early.

Competition

DDR’s Competition mainly comes from 3 global players headquartered in the US.

Ingram Micro (CA), TD Synnex (CA) and Westcon (NY) have weighted average shares of the ANZ market of 21%, 14% & 7% respectively (42% total) versus DDR’s share of 34%.

These are much bigger players with lower margins: Ingram EV = US$2.7bn, NPAT 0.7% and TD Synnex EV = US$13.9bn, NPAT 1.1% versus DDR EV = US $1.2bn, NPAT 3.3% (Westcon is private).

So DDR is the only significant sized locally based supplier. DDR are the biggest in AUS (35% vs Ingram’s 17%) and 2nd biggest in NZ with 29% vs Ingram’s 36%.

DDR is improving margins and Market share in NZ following some acquisitions there and expect to become the biggest in NZ organically from here.

Vlad (COO) claims to grow market share faster in down markets so this may have helped NZ grow share recently.

Smaller players in each market may provide additional scale if M&A looks attractive – but unlikely worth doing for global players.

ACCC unlikely an issue as it’s a B2B market and still fragmented.

Sentiment

Dec strong, June weakness – The last 3 June HY’s have seen Revenue and NPAT falling from the prior 6 months, so the Dec half is seasonally stronger than June halves. This June’s seasonal dip may have contributed to recent poor sentiment - following cyclically lower revenue after interest rate (and rent) rises have squeezed DDR’s end customers. Also, higher interest costs, costs from reinvesting in capacity growth, the founder selling shares at higher prices – a lot of things may have contributed to the current trailing 19x (forecast 19x) PE Multiple being in the bottom 25% of the last 5 year range.

There were a lot of brokers on the 1H 24 call and all had predictably short term focused questions. I’m surprised how many brokers cover DDR but this may be a function of their ASX300 inclusion and potential for a cap raise for M&A or to fund WC expansion? Or sniffing a chance to skim a block trade from David’s next forced sale event?

I expect that the analyst community and market more generally are waiting to see the numbers actually improve (or at least firm guidance is given when pipeline is clearer), by which time the opportunity will have at least partly receded. It will have also been partly de-risked.

A more prudent approach may be to wait for the first (clear) sign that the numbers are sustainably improving and confirmation of why – expected PC sales uptick, business cycle pressures easing, etc. Then to buy into an improved fundamental situation in line with expectations in anticipation of improving sentiment.

Next 6-12 months - Actuals and Outlook

Next indication of this is likely to come close to 31st Oct when DDR typically release a Q3 update to market.

However Q3 is the weakest seasonally, so the outlook statement is likely most interesting, especially if they provide firm / narrow FY Guidance.

Q4 24 should be an absolute belter (H2 is the strongest half and Q3 is the weakest quarter, so Q4 must be the strongest quarter seasonally) – and it would be a big concern if it was not.

Next stop is FY24 reporting at end Feb, then AGM Preso in May-25. If these show significant growth in NPAT actuals and outlook, the share price could be materially higher in 6-12 short months.

If not, it may take longer or there could be some other hiccup / hit to sentiment. This is where the quality of the business and dividend support (being paid to wait) should minimise downside.

Valuation

From current price of $8.50, a 10% RRR could be earned if in 5 years NPAT Margin is 3.3% (3.3% in FY22, 3.6% in FY23), 5yr PE is 21x (80% of 5 year historical average), 5yr Revenue CAGR is 9.5% (last 5 year average).

I think the 5 year NPAT Margin and Multiple are likely conservative but Revenue CAGR may be harder to hit.

On balance I would expect a TSR CAGR > 10% from here, and significantly better than that if the above catalysts materialise over the next 1-2 years.

A note on Market Psychology

I feel like there are a number of features of this business that could be used to explain historical performance and outlook in either a positive or negative way depending on how you look at them / what type of investor you are.

These include the eccentric / unorthodox founder CEO, dominates a mature market niche (Saturation vs mkt leadership), low NPAT margins (competitive industry vs barrier to entry), distributor / picks and shovels (limited upside and downside), 100% payout ratio (capital discipline vs lack of reinvestment opportunities), exposed to the business cycle (volatility vs opportunity).

When DDR seems to be performing well these things can be viewed as contributing to past success and indicative of continued success.

But when performance has underwhelmed, these things can be seen as negatives and reasons to doubt future success.

If this is correct, DDR could make for a good long term investment at currently lower multiples as price volatility could be exaggerated by good or bad performance that are actually due to seasonal (H1 vs H2), cyclical (business cycle, PC refresh) and structural (AI, shift to software) factors – all of which look more positively than negatively positioned to me and explain why tepid recent performance is likely to give way to a better 12-24 months.

This is in line with management commentary which seems to be candid and transparent which I would expect based on their alignment and experience (LT owner operators).

Disc: Held

The investment thesis is well described here on SM (check out the company page and posts over the last year by some great StrawPeople).

Although maybe the SP hasn't bottomed out yet, I've bought my first position (1/3 or 2%) in RL this morning at a smidge over $8.60.

While I haven't done my own detailed valuation work, I am comfortable with valuations in the range anywhere from $9.50 to $12.00, as posted by both StrawPeople and analyst views, as well as looking at historical P/Es, current P/E, and a reasonable expection of >10% annual EPS growth for the next several years.

$DDR has been on my watchlist for a few years now, and I've been patient. What's made me take a bite now, in addition to the various cyclical tailwinds that others have written about, is also that we are now into the monetary easing cycle (which should be good for business investment, which will address some of the cyclical issues, like the ending of support for old platforms) or we likely will be in early 2025 in Australia.

In addition, the recent strong cloud computing / AI results in the current results for Google and Microsoft appear to bode well for higer value hardware and software offerings that $DDR will be distributing in the next 2-3 years.

Given that founder CEO discussions have featured significantly here over recent years, and that one day we will see succession from David for whatever reason, I have spent a bit of time examining the executive team below him. As others have written here, they are impressive and I think this is the kind of business that any good CEO can run.

Plenty of dry powder left to add more for this one, and I intend to accumulate a 6% RL position over time, but will be prepared to respond if the SP starts trending back up.

Disc. Held RL

Updated Valuation Sept 2024 based on 44c EPS and 8% growth rate for next 5 years (half of historical average) with PE of 22 (PE of 22 is in bottom quartile of its trailing 5 year history.)

Why do I own it?

# Mid cap and market leader which provides IT hardware and software from most major brands to predominantly commercial and government customers across Australia and NZ

# Has 10 years of 25% p.a. earnings growth

# Has approx.1/3 market share of their stated domestic market so there is still room to take some share. Have mentioned possible international expansion also. NZ market share is smaller but growing quickly.

# Founder led by David Dicker who is still Chair and CEO. Between he and his ex wife (amicable!) who is also on the Board they hold around 60% of the company.

# Unusual but successful approach of using debt to fuel growth and paying most of earnings out each year as dividends. David Dicker takes no salary - only dividends, so very aligned with other owners.

# Consistently high ROE / ROCE of over 30%

# Significant MOS at current price of $9.00 in September 2024 at only half the previous growth rate

# They can deliver double digit revenue and earnings growth for 5 + years so the return should exceed my 15% p.a. + target

# Assuming growth is maintained for another few years they will probably enter the ASX200 providing indexing tailwinds to the share price.

# Probably has structural tailwinds as Australia keeps growing and spending more on IT and in particular cyber and security products that have been a source of good growth in recent years. Also has tailwind of Microsoft 10 support ending in 2025, that should lead to customer upgrade needs.

What to watch

# High debt to equity - its an unusual approach but has worked historically - needs to be watched carefully though as do audits.

# Low net profit margin of 3.6% although it has steadily improved over the years. This is probably a moat though as given their large volume it will be tough for competitors to undercut them. Want to see it stay in the 2 to 3% + range. Risk if interest rates were to rise sharply and they couldn't increase prices to match.

# Key person risk around David Dicker - they do have a strong culture and strong bench under him so hopefully just a short term reaction if he does exit for some reason.

Dicker data released results yesterday for their first half, which you can see on the below link as well as listen to managements comments on the call and some better than usual Q & A afterwards.

https://openbriefing.com/OB/Dicker-Data-Limited/2024/8/30/Half-Year-2024-Results-Presentation/5564.aspx

Key takeaway for me was it was a very soft 1st quarter and then a much stronger 2nd quarter, so revenue came in flat for the half and profit came in 5% down vs 1H 2023 (mostly due to some higher costs and change in the margin mix of what was sold).

While that doesn't look great at first glance for a business that has been compounding sales at 15% p.a. for the last 5 years, it is what Vlad and Mary advised was likely to be the case at the AGM in May. So I give them a tick for reasonable guidance and also for them not giving specific ranges of guidance and just a general view. They also said they expected the 2nd half to be much stronger in May and they then reiterated that again yesterday.

Catalysts for stronger growth over the next 12 months are -

- Windows 10 support ending Oct 2025, so many businesses/government will need to upgrade equipment and software

- They are confident AI adoption is going to expand considerably over the next few years, so again many businesses/government will need to upgrade equipment and software

- They are getting nice market share growth in NZ, so can hopefully keep getting closer to the market leader there like they are in Australia

- Hopefully interest rates are at a peak, so financing larger orders will get a little cheaper moving forward

So, if most of that's the case and they can sustain growth for the next 5 years at only half the rate of the past 5 years, I expect to still get a return in the mid teens from the current share price of $9.10 in Aug 24. No change to valuation at this point.

Will be watching the 2nd half results closely to see how genuine the above expectations they are setting are.

I have update the Inside Ownership of Dicker Data, I left my previous straw showing Directors ownership from over 12 months ago, so you can compare!

Inside Ownership Ordinary Shares % DDR Issued Net Value at $8.96

David Dicker 38,032,417 21.09% $340.77m

Fiona Brown 55,777,110 30.93% $499.762m

Vladimir Mitnovetski 928,176 0.51% $8.316m

Mary Stocjcevski 339,335 0.19% $3.04m

Ian Welch 85,000 0.05% $761.6K

Leanne Ralph 3553 0.00% $31.8K

Kim Stewart-Smith 4941 0.00% $44.3K

Total 95,170,532 52.77% $852.728m

Vladimir brought some more shares as announced today. Please find below the summary of purchase below for last 6 months

Buying 6 Month Summary

Vladimir Mitnovetski

· 29 May 2024

Direct 20,000 shares average price $9.025 ($180,500)

· 21 May 2024

Direct 20,000 shares average price $9.025 ($180,500)

· 11 March 2024

Direct 5,000 shares average price $10.70 ($53,500)

Mary Stojcevski

· 21 May 2024

Indirect 12,000 shares average price $9.04 ($108,480)

· 6 March 2024

Indirect 9,334 shares average price $10.84 ($101,228.52)

Ian Welch

· 11 March 2024

Direct 7,000 shares average price $10.93 ($76,550)

Leanne Ralph

· 1 March 2024

Direct 46 shares average price $11.3920 ($524.032)

Selling

David Dicker

· 05 March 2024

Direct 8,651,041 shares average price $10.90 ($94,296,346.90)

Indirect 9,967,583 shares average price $10.90 ($108,646,655)

I attended the DDR AGM in Kurnell yesterday and wanted to share my takeaways while they’re fresh.

David Dicker, CEO was not there in person, zoomed in on video instead as he’d received a death threat if he turned up due to share price being down (a brave but anonymous warrior in Elon’s Twitter army I suspect). This was initially met with a few chuckles from the audience but seems it was legit, the police turned up but there were no scuffles, shots fired or arrests that I noticed.

David took the opportunity to emphasis that he had not wanted to sell any shares and only did so under the obligation of a highly unfavourable divorce judgement.

So timing was seemingly out of his hands too?

Presentation

This went for about an hour – led by David, followed by Exec Directors Mary the CFO and Vlad the COO.

Overarching theme was that business conditions are tough across ANZ at the moment, which doesn’t bode well for the remainder of 1H 24.

Vlad made the point that DDR has historically taken market share in up and downturns but this usually is faster in downturns.

They seem to think about the business like owners (because they are) so a little unorthodox in some of their presentation / thinking but mostly in a good way.

Moat seems to be largely cultural and defensible (operating efficiency is a big feature can't really be a moat as this can be copied by competitors).

CFO

Cycling difficult comps – specifically they were a big beneficiary of Covid IT demand in FY21, then impacted by supply chain issues in FY22. These resulted in a big pcp for Mar-23 Qtr when a lot of the high demand, then low supply from FY22 worked its way through, a lot of which got invoiced in Q1 23. This made Q1 24 Revenue hard to comp on a like for like basis.

My take is that they are confident that better times are coming but probably not in Q2, hopefully H2.

Dividend policy to pay out 100% of NPAT on a quarterly basis to fund the F1 ambitions of all shareholders will not be changing while David remains alive / a shareholder.

COO

NZ is seen as a big opportunity in terms of both market share (they are 2nd) and margin as they work through the acquisitions they made there.

They are looking to sign ANZ vendor and partnership agreements as opposed to being siloed to leverage the strength of the Aussie business to expand the NZ arm.

That said, the NZ economy is doing it tougher than here.

Digital is a larger piece, growing steadily, higher margin and expected to continue for the foreseeable.

Official business

The unorthodox Rem Report got a 2nd strike but the spill was easily defeated.

Given David's attitude towards it, I expect this to be a feature - lots of strikes but no spills to protest but not punish the board / Rem & Nom committee.

Site Tour

Did a site tour afterwards.

The CFO led us through with the head of property mgmt. and about 15 other shareholders, fund managers (I only recognised the Hayborough guys) and punters / brokers?

Kurnell is an Impressive set up, very modern, lots of capacity, and DA being sought to add another adjacent 30k sq feet (in addition to the 22 + 17 = 39k sq foot facilities they have currently operational but not fully utilised.

Disc: Held

COO Vladimir Mitnovetski has purchased $180,500 of shares on market this week. Encouraging sign that the market reaction might be overdone.

Interim Dividend In line with the Company’s dividend policy to pay out 100% of after-tax profits, the Company will retain the current policy of paying quarterly dividends. The proposed rate for the interim dividends for FY24 will be 11.0 cents per share fully franked, an increase on the 10.0 cents per share paid in Q1 2023. The first interim dividend was declared 13th May 2024. It is expected that as per prior years the final dividend for FY24 to be paid in March 2025.

The Company remains well positioned in the market, retaining its strong market share across all key vendor partnerships. This demonstrates the broader market trends impacting the wider industry, which have been generally subdued. Our ability to hold our market share, despite the challenging economic climate, underscores our competitive strength and the effectiveness of our strategic market positioning. It reflects our resilience and adaptability in the face of industry-wide headwinds, and our commitment to delivering value to our customers remains unwavering. The Company retains an optimistic outlook for the second half of the FY24 period. Authorised for release by the Board of Dicker Data Ltd.

Punished down 13%

Dicker Data released a dividend announcement this morning.

Dividend of 11c per share for Q1 (They pay dividends every quarter and report on a calender year basis).

This compares to dividends of 10c per share in Q1FY23 but still down from 13c in Q1FY22.

Given that DDR have a policy of paying out 100% of NPAT as a dividend, I expect NPAT to be around $19.8m for Q1FY24. Although I'm sure they will release a market update in the coming days.

Disc: Held IRL and on Strawman

Interesting point from Wesfarmers's strategy day (re Officeworks) which has impacts for DDR and DTL.

"With the rise of AI, management noted that AI-enabled personal computers will be hitting the market in the next few months, and both Officeworks and its suppliers are of the view that this will lead to a major replacement cycle over the coming years."

Two directors buying around 110k worth of shares between them on market at current prices.

positive signs

David Dicker now claiming his ex-wife’s shares

David Dicker may be the Australian business magnate whose antipodean absence and general low profile we most rue.

The Dicker Data founder and CEO – who looks more like Colonel Sanders with every passing year – upped sticks and moved to the liberal utopia that is Dubai in 2019 because Australia was (even then) an “authoritarian shithole”.

He’s dumped stock to fund the purchase of a private jet. He signs all his disclosure forms from Apartment 702 of Dubai’s pricey Kempinski Hotel. And his main passion these days seems to be getting his Rodin motorcars into Formula 1,which he tried and failed to do last year.

If only for the colourful copy, we should pay him more attention. And what better way to start than with his second, recent divorce and the spot of capital reallocation it’s forced.

David Dicker is a permanent resident of Dubai’s Kempinski Hotel.

At his eponymous ASX-listed hardware distributor Dicker Data, Dicker last week sold 18.3 million shares, citing a divorce settlement. The sale, which presumably netted ex-wife Delwyn Dicker some $200 million, was secured via a Barrenjoey block trade at $10.90 a pop, and represented some 10.2 per cent of the company’s issued capital.

Dicker still owns, his most recent 3Ys suggest, most of Dicker Data. But shareholders needn’t fear any more sales, given he has a six-month escrow on his remaining holdings.

But what are those?

His filings say Dicker speaks for 97 million shares. That includes a “relevant interest” in 55 million shares long held by his other ex-wife. Nonetheless, Dicker Data co-founder and director Fiona Brown “does not enjoy any power to vote in respect of the shares unless she becomes CEO of the company”, by virtue of a bloc agreement entered into in 2010.

The 3Y notices also refer to sections of the Corporations Act that define “relevant interest” as having the right to both vote and sell shares, suggesting Dicker sees Brown’s shares as his in every way that counts.

While the bloc agreement is almost 15 years old, reference to it in Dicker’s director interest statements is relatively recent, having first been made in June last year. And Brown, who files her own notices, doesn’t seem on board.

Three of her 3Ys, the last of which was lodged in December, state that: “Ms Brown considers that the bloc agreement is of historical relevance only [and has] ceased to be legally binding on the parties”. As a result, the 3Y notices explain, she doesn’t include Dicker’s shares in her relevant interests, and doesn’t think he has any relevant interest in hers.

This bloc agreement was discussed in Dicker Data’s prospectus. As described, it bound Dicker Data’s non-CEO founder (that is, Brown) to follow the voting recommendations of its CEO founder (that is, Dicker), while also giving both Dicker and Brown first right of refusal on the other’s share sales and transfers.

Brown clearly views the whole thing as “historical” and thus moot. And Dicker, evidently, disagrees, and told this newspaper last year that if he lost control of Dicker Data he’d “probably leave”.

This is no quibbling dispute. It affects shares worth $592 million, or a bit less than a third of the company. Dicker Data’s annual reports, including the most recent released in February, have long counted Brown as a separate, significant shareholder. And yet, recently, and as he completes his second divorce, Dicker has started prominently telling shareholders all his ex-wife’s shares might as well be his!

We asked Dicker Data if the dispute over who has a relevant interest in the shares had been resolved, and whether Dicker’s escrow applies to the shares actually owned by Brown. We didn’t hear back.

The last annual report also reveals Dicker was, in FY23, a debtor to the company he founded. For example, Dicker Data Financial provided Dicker with $524,968.91 at “arms length commercial rates”, which he had repaid by January 24 this year.

Brown’s transactions with the company were on the other side of the ledger. She advanced Dicker Data a short-arm loan of $20 million at some point during 2023, for which she was paid “commercial market” interest of $398,213.92.

Do you think Dicker could have just asked her for the cash and kept it off the company’s books? Suppose, for as long as he’s claiming her shares, and she disagrees, that’s not really an option.

Director buying ~80k worth of shares on market at $10.8

Big drop for Dicker Data this morning with the announcement that David Dicker has sold over 10% of the shares on issue for the company. This is similar drop to the last time this happened although this time the reason given is due to a divorce settlement. Last time he was spending on money toys such as his goal of entering a team in F1 that was ultimately knocked back.

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02781655-2A1510016

Update 29/02/2024

NPAT of $82.1m for FY23

Growth has been pretty good in the past year so applying a 25x PE multiple gives a valuation of $11.38.

Disc: Held IRL and on Strawman.

Update 04/08/2023

Unaudited NPBT of $54m for 1H FY23.

Therefore NPAT of around $37.8m

Doubling this for a full year and applying a 20x PE gives a valuation of $8.39

Update 08/02/2023

DDR results today were quite ordinary (and punished accordingly by the market) given they did a raise already this year and also made an acquisition of Hills Security division.

NPAT of $73.4m was basically flat YOY even though revenue was up 25%. The company blaming supply chain issues and also them trying to digest the new acquisition as a result for the decrease in margins.

I'm hoping this drop in margins is more temporary (and it was flagged with updates during the year) and that they will be able to continue their growth trajectory in the next few years.

A PE of 30x is probably a bit too much to pay for a business with flat growth but they still pay out 100% of their profit as a dividend and although it was cut quite drastically this quarter, for the full year the current yield was still around 4%.

Will give them a valuation of 20x PE (SP = $8.15) for now until their annual report is released later in the month and hopefully we will get some more detail into what the future holds.

Disc: Held IRL and on Strawman.

Update 28/02/2022

Will read more detail into their results released today later but just based off a 30x PE on their NPAT of $73.562m gives valuation of around $12.76.

Original Valuation

Dicker Data report on a calendar year basis.

In FY20 (Dec end) they achieved NPAT of $57.2m

A market update in October had NPBT for 9 months ended Sept 31 at $76.6m. Extrapolating that out to 12 months would give us NPBT of around $102.1m and therefore NPAT of around $71.5m.

Applying a PE of 30x would give a valuation of $12.40.

Now if we look forward 5 years, what does DDR need to achieve to justify the current share price ($12.05).

Increasing NPAT by 15% every year for 5 years and then applying a PE of 25 would give a share price of $17.97. Discounting that back 10% per year would give a valuation of $12.28.

I expect with the current sell off in the market that there may be further downside risk with the DDR share price however I do think they are at a fair value now and have started to slowly build a position.

Disc: Held IRL and on Strawman

Dicker Data released their FY23 results a few days ago. From their presentation:

I thought the result was pretty good considering FY22 was a disappointing year. Overall gross margins finished at 9.7% which is the highest in 5 years.

Revenue reporting will change from this report onwards due to a difference in revenue recognition. Above shows how revenue would have been reported in FY22 under the new reporting standard.

Overall a good result in a sector with some good tailwinds. The increase in computing needed to drive the AI sector will benefit DDR going forward. Also the windows refresh cycle will begin soon with Windows 10 losing support later this year.

Disc: Held IRL and on Strawman.

Net Profit of $82.1m and a really good story on the impact of AI on the business were the key takeaways for me from today’s results call. The pc refresh cycle that Vlad flagged last call is still be touted but now in the second half of calendar 24. Still holding IRL and hoping to get a good entry point for Strawman portfolio.

Dicker Data announced a final dividend for FY23 of 15c per share for the December quarter. Total dividends for FY23 came in at 45c per share.

Given that DDR have a 100% NPAT payout policy, we can assume that EPS will be around 45c per share or around $81m NPAT (compared to FY22 NPAT of $73.4m).

Disc: Held IRL and on Strawman.

Assumed 3 scenarios of growth from 15% - 7% per year for next 5 years. Share count 212.6m by FY28 Discounted back to today and 3% net margins giving me valuation $12.31

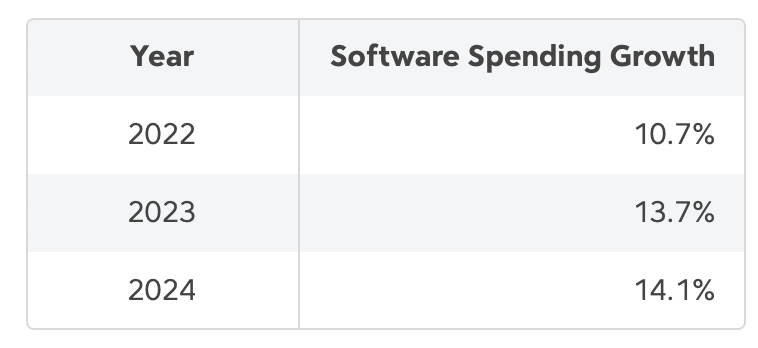

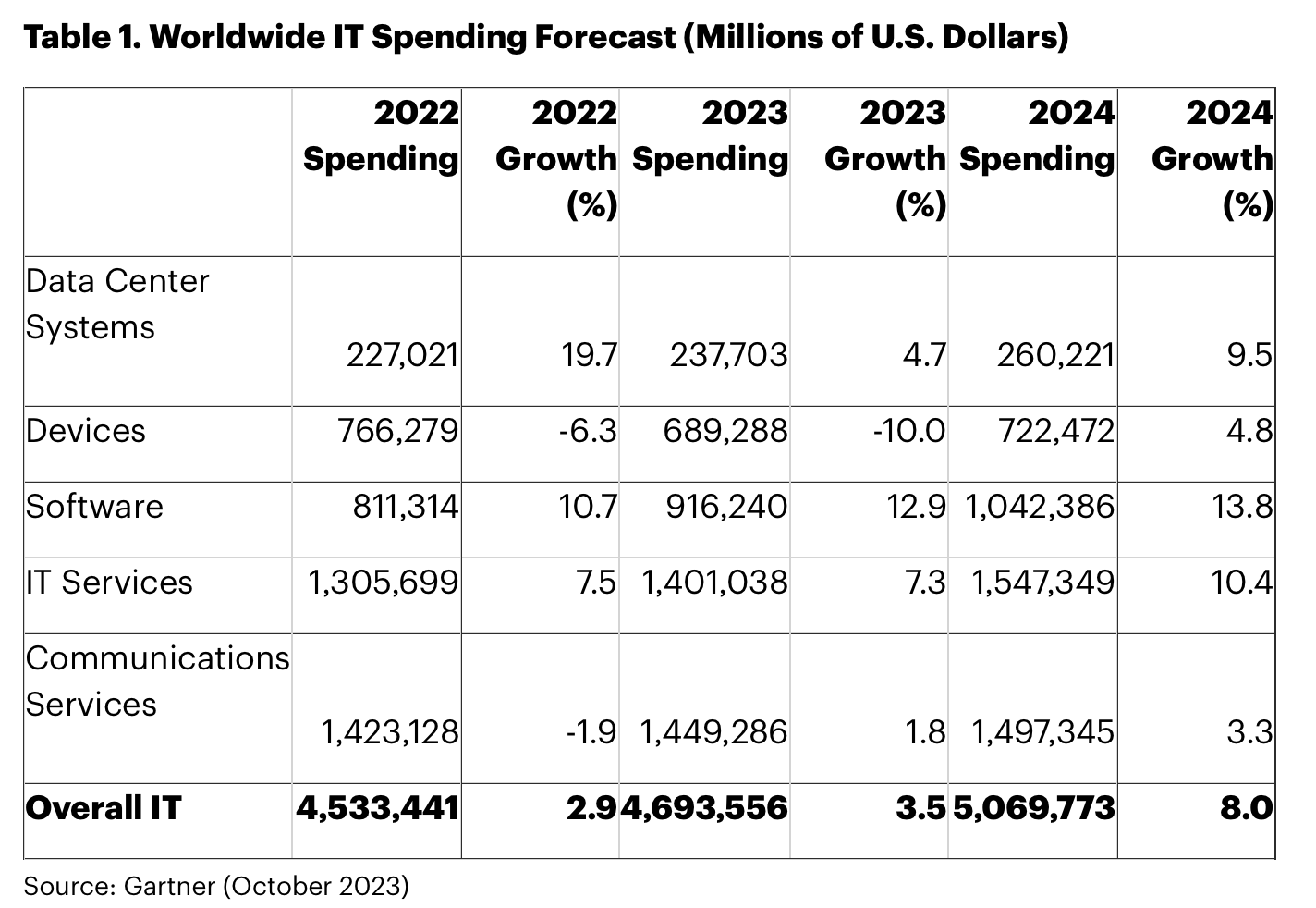

I came across this blog post by Tomasz Tunguz, a venture capitalist, estimating software spending growth for 2024:

His analysis is based on a Gartner report . It is mainly concerned with cloud spending but breaks out some subcategories of IT spending.

Dicker Data released an encouraging update last week which showed an 8% increase in revenue compared to the prior corresponding period.

If the forecasts are correct this is promising for Dicker Data sales growth going forward. Although software only makes up a small percentage of their revenue I would assume it is higher margin (but I couldn’t confirm what this is from a brief search.)

Also worth noting is that hardware, which is the bulk of DDR’s revenue, is also forecast to grow modestly after two grim years.

This is all speculative, obviously, but my thinking is that IT spending has been constrained recently but that can't continue forever.

Disc: Held IRL

Dicker Data released an update for their Q3 performance yesterday (Note they report on a calendar year basis).

I thought this was a pretty good result considering the issues they have been having in the past few years with supply chain and also the decreasing gross margin.

The newest segment DAS has been a good contributor to the growth in Revenue and Profit.

They mentioned that YTD gross margin has come in around 9.6% which is a good turnaround from it being sub 9% in FY22. This has been a result of increased gross margins in their NZ segment of the business.

The next few years will be interesting as they have mentioned that there will be a new refresh cycle for Microsoft devices with Microsoft stopping support for Windows 10 devices in October 2025. Management predict that there the current downturn in PC demand will bottom out in the current half and accelerate towards the end of next year.

Full Announcement Here

Disc: Held IRL and on Strawman.

I just got off the call for the HY update and feel very positive about the next couple of years given the way Vlad broke down the business performance by segment. As previously noted there was a marked decline on the PC side of the business (which makes sense given the covid boom), but this was offset by big jumps in areas with better margins ie software and DAS.

The upcoming retirement of Windows10 support by Microsoft and the next refresh cycle to support compute power required for AI adoption - ongoing digital tranformation, cybersecurity focus etc - looks like some very nice tail winds.

I feel like I'm missing something with Dicker Data's half year results.

The vibe here on SM seems positive, and the share price jumped. But the results strike me as poor. Rev of $1596, which included $73m from new DAS business/acquisition. If we take out the acquisition boost, we get 4.5% pa organic growth. And they said that this period showed a normalising of supply and included a catch up in backlogged orders. Without those backlogged orders there wouldn't have been much growth at all.

Given software grew 21%, and it's roughly a quarter of revenue, there must have been a decline in revenue from other parts of the business.

There's also a lot of attention given to the new DAS business, which concerns me given it makes up less than 5% of total revenue.

Given they grew 25% in 2022, feels like growth is falling off a cliff. If so, I can't see how 20x PE is warranted.

What are other strawpeople predicting for growth over the coming 1-5 years?

Dicker Data released some unaudited results today:

Company said that the increase in revenue was partly due to an increased demand for networking and storage products, software and the new DAS business (access and surveillance) which offset a decrease in demand for personal computing devices. The decrease was attributed to an increase in hybrid working environments.

Pleasingly, gross margins improved back to above 9%, finishing at 9.4% which was up from 8.8% from pcp.

DDR also mentioned that there were signs that the supply chain was normalising which had impacted them with large amounts of backorders in previous periods having been completed this half.

Audited results will be out Aug 30.

Full announcement here

Disc: Held IRL and on Strawman.

The shares have hit a level of support around $7.80 multiple times over the past couple of years, with the price holding each time. We saw that yesterday too, with a brief overshoot below those levels followed by a good close, and today we seem to have some follow through as well.

Generally bullish portends, though the ceveat is that the more times a support level is tested, the more likely it will eventually break as well :)

Dicker Data released a market update this morning. From their release:

Overall a good improvement compared to info they released towards the end of last FY. Gross margins improving back to above 9% having dropped below for the previous few quarters.

Dividend is expected to be 10c per share (down from 13c PCP). Most likely the decrease is related to an increase in share count given they did a raise last year. Dividend policy unchanged at paying out 100% of NPAT.

Will maintain my valuation for now until we get some more information but seems like the business is stabilising after a disappointing FY22.

Full Announcement here

I do also note that CEO Vlad Mitnovetski purchased 20000 shares last week.

Disc: Held IRL and on Strawman

Potential Hyperscaler Headwinds

A bit about the industry

As someone who works in this space, I thought I’d leave some food for thought on changes that may impact all technology distributers (or 'disties' as they're called in the industry).

Disties such as Dicker act as an intermediary between technology resellers and IP owners / technology manufacturers. They transact with major retailers such as JB-HIFI who provide a B2C and B2B motion; and resellers such as SoftwareOne, NTT, Insight and D#3 who primarily support a B2B motion.

If a business goes to their reseller to buy some Adobe or Citrix licenses, or perhaps some laptops etc, the reseller then goes to a distie to buy the IP (software licence / subscription) or technology. Sometimes the reseller goes direct to the IP owner / technology manufacturer, but this is dictated by the IP owner / technology manufacturers GTM strategy.

One of the main reasons why IP owners / manufacturers may want to use disties and resellers is to get better and quicker access to the market without having to heavily invest in local sales operations.

There are numerous other disties in Australia but some of the major ones include: Aquion, Ingram Micro, Nextgen and Tech Data.

Potential Headwinds – Hyperscaler Disruption

For B2B software transactions the market has long been used to a model supported by a small number of resellers who deal directly with software publishers or via disties. The customer is forced to buy from a reseller if they want access to enterprise agreements and volume discounts for large purchases, or access to charity / educational discounts and so forth.

Hyperscaler marketplaces may disrupt this motion. Hyperscalers are the big cloud suppliers such as Amazon (with Amazon Web Services or AWS) and Microsoft (with Azure). Both these companies have launched their own online marketplaces which sell subscriptions to applications that are designed to run on the platforms that Amazon / Microsoft host.

The marketplaces however can also support technology transactions – and just think about it, Amazon is a world leader in provide e-commerce experience excellence. What Amazon and Microsoft are doing is engaging with other IP owners to get them to sell their software as a subscription through their marketplaces (i.e., they’re becoming disties). They can pit the IP owners against each other to drive adoption – e.g., if NitroPDF are onboarded to Amazon’s marketplace, it motivates Adobe to get onboarded too.

What Amazon and Microsoft do is sell multi-year pre-commit agreements that are heavily discounted e.g., pay $5m up front to get $6m credit over 3 years. This is offered on a ’use it or lose it basis’. This pool of funds can be spent on both cloud services provided by the hyperscaler as well as subscriptions available on the marketplace. This means that if a business is mid-way through their agreement term and they are tracking under the spend forecast e.g. it looks like they won’t spend that $6m, they could look to spend that money on subscriptions from other providers through the marketplace, to ensure that they don’t waste their pre-pay. This then could take money away from the distie.

It's very early days on this front and it’s difficult at this stage to assess the magnitude of this risk and what it will mean for companies like Dicker, but as software publishers continue to move to SaaS models and start to transition away from using disties and resellers, companies like Dicker will be impacted.

Into the future

The good news is that distributing software is only a portion of Dicker’s business and this potential headwind does not appear to be particularly disruptive at this stage. One of the reasons that disties and resellers exist is that like good travel agents, they advocate on behalf of the customer to get the best technology solution for the best price. So many companies will still want to continue to work with resellers and the disties because it minimises the number of vendor relationships that procurement teams need to manage and it provides customers peace of mind that they have a partner advocating for them both in terms of technology fit and hunting discounts. Oh, and don’t forget that cost savings is a procurement KPI and can mean the difference between going on that holiday or not when it comes to bonus time. So it’s important to not understate the power that resellers and disties have here when they’ve been able to demonstrate a strong track record of delivering cost savings to their customer’s procurement counterparts.

For this reason, we may even see a blended model emerge where disties and / or resellers clip the ticket or receive rebates on transactions through the hyperscalers where they have been supporting the presales process on behalf of the IP owner.

It will be interesting to see how the hyperscaler marketplaces start to disrupt these traditional technology supply chain motions.

I’ll be sure to provide further updates as I learn more and would be glad to share my experience if there are any questions people may have about how these businesses operate.

Disclosure: I hold Dicker in RL and on Strawman

*Edited due to some typos

DDR Acquisitions/ Land Purchase

· February 2022 Hills Security and IT Division $19.35m - largest distributor of physical security products in the Australian market https://www.asx.com.au/asxpdf/20220221/pdf/4565x601gdk7ny.pdf

· July 2021 Exeed Group $68m - is a leading distributor of key technology brands including Apple, HP, Hewlett Packard Enterprise and Microsoft, with a focus on both the commercial and retail sectors. Exeed carries a number of exclusive distributorships in New Zealand including Motorola, Ruckus and Webroot. The business employs a total of 119 staff, with 95 based in New Zealand and 24 in Australia. https://www.asx.com.au/asxpdf/20210730/pdf/44yvv0w3nfbjdg.pdf

· February 2016 Purchase additional adjacent land in Kurnell - $18m for additional 17.2 hectares of land adjacent to current facility. (Sale of 230 Captain Cook Dr, Kurnell $36m August 2019 https://www.asx.com.au/asxpdf/20190801/pdf/4474ckh41hb5t2.pdf ) https://www.asx.com.au/asxpdf/20160225/pdf/435bf97pl50hj3.pdf

· February 2014 Express Data Holdings $65.5m - acquisition includes both the Australian and New Zealand operations and Express Online. Express Data offers a comprehensive selection of software and hardware products from a blue-chip vendor base which has very little overlap with Dicker Data’s existing vendor portfolio https://www.asx.com.au/asxpdf/20140211/pdf/42mn0zdx8h5bj5.pdf

Capital Raises

· August 2022 Raised $71.8m - $50m Institutional, $21.8m SPP Retail

· May 2020 – Raised $65m - $50m Institutional, $15m SPP Retail

· August 2015 - Raised $45.5m - $40.25m Institutional , $5.25m SPP retail

· March 2015 - Raised $40m Corporate Bond offering https://www.asx.com.au/asxpdf/20150316/pdf/42x98gn9sv5jvf.pdf

· January 2011 - IPO Raised $1m

After raising $50m from institutional investors, Dicker Data opened a share purchase plan for retail investors with the aim of raising a further $10m. Subsequently $21.8m in new shares were applied for and DDR opted against a scale back.

I'm always interested in the numbers behind the capital raising and DDR obliged providing further info in their release. There were 14,111 eligible shareholders who could apply. Of that number only 9.7% (1373) actually did so at an average of $15,856 (maximum allowable of $30k). The share price at times did hover slightly below the issue price of $10.30 and is currently still doing so. An extra $70m sures up the balance sheet with storm clouds on the horizon given the current macro thematic which one would think will be putting further pressure on the share price in the near term. There has been a continuation of director buying so internally there still appears to be a lot of confidence in the business still.

Disclosure; I hold IRL but did not partake in the SPP as it has grown to be my largest holding so held off due to weighting

Dicker Data released a Q1 update this afternoon (they report on a calendar year basis). From their release:

- Revenue in Q1 2022 finalised at $673.6m, up by $225.9m representing an increase of 50.5%

- The revenue split between Australia and New Zealand was $534.9m and $138.7m respectively

- The increase in revenue is partly attributed to full quarter contribution from the Exeed acquisition that was not available in the comparative period, with the balance attributable to organic growth

- The revenue contribution from the Exeed business across Australia and New Zealand (ANZ) was $90.3m in the Q1 2022 period • Existing and new vendor additions delivered $135.5m in incremental revenue, driven by increased demand for virtual capabilities and accelerated digital transformation of businesses across ANZ

- In line with the Company’s expectations, supply chain disruptions have continued and together with the introduction of the retail business in NZ, gross margins finalised lower for the quarter at 8.6% as a result

- Despite lower margins for the quarter, the Company expects to see margins finalising around 9.0% for the full year ending 31 December 2022

- Net profit before tax for the first quarter was $23.8m, an increase of 22.7% on the prior corresponding period (pcp)

- Operating expenses increased by 17.5%, finalising at 4.4% of revenue, down from 5.6% in the pcp

My Takeaway:

A pretty good quarter from DDR with good organic growth coupled with a full quarter contribution from Exeed (compared to FY21 Q1). I think this was needed given the decreasing margins that management have stated. I expect NPBT margins to be around 3.6% which is similar to FY19.

If revenue growth stays at 50% compared to FY21 then NPBT growth would come in around 23%. I see shares at around fair value at the moment trading at a PE of around 28x so I will maintain my valuation of $12.75. Was also good to see directors buying in the last few weeks.

Disc: Held IRL and on Strawman.

Dicker Data released their FY21 results today (they report on a yearly basis). From their release:

- Total revenue of $2.48b for the year, representing an increase of 24.2%, or $484.3m

- Australian revenue grew by $300.3m, representing an increase of 16.3%

- New Zealand revenue grew by $184.1m, representing an increase of 128.7%

- Nine new vendors were added in FY21 (excluding Exeed) which contributed an incremental $54.7m

- Software recurring revenues increased by 19.7% to $520m

- Statutory net profit before tax increased to $105.1m, representing an increase of 28.4%

- Earnings per share increased to 42.63 cents per share, an increase of 25.6%

Another solid year of business for a DDR. I think this slide in particular outlines what a high quality company this is:

At the current share price ($14.15) they are on a PE of around 33x. Historically shares have traded at a PE of between 10 and 20 however since 2020 there has been some multiple expansion and shares have traded between 20x and 40x.

I have updated my valuation based on their latest results. If the PE got down to 20x ($8.50) I would likely back up the truck.

Disc: Held IRL and on Strawman

Dicker Data has gone into a trading halt today pending announcement of an acquisition.

You tend to shudder when some companies do things like that but you'd have to back David Dicker in to know what he's doing. The bloke just keeps putting runs on the board over a very long period.

[Not held]

DDR just 'keeps on keeping on'... Today they provided their 3rd quarter update

Highlights as follow:-

With two months contribution from Exeed Group business, total revenue YTD to September 2021 was $1,720.4m, an increase of 16.1% on the prior corresponding period (PCP)

- Net profit before tax YTD to September 2021 was $76.6m, an increase of 26.0% on the PCP

- Excluding the contribution from Exeed business total revenue was $1.655.2m, up 11.7% on PCP and net profit before tax at $74.7m, up 22.9% on PCP

- A strong result despite ongoing supply constraints being experienced during the year

- Supply constraints are predicted to continue for the foreseeable future, however, our ability to forecast and manage allocation of stock continues to strengthen each quarter

- Despite the global chip shortages, we are experiencing increased stock allocations across a large number of categories, improving the overall health of the supply chain

- There is still a significant backlog of orders that we expect to fulfil in the last quarter of 2021

Still one of my best income & dividend stocks