Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Taking a cue from the @mikebrisy playbook to write up expectations ahead of companies reporting. This seems like a nice device to prepare for updates ahead of time, set your own expectations and help support independent thinking in the face of management speak once results drop.

Here I’m checking in on DDR to see what competitors are saying in case this helps prep me for their AGM on Wednesday.

I’m thinking there may be an opportunity from the recent CEO exit and potentially softer sales numbers from companies not investing as much in IT due to uncertainty from AUS election and US Tariff uncertainty.

If these conspire to send the share price down far enough, could be a chance to pick up some more – as long as my LT thesis remains intact.

This could be a nice set up if the PC refresh cycle looks delayed again or at least off to a slow start. It can’t be delayed indefinitely and I think there could be good reasons why it may be slow to gather pace. Ditto AI PC Sales, and these could well be related.

I expect these potential impacts to hit SME & SMB segments hardest if at all. Lower margin Enterprise will likely not be as impacted, seeing IT (particularly AI focused) investment as less discretionary.

I put the last few quarterly transcripts for US competitors and counterparts (TD Sennex, Ingram Micro and CDW) through NotebookLM and asked it for trends and themes especially related to PC refresh and AI PC sales.

Unfortunately these companies are not as useful a comparison as usual due to US tariffs hitting their customers with some potential pull forward to beat the tariffs. I wouldn’t expect AUS to see this effect. Comps have been saying that the PC Refresh cycle looks to have kicked off now but they’re unsure how much of this is pulled forward to beat tariffs.

Anecdotally there has been a lot of pre-tariff purchases in the US so this could be a decent part of it. Also that they generally experienced better PC sales in Q1 than they are forecasting for Q2 and beyond.

IDC are saying the relatively strong Q1 in PC sales was likely due to pre-tariff purchasing too saying “The primary catalyst for the growth in personal computing devices was the heightened uncertainty around tariff negotiations between the USA and trading partners.” - https://my.idc.com/getdoc.jsp?containerId=prUS53355825

Still, this is a useful reference point. As a result I expect the DDR outlook to be relatively strong even if PC sales are not significantly on the rise here yet. If it is, the question will be how much are they seeing in Q1 numbers (assuming they provide some) and how does the market take this and mgmt. restructure alongside whatever else they release on Wednesday.

Ideally Q1 is weak, outlook is strong, market doesn’t buy this due to management restructure and poor communication around this (along with David’s recent share sales, etc). Let’s see…

Disc: Held

David Dicker has left the building...https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02947520-2A1596991&v=7bc42bd11d853ed5e8c28f2ffcd6a069ee5cd6b4

This is not a surprise as he has been edging out the door to spend more time on hobbies for a while now.

A few things about this announcement seem a little odd tho

Timing - Doesn't say when this is effective. I assume this is immediate and if so this seems sudden. He's not a young man so could be health related. Didn't give a reason except "to pursue other interests". Their AGM is next week, so not sure who will be there for it - I assume Fiona a new Chair will run it but David may Zoom in from Dubai like last time? Results haven't been great recently and 2025 was supposed to be a better year, maybe not?

Succession - seems obvious but no mention of who (if anyone will be the new CEO). Has to be Vlad, the current COO. Unless he says no for whatever reason, I can't think of anyone who could possibly be better. No mention of a process to find a CEO.

Shareholding - no commitment for escrow of David's 50% holding (including his effective control over Fiona's holding).

Will need to see what's said at the AGM which will be IRL only I believe so should be well attended and more interesting than usual...

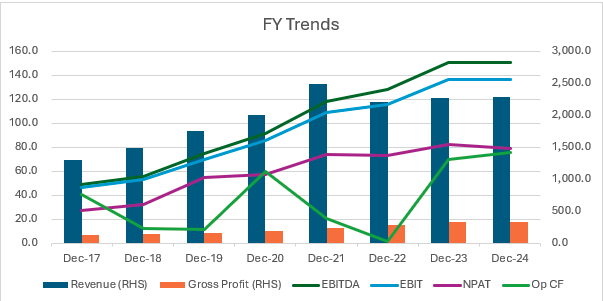

Some scattered thoughts from my first pass on DDR FY24 release this morning. It’s drinking from a fire hose time in the dying days of earnings season…

FY24 was flat and disappointing vs where they want to be but could have been worse as weak economy slowed sales to SMB & SME. A temporary pivot to (lower margin) Enterprise saved Revenue from declining but constrained margins.

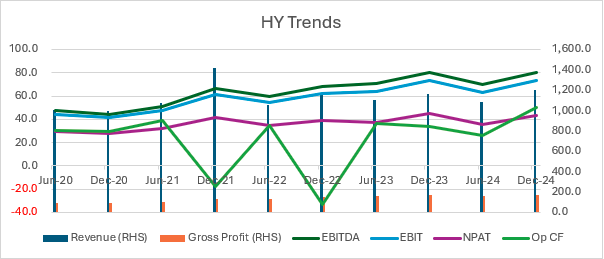

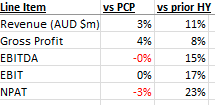

Better on a HY basis due to seasonality

Here’s the numbers for the HY comparison showing stronger HY vs H1 24 per seasonal variation but pretty flat vs PCP (H2 23).

Outlook

Q1 24 was very weak, so will be easy to cycle comps in the current Quarter and probably even Half.

Interest costs are eating into bottom line margins and this will continue while interest rates remain stable, although this looks to be moderating (BBSY floating rate has fallen recently).

Economy is starting to improve, bad debts have risen but this should improve in FY25.

They expect FY25 to be a much better year, as do I and this is part of my thesis posted here previously.

Short story is that the PC Refresh is yet to hit full swing but that was always a FY25 story, mainly because of the Oct-25 Win 10 support sunset and the introduction of mid-level (affordable) AI PC’s.

AI picks and shovels

COO Vlad is a big AI bull – can see from the front row that AI will usher in more change in the next 5 years than the last 30 years in terms of innovation and how we do things.

They are internally using AI extensively to help educate customers on products and use cases.

This is also a part of my longer term thesis, that they become a picks and shovels play on the AI proliferation meaning AI becomes table stakes for businesses to stay competitive – especially for smaller businesses looking to keep up with better resourced larger competitors.

As a side note I’ve been anecdotally hearing that the biggest Gen AI use case today is Agentic AI being deployed in Enterprise to cut a lot of headcount. This makes intuitive sense to me - if you have 10 people in a team doing something that an AI Agent(s) can do, you can probably chop this whole department. But if you have 1 person doing this in a smaller business, Sandra can be hard to axe because she is probably covering holidays for other staff / the best barista in the office / friends with the CFO’s wife, etc and the cost of an AI Agent is probably not justified.

I know Westpac are going hard on this – trying to chip away at CBA’s tech supremacy I expect. There must be a lot of consultants pitching huge costs savings from deploying AI Agents in large enterprises. This should trickle down to medium and smaller competitors over time as they look to keep up. DDR will be waiting to help them when they do. This is largely speculation on my part but could provide some upside for DDR over the next couple of years.

Longer Term

DDR are still growing but they are bumping up against industry growth rates as their growing market dominance means they can’t take market share from others at the same rate as previously.

DDR have talked about geographic expansion in the past but are now looking more closely at opportunities in Singapore, etc.

Margins should hold up as they continue to be strong in higher margin SMB & SME. This makes sense as DDR being locally focused should give them an edge vs larger global competitors who are necessarily spread thinner but perhaps better placed to have global supplier agreements with local offices of global enterprise customers.

This should also insulate them from Microsoft efforts to go direct with Enterprise customers, etc.

I’ll add more as I digest this and other releases this and next week...

This is a subset of my full DDR Thesis which is here https://strawman.com/reports/DDR/Slomo?view-straw=27568.

The cornerstone of that thesis is that DDR is a high quality (but low margin) compounder that dominates a competitive, cyclical industry so volatility in their financials and share price may throw up opportunities from time to time.

This is the PC Refresh part of the Thesis which looks at the structural (AI PC’s), cyclical (Refresh cycle, Windows support) and seasonal (Q3 weak, Q4 strong?) factors that may be presenting an opportunity at current price / Mkt Cap.

PC Sales Background

PC Sales made up 19% of Revenue for DDR in FY23.

This is down from ‘normal times’ in FY19 when it was 25%. It grew to 27% and 28% in the covid years of FY20 and FY21 before flattening to 23% in FY23 and then 19% most recently.

Covid saw a big bring forward of demand due to a combination of factors including WFH and free money. In those years FY20 and FY21 PC Sales Revenue jumped 25% and 26% respectively. FY22 and FY23 normalised to a 5% increase and then a 13% decrease.

Given the size of this segment, recent PC sales falling has had a negative impact on revenues and profits.

There is now an expectation of a large increase in PC sales will occur due to – replacement of aged PC bought in the Covid years, Windows 10 support expiring in Oct-25 and the introduction of AI PC’s.

Questions

The big questions now are how big will this be and when will it occur?

DDR has been spruiking this Refresh cycle for a while and it makes good sense.

The last time they talked about this was 1H24 results in August.

I was expecting an update based on Q3 24 (Sep-24) in Oct but none was given.

Their competitors and comparables are mainly listed in the US so they report quarterly and might give us a better sense of where this Refresh cycle is up to.

If we assume the ANZ market is not far behind the US this might give some clues as to timing and potential size.

US Comps

I looked at Ingram Micro (INGM) and TD Synnex (SNX) on the NASDAQ as they are many multiples bigger than DDR (35x and 42x bigger by revenue respectively), have a similar business model and are the biggest DDR competitors in ANZ.

INGM’s last report for Q3 24 was on 13-Nov-24 and SNX reported Q4 24 on 10-Jan-25.

INGM and SNX are essentially singing the same song as DDR – that the PC Refresh cycle should be starting up by about now and should be big when it gets here, but it’s running late... should be here any quarter now…

Ingram Micro on 13-Nov-24: “PC refresh cycle starting to happen, although it may not be at the pace that industry analysts had predicted”

SYNNEX on 10-Jan-25: “TD SYNNEX observed a recovery in the PC market in Q3 and Q4, with high-single digit growth in the PC category.” And

“For the full fiscal year 2025, TD SYNNEX expects gross billings to grow in the mid-single-digit percentage year-over-year, partly due to the anticipated PC and server refresh cycle.”

This may be why DDR did not release a Q3 result – because there was nothing good to say on the hotly anticipated PC refresh cycle or more broadly?

Other forecasts

I also looked at the forecasts from IDC (https://www.idc.com/getdoc.jsp?containerId=prUS53061925) who claim to be “the premier global market intelligence, data, and events provider for the information technology, telecommunications, and consumer technology markets.”

On 8-Jan-25 they said “The PC Market Closed out 2024 with Slight Growth and Mixed Views on What 2025 Will Bring”

Further, that:

Looking ahead to 2025, the PC industry has several tailwinds and headwinds, which makes for a challenging outlook and difficult demand planning.

Enterprises continuing on the path of upgrading hardware before the end of support for Windows 10 which is scheduled for October 2025.

The impact that on-device AI will have on the industry will be positive, even if the inflection point is delayed.

On-device AI for PCs is inevitable, but suppliers trying to be patient as their customers are dealing with macro headwinds.

Conclusions

The PC Refresh is surely a thing and is due soon but as not started yet. This is likely for a few reasons.

Firstly the Windows 10 Support End Date is not until Oct-25, still plenty of time.

AI PC’s are in their infancy and more affordable mid tier models will be released through 2025.

End customers of DDR’s customers are still doing it tough with persistent inflation keeping interest rates higher for longer than expected – NZ is in a second recession, AUS is in a per capital recession.

AUS election cycle due to start (often capex decisions get delayed in times of policy uncertainty – this has been noted in the US market).

Things should be a lot clearer by mid-2025.

If I had to guess

The PC refresh cycle has only been delayed as it can’t be cancelled.

There may be a confluence of waiting for affordable mid range AI PC’s in mid 2025 and not needing to get onto Windows 11 (Win 12 is expected later in 2025) until mid 2025 or later.

Opportunity: This could see a long awaited surge in PC sales to corporates and a big bump in revenues in H2 25 if not sooner.

Risk: This also has the potential to cause inventory build up and write / mark downs if distributors over prepare for a cycle that is delayed and seeks different inventory (AI PC’s) than what they have in store.

The best distributors should be able to benefit by positioning appropriately for this now and as 2025 unfolds.

Next Steps

These findings are not what I had expected but are understandable.

So PC refresh part of the thesis is delayed at this stage, rather than broken.

I don’t expect a strong H2 24 for DDR but do expect better clarity on the outlook for FY25.

This may present a buying opportunity if the market is ST and marks DDR down on FY24 results as it’s been doing after recent stumbles.

I'll also be keeping an eye on the INGM Q4 24 result which is due mid-Feb, just before the DDR FY24 one.

Disc: Held

My DDR Thesis is as follows.

Very keen to hear from anyone with a different view / other insights!

It's a bit wordy / long winded as these are effectively notes to myself and it's a live document, so may be a little rough, hopefully it makes sense to others who know the business.

Summary

I see Dicker Data (DDR) as a high quality business with Short Term issues and limited downside.

For this reason I see significant potential upside from the current share price of ~$8.50 (Mkt Cap of $1.5bn).

I expect returns to come from improving fundamentals driving NPAT (and DPS) growth leading to an improvement in sentiment (multiple expansion) over the medium term (1-2 years).

Quality

The quality aspects include the longevity of a business that has been built over 4 decades by a founder CEO & Chair (intelligent fanatic) and run by empowered, aligned deputies – mainly Vlad, COO (14 years) and Mary (CFO).

Other indicators are niche market leadership in AUS, and gaining on this in NZ.

Sources of moat mainly scale, some network effects (more vendors are better for customers and vice versa) and probably cultural moat. All evidenced by sustained high ROE & ROIC (> WACC). The IP of LT vendor relationships, customer contacts, deep industry experience, etc also hard to replicate by others.

Niche market should keep bigger well resourced operators out (eg. Amazon is unlikely to enter).

Low NPAT Margins on the surface suggest low quality but they’re much higher than competitors (DDR 3%+ vs Competitors ~1%) and a significant barrier to entry so I see their margins as indicative of quality.

Market share growth - Vlad has mentioned that they take more market share in tougher economic conditions. I see this as a great indicator of business quality and long term, opportunistic thinking by management (as long as they are not overly sacrificing margins to do it).

Short Term Issues

PC refresh cycle low, business cyclical low w bad debt provision hitting NPAT and slower collections hitting Op CF, loss of vendors (mainly Autodesk), founder (forced) selling stock at higher prices hitting sentiment, weaker financials with flat FY revenue, first fall in FY DPS in 7 years and 21% fall in 1H NPAT (the worst HoH in >4 years).

Vendor loss. Losing Autodesk was significant – but that has now happened and they can’t lose them again (could lose others though). It was not a loss to a competitor, as Autodesk now going direct. Would be concerning if this becomes a trend – especially with big vendors. This concern partly offset with the addition of Adobe and being the only full suite reseller of Nvidia.

Mgmt - Concerns from David selling down shares to settle (another!) divorce, only zooming into the AGM (due to death threats!) and not showing up to the 1H 24 Call.

Potential reversal of fortunes?

Business cycle at a low? Interest rates stabilised from the fastest rise in history. Potential for cuts – other economies already cutting w RBA to follow in FY25 all else being equal.

For DDR internally this means financing costs should have stabilised and may even fall if they manage debt down over time, but I expect them to maintain some debt (for funding inventory).

Natural PC refresh cycle to be aided by Windows 10 support expiry, and AI optimised PC’s hitting the market. This should turn a recent headwind into a decent tailwind as 30% of sales are PC related.

I’m not expecting boom times, but also not expecting a deep or protracted recession (noting the per capita recession we’ve been in).

NZ market share and margins growing – to become a more meaningful contributor to NPAT growth – especially at the margin.

Investing for growth largely done via additional headcount and warehouse expansion with optionality for more space if required.

Growing contribution from higher margin software sales (although a concern that distributors could be cut out in time – see Autodesk).

NPAT and Dividends

The policy to pay out 100% of NPAT as dividends provides dividend yield support.

This provides a strong incentive to mgmt. to grow NPAT through direct incentives (STI) and their personal holdings – especially Exec Chair and CEO, David Dicker who remains a significant shareholder and does not draw a material salary so is reliant on dividends to fund his expensive lifestyle.

I asked about the dividend policy at the FY23 AGM and came away with the impression that this is rusted on – as long as David remains Chair / CEO / on the board.

So I expect that dividends are likely to grow over time in line with Mgmt being strongly incentivised to grow NPAT and pay out 100% of NPAT as Dividends.

Except for last year (-13%), DPS has compounded between 13-21% p.a. for the last 7 years.

Limited Downside

At $8.50 share price, the expected dividend of ~ $0.45 ($0.52 in FY22 and $0.45 in FY23) equates to a prospective Fully Franked Dividend Yield of 5.3%. Grossed up this 7.6% return is about 50% more than you can get in a Term Deposit.

The most recent Quarterly Dividend was $0.11 per share ($0.44 annualised).

I expect TD rates to fall and dividends to rise over time, so this gap should widen providing additional share price support.

Some Mgmt buying after recent price weakness from a result showing ST results were average but LT expected to improve. Management are eating their own cooking and running the business like the long term owner operators that they are.

Management

Trust is management is key for my thesis – partly because they are saying things about the future (bright) that are different from the past (dim).

David stepping down / sideways would likely cause investor concern but I expect this will happen sooner rather than later and I would be more worried about losing Vlad, or if David stepped back and Vlad was not promoted to CEO.

Other potential catalysts

ASX200 inclusion would attract passive flows but I don’t expect this any time soon. Sitting at the ~260th largest stock by market cap makes this seem possible with a 30% rise in the share price to $11 (all else remaining equal) but I expect liquidity / free float issues from NED Fiona Brown and others may stymie this.

The ASX 200 is “The 200 largest and most liquid stocks listed on the ASX by float-adjusted market capitalization“. Note that: “Stocks require a minimum Relative Liquidity of 50% for inclusion in the S&P/ASX 200” whereas this is only 30% for ASX300 inclusion which DDR is currently in. Source: https://www.spglobal.com/spdji/en/documents/methodologies/methodology-sp-asx-australian-indices.pdf

If the emerging AI opportunity sees DDR operate as a key ‘picks and shovels’ seller where AI is becoming table stakes for SME’s & SMB’s, there may be a material uptick in sales (may not be sustained though?). This may significantly boost sentiment / multiples. There’s been some buzz about the opportunity for JBH & Officeworks from selling AI capable hardware, so DDR will likely catch some of this at some point, especially as the pipeline comes into clearer view.

More broadly on AI – as this functionality gets embedded in most / all vendor offerings there may be a rush to buy / or shortened refresh cycle for the enhanced products (be they hardware, software or hardware capable of optimising AI enabled software).

NZ growth as a leading indicator for AUS cyclical recovery? It was noted by Vlad at the FY23 AGM that NZ’s downturn was more severe than AUS and NZ underperformed in 2023 as a result. This makes sense given NZ followed a steeper rate tightening cycle to AUS (as did most developed economies). If NZ’s current recovery (in 1H 24) is leading AUS as would make sense, a cyclical trough may be in or close by with a stabilisation / upswing over the next 12-24 months.

M&A into other verticals / geographies – NZ is working out nicely after M&A there. I see a risk that if DDR continue to approach ANZ market saturation this may be a handbrake on organic growth, so they may need to look elsewhere. It might then make sense to utilise their capabilities and relationships to extend their offering into new markets (generally lower risk) or new products / verticals (generally higher risk) via M&A. Not expecting this any time soon though.

Continued growth in NZ market share and margins sees more benefits of scale as DDR are able to negotiate ANZ wide deals with vendors (not just AUS & NZ siloed deals). This improved scale may also benefit inventory management across the region.

Risks

Increased willingness for vendors to go direct (like Autodesk). This may make sense if the vendor is big enough to deploy their own sales capability and if they want to get closer to their end customers. This is probably more likely at the competitive, lower margin enterprise end of the market.

Threats from AI – could an AI app or capability provide a procurement department in an app? Could this circumvent distributors via a seamless discovery / procurement consultant capability? Anything seems possible with AI these days but if this threat or similar did emerge, DDR is well placed to see it early.

Competition

DDR’s Competition mainly comes from 3 global players headquartered in the US.

Ingram Micro (CA), TD Synnex (CA) and Westcon (NY) have weighted average shares of the ANZ market of 21%, 14% & 7% respectively (42% total) versus DDR’s share of 34%.

These are much bigger players with lower margins: Ingram EV = US$2.7bn, NPAT 0.7% and TD Synnex EV = US$13.9bn, NPAT 1.1% versus DDR EV = US $1.2bn, NPAT 3.3% (Westcon is private).

So DDR is the only significant sized locally based supplier. DDR are the biggest in AUS (35% vs Ingram’s 17%) and 2nd biggest in NZ with 29% vs Ingram’s 36%.

DDR is improving margins and Market share in NZ following some acquisitions there and expect to become the biggest in NZ organically from here.

Vlad (COO) claims to grow market share faster in down markets so this may have helped NZ grow share recently.

Smaller players in each market may provide additional scale if M&A looks attractive – but unlikely worth doing for global players.

ACCC unlikely an issue as it’s a B2B market and still fragmented.

Sentiment

Dec strong, June weakness – The last 3 June HY’s have seen Revenue and NPAT falling from the prior 6 months, so the Dec half is seasonally stronger than June halves. This June’s seasonal dip may have contributed to recent poor sentiment - following cyclically lower revenue after interest rate (and rent) rises have squeezed DDR’s end customers. Also, higher interest costs, costs from reinvesting in capacity growth, the founder selling shares at higher prices – a lot of things may have contributed to the current trailing 19x (forecast 19x) PE Multiple being in the bottom 25% of the last 5 year range.

There were a lot of brokers on the 1H 24 call and all had predictably short term focused questions. I’m surprised how many brokers cover DDR but this may be a function of their ASX300 inclusion and potential for a cap raise for M&A or to fund WC expansion? Or sniffing a chance to skim a block trade from David’s next forced sale event?

I expect that the analyst community and market more generally are waiting to see the numbers actually improve (or at least firm guidance is given when pipeline is clearer), by which time the opportunity will have at least partly receded. It will have also been partly de-risked.

A more prudent approach may be to wait for the first (clear) sign that the numbers are sustainably improving and confirmation of why – expected PC sales uptick, business cycle pressures easing, etc. Then to buy into an improved fundamental situation in line with expectations in anticipation of improving sentiment.

Next 6-12 months - Actuals and Outlook

Next indication of this is likely to come close to 31st Oct when DDR typically release a Q3 update to market.

However Q3 is the weakest seasonally, so the outlook statement is likely most interesting, especially if they provide firm / narrow FY Guidance.

Q4 24 should be an absolute belter (H2 is the strongest half and Q3 is the weakest quarter, so Q4 must be the strongest quarter seasonally) – and it would be a big concern if it was not.

Next stop is FY24 reporting at end Feb, then AGM Preso in May-25. If these show significant growth in NPAT actuals and outlook, the share price could be materially higher in 6-12 short months.

If not, it may take longer or there could be some other hiccup / hit to sentiment. This is where the quality of the business and dividend support (being paid to wait) should minimise downside.

Valuation

From current price of $8.50, a 10% RRR could be earned if in 5 years NPAT Margin is 3.3% (3.3% in FY22, 3.6% in FY23), 5yr PE is 21x (80% of 5 year historical average), 5yr Revenue CAGR is 9.5% (last 5 year average).

I think the 5 year NPAT Margin and Multiple are likely conservative but Revenue CAGR may be harder to hit.

On balance I would expect a TSR CAGR > 10% from here, and significantly better than that if the above catalysts materialise over the next 1-2 years.

A note on Market Psychology

I feel like there are a number of features of this business that could be used to explain historical performance and outlook in either a positive or negative way depending on how you look at them / what type of investor you are.

These include the eccentric / unorthodox founder CEO, dominates a mature market niche (Saturation vs mkt leadership), low NPAT margins (competitive industry vs barrier to entry), distributor / picks and shovels (limited upside and downside), 100% payout ratio (capital discipline vs lack of reinvestment opportunities), exposed to the business cycle (volatility vs opportunity).

When DDR seems to be performing well these things can be viewed as contributing to past success and indicative of continued success.

But when performance has underwhelmed, these things can be seen as negatives and reasons to doubt future success.

If this is correct, DDR could make for a good long term investment at currently lower multiples as price volatility could be exaggerated by good or bad performance that are actually due to seasonal (H1 vs H2), cyclical (business cycle, PC refresh) and structural (AI, shift to software) factors – all of which look more positively than negatively positioned to me and explain why tepid recent performance is likely to give way to a better 12-24 months.

This is in line with management commentary which seems to be candid and transparent which I would expect based on their alignment and experience (LT owner operators).

Disc: Held

I attended the DDR AGM in Kurnell yesterday and wanted to share my takeaways while they’re fresh.

David Dicker, CEO was not there in person, zoomed in on video instead as he’d received a death threat if he turned up due to share price being down (a brave but anonymous warrior in Elon’s Twitter army I suspect). This was initially met with a few chuckles from the audience but seems it was legit, the police turned up but there were no scuffles, shots fired or arrests that I noticed.

David took the opportunity to emphasis that he had not wanted to sell any shares and only did so under the obligation of a highly unfavourable divorce judgement.

So timing was seemingly out of his hands too?

Presentation

This went for about an hour – led by David, followed by Exec Directors Mary the CFO and Vlad the COO.

Overarching theme was that business conditions are tough across ANZ at the moment, which doesn’t bode well for the remainder of 1H 24.

Vlad made the point that DDR has historically taken market share in up and downturns but this usually is faster in downturns.

They seem to think about the business like owners (because they are) so a little unorthodox in some of their presentation / thinking but mostly in a good way.

Moat seems to be largely cultural and defensible (operating efficiency is a big feature can't really be a moat as this can be copied by competitors).

CFO

Cycling difficult comps – specifically they were a big beneficiary of Covid IT demand in FY21, then impacted by supply chain issues in FY22. These resulted in a big pcp for Mar-23 Qtr when a lot of the high demand, then low supply from FY22 worked its way through, a lot of which got invoiced in Q1 23. This made Q1 24 Revenue hard to comp on a like for like basis.

My take is that they are confident that better times are coming but probably not in Q2, hopefully H2.

Dividend policy to pay out 100% of NPAT on a quarterly basis to fund the F1 ambitions of all shareholders will not be changing while David remains alive / a shareholder.

COO

NZ is seen as a big opportunity in terms of both market share (they are 2nd) and margin as they work through the acquisitions they made there.

They are looking to sign ANZ vendor and partnership agreements as opposed to being siloed to leverage the strength of the Aussie business to expand the NZ arm.

That said, the NZ economy is doing it tougher than here.

Digital is a larger piece, growing steadily, higher margin and expected to continue for the foreseeable.

Official business

The unorthodox Rem Report got a 2nd strike but the spill was easily defeated.

Given David's attitude towards it, I expect this to be a feature - lots of strikes but no spills to protest but not punish the board / Rem & Nom committee.

Site Tour

Did a site tour afterwards.

The CFO led us through with the head of property mgmt. and about 15 other shareholders, fund managers (I only recognised the Hayborough guys) and punters / brokers?

Kurnell is an Impressive set up, very modern, lots of capacity, and DA being sought to add another adjacent 30k sq feet (in addition to the 22 + 17 = 39k sq foot facilities they have currently operational but not fully utilised.

Disc: Held

Post a valuation or endorse another member's valuation.